Introduction: Short Selling Explained

Ever wondered how traders make money when stocks fall? Welcome to the world of short selling explained – a trading strategy that flips the traditional 'buy low, sell high' approach on its head. Instead, short sellers aim to 'sell high, buy low' by borrowing shares, selling them immediately, and hoping to repurchase them later at a lower price. While potentially profitable in declining markets, stock market shorting carries unique

In this data-driven exploration, we'll break down how short selling works using a synthetic short selling simulation, then analyze two contrasting real-world examples from 2021: the infamous GameStop short squeeze that crushed hedge funds, and a more typical Tesla short position. By the end, you'll understand not just how short selling works, but when it might succeed – and when it could lead to financial disaster.

Short selling has been a controversial practice since its inception. Critics argue it can exacerbate market downturns and hurt companies, while proponents maintain it provides necessary market liquidity and price discovery. Regardless of one's stance, understanding how short selling works is essential for any investor navigating today's complex markets – whether you plan to use the strategy yourself or simply want to recognize its effects on stocks you own.

Short Selling Mechanics: A Synthetic Scenario

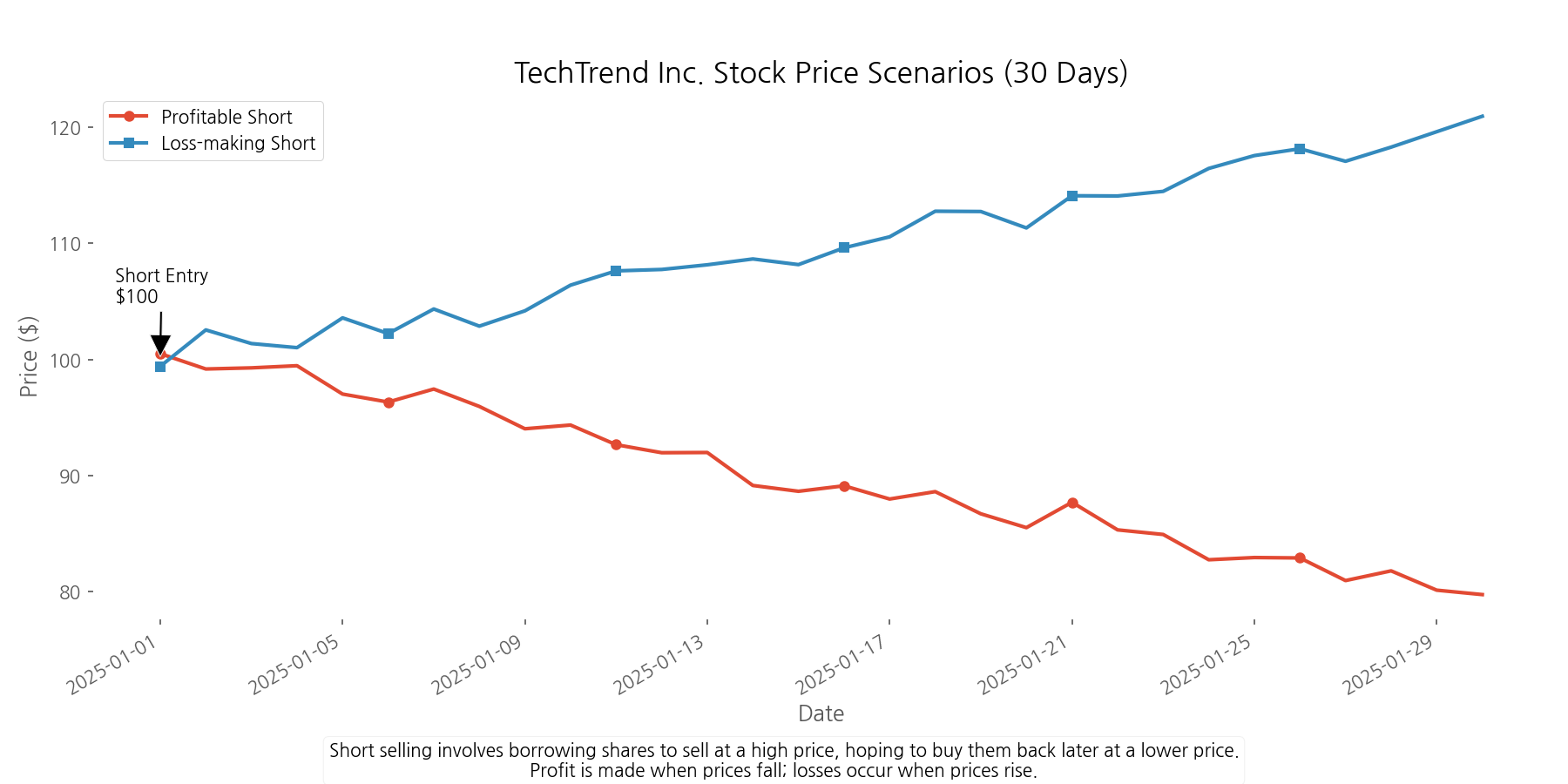

Let's start with a fictional company, "TechTrend Inc.," to illustrate how short selling works. Imagine you believe TechTrend's stock price of $100 is overvalued and likely to fall. Here's how a short position would play out:

- You borrow 1,000 shares of TechTrend from your broker

- You immediately sell these shares at $100 each, receiving $100,000

- Your broker holds this money as collateral while you maintain the short position

- You wait for the price to (hopefully) decline

- Eventually, you must buy back 1,000 shares to return to your broker

The profit or loss depends entirely on the price when you repurchase the shares. Our analysis modeled two scenarios over a 30-day period:

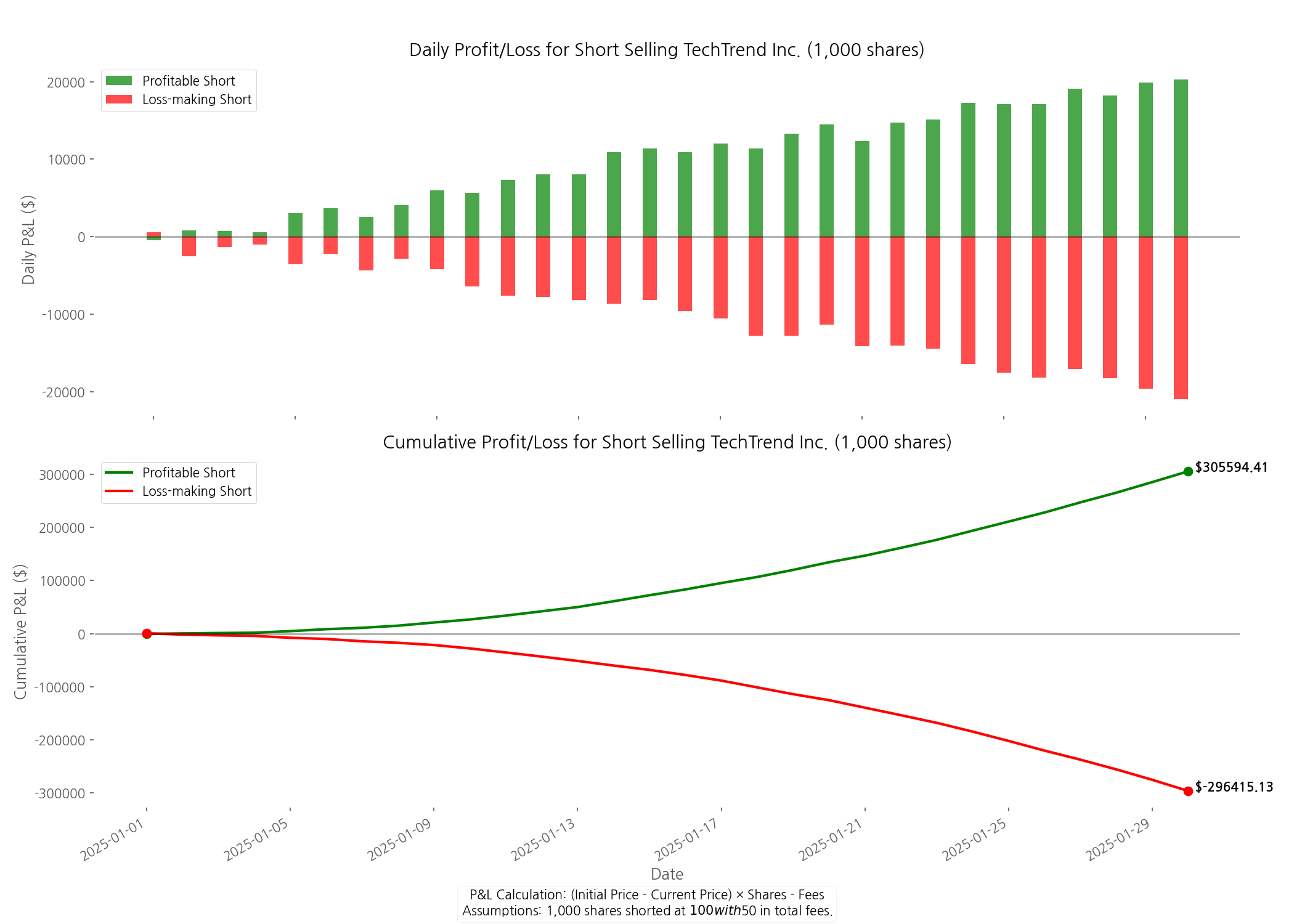

It's important to note that short selling typically involves fees and interest charges that reduce profitability. In our TechTrend example, we've included a $50 transaction fee for opening the position and another $50 fee for closing it, plus a 1% annual interest rate on the borrowed shares. These costs are relatively modest in our example but can be substantial for hard-to-borrow stocks or during periods of market stress when borrowing shares becomes more expensive.

In the profitable scenario, TechTrend's price falls to $80, allowing you to buy back shares for $80,000 – giving you a $20,000 profit (minus fees). However, in the loss scenario, the price rises to $120, forcing you to spend $120,000 to repurchase shares – resulting in a $20,000 loss (plus fees).

The daily profit and loss fluctuations reveal how volatile short positions can be, with gains and losses accumulating as the stock price moves:

Case Study 1: The GameStop Short Squeeze Disaster

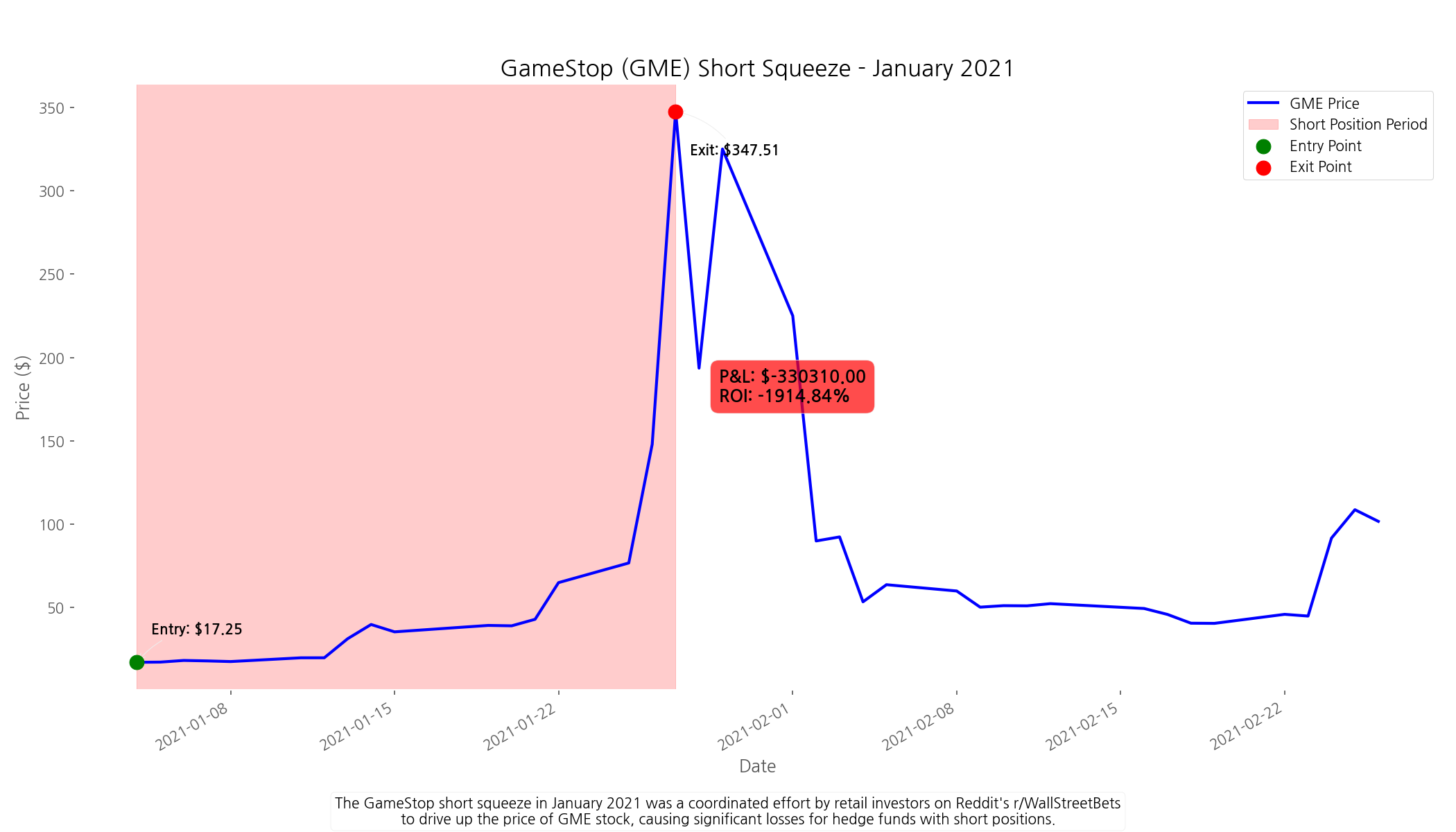

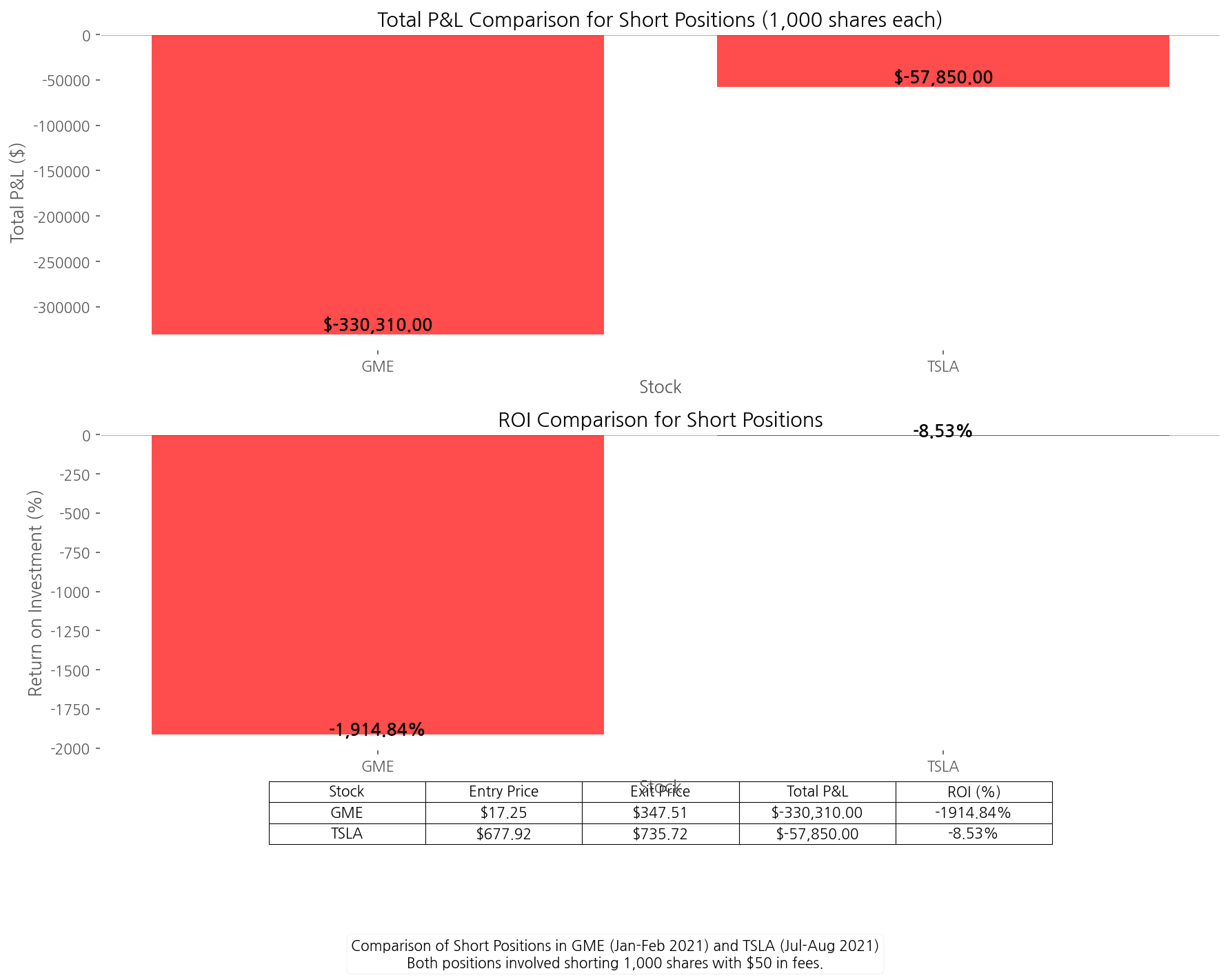

While our synthetic example is instructive, nothing illustrates the extreme risks of short selling better than the GameStop (GME) saga of January 2021. Using historical price data from the Tiingo API, we analyzed what would have happened to a short seller who shorted 1,000 shares of GME on January 4, 2021, at $17.25 per share.

The GameStop saga wasn't just a financial event – it became a cultural phenomenon that pitted retail investors against Wall Street institutions. As hedge funds with significant short positions scrambled to cover their losses, trading platforms controversially restricted buying of GME shares, sparking outrage and congressional hearings. The episode demonstrated how social media could coordinate retail investors into a formidable market force capable of creating a 'short squeeze' of historic proportions.

What followed was one of the most dramatic short squeezes in stock market history. As retail investors coordinated on Reddit's r/WallStreetBets forum to buy GME shares en masse, the price skyrocketed to $347.51 by January 27 – a staggering 1,914% increase in just 23 days.

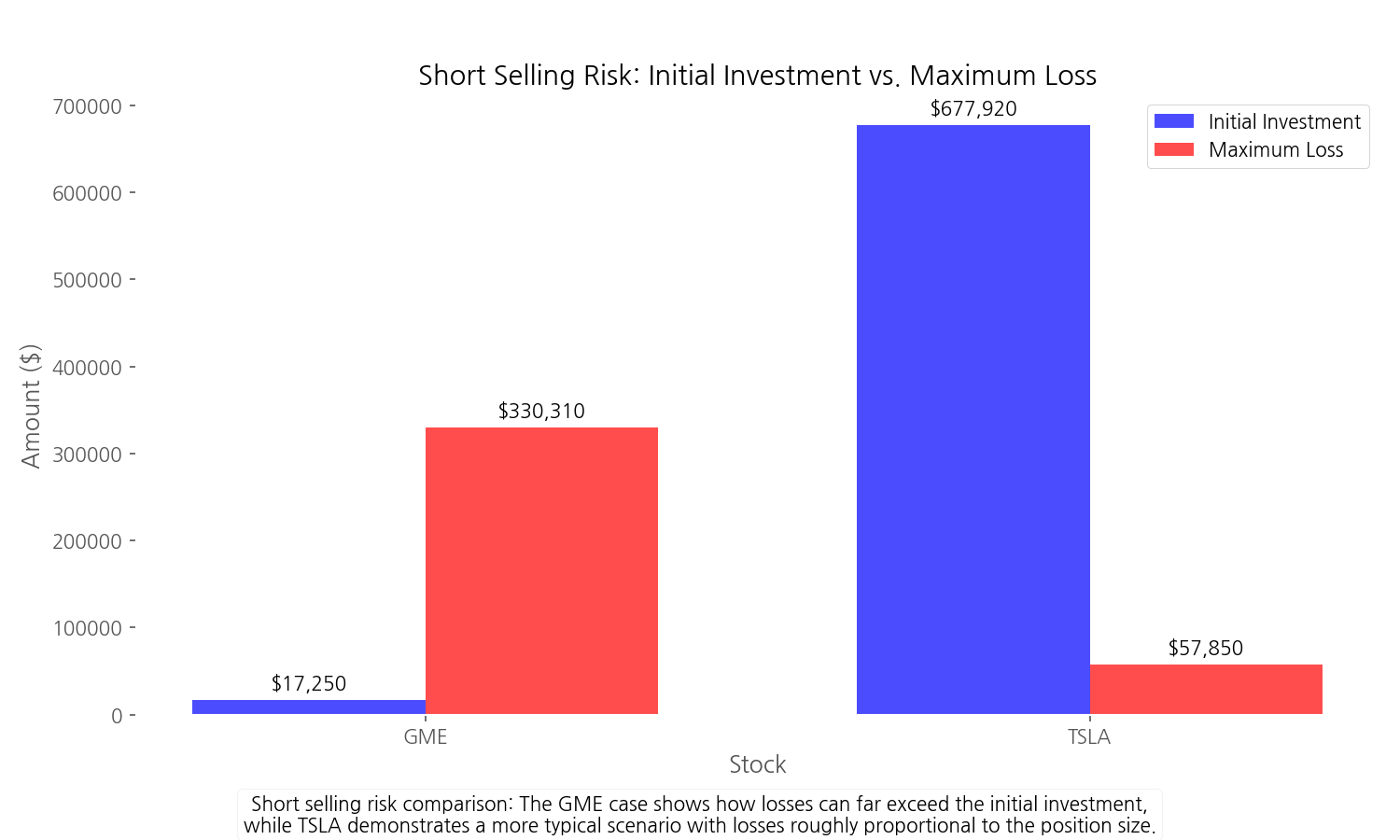

For our hypothetical short seller, the results were catastrophic. The position that initially required $17,250 (plus margin) resulted in a loss of $330,310 – a -1,914.84% return on investment. This real-world example demonstrates why short selling is considered one of the riskiest trading strategies: losses can far exceed your initial investment.

Case Study 2: Shorting Tesla in 2021

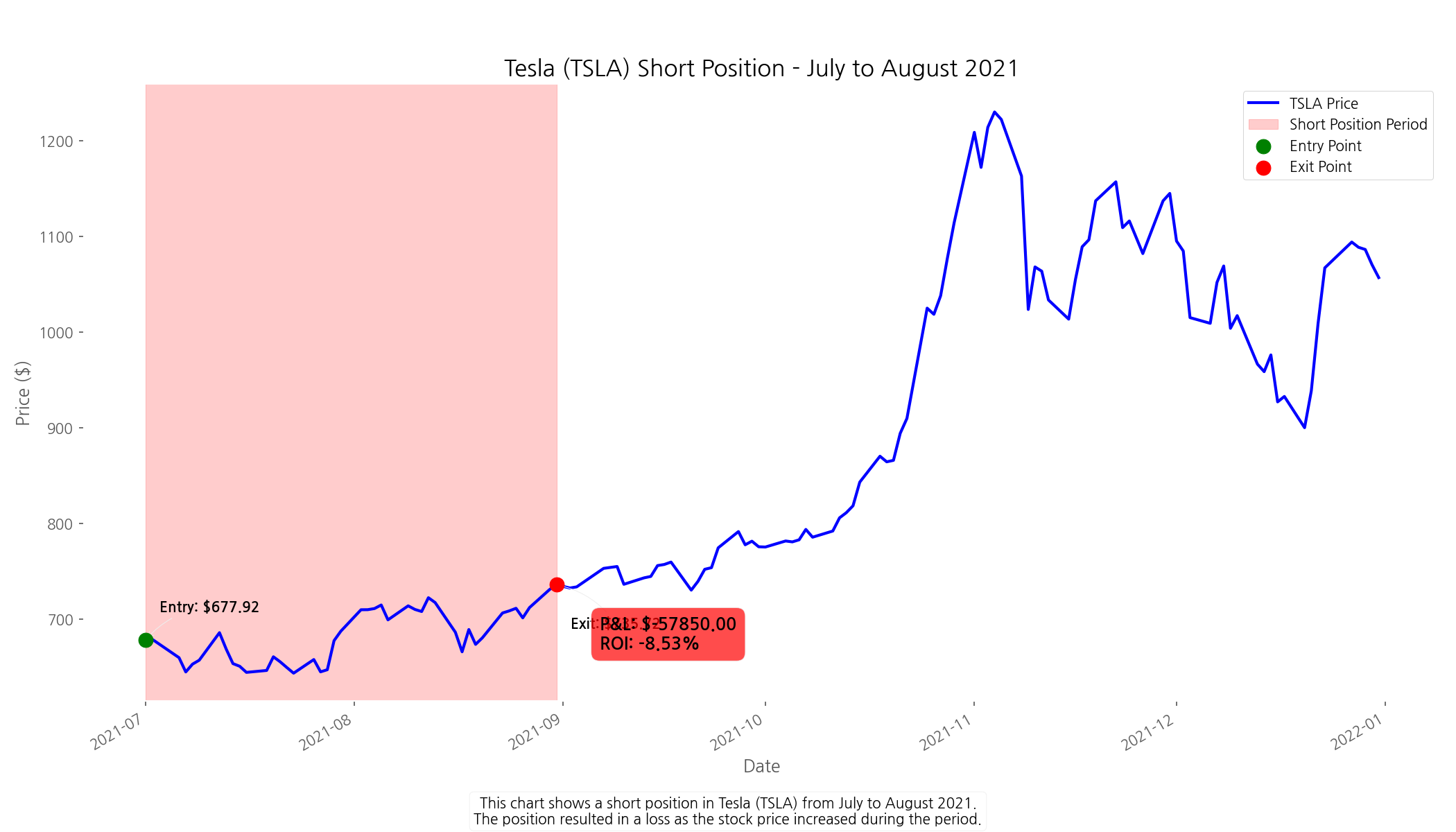

Not all short positions result in such dramatic losses. Let's examine a more typical scenario: shorting Tesla (TSLA) from July 1 to August 31, 2021. Using the same methodology, we analyzed what would happen to a short seller who shorted 1,000 shares of TSLA at $677.92 per share.

Tesla has long been a battleground stock for short sellers. Bears point to the company's historically inconsistent profitability, intense competition in the electric vehicle market, and high valuation metrics as reasons to short the stock. Bulls counter with Tesla's innovation leadership, brand strength, and expanding product lineup. Our July-August 2021 example shows how even a relatively short holding period can result in significant losses when shorting a volatile, momentum-driven stock like Tesla.

During this period, Tesla's stock experienced some volatility but ultimately rose to $735.72 by the exit date – resulting in a loss, but one of much smaller magnitude than the GME case.

Our analysis shows that this TSLA short position would have resulted in a loss of $57,850 – representing an -8.53% return on investment. While still a significant loss, it's far more manageable than the GME scenario and represents a more typical outcome for short sellers who bet against a stock that moves against their position.

The stark contrast between these two real-world examples becomes clear when we compare them directly:

Understanding the Financial Context and Risks

Beyond the technical aspects of short selling, understanding the fundamental financial health of companies you're shorting is crucial. While our financial data for GME and TSLA was limited, professional short sellers typically conduct extensive fundamental analysis, looking for deteriorating financial metrics, unsustainable business models, or accounting irregularities that might precede price declines. However, as both our examples show, even companies with challenging fundamentals can see their stock prices rise

What makes short selling particularly risky? Our analysis identified five key risk factors that every potential short seller should understand:

- Unlimited Loss Potential: Unlike buying stocks (where your maximum loss is your investment), short positions have theoretically unlimited loss potential as stock prices can rise indefinitely.

- Short Squeeze Risk: When prices rise rapidly, short sellers rush to cover positions by buying shares, further driving up prices in a vicious cycle – as seen with GME.

- Timing Sensitivity: Both entry and exit timing are critical for short selling success, making it challenging even for professional traders.

- Margin Requirements: Short positions require margin accounts with maintenance requirements that can trigger forced buying if prices rise.

- Borrowing Costs: Fees for borrowing shares reduce profitability, especially for popular short targets with high borrow rates.

Conclusion: Balancing Opportunity and Risk

Our data-driven analysis reveals the dual nature of short selling: while it offers a way to profit from declining markets, it comes with significant risks that can lead to catastrophic losses. The synthetic scenario demonstrated a potential $20,000 profit in favorable conditions but an equal loss when conditions turned unfavorable. More dramatically, our real-world examples showed how a GME short position could have lost $330,310

For investors considering short selling, these examples underscore the importance of thorough research, risk management strategies, and an understanding of market sentiment. While short selling has its place in sophisticated trading strategies, it's a tool that demands respect for its potential downside – especially in an era where coordinated retail investors have demonstrated their power to create devastating short squeezes.

Remember: in short selling, your potential gains are limited (a stock can only fall to zero), but your potential losses are theoretically unlimited. This asymmetric risk profile makes short selling a strategy best approached with caution, expertise, and careful position sizing.

Comments (0)

No comments yet. Be the first to comment!