U.S. Financial Market Update: Rate Cut Uncertainty and Rising Market Volatility

November 17, 2025

Executive Summary

- December rate cut probability plummets from 95% to below 50% in one month

- AI and tech stock volatility intensifies ahead of Nvidia earnings report

- 43-day government shutdown ends, economic data releases resume increasing market uncertainty

1. Fed's December Rate Cut Probability Plunges Below 50%

Sharp Reversal in Market Expectations

The probability of a December rate cut has plummeted from 95% to below 50% in just one month. Fed officials are sharply divided on rate cuts, and the 43-day government shutdown has created a data vacuum that is amplifying uncertainty.

Boston Federal Reserve President Susan Collins and other hawkish members have stated they are hesitant to cut rates further without clear evidence of labor market deterioration. Fed Chair Jerome Powell made it clear after the October meeting that "a December rate cut is not a done deal, and it never was."

As shown in the chart above, the probability of a rate cut at the December FOMC meeting has dropped sharply from 95% in mid-October to as low as 47% in mid-November, before recovering slightly to around 60% recently. This dramatic shift illustrates just how uncertain market participants are about the Fed's monetary policy direction.

The Federal Funds Rate has remained stable within the target range of 3.75-4.00% since early 2025, but market expectations for future policy direction are highly volatile.

Key Lesson

Central bank policy decisions are data-dependent, but the government shutdown halted key economic indicator releases, leaving the Fed "driving in the fog." When uncertainty is high, caution becomes the priority, creating a disconnect between market expectations and actual policy.

Investors should pay close attention to upcoming employment reports and inflation indicators, given the Fed's data-dependent approach.

2. AI Stock Volatility Intensifies - Markets on Edge Ahead of Nvidia Earnings

Tech Stocks Face Critical Test

Nvidia's earnings report, scheduled for next Wednesday, has emerged as the most critical market event. The Nasdaq has fallen approximately 3.5% in November, with roughly $1.74 trillion in market capitalization evaporating in just two weeks.

Major tech companies have experienced significant declines:

- Meta: Down 23% from August highs

- Nvidia: Down 10% from October highs

- Palantir: Down 16% from early November highs

Oracle has fallen sharply as investors express concern over increased borrowing to fund AI investments.

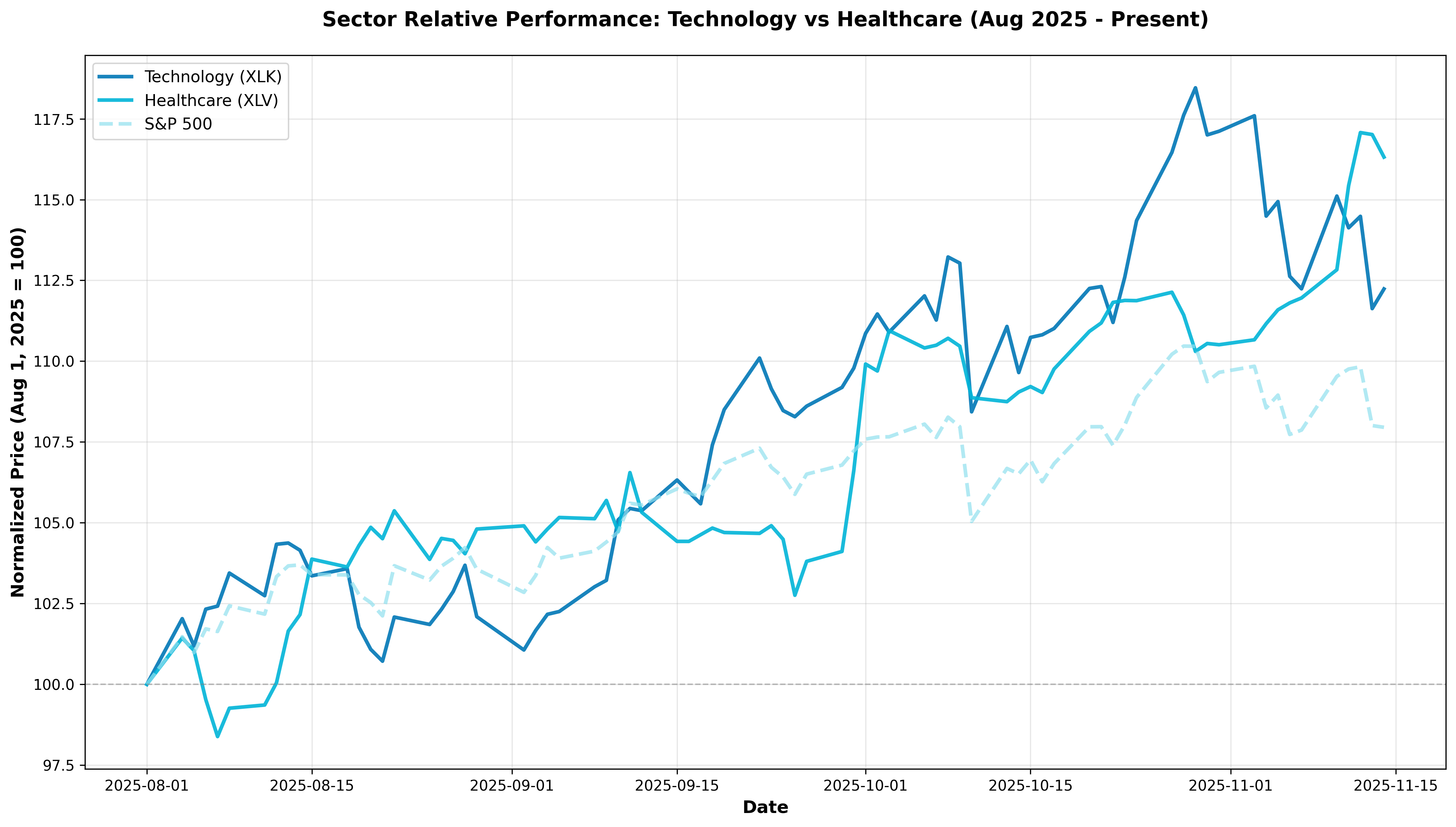

The chart above shows the relative performance of Technology (XLK), Healthcare (XLV), and the S&P 500 from August 2025 to present. Normalized to 100 as of August 1st, technology stocks showed initial strength but experienced sharp correction starting in late October, underperforming both healthcare and the S&P 500.

This clearly demonstrates how vulnerable high-valuation tech stocks are to profit-taking pressure. While healthcare has maintained relatively stable performance, technology stocks have seen significantly increased volatility.

Divergent Views from Market Experts

Michael Burry, famous for "The Big Short," accused major U.S. tech companies of using aggressive accounting to inflate AI boom profits. In contrast, a Morgan Stanley strategist assessed that "recent market volatility has not changed the long-term bullish thesis on AI."

Key Lesson

High-valuation sectors are easily disappointed due to elevated expectations. Stocks that surged on the AI boom are vulnerable to profit-taking pressure and valuation reassessment, and the market has become so concentrated that a single company's (Nvidia) earnings can sway the entire market.

The importance of diversification has never been greater. Excessive exposure to tech stocks carries high volatility risk.

3. Government Shutdown Ends - Economic Data Releases Resume with Market Implications

End of the Longest Shutdown in History

The 43-day government shutdown, the longest in U.S. history, ended on November 14th. Approximately 1.4 million federal employees went without pay, with half on unpaid furlough.

The shutdown delayed the September and October employment reports and recent inflation data. The Bureau of Labor Statistics announced it will release the September employment report next Thursday, November 20th.

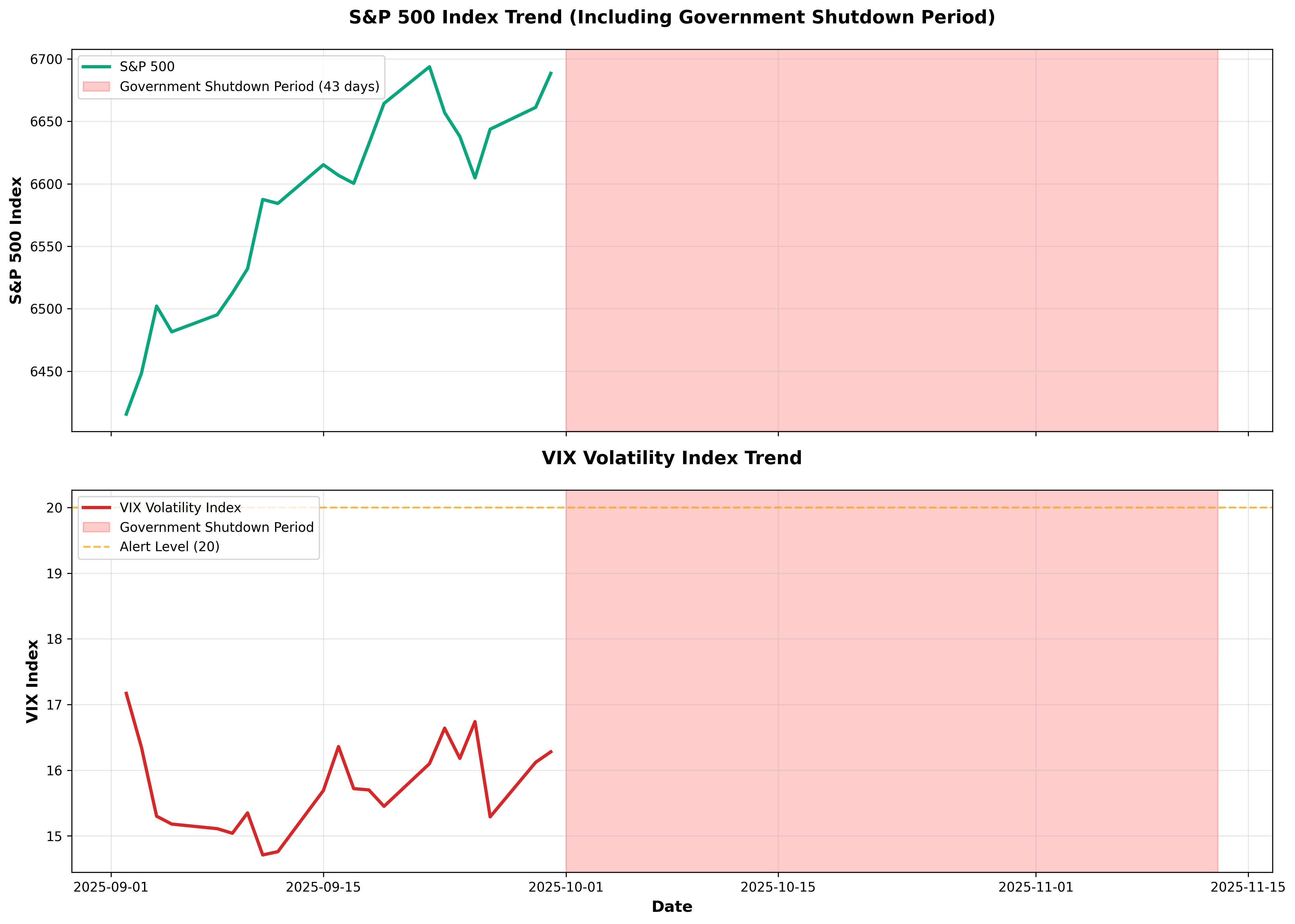

The chart above shows market volatility during the government shutdown period (red shaded area, October 1 - November 13).

The S&P 500 remained relatively stable during the shutdown but has shown increased volatility following its end. This suggests the market is nervous ahead of the release of delayed economic data.

The VIX Index rose in the middle of the shutdown before declining, but has maintained levels above 20, indicating sustained market anxiety.

Historical Patterns and Future Outlook

Historical data shows that since 1981, the S&P 500 has averaged a 2.7% gain in the month following 15 government shutdown endings. However, there are concerns that the flood of delayed economic data could dramatically move markets.

If delayed employment reports and inflation data come in worse than expected, the market could face sharp correction. Conversely, if positive data is released, expectations for Fed rate cuts could rise again, potentially triggering a market rebound.

Key Lesson

Information voids amplify uncertainty and market volatility. As the data blackout period ends—during which investors and policymakers could "believe what they wanted to believe"—markets may react sharply when actual economic conditions are revealed.

Next week's September employment report will be a critical event determining market direction.

Conclusion: Investment Strategy Amid Uncertainty

Financial markets currently face three major uncertainties:

- Fed's interest rate policy direction: With December rate cut probability fluctuating, policy direction will be determined by upcoming economic data

- Tech stock valuation: Growing questions about AI boom sustainability and earnings justification

- Data gap resolution: Impact of shutdown-delayed economic indicator releases on markets

Implications for Investors

- Data-driven approach: Focus on next week's employment report and Nvidia earnings release

- Diversification: Consider reducing tech concentration and sector diversification

- Prepare for volatility: With VIX maintaining levels above 20, strengthen portfolio risk management

- Avoid short-term thinking: While short-term volatility from data and policy releases is inevitable, maintain long-term investment perspective

In times of high uncertainty, prudent position management and risk diversification are key to investment success.

This report is prepared for educational and informational purposes only and does not constitute investment advice. Investment decisions should be made based on individual judgment and responsibility.

Comments (0)

No comments yet. Be the first to comment!