US-China Trade War and Stock Market Crash (October 2025)

Executive Summary

Stock markets plummeted after President Trump threatened to impose 100% tariffs on Chinese goods in response to China's restrictions on rare earth exports. This marks a reignition of the US-China trade conflict that began earlier this year, as both nations continue their high-stakes game of chicken.

The Critical Importance of Rare Earth Elements

Rare earth elements are essential materials for military weapons including F-35 fighter jets, submarines, and missiles, as well as semiconductors, AI chips, electric vehicles, and smartphones. China dominates global production with 61% of mining and 92% of processing capacity. The United States depends on China for 70% of its rare earth imports. Even rare earths mined in California must be sent to China for processing.

Timeline of Events

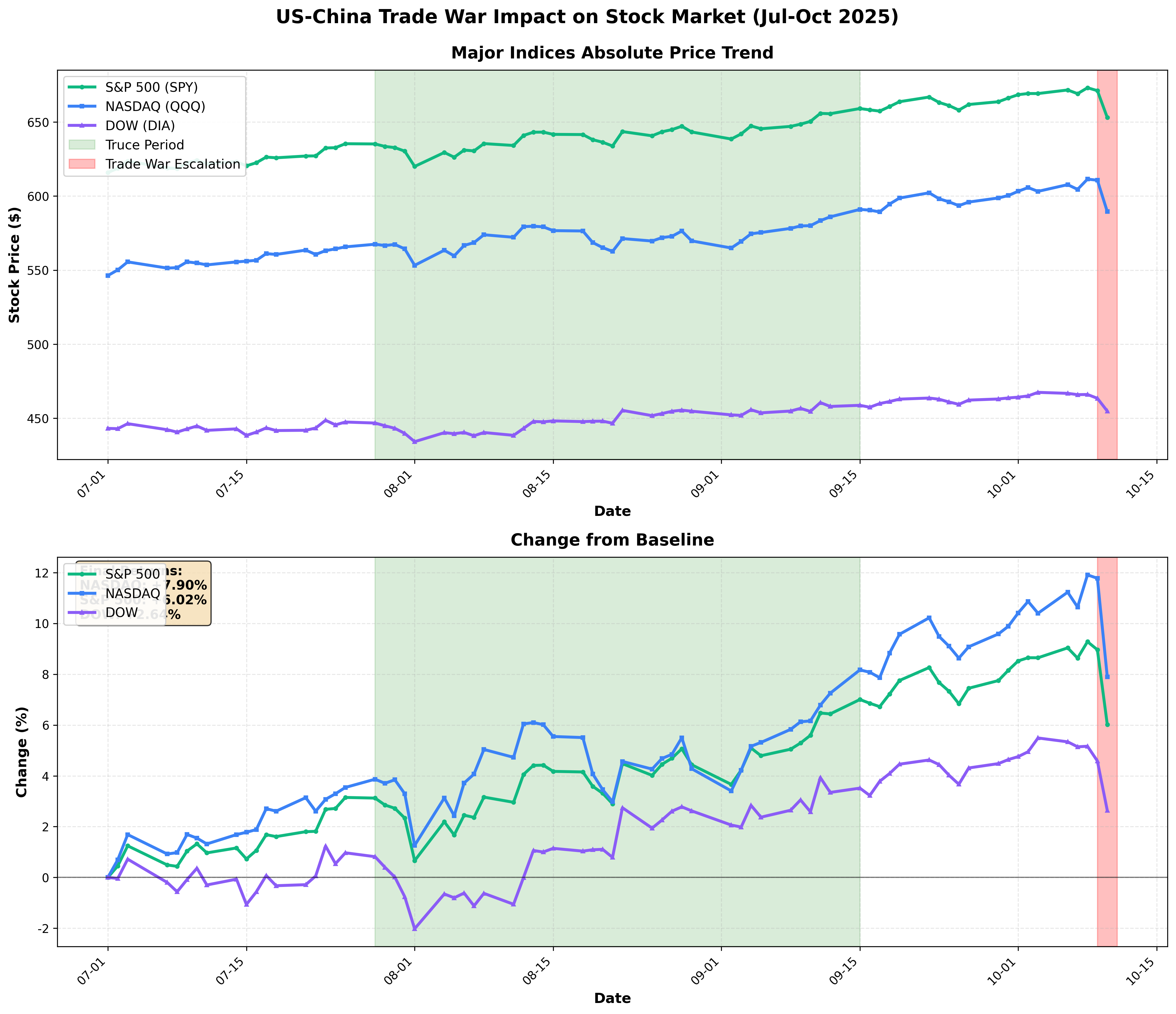

Phase 1 (Early 2025): Trump imposed 145% tariffs on Chinese products, prompting China to retaliate with 125% tariffs, causing significant stock market declines.

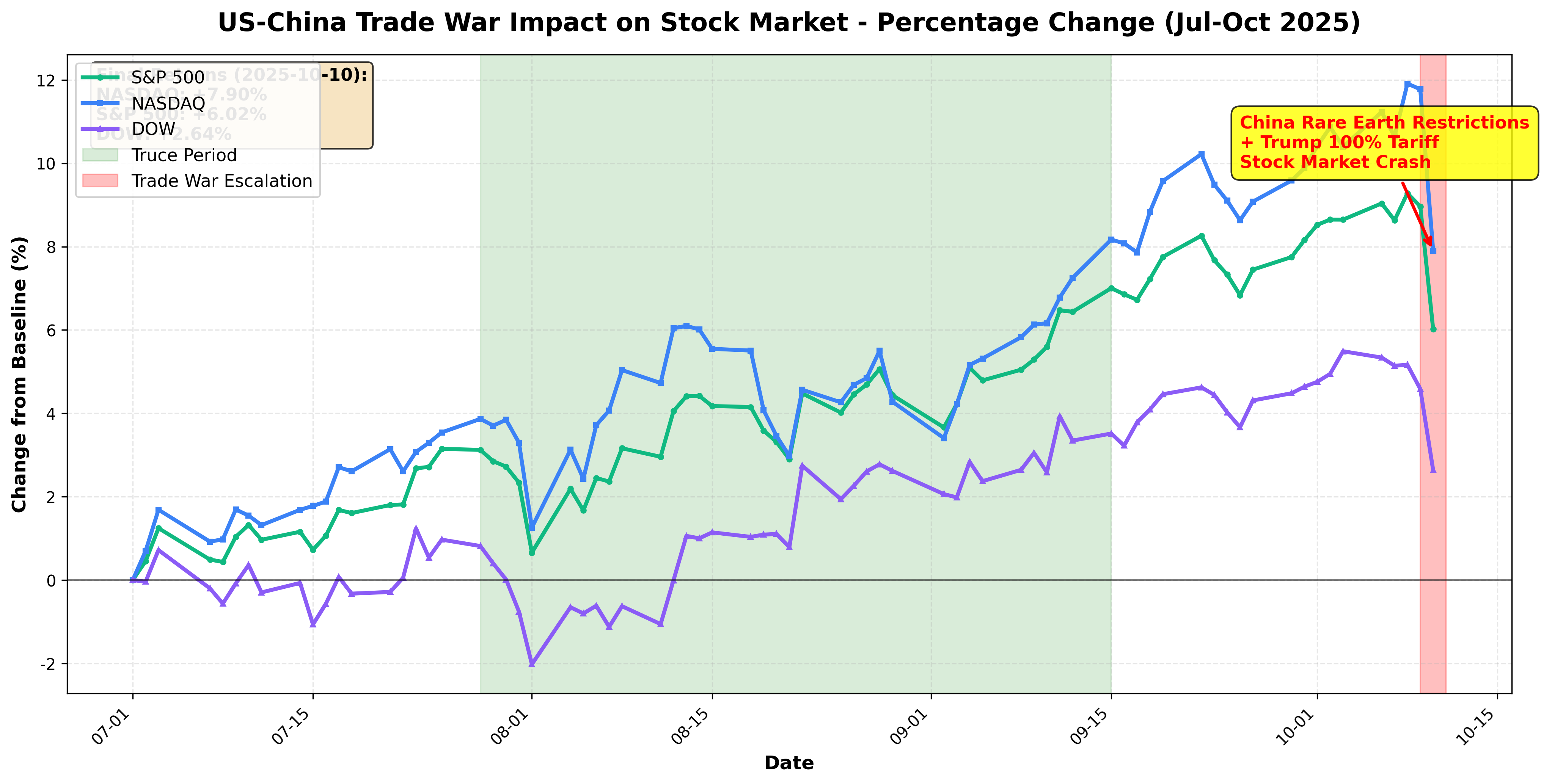

Phase 2 (May-August): Both nations reduced tariffs (US to 30%, China to 10%) and agreed to a 90-day truce, leading to stock market recovery and record highs.

Phase 3 (October 10): China announced export restrictions on five additional rare earth metals. Combined with seven previously restricted metals, a total of 12 rare earth elements are now under export controls, set to take effect November 1st.

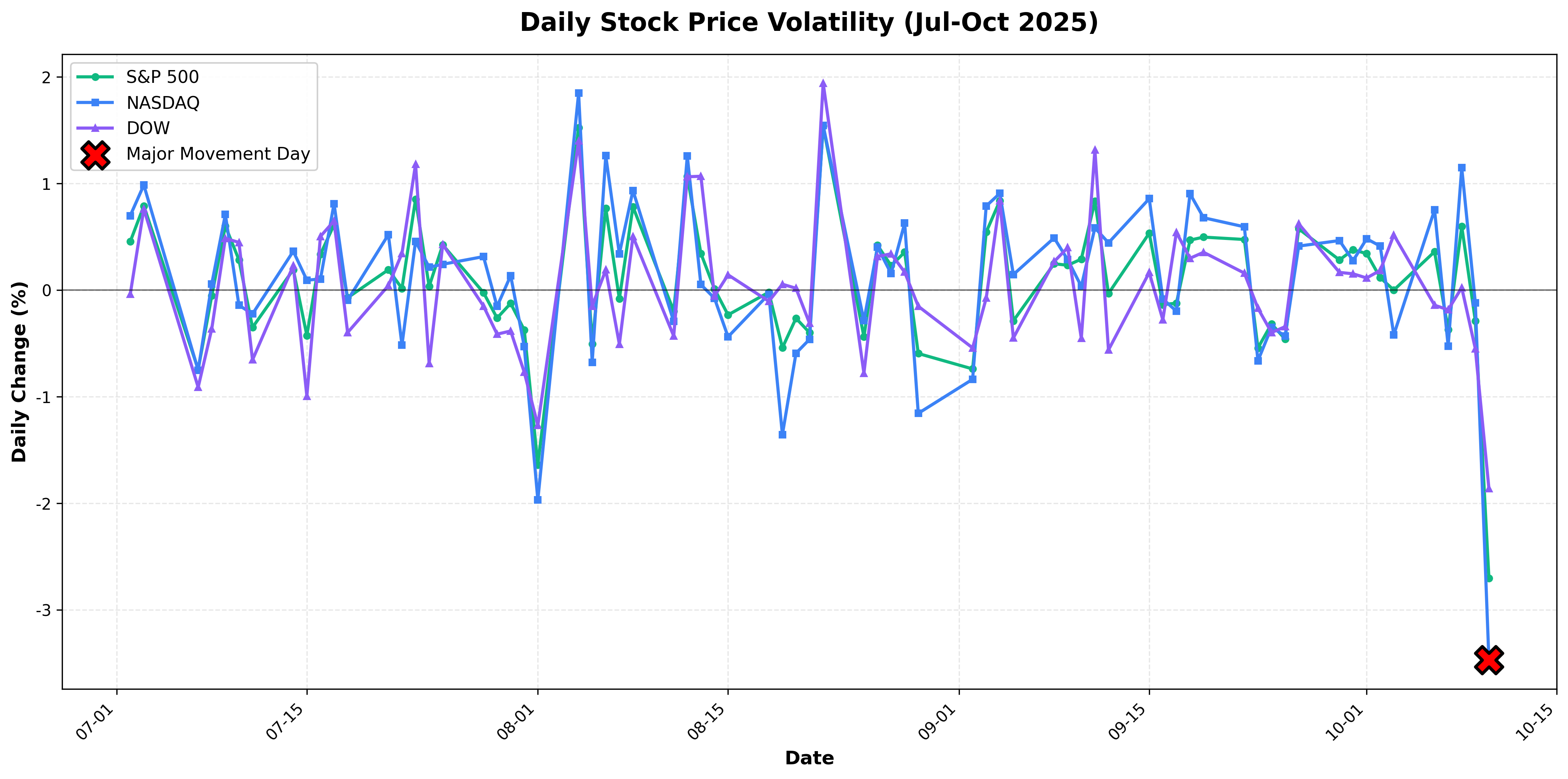

Phase 4 (October 11): Trump announced plans to impose an additional 100% tariff on Chinese products and hinted at canceling his planned meeting with President Xi. The S&P 500 fell 2.7%, NASDAQ dropped 3.6%, and the Dow Jones declined 1.9%.

America's Strategic Dilemma

MP Materials, the leading US rare earth producer, is projected to manufacture only 1,000 tons of neodymium magnets annually by the end of 2025—less than 1% of China's 2018 production of 138,000 tons. Establishing complete domestic production capabilities will require several more years. China has already demonstrated its willingness to weaponize rare earths, having banned exports to Japan in 2010. President Xi publicly outlined this asymmetric capability development strategy in 2014.

Future Outlook

This escalation could be a negotiating tactic or signal an actual breakdown in trade relations. Both nations have much to lose: the United States is China's largest export market, while China's absence would cripple America's advanced technology industries. The standoff continues as a high-stakes game of chicken, with stock market volatility expected to persist in the near term.

Comments (0)

No comments yet. Be the first to comment!