Netflix Shock, TXN Guidance, Tesla Earnings — Top 5 US Market Insights (Oct 23)

(Thursday, October 23, 2025, Korea Time — Based on US market close on Wednesday, October 22)

1️⃣ "Broad Market Decline" — Early Earnings Season Enters 'Valuation Recheck' Mode

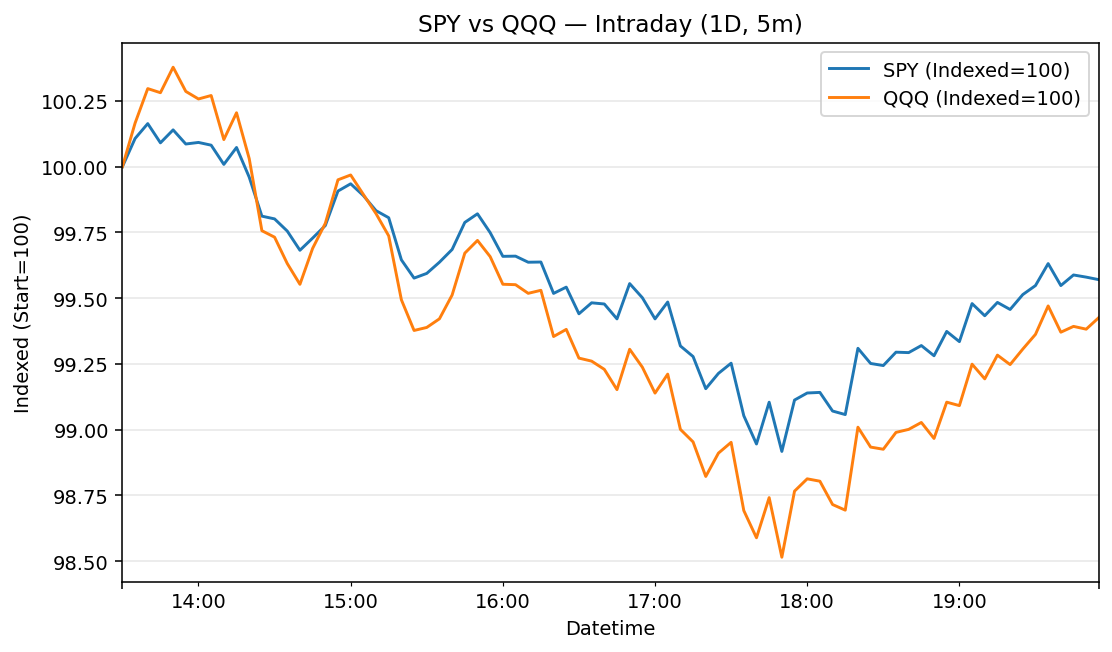

S&P 500, Nasdaq, and Dow all declined on Wednesday. This correction wasn't simply about "earnings misses"—it was the result of market fatigue from overextended expectations. The Nasdaq, driven by tech stocks, had surged over the past few weeks on 'AI optimism + rate stability', but when actual earnings failed to justify those gains, the market faced a 'reality check'.

The 10-year Treasury yield dipped slightly below 4%, but this offered little comfort to equities. Investors are now focused on 'earnings' over 'rates' as their primary compass. In other words, the market's focus has shifted from macro variables (rates, inflation) to micro variables (corporate earnings). From this point forward, falling rates alone won't be enough to lift stocks. What matters now is how much money companies are actually making.

- Chart 1:

SPY·QQQIntraday (1D·5m) — Visualizes intraday selloff depth and pre-close recovery patterns.

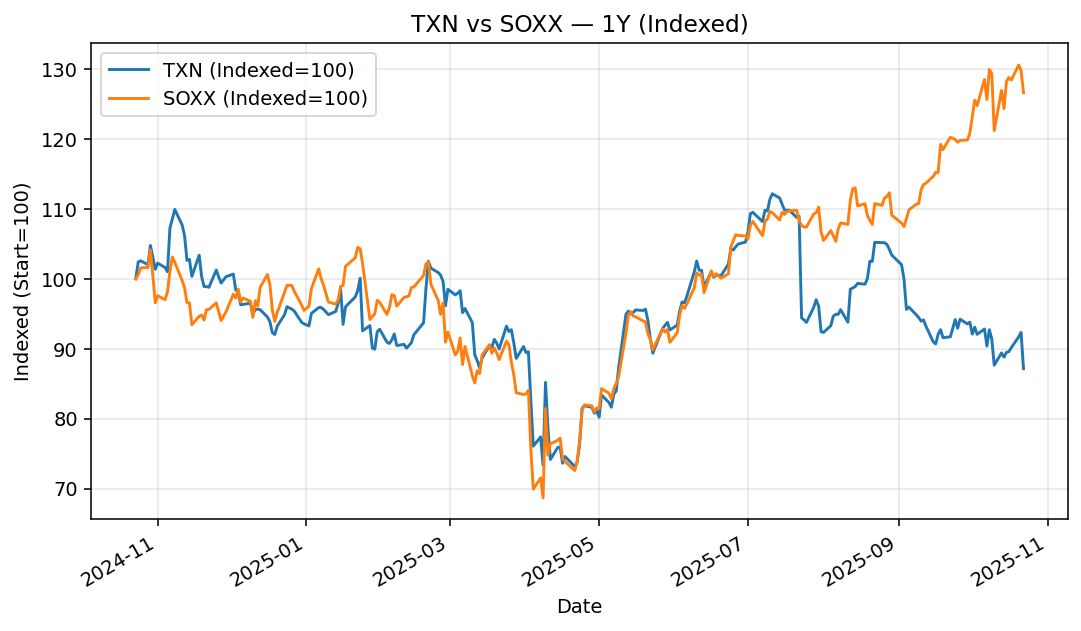

- Chart 1b: 10-Year Treasury Yield (FRED: DGS10) vs S&P 500 (SPY) 6-Month Comparison — Shows that stocks declined despite falling discount rates, confirming this selloff was earnings-driven, not rate-driven.

Key Takeaways

- The market is now laser-focused on "how much money companies made."

- Even with easing rates, weak earnings will limit stock price appreciation.

- The next two weeks of earnings releases will be the critical variable determining whether we get a year-end rally.

2️⃣ "Netflix: Brazil 'Tax Variable' Leads to EPS Miss" — Not a Fundamental Breakdown, But a Non-Recurring Factor

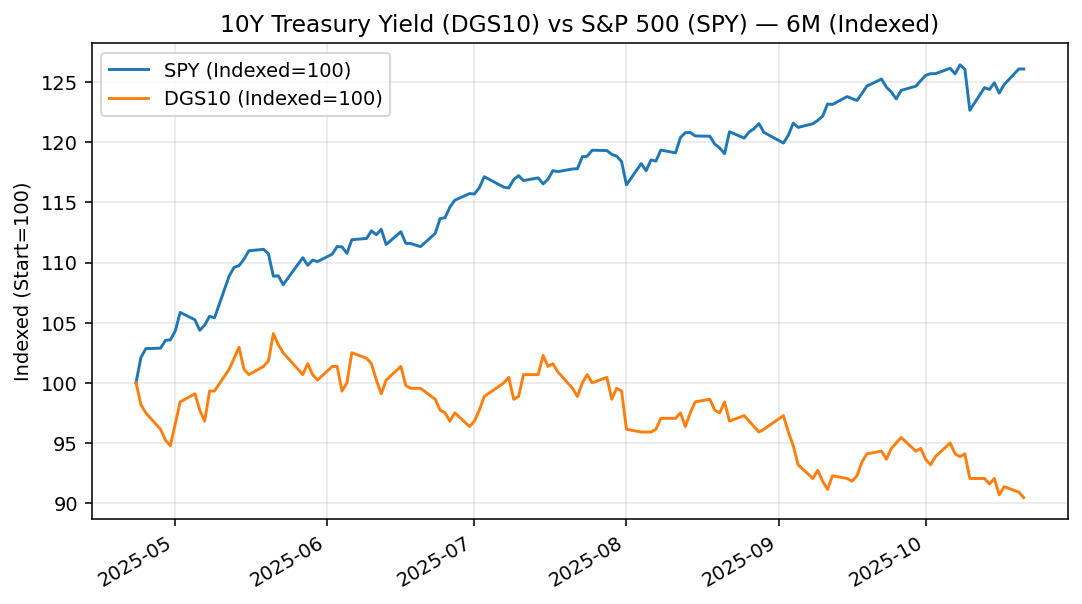

Netflix beat revenue expectations in Q3, but a dispute with Brazilian tax authorities resulted in a one-time charge of approximately $100 million, causing EPS to miss consensus. The issue wasn't "profits declined"—it was "why they declined." For investors, unpredictable tax and regulatory issues translate into 'valuation discounts'.

However, the core business remains healthy. Paid subscriber growth continues steadily, and profitability of the ad-supported subscription tier is improving. In other words, this earnings report represents more of a 'temporary accounting shock' than fundamental deterioration. That said, if overseas tax/regulatory uncertainties recur, the market may price in a persistent risk premium.

- Chart 2:

NFLX6-Month Price + Recent Earnings Markers — Shows price gaps and volatility around earnings announcements.

Key Takeaways

- Revenue momentum remains intact.

- Investors must distinguish whether "the reason for profit decline" is structural or temporary.

- This correction reflects a 'reaction to accounting factors' rather than fundamental concerns.

3️⃣ "TXN Guidance Shock" — The Realistic Pace of Analog Semiconductors

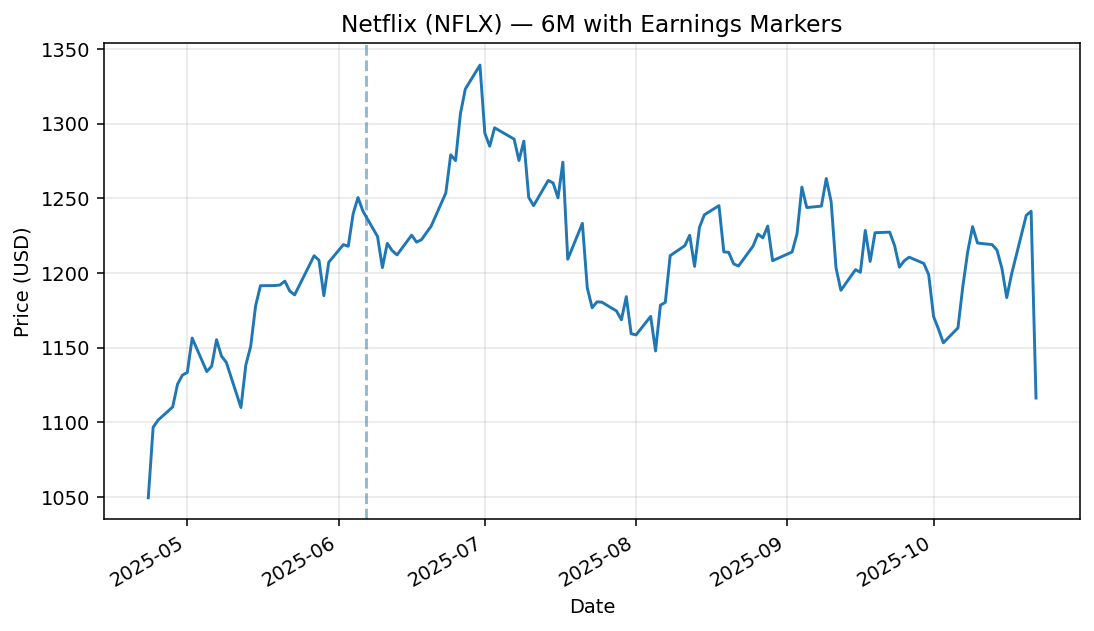

Texas Instruments (TXN) issued Q4 guidance with both revenue and EPS below market consensus. TXN doesn't make flashy AI server GPUs—it primarily produces automotive and industrial analog chips. This segment is directly exposed to economic and manufacturing cycles. In other words, no matter how hot the AI bubble gets, TXN cannot escape 'delayed recovery'.

TXN's message is clear:

"Inventory corrections are not yet complete. Automotive and industrial segments need more time to normalize."

This isn't just TXN's problem—it's a signal that 'the AI vs. non-AI gap is becoming structural'.

- Chart 3:

TXNvsSOXX1-Year Return Comparison — Shows widening divergence between analog companies and semiconductor ETFs.

Key Takeaways

- Semiconductor recovery is highly skewed toward "AI-centric" demand.

- TXN's dependence on 'cyclical demand' may limit near-term rebounds.

- However, this selloff could present an entry opportunity for long-term value investors.

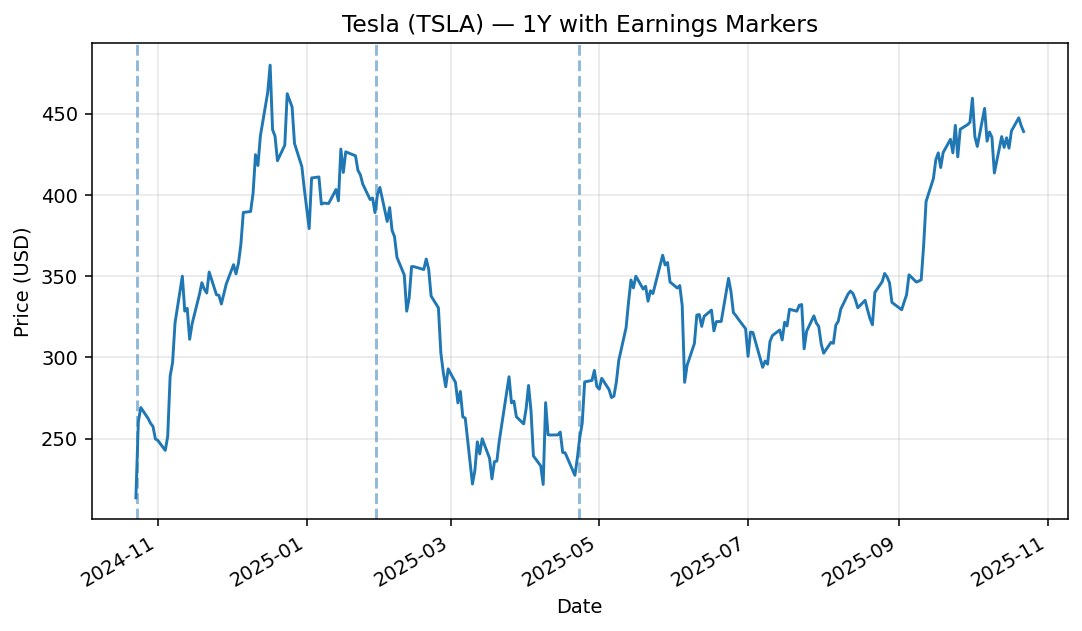

4️⃣ "Tesla: Record Revenue vs EPS Miss" — Growth Continues, Profitability Stalls

Tesla posted record Q3 revenue of $28.1 billion (all-time high), but EPS came in below expectations ($0.50 vs. est. $0.55). The core issue: "Growth continues, but margins are the problem." Price cuts, model mix shifts, and rising production costs combined to push automotive operating margin down to around 18%.

However, some view this as a "strategic sacrifice." Tesla is in an investment phase focused on expanding market share and building next-generation platforms (Robotaxi, Energy business). In other words, this could be a 'margin sacrifice phase' to establish a foundation for future growth rather than short-term profit optimization.

- Chart 4:

TSLA1-Year Price + Earnings Markers — Shows how earnings events influenced stock price trends.

Key Takeaways

- Tesla remains a growth stock, but stock price will be limited without margin recovery.

- Whether 'Robotaxi and Energy business' translate into actual earnings post-2026 is critical.

- When the "margin sacrifice phase" ends will determine future stock direction.

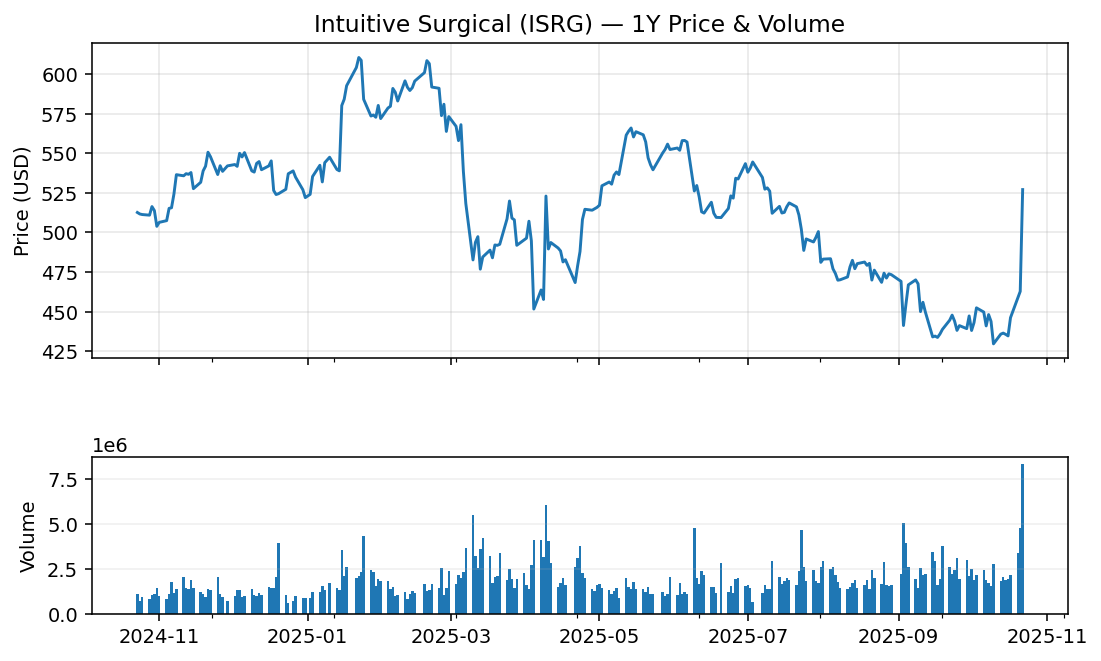

5️⃣ "Medical Device (Robotic Surgery) Surprise Earnings" — Intuitive Surgical, the 'Quiet Champion' Returns

Intuitive Surgical (ISRG) is a leading 'defensive growth stock' in the medical device sector. Q3 results beat both revenue and profit expectations, and the company raised full-year guidance (surgical procedures +17%). This signals that pent-up surgical demand from the COVID era is fully normalizing. Additionally, rapid adoption of the latest 'da Vinci 5' system is driving explosive growth in consumables revenue (high-margin recurring revenue).

In other words, ISRG has a 'non-cyclical growth engine' that can expand regardless of economic conditions. This is why such companies command premiums during market uncertainty.

- Chart 5:

ISRG1-Year Price·Volume — Volume spikes around earnings dates prove the 'surprise' factor.

Key Takeaways

- ISRG is a defensive growth stock that can profit even during "economic slowdown = risk-off" phases.

- If hospital procedure volumes and equipment replacement demand continue, the stock could see further re-rating.

- The medical device sector exemplifies the 'era of quiet growth stocks'.

📊 Summary at a Glance

| Category | Key Content | Investment Insight |

|---|---|---|

| 1. Indices | Earnings miss-driven decline | Earnings news density will drive near-term direction |

| 2. NFLX | Brazil tax variable causes EPS miss | Non-recurring factor, core business solid |

| 3. TXN | Conservative guidance (delayed recovery) | AI vs. analog asymmetry persists |

| 4. TSLA | Record revenue vs EPS miss | Margin sacrifice phase, focus on long-term growth |

| 5. ISRG | Surprise + guidance raise | Defensive growth stock re-emergence |

Data: yfinance, FRED

Comments (0)

No comments yet. Be the first to comment!