US Stock Market Hits All-Time High on US-China Trade Progress - October 28

1. S&P 500 Surges 1.2% on US-China Trade Negotiations Progress

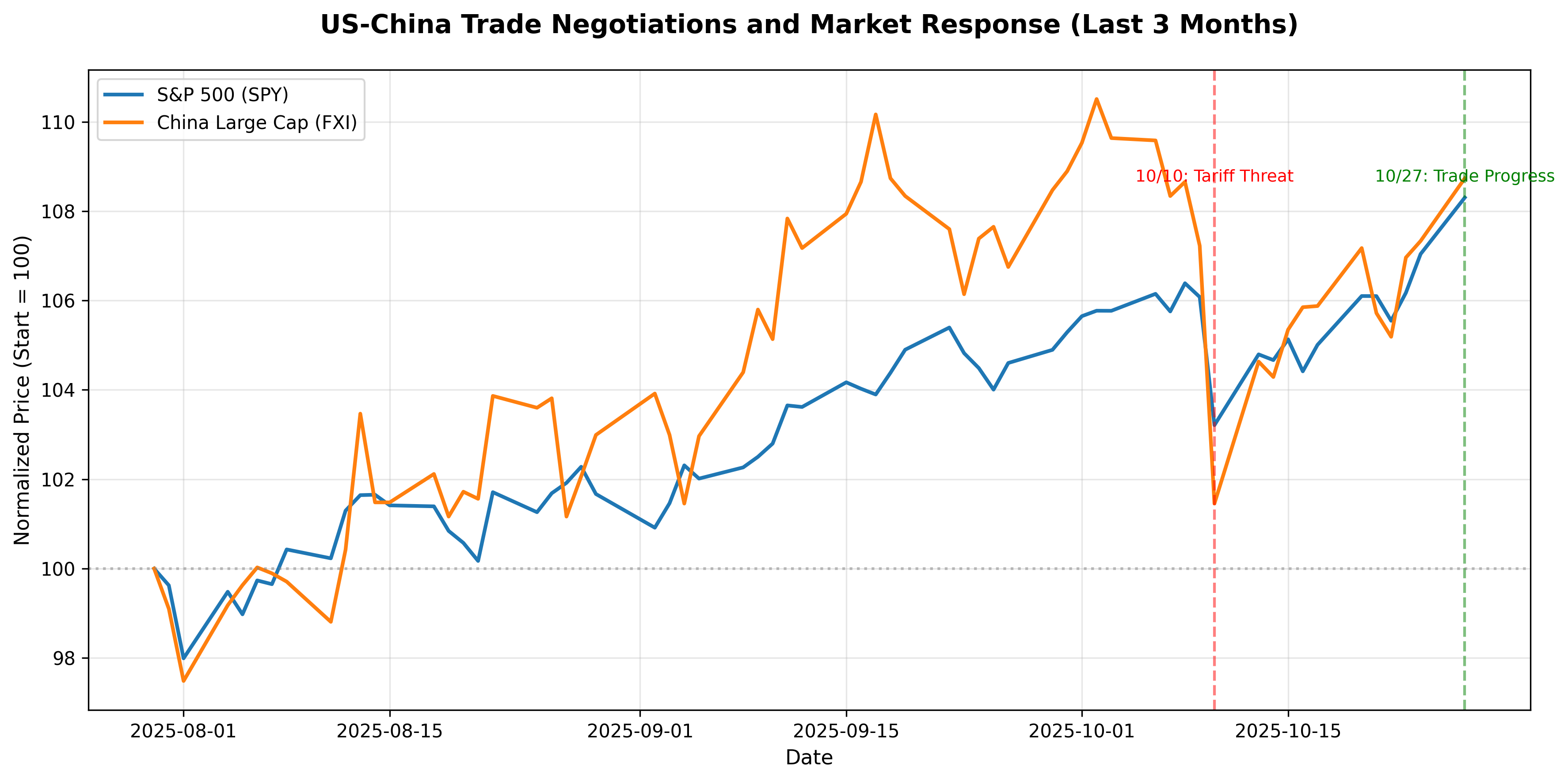

The S&P 500 rose 1.2% to hit an all-time high as the United States and China made progress in trade negotiations. Ahead of a summit between President Trump and President Xi Jinping in South Korea on Thursday, trade negotiators from both countries are preparing a series of diplomatic achievements.

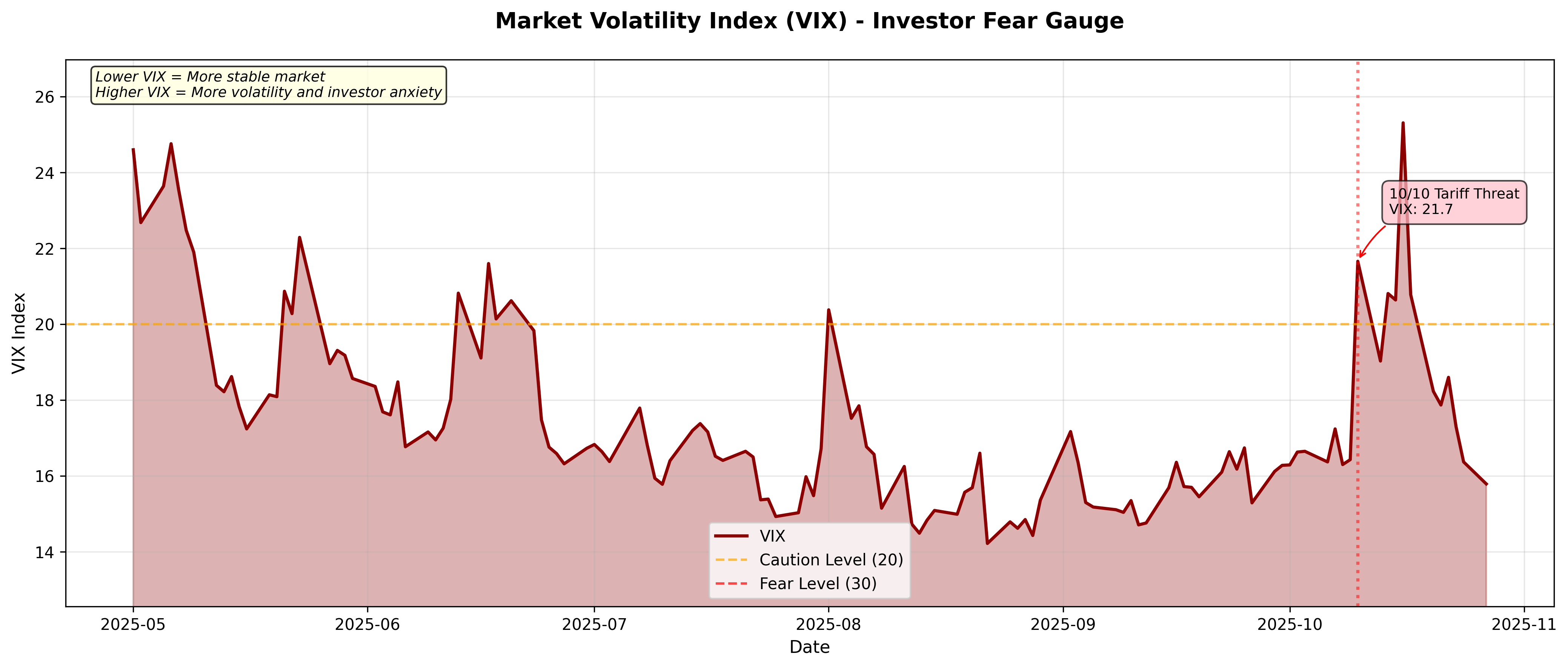

📊 Context: On October 10, the market plunged 3% when Trump threatened to impose an additional 100% tariff on Chinese goods. However, news of progress in trade negotiations has sparked a rebound on expectations that uncertainty will be resolved. Treasury Secretary Scott Bessent announced that a negotiation framework has been agreed upon and the threat of imposing 155% tariffs scheduled for November 1 has been removed. This gave investors a sense of relief that "the worst-case scenario of a trade war can be avoided."

2. Big Tech Earnings Week: The Fate of $15 Trillion in Market Cap

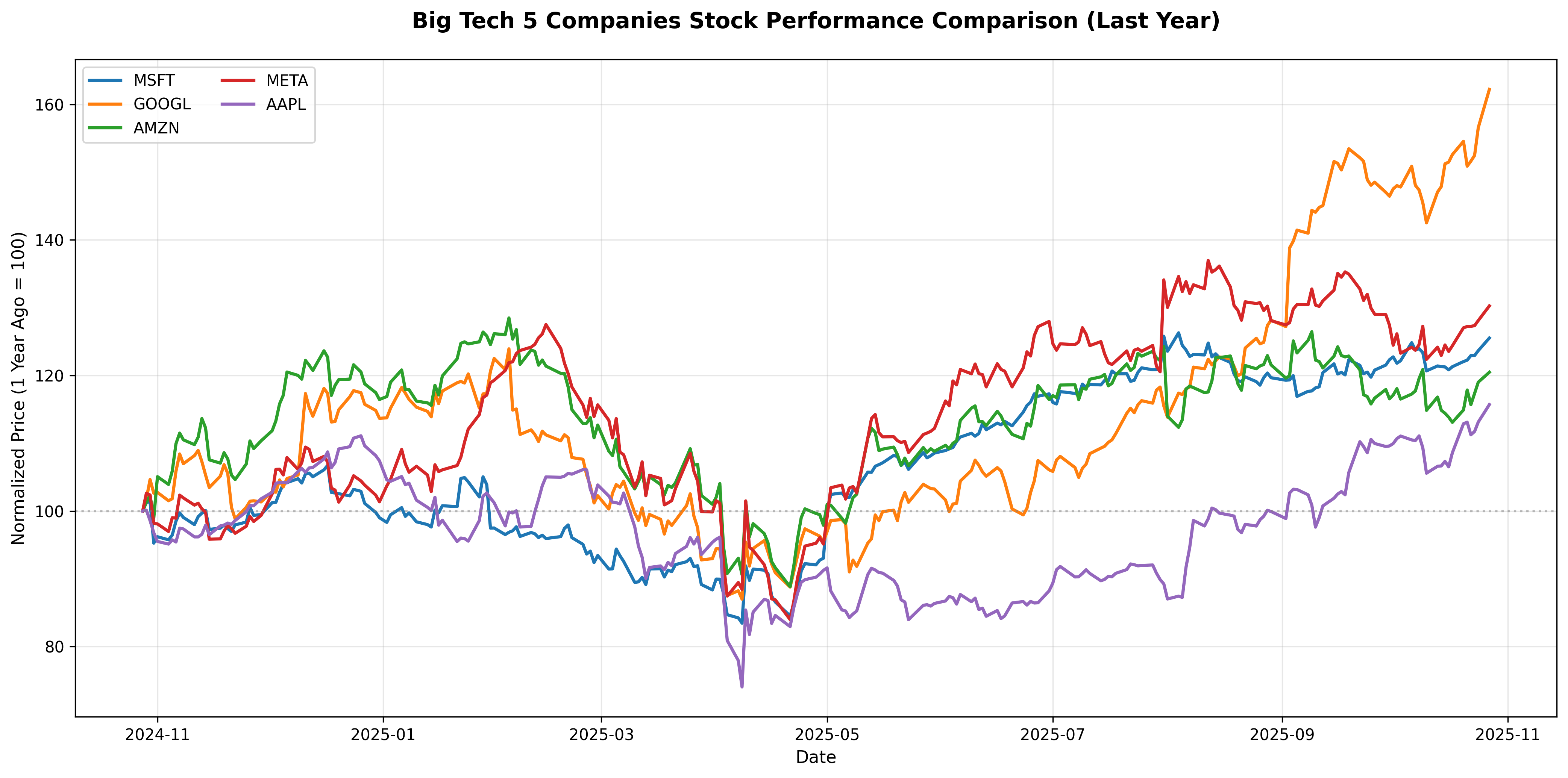

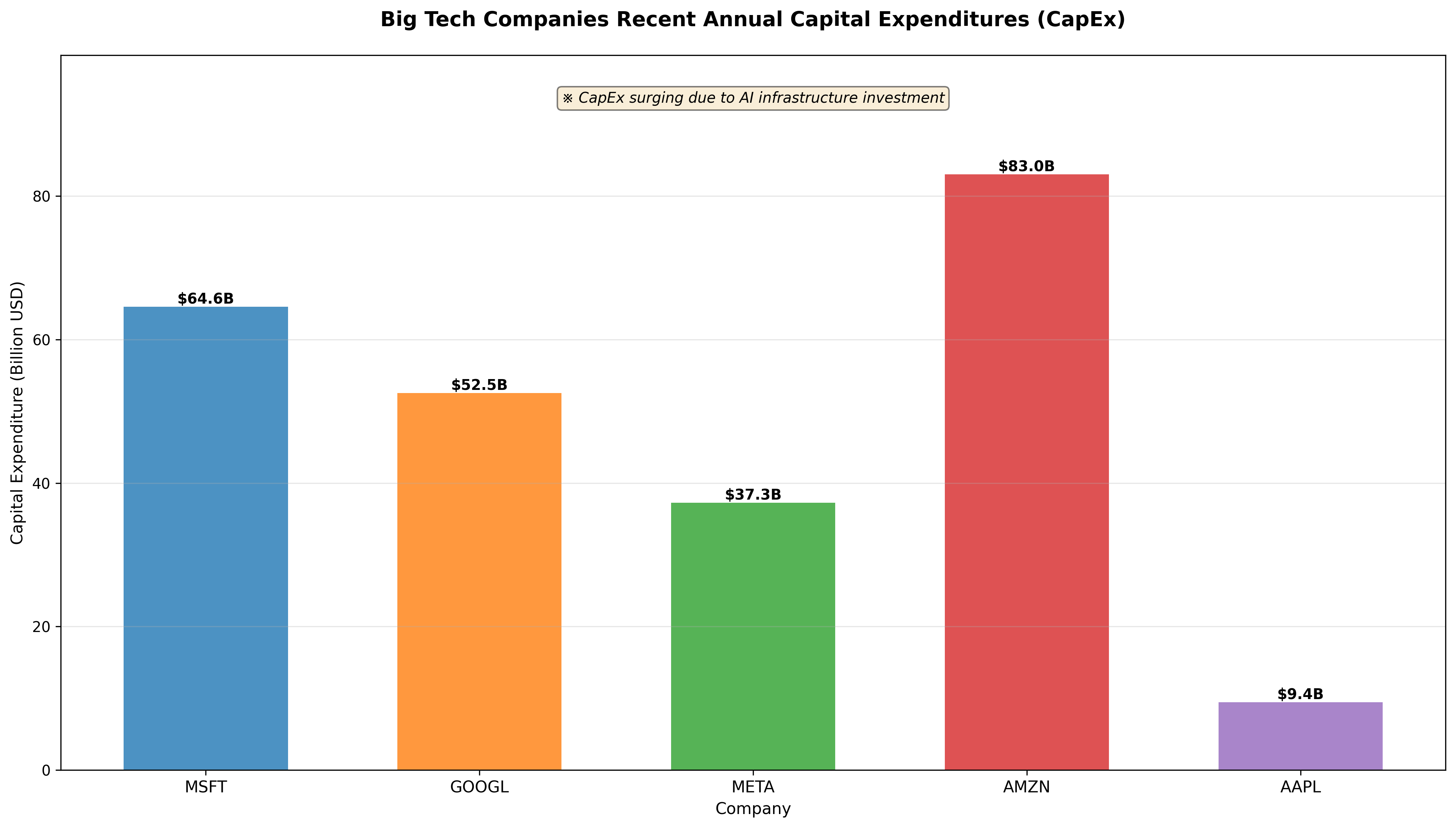

Microsoft, Alphabet (Google), Amazon, and Meta will report earnings on Wednesday and Thursday, with these companies planning to invest approximately $400 billion in AI infrastructure this year. These Big Tech companies represent about $15 trillion in market capitalization, accounting for 44% of the S&P 500.

📊 Context: This earnings season carries significance beyond quarterly results. Key executives including OpenAI CEO Sam Altman, Amazon founder Jeff Bezos, and Goldman Sachs CEO David Solomon have warned about excessive enthusiasm for tech stocks in recent months. In other words, it's time to answer the question: "Are massive AI investments actually generating profits?" Most companies have yet to see measurable returns from AI adoption, fueling skepticism about whether current valuations reflect speculative fervor.

For investors, this is a critical moment to judge whether we're in an "AI bubble or real value creation." Notably, Meta recently secured $27 billion in private credit financing for data center construction, indicating a shift toward debt-financed AI investments, unlike previous approaches.

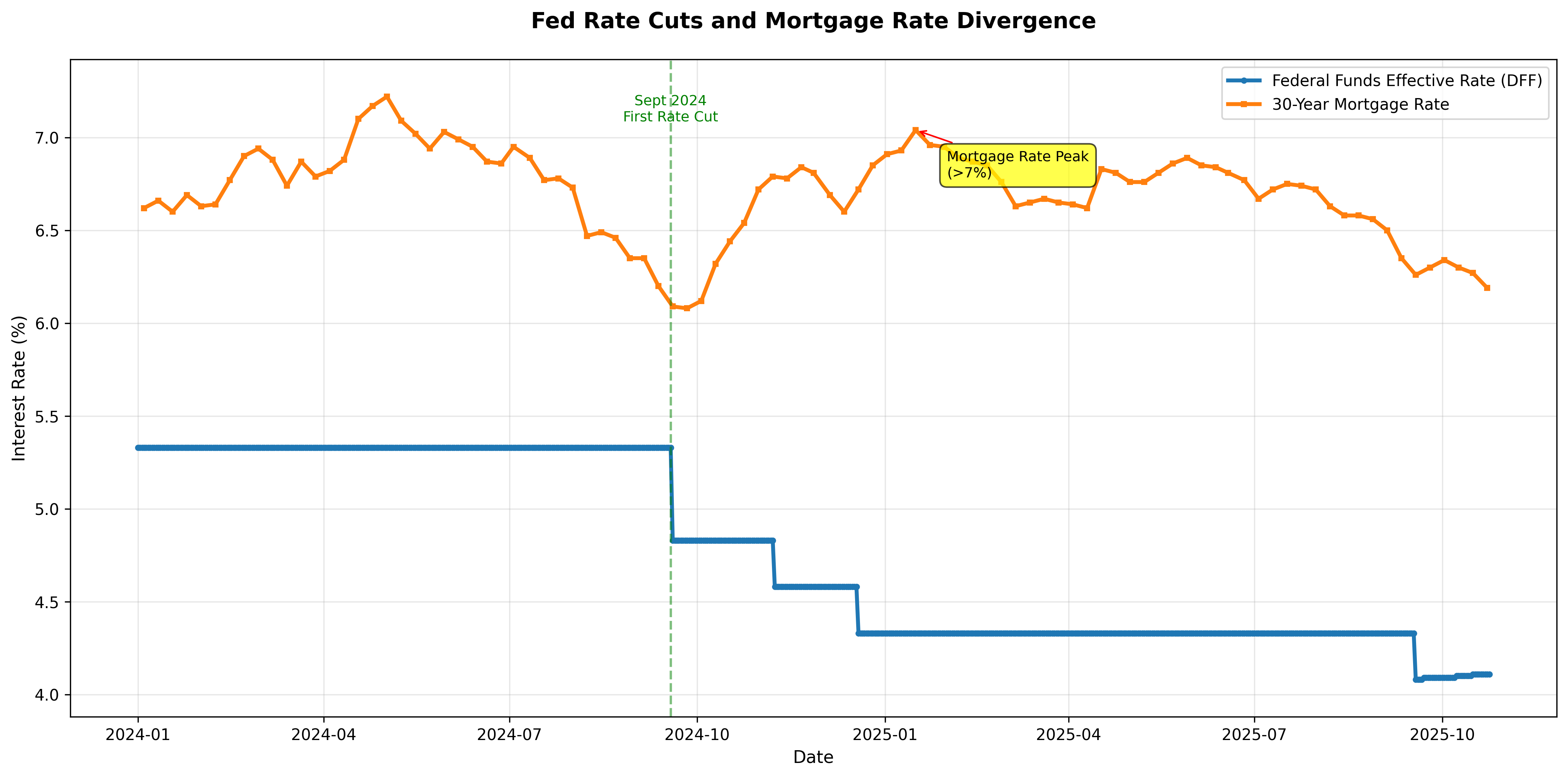

3. Fed Rate Cut Almost Certain: 99% Probability of 0.25% Cut

Investors expect with 99% probability that the Fed will cut interest rates by 0.25 percentage points at next week's meeting, with the probability of an additional December cut also high at 96%. At the September meeting, the Fed voted 11-1 to cut rates by 0.25%, with the only dissenting vote from Fed Governor Stephen Miran, who preferred a 0.5% cut.

📊 Context: Confidence in rate cuts strengthened as the September Consumer Price Index (CPI) came in lower than expected. However, there's an important caveat. Governor Miran argues that the Fed's current rate is about 2% too high, believing that structural changes in immigration, tariffs, regulations, and tax policy have lowered the "neutral rate."

What does this mean for you? While rate cuts are short-term positive for the stock market, it's uncertain whether mortgage rates will continue to fall even as the Fed cuts rates. After the Fed cut rates last fall, mortgage rates actually rose, exceeding 7% in January. In other words, rate cuts don't automatically mean lower borrowing costs.

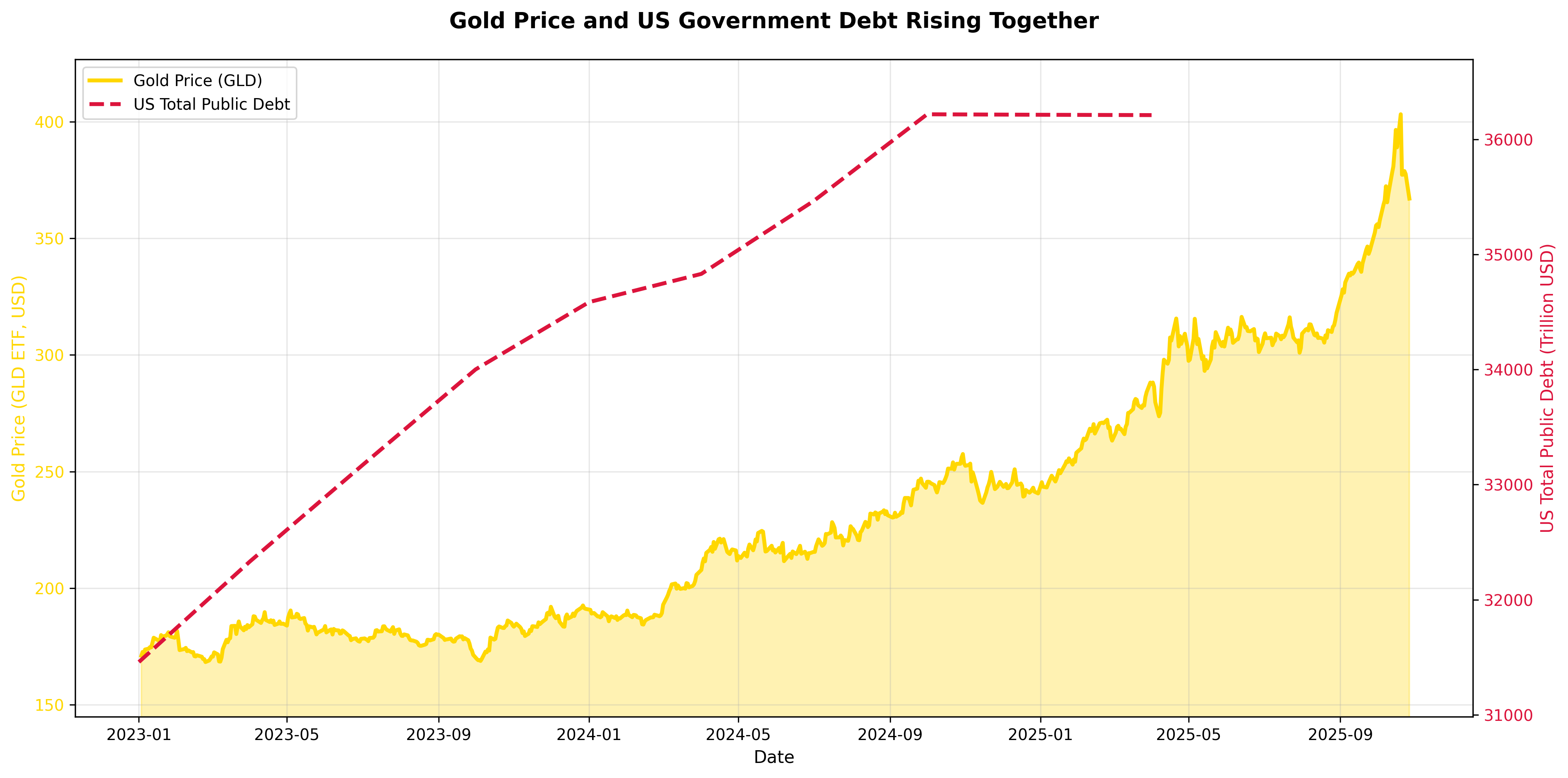

4. Gold Price Surge Continues: Recording Highest Annual Gain Since 1979

Gold is posting its largest annual gain since 1979, having risen more than 50% this year. While gold dropped below $4,000 per ounce on Monday, it remains at elevated levels.

📊 Context: While Fed rate cuts have increased risk appetite, gold has also surged unusually. Concerns about fiscal outlooks in major economies are one factor, with investors seeking gold as a portfolio diversification tool instead of long-term bonds. Central bank gold purchases remain a sustained factor.

The meaning is clear: while gold is traditionally an inflation hedge, it's now also acting as a hedge against "government debt and fiscal uncertainty." Both gold and silver continued their decline from recent highs last week, suggesting that "safe-haven" trades are fading. As uncertainty diminishes with trade negotiation progress, gold demand has temporarily weakened.

5. AI Infrastructure Investment Dilemma: Revenue vs. Cost Tug-of-War

Microsoft is expected to spend $30 billion in capital expenditures for the July quarter, representing annual growth of more than 50%. Alphabet raised its capital expenditure target from $75 billion to $85 billion this year and plans to increase it again in 2026.

📊 Context: These investment costs include not only computing infrastructure but also specialized personnel, research facilities, and operating expenses, putting pressure on profit margins in the short term. All major tech companies except Microsoft are expected to post their weakest profit growth in 10 quarters.

What this means for you: If you're investing in tech stocks, you need to look beyond short-term earnings to long-term AI competitiveness. In Apple's case, capital expenditures were only $9.4 billion in fiscal 2024 (down year-over-year), but are expected to increase 28% to $12.1 billion in 2025, with CEO Tim Cook stating they are "significantly increasing investment." In other words, all Big Tech companies are pouring enormous capital into "not falling behind in the AI race." The question is when this investment will convert to profits.

Bonus: Market Volatility Index (VIX)

The VIX index, which represents market fear, provides insight into investor sentiment. Volatility spiked at the time of the October 10 tariff threat, then regained stability with news of trade negotiation progress.

Key Takeaways for Investors

-

Trade negotiation progress is positive, but uncertainty remains: Short-term rallies are good, but structural trade issues persist.

-

Big Tech earnings are the litmus test for AI investment authenticity: It's crucial to verify whether massive capital investments are converting to actual profits.

-

Rate cuts don't mean all borrowing costs will fall: Mortgage and corporate lending rates can move based on other factors.

-

Gold has evolved beyond inflation hedge to fiscal uncertainty hedge: It's time to reassess gold's role in long-term portfolio diversification.

-

Low volatility doesn't mean risk has disappeared: Don't be complacent just because VIX is low - continue portfolio risk management.

Comments (0)

No comments yet. Be the first to comment!