Supreme Court Questions Trump Tariffs... Market Hopes for Rollback Grow

1. Supreme Court Tariff Hearing Sparks Market Optimism

On Wednesday, November 5, the U.S. Supreme Court held a hearing on President Trump's authority to impose tariffs. The key issue was whether the president has the power to impose such tariffs under the International Emergency Economic Powers Act (IEEPA). As Supreme Court justices posed tough questions about the tariffs, investor expectations grew that some tariffs could be rolled back.

Context: The Trump administration announced aggressive tariff policies in April 2025, causing the S&P 500 to plunge 19%. However, as markets crashed, the administration rolled back some of the most aggressive measures, and markets subsequently rallied for six consecutive months. This Supreme Court hearing represents a critical opportunity to review the legal basis for the tariff policy.

Lesson: Markets closely watch the "actual enforceability" of policies. The "final enforcement form" that passes through legal and political constraints has a greater impact on stock prices than initial extreme policy announcements.

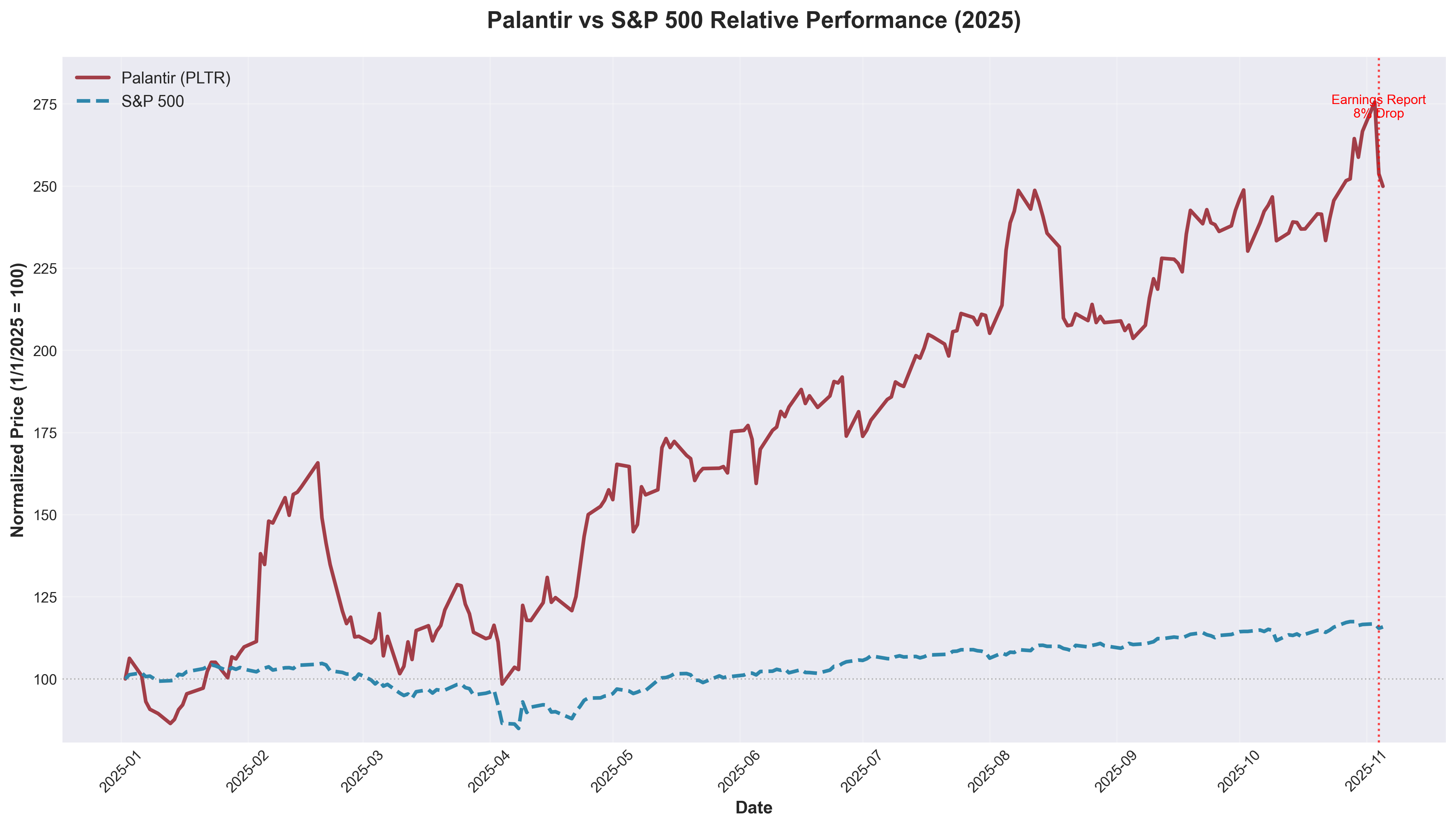

2. AI Valuation Warning: The Message from Palantir's Plunge

On Tuesday, November 4, Palantir (PLTR) shares plummeted 8%. This happened despite the company beating Q3 earnings estimates and providing strong guidance. U.S. business growth surged 77% year-over-year and 2025 revenue guidance was raised, but shares fell due to a forward P/E ratio exceeding 200x. Investors were concerned about lack of visibility into 2026.

Context: AI-related stocks had been strong throughout 2025, but high valuations have always been a double-edged sword. Goldman Sachs CEO David Solomon and Morgan Stanley CEO Ted Pick warned of a 10-20% market correction within the next 12 months. As the market rally increasingly concentrates in fewer stocks, technical indicators are also showing overheating signals.

Lesson: "Good earnings" and "stock price appreciation" are separate matters. High valuations can only be justified if companies consistently beat expectations by wide margins. When the market has already priced in "perfect results," good earnings alone may not be enough.

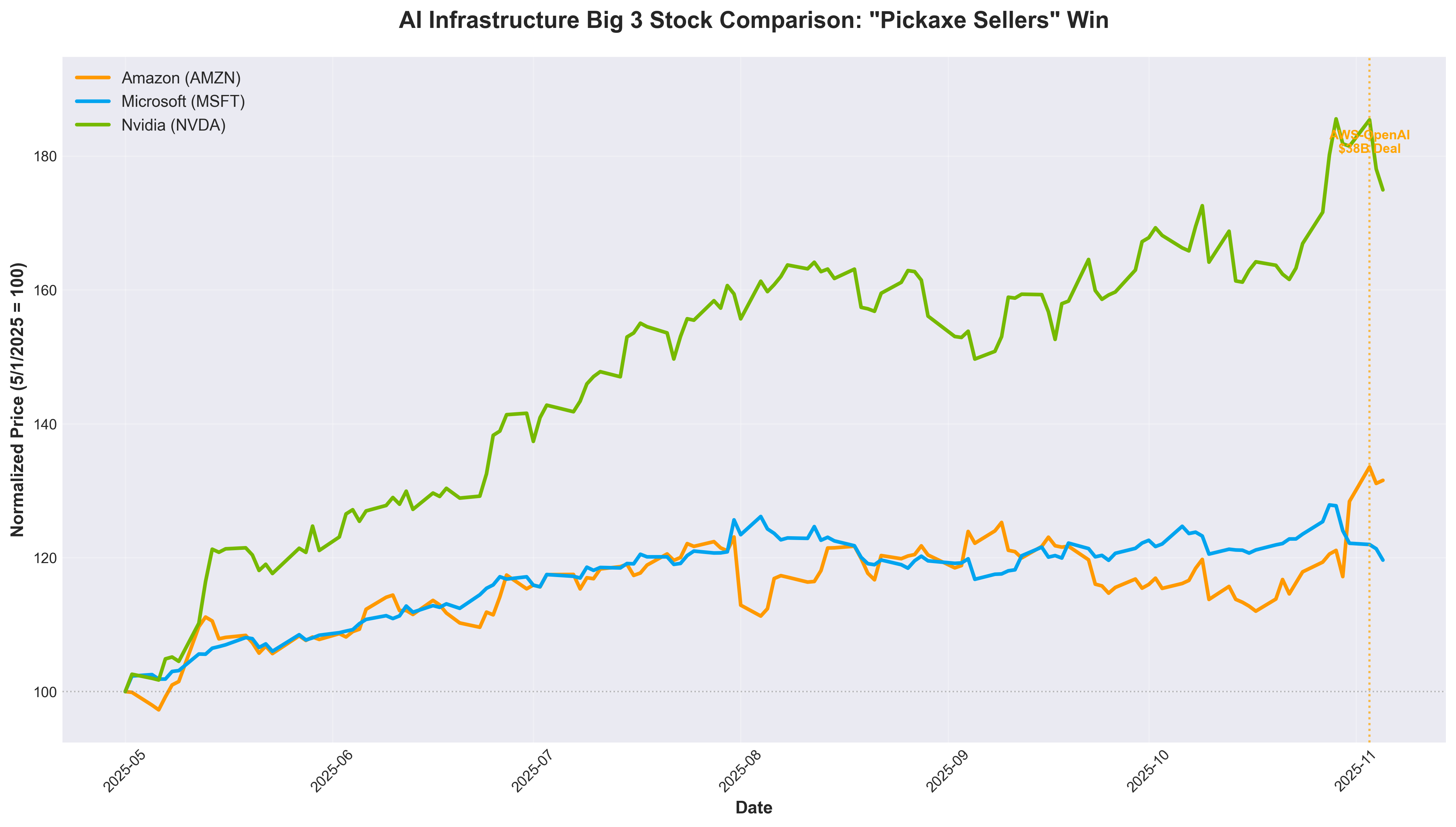

3. Amazon-OpenAI $38B Mega Deal: New Phase in Cloud Wars

On Monday, November 3, Amazon and OpenAI signed a $38 billion contract over 7 years. This deal gives OpenAI access to hundreds of thousands of Nvidia GPUs on AWS infrastructure. Amazon shares surged 4%, and Nvidia shares also rose more than 2%.

Context: This marks the first major contract with AWS, the cloud infrastructure industry leader, signaling that the $500 billion AI startup will no longer rely solely on a single supplier. On the same day, data center company IREN also signed a 5-year, $9.7 billion contract with Microsoft to provide access to Nvidia GB300 GPUs.

Lesson: The biggest beneficiaries of the AI boom are not just the companies building AI models, but the "pickaxe sellers" providing the infrastructure. During the gold rush era, the people who made the most reliable profits weren't those who panned for gold, but those who sold pickaxes.

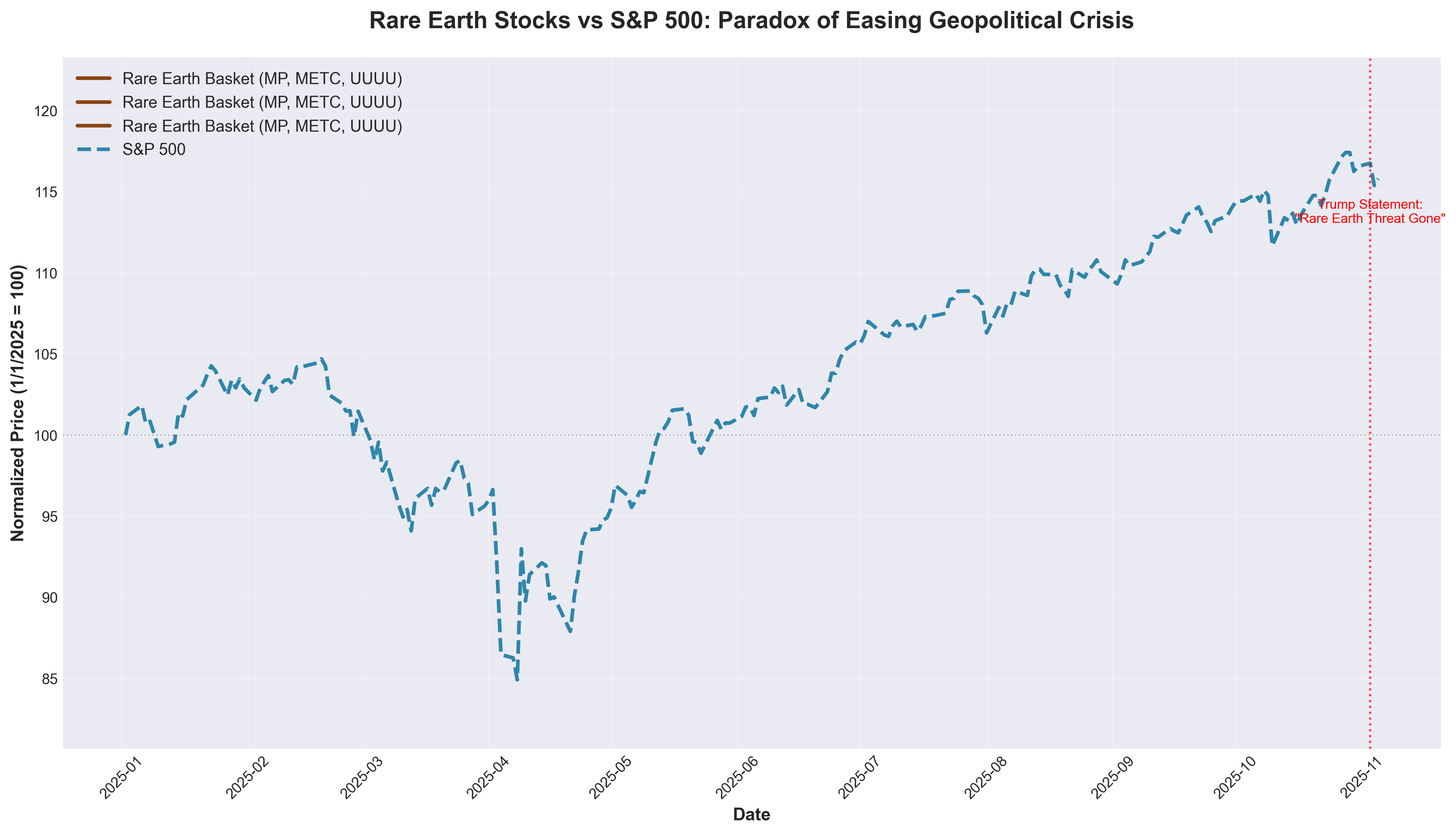

4. Rare Earth Crash: The Paradox of Trump-Xi Summit

On Monday, November 3, after President Trump announced in a CBS interview that China's rare earth threat had "completely disappeared," rare earth-related stocks plunged. MP Materials (MP) fell 4.5%, USA Rare Earth (USAR) dropped 6.2%, Ramaco Resources (METC) declined 6.5%, and Energy Fuels (UUUU) fell 6.7%.

Context: At the U.S.-China summit held in South Korea in early November, China agreed to postpone the strict rare earth export controls introduced in early October for at least one year. China controls 70% of global rare earth mining, 90% of separation and processing, and 93% of magnet manufacturing. U.S. rare earth companies had expected China's export controls to increase demand for their products, but as the threat disappeared, the investment thesis also weakened.

Lesson: "Crisis" often becomes an investment opportunity for specific sectors. However, when geopolitical tensions ease, investment theses based on crisis quickly collapse. Rare earth companies temporarily lost their value as a "China risk hedge."

5. October Employment Surprise: Labor Market Collapse Fears Ease

On Wednesday, November 5, the ADP employment report showed private sector jobs increased by 42,000 in October. This exceeded expectations of 22,000 jobs added. While September saw a decline of 29,000 jobs, the revised figure showed 3,000 fewer losses. An increase of 47,000 in trade, transportation, and utilities offset losses in other sectors.

Context: The U.S. economy is demonstrating that the labor market hasn't completely collapsed despite uncertainties such as the government shutdown (now in its 5th week) and delayed SNAP food assistance payments. Bank of America warned that delays in food assistance payments could reduce November consumer spending by up to 0.5 percentage points. However, the worst-case scenario was avoided when a federal judge ordered SNAP benefits to be paid with emergency funds.

Lesson: The labor market is a "lagging indicator," not a "leading indicator" of the economy. However, if employment remains stable, consumption continues, leading to a virtuous cycle of economic growth. The fact that companies continue to hire amid policy uncertainty suggests we should be cautious about excessive fears of recession.

Comments (0)

No comments yet. Be the first to comment!