Can You Replicate JEPQ's Income with QQQ? A Real-World Backtest

What happens when you try to turn a growth ETF into an income machine? I ran the numbers, and the results might surprise you.

The Million-Dollar Question

You've probably heard this debate before: "Why pay fees for an income ETF like JEPQ when you could just sell shares of QQQ periodically to create your own dividends?"

It sounds logical, right? QQQ has historically delivered better growth, so theoretically, you could invest in QQQ, let it compound, and then sell small portions whenever you need income. You'd get the best of both worlds: growth potential and regular cash flow.

But does this strategy actually work in practice? I decided to find out by running a comprehensive backtest comparing two approaches:

- The "Natural" Approach: Buy JEPQ and collect its monthly dividends

- The "DIY" Approach: Buy QQQ, reinvest its quarterly dividends, but sell shares whenever JEPQ pays dividends to match the exact cash flow

Both strategies started with $10,000 on May 04, 2022, and I tracked them through November 07, 2025. Here's what I discovered.

The Setup: Two Investors, One Goal

Let's call our investors Alice and Bob. Both start with $10,000 to invest.

Alice (The JEPQ Investor)

- Buys 288.1 shares of JEPQ at $34.71 per share

- Collects monthly dividends as cash

- Holds her shares and lets them grow

Bob (The QQQ "Dividend Mimicker")

- Buys 31.0 shares of QQQ at $322.21 per share

- Reinvests QQQ's quarterly dividends to buy more shares

- Sells shares whenever JEPQ pays dividends to generate identical cash flow

The key question: Who comes out ahead after 3.5 years?

The Results: A Tale of Two Strategies

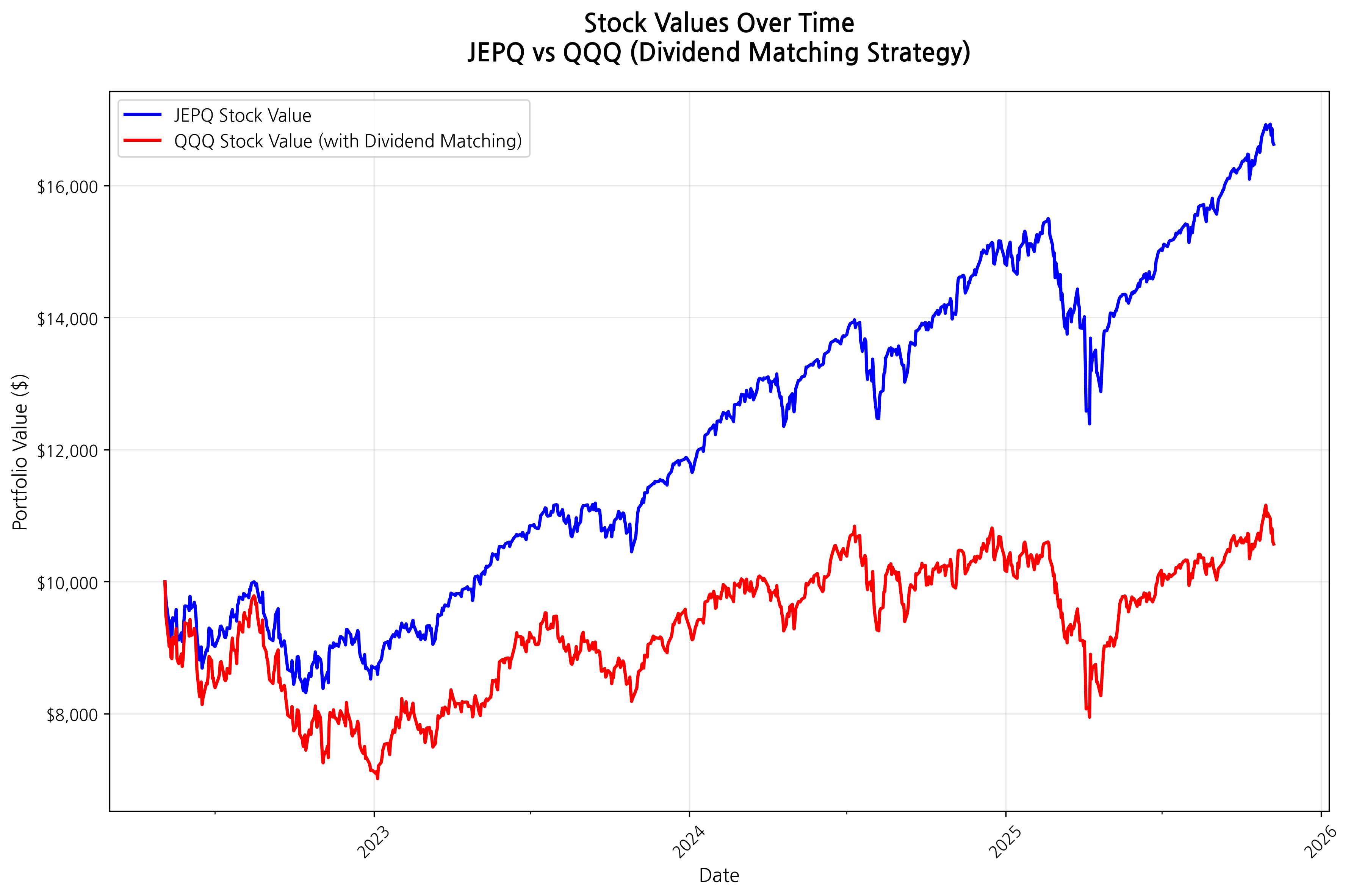

Stock Values: The Growth Story

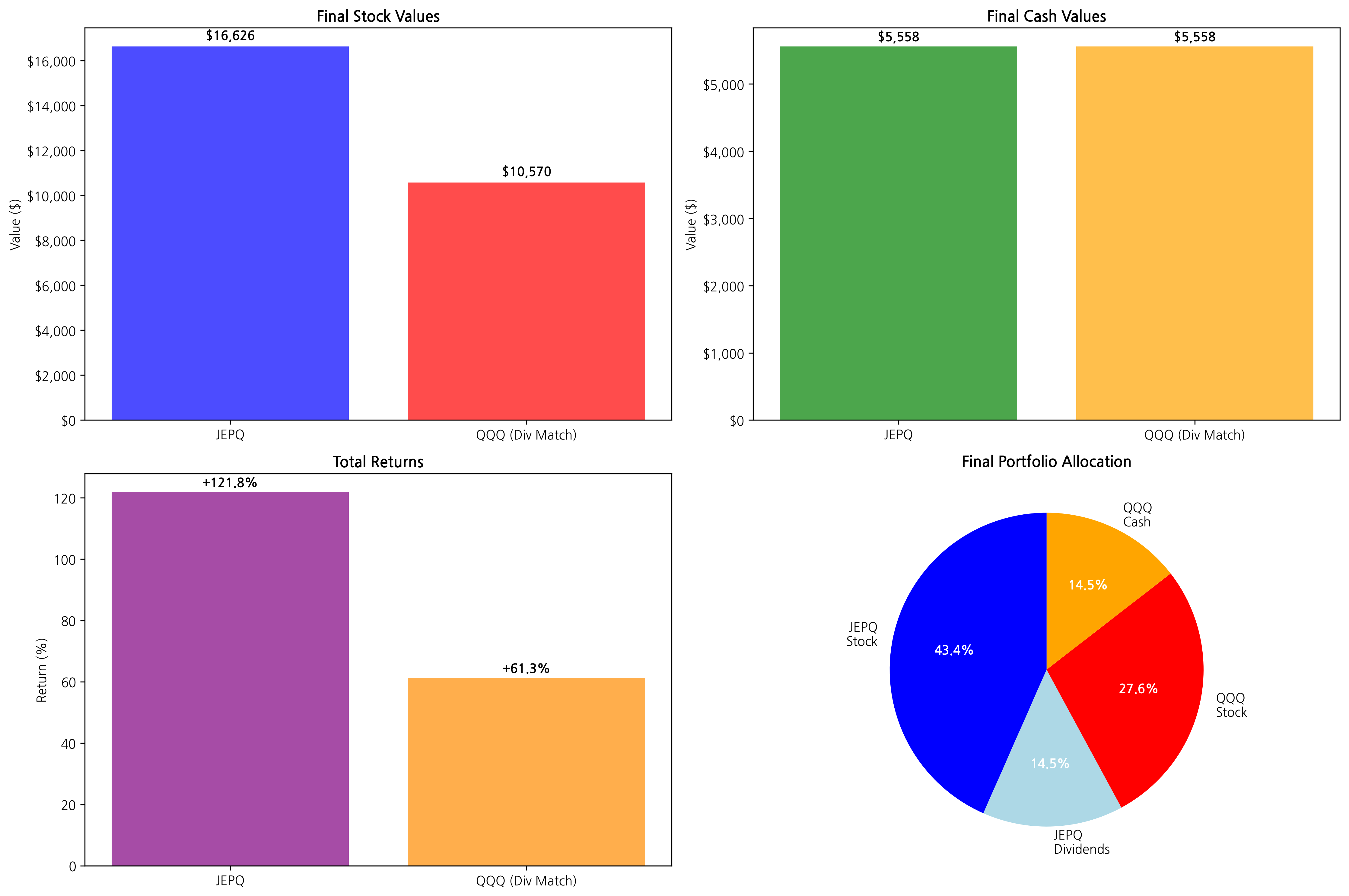

The stock value chart tells an interesting story. Alice's JEPQ shares grew steadily from $10,000 to $16,626 – a respectable performance for an income-focused ETF.

Bob's story is more complex. His QQQ shares initially grew alongside QQQ's impressive performance, but then something interesting happened: his stock value started declining. Why? Because every time JEPQ paid dividends, Bob had to sell QQQ shares to match that cash flow.

By the end, Bob owned only 17.3 shares compared to his original 31.0 shares. His remaining QQQ position was worth just $10,570.

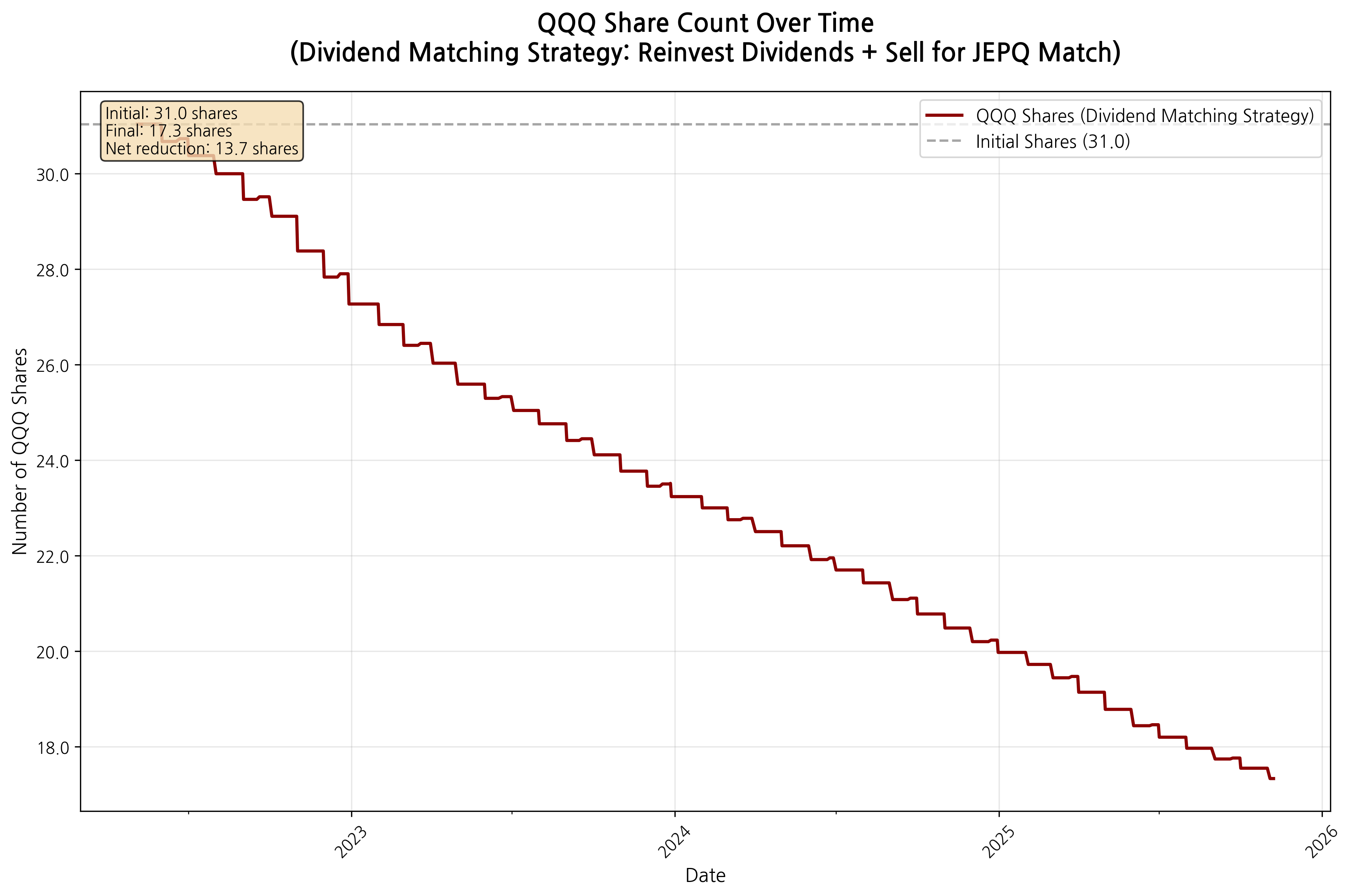

The Share Erosion: Bob's Hidden Cost

This chart reveals the true cost of Bob's strategy. Starting with 31.0 QQQ shares, Bob's position gradually eroded over time. Each time JEPQ paid dividends, Bob had to sell shares to match that cash flow.

The pattern is clear: Bob's share count dropped from 31.0 to 17.3 shares – a reduction of 13.7 shares or 44.1% of his original position. Those sold shares would have participated in QQQ's continued appreciation, representing a significant opportunity cost.

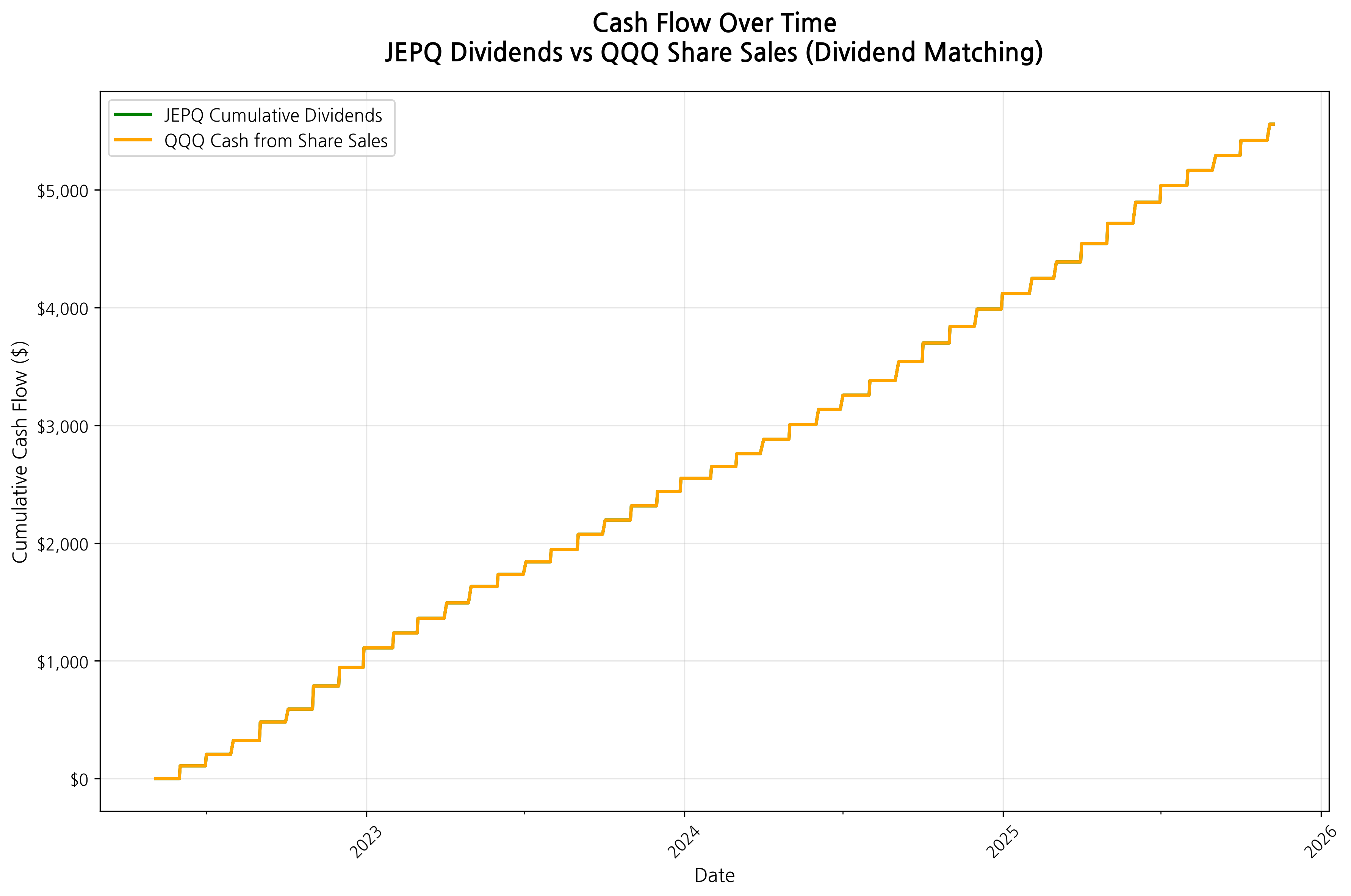

Cash Flow: Mission Accomplished?

Here's where Bob's strategy worked exactly as planned. The cash flow chart shows both investors generated identical income streams, ending with $5,558 in cash. Bob successfully replicated JEPQ's dividend payments by selling QQQ shares.

This proves the mechanical aspect of the strategy works: you can create artificial dividends by selling growth stocks. But at what cost?

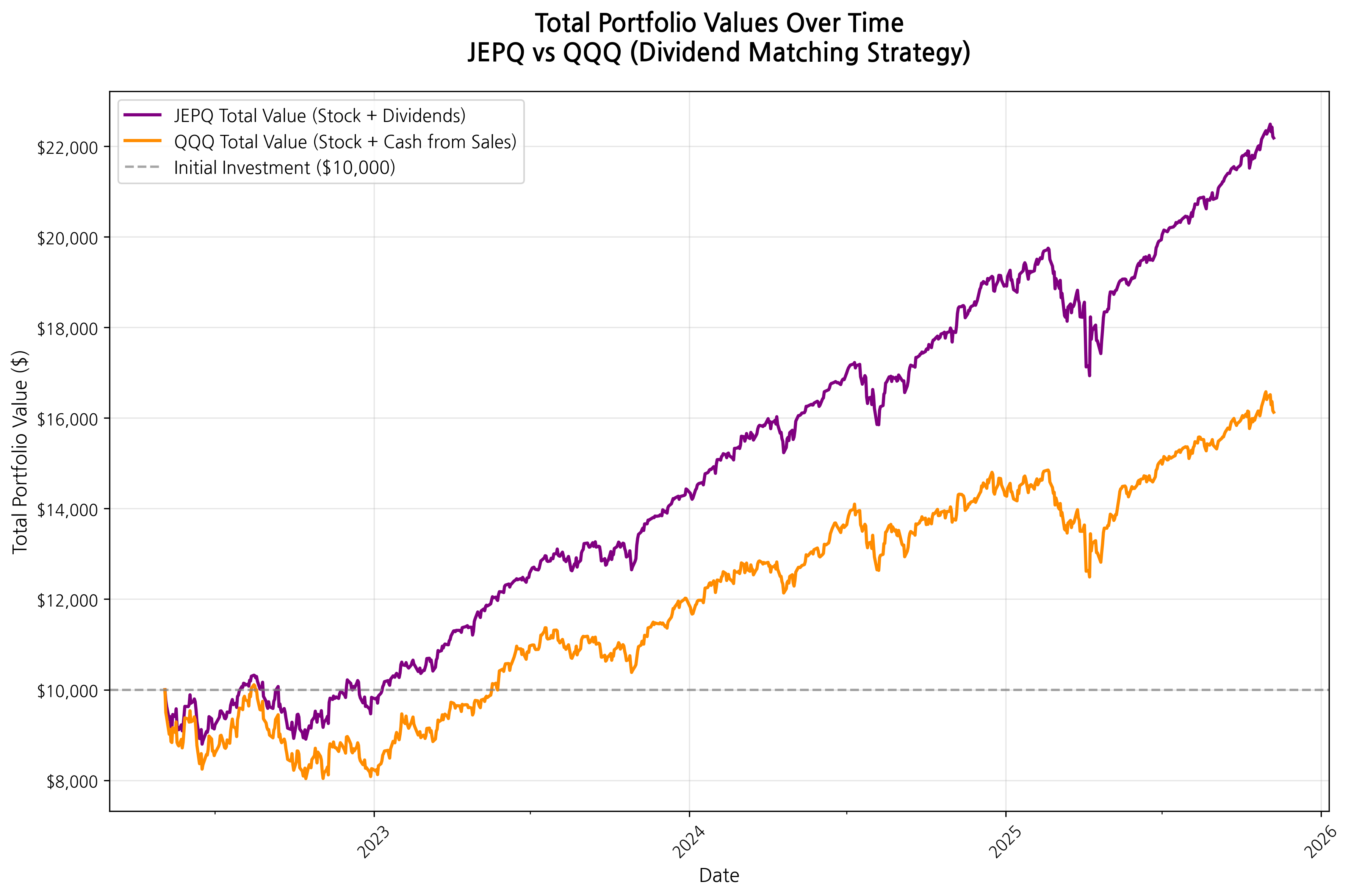

Total Performance: The Bottom Line

This is where the rubber meets the road. When we combine stock values with cash generated, the performance gap becomes clear:

Alice (JEPQ Strategy)

- Final Value: $22,184

- Total Return: +121.8%

Bob (QQQ Dividend Mimicking)

- Final Value: $16,128

- Total Return: +61.3%

Performance Gap: 60.6 percentage points in favor of JEPQ

Why Did the QQQ Strategy Underperform?

The numbers reveal a crucial insight about "creating your own dividends." While Bob successfully generated the same cash flow as Alice, he had to pay a hidden cost: opportunity cost.

Every time Bob sold QQQ shares to create artificial dividends, he was selling appreciating assets. Those shares he sold in 2022 and 2023 would have been worth much more by 2025. Alice, meanwhile, received her dividends without reducing her share count.

Here's the math that matters:

- Bob sold QQQ shares worth $5,558 over the investment period

- If he had kept those shares instead, they would have participated in QQQ's continued growth

- The "cost" of creating artificial dividends was the forgone appreciation on sold shares

The Performance Breakdown

The final performance summary reveals the complete picture:

What Worked Well for Bob:

- Successfully matched JEPQ's cash flow dollar-for-dollar

- Benefited from QQQ's dividend reinvestment during accumulation

- Proved the strategy is mechanically feasible

What Didn't Work:

- Selling appreciating QQQ shares created significant opportunity cost

- Total return lagged JEPQ by 60.6 percentage points

- Final portfolio was 60.6% smaller despite identical cash generation

The Real-World Lessons

1. Income and Growth Aren't Always Interchangeable

JEPQ generates income through options strategies and dividend collection without requiring investors to sell shares. QQQ generates returns primarily through capital appreciation. Converting appreciation into income isn't free – it costs you future growth potential.

2. Dividend-Focused ETFs Have Their Place

While growth investing often beats income investing in pure return comparisons, this backtest shows that income-focused funds like JEPQ can deliver both income and competitive total returns for investors who need regular cash flow.

3. Timing Matters More Than You Think

Bob's strategy required selling QQQ shares throughout the entire period, including during market downturns in 2022. Forced selling during various market conditions, rather than selling at optimal times, added to the strategy's underperformance.

4. The Hidden Costs of DIY Strategies

Creating artificial dividends sounds simple, but it involves:

- Transaction costs (not modeled in this backtest)

- Tax implications (selling shares triggers capital gains)

- Behavioral challenges (harder to stick with during volatile periods)

- Opportunity costs (as demonstrated by our results)

The Bottom Line

After 3.5 years and nearly 900 trading days, the verdict is clear: trying to replicate JEPQ's income by selling QQQ shares resulted in 60.6 percentage points of underperformance.

This doesn't mean income ETFs are always better than growth ETFs – that would depend on many factors including time horizon, market conditions, and specific funds compared. But it does show that converting growth into income isn't free.

For investors seeking regular income, this backtest suggests that dedicated income-focused investments like JEPQ may be more efficient than trying to create artificial dividends from growth investments.

For investors focused on total return, the traditional approach of holding growth investments like QQQ (without artificial dividend creation) would likely produce better results.

The key insight? Match your investment vehicle to your actual financial goals. If you need income, use income investments. If you need growth, use growth investments. Trying to force one to behave like the other often comes with hidden costs.

This analysis is based on historical data from May 04, 2022 to November 07, 2025 and should not be considered investment advice. Past performance doesn't guarantee future results, and all investments carry risk.

Methodology Note: This backtest assumed perfect execution with no transaction costs or taxes. Real-world implementation would face additional costs that could further widen the performance gap.

Comments (0)

No comments yet. Be the first to comment!