📈 Dow Breaks 47,000! Inflation Cools, US-China Talks Resume, Ford & GM Surge

1. Major Indices Hit Record Highs - Rally on Inflation Slowdown

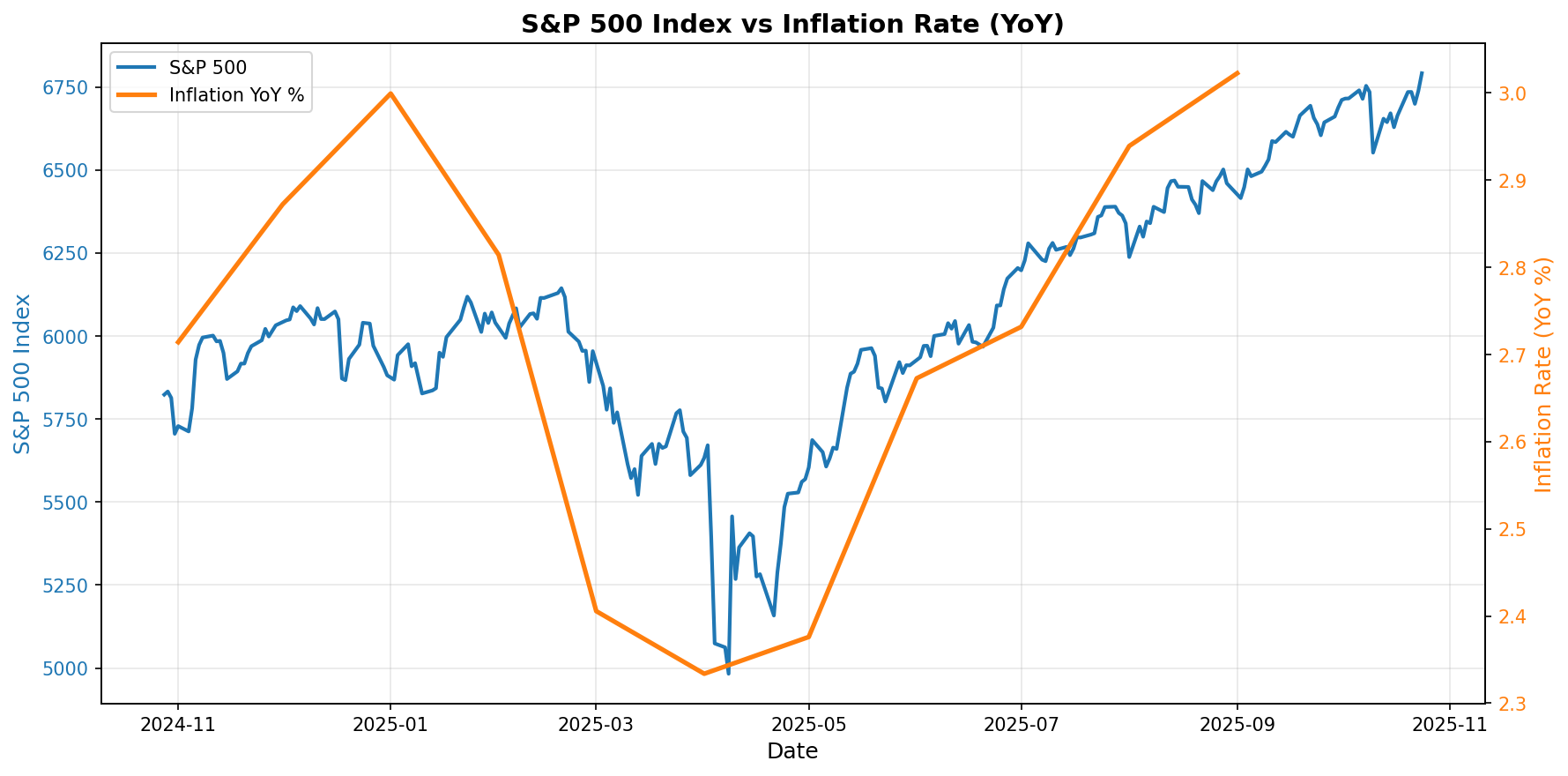

U.S. stock markets reached record highs on Friday as September's Consumer Price Index (CPI) came in lower than expected. The Dow Jones Industrial Average closed at 47,207.12, up 472.51 points (1.01%), breaking through the 47,000 level for the first time. The S&P 500 rose 0.79% to 6,791.69, and the Nasdaq Composite gained 1.15% to 23,204.87, with all three indices closing at all-time highs. September's CPI increased 0.3% month-over-month, with annual inflation at 3.0%, below expectations of 0.4% and 3.1%, respectively.

Chart Analysis: The chart above shows the trend of the S&P 500 index and year-over-year inflation rate based on the Consumer Price Index (CPI). You can observe the inverse correlation between declining inflation and a strengthening stock market.

2. Optimism for U.S.-China Trade Talks - Trump-Xi Summit Scheduled

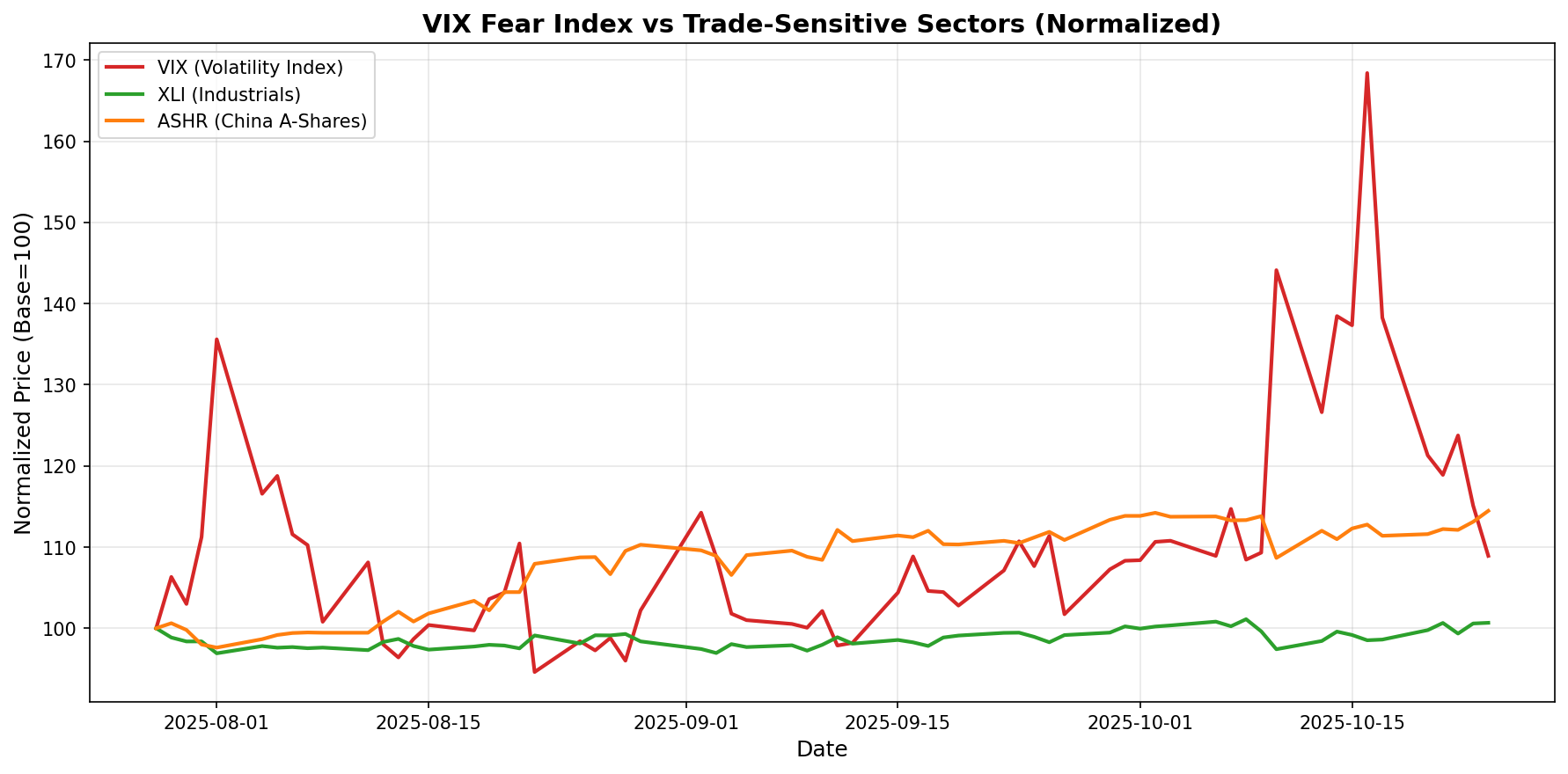

President Trump claimed that his tariff policies have strengthened the stock market. Investor concerns about U.S.-China trade relations eased after the White House announced on Thursday that President Trump and Chinese President Xi Jinping will hold a bilateral meeting in South Korea next week. Meanwhile, Trump announced the suspension of all trade negotiations with Canada after the country aired advertisements critical of his tariffs, though markets remained largely unaffected.

Chart Analysis: This chart compares the VIX fear index with normalized prices of trade-sensitive sectors (Industrial Sector ETF XLI and China A-shares ETF ASHR). It shows volatility declining and trade-related sectors rebounding on optimism for renewed trade negotiations.

3. Consumer Sentiment Deteriorates - Concerns Over Prolonged Government Shutdown

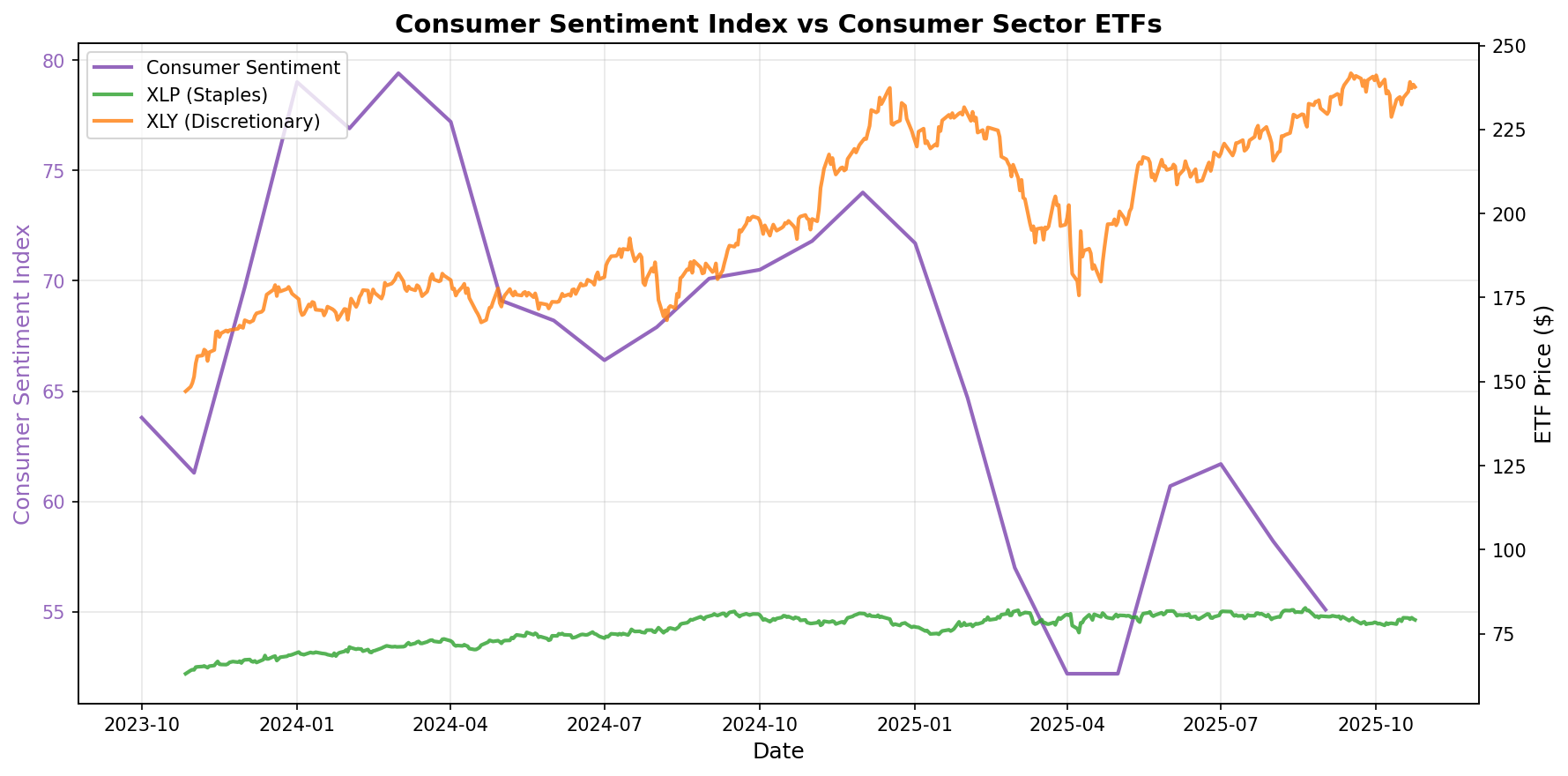

The University of Michigan Consumer Sentiment Index fell to 53.6 in late October, down 2.7% from September and plunging 24% year-over-year. One-year inflation expectations dropped to 4.6%, the lowest since July, while five-year expectations rose to 3.9%, the highest since June. Consumers are worried about the prolonged government shutdown, with federal workers missing their second paycheck.

Chart Analysis: This chart displays the relationship between the Michigan Consumer Sentiment Index and consumer sector ETFs (Consumer Staples XLP and Consumer Discretionary XLY). Despite deteriorating consumer sentiment, consumer staples show relatively stable performance.

4. Ford Motor Surges on Strong Earnings - Auto Sector Strength

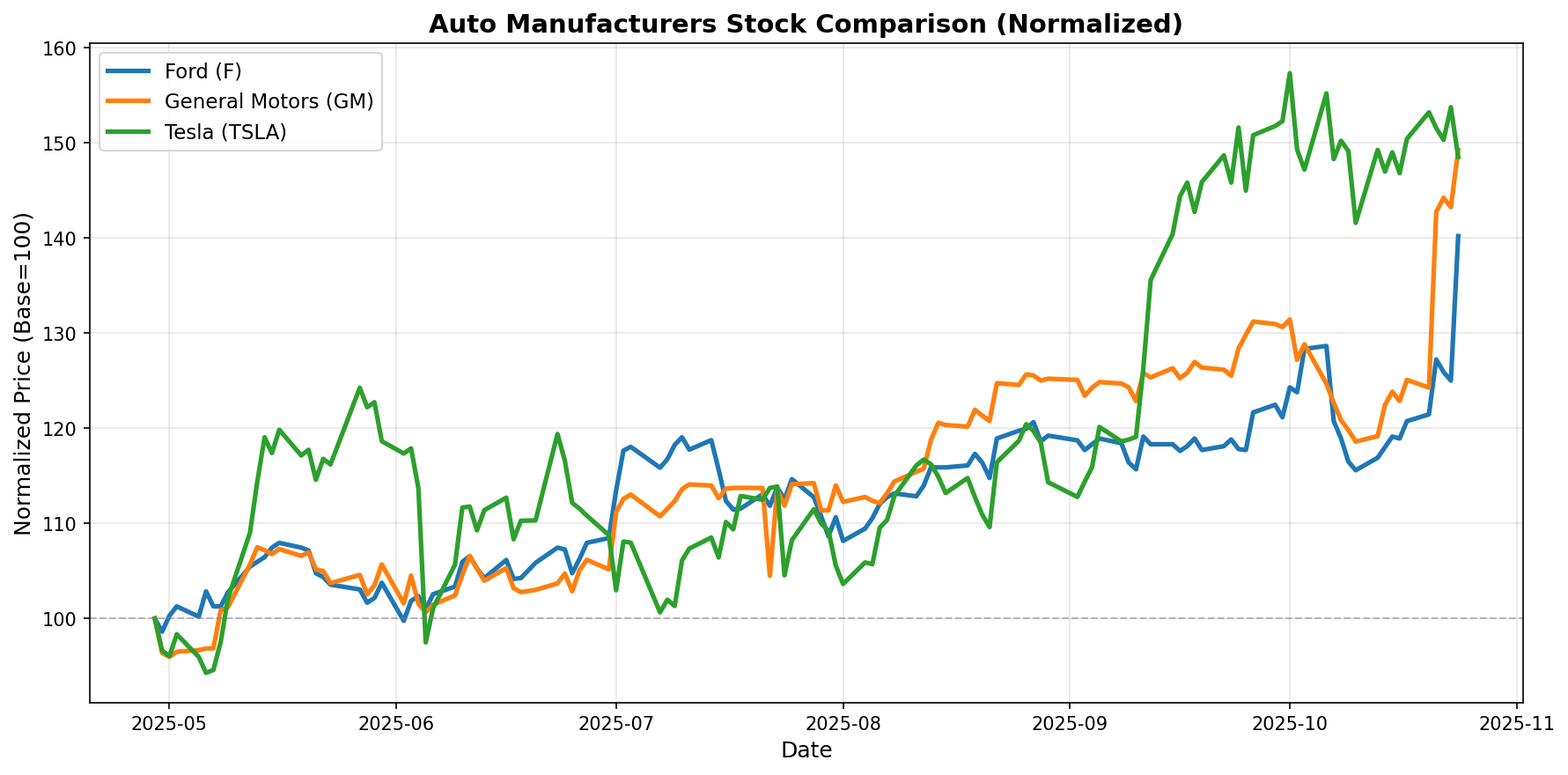

Ford Motor jumped 10.7% following strong third-quarter earnings. General Motors (GM) also surged 14.9% after beating earnings expectations and raising guidance. GM announced it expects to offset approximately 35% of the impact from President Trump's 2025 tariffs.

Chart Analysis: This chart compares normalized stock prices of Ford (F), General Motors (GM), and Tesla (TSLA) over the past six months. You can see the strong earnings recovery of traditional automakers.

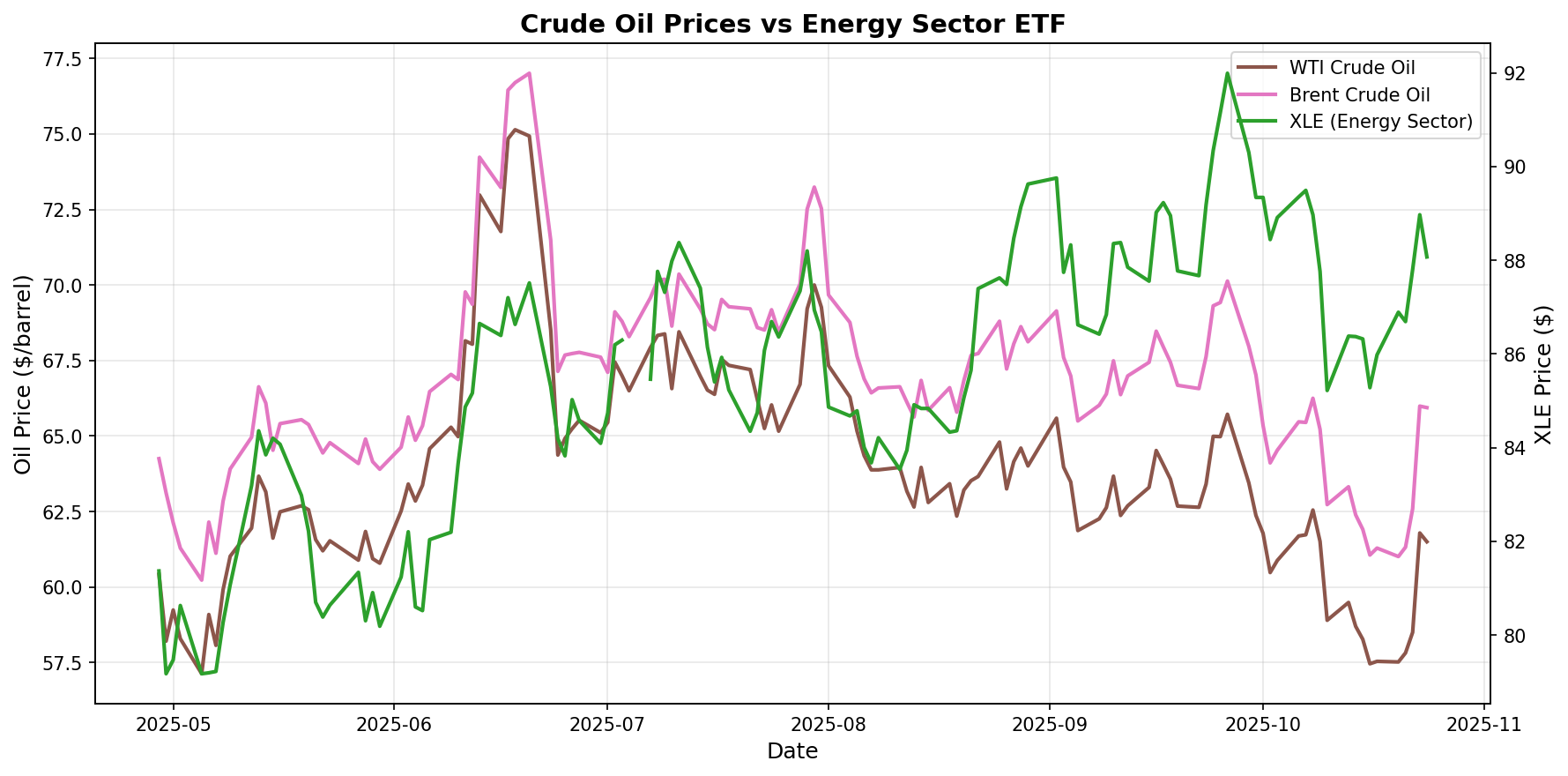

5. Additional Sanctions on Russian Oil Companies - Oil Prices Surge 5%

The Trump administration imposed additional sanctions on Wednesday against Russia's two largest crude oil companies, citing Russia's lack of serious commitment to the Ukraine peace process. Sanctions were applied to Rosneft and Lukoil. On Thursday, international benchmark Brent crude rose $3.06 (4.89%) to $65.65 per barrel, and U.S. crude increased $3.10 (5.3%) to $61.60 per barrel.

Chart Analysis: This chart shows the correlation between WTI crude oil and Brent crude futures prices and the Energy Sector ETF (XLE). You can see supply concerns from Russian sanctions driving oil price increases, with the energy sector rising in tandem.

Investment Implications

-

If Inflation Slowdown Continues: Positive for growth stocks and technology stocks. Expectations for interest rate cuts may expand.

-

If Trade Negotiations Progress: Industrials and semiconductor sectors with high China exposure expected to benefit.

-

Responding to Weakening Consumer Sentiment: Consider increasing allocation to consumer staples and healthcare sectors for a defensive portfolio.

-

Auto Sector: Focus on traditional automakers improving earnings. Monitor tariff impacts.

-

Energy Sector: Geopolitical risks amplify oil price volatility. Short-term trading opportunities exist, but exercise caution with long-term investments.

Disclaimer: This news summary is for informational purposes only and is not investment advice. Investment decisions should be made at your own judgment and risk.

Comments (0)

No comments yet. Be the first to comment!