DCA vs. "Buy the Dip": Which Investment Strategy Actually Wins?

A 5.0-year simulation on QQQ reveals surprising insights about timing the market

If you've ever invested money in the stock market, you've probably heard two competing pieces of advice:

- "Just invest consistently, don't try to time the market" (Dollar Cost Averaging)

- "Wait for the dip, then buy low" (Buy the Dip)

Both sound reasonable. But which one actually works better? I ran a 5.0-year simulation on QQQ (the Nasdaq-100 ETF) to find out, and the results might surprise you.

The Setup: Two Strategies, Same Budget

Imagine you have $100 to invest every month. That's it—nothing fancy, just a consistent monthly budget that most people can relate to.

I tested two approaches:

Strategy 1: Dollar Cost Averaging (DCA)

Simple and boring: invest your $100 immediately on the first trading day of each month, no matter what the price is.

Strategy 2: Buy the Dip

A bit more sophisticated: each month you receive $100, but instead of investing immediately, you wait. You only buy when the price falls below 95% of the 20-day moving average—essentially waiting for a "discount."

The simulation ran from November 16, 2020 to November 14, 2025—a period of 5.0 years covering 1256 trading days. This gave us 61 months of investing, for a total of $6,100 invested across both strategies.

What Happened to the Price?

Before we dive into results, let's look at what QQQ actually did during this period:

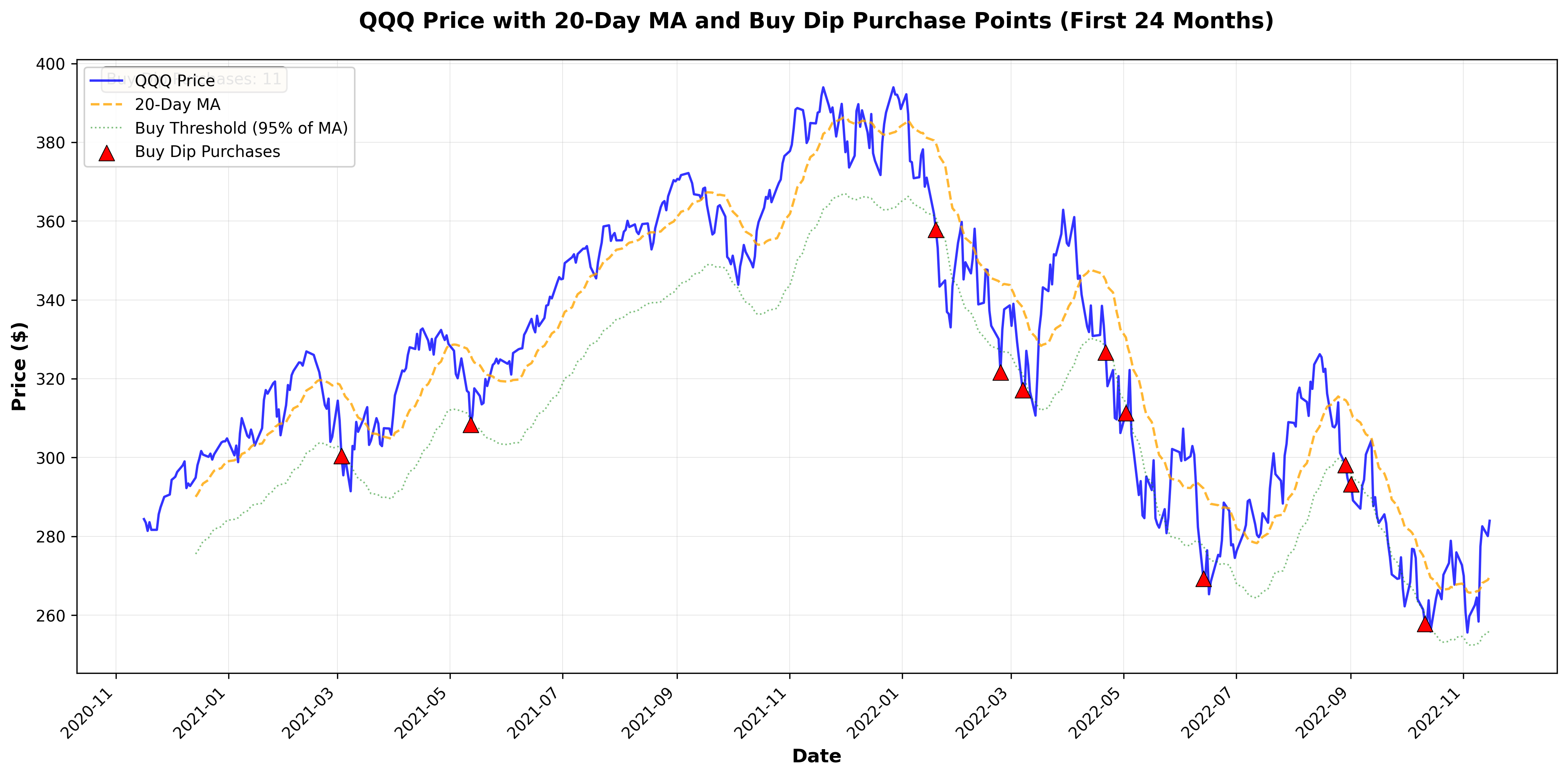

The chart above shows the entire 5.0-year period. The blue line is QQQ's actual price, the orange dashed line is the 20-day moving average, and those red triangles? Those are the moments when the Buy the Dip strategy actually made purchases.

QQQ started at $284.38 and ended at $608.86—a massive 114.1% increase. Not bad for a 5.0-year hold!

But here's what's interesting: notice how few red triangles there are? The Buy the Dip strategy only triggered 17 times over 61 months. That means it was sitting on cash, waiting for a dip, about 72% of the time.

A Closer Look at the Early Days

Let's zoom into the first 24 months to see this more clearly:

See those periods where the price stays above the green dotted line (the 95% threshold)? During those times, the Buy the Dip strategy was just... waiting. Accumulating cash. Missing out on gains.

The Cash Problem

This brings us to one of the biggest issues with the Buy the Dip strategy: cash drag.

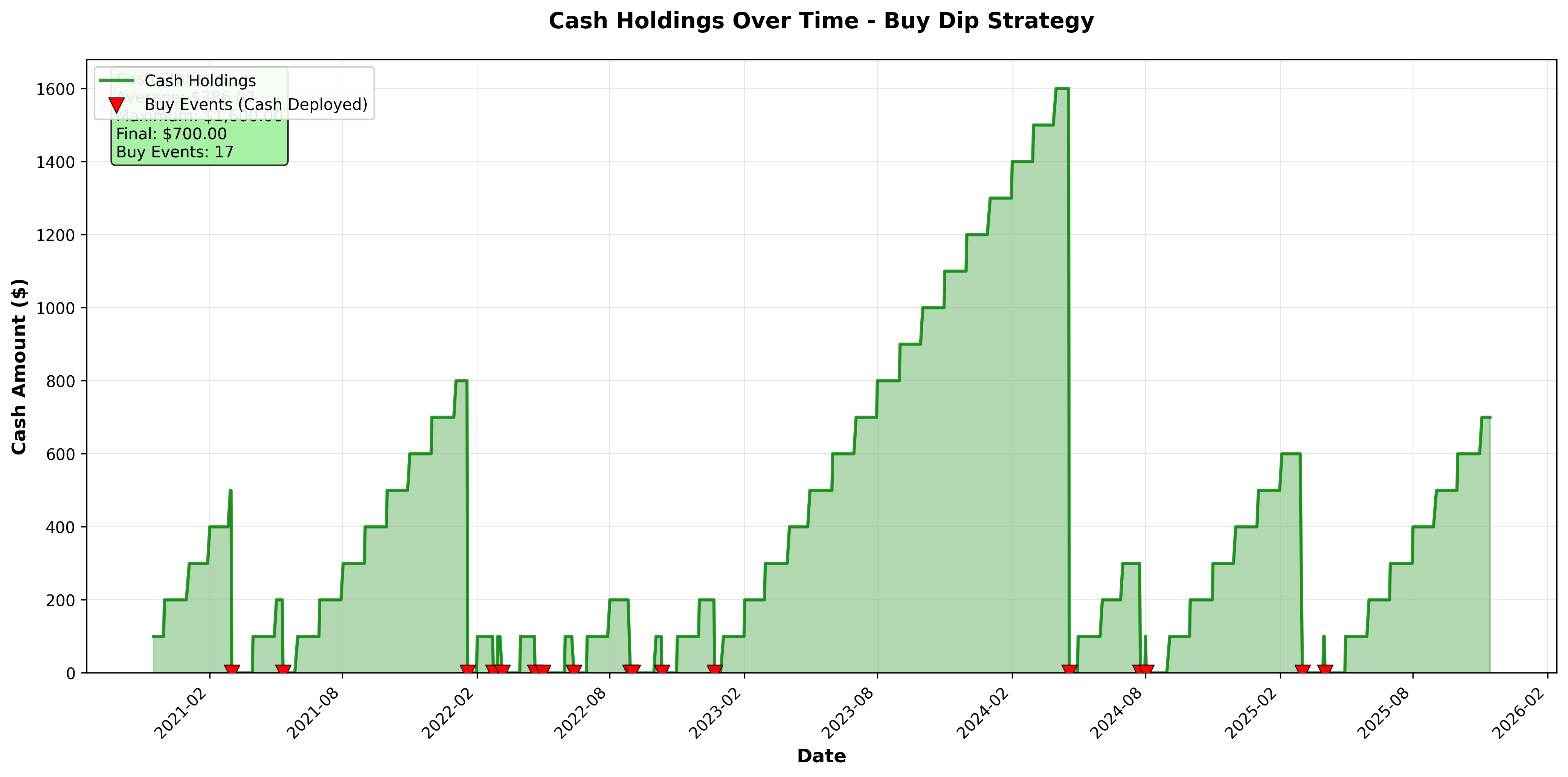

This chart shows how much cash the Buy the Dip strategy was holding at any given time. Every month, another $100 came in. Sometimes it got deployed immediately when a dip happened (the red triangles), but often it just sat there.

The numbers tell the story:

- Average cash held: $386.07

- Maximum cash accumulated: $1,600.00

- Final uninvested cash: $700.00

That final number is crucial: the Buy the Dip strategy ended with $700.00 still sitting in cash, waiting for a dip that never came. Meanwhile, QQQ kept climbing.

The Results: Show Me the Money

Alright, enough build-up. Here's how the two strategies actually performed:

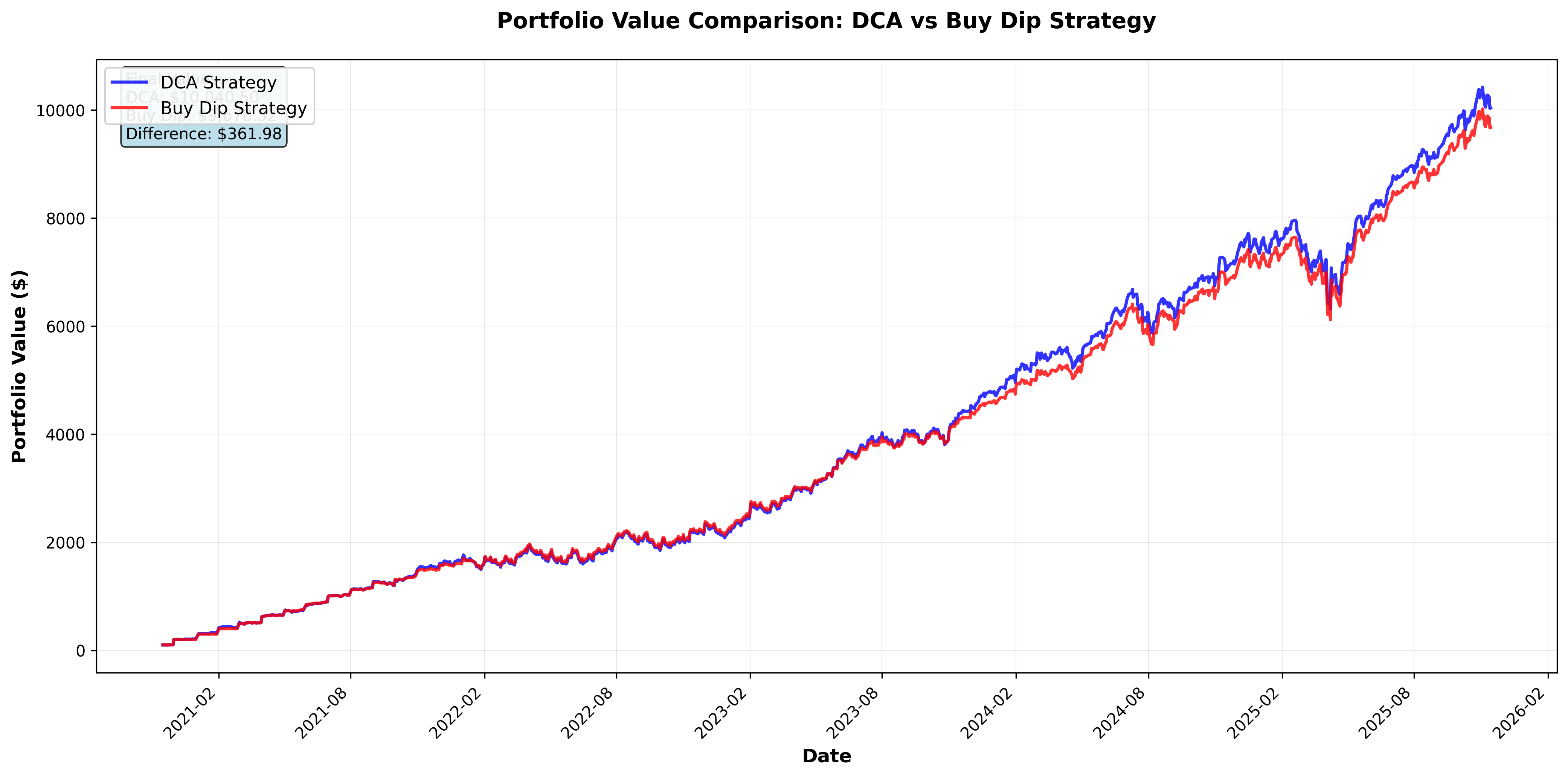

The blue line (DCA) and red line (Buy the Dip) track closely for much of the journey, but notice how they diverge—especially toward the end when the market was trending strongly upward.

Final Numbers

Dollar Cost Averaging (DCA):

- Final Portfolio Value: $10,040.50

- Total Shares Owned: 16.49

- Cash Remaining: $0.00

- Total Return: 64.60%

Buy the Dip:

- Final Portfolio Value: $9,678.52

- Total Shares Owned: 14.75

- Cash Remaining: $700.00

- Total Return: 58.66%

The Verdict: DCA won by $361.98 (3.7% more than Buy the Dip).

Why Did "Buy the Dip" Underperform?

You might be thinking: "Wait, buying at a discount should be better!" In theory, yes. But here's what actually happened:

-

The market trended up more than it dipped. QQQ gained 114.1% over this period. When the overall trend is up, waiting for dips means missing gains.

-

Cash drag killed returns. That $700.00 sitting uninvested at the end? If it had been invested from the start, it would be worth much more.

-

Dips weren't deep enough, or frequent enough. The strategy only bought 17 times. DCA bought 61 times, getting more opportunities to accumulate shares.

-

Time in the market > timing the market. This old saying proved true. The DCA strategy was fully invested almost the entire time, capturing all the upside.

What If You're Still Tempted to Time the Market?

I get it. Buying during a dip feels smart. And sometimes it is smart—if you can actually predict when dips will happen and how deep they'll be.

But here's the thing: this simulation used a pretty generous definition of a "dip" (95% of the 20-day MA). In reality, most people who try to time the market are waiting for even bigger drops—10%, 20%, or more. Which means even more cash drag and even more missed opportunities.

The Takeaway

After investing $6,100 over 5.0 years:

- DCA turned it into $10,040.50 (64.60% gain)

- Buy the Dip turned it into $9,678.52 (58.66% gain)

The difference? $361.98. That might not sound huge, but remember—this is with the exact same amount of money invested. The only difference was when it was invested.

My Two Cents

Look, I'm not saying you should never try to buy the dip. If you have extra cash sitting around and the market tanks, go for it! But if you're trying to decide what to do with your regular monthly investment? The data is pretty clear:

Just invest it. Don't wait.

The best time to invest was yesterday. The second best time is today. Waiting for the "perfect" entry point usually means missing out on pretty good entry points along the way.

Disclaimer: This is a simulation based on historical data. Past performance doesn't guarantee future results. QQQ might not go up 114.1% over the next 5.0 years (or it might go up more—who knows?). This isn't financial advice; it's just what the numbers showed in this particular test.

Methodology note: All data sourced from yfinance. The simulation assumes fractional shares (so you can invest exactly $100 each time) and ignores trading fees and taxes. In the real world, those would eat into returns slightly, but they'd affect both strategies roughly equally.

What's your take? Have you tried either of these strategies? Let me know in the comments!

Comments (0)

No comments yet. Be the first to comment!