Jamie Dimon's Market Correction Warning — A Wake-Up Call Amid Optimism

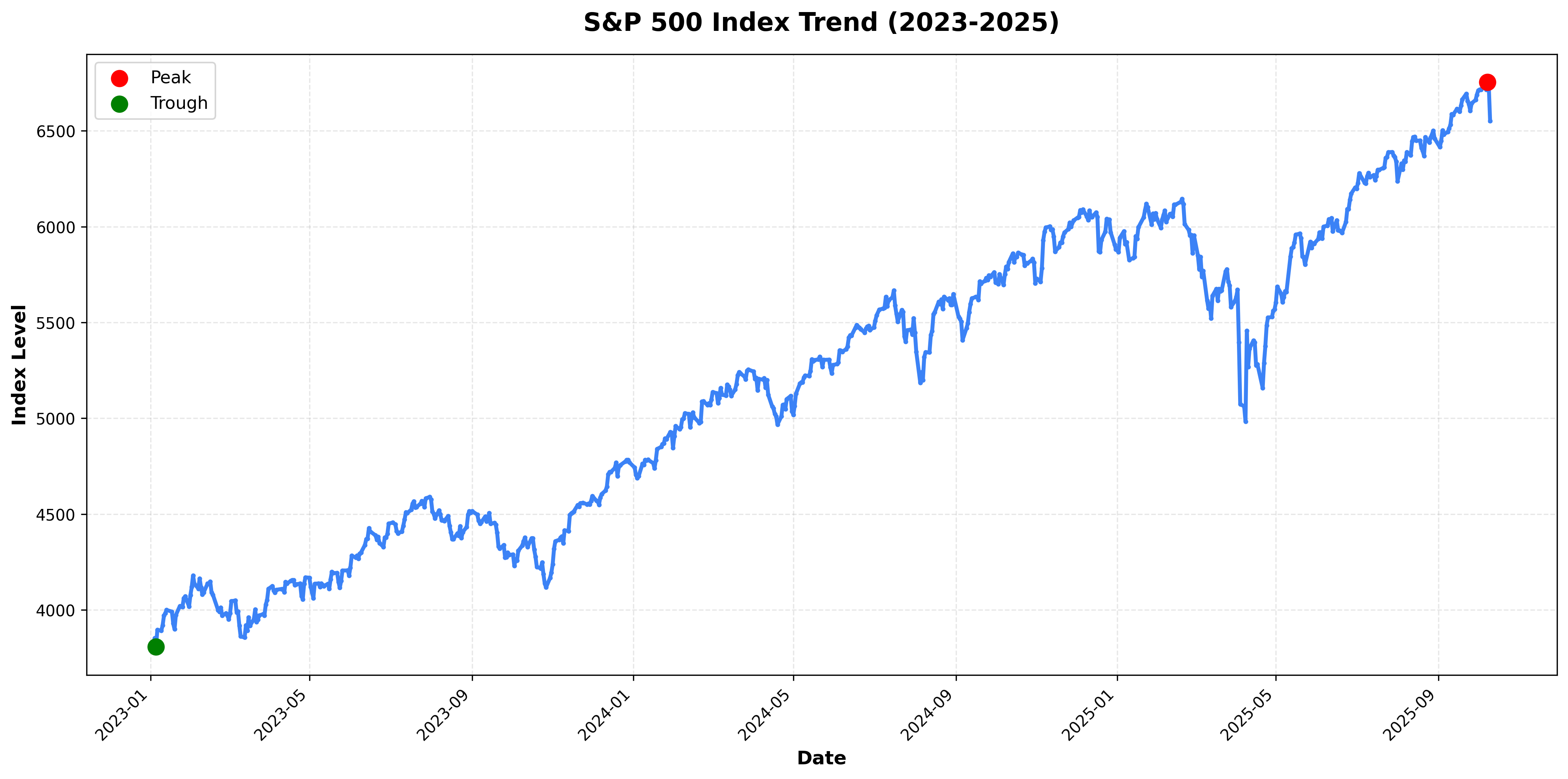

JPMorgan CEO Jamie Dimon recently warned in a BBC interview that "over the next 6 months to 2 years, U.S. stock markets are likely to experience significant correction." He wasn't talking about a minor pullback—he explicitly mentioned the possibility of market-wide repricing or a sharp decline. He cautioned against excessive optimism, noting that "market participants see only a 10% risk right now, but the actual probability of correction could be closer to 30%."

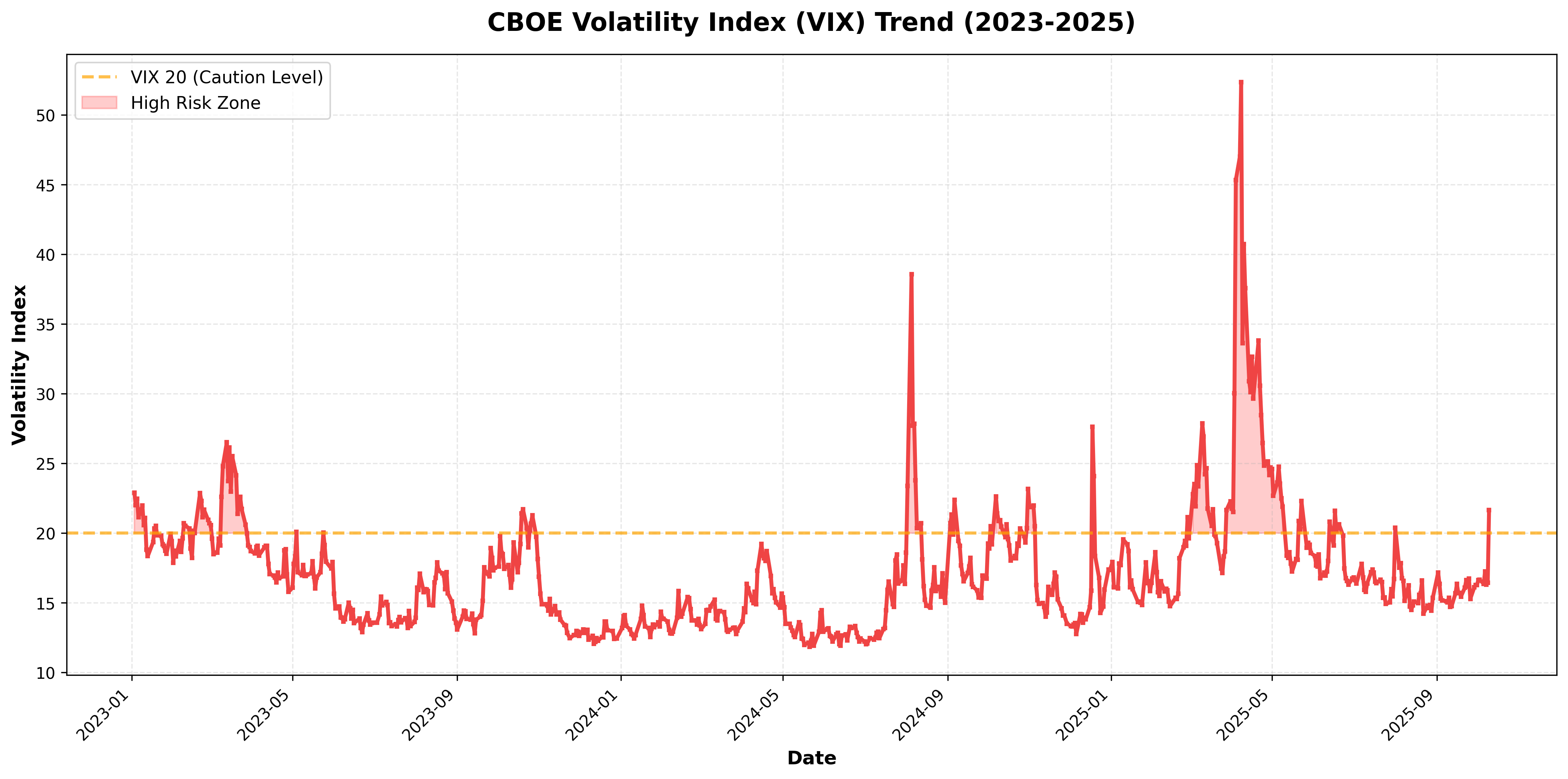

His message isn't simple pessimism—it's a call to recognize the absence of realistic risk awareness. Dimon described the current economic environment as "a bundle of compounding uncertainties." U.S.-China trade tensions, global military buildups, rising fiscal spending, and renewed inflationary pressures are all intertwined. Unlike the past, where investors could focus on one or two key risks, today multiple threats are converging simultaneously, creating a structure where markets could collapse quickly in one direction.

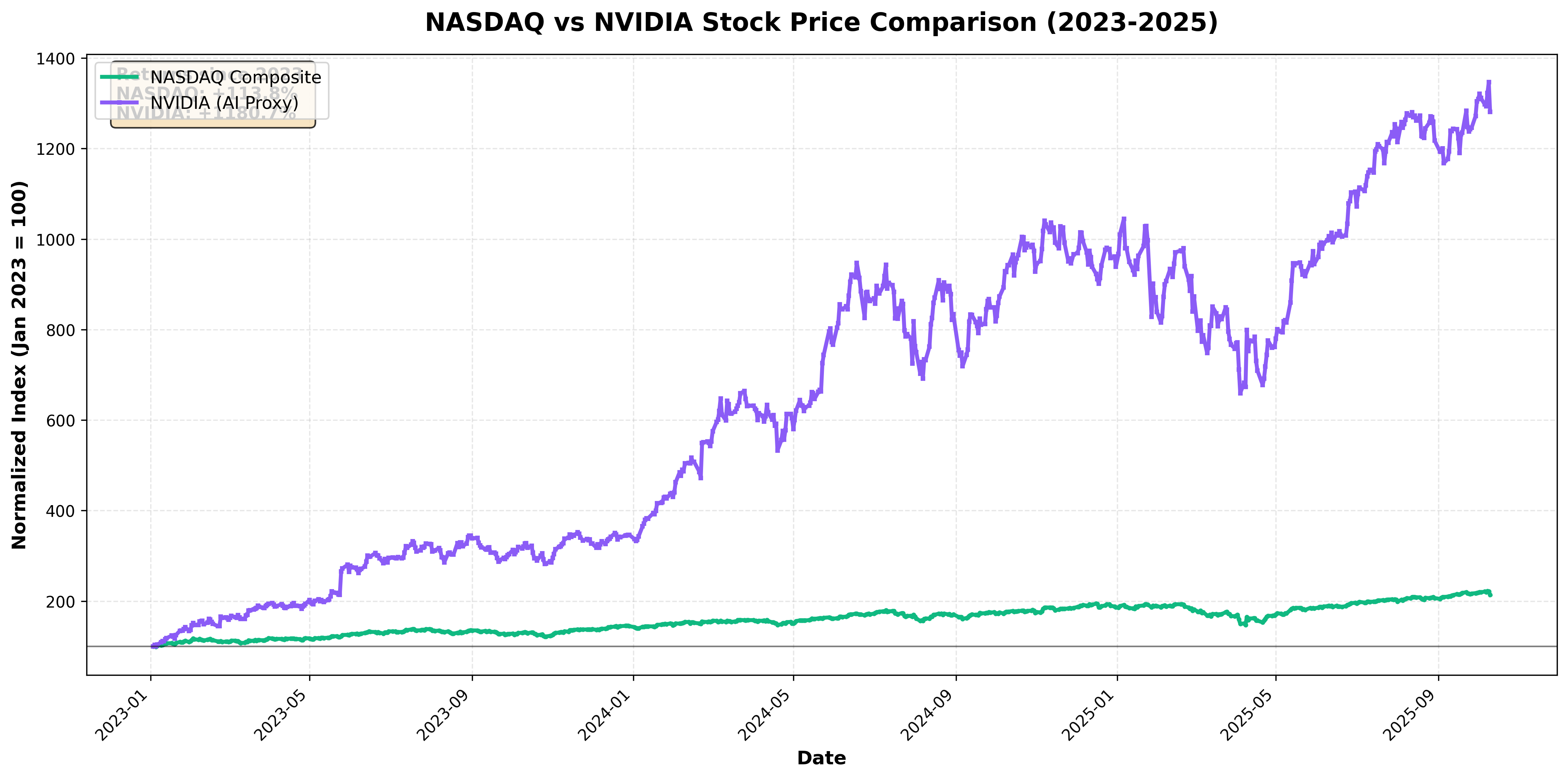

Dimon also expressed caution about the recent AI investment boom. "AI is real technology and will boost productivity in the long run. But the current situation, where all capital is flowing in one direction, is dangerous. Many investors could lose money," he said. This echoes the speculative frenzy of the 1990s dot-com bubble.

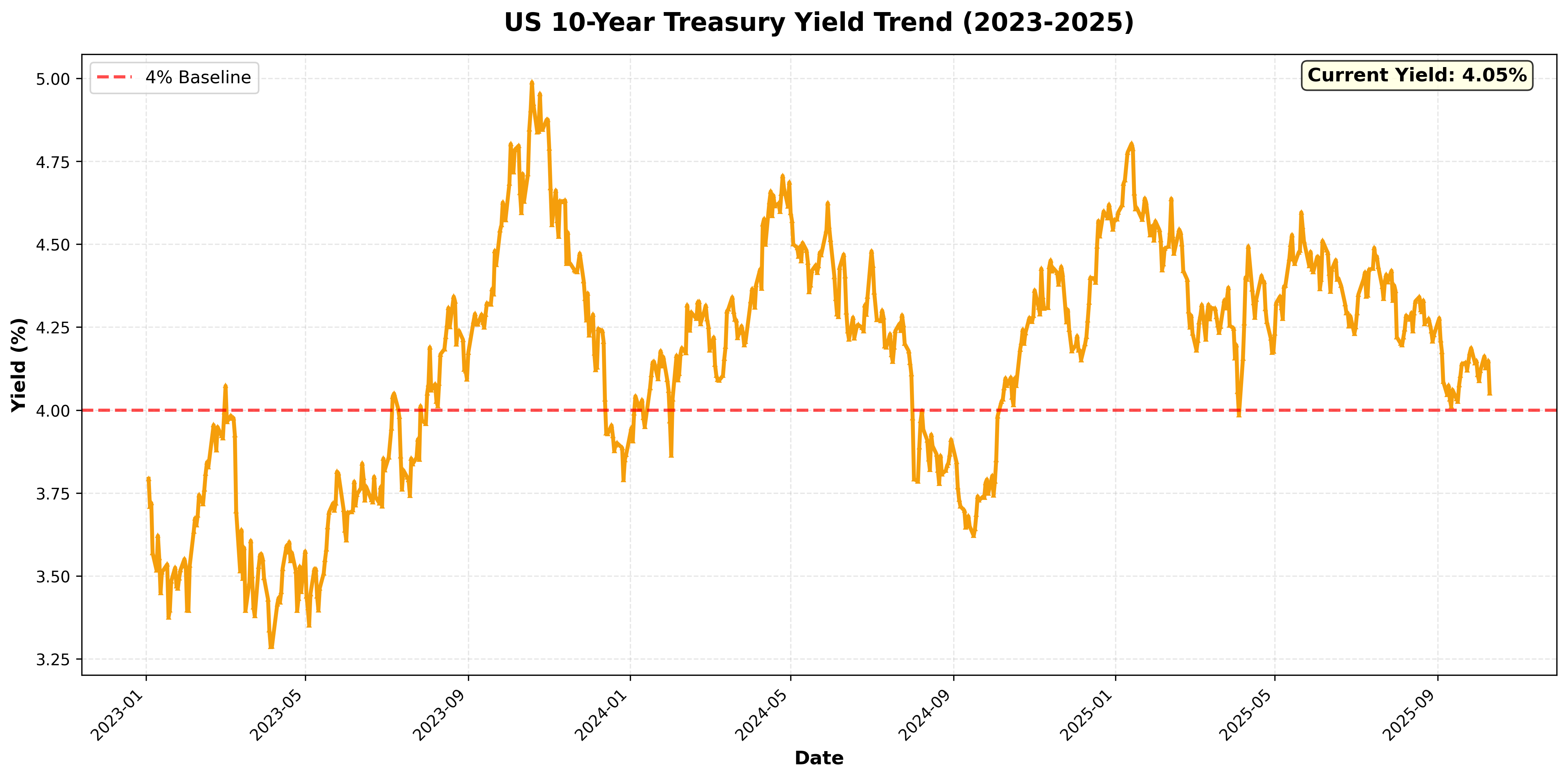

He also pointed out that expectations for interest rate cuts are excessive. While markets anticipate a swift pivot to easing, Dimon warned, "Inflation remains a latent risk, and the Fed won't easily lower rates." In other words, investors must abandon the illusion that the era of low interest rates will return.

Ultimately, his core message is: "Now is the time to be cautious." Markets have grown accustomed to rising prices, dulling their sense of risk—meaning any correction could hit harder than expected. He's effectively recommending defensive strategies such as increasing cash holdings, diversifying assets, and reassessing valuations. In summary, Dimon's warning is not about fear—it's a call to restore balance. The belief that "good times will continue indefinitely" may itself be the biggest risk.

Comments (0)

No comments yet. Be the first to comment!