Introduction: The Income Investor's Dilemma

As interest rates have climbed to their highest levels in over a decade, income-focused investors face a genuine dilemma. Should they embrace the perceived safety of bonds with their newly attractive yields? Or should they continue allocating to dividend-paying REITs that offer both income and growth potential? The conventional wisdom suggests bonds provide stability while REITs offer growth—but what does the data actually tell us?

In this analysis, we'll cut through the noise and let hard numbers guide our understanding. We've analyzed a decade of performance data comparing prominent dividend REITs against major bond ETFs to determine which asset class truly delivers superior results for income-seeking investors in today's high-rate environment.

Understanding the Players: REITs vs. Bonds

Before diving into performance data, let's understand the key players in our analysis:

Dividend REITs

- **PLD (Prologis)**: The world's largest industrial REIT, specializing in logistics facilities and warehouses—a sector that has boomed with e-commerce growth.

- **O (Realty Income)**: Known as 'The Monthly Dividend Company,' focusing on retail properties with long-term net lease agreements.

- **MAA (Mid-America Apartment Communities)**: A residential REIT owning apartment communities primarily in the Southeast and Southwest United States.

Bond ETFs

- **TLT (iShares 20+ Year Treasury Bond ETF)**: Provides exposure to long-term U.S. Treasury bonds.

- **BND (Vanguard Total Bond Market ETF)**: Offers broad exposure to U.S. investment-grade bonds.

- **IEF (iShares 7-10 Year Treasury Bond ETF)**: Focuses on intermediate-term Treasury bonds.

The structural differences between these assets are significant. REITs own physical properties, generating income through rents that can adjust with inflation and market conditions. They're required to distribute at least 90% of taxable income to shareholders. Bonds, meanwhile, represent debt with fixed interest payments, offering predictability but limited growth potential.

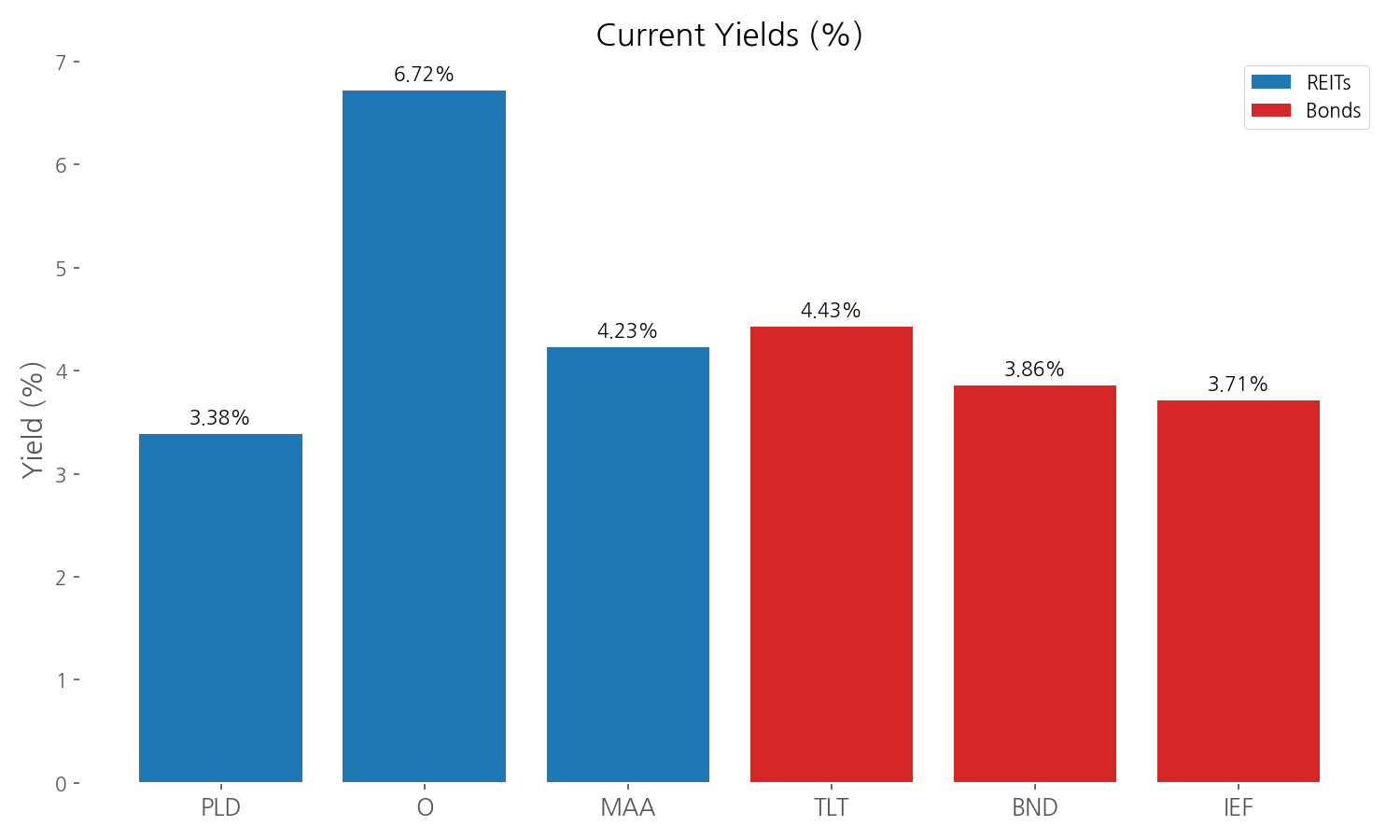

Current Yield Comparison

Let's start with what many income investors focus on first: current yield. Our analysis reveals a compelling picture of today's income landscape:

The data shows Realty Income (O) leading the pack with an impressive 6.72% yield, significantly higher than even the longest-duration Treasury ETF (TLT) at 4.43%. While MAA offers 4.23%, slightly below TLT but above the other bond ETFs, Prologis (PLD) yields 3.38%, reflecting its greater focus on growth. The bond ETFs cluster between 3.71% and 4.43%, showing the improved income potential of fixed income in today's higher rate environment.

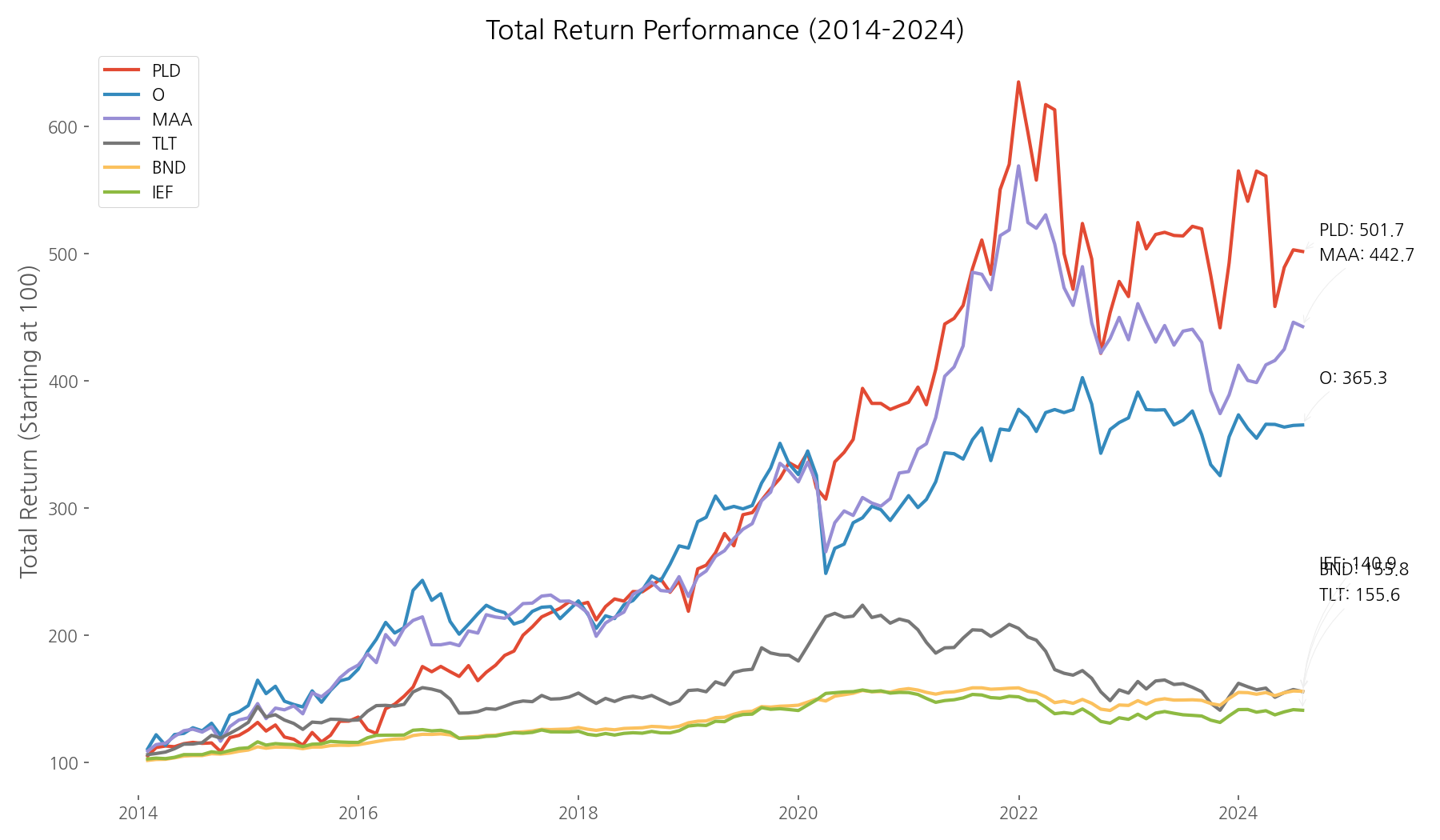

The Last Decade: Who Really Delivered More?

Current yield only tells part of the story. To truly understand which asset class serves income investors better, we need to examine total returns—combining price appreciation with dividends/interest payments—over a meaningful timeframe that includes both low and high interest rate environments.

The results are striking. Over the past decade, REITs have dramatically outperformed bonds in total return. A $100 investment in Prologis (PLD) would have grown to an impressive $501.74, representing an annualized return of 16.61%. Mid-America Apartment Communities (MAA) and Realty Income (O) also delivered exceptional results, with $100 growing to $442.68 (15.23% annually) and $365.30 (13.14% annually), respectively.

In stark contrast, the bond ETFs delivered far more modest growth. The same $100 invested in BND would have grown to just $155.83 (4.32% annually), while TLT reached $155.59 (4.30% annually) and IEF lagged at $140.89 (3.32% annually).

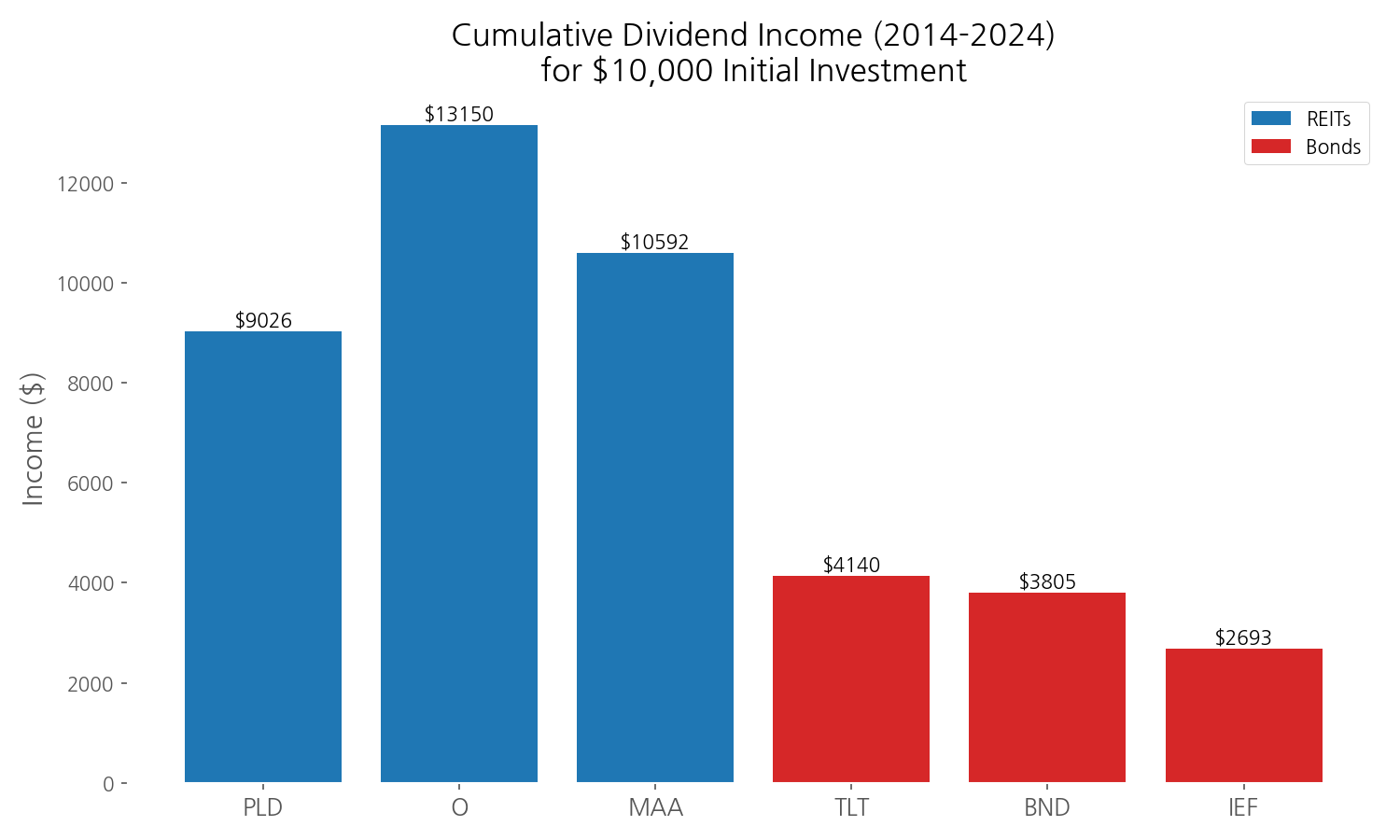

Cumulative Income: The True Test for Income Investors

For many income-focused investors, the actual cash distributions received matter most. Our analysis calculated the cumulative income generated by each asset from a $10,000 initial investment over the past decade:

The income generation gap is substantial. Realty Income (O) produced the highest cumulative income at $13,149.51—more than three times what the best-performing bond ETF delivered. PLD and MAA also generated significant income of $8,461.80 and $10,577.57, respectively. Meanwhile, the bond ETFs produced between $2,692.89 (IEF) and $4,139.55 (TLT) in cumulative income over the same period.

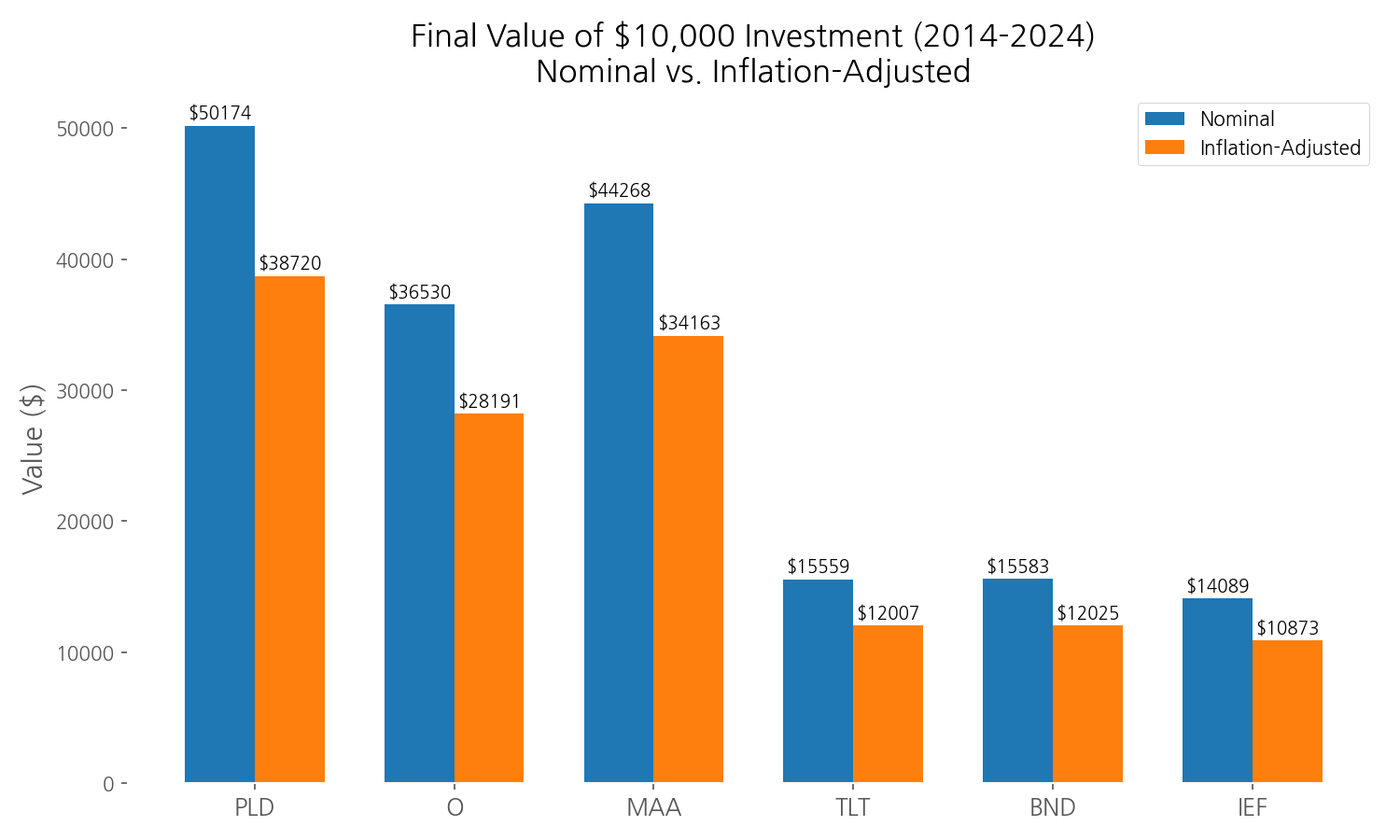

What About Inflation?

No discussion of income investing would be complete without addressing inflation—the silent wealth eroder. This is where the structural differences between REITs and bonds become particularly important. REITs own real assets with rents that can adjust upward with inflation, while bonds pay fixed interest regardless of rising prices.

Our analysis shows that over the past decade, with cumulative inflation estimated at approximately 30%, REITs provided substantially better inflation protection. The real (inflation-adjusted) returns of all three REITs remained well above those of bonds. While inflation eroded the already modest returns of bond ETFs to near-zero real growth, the REITs maintained strong positive real returns despite the inflationary environment.

Looking Ahead: REIT Income Potential vs. Bonds

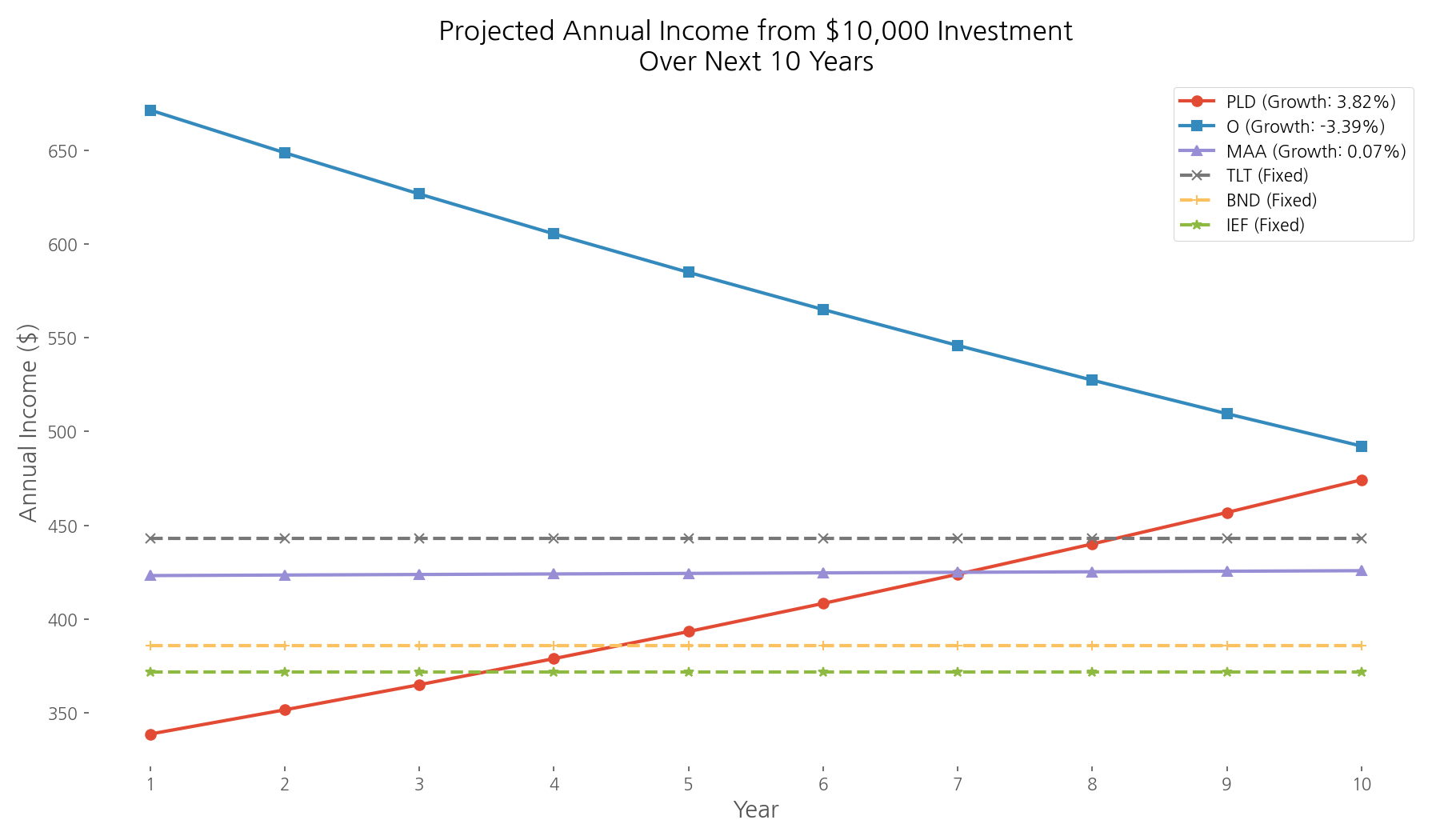

Past performance is informative, but forward-looking investors need to consider future income potential. Unlike bonds with their fixed payments, REITs have the capacity to grow their dividends over time. Our analysis of dividend growth rates shows PLD with an impressive dividend CAGR of 3.82%, though O showed a negative rate of -3.39% (likely influenced by pandemic disruptions to retail).

Using historical dividend growth rates, we projected potential income streams from a $10,000 investment over the next decade:

The projection illustrates a key advantage of REITs: income growth potential. While bond income remains flat (represented by the horizontal lines), REIT income has the potential to grow substantially over time. Even with conservative growth estimates, the compounding effect of rising dividends could result in significantly higher income in later years compared to the fixed payments from bonds.

Several forward-looking indicators support the case for continued REIT dividend growth. Prologis benefits from the structural shift toward e-commerce and supply chain resilience. Mid-America Apartment Communities operates in markets with strong population growth and housing supply constraints. Realty Income continues to diversify internationally while maintaining its focus on recession-resistant tenants.

Conclusion: What the Data Suggests

Our comprehensive data analysis reveals that dividend REITs have significantly outperformed bonds over the past decade across multiple metrics—total returns, income generation, and inflation protection. Even in today's higher interest rate environment, select REITs continue to offer competitive current yields plus the potential for income growth that bonds structurally cannot match.

The data suggests that for income-focused investors with longer time horizons and some tolerance for price volatility, dividend REITs merit serious consideration as a core income-generating holding—even in a high interest rate environment. While bonds provide predictability and lower volatility, their limited growth potential and vulnerability to inflation represent significant drawbacks for long-term income investors.

That said, the optimal approach for many investors may involve strategic allocation to both asset classes—bonds for stability and near-term income certainty, and REITs for growth potential and inflation protection. The specific allocation should align with each investor's time horizon, income needs, and risk tolerance.

Why settle for static yield when you can explore income that grows—as the data clearly supports?

Comments (0)

No comments yet. Be the first to comment!