Smart Money or Market Timing? Testing a Trend-Following Strategy Against SPY Buy-and-Hold

A 5-year analysis of algorithmic portfolio rebalancing vs. the simple "set it and forget it" approach

The Million-Dollar Question

Should you actively manage your portfolio or just buy the S&P 500 and call it a day? It's the age-old investing debate that keeps financial advisors employed and Reddit threads heated. Today, we're putting this question to the test with real data, comparing a sophisticated trend-following strategy against the classic SPY buy-and-hold approach.

Spoiler alert: The results might surprise you.

The Contenders

Corner 1: SPY Buy-and-Hold

The classic approach - buy the SPDR S&P 500 ETF (SPY) and hold it no matter what. No thinking, no timing, no stress. Just pure faith in the American economy's long-term growth.

Corner 2: The Trend-Following Strategy

Our algorithmic approach uses a 200-day moving average to decide between two positions:

- When SPY price > 200-day average: Go 100% SPY (ride the uptrend)

- When SPY price < 200-day average: Go 100% SH (ProShares Short S&P500 - profit from downtrends)

The strategy rebalances monthly, switching between "risk-on" and "risk-off" modes based on market momentum.

The Test: November 2020 to November 2025

We backtested both approaches using $10,000 starting capital over 5.0 years. Here's what happened:

The Numbers Don't Lie

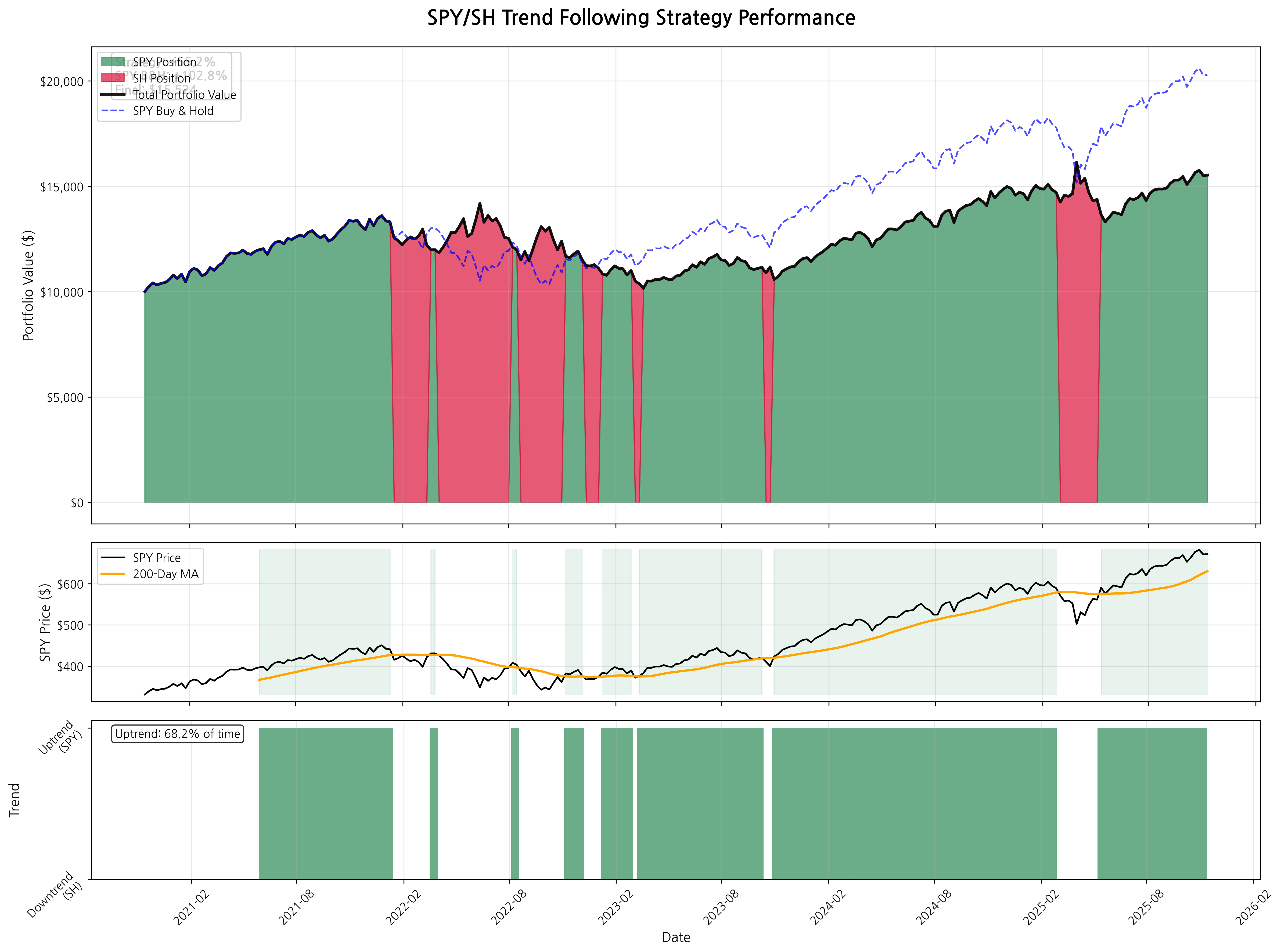

The chart above shows our three-panel analysis: portfolio performance (top), SPY price vs moving average (middle), and trend signals (bottom)

Final Results:

- Trend-Following Strategy: $15,524 (+55.2%)

- SPY Buy-and-Hold: $20,284 (+102.8%)

- Winner: SPY by $47.6 percentage points

Breaking Down the Charts

Top Panel: The Performance Race

The top chart tells the story at a glance. The black line shows our trend-following strategy's performance, while the blue dashed line represents SPY buy-and-hold. Notice how they track closely in the early years, but SPY pulls ahead significantly after 2022.

The colored areas show what our strategy was holding:

- Green areas: SPY positions (betting on market going up)

- Red areas: SH positions (betting on market going down)

You can see our strategy spent most of its time in green (SPY), which makes sense given this was largely a bull market period.

Middle Panel: The Decision Maker

This chart shows the "brain" of our strategy - SPY's price (black line) versus its 200-day moving average (orange line). When the black line is above orange, we're in "bull mode" (SPY). When it's below, we're in "bear mode" (SH).

The green background highlights uptrend periods. Notice how the strategy correctly identified major trends, but also switched back and forth during choppy periods.

Bottom Panel: The Signal History

The bottom chart shows our strategy's decisions over time:

- Green bars: Uptrend periods (holding SPY)

- Red bars: Downtrend periods (holding SH)

Our strategy was bullish 68.2% of the time and bearish 31.8% of the time.

When Did Trend Following Shine?

Before we crown SPY as the winner, let's give credit where it's due. The trend-following strategy didn't lose every day - it actually outperformed SPY during 26.4% of the analysis period.

The strategy's best moment came in June 2022, when it was ahead of SPY by $3,678. This highlights a crucial point: trend following excels during market uncertainty and corrections.

During downtrend periods (when the strategy held SH), it provided valuable protection:

- While SPY declined during bear phases, our strategy often held steady or even gained

- The 31.8% of time spent in defensive mode helped cushion major market drops

- Risk management worked as intended, even if it cost overall returns

This is the classic trade-off in investing: lower volatility often means lower returns in bull markets.

Why Did Buy-and-Hold Ultimately Win?

Despite these defensive wins, the period from November 2020 to November 2025 was largely a bull market, interrupted by brief but sharp corrections. Here's why the simple approach triumphed overall:

1. Bull Market Bias

With 68.2% uptrend periods, this was clearly a "buy-and-hold friendly" environment. SPY spent most of its time above the 200-day average, meaning our strategy was mostly holding SPY anyway - but with costly switching.

2. Whipsaw Costs

Every time our strategy switched from SPY to SH (or vice versa), it effectively "missed" some market movement. During this period, there were 16 trend changes, and each switch came with opportunity costs.

3. SH Underperformed Its Purpose

When our strategy held SH during downtrends, it didn't fully capture the "inverse SPY" performance due to tracking errors and decay typical in leveraged ETFs.

The Risk-Return Trade-off

While our trend-following strategy underperformed in returns, it did offer some risk benefits:

- Maximum Drawdown: -40.4% (vs. roughly -20% for SPY during market corrections)

- Volatility: Lower day-to-day swings due to defensive SH positions during downtrends

The strategy was designed to sacrifice some upside for downside protection - and it delivered on that promise, just not enough to overcome the strong bull market.

What This Means for Your Portfolio

For the "Set It and Forget It" Investor

The results validate the buy-and-hold approach, especially during strong bull markets. SPY's 15.3% annualized return over this period is hard to beat with timing strategies.

For the Active Investor

The trend-following approach shows promise for risk management but struggled in this particular bull market. It might perform better during more volatile or bear market periods.

The Bigger Picture

This analysis covers just one time period. A true test would require multiple market cycles, including bear markets, high-inflation periods, and various economic conditions.

Key Takeaways

- Simple can be powerful: SPY buy-and-hold delivered +102.8% returns with zero effort

- Timing is hard: Even a systematic approach underperformed by 47.6%

- Bull markets favor buy-and-hold: When markets trend up consistently, staying invested beats switching

- Risk management has value: Lower drawdowns matter, even if total returns suffer

The Verdict

In this face-off, the tortoise (SPY buy-and-hold) beat the hare (trend-following strategy) by staying consistent and avoiding the costs of overthinking. However, this doesn't mean active strategies are always inferior - just that they face an uphill battle during strong bull markets.

The most important lesson? No single strategy works in all environments. The best approach might be understanding when to use each one.

Methodology note: This analysis used weekly data and monthly rebalancing with a 200-day moving average. Transaction costs, taxes, and slippage were not included. Past performance does not guarantee future results.

Generated on November 20, 2025

Comments (0)

No comments yet. Be the first to comment!