U.S. Market Crash on November 4, 2025: Valuation Concerns and Government Shutdown Double Blow

Key Summary

On November 4, 2025, major U.S. indices fell sharply. The S&P 500 dropped 1.17%, the Nasdaq fell 2.04%, and the Dow Jones declined 0.53%. AI darling Palantir plunged 8% despite strong earnings, triggering valuation concerns across tech stocks. CEOs of Goldman Sachs and Morgan Stanley warned of market corrections, worsening investor sentiment. The 35-day government shutdown added fears of consumer spending slowdown.

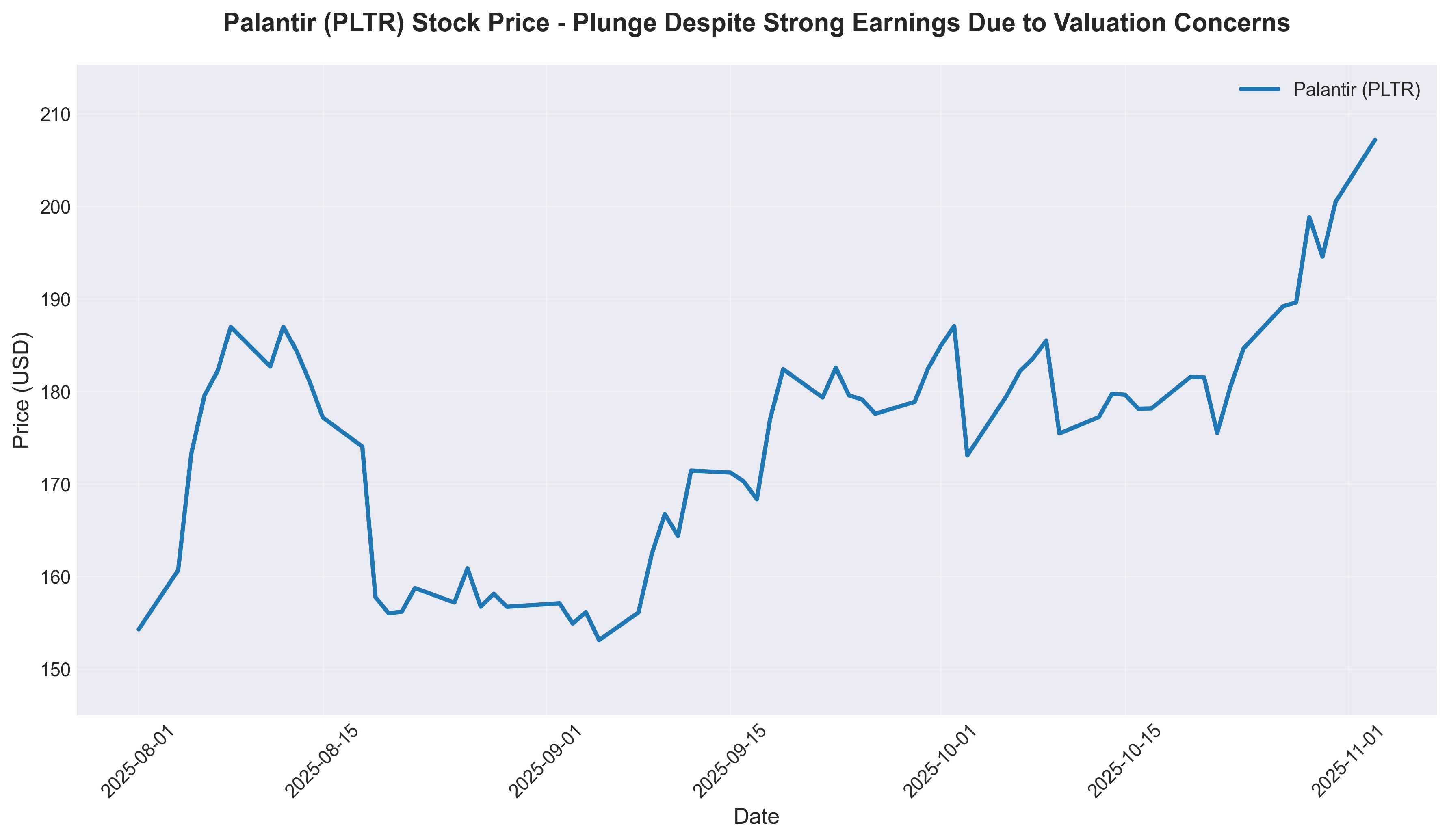

1. The Palantir Paradox: Good Results, Bad Reaction

The trigger for the November 4 market correction was Palantir's paradoxical decline.

Palantir's Q3 results beat Wall Street expectations, and its Q4 guidance exceeded consensus. The company emphasized that its AI business grew 77%. Yet the stock plunged 8%.

The reason is valuation. Palantir's forward P/E exceeds 200x. Investors believe the current stock price is only justified if the company continues growing at an extraordinary pace. Even though results were good, the perception that they weren't "good enough" and lack of 2026 visibility triggered selling.

This wasn't just one stock's problem. Concerns spread across the AI sector, with AMD down 3%, Nvidia down 2%, and Oracle down 4%.

Lesson 1: When valuation reflects a perfect future, even good earnings can disappoint

When expectations are too high, even good news can't prevent a stock decline. Markets trade future earnings, not just current results.

Chart 1: Palantir Stock Price Trend (Last 3 Months)

Ticker: PLTR Period: 2025-08-04 ~ 2025-11-04 Description: Palantir's sharp drop after earnings announcement

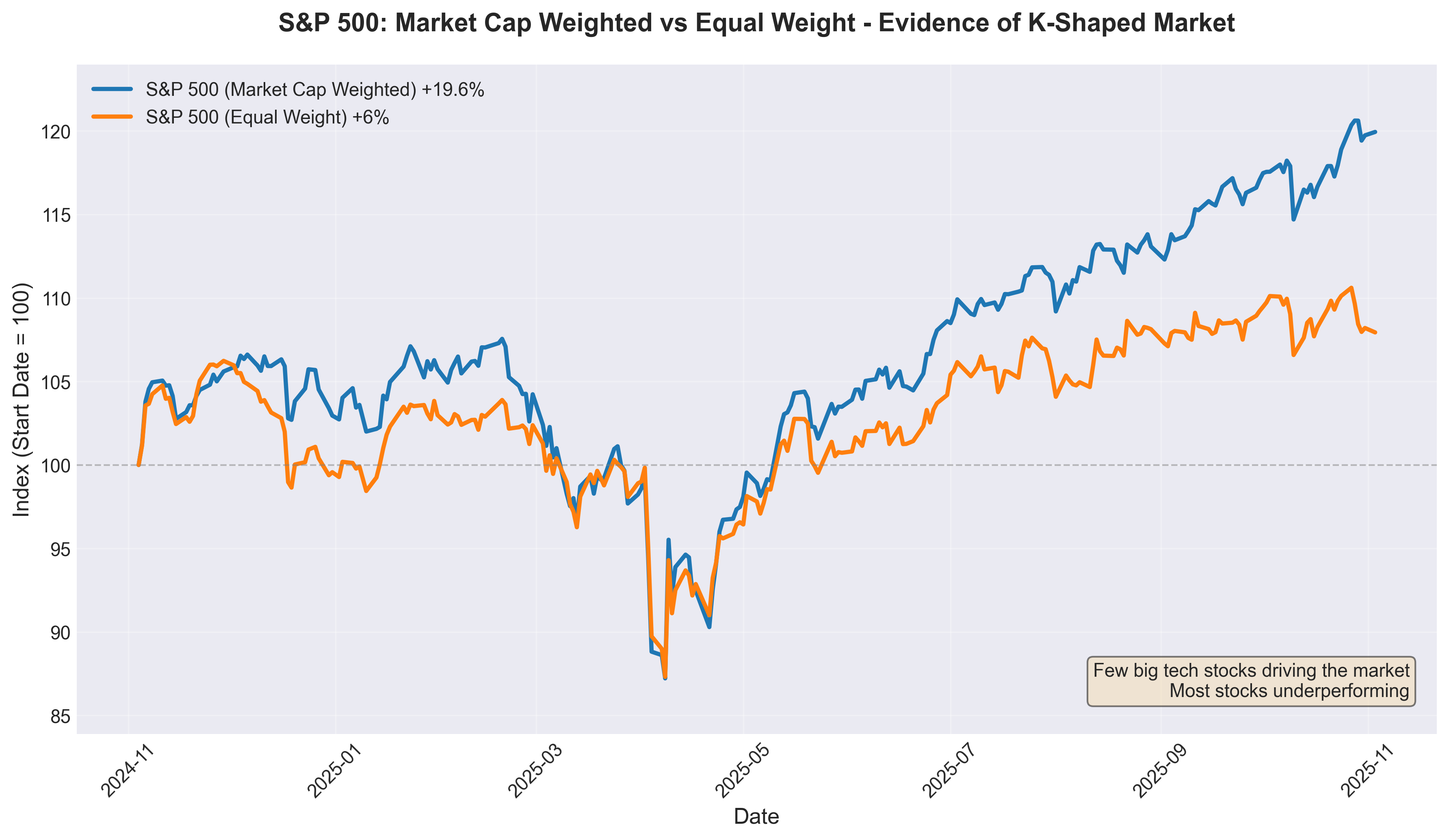

2. K-Shaped Market: The Danger of Only a Few Stocks Rising

The market's extreme concentration was the problem. Over the past month, the 'Magnificent 7' rose 5.4%, but the S&P 500 Equal Weight Index fell 2.1%. Schwab's Kevin Gordon called this a "K-shaped market."

More striking: Only 38% of S&P 500 stocks are trading above their 50-day moving average. This means market gains depend on a few big tech stocks, while the majority are already in correction.

Nvidia's market cap of $5 trillion represents 8% of the entire S&P 500. The market-cap weighted S&P 500 is up 19.6% year-to-date, but the equal-weight index is up only 6%.

Lesson 2: A concentrated market is a fragile market

Rallies driven by a few stocks create greater volatility during corrections. Diversification isn't a return maximization strategy—it's a risk management tool.

Chart 2: S&P 500 vs Equal Weight S&P 500 (Last 1 Year)

Ticker: ^GSPC (S&P 500), RSP (Equal Weight ETF) Period: 2024-11-04 ~ 2025-11-04 Description: Extreme divergence between market-cap weighted and equal-weight indices

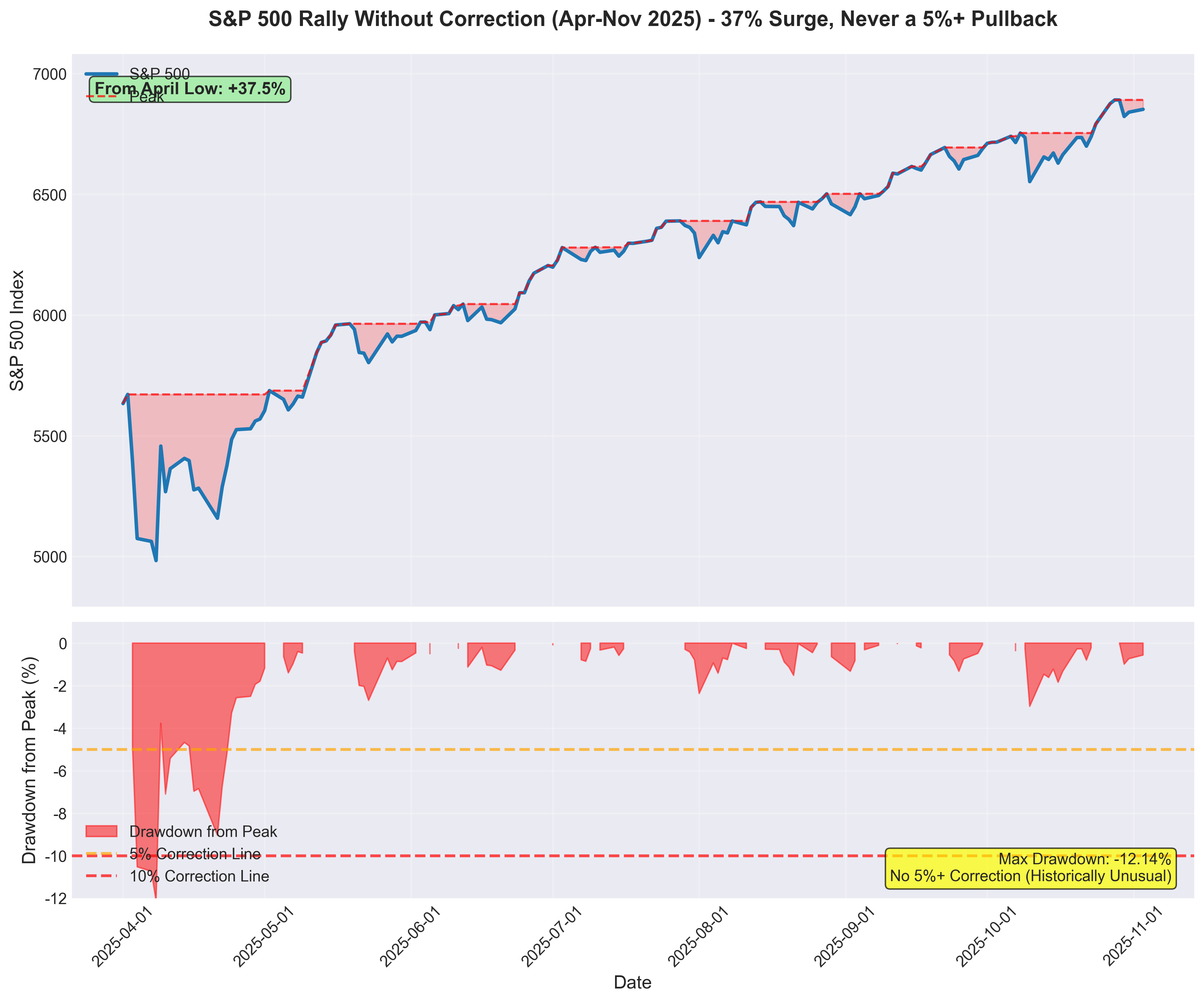

3. Wall Street Giants' Warning: "10-20% Correction Coming"

On the morning of November 4 (Korea time), as markets wobbled, bombshell warnings came from the Hong Kong Global Financial Leaders Summit.

Goldman Sachs CEO David Solomon: "There's a high probability of a 10-20% stock market correction within the next 12-24 months"

Morgan Stanley CEO Ted Pick: "A 10-15% decline without a macro shock would be a healthy correction"

Capital Group CEO Mike Gitlin: "Corporate earnings are strong, but valuation is the issue"

These statements align with recent valuation warnings from the IMF, Fed Chair Jerome Powell, and the Bank of England Governor.

Notably, since the April 2025 low, the S&P 500 has surged 37% and the Nasdaq 56%, without a single 5%+ correction. This is historically unusual.

Solomon compared the current AI frenzy to the dotcom boom. "AI will create winners and losers, and some AI investments won't be profitable." He acknowledges technology's potential but warns that if markets have already priced in 10 years of growth, it's risky.

Lesson 3: Rallies without corrections aren't sustainable

Even healthy bull markets periodically cool down. A 10-15% correction is historically common and shouldn't be a reason to abandon long-term strategy.

Chart 3: S&P 500 Rally Without Correction (April-November 2025)

Ticker: ^GSPC Period: 2025-04-01 ~ 2025-11-04 Description: Unusual 37% surge without a 5%+ correction

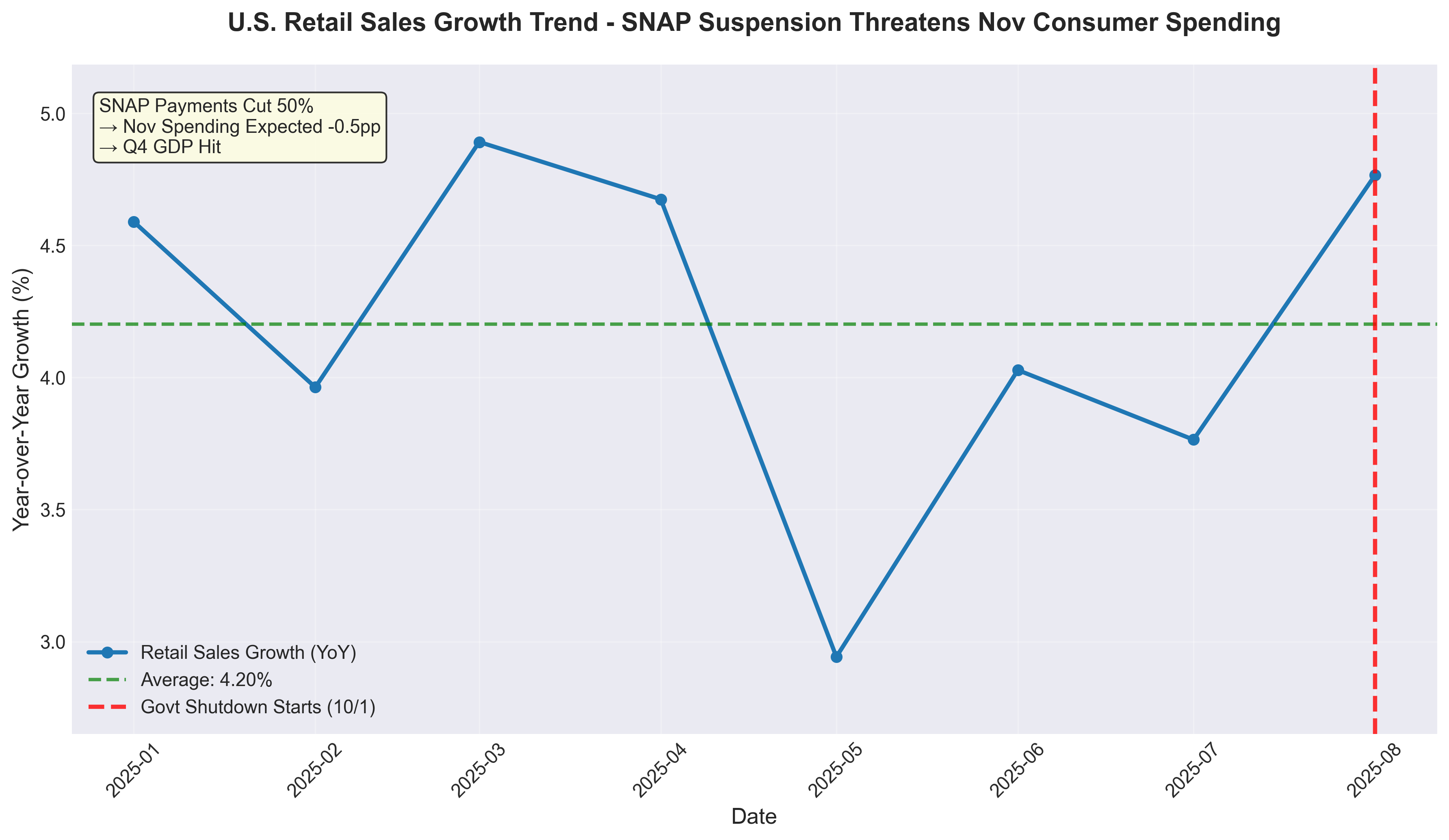

4. Government Shutdown Day 35: The Consumer Spending Time Bomb

Real economy risk added to market concerns. The government shutdown that began October 1 reached day 35 on November 4, approaching the longest shutdown in history.

SNAP (food assistance) payments were suspended starting November 1. A court order allocated $4.65 billion in emergency reserves to pay only 50% of November benefits, but delays are inevitable.

Impact scale:

- SNAP recipients: 42 million people (1/8 of U.S. population)

- Average monthly benefit: $187 per person

- 39% of recipients are under 18

Bank of America warned that SNAP payment delays could reduce November consumer spending by up to 0.5 percentage points. This would directly hit Q4 GDP.

Congressional Budget Office (CBO) estimates:

- First month of shutdown: $33 billion in delayed spending

- If it lasts 6 weeks: $54 billion (including $2 billion in SNAP)

A bigger problem is the economic data blackout. During shutdowns, employment, unemployment, and retail sales statistics aren't collected. The Fed won't have a clear picture of the economy when making its December rate decision.

Lesson 4: Political uncertainty creates economic costs

Government shutdowns are a "game where nobody wins." Real costs emerge: consumer contraction, data gaps, and market uncertainty.

Chart 4: U.S. Retail Sales Growth Trend

FRED Code: RSXFS (Advance Retail Sales) Period: 2024-01-01 ~ 2025-10-01 Description: Consumption trend and potential impact of SNAP cuts

Conclusion: Lessons From the Market

November 4, 2025 was a day when multiple warnings converged:

-

The trap of valuation and expectations - When a perfect future is priced in, even good earnings create disappointment

-

The danger of market concentration - Dependence on a few stocks is advantageous in rallies but vulnerable during corrections

-

Corrections are inevitable - A 37% gain in 5 months without corrections is historically unusual; even healthy markets periodically cool down

-

Politics shakes the economy - Government shutdowns lead to consumer slowdown and policy uncertainty

So what should investors do?

The Goldman Sachs CEO advised clients to "stay invested but periodically rebalance your portfolio." Don't try to time the market, maintain diversification, and prepare for volatility.

Even Wall Street titans admit "we won't know when a correction will come until it actually happens." But their warnings highlight the need for risk management.

Markets rise, correct, and rise again. As Solomon said, "In cycles, things progress for a while, then there's a correction, people reassess. And then they move forward again."

For long-term investors, what matters isn't timing, but time in the market.

Disclaimer: This article is for informational purposes only and is not investment advice. All investment decisions are the reader's responsibility.

Comments (0)

No comments yet. Be the first to comment!