Introduction

As inflation erodes the purchasing power of your hard-earned dollars, the search for effective hedges becomes increasingly important. Real estate has long been touted as one of the best inflation hedges available to investors. The logic seems sound: as the cost of living rises, so too should property values and rental income. But does this conventional wisdom hold up under scrutiny?

For many investors, Real Estate Investment Trusts (REITs) offer an accessible way to add real estate exposure to their portfolios without the headaches of direct property ownership. These publicly traded companies own, operate, or finance income-producing real estate across various sectors, from apartments and offices to shopping malls and data centers.

In this data-driven analysis, we'll examine whether REITs truly deliver on their promise as inflation hedges by analyzing their performance during two significant inflationary periods: the 2006-2008 housing bubble/financial crisis and the 2021-2023 post-COVID inflation spike.

Why Real Estate is Considered an Inflation Hedge

Before diving into the data, let's understand the theoretical reasons why real estate is often considered an effective inflation hedge:

- Rising rents: As inflation increases, landlords can typically raise rents to keep pace with or exceed inflation, leading to higher income streams.

- Increasing replacement costs: Inflation drives up the cost of construction materials and labor, making existing properties more valuable.

- Fixed-rate debt advantage: Property owners with fixed-rate mortgages benefit as inflation effectively reduces the real value of their debt over time.

- Limited supply: Unlike paper assets, real estate cannot be created infinitely, which helps maintain its value during inflationary periods.

- Pass-through structure: REITs are required to distribute at least 90% of their taxable income to shareholders, potentially allowing investors to benefit from rising rental income.

However, there's a significant counterforce that can undermine these benefits: rising interest rates. Central banks often combat inflation by raising interest rates, which increases borrowing costs for real estate companies and can put downward pressure on property valuations.

Data & Methodology

To test whether REITs actually serve as effective inflation hedges, we analyzed the following data:

- Consumer Price Index (CPI) data from the Federal Reserve Economic Data (FRED) as our inflation indicator

- VNQ (Vanguard Real Estate ETF) price and return data as our proxy for REIT performance

- Federal Funds Rate data from FRED to analyze interest rate impacts

We focused on two key inflationary periods:

- 2006-2008: Housing Bubble/Financial Crisis period with average YoY inflation of 3.31%

- 2021-2023: Post-COVID Inflation period with average YoY inflation of 5.61%

Our analysis included calculating correlations between inflation and REIT returns, comparing REIT performance during high vs. low inflation environments, and examining the impact of interest rate changes on REIT performance.

Visual Analysis

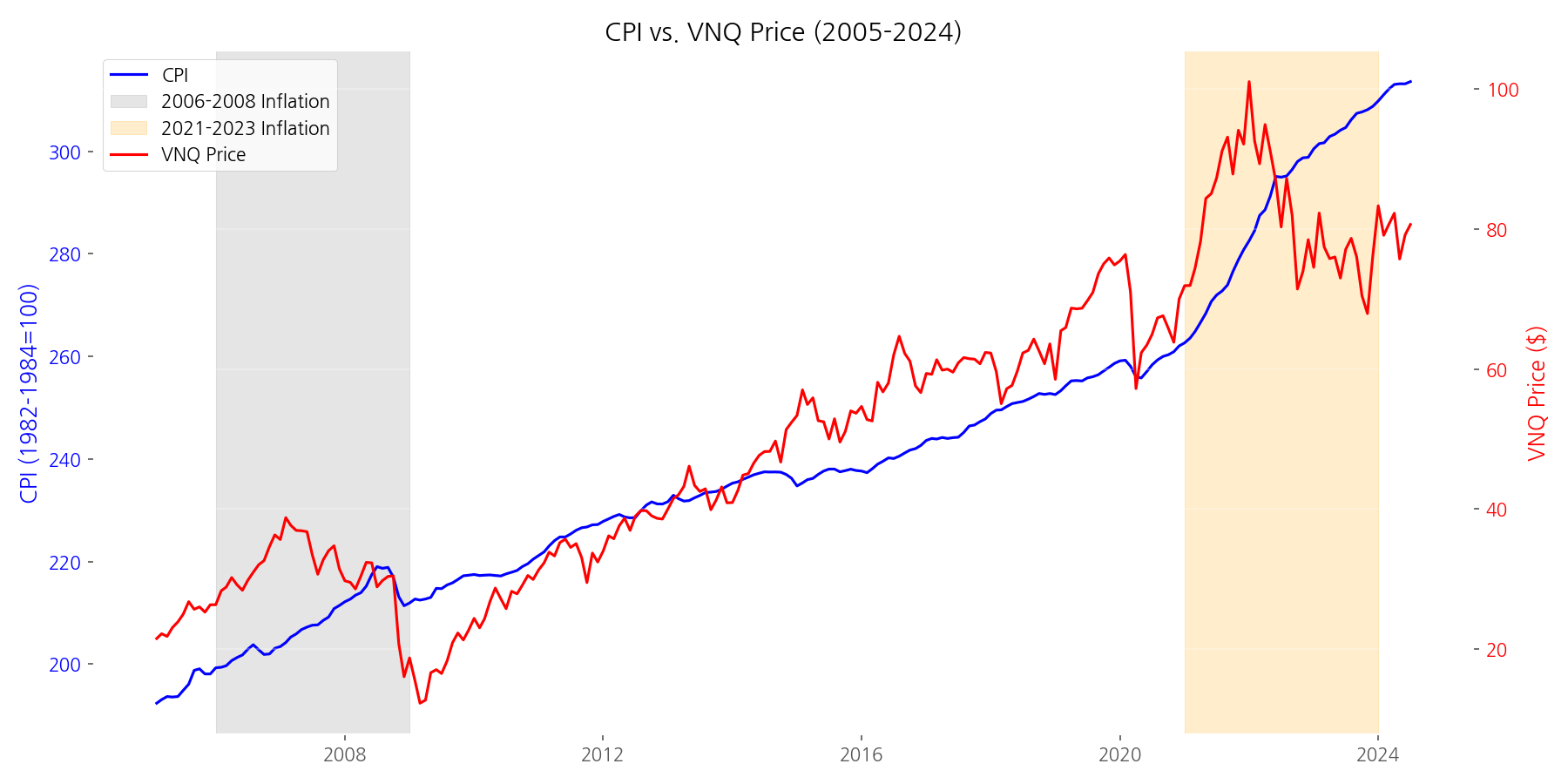

CPI vs. VNQ Price Over Time

Let's start by examining the relationship between inflation (CPI) and REIT prices (VNQ) over the entire period from 2005 to 2024:

This chart reveals several interesting patterns. While both CPI and VNQ show an overall upward trend over the nearly two-decade period, their paths diverge significantly at key moments. Most notably, VNQ experienced a dramatic decline during the 2008 financial crisis despite relatively stable inflation. Similarly, VNQ suffered another significant drop during the COVID-19 pandemic in early 2020, followed by a recovery and then another decline as inflation and interest rates rose sharply in 2022.

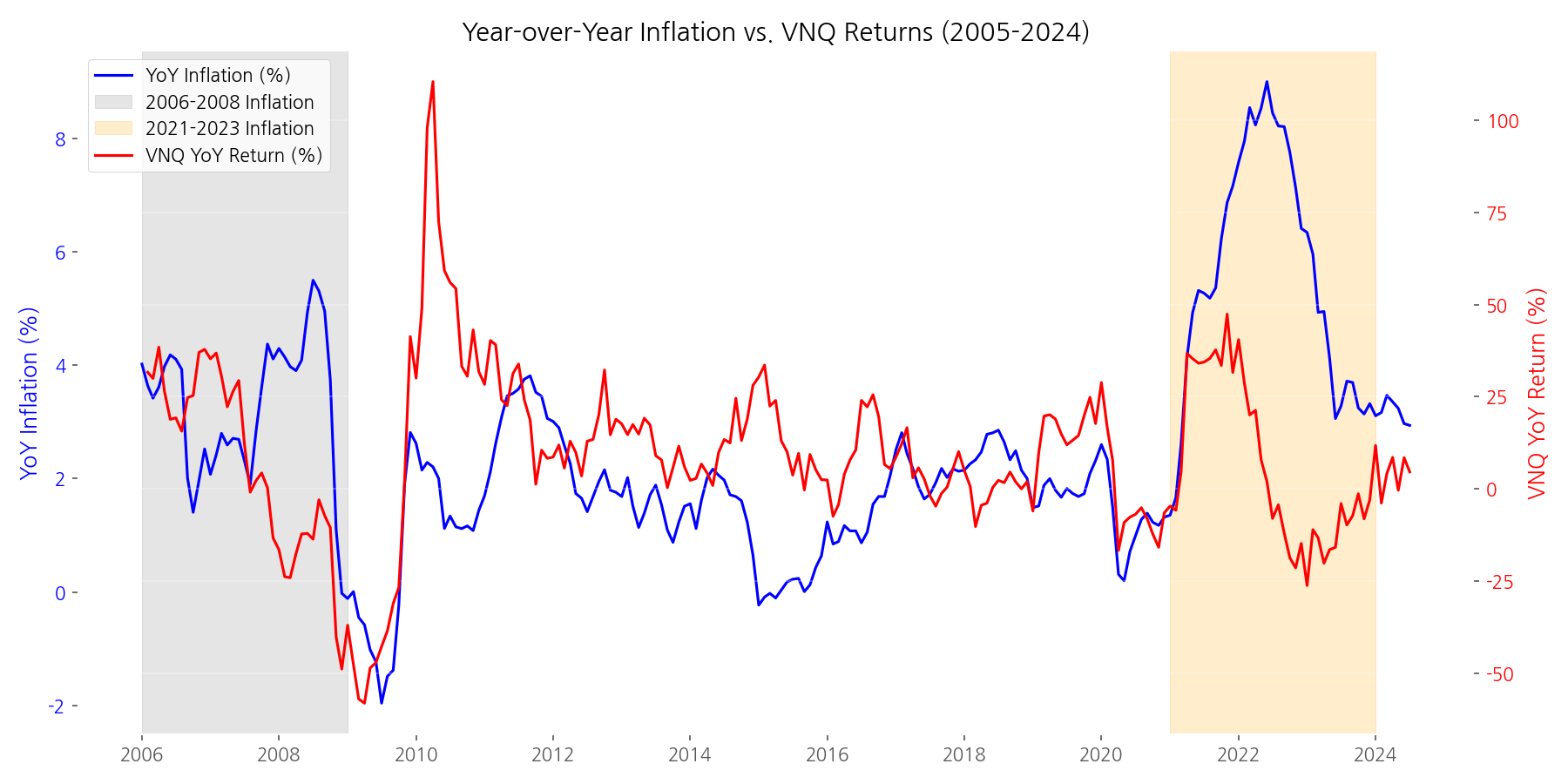

Inflation vs. REIT Returns

To better understand the relationship between inflation and REIT returns, let's look at a visualization that directly compares year-over-year inflation rates with VNQ returns:

This chart highlights the inconsistent relationship between inflation and REIT returns. During some periods, such as parts of 2021, REITs performed well as inflation rose. However, during other inflationary periods, such as 2022, REITs performed poorly despite high inflation. This suggests that other factors beyond inflation significantly influence REIT performance.

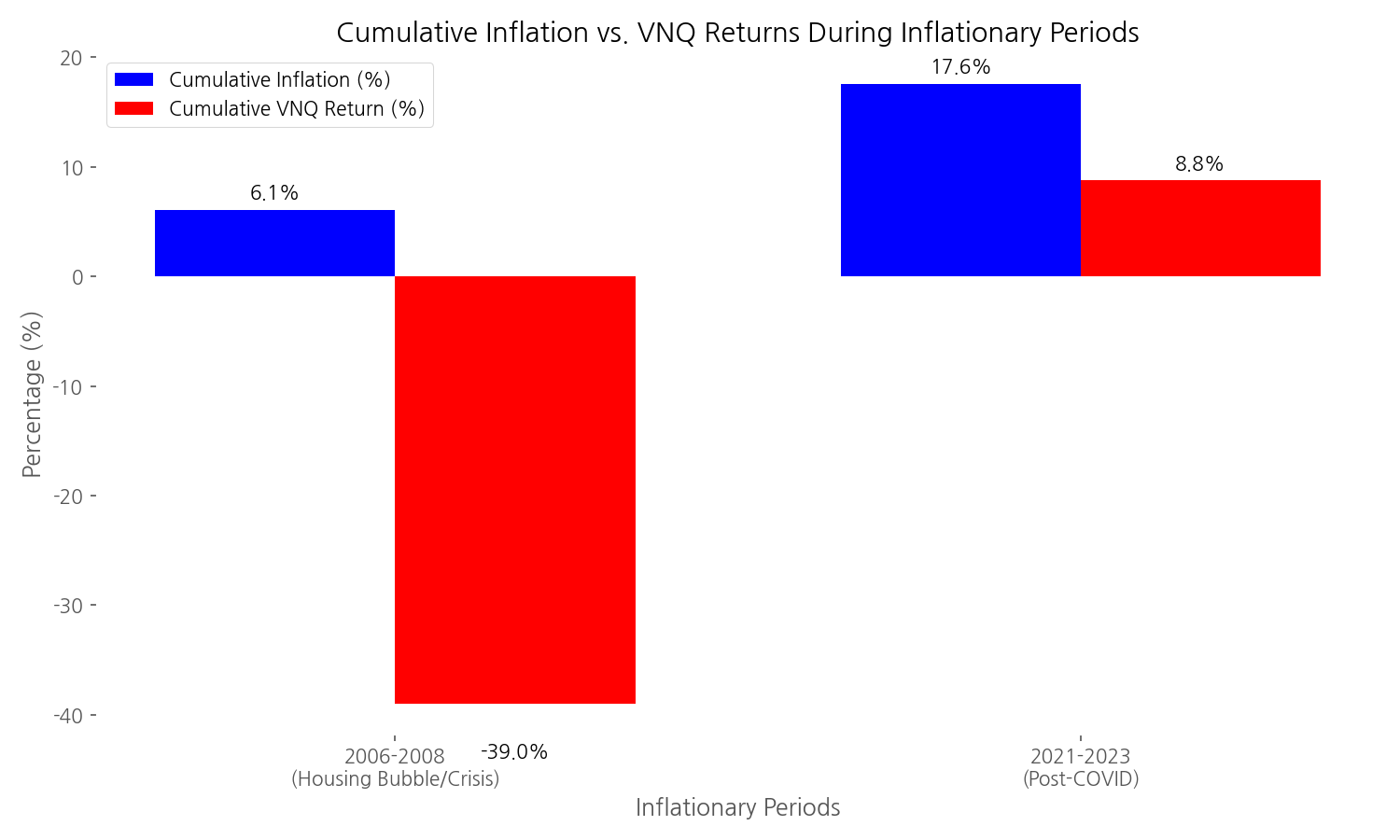

REIT Performance During Inflationary Periods

Let's compare the performance of REITs during our two key inflationary periods:

This bar chart reveals a striking contrast between the two inflationary periods. During the 2006-2008 period, despite moderate inflation averaging 3.31% annually, REITs performed poorly with a cumulative return of -38.97% and an annualized return of -15.18%. In contrast, during the 2021-2023 period with higher inflation averaging 5.61% annually, REITs performed better with a cumulative return of 8.75% and an annualized return of 2.84%.

These divergent outcomes challenge the simplistic view that REITs reliably serve as inflation hedges. Clearly, other factors were at play during these periods.

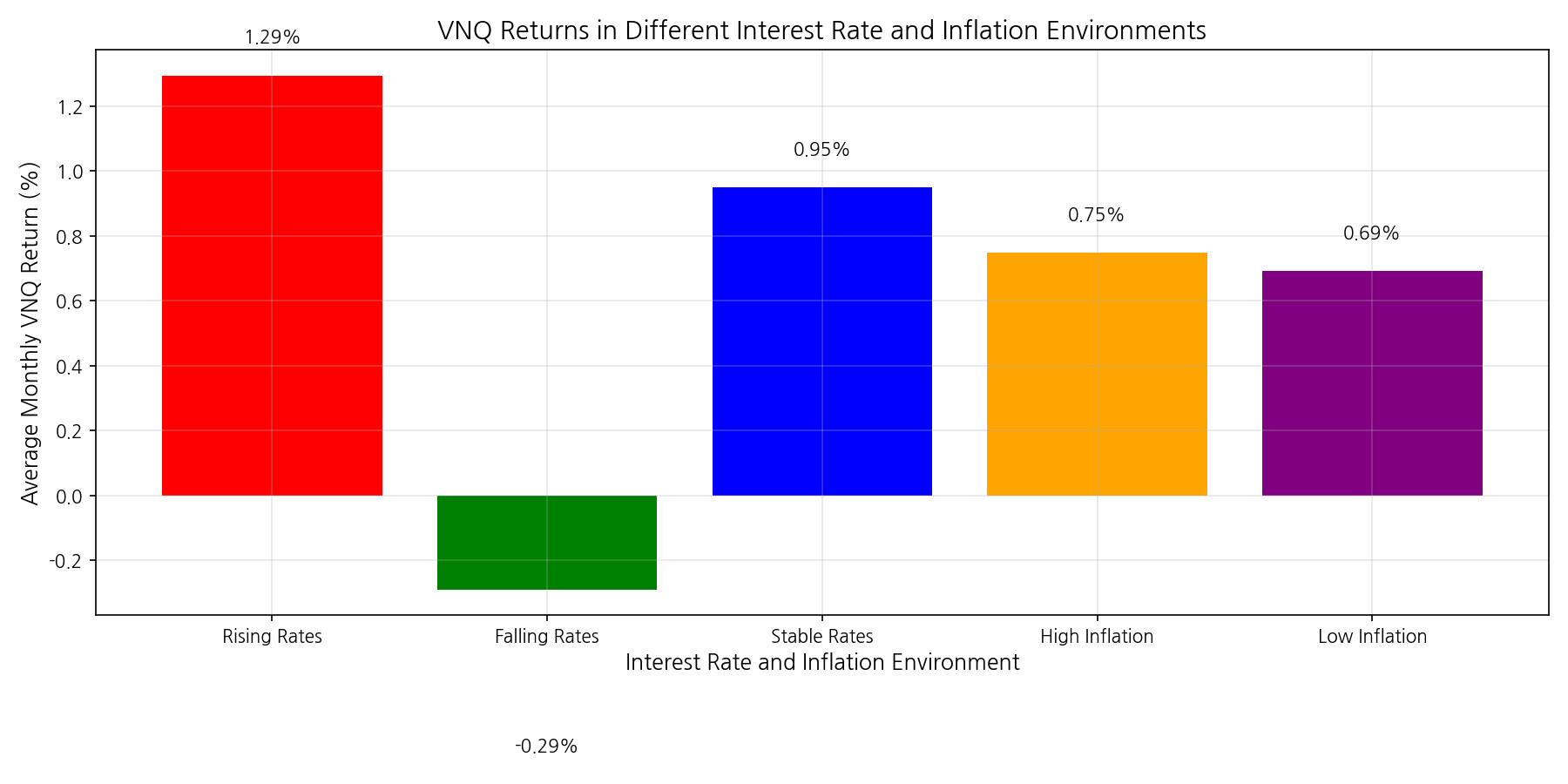

The Interest Rate Factor

One critical factor that significantly impacts REIT performance is interest rates. Let's examine how REITs performed in different interest rate environments:

This visualization reveals a surprising pattern: REITs actually performed better during periods of rising interest rates (average monthly return of 1.29%) compared to falling rates (average monthly return of -0.29%). This counterintuitive finding suggests that the broader economic context surrounding interest rate changes matters more than the direction of the changes themselves.

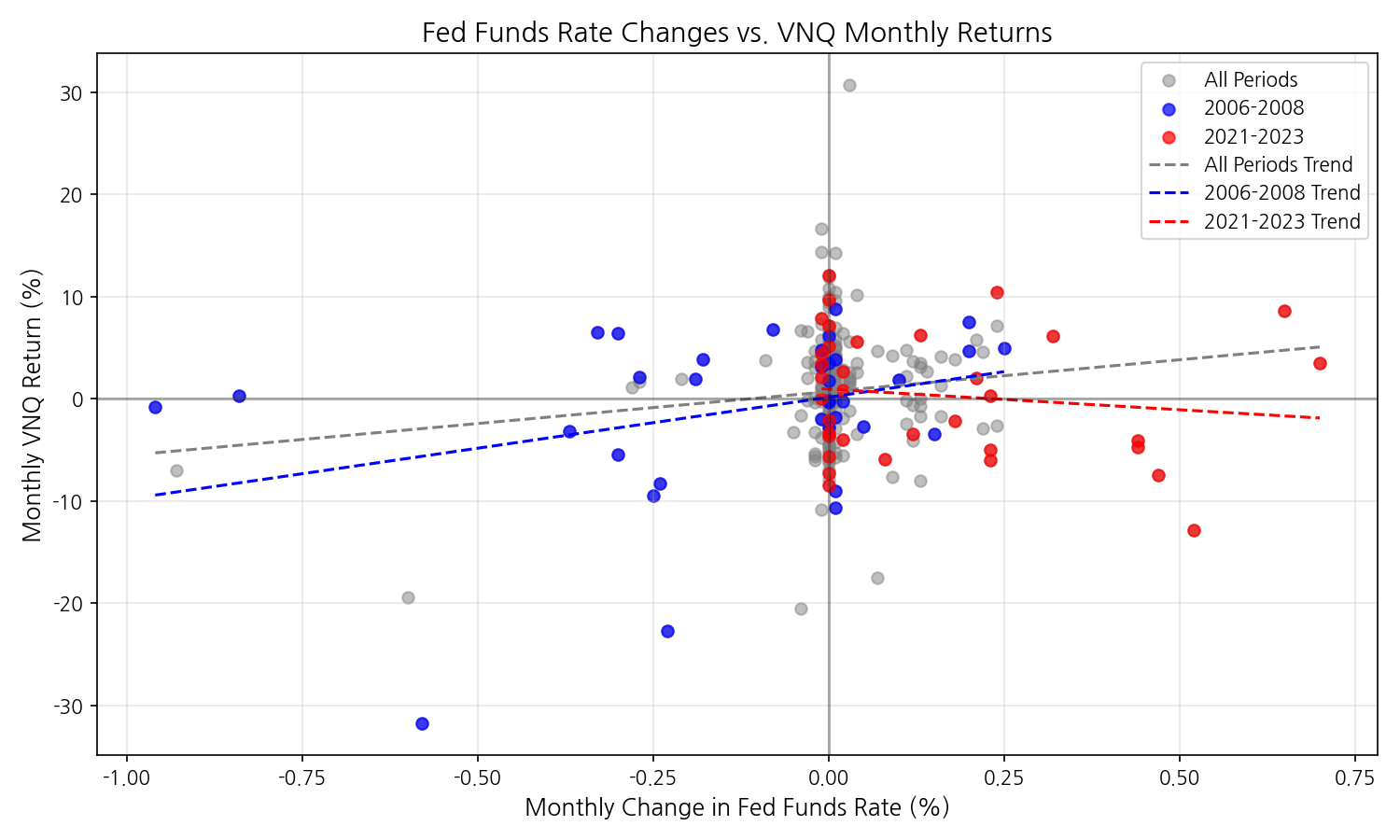

To further explore this relationship, let's look at how changes in the Federal Funds Rate correlate with VNQ returns:

The scatter plot shows a complex relationship between interest rate changes and REIT returns. While there's no strong linear correlation across the entire dataset, our period-specific analysis revealed important differences:

- During 2006-2008, despite falling interest rates (net change of -3.75%), REITs performed poorly due to the housing crisis.

- During 2021-2023, the sharp rise in interest rates (net change of +5.24%) negatively impacted REIT performance despite high inflation.

Importantly, our statistical analysis found that the correlation between interest rate changes and REIT returns was stronger than the correlation between inflation and REIT returns. This suggests that interest rate policy is a more important factor for REIT investors to monitor than inflation itself.

Risk Factors for Real Estate During Inflation

Our data analysis highlights several key risk factors that can undermine real estate's effectiveness as an inflation hedge:

- Interest rate sensitivity: Rapid increases in interest rates can negatively impact REIT valuations, potentially offsetting any inflation-hedging benefits.

- Economic context: The broader economic environment (recession, growth, financial crisis) can overwhelm inflation-related effects on real estate.

- Sector differences: Different types of REITs (residential, commercial, healthcare, etc.) likely respond differently to inflation, though our analysis used VNQ as a broad proxy for the entire sector.

- Time lag: There may be significant delays between inflation increases and corresponding adjustments in property values and rental income.

- Valuation starting points: REITs that are already trading at premium valuations may be more vulnerable during inflationary periods, especially if accompanied by rising interest rates.

Perhaps most importantly, our statistical analysis found that the difference in REIT returns between high-inflation and low-inflation periods was not statistically significant (p=0.95). This suggests that factors other than inflation have a more significant impact on REIT performance.

Conclusion

So, can real estate really hedge inflation? Our data-driven analysis suggests a nuanced answer: it depends.

The data reveals that REITs do not automatically or reliably serve as inflation hedges in all environments. Their performance during inflationary periods is heavily influenced by interest rate changes and broader economic conditions. During the 2006-2008 housing crisis, REITs performed poorly despite moderate inflation. During the 2021-2023 post-COVID period, REITs initially performed well as inflation rose but then struggled as interest rates increased sharply.

For investors seeking inflation protection, several key takeaways emerge:

- Monitor both inflation and interest rates when considering REIT investments.

- Understand that REITs may be more effective as long-term rather than short-term inflation hedges.

- Consider the specific economic context surrounding inflationary periods.

- Diversify inflation hedges beyond just real estate to include other assets like TIPS, commodities, or value stocks.

- Pay attention to REIT valuations and avoid overpaying, especially when interest rates are expected to rise.

While real estate does possess inherent qualities that should theoretically provide inflation protection, our analysis shows that these benefits can be overwhelmed by other factors, particularly interest rate changes. Investors should view REITs as part of a diversified inflation-hedging strategy rather than as a standalone solution.

As with most investment decisions, context matters. Understanding the complex interplay between inflation, interest rates, and real estate performance is essential for making informed investment choices in an inflationary environment.

Comments (0)

No comments yet. Be the first to comment!