Trump-Xi Summit, Meta Plunges 11%, Fed Cuts Rates by 0.25%

1. 🇺🇸🇨🇳 Trump-Xi Summit: Tariff Reduction and Rare Earth Export Reprieve

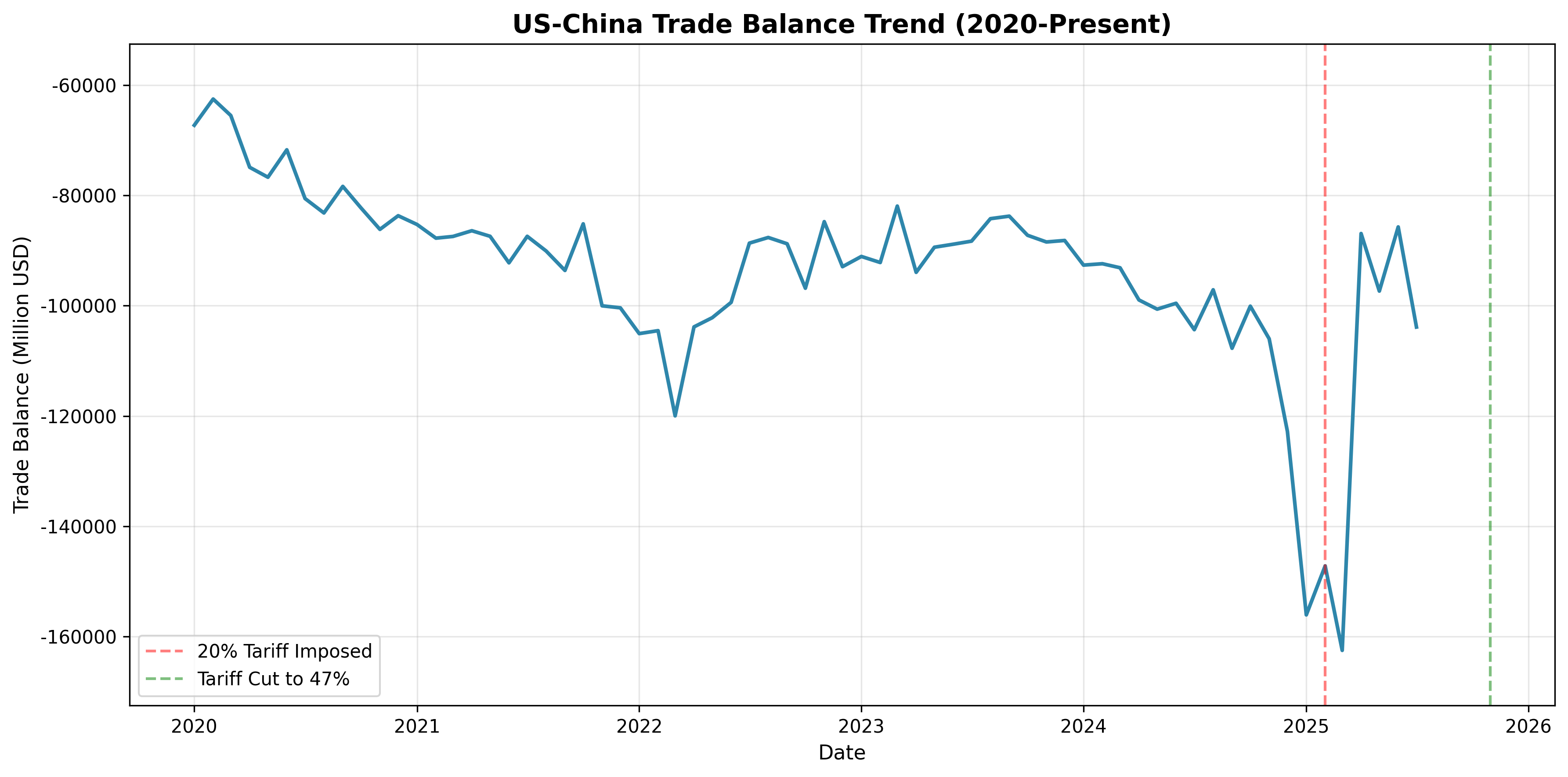

On October 30, 2025, President Trump and President Xi met on the sidelines of the APEC Summit in Busan, South Korea, and reached a significant agreement. During the 1 hour and 40-minute meeting, the U.S. agreed to reduce tariffs on Chinese goods from 57% to 47%, a 10-percentage-point cut. This came in exchange for China's commitments to crack down on fentanyl, resume imports of U.S. soybeans, and delay rare earth export restrictions.

Notably, China agreed to suspend for one year the rare earth export controls announced in early October, while the U.S. agreed to halt special port fees on Chinese vessels. While this agreement doesn't fully resolve the trade war between the two nations, analysts view it as providing the "stability" markets have been craving. President Trump praised the meeting as "a 12 out of 10."

Why It Matters: Rare earths are critical materials for AI chips and defense industries. The easing of China's export restrictions temporarily alleviates global supply chain concerns and could positively impact tech and defense stocks. Additionally, the tariff reduction is expected to help stabilize consumer prices and improve corporate margins.

2. 💬 Meta Plunges 11% Despite Strong Earnings: AI Investment Concerns Intensify

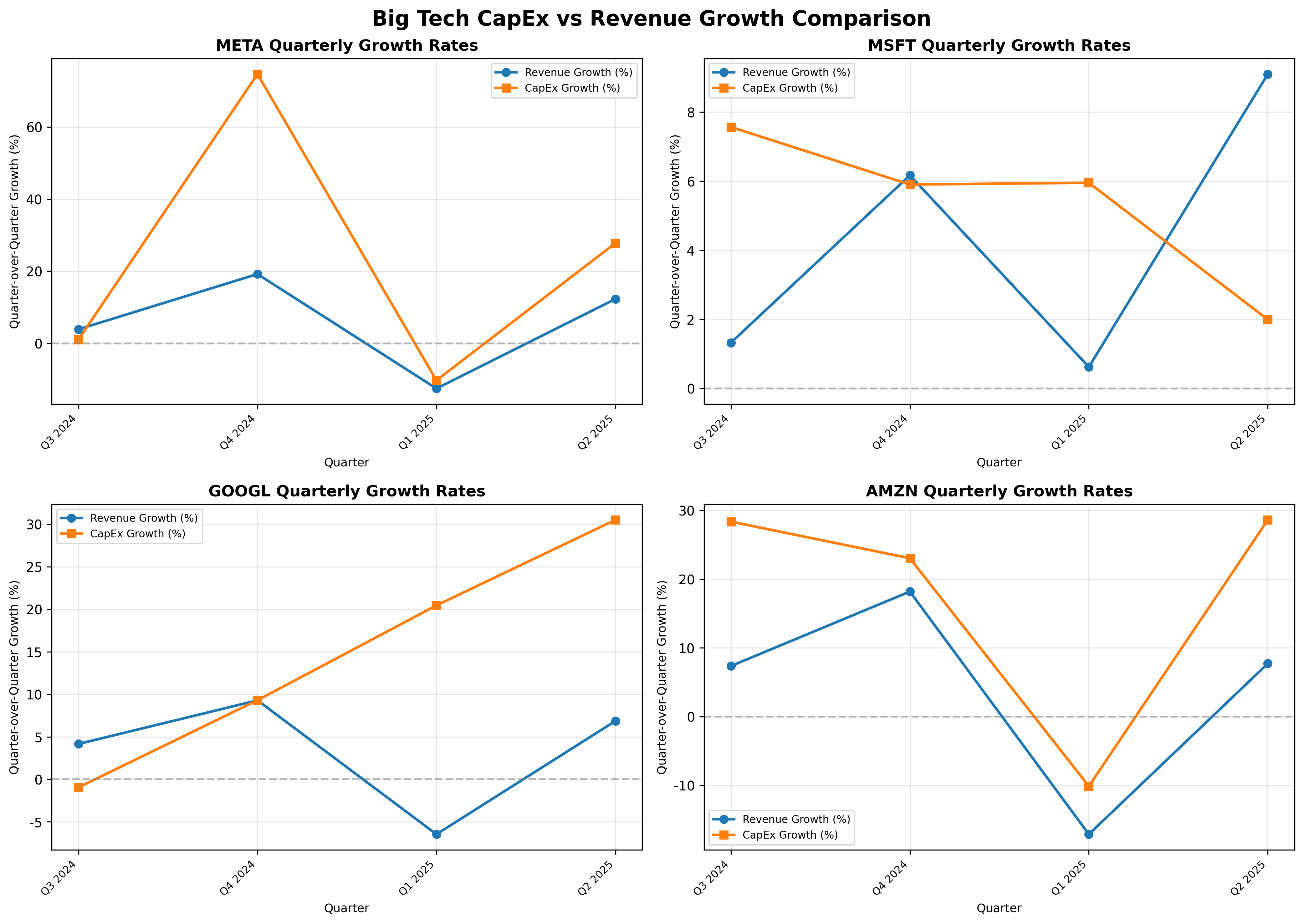

Meta reported Q3 earnings with revenue of $51.2 billion (up 26% YoY) and EPS of $7.25, significantly beating Wall Street expectations. Daily active users also surpassed 3.5 billion, showing robust growth. However, on October 30, the stock plummeted more than 11%.

There are three main reasons for the selloff. First, Meta raised its 2025 capital expenditure guidance from $66-72 billion to $70-72 billion, with most of the spending going toward AI infrastructure. Second, the CFO stated that spending would continue to grow at a "significantly faster pace" in 2026. Third, a one-time tax charge caused net income to plummet 83% YoY to $2.7 billion.

Investor Concerns: While CEO Mark Zuckerberg claimed "AI investments are starting to show returns," investors remain skeptical about whether massive AI spending will actually translate into profits. Microsoft, which reported the same day, also fell 3% for similar reasons.

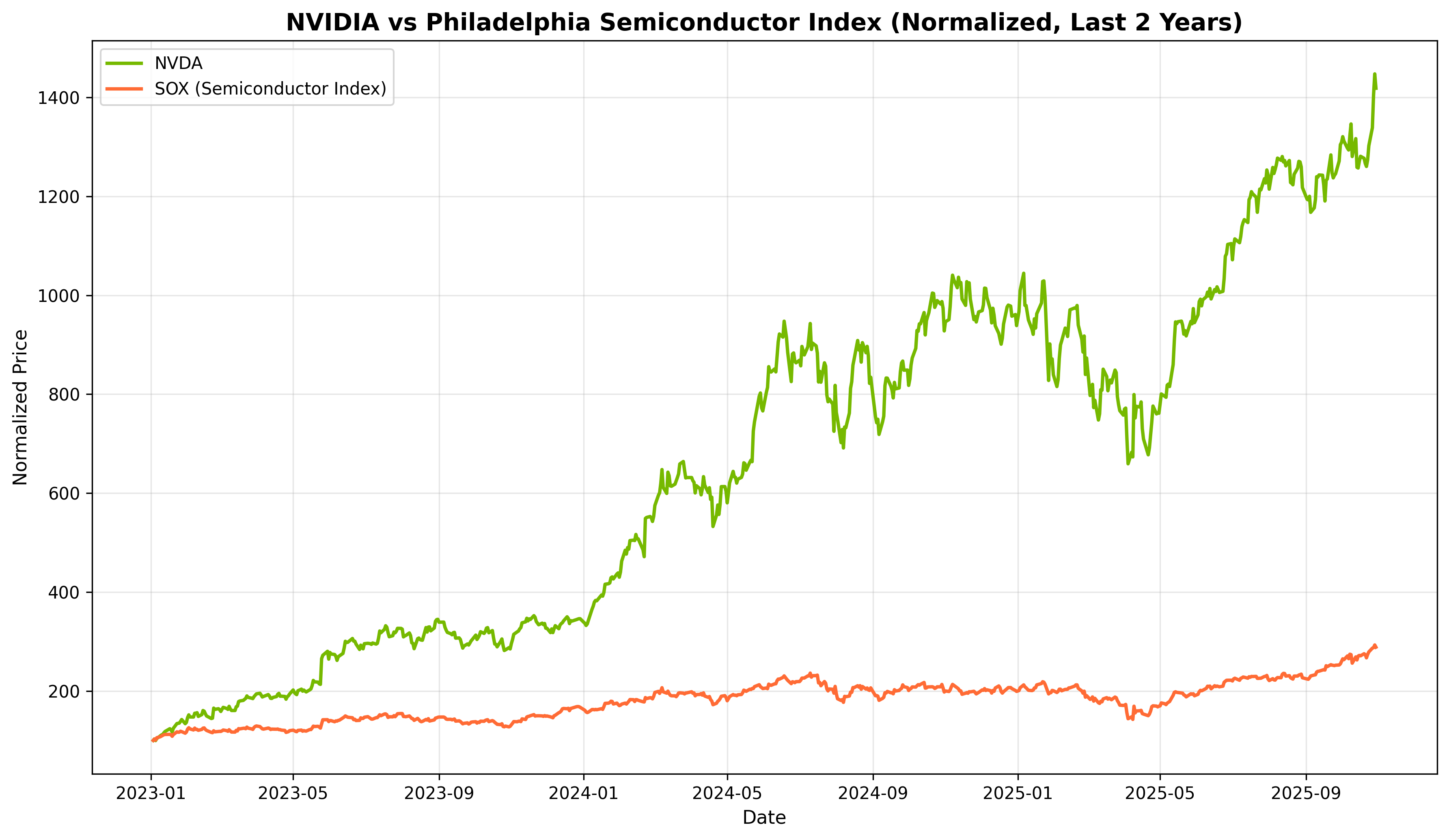

3. 🎯 NVIDIA Becomes First Company to Break $5 Trillion Market Cap

On October 29, NVIDIA became the first company ever to surpass $5 trillion in market capitalization, both intraday and at close. Shares rose 5.6% to close at $212.19. The company crossed $4 trillion just three months ago and $1 trillion two years ago. Over the past five years, the stock has surged 1,500%.

Multiple catalysts drove the rally. First, CEO Jensen Huang announced AI chip orders totaling $500 billion. Second, the company revealed plans to build seven new supercomputers for the U.S. government. Third, NVIDIA announced a $1 billion investment in Nokia to develop 6G technology. Fourth, President Trump suggested at his meeting with President Xi that Blackwell chip exports to China might be approved.

Significance: NVIDIA now joins Apple and Microsoft in the $4+ trillion club and has a larger market cap than all its competitors (AMD, Intel, Broadcom, TSMC, etc.) combined. While the company is the biggest beneficiary of the AI investment boom, concerns about valuation overheating and a potential bubble are also growing.

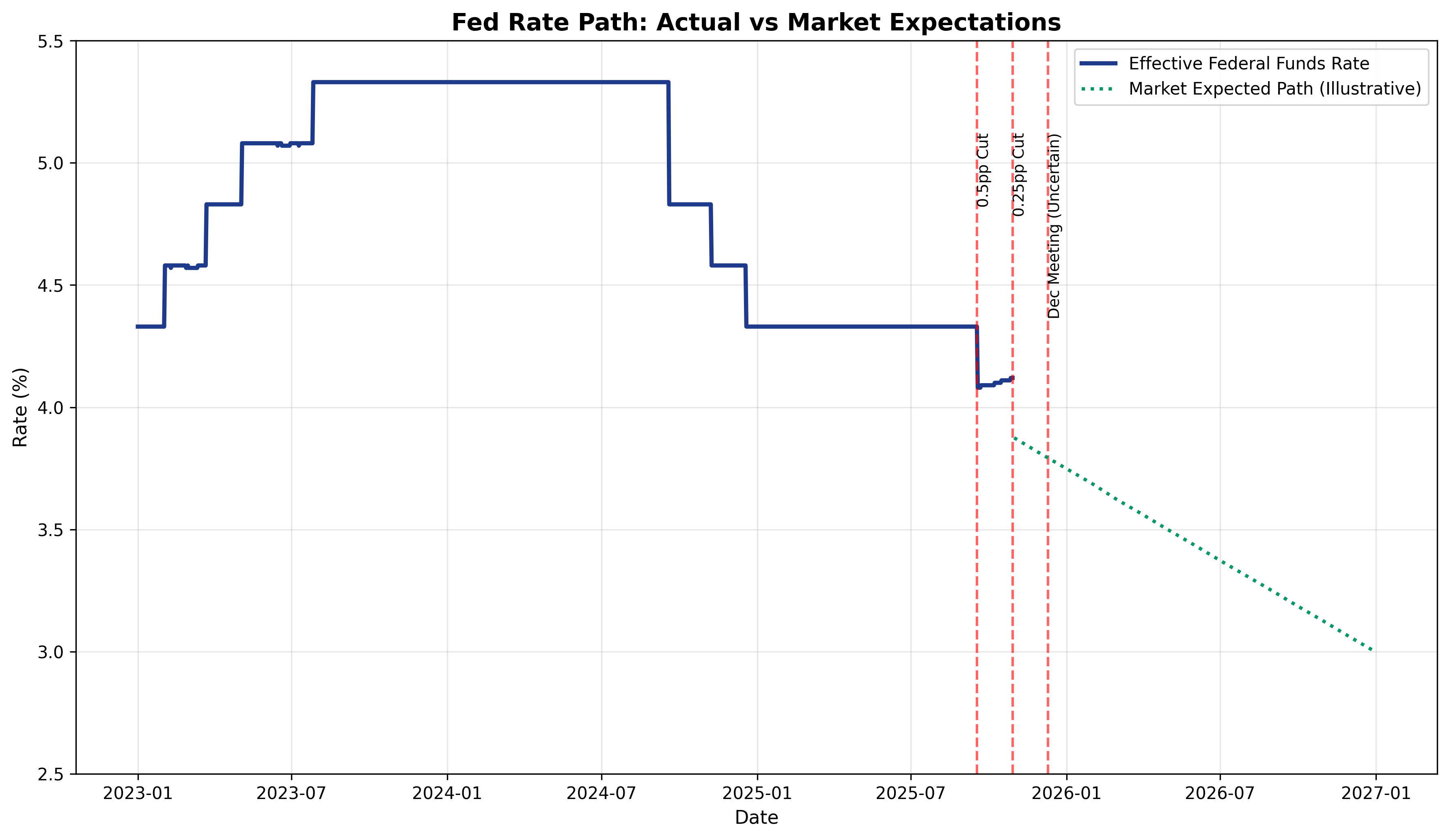

4. 🏦 Fed Cuts Rates 0.25% But Powell's 'Hawkish' Comments Roil Markets

The Fed cut interest rates by 0.25 percentage points to a range of 3.75-4.0% at its October 29 FOMC meeting. This was the second consecutive cut and in line with market expectations. However, Fed Chair Jerome Powell's press conference remarks surprised markets.

Powell emphasized that a December rate cut "is not a foregone conclusion, far from it." He revealed there are "strongly divergent views" among FOMC members about the path forward and that voices calling to "wait at least one cycle" are growing louder. After these comments, the probability of a December rate cut plunged from 90% to 67%, and stocks reversed from gains to losses.

Background: Due to a government shutdown, key economic data including September employment numbers were not released, creating a historic situation where the Fed was making policy "blindfolded." Powell noted that inflation remains "somewhat elevated" and that tariffs pose an upside risk to prices.

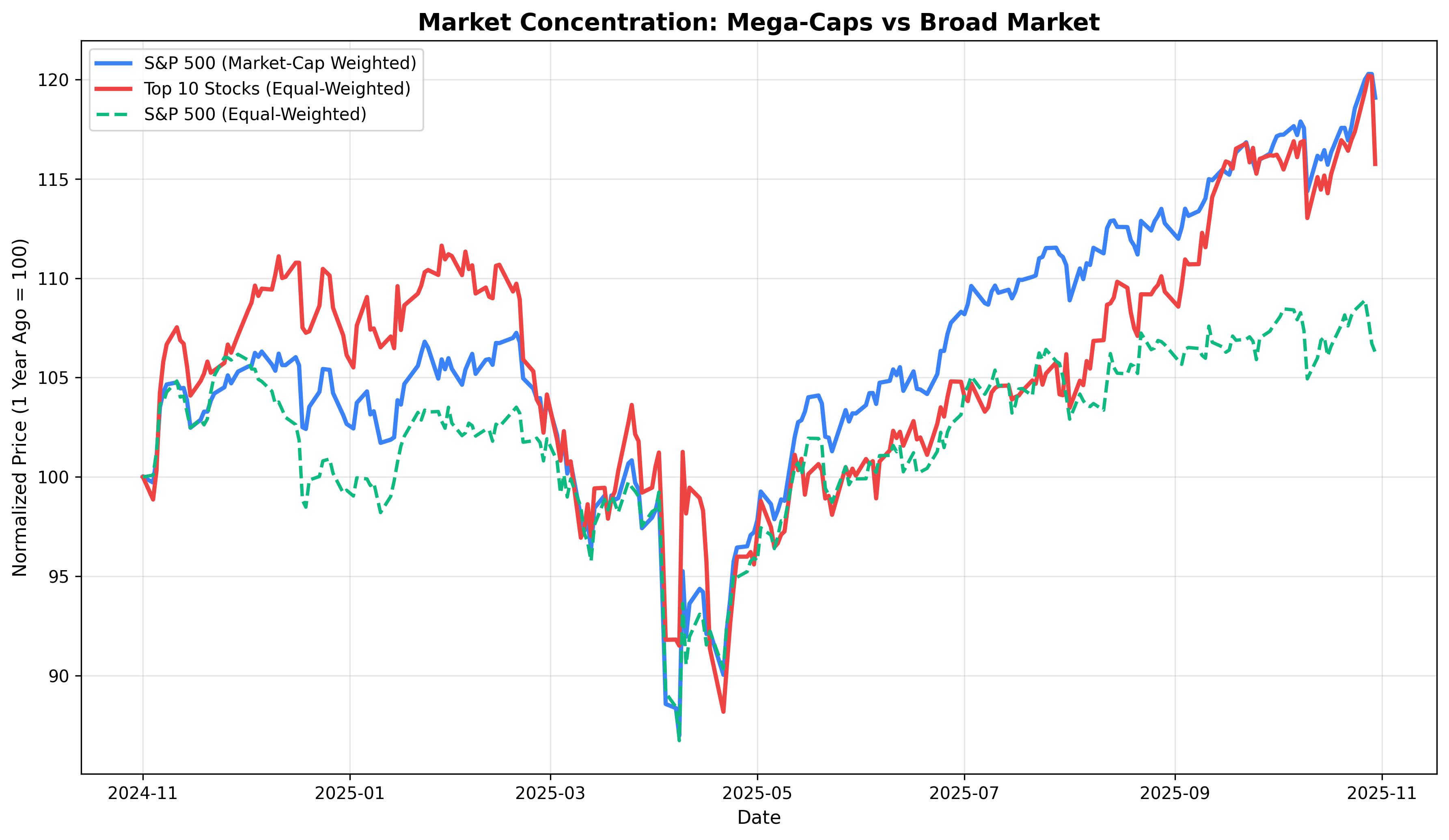

5. 📊 Market Concentration Concerns: Stock Market Swings on Big Tech Earnings

Only 47% of S&P 500 constituents are above their 50-day moving average, while the Nasdaq figure stands at just 45%. Despite major indexes trading near all-time highs, market breadth is deteriorating. Only 4 of the 11 sectors have more than 50% of constituents above their 50-day moving averages.

Over the past week, declining stocks outnumbered advancing stocks by a ratio of 1.5 to 1. This indicates an extremely high concentration in a handful of mega-cap companies, particularly Big Tech. Indeed, the entire market shook on October 30 following disappointing reactions to Meta and Microsoft earnings.

Risk: Experts warn of a lack of broad participation to support further gains. While this doesn't necessarily mean a decline is imminent, it highlights growing "concentration risk" tied to mega-cap companies and their earnings. Some observers noted the market showed a "Hindenburg Omen" signal, a technical indicator suggesting momentum loss in a polarized market.

This information is as of October 31, 2025 (KST) and is for informational purposes only, not investment advice.

Comments (0)

No comments yet. Be the first to comment!