US Government Shutdown Ending, Market Rally Underway

1. 🏛️ US Government Shutdown Ending After 41 Days, Markets Surge on Optimism

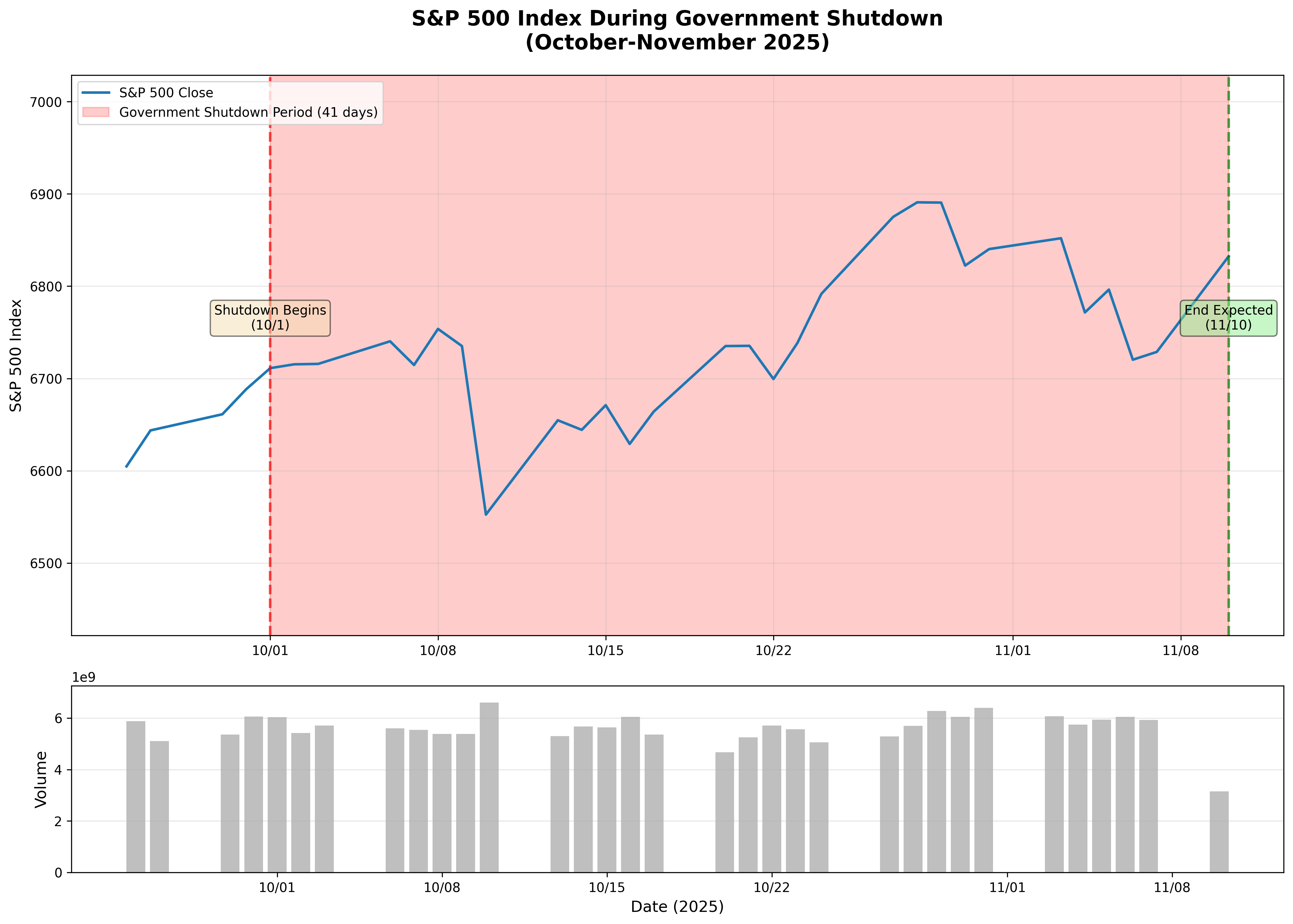

On Monday, November 10th, eight Senate Democrats joined Republicans in voting to advance a short-term spending bill, raising expectations that the 40+ day US government shutdown will end this week. The Dow Jones Industrial Average closed up 381.53 points (0.81%) at 47,368.63, while the S&P 500 gained 1.54% to 6,832.43, and the Nasdaq surged 2.27% to 23,527.17.

The shutdown caused significant disruption nationwide, with over 10,000 flight delays and 2,700+ cancellations, and the suspension of SNAP (food assistance program) benefits affecting 42 million Americans. Economic experts estimate the shutdown costs approximately $15 billion per week to US GDP (roughly 0.2 percentage points annualized).

Investment Lesson: Political uncertainties like government shutdowns cause short-term market volatility, but markets recover quickly once resolution appears likely. Political risks are often overestimated, and investors rapidly return to risk assets when solutions emerge.

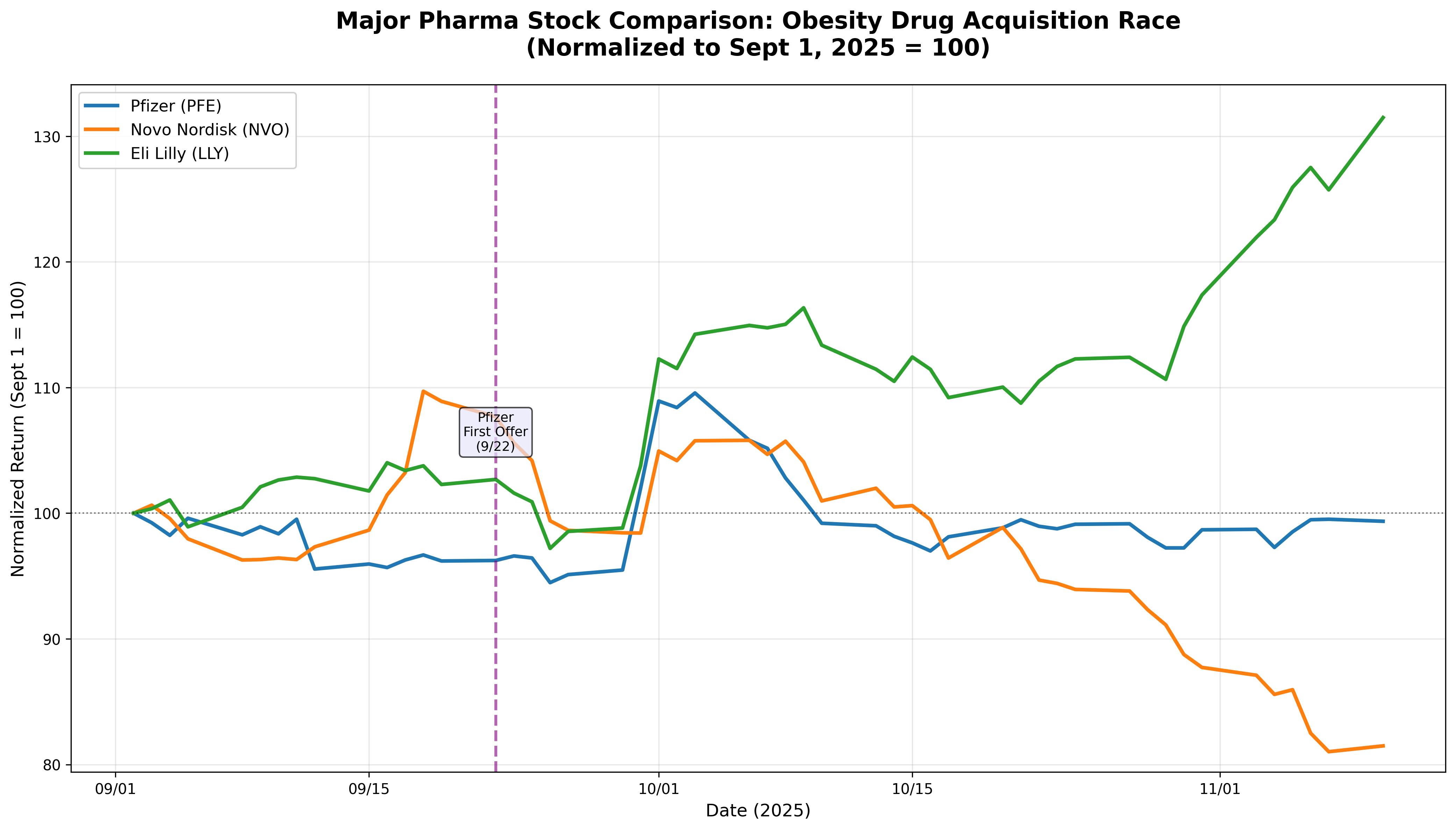

2. 💊 Pfizer Wins $10 Billion Acquisition of Obesity Drug Maker Metsera

On Friday, November 8th, Pfizer signed a deal to acquire obesity drug developer Metsera for up to $10 billion ($86.25 per share). Pfizer will pay $65.60 per share in cash upfront, with an additional contingent value right (CVR) of up to $20.65 per share upon achieving certain clinical and regulatory milestones.

The acquisition came after intense competition with Novo Nordisk. Novo Nordisk raised its bid twice, but the Federal Trade Commission (FTC) expressed antitrust concerns, leading Metsera's board to accept Pfizer's offer, citing "unacceptably high legal and regulatory risks" with the Novo bid.

Metsera's lead candidates, MET-097i (a GLP-1 injectable) and MET-233i (an amylin analog), are next-generation obesity treatments requiring only once-monthly dosing. Leerink Partners analysts project both drugs could generate up to $5 billion in annual peak sales if approved and successfully commercialized. Analysts estimate the obesity drug market will reach $150 billion by the early 2030s.

Investment Lesson: Major pharmaceutical companies are willing to pay significant premiums to secure next-generation blockbuster drug pipelines. The obesity treatment market is expected to grow explosively, driving up M&A valuations for related biotech companies. Regulatory risks (antitrust laws) are also critical variables in M&A success.

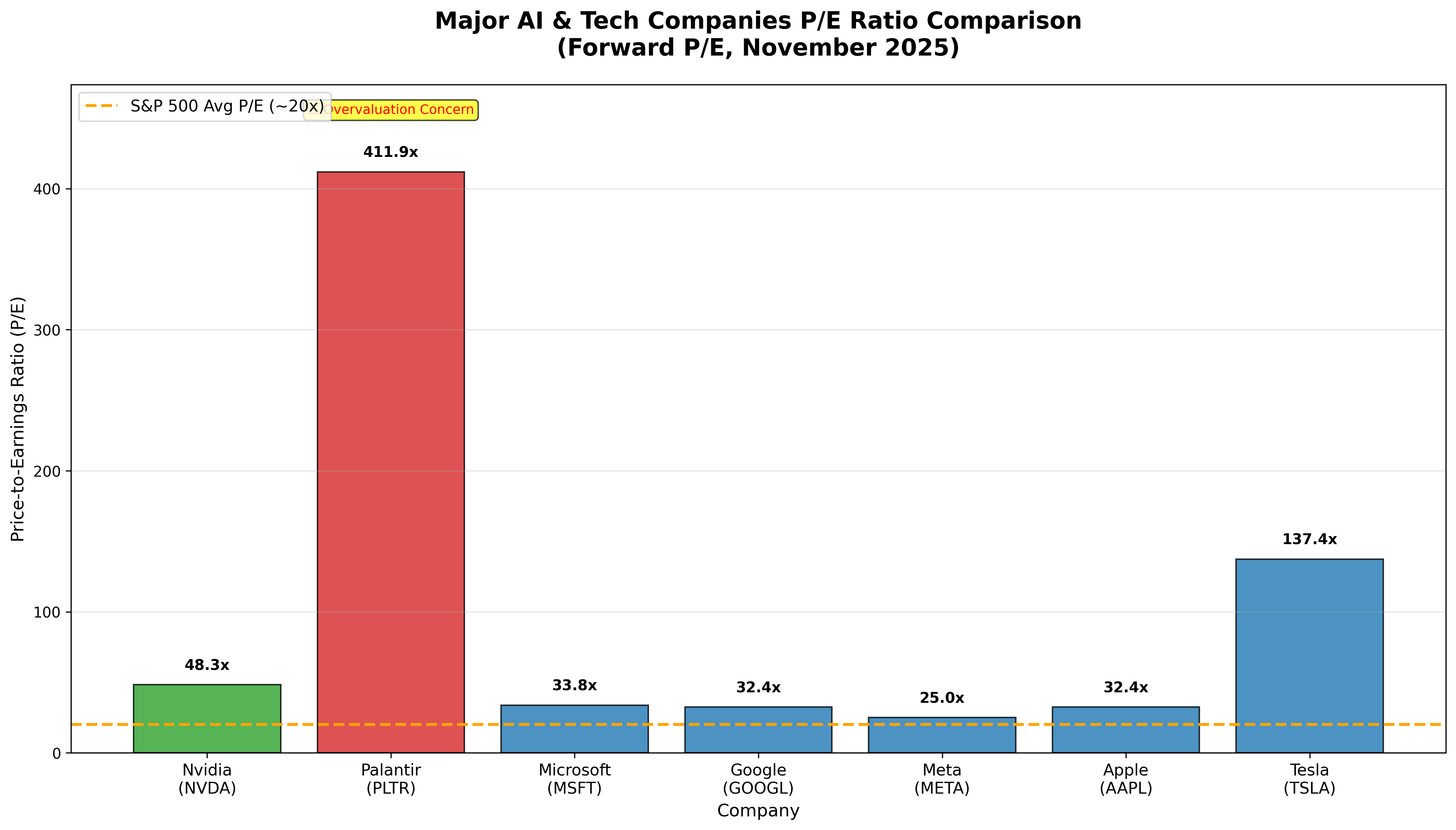

3. 🤖 AI Stock Volatility Surges on Valuation Concerns, Palantir and Nvidia Plunge

In the first week of November, the Nasdaq fell 3.04%, marking its worst week since April. Concerns over excessive valuations in AI-related stocks intensified, with Palantir dropping approximately 11.2% (currently trading at 200+ P/E ratio) and Nvidia declining about 7.1%. On Wednesday, November 5th, Super Micro Computer fell 11% on disappointing Q1 results, and Arista Networks plummeted 9%.

Year-to-date, the S&P 500 has gained roughly 19% following Trump's reelection, but this rally has been driven primarily by Big Tech and AI companies. According to Morningstar Research, US stock market capitalization increased by $4.2 trillion in October alone, with just six companies—Google ($1.2T), Nvidia ($800B), Apple ($440B), and three others—accounting for $3.1 trillion of that increase.

Investment experts note growing skepticism about whether AI companies' excessive valuations and massive AI infrastructure investments will translate into actual profits. Goldman Sachs CEO David Solomon stated he expects the stock market to experience a 10-20% correction within the next 1-2 years.

Investment Lesson: Even high-growth thematic stocks cannot avoid corrections when valuations become excessively stretched. When markets become overly concentrated in a handful of stocks, volatility increases. Long-term investors must continuously monitor the balance between companies' actual profit-generating capabilities and their valuations.

Comments (0)

No comments yet. Be the first to comment!