AI Hype Fuels Chip Rally: TSMC Lifts Guidance, U.S. Futures Jump

Introduction In the past 12-18 hours, Taiwan Semiconductor Manufacturing Company (TSMC) raised its 2025 revenue outlook, fueling expectations of strong AI demand and lifting global semiconductor stocks. U.S. index futures surged, and the tech-led rally regained momentum.

Body TSMC announced its Q3 earnings alongside an upward revision to its annual revenue growth targets. According to Barron's, TSMC ADR rose approximately 1.9% in pre-market trading. Reuters reported that this announcement triggered gains in U.S. stock futures, providing positive momentum for major semiconductor stocks including Nvidia, Micron, and Broadcom.

Simultaneously, major U.S. banks reported third-quarter earnings that beat market expectations. Bank of America and Morgan Stanley posted positive results driven by improved profitability and expanded trading revenue.

Global equity indices also showed strength. Major Asian markets climbed near record highs, with South Korea's KOSPI riding tech stock gains upward.

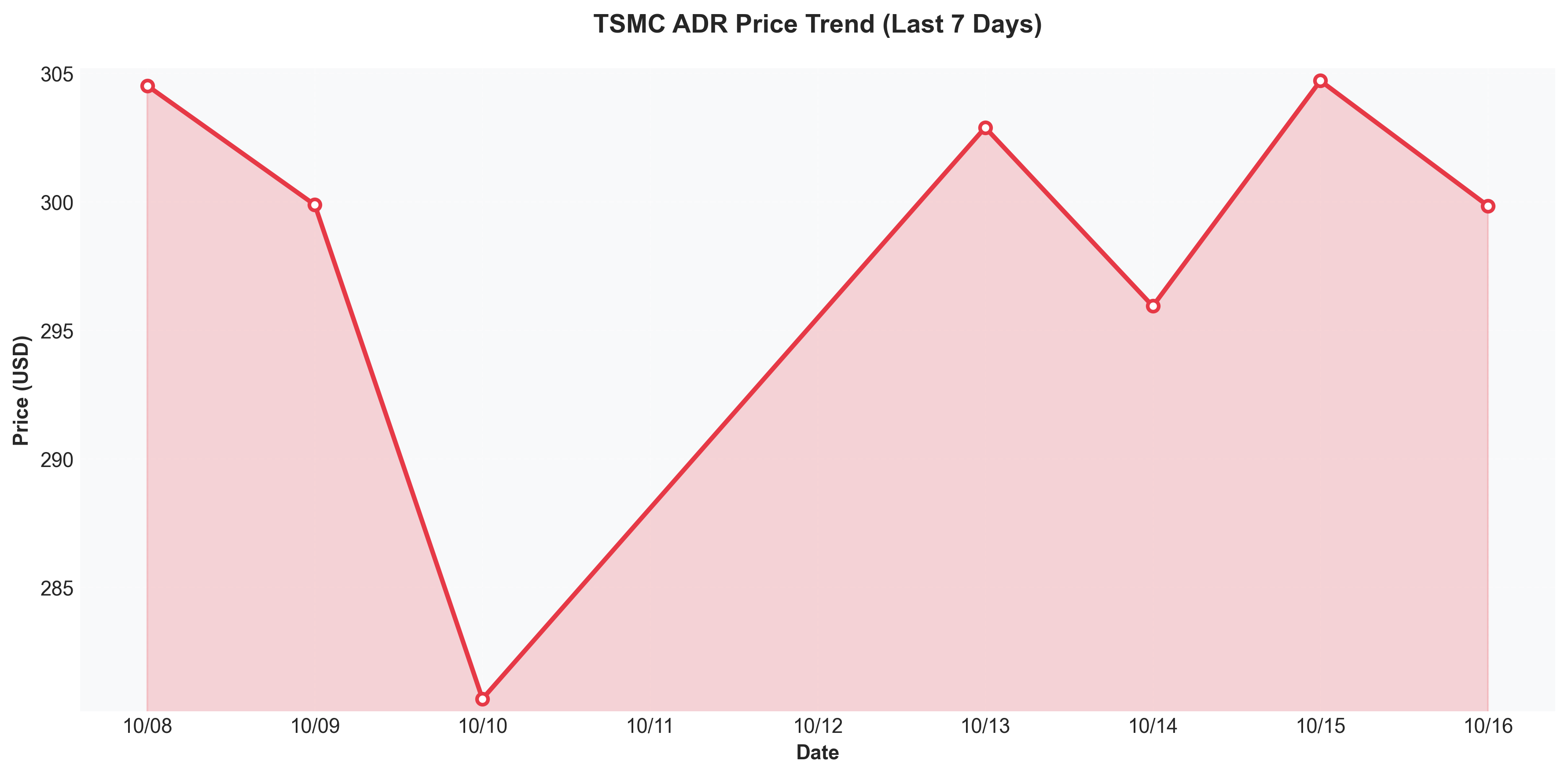

Below is a chart showing TSMC ADR's recent price trend.

Caption: TSMC ADR closing price trend over recent days, showing notable rebound following earnings announcement.

Caption: TSMC ADR closing price trend over recent days, showing notable rebound following earnings announcement.

Analysis What drove this trend?

-

Sustained AI Investment Expectations As AI model training and infrastructure expansion demand grows, markets expect continued demand for data centers and high-performance semiconductors. TSMC, a leading advanced process foundry for multiple companies, is viewed as a key AI boom beneficiary.

-

Symbolism of Guidance Upgrade When a company raises its outlook mid-stream, it signals more than just strong quarterly results. It tells investors "our market demand will remain strong going forward." This signal is particularly important in the tech sector, which trades on expectations.

-

Bank Earnings Provide Reassurance If financials had been weak, it would have weighed on broader markets. Instead, major banks delivered solid results, acting as a buffer against market uncertainty. This gave investors more room to take on risk.

-

Trade Risk and Rate Expectations Intersect However, China-U.S. trade tensions and tariff risks could reverse this trend at any time. Meanwhile, as Fed rate cut expectations grow, momentum in tech and growth stocks may strengthen significantly.

Implications Investors and market observers should watch for:

-

Broader Semiconductor Sector Movement If only TSMC shows strength, it could be a one-off event. Monitor earnings and guidance from other semiconductor stocks like AMD, Micron, and Intel.

-

U.S. Monetary Policy and Fed Commentary Tech and growth stock flows are highly sensitive to rate expectations. Fed official statements and meeting minutes could determine market direction.

-

Trade and Supply Chain Risks Export controls on semiconductor equipment and critical materials, along with tariff conflicts, could impact sector-wide valuations.

-

Valuation Adjustment Risk If AI expectations become too overheated, concerns about tech stock valuation bubbles could resurface.

Ultimately, this rally reflects the convergence of 'AI momentum' and 'earnings optimism.' However, without a solid foundation, strategies that prepare for potential pullbacks or momentum breaks are necessary.

(Sources: Reuters, Barron's, Bloomberg)

Comments (0)

No comments yet. Be the first to comment!