November 26: Fed Rate Cuts, Alphabet's Comeback, and Nvidia's Challenge

November 26, 2025 | US Market Deep Dive

The final week of November 2025 witnessed three dramatic reversals in US markets. A sudden shift in Fed policy signals, Google's AI competitive comeback, and cracks in Nvidia's monopoly. These aren't just news stories—they're early signals of structural shifts that could reshape financial markets and the technology industry for years to come.

1. One Speech, Market Upheaval: Williams Remarks Spark December Rate Cut Frenzy

Market Consensus Flipped in 24 Hours

On Friday, November 21, 2025, New York Fed President John Williams delivered a speech in Santiago, Chile that sent shockwaves through markets. His statement that there is "room for further rate cuts in the near term" caused the probability of a 25bp rate cut in December to nearly double from 39.1% to 70.9% in a single day, according to the CME FedWatch tool.

The timing and context make this particularly significant. With September employment data delayed due to a government shutdown, markets were navigating extreme uncertainty. When the September jobs report finally arrived, it showed better-than-expected payroll growth (+119K vs. consensus +51K), but the unemployment rate ticked up to 4.4%. Before Williams' remarks, markets had priced December cut odds in the low 30s.

The Big Picture on Rates

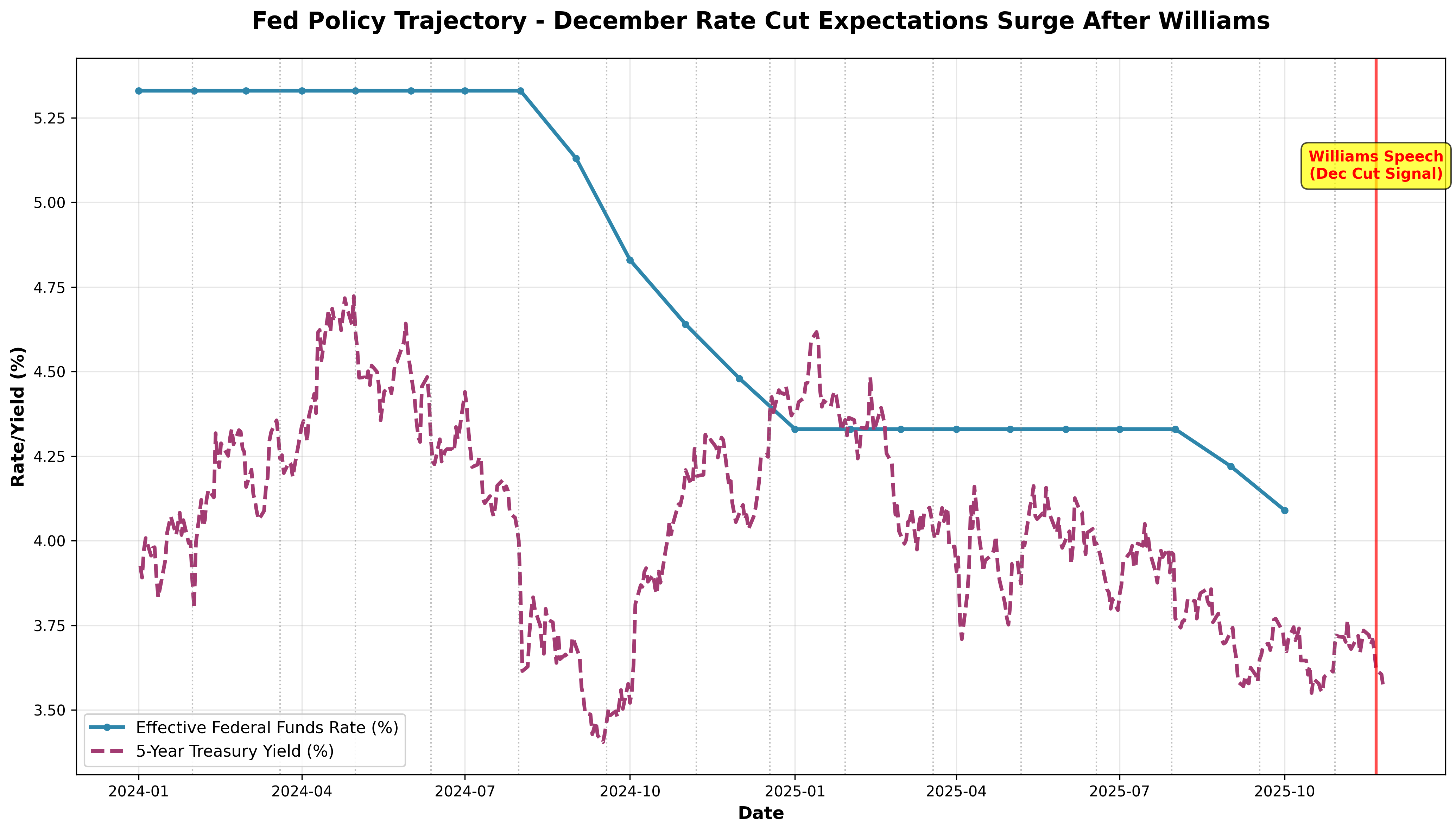

[Chart 1] The chart above traces the effective federal funds rate (blue solid line) and 5-year Treasury yield (purple dashed line) from early 2024 to present. Gray dotted vertical lines mark each FOMC meeting, showing how policy has evolved. Note the dramatic shift in market expectations around Williams' speech date (red vertical line).

Williams justified his dovish stance by citing increased downside risks to employment and moderated upside risks to inflation. He acknowledged that tariffs contributed 0.5-0.75 percentage points to inflation but forecast limited second-order effects. This signals the Fed is building its case for rate cuts despite mixed data.

Lessons for Investors

This episode underscores the power of central bank communication. A single speech from Williams—FOMC Vice Chair and a key Powell ally—reversed market expectations 180 degrees. In uncertain data environments, investors must track not just economic indicators but the tone and nuance of key Fed officials' remarks.

Chart 1 reveals that the spread between the federal funds rate and Treasury yields has been narrowing since mid-2024, indicating markets had already been pricing in an eventual Fed easing cycle. Williams' speech effectively validated and accelerated this market narrative.

2. Google Strikes Back: Gemini 3 Launch Reshapes AI Competition

"I Won't Go Back to ChatGPT"

On November 18, 2025, Alphabet unveiled its Gemini 3 AI model, delivering a market shock. The stock surged over 6% on November 24, breaking through $300 per share, pushing its market capitalization to $3.82 trillion—approaching the $4 trillion threshold.

D.A. Davidson analysts called Gemini 3 "state-of-the-art," outperforming competing models from OpenAI and Anthropic. The most dramatic endorsement came from Salesforce CEO Marc Benioff: "I used ChatGPT daily for three years, but after two hours with Gemini 3, I'm not going back."

Big Tech AI Competitive Landscape

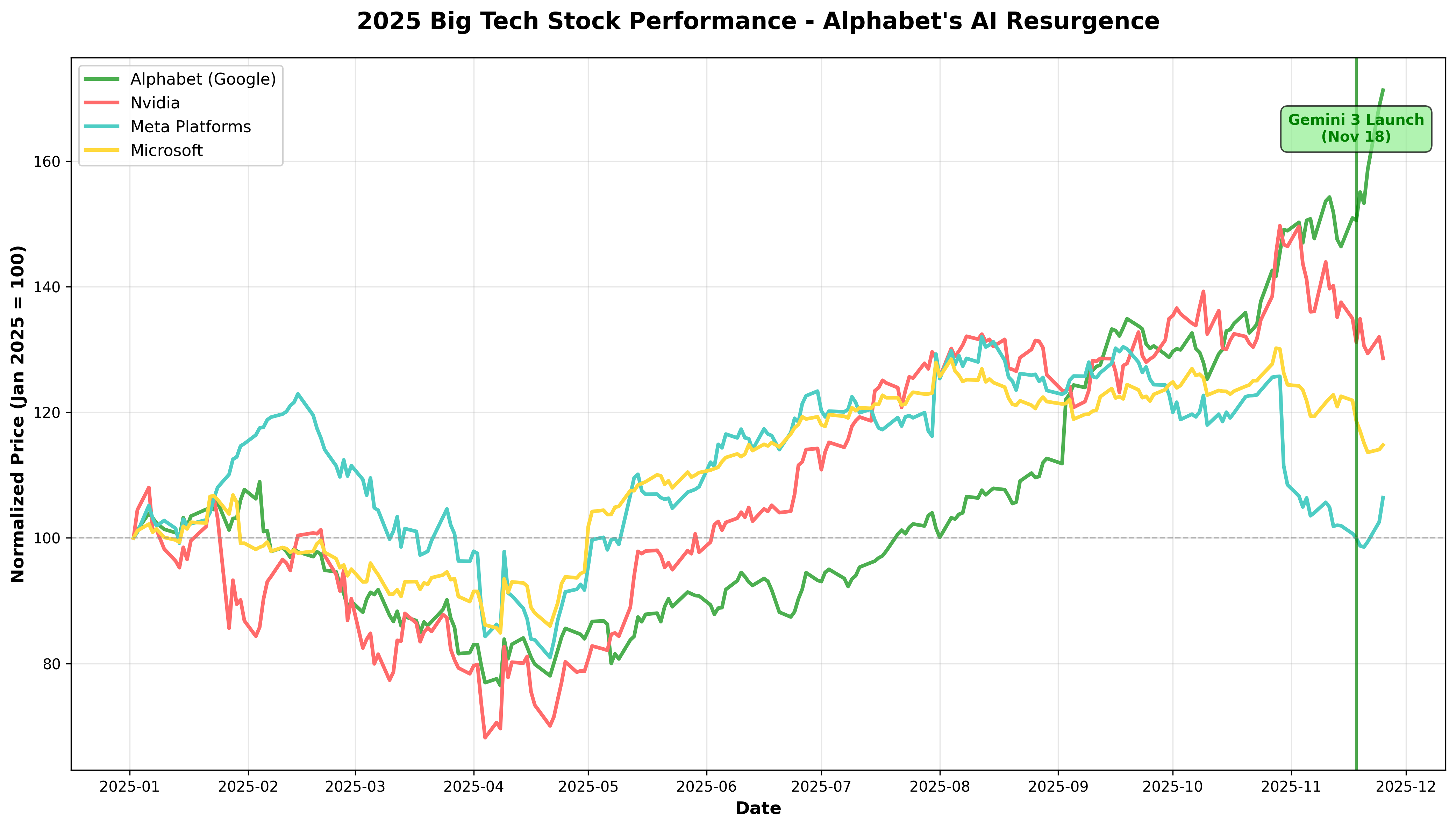

[Chart 2] This chart normalizes major big tech stocks to a baseline of 100 at the start of 2025. The green line representing Alphabet surges after the November 18 Gemini 3 launch (green vertical line), overtaking competitors.

Particularly noteworthy: while Nvidia (red) and Meta (cyan) both show year-to-date gains, Alphabet exhibits the steepest upward trajectory after proving its AI model competitiveness. Microsoft (yellow) shows more modest gains despite its OpenAI partnership, suggesting the market values Alphabet's in-house AI capabilities more highly.

Vertical Integration Wins

Alphabet's success isn't just about a superior AI model. Gemini 3 was developed and deployed using Google's proprietary TPU (Tensor Processing Unit) chips. This provides two strategic advantages:

- Cost Efficiency: Reduces dependency on Nvidia GPUs, cutting AI training and inference costs

- Hardware-Software Optimization: Co-designing chips and models maximizes performance

Gemini 3 reached 650 million monthly active users shortly after launch, benefiting from tight integration with Google's ecosystem (Search, Gmail, YouTube, etc.). As Chart 2 demonstrates, this vertical integration strategy directly translates to stock appreciation.

Late Starter's Reversal

Since ChatGPT's 2022 launch, Alphabet faced concerns about falling behind in AI competition, with questions even raised about the future of Google Search. Gemini 3 silenced all doubters. Comparing Chart 2 before and after the November 18 launch date reveals Alphabet gained clear upward momentum.

A tech company's core competitiveness comes not just from software but hardware integration capability. Alphabet's case proves "vertical integration" is the new battleground in big tech competition.

3. Nvidia's Moat Cracks: Meta-Google Chip Deal Signals End of Monopoly

7% Plunge in a Day

On Tuesday, November 25, 2025, a report from The Information rocked Nvidia. News that Meta was considering using Google's TPU (Tensor Processing Unit) chips sent Nvidia's stock down as much as 7% intraday, closing down 4.3%.

According to the report, Meta plans to deploy Google TPUs in its data centers starting in 2027 and could rent TPUs from Google Cloud beginning next year. This marks Google's second major chip deal following an agreement to supply up to 1 million chips to Anthropic.

AI Chip Market Power Shift

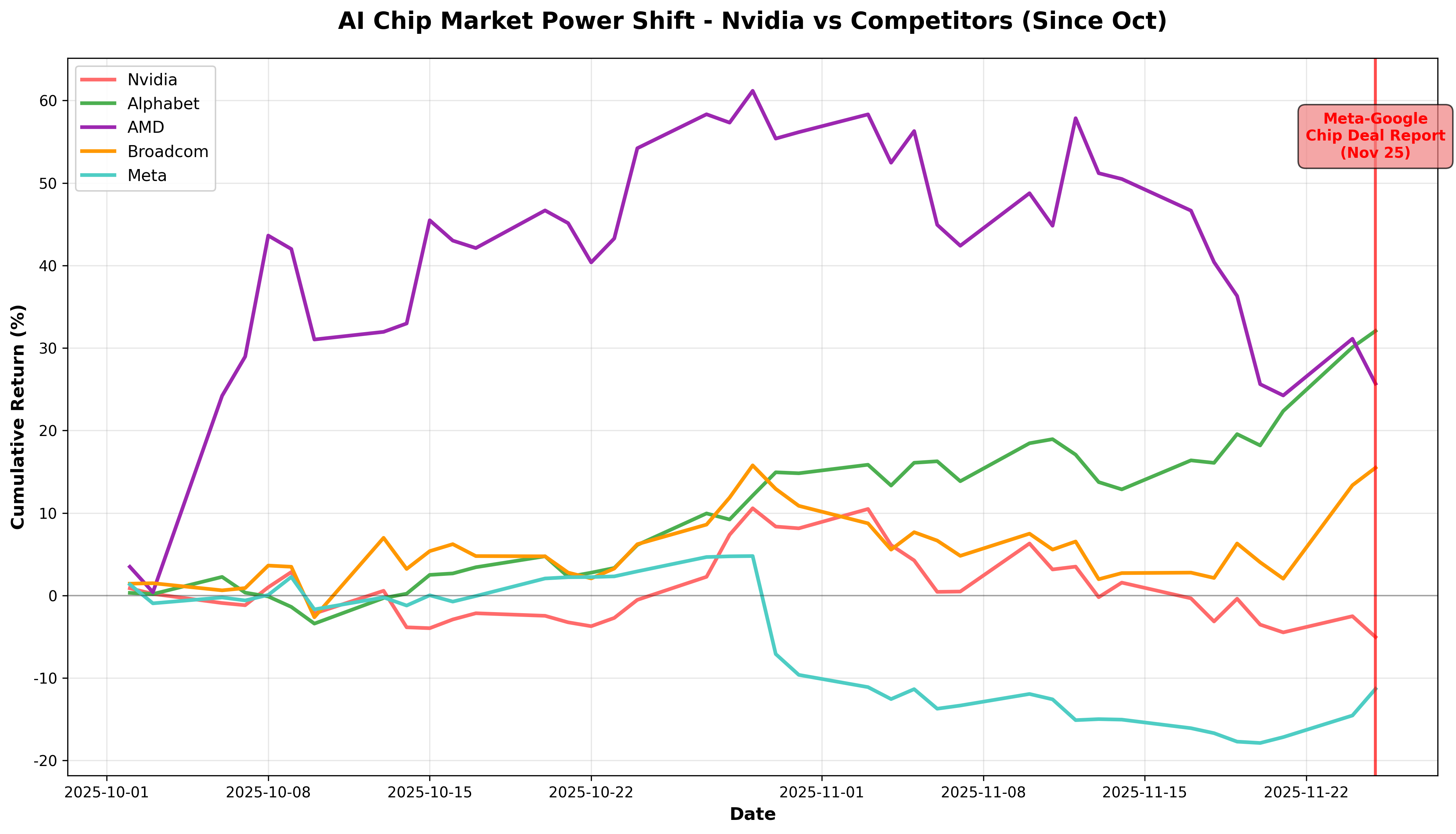

[Chart 3] This chart shows cumulative returns for major AI chip-related companies since October 2025. After the November 25 Meta-Google chip deal report (red vertical line), Nvidia (red line) plunged while Alphabet (green line) and Broadcom (orange line) rallied.

Key observations:

- Nvidia: Sharp decline post-report, reflecting market concerns about long-term growth

- Alphabet: Sustained rally, buoyed by expectations of TPU business expansion

- AMD: Similar decline to Nvidia, indicating broader GPU market competition fears

- Broadcom: Continued gains as a TPU manufacturing partner positioned to benefit

Chart 3 shows Nvidia maintained relatively stable performance from early October through mid-November, but experienced a clear downward reversal after the Meta-Google deal news. Meanwhile, Alphabet shows the strongest upward momentum as the Gemini 3 launch (Nov 18) and Meta chip deal news (Nov 25) overlapped.

End of the "Nvidia Monopoly" Era?

For the past two years, Nvidia has been AI boom's biggest beneficiary. Its H100 and A100 GPUs became the industry standard for AI training, sending its market cap soaring. But major customers (Google, Meta, Microsoft, Amazon) are now developing their own chips, changing the game.

Google's TPU is particularly cost-efficient for inference operations, making it advantageous for large-scale AI service deployments. Meta's pivot to TPU isn't just supply diversification—it's a strategic choice for operational cost reduction.

AMD's (purple) 9% plunge in Chart 3 indicates the entire GPU market faces structural challenges. Meanwhile, Broadcom's (orange) gains reflect new opportunities as a TPU manufacturing partner.

The Monopoly Trap

Nvidia's case offers an important lesson: monopolistic positions aren't eternal, especially in tech where customers constantly seek alternatives for supply chain diversification and cost savings.

As Chart 3 reveals, the market is already preparing for a "Post-Nvidia" era. While Nvidia remains formidable, investors are beginning to reassess the durability of its "moat."

Conclusion: What Three Charts Tell Us About the Market's Future

This week's three US market dramas appear independent but are intimately connected:

1. New Phase in Monetary Policy (Chart 1)

- Williams' remarks suggest the Fed prioritizes market communication over data dependency

- Surging December rate cut odds create a favorable environment for tech stocks, especially AI names

- Investors must track not just FOMC meetings but informal remarks from key officials

2. New AI Competition Champion (Chart 2)

- Alphabet's vertical integration success highlights the importance of "software + hardware" competitiveness

- The OpenAI-centric AI narrative is fragmenting, with chip-owning companies gaining advantage

- Alphabet enters the leading group in 2025 big tech performance, signaling AI leadership realignment

3. Semiconductor Supply Chain Reorganization (Chart 3)

- Signs of Nvidia monopoly's end represent not just one company's crisis but industry structure change

- The TPU and custom chip development boom extends the "chip sovereignty" competition

- Foundry/manufacturing partners like Broadcom emerge as new beneficiaries

Investment Implications

Synthesizing the three charts, key investment themes for late 2025 through early 2026:

- Position for Fed Rate Cut Cycle Beneficiaries: As Chart 1 shows, if rate cut expectations materialize, it's broadly positive for growth stocks

- Favor Vertically Integrated Players: Like Alphabet in Chart 2, companies owning both AI models and chips hold competitive advantages

- Identify Supply Chain Reorganization Winners: Like Broadcom in Chart 3, companies playing partner roles in new chip ecosystems deserve attention

Markets are always in motion. But with data literacy, chart analysis, and structural change recognition, you can find opportunity within that motion. This week's three charts aren't just stock price graphs—they're early signals of coming market realignments.

Data Sources:

- Chart 1: FRED API (Federal Funds Rate), Yahoo Finance (Treasury Yields)

- Charts 2-3: Yahoo Finance

- News Sources: CME FedWatch, The Information, D.A. Davidson Research

Disclaimer: This article is for informational purposes only and does not constitute investment advice. All investment decisions should be made at your own discretion and risk.

Comments (0)

No comments yet. Be the first to comment!