Powell’s Jackson Hole Pivot

In late August 2025, Jerome Powell surprised markets at the Jackson Hole symposium by opening the door to possible rate cuts as early as September. He emphasized that while inflation risks from tariffs remain, the labor market is weakening—and the Fed must stay responsive to both. Investors quickly repriced expectations, cheering the idea of looser policy after one of the most aggressive tightening cycles in decades.

Why Fed Rates Matter for Banks

When the Federal Reserve moves rates, banks feel it first. Higher rates usually widen the spread between loan yields and deposit costs, boosting Net Interest Margin (NIM). But this benefit can fade if rates climb too far, as loan demand drops and defaults rise. That’s where Return on Equity (ROE) comes in: it captures whether banks turn wider margins into actual profitability for shareholders.

What the Data Shows

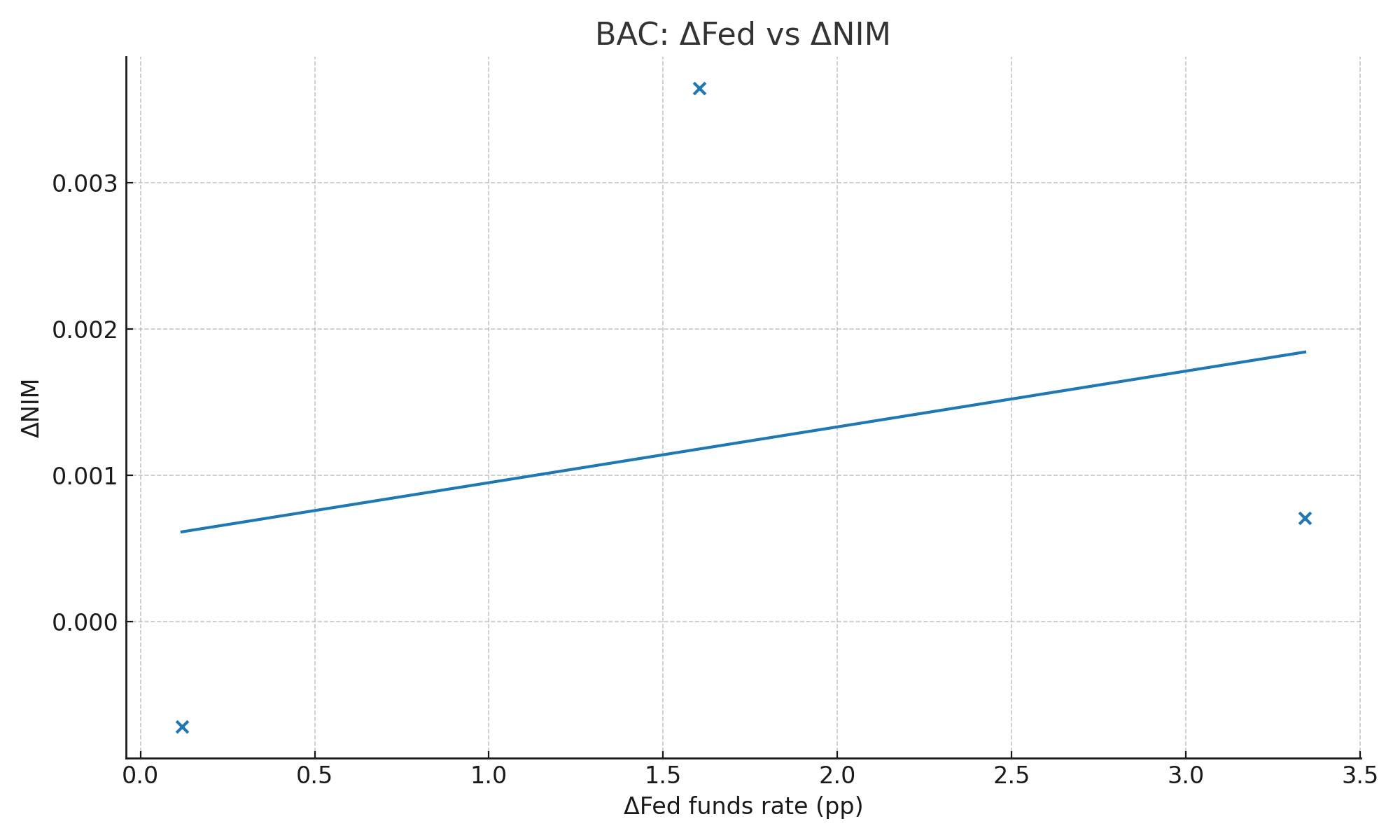

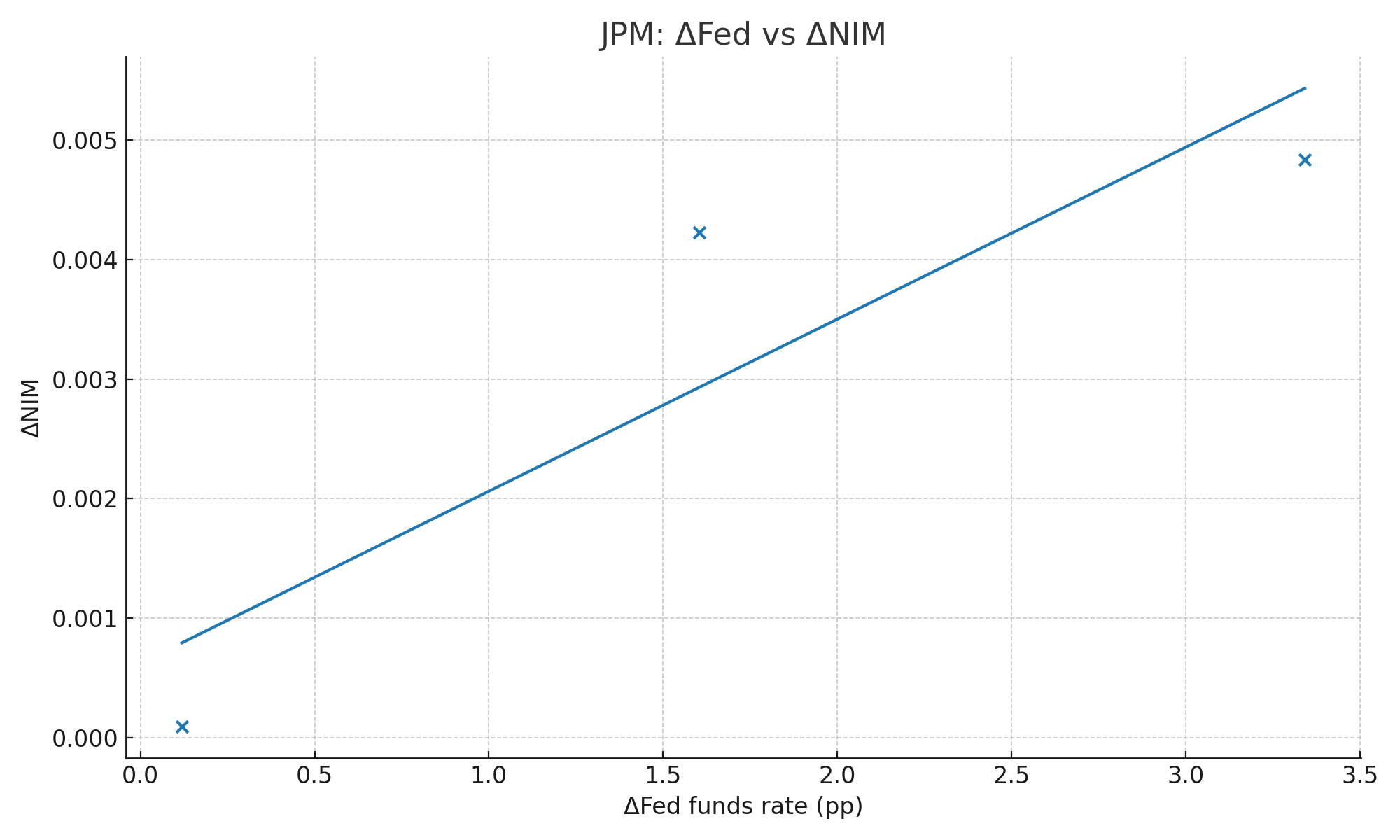

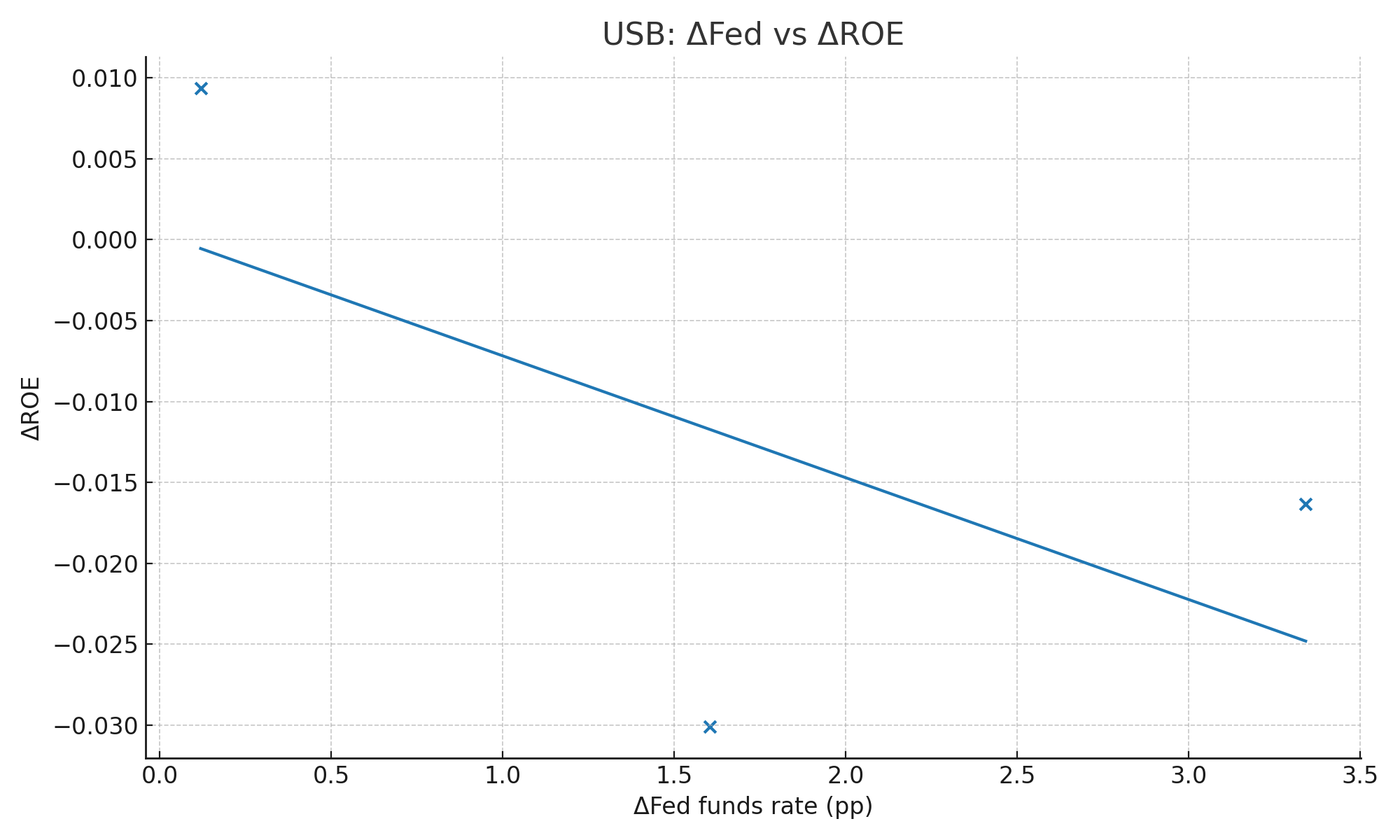

Looking at four years of annual statements from major U.S. banks—Bank of America (BAC), JPMorgan (JPM), PNC, U.S. Bancorp (USB), and Wells Fargo (WFC)—we see clear patterns. NIM is strongly correlated with Fed rates across the board, with JPMorgan showing the tightest relationship. But ROE tells a different story: BAC and USB actually saw profitability weaken as rates rose, suggesting that strong margins didn’t fully offset the drag from softer loan growth.

| Bank | Corr(Fed vs NIM) | Corr(Fed vs ROE) | Slope(ΔNIM/ΔFed) | Slope(ΔROE/ΔFed) |

|---|---|---|---|---|

| BAC | 0.81 | -0.94 | 0.00038 | -0.0031 |

| JPM | 0.99 | 0.22 | 0.00144 | 0.0021 |

| PNC | 0.88 | -0.11 | 0.00059 | -0.0074 |

| USB | 0.87 | -0.90 | 0.00206 | -0.0075 |

| WFC | 0.87 | 0.06 | 0.00165 | 0.0072 |

What It Means After Powell’s Signal

If Powell follows through with a rate cut, the cycle may flip: margins could compress as lending spreads narrow, but loan demand might revive, giving ROE a lift. Banks like JPM, which showed both margin sensitivity and stable ROE correlation, may weather the shift best. Regional lenders like USB, already struggling to translate higher rates into profitability, could feel more pressure. The key is that Powell’s pivot doesn’t just move Wall Street—it directly reshapes how banks make money.

Key Takeaways

- Powell’s latest remarks hint at rate cuts, potentially reversing recent margin gains for banks.

- NIM rises with higher rates, but ROE responses are mixed—profitability depends on loan demand.

- JPMorgan appears best positioned to adapt if the Fed eases policy.

- Regional banks like USB may face challenges turning margins into shareholder returns.

- The Fed’s balancing act—between inflation, jobs, and growth—directly shapes bank earnings power.

Comments (0)

No comments yet. Be the first to comment!