US Fed Warns December Rate Cut Uncertain, AI Bubble Concerns Rise

1. Fed's Hawkish Pivot: December Rate Cut "Not a Done Deal"

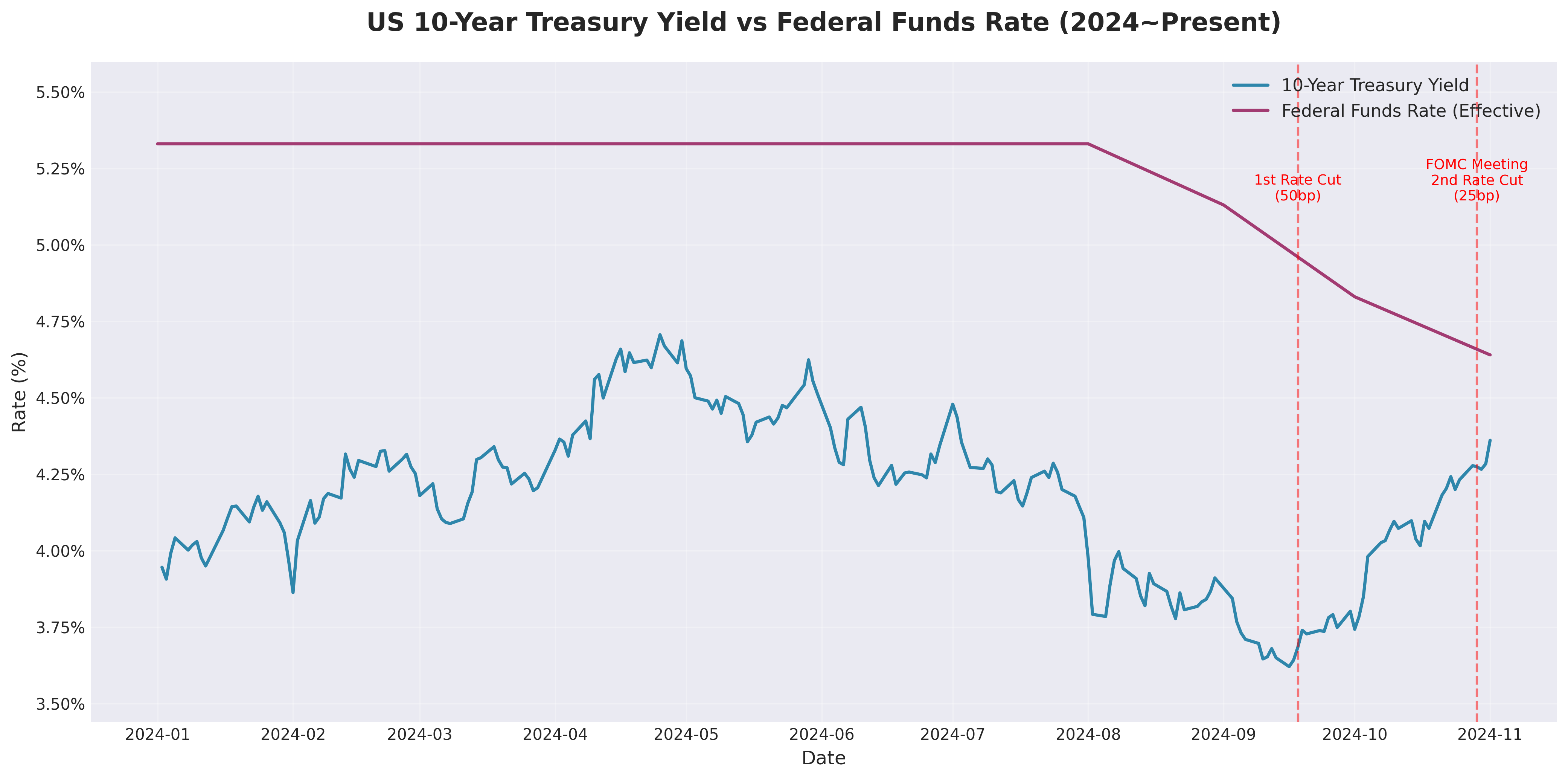

Background: The Federal Reserve cut interest rates for the first time since 2024 in September and October of this year, marking two consecutive rate cuts. Markets expected the Fed to pursue an aggressive easing policy to alleviate the economic burden caused by high interest rates following the pandemic.

Key Content: The Fed delivered an expected 25bp (0.25%p) rate cut at the October 29 FOMC meeting, lowering the federal funds rate to 3.75-4.00%. However, Chair Powell took a very cautious stance during the press conference, stating that "a December rate cut is not a done deal, not at all." The decision-making process revealed significant divisions among committee members, with Governor Steven Miran favoring a 50bp cut while Jeffrey Schmid preferred holding rates steady.

Chair Powell referenced the lack of economic data due to the government shutdown, using the metaphor "when you're driving in the fog, you slow down." Indeed, key economic indicators including the September jobs report have not been released, making it difficult for the Fed to accurately assess the economic situation.

Market Impact: Following Powell's remarks, the probability of a December rate cut plunged from 95% the previous day to 63%. The 10-year Treasury yield rose to 4.09%, and the stock market, which initially rallied after the announcement, reversed course lower following Powell's hawkish comments.

Lesson: Data-driven decision-making is central to central bank monetary policy. The economic data vacuum created by the government shutdown increases Fed uncertainty, which translates into heightened market volatility. Investors must understand the Fed's "data-dependent" approach and focus on real-time economic conditions rather than simply following past patterns.

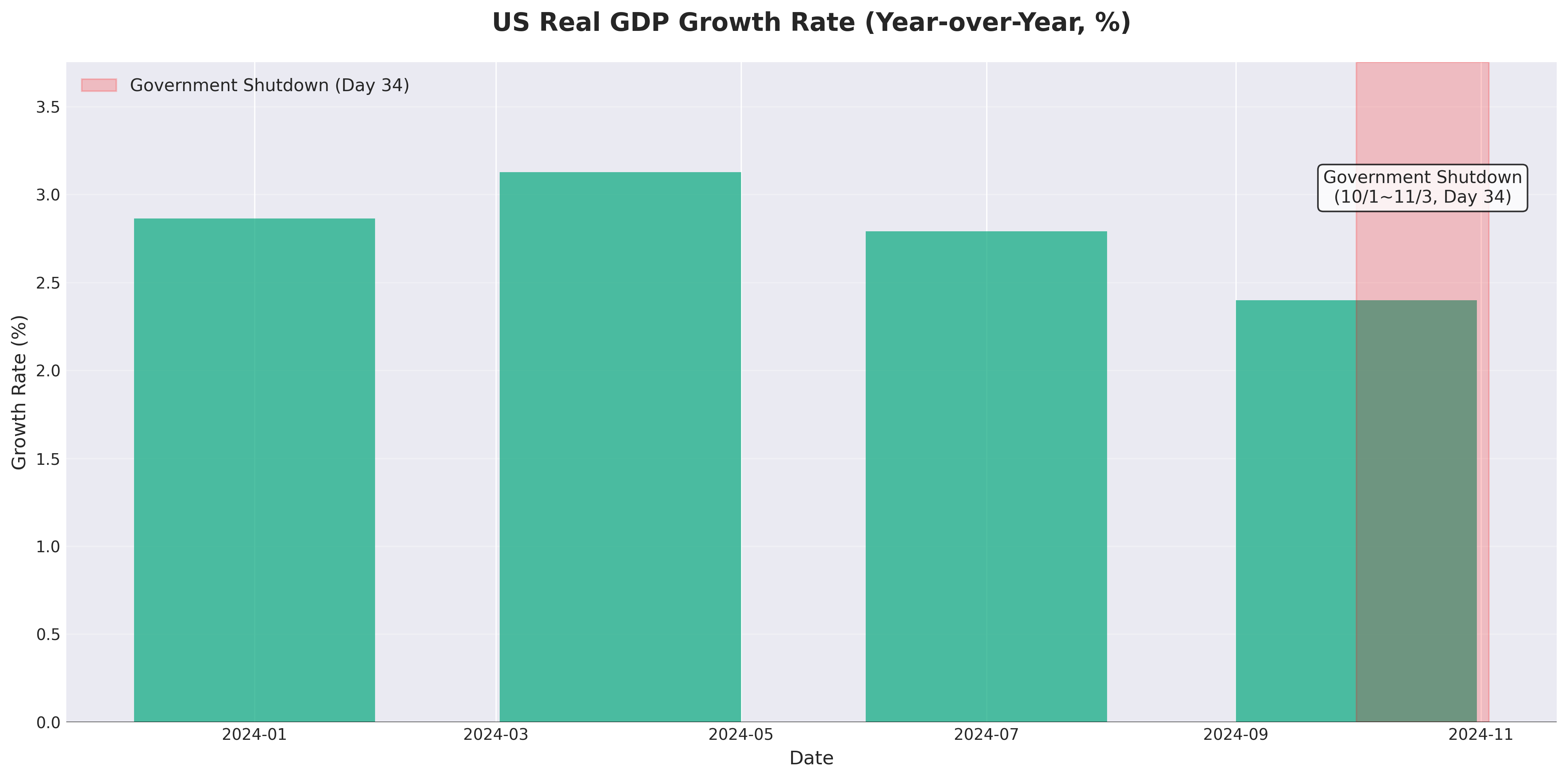

2. Government Shutdown Surpasses One Month: $40 Billion Economic Hit

Background: The US federal government entered a shutdown on October 1 after Democrats and Republicans failed to reach a budget agreement over the extension of Affordable Care Act (ACA) subsidies. Republicans claimed that health insurance subsidies support illegal immigrants, which is false.

Key Content: As of November 3, the shutdown has entered its 34th day, with approximately 1.4 million federal employees working without pay or on furlough. The Congressional Budget Office (CBO) estimates that an 8-week shutdown would inflict approximately $40 billion in damage to GDP (about 2% of annual GDP).

The most severe impact is on food assistance programs. SNAP (food stamps) benefits were suspended starting November 1, affecting 42 million people. Despite having $5.6 billion in emergency funds, the Department of Agriculture refused to use them citing legal authority issues, until a federal judge ordered the emergency funds to be released. The WIC program also faced suspension of assistance to over 6 million pregnant women and children.

Air traffic controllers have been working without pay for 31 days under tremendous stress, with 80% of controllers in the New York area calling in sick. This has led to flight delays and cancellations.

Political Deadlock: The Senate rejected a Republican short-term budget bill for the 13th time (54-45 vote), and President Trump called for eliminating the filibuster (60-vote requirement), but Republican Senate leadership refused. House Speaker Mike Johnson anticipated progress after the November 5 election.

Lesson: Government dysfunction is not merely a political issue but delivers a direct blow to the real economy. Low-income households and essential service workers are the first and most severely affected. GDP losses and reduced consumption can have long-term negative impacts on corporate earnings and stock markets. The suspension of economic data releases increases market uncertainty and amplifies volatility.

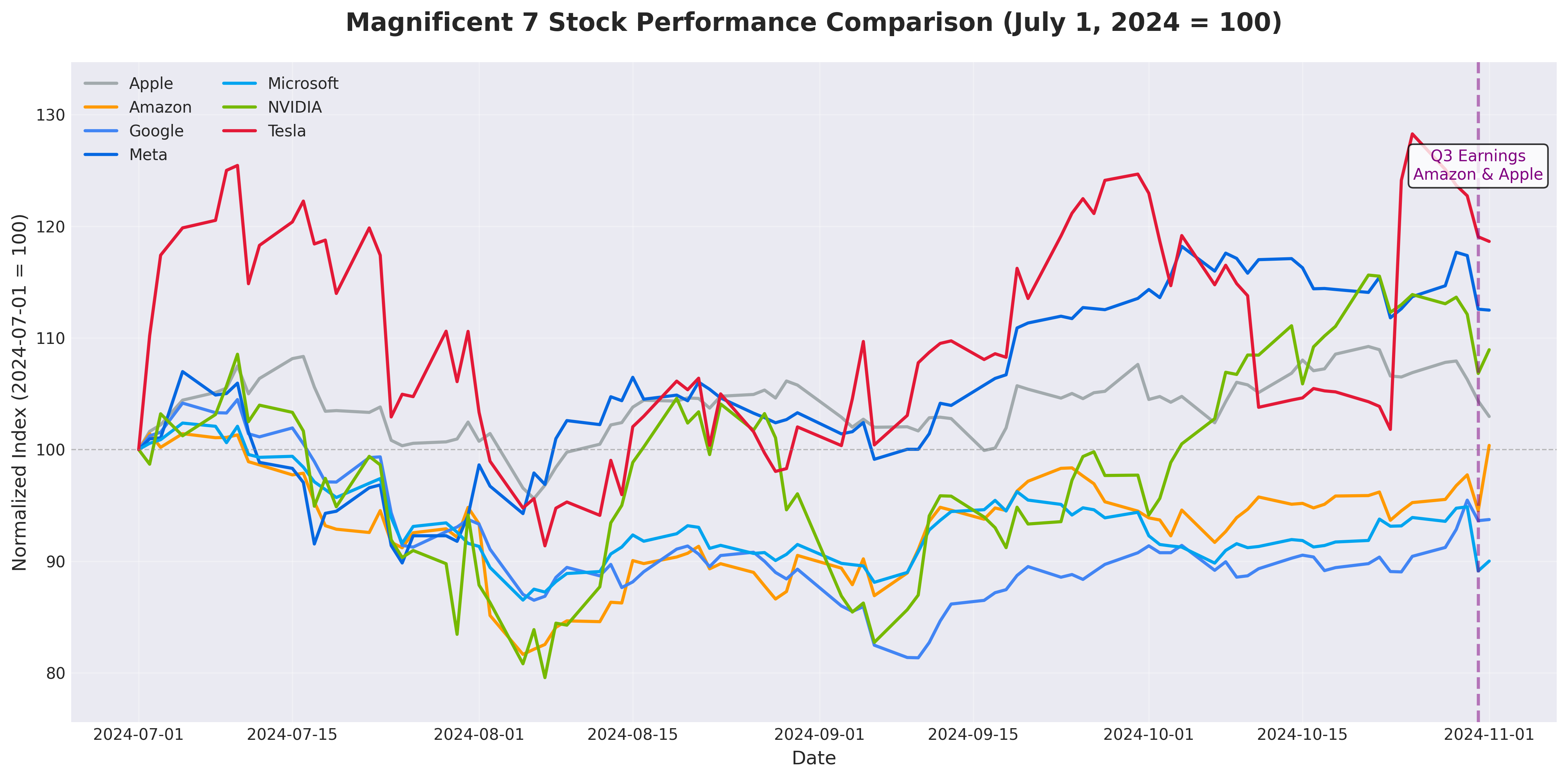

3. Amazon, Apple Strong Earnings Drive Big Tech Rally

Background: Big Tech companies consecutively released their Q3 earnings, with markets closely watching whether AI investments were translating into actual revenue generation. This was particularly important following Meta and Microsoft's stock declines after announcing expanded AI investment plans.

Key Content: Amazon released its Q3 earnings on October 31, significantly beating Wall Street expectations. Cloud computing business AWS revenue increased 20%, exceeding expectations, and CEO Andy Jassy stated that "AWS is seeing its fastest growth rate since 2022," noting strong demand for AI and core infrastructure. Amazon's stock surged 9.6%.

Apple also maintained an optimistic outlook for Q4 iPhone sales, dispelling market concerns. However, declining revenue from the China market remained a partial concern.

63% of S&P 500 companies have reported Q3 earnings, recording approximately 10% year-over-year growth, significantly exceeding the initial forecast of 7%. This was primarily driven by large technology stocks, with the "Magnificent 7" earnings leading the index's overall rise.

Market Reaction: On Friday, October 31, the Nasdaq rose 0.61% to close at 23,724.96, and the S&P 500 gained 0.26% to 6,840.20. The Dow Jones posted modest gains.

Lesson: This shows that Big Tech companies' AI investments are actually converting into sales and profits. Cloud infrastructure business in particular is playing a "pick and shovel" role in the AI era, driving stable growth. However, not all Big Tech companies are delivering the same performance, with investment efficiency and actual profit generation capability becoming the key differentiators for stock prices.

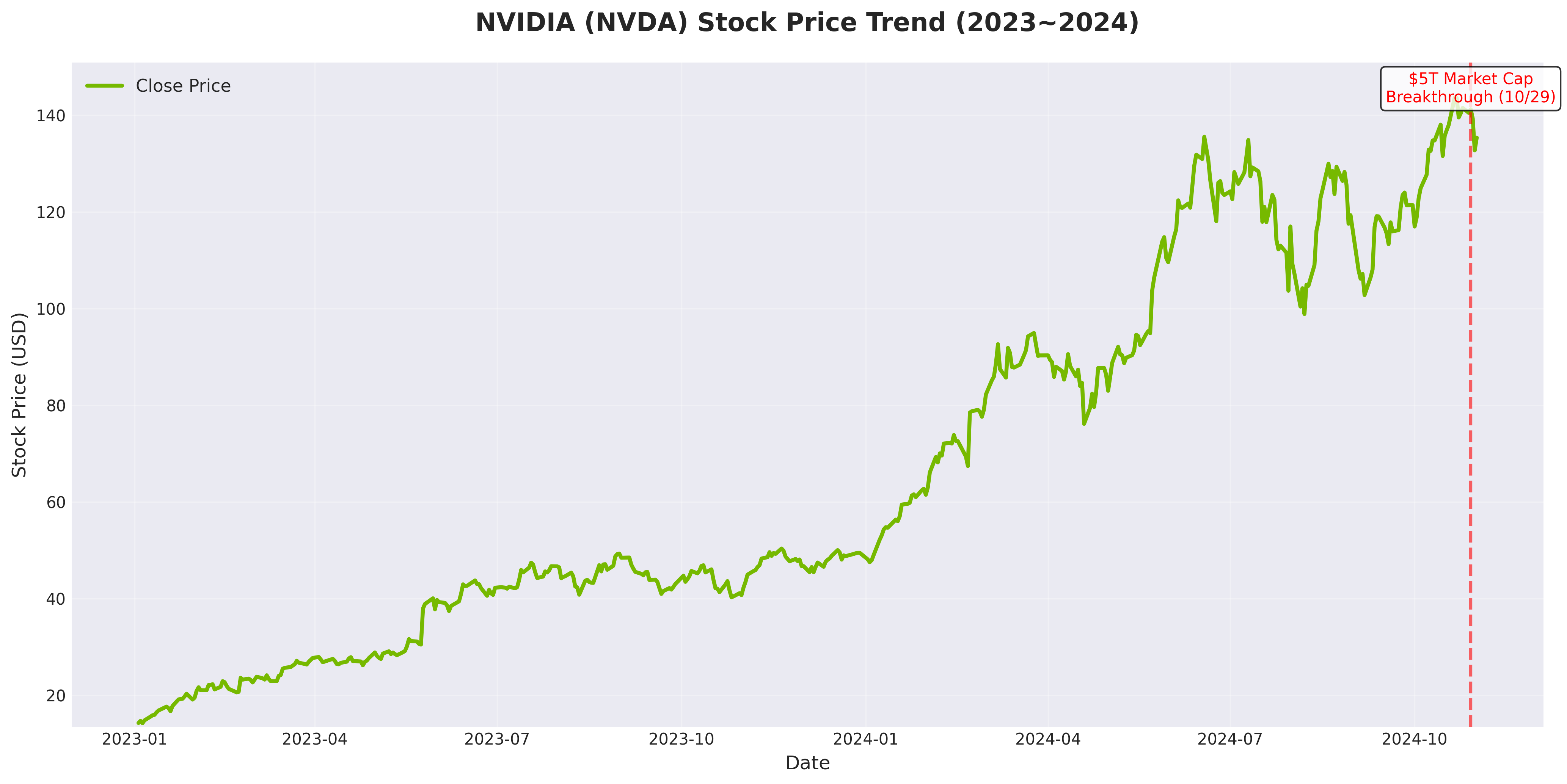

4. NVIDIA Market Cap Breaks $5 Trillion, CEO Says "Not a Bubble" Amid AI Bubble Concerns

Background: NVIDIA has achieved explosive growth as the dominant leader in AI chip manufacturing over the past two years. However, as market cap soared, concerns grew about overheating similar to the 2000s dot-com bubble. The IMF and Bank of England also warned that if AI investment fever cools, global stock markets could suffer significant damage.

Key Content: On October 29, NVIDIA became the first listed company in history to surpass a $5 trillion market capitalization. The stock has risen over 50% year-to-date, closing at $201.03 on October 28 with a 5% gain.

CEO Jensen Huang stated at the GTC conference in Washington DC that he expects $500 billion in revenue from Blackwell and Rubin chips. He emphasized, "I don't think it's an AI bubble," noting that "AI models are now powerful enough that customers are willing to pay for them, which justifies building massive computing infrastructure." Huang expects to ship 20 million Blackwell chips, a 5x increase compared to 4 million Hopper chips from the previous generation.

NVIDIA has formed new partnerships with Palantir, Uber, Deutsche Telekom, Nokia, and others, expanding business into 6G wireless technology and quantum computing. The company also announced collaboration with the US Department of Energy to build seven quantum supercomputers, expressing commitment to contributing to "American manufacturing renaissance."

Bubble Concerns: Some experts warn that NVIDIA could follow a similar path to Cisco in the late 1990s. Cisco has not recovered its peak price from the dot-com bubble even 25 years later. There are also concerns that the circular investment structure between NVIDIA, OpenAI, and AMD resembles the "mutual valuation inflation" of the late 1990s.

Lesson: When innovative technology actually begins generating revenue, valuations can be justified. However, historically, technology bubbles have peaked when investors believe "this time is different." While NVIDIA's case shows clear technological advantage and market dominance, the possibility that valuations have excessively priced in future growth cannot be ruled out. Investors must balance assessment of company fundamentals with market valuations.

5. China-US Trade Easing Sends Positive Signal to Global Markets

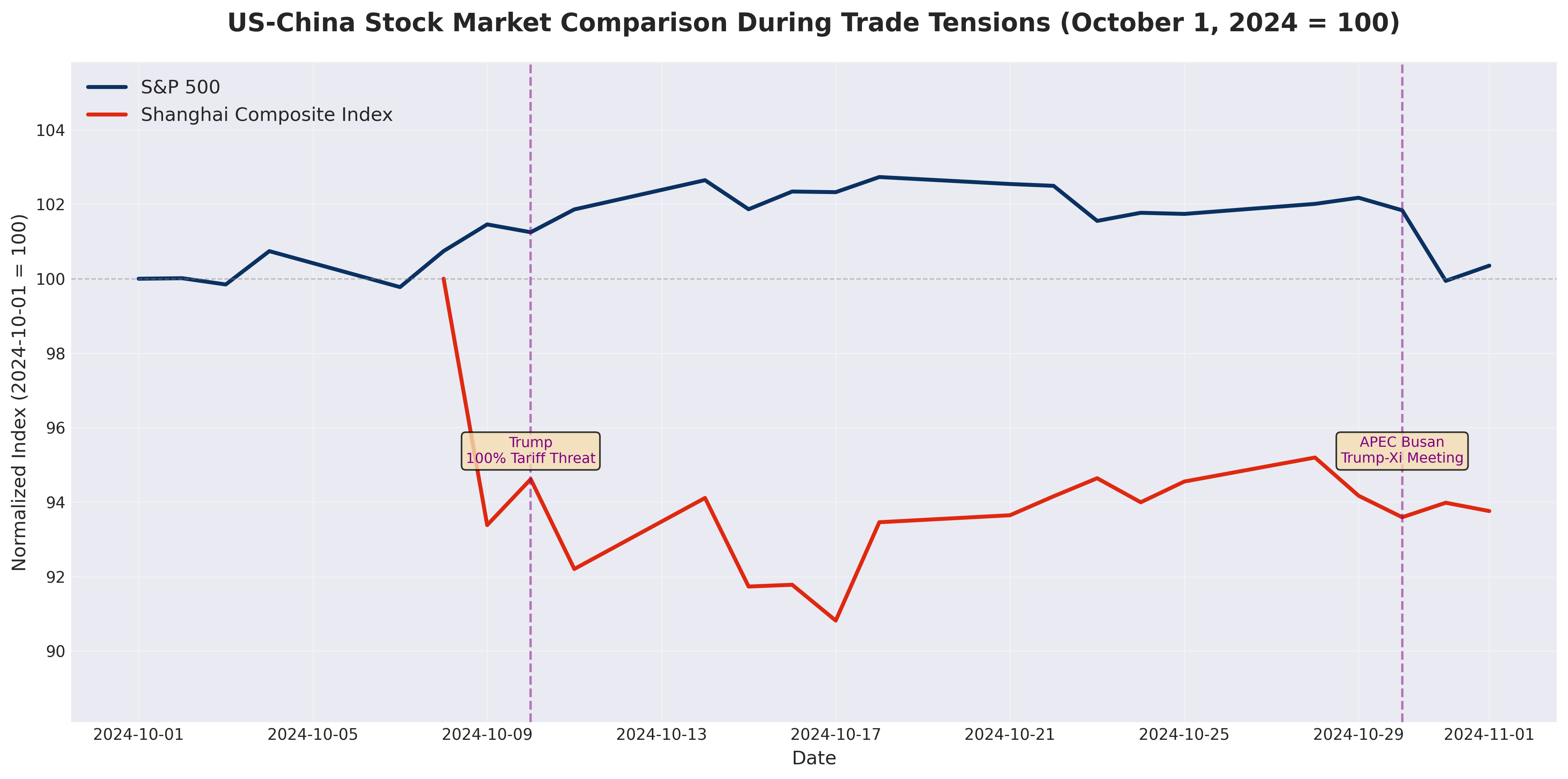

Background: President Trump threatened to impose 100% tariffs on China on October 10, and China responded with rare earth export controls, bringing trade tensions to a peak. The bilateral conflict posed a direct threat to global supply chains and the semiconductor industry, with companies like NVIDIA particularly concerned about restricted access to the Chinese market.

Key Content: President Trump and President Xi Jinping held talks at the APEC summit in Busan, South Korea on October 30. While both sides did not reach a complete agreement, the US significantly reduced fentanyl-related tariffs on China from 100% to 10%, and China agreed to postpone rare earth export control implementation by one year.

Importantly, both countries agreed to resume soybean trade and stabilize rare earth supply. However, NVIDIA's latest Blackwell chips remain restricted for export to China. While NVIDIA had projected zero revenue from China this year, this agreement could improve the 2025-2026 outlook.

Market Reaction: UBS Americas CIO Ulrike Hoffmann-Burchardi commented, "While no official agreement was signed, this positive outcome is sufficient for global markets and adds a positive backdrop to the stock rally powered by strong AI demand and innovation from the US and China."

US-listed rare earth mining companies' stock prices rose, with USA Rare Earth up 4.5% and MP Materials up 3.3%.

Lesson: Even when trade conflicts are not fundamentally resolved, practical compromises by both sides can significantly reduce market uncertainty. Easing tensions around strategic resources important to global supply chains, such as rare earths and semiconductors, directly impacts technology stock valuations. Investors should recognize that geopolitical risks tend to be overestimated in the short term and coolly evaluate actual negotiation outcomes. Understanding that trade negotiations are not a "zero-sum game" but a process where both sides seek practical benefits is important.

Comments (0)

No comments yet. Be the first to comment!