Should Your Portfolio Change When the Economy Changes?

— 60/40 vs Regime-Switching: A 10-Minute Visual Guide

"Should I just ride out a 60/40 portfolio, or adjust allocations based on economic 'weather'?" Using monthly data from March 2006 to September 2025, I've broken down this question visually. Instead of complex formulas, we'll follow a story about when each approach wobbles less and when it misses out. As you read, just think: "Which rhythm fits my style?" That's enough.

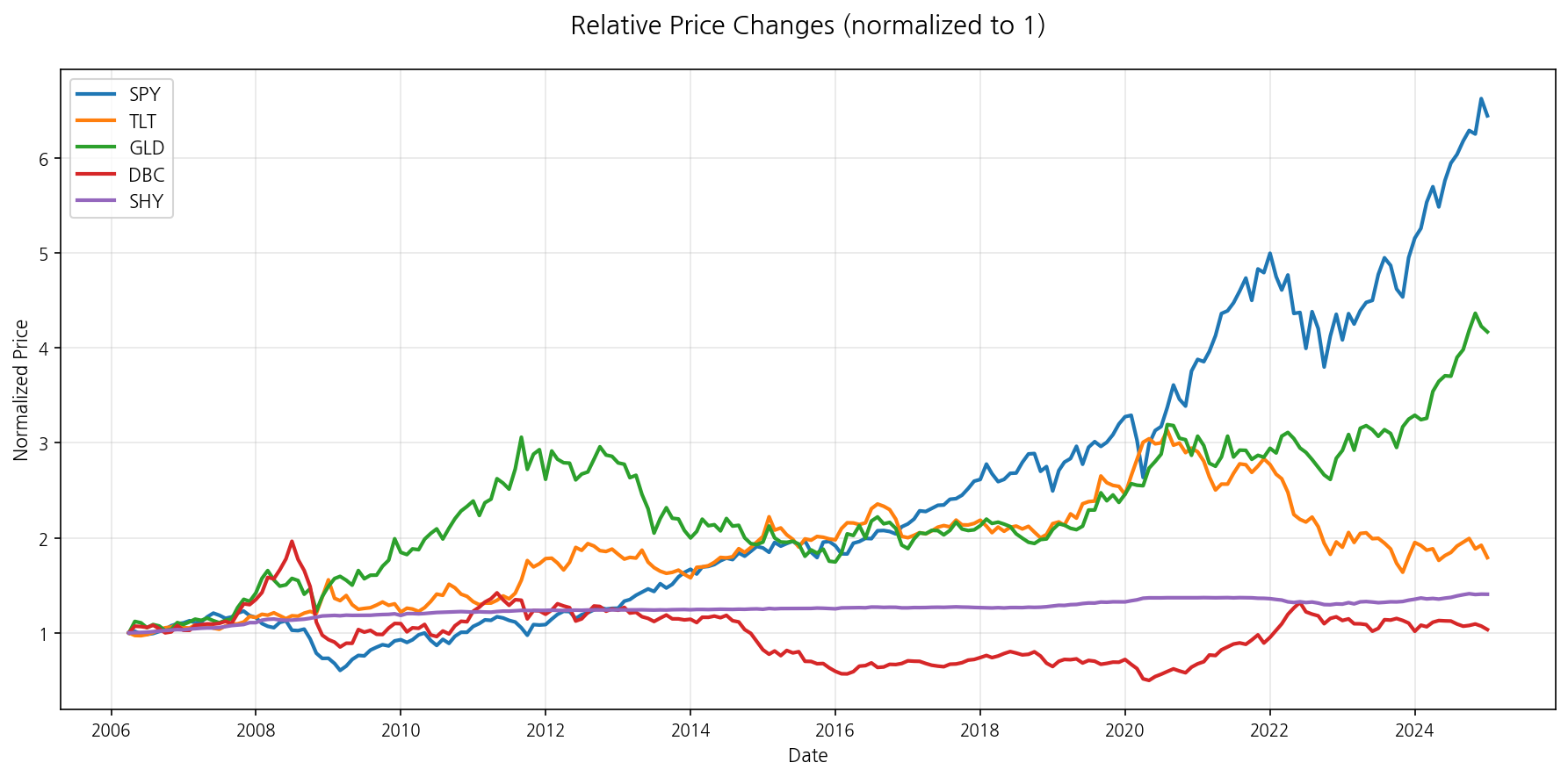

- Assets: SPY (US stocks), TLT (US long-term bonds), GLD (gold), DBC (commodities), SHY (short-term bonds)

- Macro signals: Real GDP YoY (growth), CPI YoY (inflation)

- Rule: "This month's signal" applies next month (no look-ahead bias)

- Assumptions: Zero transaction costs/taxes, month-end (Adj Close) data

1) Two Strategies, Very Simply

-

Static 60/40: Start with 60% stocks / 40% bonds, then hold (allow natural drift). → Pros: Simple, cheap, low maintenance. → Drawbacks: Takes full hit during major downturns.

-

Regime-Switching: Use growth & inflation values to determine economic weather (regime), and adjust allocations significantly only when regimes change.

- Expansion (growth↑ inflation↓): stocks↑

- Overheating (growth↑ inflation↑): commodities↑

- Stagflation (growth↓ inflation↑): gold & commodities↑

- Recession (growth↓ inflation↓): long bonds & gold↑ → Pros: Cushions crises/inflation periods. → Drawbacks: Slow signals often miss early rebounds.

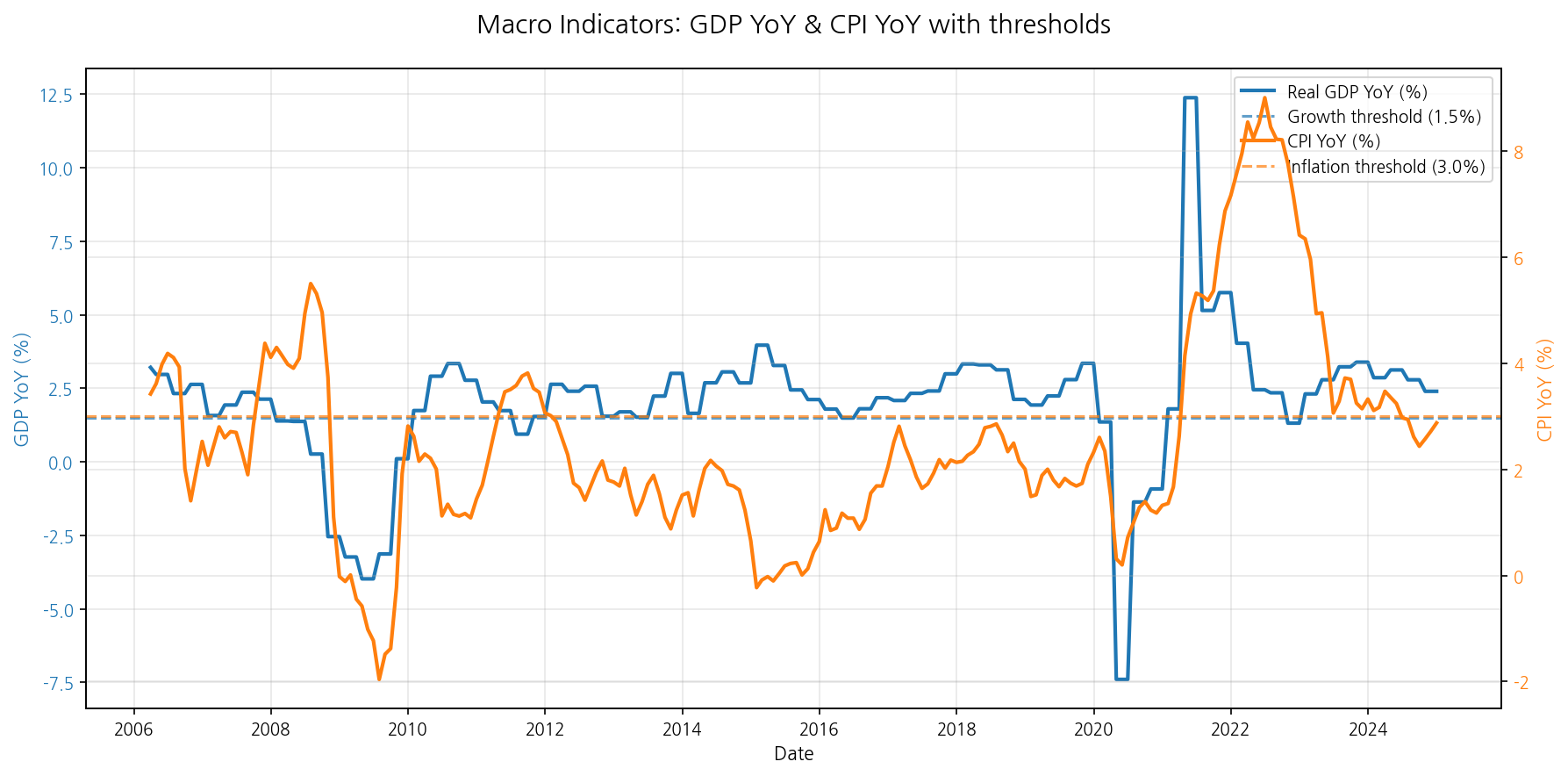

2) First, See the 'Weather Map'

We use simple thresholds—growth 1.5%, inflation 3.0%—to divide into four regimes. The chart below shows how these two values moved.

- 2008~2009: Growth plunged → long Recession period.

- 2022: Inflation spiked → frequent Stagflation/Overheating.

- Signals are applied one beat late (next month). So there's often a "reacting late" feeling.

3) Results at a Glance: "Did It Earn More, Wobble Less?"

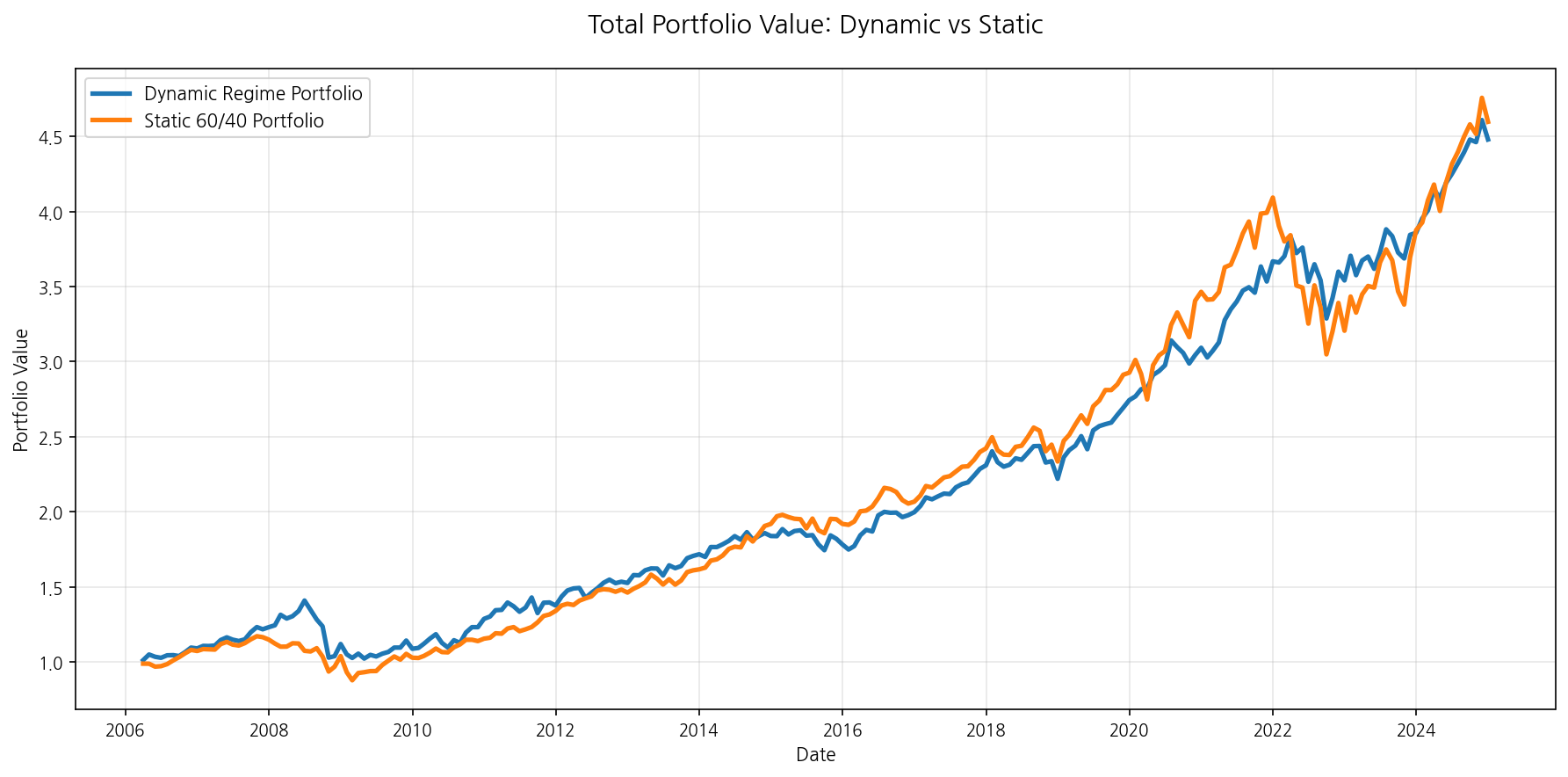

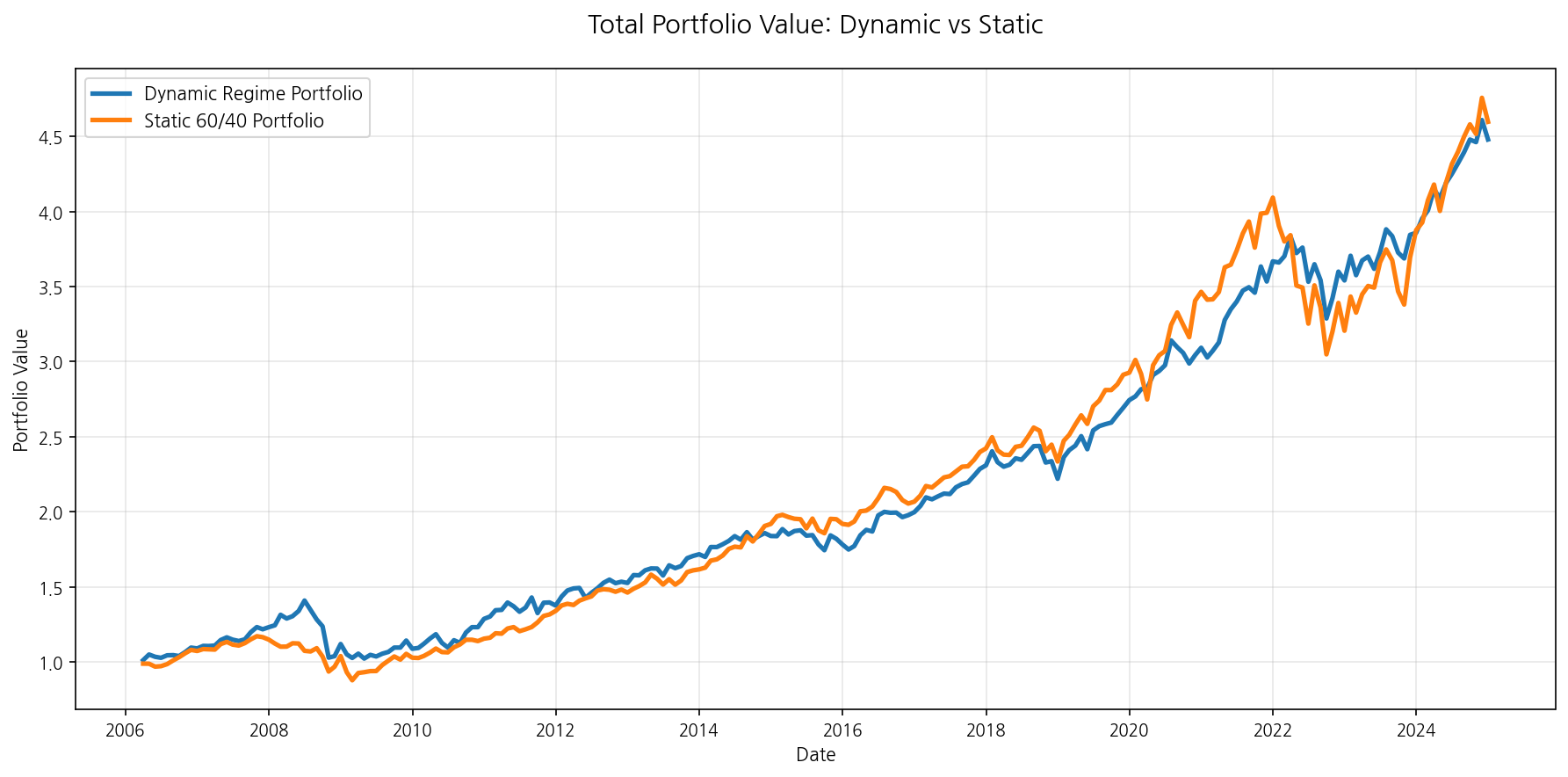

Let's start with cumulative value.

Here's the feel.

- Final value alone: 60/40 slightly higher.

- But regime-switching has slightly lower volatility, and risk-adjusted efficiency (Sharpe) is marginally better.

- Early rebounds: regime-switching often lags by one tempo.

Numbers summarized (2006-03 → 2025-09, month-end basis):

| Metric | Regime-Switching | 60/40 |

|---|---|---|

| CAGR | 8.22% | 8.50% |

| Annual Vol | 9.98% | 10.57% |

| Sharpe (rf=0) | 0.85 | 0.83 |

| Max Drawdown | −27.4% | −25.5% |

| Total Return | +342% | +365% |

One-liner: 60/40 earned slightly more, while regime-switching was (slightly) more efficient with less wobble. However, the depth in worst moments was sometimes deeper for regime-switching.

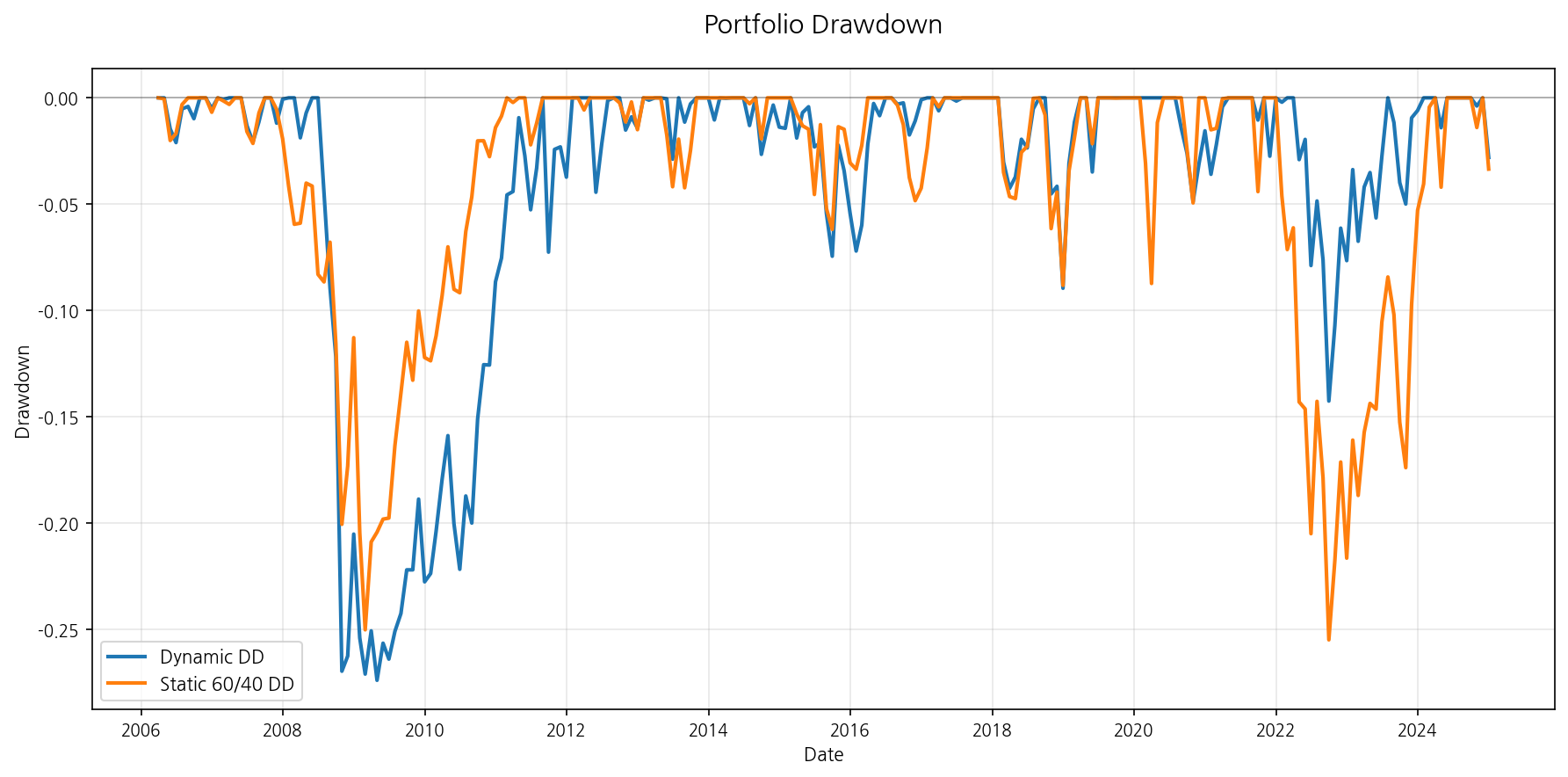

4) "Falling Periods" Are the Real Test

How deep your account drops and how fast it recovers matters more in actual experience.

- 2008~2009 early: Regime-switching also took the full hit initially (signals are slow).

- 2022 inflation: Regime-switching leaned on commodities & gold, reducing the felt drawdown.

- Overall, both strategies experienced deep valleys of −20% to high −20s.

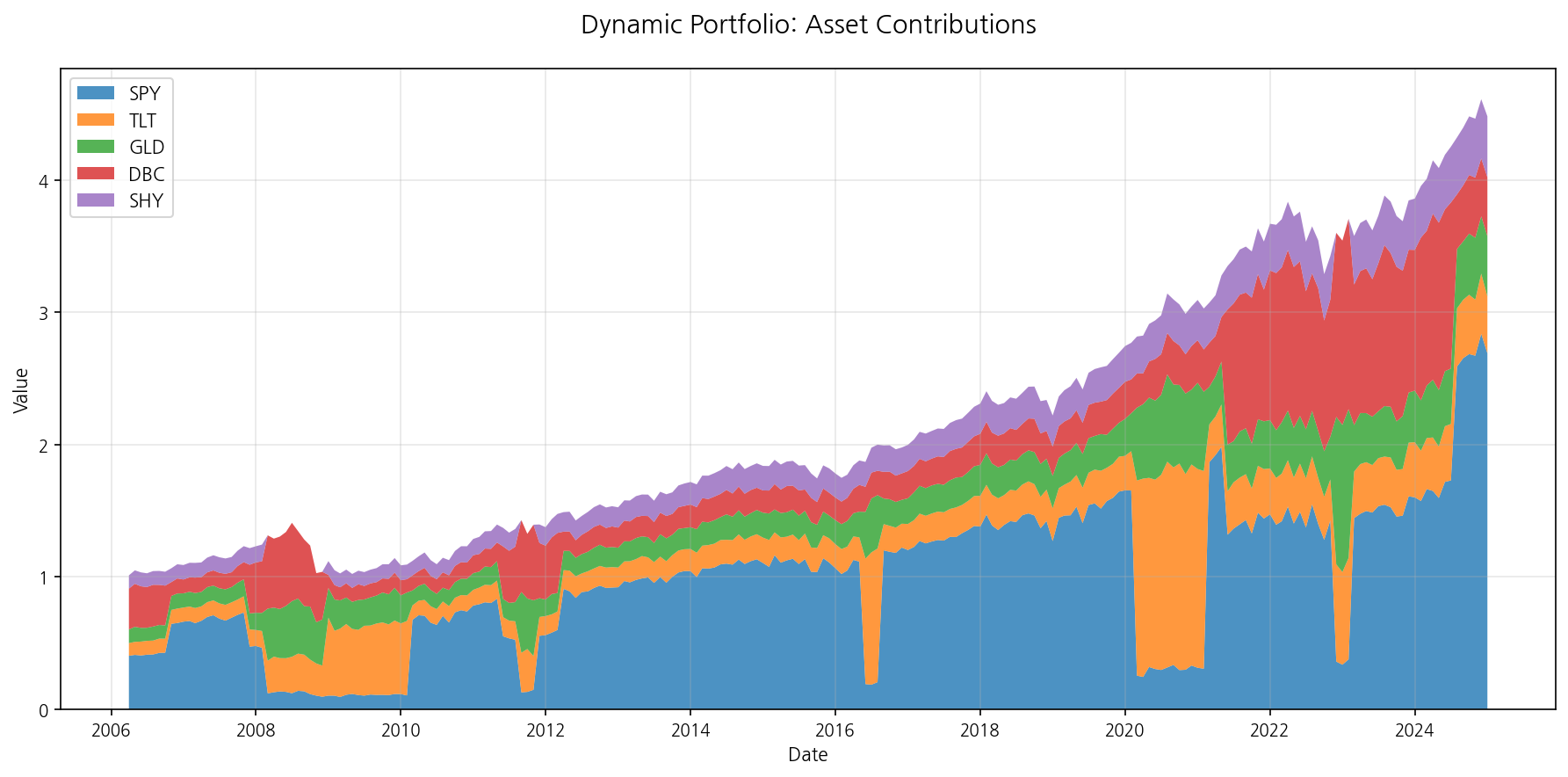

5) What Actually Happened Inside the Portfolio

Below shows who struggled when, and who helped when inside regime-switching.

- Crisis/shock periods (2008, 2020): TLT & GLD areas thickened for defense.

- Inflation peak (2022): DBC & GLD moved to the front.

- Recovery: SPY regained leadership.

It's also good to see the long-term flow of each asset at once.

- SPY: Long-term uptrend, but heavy damage in bear markets.

- TLT: Solid in 2008 & 2020, but weak during 2022 rate spike.

- GLD/DBC: Presence↑ during inflation/risk periods.

- SHY: Low-volatility 'buffer'.

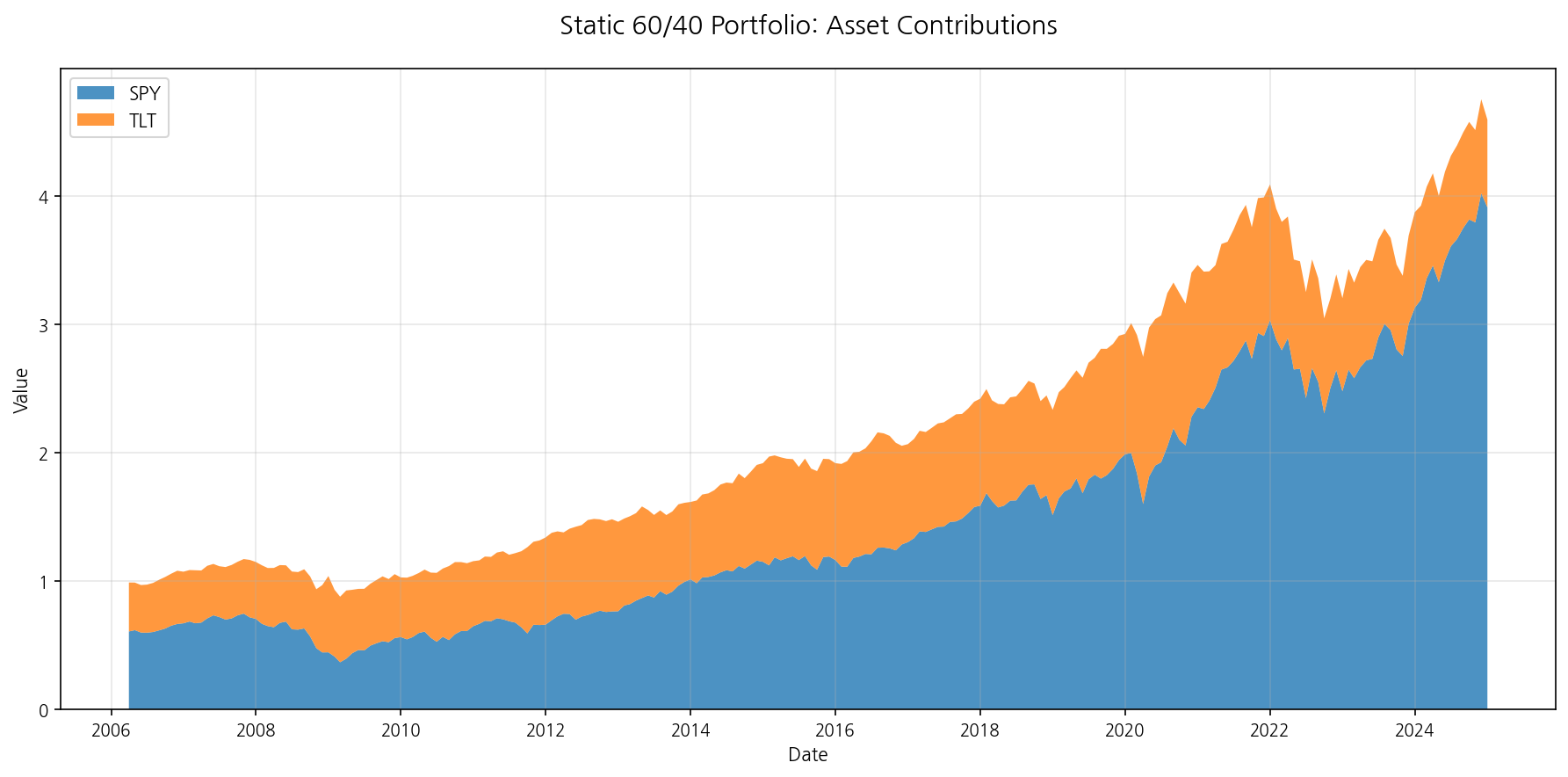

And for reference, here's the cumulative contribution inside static 60/40.

- Over time, stock area naturally grows from drift.

- Solid in bull markets, but drawdown risk increases in major declines.

6) Understanding in Three Scenes

Scene ① 2008 Financial Crisis Difficult for everyone. Regime-switching couldn't avoid the initial crash either, but after judging recession, it increased bond & gold allocations to slow the drawdown. Think "can't fully block, but slows the deepening."

Scene ② 2020 Pandemic V-shaped rebound after crash. Regime-switching's late signal missed part of the early rally. Conversely, 60/40 sat still and caught more of the first wave. "Reward for staying calm."

Scene ③ 2022 Inflation Shock When bonds struggled, regime-switching increased commodities & gold, reducing the feeling of "getting hit from just one side." Not a perfect shield, but definitely cushioned psychological stress. Reduces the "everything breaking at once" feeling.

7) Why Didn't Dynamic 'Always' Win?

- Signal lag: GDP & CPI are slow. We intentionally apply next month. So we're bound to miss early rebounds.

- Policy/market sudden reversals: When policy flips instantly like 2020, naturally slow signals become a game of catch-up.

- Commodity ETF characteristics: Commodity ETFs can diverge from spot due to rollover costs/index structure.

- Real-world friction: This backtest assumes zero costs/taxes. Actual implementation may be slightly more disadvantageous for dynamic strategies.

What if we change thresholds?

- Lower thresholds (e.g., growth 1.0, inflation 2.5): signals become more sensitive, transitions more frequent (whipsaws↑).

- Higher thresholds (e.g., growth 2.0, inflation 3.5): signals become duller, catching only big trends, slower reactions.

- Point is "frequency I can stick with". Too frequent becomes burdensome to execute; too rare makes its purpose fade.

What if we change the asset universe?

- Commodities vary by ETF composition/roll method, affecting felt performance. Gold also differs between physical & mining stocks.

- Using intermediate bonds instead of long bonds (TLT) reduces rate sensitivity but may also reduce defensive power in recession.

- Key is maintaining role division: stocks (growth), bonds (recession defense), gold/commodities (inflation defense), short bonds (buffer).

8) Which Personality Fits My Account?

- "Don't want to watch markets monthly" → 60/40 (power of simplicity)

- "Big drawdowns keep me awake" → Regime-switching (automatic defense in crises)

- "I can stick to rules all the way" → Monthly check of two numbers → automated rebalancing

For reference, in this sample:

- Regime changes: 18 times

- Average monthly turnover (sum of abs weight changes): about 5.4%

- Regime distribution (months): Expansion 129 / Overheating 52 / Recession 29 / Stagflation 16

9) To Follow Exactly (Expanded Implementation Checklist)

- Fix rhythm: "Month-end (or first trading day of next month)" fixed.

- Check two values only: Real GDP YoY, CPI YoY.

- Fix thresholds: Growth 1.5%, inflation 3.0% — don't change often.

- Apply next month: This month's judgment reflected in next month's rebalancing.

- Regime allocation table (simple version):

- Recession: bonds & gold heavy

- Stagflation: commodities & gold front

- Overheating: commodities↑, stocks at certain weight

- Expansion: stocks weight expanded

- No overrides: Blocking "this month feels like..." is more important than returns.

- Reflect real friction: Even small amounts—transaction costs & taxes accumulate.

- Automation tips:

- Save signal snapshot at month-end (reproducibility).

- For rebalancing, consider tolerance bands: only execute when target-current weight difference exceeds threshold (e.g., 5%p).

- For commodity ETFs, check roll calendar and K-1/tax issues in advance (varies by country).

10) Five Common Beginner Misconceptions

- "Regime means perfectly avoiding declines?" → No. Goal is cushioning, not prediction.

- "Signal was right, so obviously returns↑" → Transition timing/frequency and asset characteristics must work together.

- "Commodities always defend against inflation" → During structural weakness or high roll costs, may underperform expectations.

- "Bonds are always safe" → In rate spike scenarios like 2022, bonds shake too.

- "Change thresholds often for better results" → Ultimately, simplicity you can stick with wins.

11) Final Summary — "Strategy You Can Stick With All the Way"

- 60/40: Earned slightly more, strategy of believing and riding long bull markets.

- Regime-switching: Wobbled less, naturally defends during inflation/crises.

- Both experienced deep valleys of −20%+. The real difference is having rules you can stick with all the way.

Mark "monthly rebalancing" on your calendar today. That small habit changes your account's temperature and sleep quality. "Weather always changes, but our routine can be solid" — that's this post's conclusion.

Comments (0)

No comments yet. Be the first to comment!