Longest Government Shutdown in U.S. History Triggers Aviation Chaos

1. Government Shutdown Day 37: Longest in U.S. History

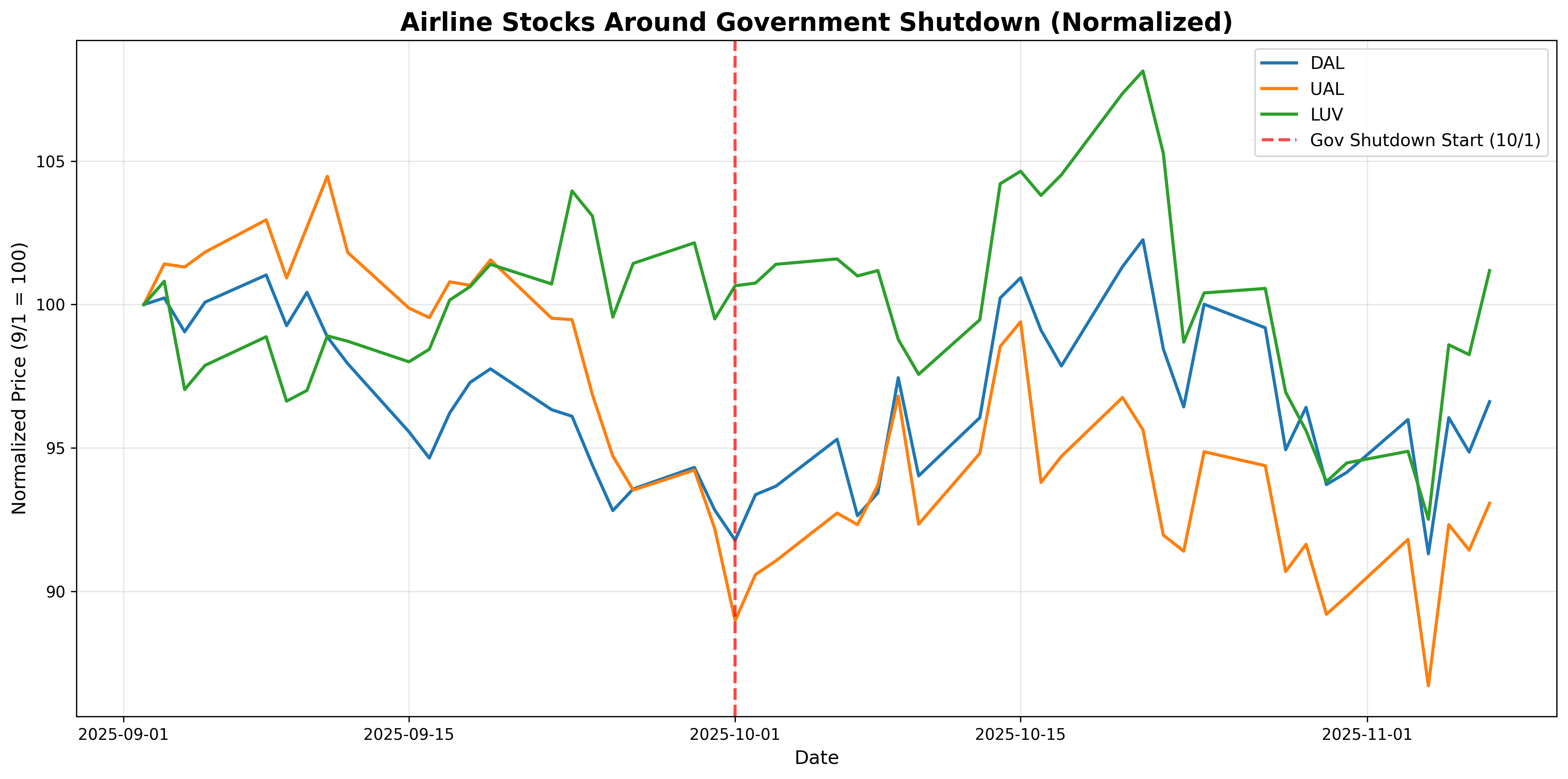

The government shutdown, triggered by failed budget negotiations between the Trump administration and Congress, has entered its 37th day, making it the longest government closure in American history. Democrats are demanding a one-year extension of ACA (Affordable Care Act) subsidies for health insurance tax credits, while Republicans refuse, creating a persistent stalemate.

Background & Lessons: A government shutdown is not just a political battle. Air traffic controllers are working without pay and resigning daily, while SNAP (food assistance) benefits for 42 million Americans are under threat. This is a textbook case of how political gridlock directly impacts the real economy and citizens' lives. It demonstrates that "politics can stop the economy" while also allowing us to observe how markets digest such uncertainty.

2. AI Valuation Fears: Palantir and NVIDIA Plunge

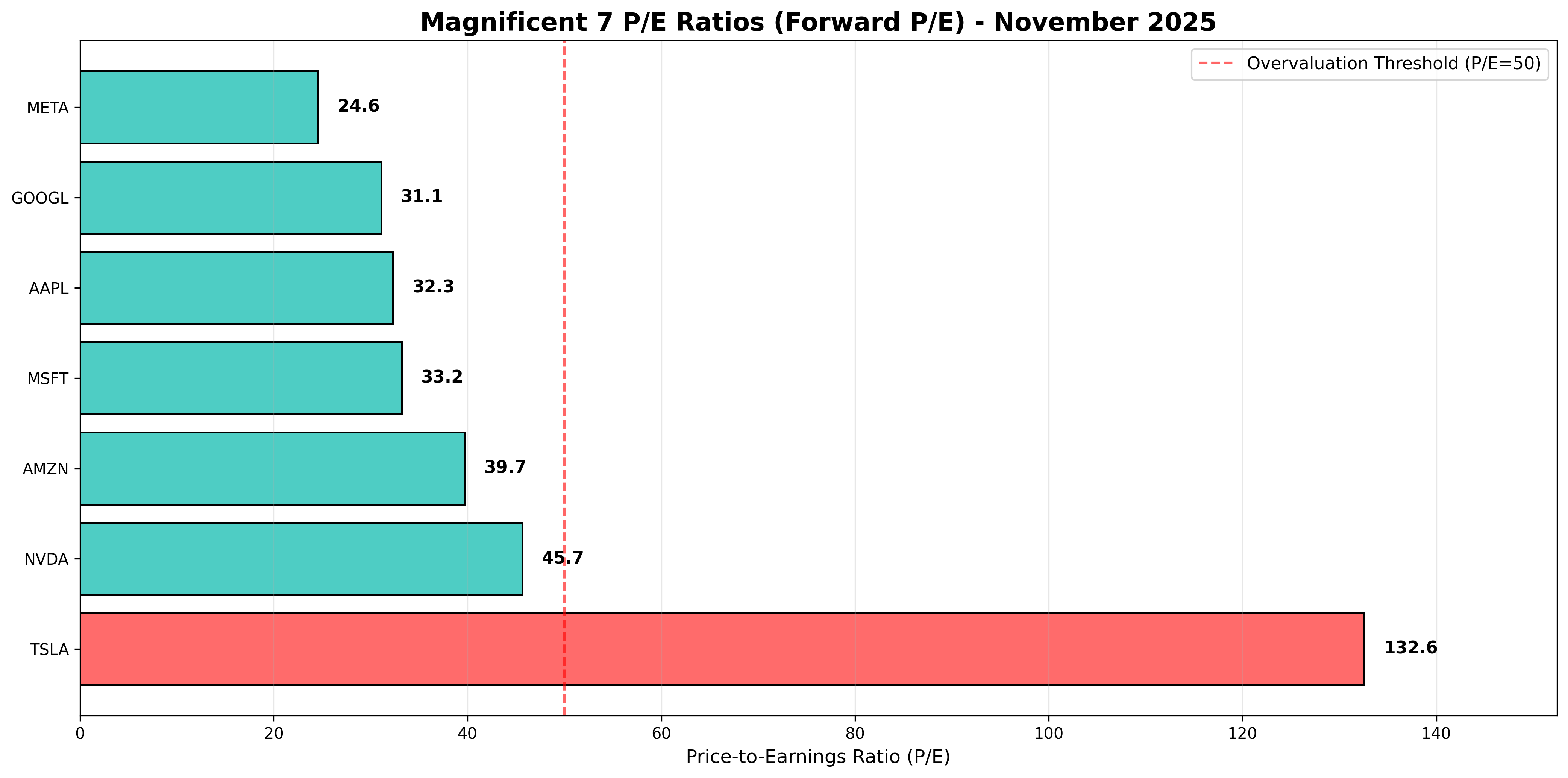

Concerns about elevated valuations in AI stocks hit the market hard. Palantir (PLTR) dropped 8-9% despite Q3 earnings and guidance exceeding Wall Street expectations. With price-to-earnings ratios exceeding 200x, investors began questioning "Is this price justified?" The Nasdaq fell more than 3% over the week, and NVIDIA dropped over 7%.

Background & Lessons: The 2025 AI boom shows patterns similar to the 2021 meme stock frenzy. The paradox of "stocks falling despite good earnings" signals that the market has already overpriced future growth. Goldman Sachs and Morgan Stanley CEOs warning of "potential 10-20% correction within 1-2 years" reflects this context. Investors have started making cold calculations: "The growth story is right, but the price got ahead of itself."

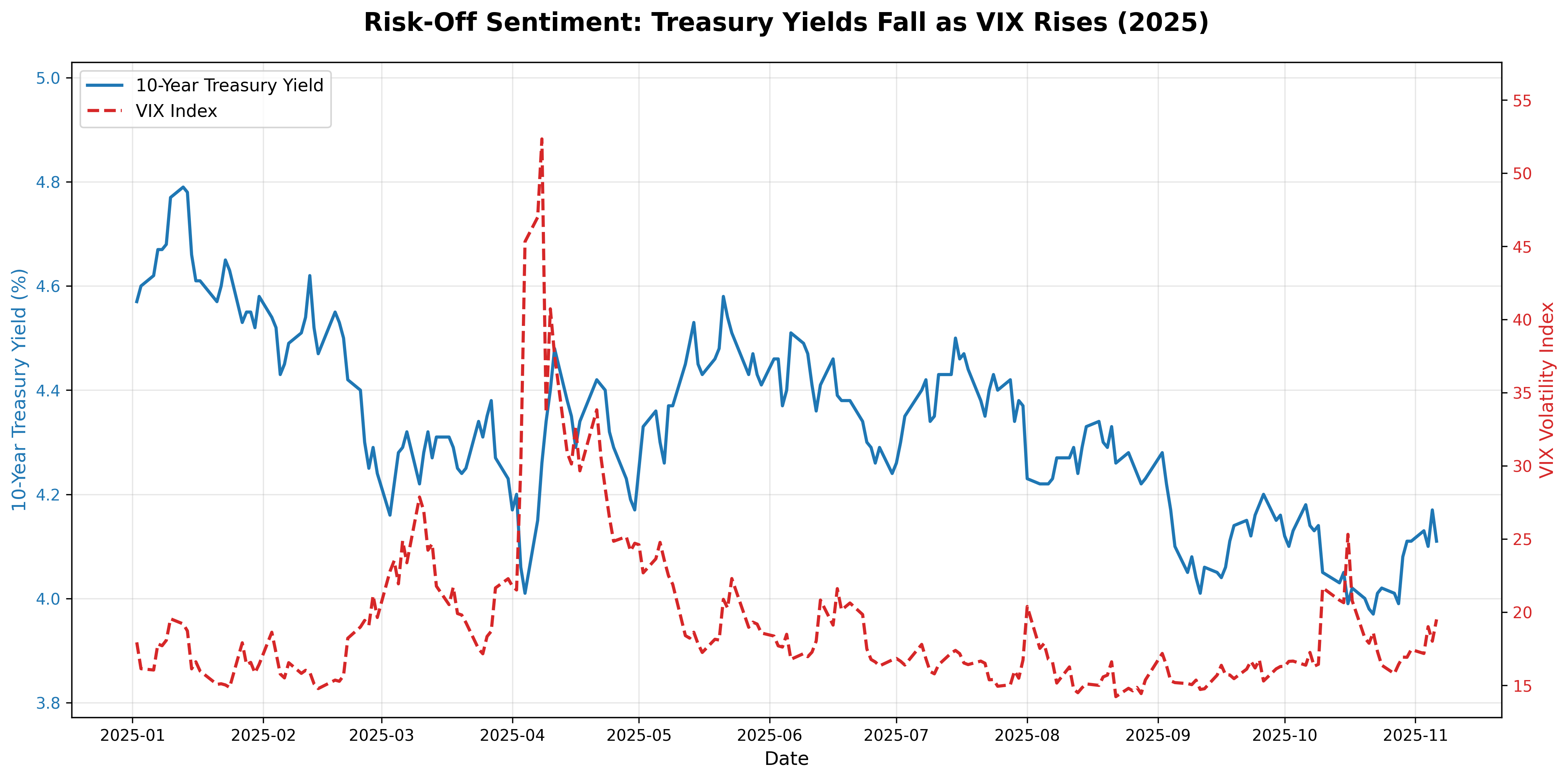

3. Bond Market Rally: Flight to Safety Intensifies

As stock market volatility increased, investors fled to Treasuries. The 10-year U.S. Treasury yield fell to 4.09% (bond prices rose), and the VIX volatility index broke above 20, hitting a two-week high. The Challenger report showing October layoff announcements were the worst since 2003 reignited recession fears.

Background & Lessons: The traditional portfolio diversification principle—"when stocks fall, bonds rise"—continues to work. But the more important lesson is that "markets continuously reassess the Fed's rate-cutting path." Futures markets are pricing in one more cut this year and two additional cuts next year, suggesting labor market weakness could force the Fed into more aggressive easing.

4. Major Bank CEOs Warn of Correction: "Prepare for 10-20% Decline"

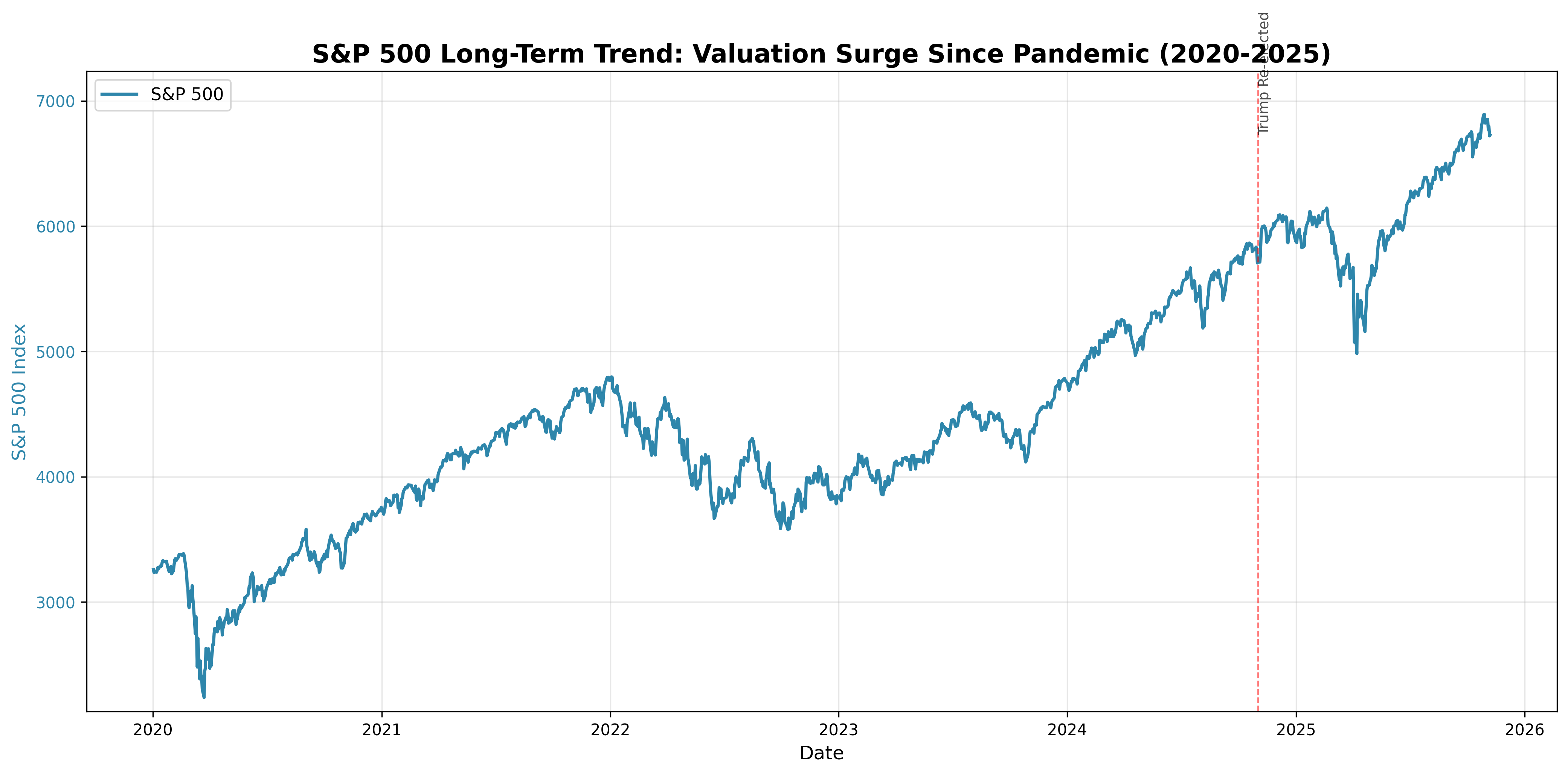

Goldman Sachs CEO David Solomon and Morgan Stanley CEO Ted Pick warned at a financial leadership summit in Hong Kong that stock markets face a likely 10-20% correction within the next 1-2 years. The IMF, Fed Chair Jerome Powell, and Bank of England Governor Andrew Bailey also expressed concerns about excessive stock valuations.

Background & Lessons: Wall Street titans publicly mentioning a correction is highly unusual. It signals a consensus that "markets have risen too fast, too far." With the S&P 500 up for six consecutive months and forward P/E at 23.1x—a 3-year high—investors need to consider "profit-taking timing." The lesson is clear: "Don't neglect risk management even in a bull market."

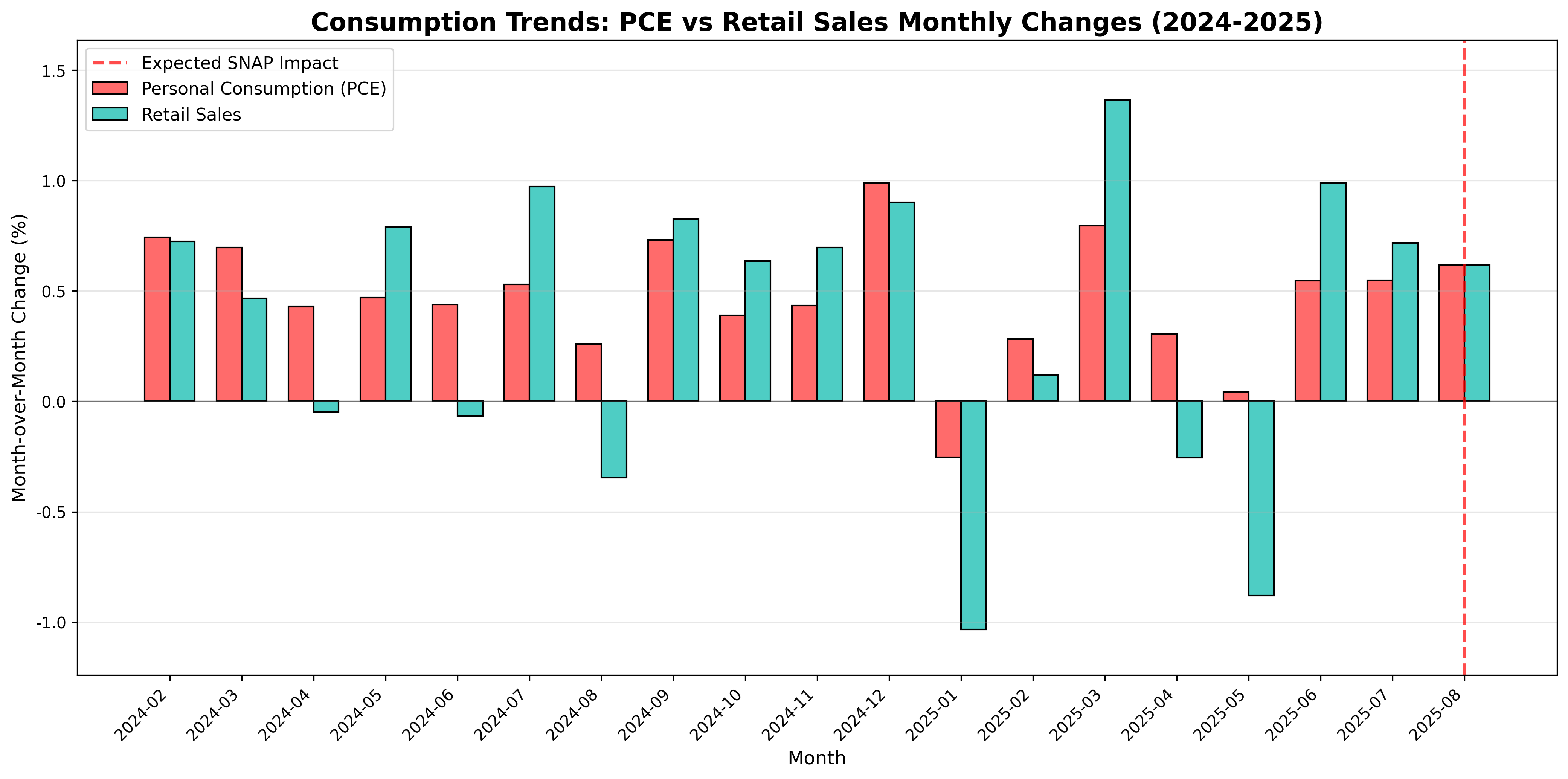

5. Consumer Spending Hit: SNAP Delays Expected to Cut November Spending by 0.5pp

Bank of America projects that SNAP (food assistance) payment delays due to the government shutdown will reduce November consumer spending by up to 0.5 percentage points. With monthly food assistance for 42 million people at risk of suspension, low-income consumption is expected to plummet. A federal court ordered the Trump administration to disburse at least half of November benefits using USDA emergency funds, but payments remain delayed.

Background & Lessons: U.S. consumer spending accounts for roughly 70% of GDP. Since SNAP recipients spend nearly 100% of received funds immediately on consumption, their spending reduction has a direct and rapid impact on the real economy. This case teaches us that "government policy can shake macroeconomic indicators in real-time." Short-term impacts on earnings of grocery retailers like Walmart and Kroger, as well as consumer goods companies, are expected.

Comments (0)

No comments yet. Be the first to comment!