Shares Rebound as Fed Hints at Easing, Though Trade Tensions Linger

Intro Global equities retraced earlier losses in the past 12–18 hours, bolstered by dovish signals from Federal Reserve Chair Jerome Powell and solid U.S. bank earnings. But renewed U.S.–China trade friction continues to temper full-blown optimism.

Main According to Reuters, global stocks "clawed back losses" as markets responded to comments from Powell that reinforced expectations of interest rate cuts this year. The dollar weakened, and investors appeared more willing to take risk—though the mood remained cautious.

Powell suggested that the Fed might be approaching the end of its quantitative tightening (QT) posture—the process by which the central bank shrinks its balance sheet. That expectation, in turn, has lifted market pricing for rate cuts. By some estimates, roughly 48 basis points (i.e. 0.48%) of cuts are implied by year-end.

On Wall Street, earnings from major financial firms helped underpin sentiment. However, the resurgence in trade rhetoric—particularly around port levy retaliations—kept volatility alive.

Through the day, the Cboe VIX volatility index (a widely used "fear gauge") climbed toward its highest intraday levels in five months before moderating, signaling that investors remain sensitive to downside risk.

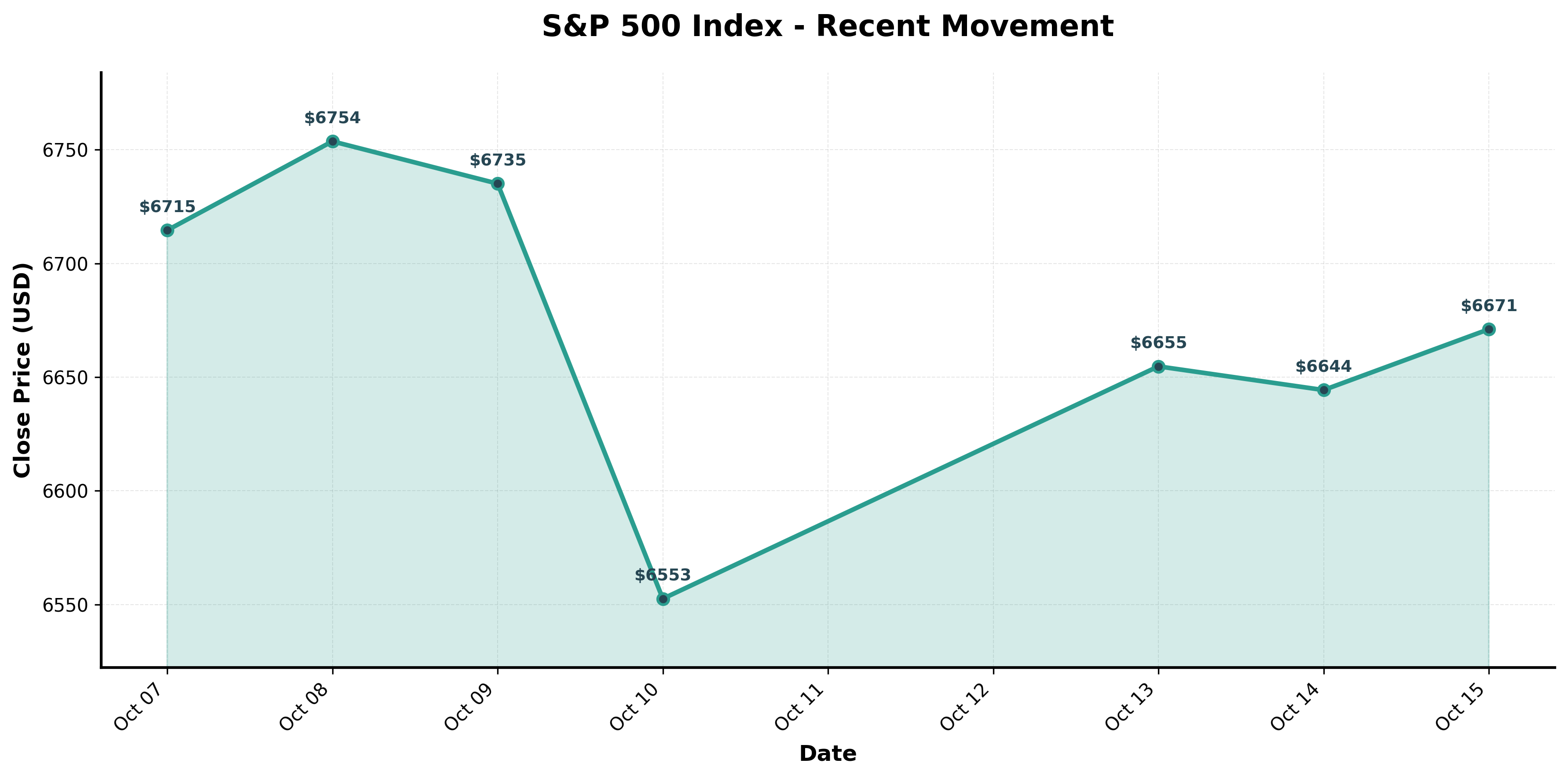

Below is a chart of the S&P 500 index over recent days, showing the bounce amid jitters:

Caption: S&P 500 index showing recovery from intraday dips as rate outlook brightened.

Caption: S&P 500 index showing recovery from intraday dips as rate outlook brightened.

Analysis Why did markets react this way, and what's at play beneath the surface?

- Fed credibility and policy pivoting: Markets have been betting heavily on rate cuts; Powell's comments that QT may be ending and that future decisions will be "meeting by meeting" provided cover for that view.

- Earnings as a stabilizer: Financial firms tend to be early litmus tests—strong results helped calm fears that credit stress or loan losses would dominate the narrative.

- Trade risk remains a drag: Even as monetary relief looms, renewed tit-for-tat port tariffs and threats to tariff ties (e.g. cooking oil) are reminders that geopolitical risk is not resolved.

- Volatility rebound: The quick swing up in the VIX shows that investors are no longer complacent. We've moved from a prolonged calm to a regime where headline noise can elicit sharp responses.

- Positioning & fragility: Many strategies were already stretched long; any surprise or disappointment could force reversals or stop-loss cascades.

In short: the market rally has legs for now, but it's resting on fine threads of confidence in central bank support and corporate resilience.

Outlook What should investors monitor going forward?

- Powell / Fed communications: Any shift toward hawkishness or pushback on easing expectations could rattle rhetoric-sensitive markets.

- Bank and tech earnings: These sectors are key — earnings that disappoint could undercut optimism.

- Trade developments: Watch port fee exchanges, tariff announcements, and U.S.–China dialogue ahead of the November 1 deadline.

- Volatility indicators: VIX, credit spreads, and liquidity measures will hint when sentiment cracks.

- Data surprises: Because the U.S. shut down its official data releases, surprises when data resumes could be magnified.

Markets are essentially in a tug-of-war: easing hopes tug in one direction, trade and policy risk tug in another. Until a clearer narrative takes hold, expect more volatile, headline-driven sessions.

(Sources: Reuters)

Comments (0)

No comments yet. Be the first to comment!