Apple Surges and Rare Earth Alliance: 5 Key Issues in U.S. Markets & Economy

(As of Tuesday, October 21, 2025)

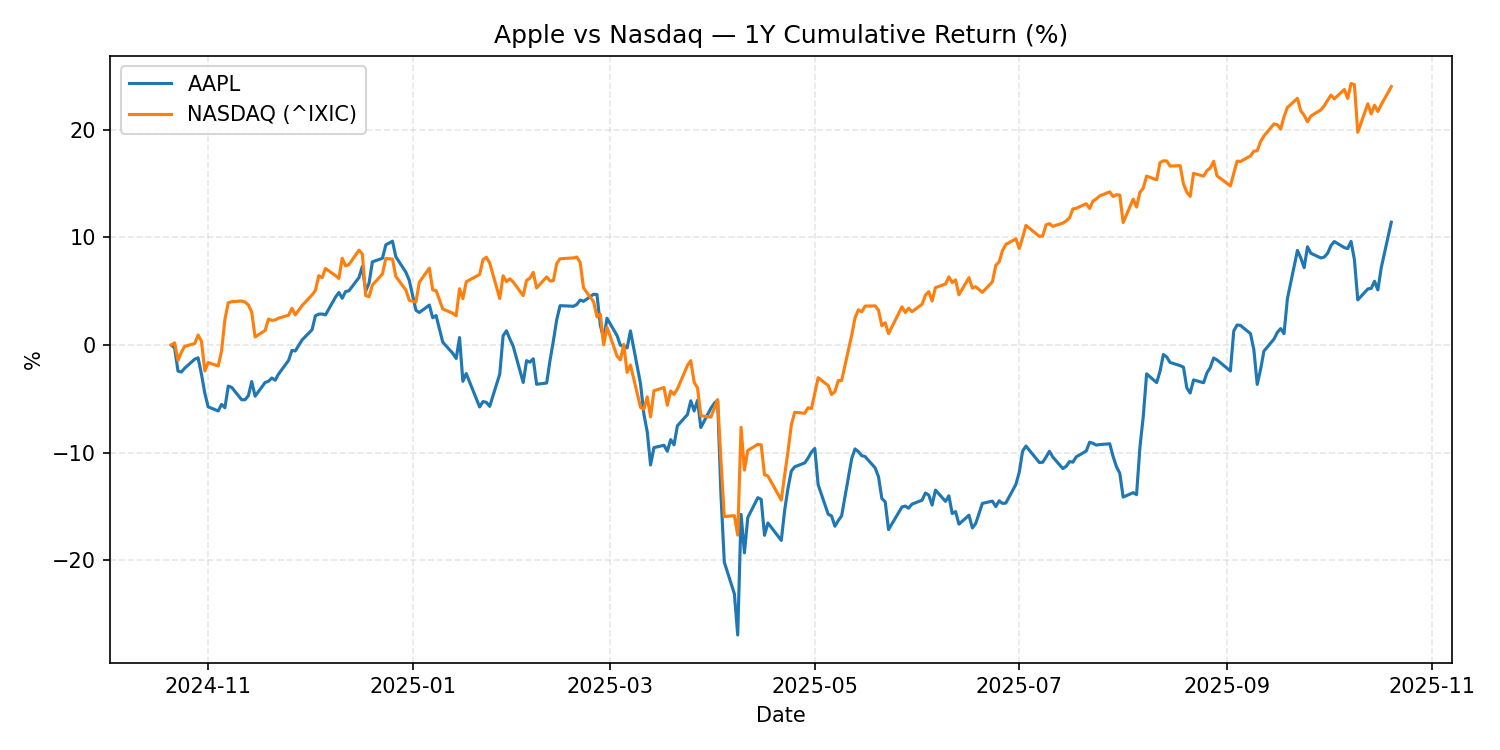

1️⃣ "Apple Lifts the Market Again" — Tech Rally Reignites

U.S. stocks rebounded strongly yesterday. Both the S&P 500 and Nasdaq rose over 1%, with Apple leading the charge. Recent expectations of iPhone sales recovery combined with AI chip announcements have drawn investors' attention back to tech stocks.

On top of this, expectations of U.S.-China trade tension easing added fuel. Reports that "the two countries may resume talks next month" were welcomed by the market as "policy risk mitigation."

Implications:

- Tech strength boosts sentiment in the short term, but

- Debates about "overvaluation" may resurface

- If the Fed delays rate cuts, growth stocks could face pressure

Recommended Chart: Apple vs Nasdaq 1-Year Return Comparison

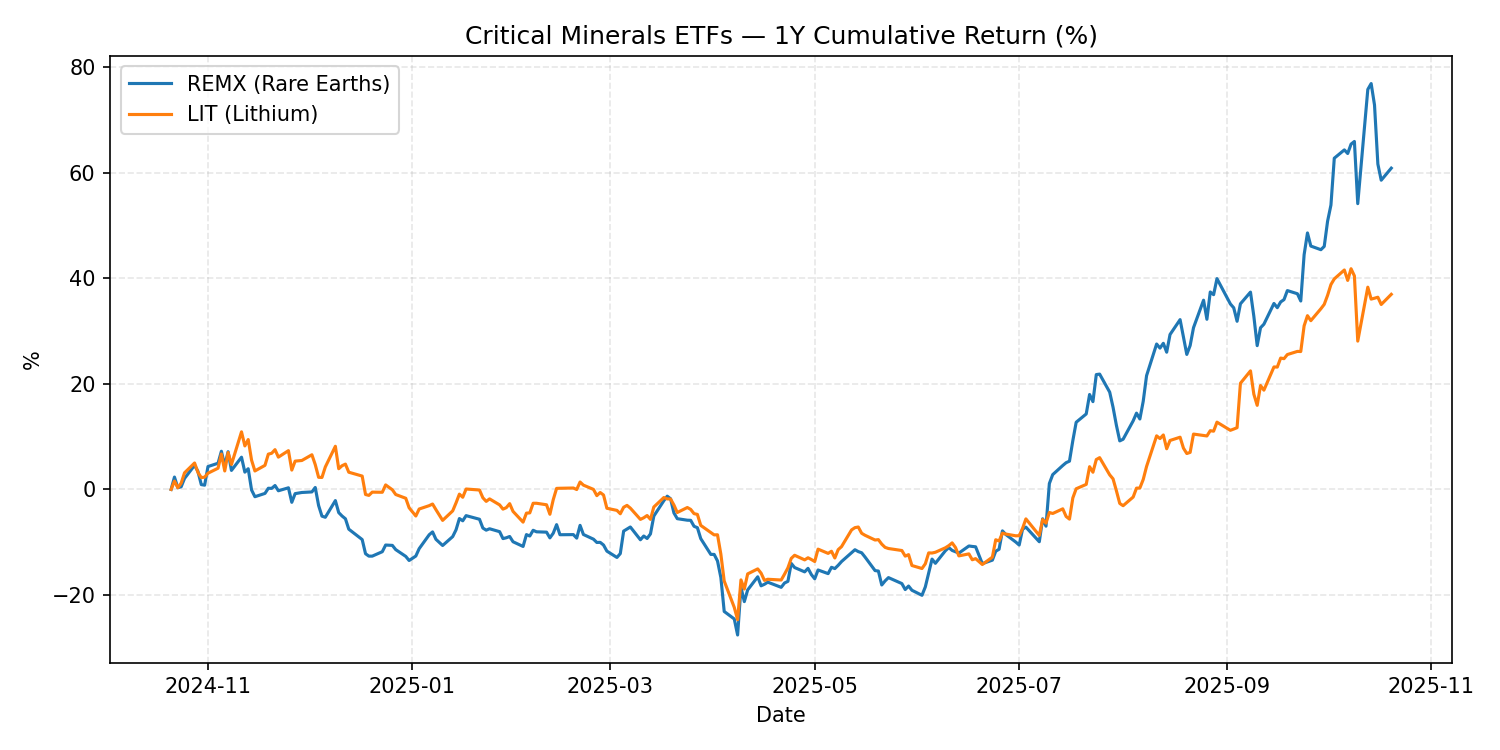

2️⃣ "U.S.-Australia Rare Earth Alliance" — Reducing China Dependence in Full Swing

The U.S. and Australia have agreed to strengthen cooperation on critical minerals supply chains. Rare earths are essential components in smartphones, electric vehicles, missiles, and semiconductor equipment. This agreement, worth approximately $8.5 billion, is essentially a move to create a "China alternative."

Why It Matters: The U.S. is pursuing a 'reshoring' policy to bring EV and semiconductor industries back home. Securing rare earths is the first step and a factor that determines AI chip and battery industry stability.

Implications:

- This signals the era of 'resource security'

- Long-term positives for resource stocks like lithium, nickel, and cobalt

- Conversely, China-related supply chain companies may face increased volatility

Recommended Chart: Rare Earth/Lithium ETF 1-Year Returns (REMX vs LIT)

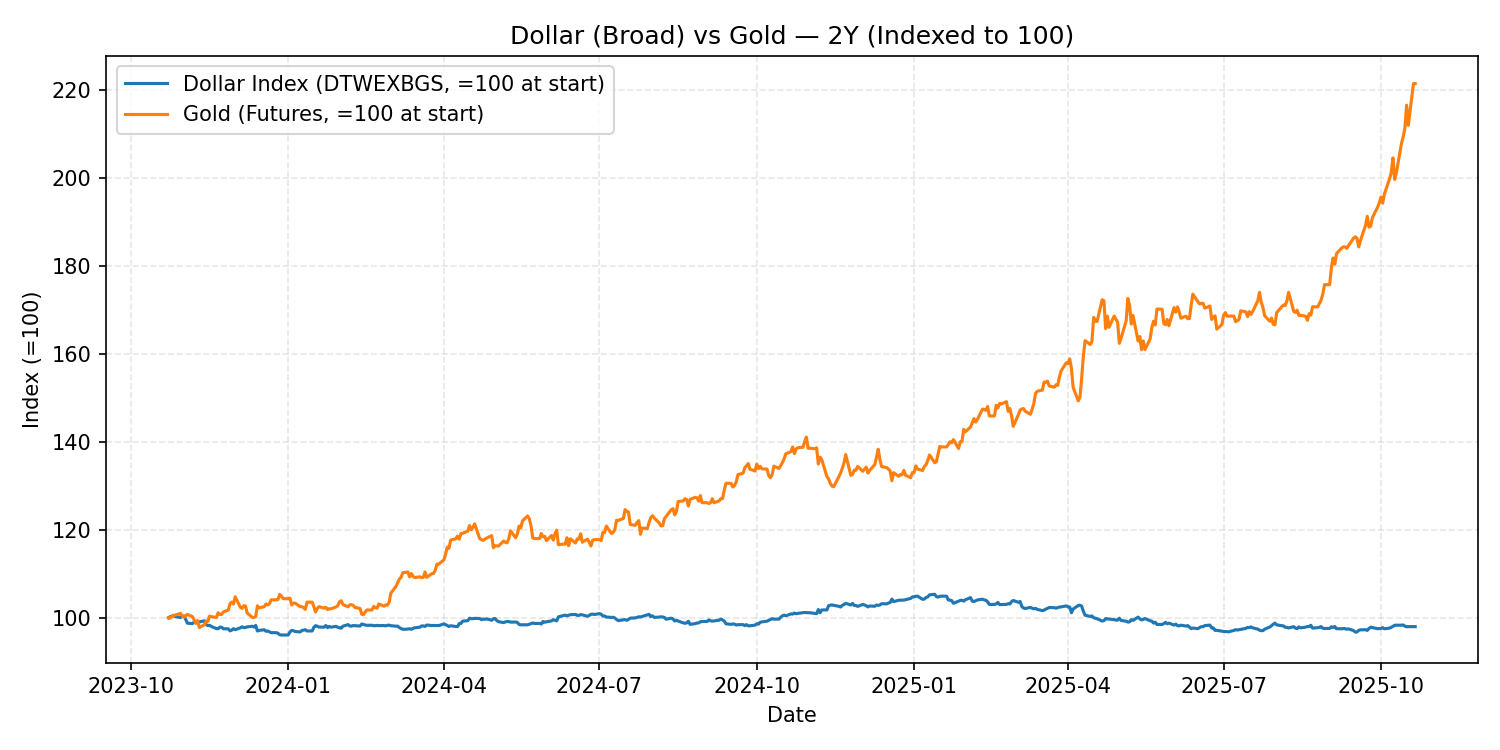

3️⃣ "Dollar Weakness — Real Crisis Signal?" — The Debasement Debate

In recent weeks, talk of "the dollar losing value" has become frequent. Some investors argue that "U.S. debt and deficits are too large" and the dollar could lose credibility long-term. In this atmosphere, attention to 'alternative assets' like gold, Bitcoin, and commodities is called the 'debasement trade'.

However, experts diagnose this as "still an exaggerated interpretation." The dollar is experiencing a slight correction, but the U.S. Treasury market remains stable.

Implications:

- If inflation re-accelerates or debt concerns grow, the 'dollar weakness trade' could regain popularity, but

- For now, it's more of a "finding equilibrium" process

- In other words, it's more reasonable to view this as 'dollar adjustment' rather than 'dollar collapse'

Recommended Chart: Trade-Weighted Dollar Index (Broad, FRED: DTWEXBGS) vs Gold 2-Year Trend

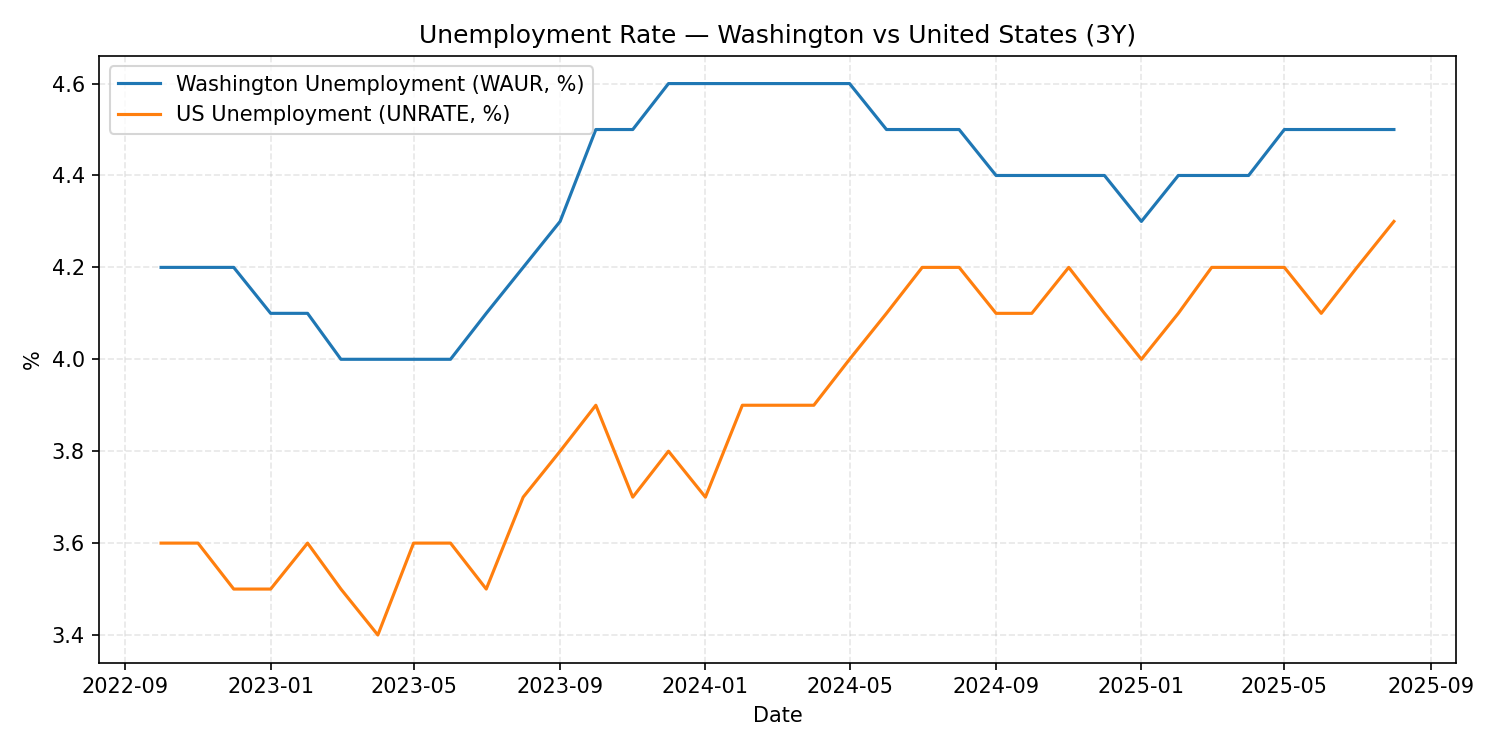

4️⃣ "Washington State Economy Stalls" — Regional Economic Divergence

Washington State's (Seattle-centered) employment growth has slowed significantly. Tech layoffs, manufacturing contraction, and consumption decline have combined to enter "stall speed" territory. The engine is running, but there's no momentum.

Why This Matters: While the U.S. economy is growing on average, 'partial recessions' have already begun regionally. Some states remain strong (Texas, Florida), while others are slowing (California, Washington, New York).

Implications:

- The Fed's confidence that "employment remains solid" could waver

- Policymakers are more likely to resume rate cut discussions

- Investors need to watch regional economic temperature differences, not just national averages

Recommended Chart: Washington State Unemployment Rate (WAUR) vs U.S. Overall (UNRATE) 3-Year Trend

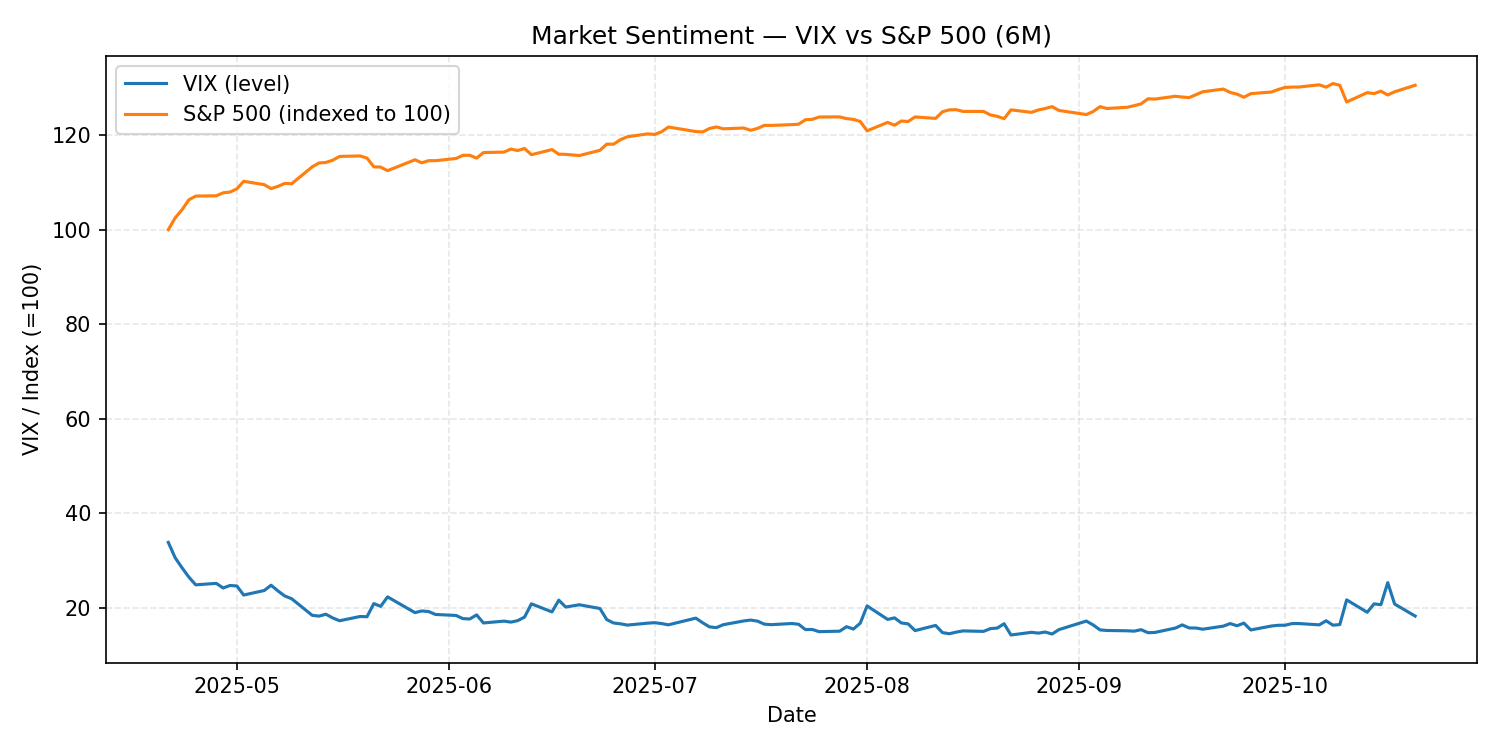

5️⃣ "Trade & Policy Risk Easing Expectations" — Market Optimism Returns

With U.S.-China relationship improvement expectations and European economic indicators coming in better than expected, optimism is spreading across global markets. Investors are receiving the message "it's time to return to risk assets."

But Be Careful:

- The current rally is based on "expectations"

- If actual trade negotiations and policy changes aren't confirmed, short-term corrections could return

Implications: Optimism is good, but "overconfidence is the market's enemy". This rebound is more likely a 'testing phase' than the 'start' of economic recovery. It could be an "overreaction to bad news" rather than 'good news'.

Recommended Chart: Fear & Volatility Indicator (VIX) vs S&P 500 Index 6-Month Trend

📊 At a Glance (Summary)

| Category | Key Content | Investment Implications |

|---|---|---|

| 1. Tech Rally | Apple-led market rebound | Watch for valuation overheating |

| 2. Rare Earth Agreement | U.S.-Australia supply chain strengthening | Positive for resource stocks & AI chips |

| 3. Dollar Debate | Debasement trade check | Dollar adjustment phase |

| 4. Regional Slowdown | Washington state economy stalling | Rate cut discussion likely |

| 5. Optimism Spreads | Trade risk easing expectations | Also consider correction possibility |

💡 Today's Core Message

"On days when good news pours in, think about 'how long it will last'."

- The market is finding balance between optimism and anxiety.

- Now is the time to confirm 'good momentum' while checking for 'sustainability'.

Data Sources: FRED, yfinance

Comments (0)

No comments yet. Be the first to comment!