Nov 18 News: Buffett's Evolution, Bitcoin's Fall, and NVIDIA's Test

Mid-November 2025 brought three critical turning points to US financial markets. Warren Buffett's surprising tech investment, Bitcoin's dramatic crash, and NVIDIA's highly anticipated earnings report—the symbol of the AI revolution. While these events unfolded in different asset classes, they all pose a common question: "When market confidence wavers, what should investors focus on?"

In this article, we'll analyze these three stories through data and charts, uncovering the investment lessons hidden within.

1. Berkshire Hathaway Finally Embraces Google

📊 What Happened?

On November 14, 2025, Berkshire Hathaway disclosed through its 13F filing that it purchased 17.9 million shares of Alphabet (Google's parent company) worth approximately $4.3-4.9 billion during Q3 (July-September). This became Berkshire's 10th largest stock holding, and the news sent Alphabet shares surging more than 3% on Monday.

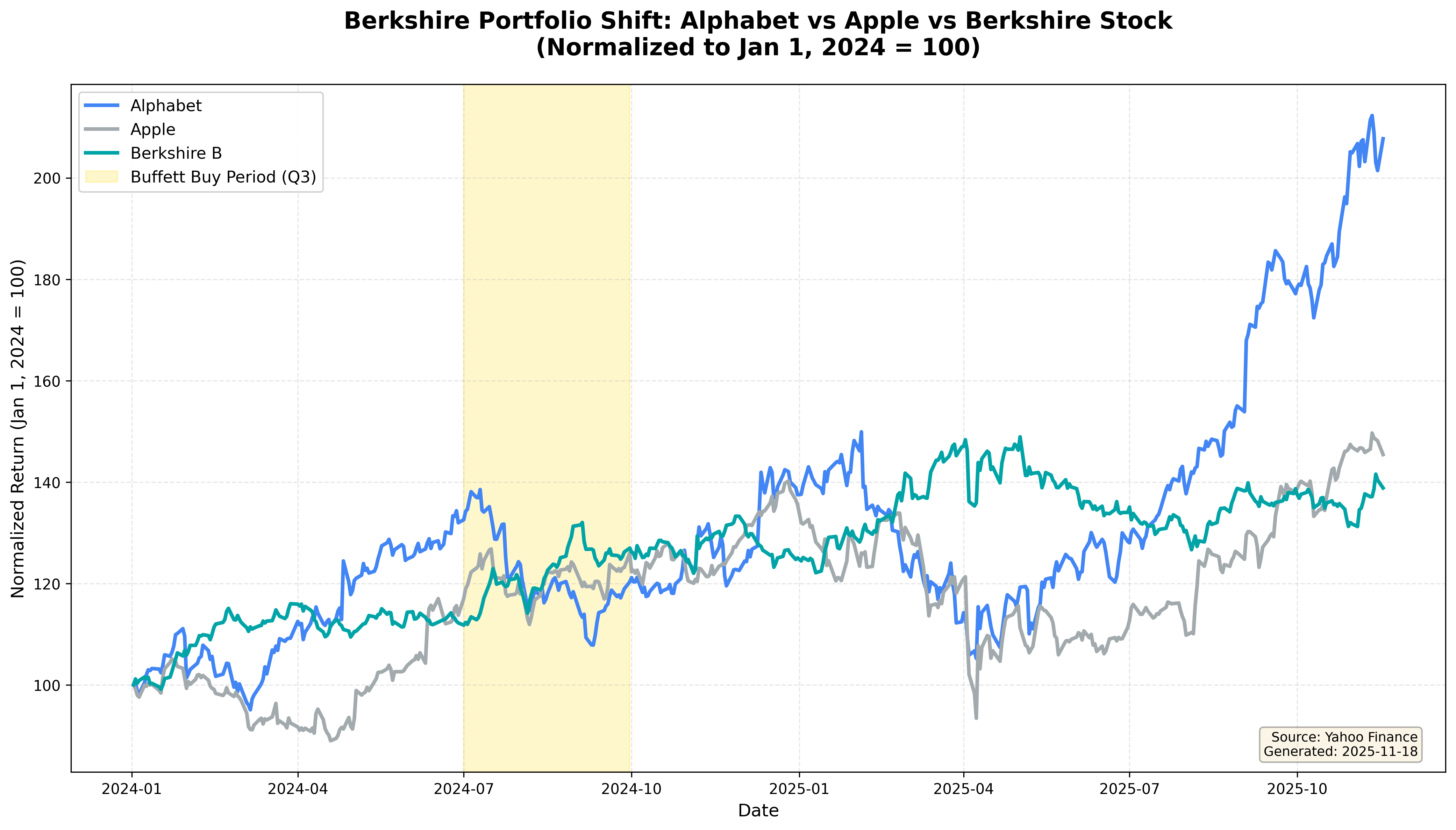

The chart above compares the returns of Alphabet, Apple, and Berkshire Hathaway itself since early 2025. The gold-shaded Q3 period marks when Buffett made his Alphabet purchases.

🔍 Why This Matters

Warren Buffett has spent a lifetime avoiding technology stocks. Even with Apple, he justified his investment by calling it a "consumer products company" rather than a tech firm. Yet here he is, at age 95 and just before stepping down as CEO, investing billions in pure-play tech company Google.

Intriguingly, Buffett already expressed regret about not investing in Google earlier at the 2018 shareholder meeting. At the time, Berkshire-owned insurance company Geico was paying Google $10 per click for ads with tremendous results, yet he didn't invest. As he said:

"We witnessed firsthand that Google could make money. But I didn't act. This was purely my mistake."

This investment appears to be a belated correction of that regret. While the actual purchases were likely led by Buffett's lieutenants Todd Combs or Ted Weschler, the $4.9 billion size would have required Buffett's approval.

📈 What The Chart Tells Us

The chart clearly shows that Alphabet has surged approximately 46% in 2025, powered by its AI cloud business boom. In contrast, Apple—which Buffett has been steadily selling—has underperformed, and Berkshire's own stock hasn't matched Alphabet's gains.

During the same period, Buffett sold an additional 15% of his Apple stake, executing a portfolio rebalancing. This isn't merely swapping one stock for another—it's a strategic shift from yesterday's winner (Apple) to tomorrow's winner (Alphabet).

Remarkably, Berkshire made this rare purchase while maintaining its 12-quarter net selling streak and accumulating $382 billion in cash. This signals Buffett's high conviction in Alphabet's value.

💡 Investment Lesson

"Even great investors acknowledge past mistakes and adapt to changing times."

Buffett regretted missing Google earlier and, this time, took action—albeit belatedly. His value investing principles of "competitive moat" and "cash generation power" can indeed apply to tech companies. Alphabet has established stable cash flows through its three-pillar strategy: Search, YouTube, and Cloud, positioning itself as infrastructure for the AI era.

The message for investors is clear: "Hold to your principles, but don't resist the changes the times demand."

2. Bitcoin Hits 6-Month Low: The Fed Ended the Party

📊 What Happened?

On November 14, 2025, Bitcoin fell below $95,000, marking its lowest level since May. From October's all-time high of $126,000, it crashed 24% in just one month, including a 9% drop last week alone. On Monday, it plunged to $92,000, with Bitcoin ETFs seeing maximum daily outflows of $318 million.

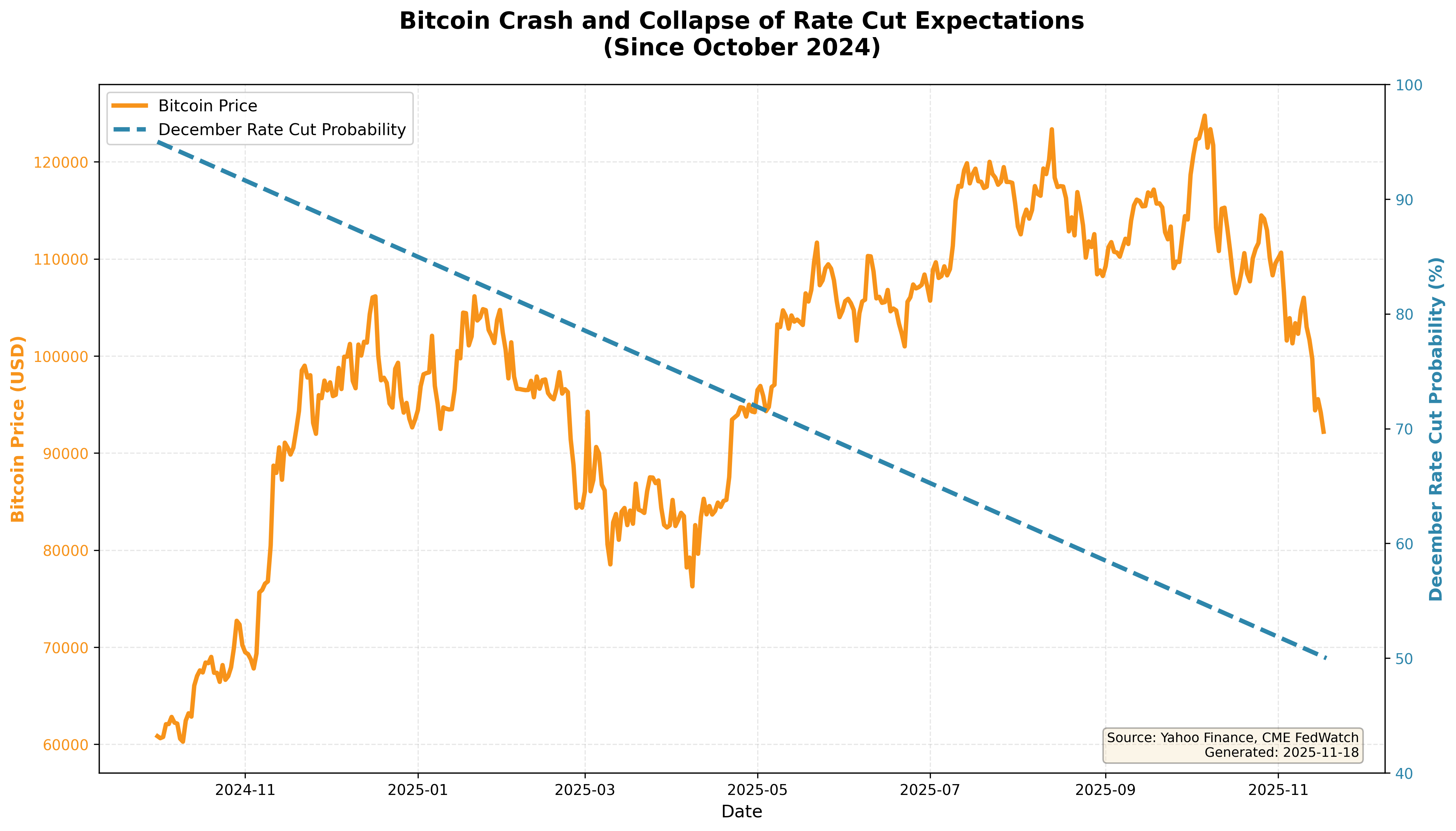

The chart above displays Bitcoin price (orange solid line) and December rate cut probability (blue dashed line) on dual axes since October 2025. Notice how both lines decline almost in tandem.

🔍 Why This Matters

The immediate cause of Bitcoin's crash is clear: The probability of a December Fed rate cut plummeted from 95% a month ago to below 50% currently.

Fed Chair Jerome Powell warned after the October meeting that "a December rate cut is far from it," while multiple Fed officials expressed inflation concerns and adopted more hawkish stances. Additionally, a government shutdown (since resolved) suspended economic data releases, leaving markets in "blind flight" mode, and concurrent AI tech stock declines accelerated Bitcoin selling.

Bitcoin is an asset that thrives in low-interest-rate environments. When rates are low, investors seek higher returns in riskier assets. But when rates rise (or rate cut expectations vanish), capital retreats to safe havens (Treasury bonds, cash). The chart illustrates this relationship dramatically.

📉 What The Chart Tells Us

The chart reveals an almost perfect inverse correlation between Bitcoin price and rate cut probability. When rate cut probability was 95% in early October, Bitcoin peaked; as probability fell to 50% by mid-November, Bitcoin crashed to $92,000.

This demonstrates that Bitcoin is no longer "independent digital gold." As institutional investors dominate the market, Bitcoin has evolved into a "macro asset" sensitive to Fed monetary policy, real economic indicators, and global liquidity.

November alone saw $3.2 billion in forced liquidations, and the Fear & Greed Index plunged to "extreme fear (10)" levels. Leverage liquidations and ETF outflows amplified short-term panic, though fortunately this isn't the 80% crash "crypto winter" seen in 2018 or 2022.

💡 Investment Lesson

"Bitcoin is now a macro asset. You can't ignore the Fed."

Bitcoin investors once believed in narratives of "decentralization" and "assets beyond government control." But reality differs. With institutional investors comprising over 50% of the market, Bitcoin has become part of the "liquidity game" alongside NASDAQ, gold, and Treasury bonds.

In the short term, the Fed's December decision will be the critical variable determining direction. However, for long-term investors, such corrections could present buying opportunities. Just avoid leverage at all costs. As the chart shows, Bitcoin remains an extremely volatile asset.

3. NVIDIA Earnings: Is AI Investment a Bubble or Revolution?

📊 What Happened?

NVIDIA's Q3 earnings report, scheduled for after market close on Wednesday, November 20, 2025, is the market's biggest focus. Ahead of the announcement, Monday saw the Dow drop 557 points (-1.18%), S&P 500 down 0.92%, NASDAQ down 0.84%, with NVIDIA shares falling 2%.

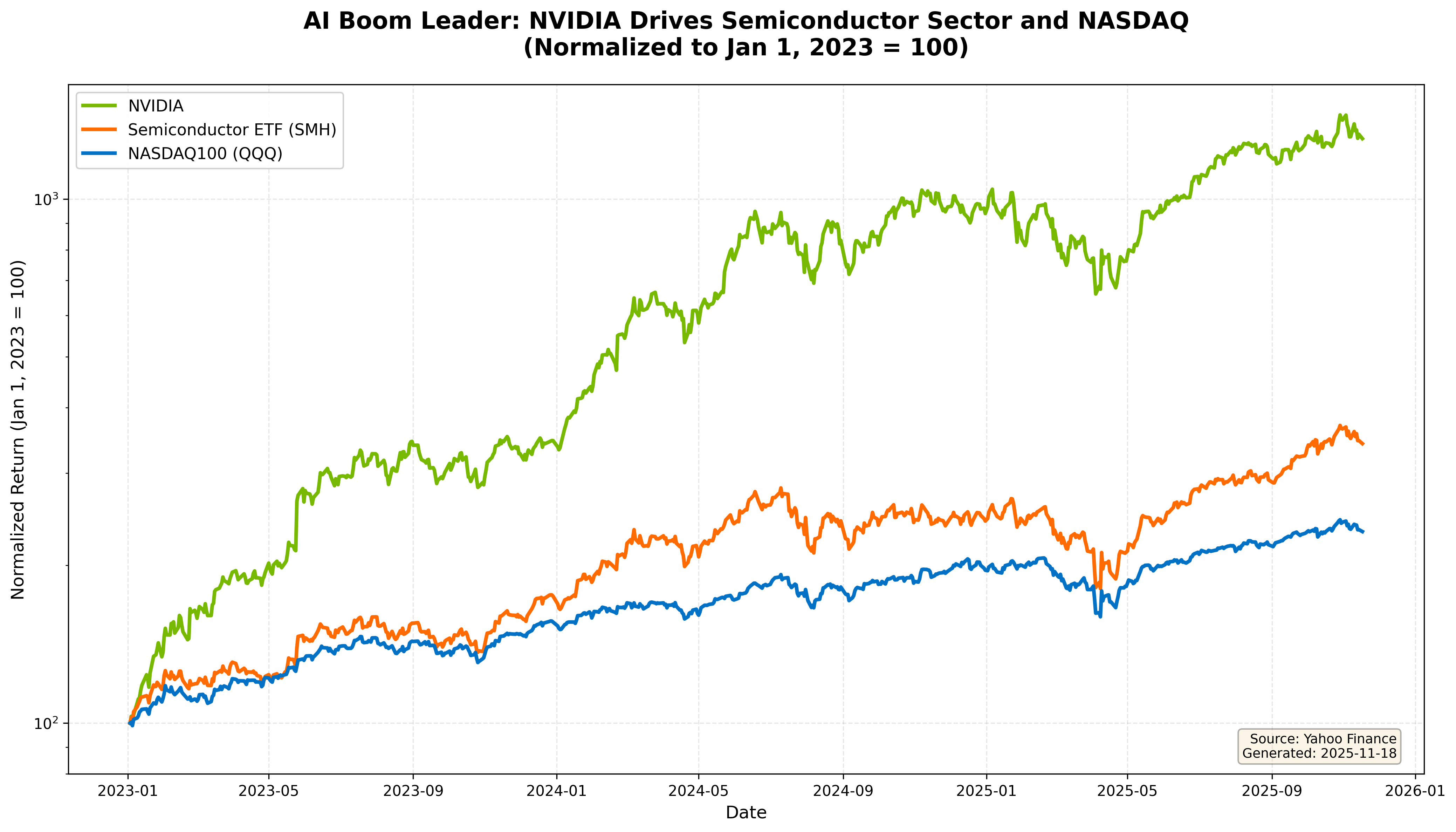

The chart above compares returns of NVIDIA (green), Semiconductor ETF (orange), and NASDAQ100 (blue) on a log scale since early 2023. NVIDIA's explosive rise and its pull on the entire sector are immediately visible.

🔍 Why This Matters

NVIDIA is the symbol of the AI boom. Over the past two years, its stock has soared to reach the top tier of market capitalization, delivering surprise earnings every quarter as data center GPU demand exploded. However, recently skepticism about AI investment has been growing.

Big Tech companies (Microsoft, Amazon, Google, Meta) are investing hundreds of billions in AI, but actual monetization is slow—that's the concern. Morgan Stanley forecasts AI hyperscalers will invest $3 trillion in data center infrastructure by 2028, but debate rages over whether this is a "bubble."

NVIDIA's earnings will provide decisive data for this debate. If NVIDIA delivers above-expectation results with strong guidance, AI skepticism will temporarily subside. But disappointing results could trigger a correction across the tech sector.

Intriguingly, news that SoftBank and Peter Thiel's Founders Fund recently sold all NVIDIA holdings has also unnerved investors. Did they read the peak, or was it simply rebalancing?

📈 What The Chart Tells Us

The chart demonstrates NVIDIA's overwhelming dominance. Since early 2023 (normalized to 100), NVIDIA has surged hundreds of percentage points (log scale used), with the semiconductor ETF also showing substantial gains. While NASDAQ100 also rose, it's modest compared to NVIDIA.

This means two things:

- NVIDIA is the core driver of the semiconductor sector

- NVIDIA's volatility creates ripple effects across the entire market

Meanwhile, Thursday's September employment report will also be a crucial variable influencing the Fed's December rate decision. The market has relied on "two pillars": AI investment and rates—and now both pillars are shaking.

💡 Investment Lesson

"Markets move on narratives, but ultimately numbers tell the truth."

AI is a revolutionary technology in the long term. But short term, it can be overvalued. NVIDIA's earnings will answer the question: "Is AI investment converting into actual profits?"

Investors must be most cautious "when everyone is confident." Concentrated expectations create large volatility. If NVIDIA exceeds expectations, markets will celebrate; if it disappoints, harsh corrections will follow.

As the chart shows, NVIDIA has already risen too much. In such situations, investors must coldly evaluate "valuation versus earnings growth rate." AI is the future, but stock prices are the present.

Conclusion: What Investors Should Focus On Amid Uncertainty

In mid-November 2025, US markets delivered one common message through three different stories:

- Berkshire's Alphabet Investment: Even great investors acknowledge past mistakes and adapt to change

- Bitcoin's Crash: All assets are sensitive to liquidity and rates. No asset is truly independent

- NVIDIA's Test: Markets move on narratives, but ultimately earnings tell the truth

While these three events occurred in different asset classes, they all teach a common lesson: "When confidence wavers, seek true value."

Practical Advice for Investors

- Portfolio Diversification: Don't go all-in on one asset class. Even Buffett rebalanced from Apple to Alphabet

- Understand Macro: Whether you invest in Bitcoin or stocks, you cannot ignore Fed policy

- Verify Earnings: AI, metaverse, crypto... all themes must ultimately be proven with numbers

- Prepare for Volatility: Stocks that rise quickly (like NVIDIA) can fall quickly too. Use leverage cautiously

- Long-term Perspective: Don't be swayed by short-term volatility; think 5-10 years ahead

Markets are always uncertain. But data and charts show us cold truths. Invest based on facts, not emotions. That's the path Buffett and all successful investors have walked.

Disclaimer: This article is provided for informational purposes only and does not constitute investment advice. All investment decisions are your own responsibility.

Data Sources: Yahoo Finance, CME FedWatch, SEC 13F Filings Publication Date: November 18, 2025

Comments (0)

No comments yet. Be the first to comment!