The Power and Limits of the Subscription Engine

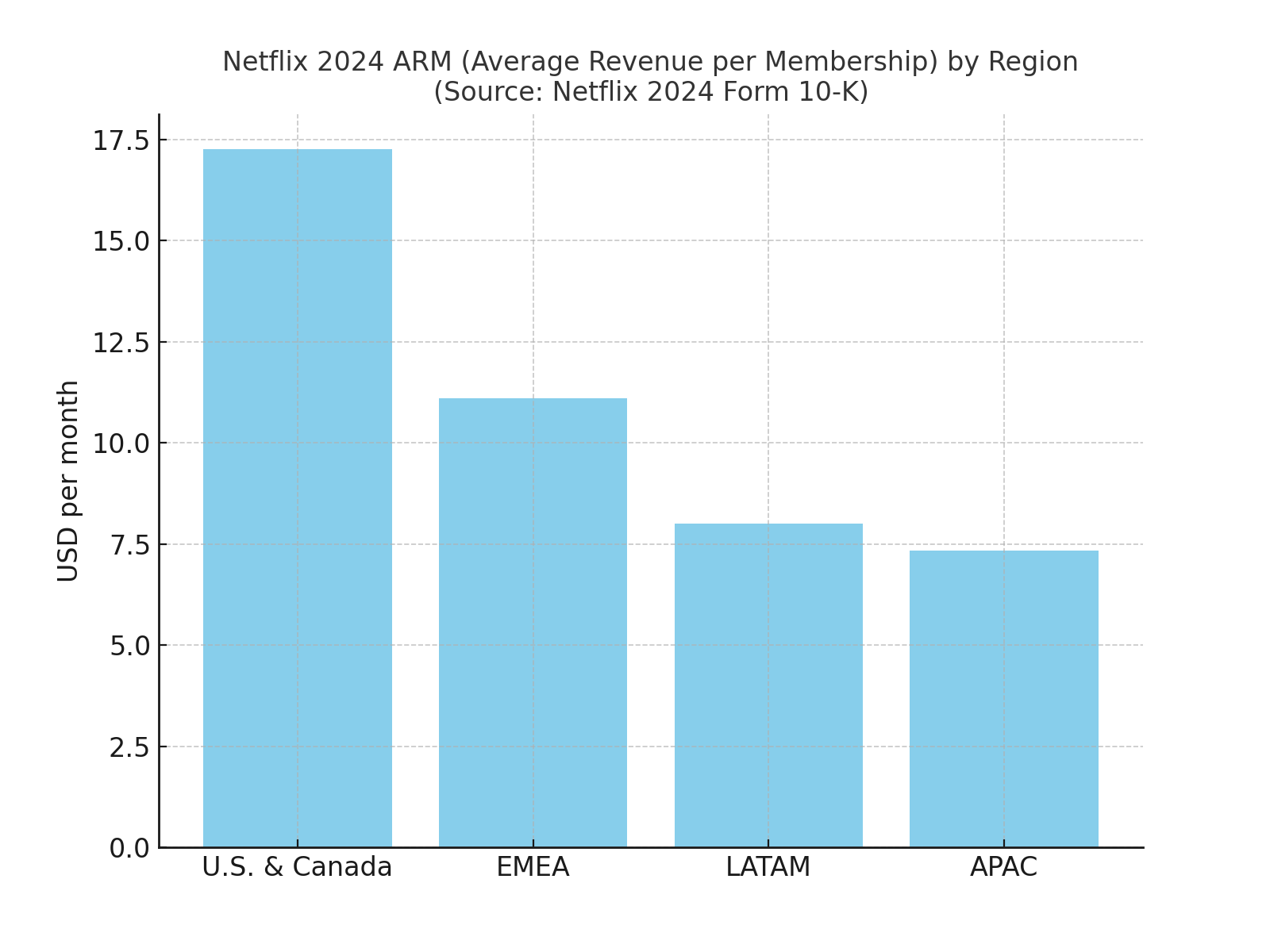

In 2024, Netflix reported $39.0 billion in revenue, $10.4 billion in operating income (a 27% margin), and about 260 million paid memberships (Source: Netflix 2024 Form 10-K). Yet, the average revenue per membership (ARM)—the amount the average user pays per month—was just $11.70, only 1% higher than the prior year.

A Data Snapshot

ARM varies sharply by region: $17.26 in the U.S. & Canada versus just $7.34 in Asia-Pacific. This gap highlights why ads could matter so much for Netflix’s growth story.

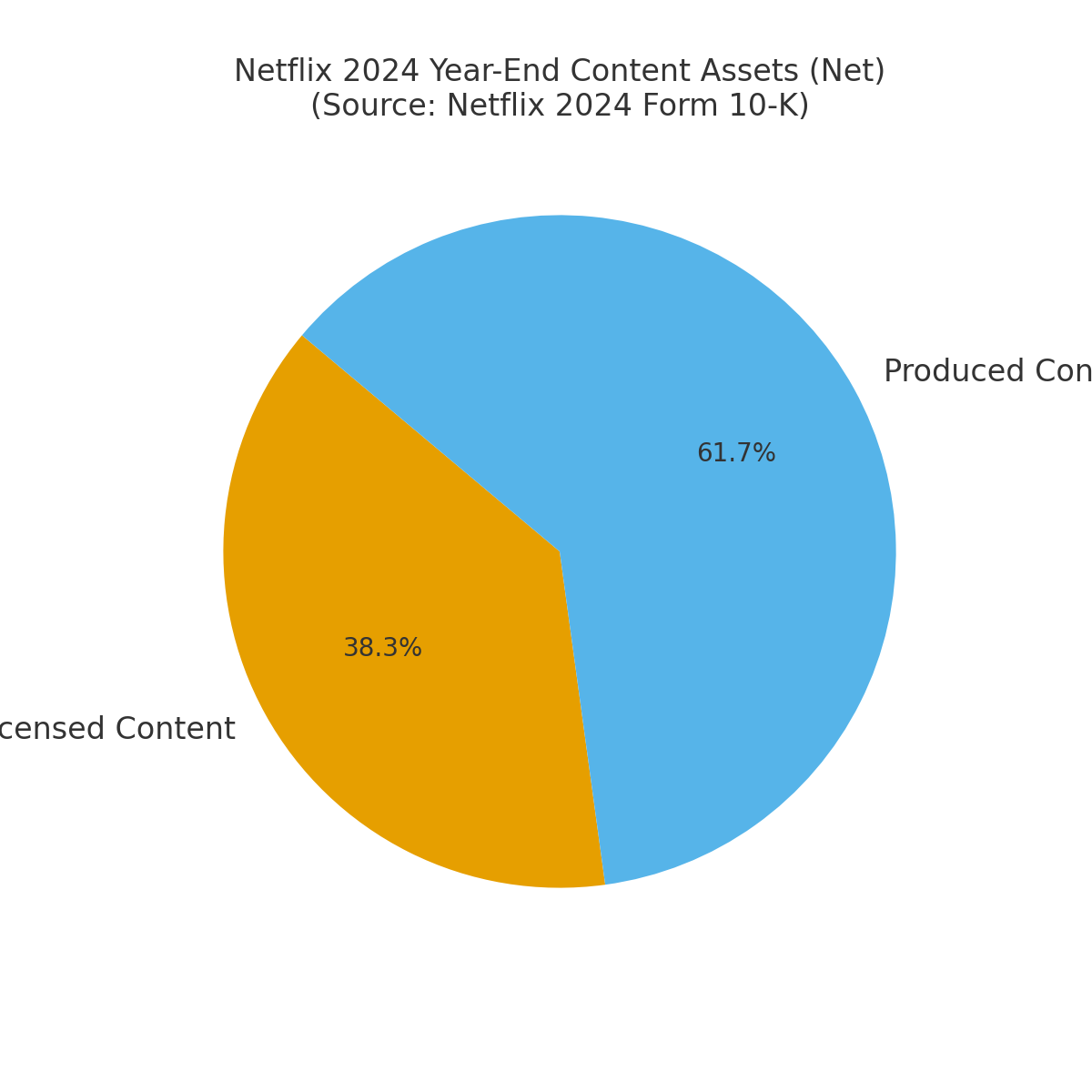

Netflix keeps fueling its engine with massive content investments. In 2024, content cash spend reached $17.0 billion, while year-end content assets stood at $32.45 billion—of which $20.03 billion came from originals and $12.42 billion from licensed content (Source: Netflix 2024 Form 10-K).

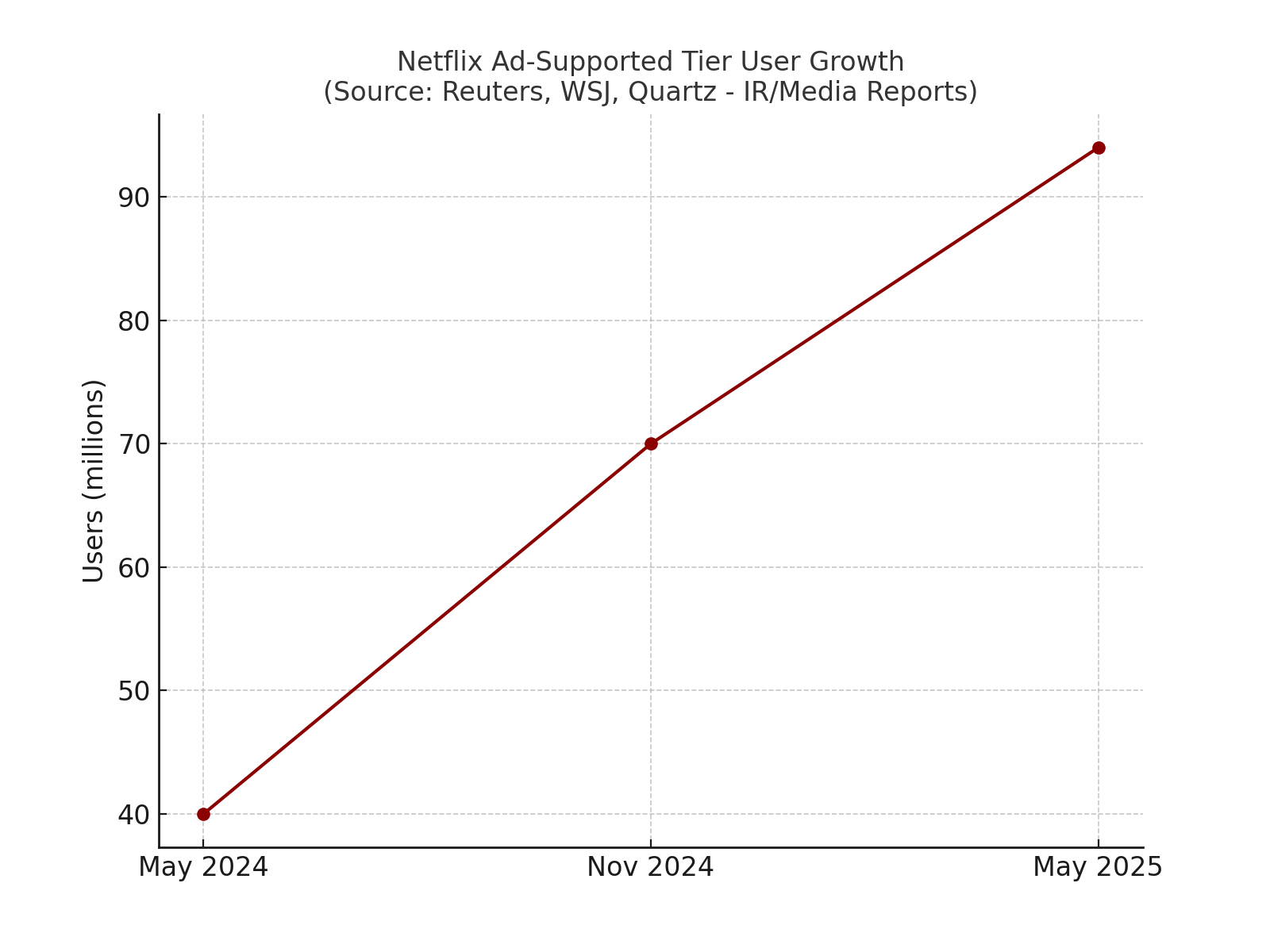

While the 10-K doesn’t break out ad revenues, management disclosures and media reports show strong momentum: 94 million ad-tier users as of May 2025 (Reuters), with more than half of new sign-ups in ad markets choosing the ad plan (WSJ). Industry reports suggest about 44% of these are new users, 40% are downgrades, and 16% are re-subscribers (Quartz).

Case Study — How Ads Could Reshape ARM

A U.S. subscriber generates about $17.26 each month. If an ad-tier user pays $7 less but contributes $2–3 from ads, Netflix recoups much of the difference. In lower-ARM regions like Asia or Latin America, $2–3 in ad revenue would lift ARM by 30–40%. That’s why ads could truly become a second subscription engine.

Takeaway

- For viewers: cheaper options with ads or premium without.

- For Netflix: ads are a new growth lever, especially in low-ARM regions.

- For the big picture: ad-tier growth to 94 million users shows this engine is already humming.

Comments (0)

No comments yet. Be the first to comment!