1. US Stock Indices Rise – Oil Price Surge and Earnings Optimism

Background

US equity markets posted gains as the S&P 500 and Nasdaq Composite indices approached record highs, driven by a surge in oil prices and the beginning of earnings season. oai_citation:0‡CommBank

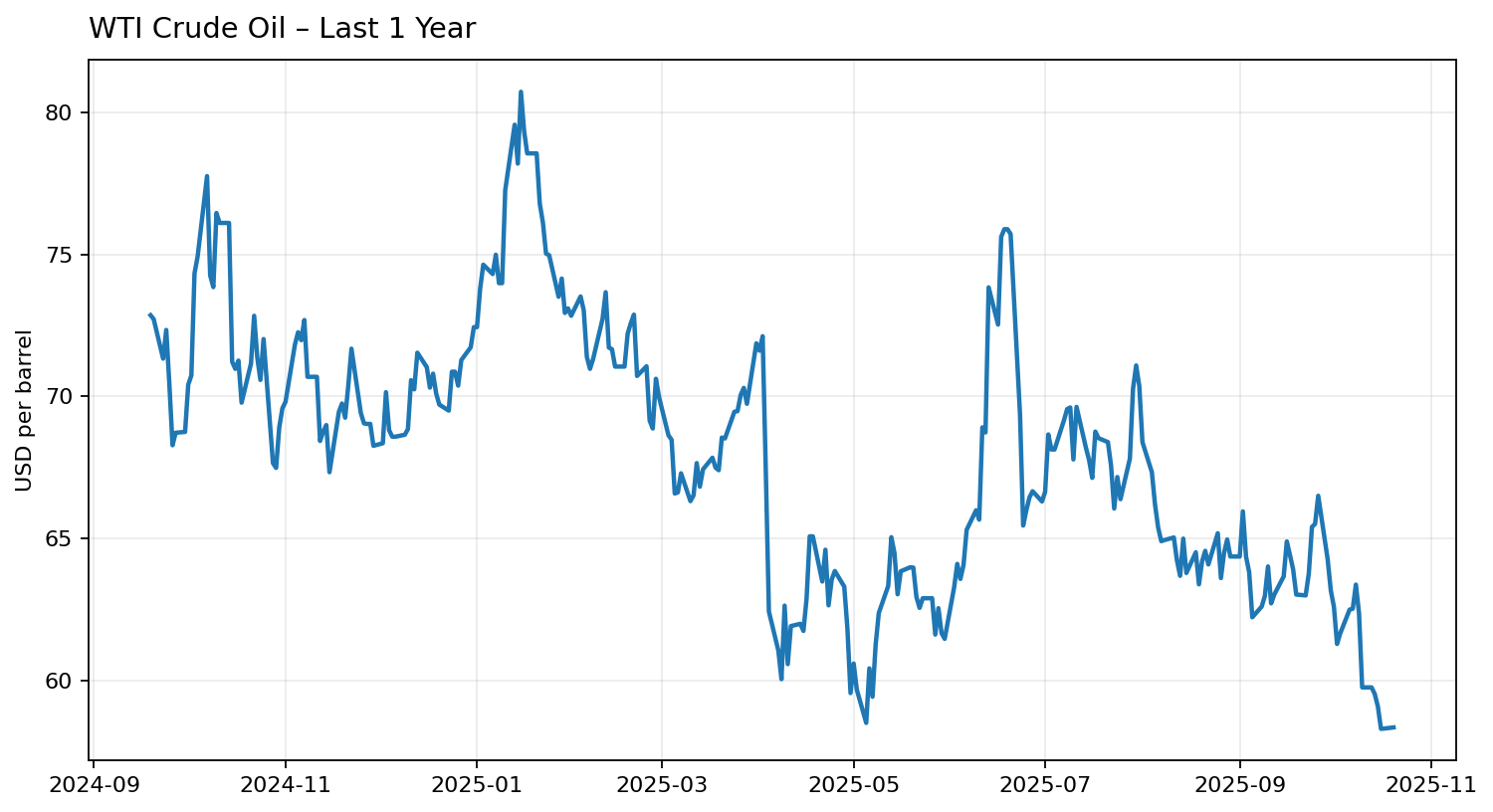

Caption: WTI crude oil futures closing prices over the past year. The sharp spike on the right visualizes the price jump following Russia sanction issues. Beyond the surge itself, whether it breaks through previous highs and the pace of the surge (daily volatility) are critical signals for inflation expectations and interest rate paths.

Caption: WTI crude oil futures closing prices over the past year. The sharp spike on the right visualizes the price jump following Russia sanction issues. Beyond the surge itself, whether it breaks through previous highs and the pace of the surge (daily volatility) are critical signals for inflation expectations and interest rate paths.

What Happened

- The US imposed sanctions on Russian oil companies including Rosneft and Lukoil, causing oil prices to surge approximately 5%. oai_citation:1‡The Guardian

- Among earnings reports, tech companies like Intel exceeded market expectations, driving their stock prices higher. oai_citation:2‡Investors

Why It Matters

- The oil price surge benefits energy stocks while also affecting commodity prices and inflation expectations. Rising inflation could lead to potential interest rate hikes, creating a variable for equity markets.

- When earnings beat expectations, it can serve as a positive signal not just for individual companies but for the broader market. Conversely, disappointing results can trigger sell-offs.

Checkpoints

- Monitor whether oil prices continue to rise and if supply chain issues or sanctions expand further

- Track corporate earnings calendars and announcements (revenue, earnings, guidance)

- Watch how inflation indicators and interest rate decisions evolve

2. Tech and AI Stocks Rebound – Earnings and Outlook Drive Market Higher

Background

Technology stocks, particularly semiconductors and artificial intelligence (AI) related names, led the market higher as investors viewed these sectors as the "next growth drivers."

Caption: ISRG daily closing prices (top line) and volume (bottom bars) over the past year. Price gaps (opening jumps) and volume spikes around earnings announcements mark where "expectations vs. reality" collide. Large bars accompanied by upward candles are easily interpreted as signals that positive news gained momentum.

Caption: ISRG daily closing prices (top line) and volume (bottom bars) over the past year. Price gaps (opening jumps) and volume spikes around earnings announcements mark where "expectations vs. reality" collide. Large bars accompanied by upward candles are easily interpreted as signals that positive news gained momentum.

What Happened

- Tesla rebounded despite significantly lower year-over-year earnings, as the CEO emphasized future technology potential. oai_citation:3‡Investors

- Intel reported better-than-expected results, spreading positive sentiment across the broader tech sector. oai_citation:4‡Investors

Why It Matters

- Tech stocks reflect growth expectations—when market sentiment strengthens, they can rally significantly, but when expectations fade, the downside can be equally sharp.

- Growth sectors like AI, semiconductors, and cloud can shift overall market capital flows and liquidity, making tech stock trends a major directional signal.

Checkpoints

- Which tech companies have upcoming earnings? Is forward guidance positive?

- How are growth stocks performing relative to value stocks? Are expectations for tech becoming excessive?

- How far has the AI theme been priced in, and is there room for further expansion?

3. Oil Surge and Russia Sanctions – Energy Sector Benefits, Manufacturing Pressured

Background

The US and EU intensified energy sanctions on Russia, heightening concerns over oil and gas supply and driving crude prices sharply higher. oai_citation:5‡The Guardian

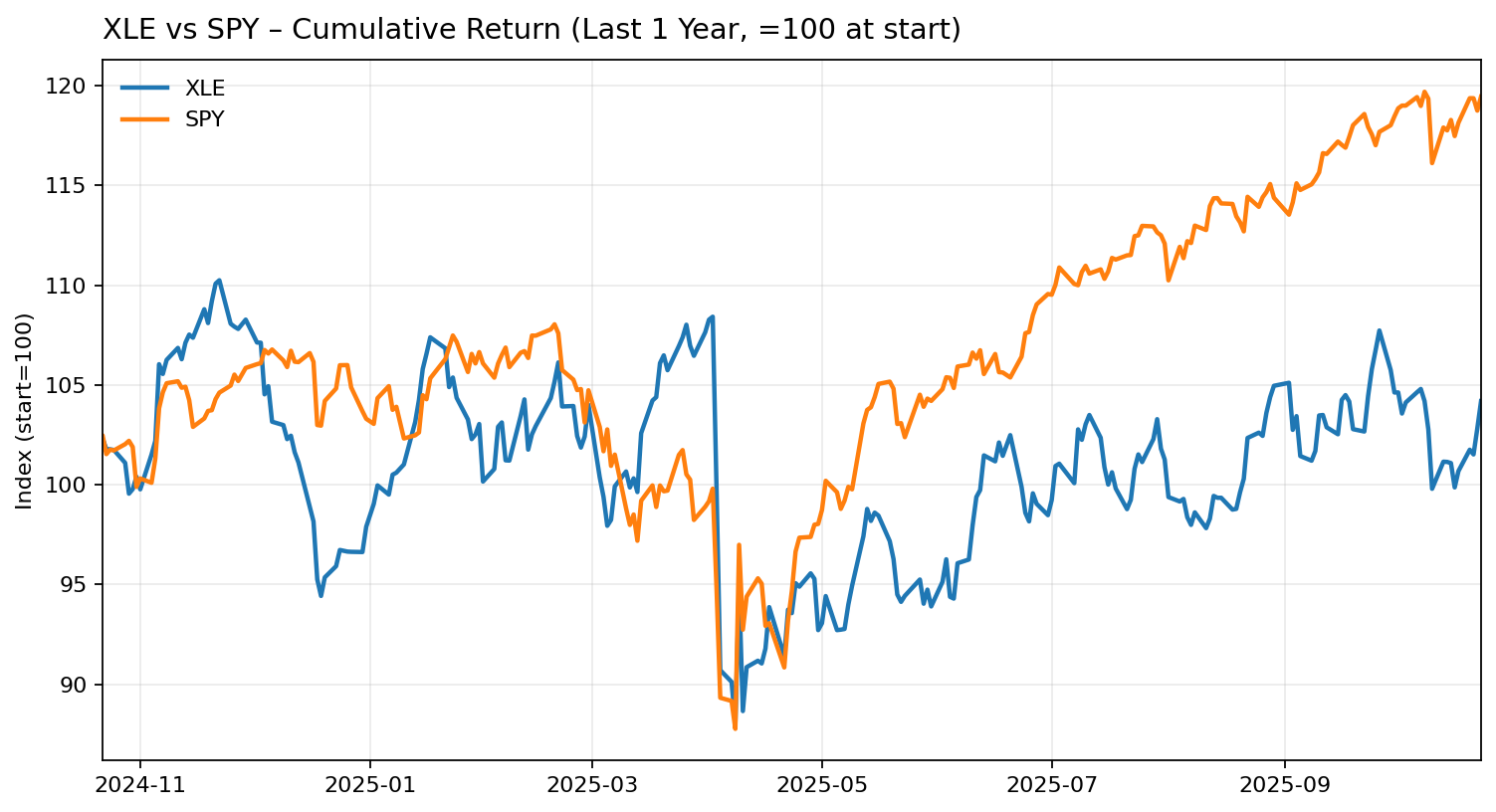

Caption: Energy sector (XLE) vs. S&P 500 (SPY) cumulative returns over the past year. You can see at a glance whether XLE outperformed the index during oil price surges and if there was subsequent mean reversion. Whether the relative strength trend persists is key to sector rotation.

Caption: Energy sector (XLE) vs. S&P 500 (SPY) cumulative returns over the past year. You can see at a glance whether XLE outperformed the index during oil price surges and if there was subsequent mean reversion. Whether the relative strength trend persists is key to sector rotation.

What Happened

- The UK's FTSE 100 index hit record levels following Russia energy sanction announcements, with British energy companies like BP and Shell benefiting. oai_citation:6‡The Guardian

- Meanwhile, UK manufacturing orders declined at the steepest pace since 2020, raising concerns about underlying economic strength. oai_citation:7‡The Guardian

Why It Matters

- Rising energy stocks can attract sector capital flows, while higher oil prices increase inflation and transportation costs, pressuring corporate margins.

- Manufacturing weakness can signal economic slowdown, creating dual effects on equity markets (positive and negative factors).

Checkpoints

- Monitor future crude oil and natural gas price trends

- Track energy company earnings and capital flows within the sector

- Check manufacturing indicators (orders, inventory, capacity utilization) for deterioration

- Consider how oil price increases affect consumer inflation

4. US-China Trade Negotiations and Export Control Risks Emerge

Background

The US-China trade and technology rivalry continues, with recent focus on potential software export restrictions that could impact global supply chains and the tech sector. oai_citation:8‡The Guardian

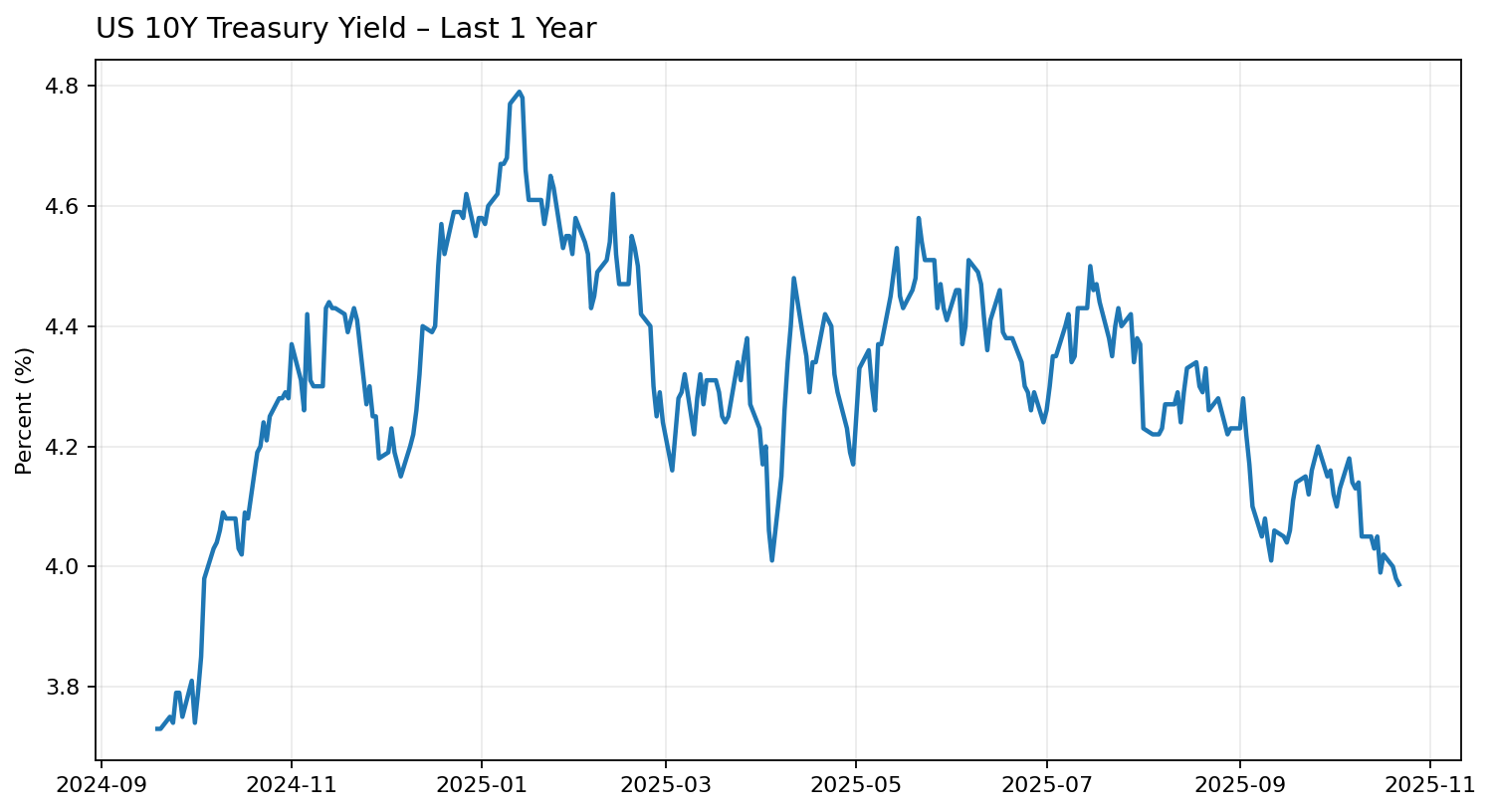

Caption: US 10-year Treasury yield (closing basis) over the past year. When geopolitical/trade risks increase, you can read whether yields fall (bond prices rise) due to safe-haven demand, or conversely rise if inflation/growth concerns emerge. This directly affects growth stock valuations.

Caption: US 10-year Treasury yield (closing basis) over the past year. When geopolitical/trade risks increase, you can read whether yields fall (bond prices rise) due to safe-haven demand, or conversely rise if inflation/growth concerns emerge. This directly affects growth stock valuations.

What Happened

- Comments from the US Treasury Secretary mentioning "all options are on the table" (including software export controls) posed risks to Chinese firms and global tech companies. oai_citation:9‡The Guardian

- Expectations of easing trade/tech risks helped support some market gains (de-escalation narrative). oai_citation:10‡Reuters

Why It Matters

- Global tech companies and semiconductor firms have significant exposure to China trade and supply chains, meaning tighter regulations could impact earnings and valuations.

- Conversely, if regulatory risks ease, it could serve as an important catalyst for tech and growth stock recovery.

Checkpoints

- Monitor US-China negotiation progress and official statements

- Assess how exposed tech/semiconductor/software companies are to China-related risks

- Review companies with supply chains concentrated in China/Asia for higher risk exposure

5. Upcoming Events and Investor Response – Inflation Data, Interest Rates, Earnings

Background

Beyond already-reported earnings and sanctions/trade risks, markets will remain sensitive to upcoming major economic indicators and events.

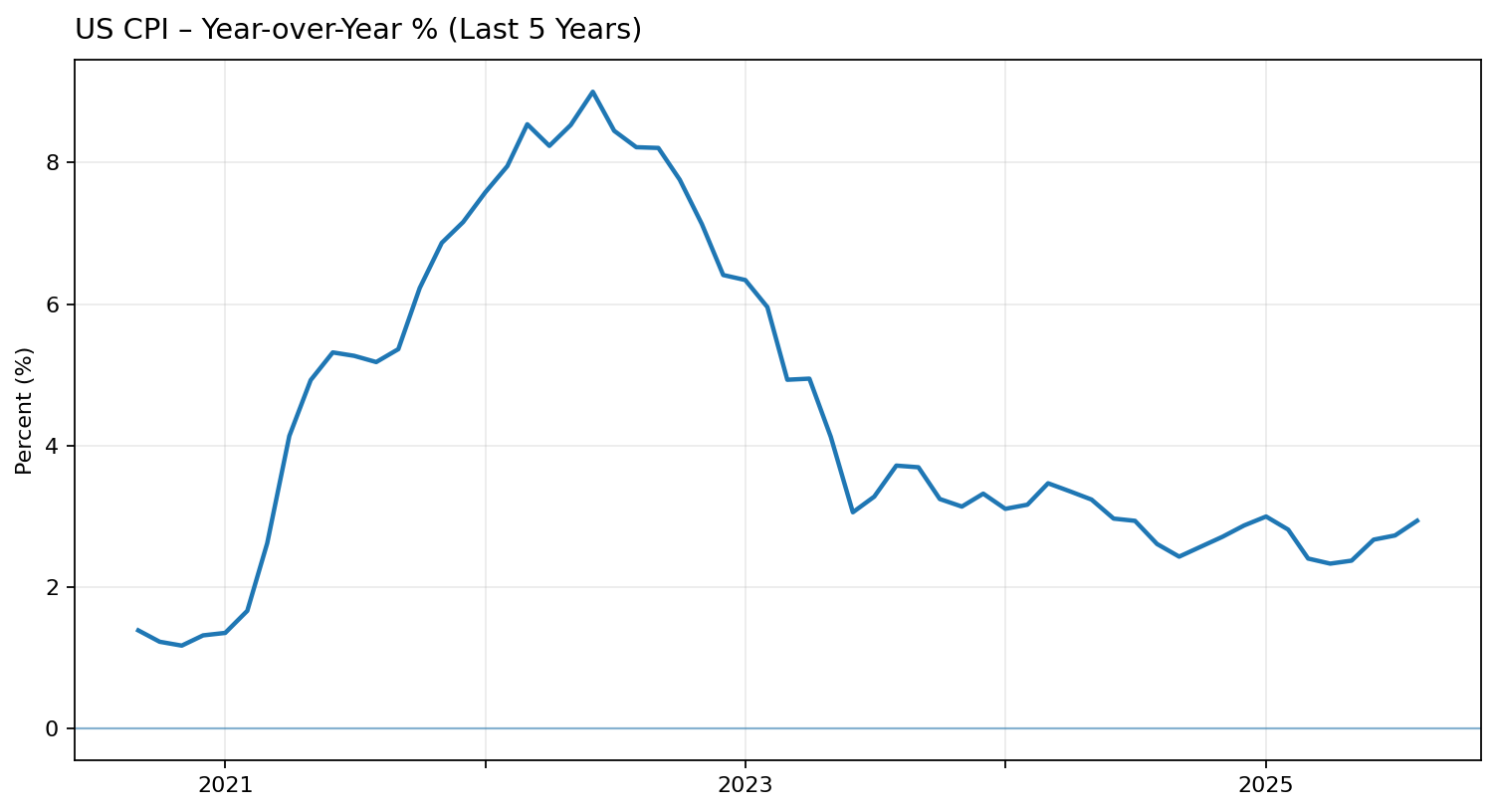

Caption: US CPI year-over-year (%) change rate. Downward trends signal easing inflation pressure and can fuel rate cut expectations. Conversely, re-acceleration (especially from energy, housing, wages) weakens easing expectations and increases equity market volatility.

Caption: US CPI year-over-year (%) change rate. Downward trends signal easing inflation pressure and can fuel rate cut expectations. Conversely, re-acceleration (especially from energy, housing, wages) weakens easing expectations and increases equity market volatility.

What Happened

- Upcoming US core inflation indicators like the Consumer Price Index (CPI) have become a market focus. oai_citation:11‡Investors

- While rate cut expectations exist in financial markets, analysts note that inflation, sanctions, and trade risks could constrain such moves. oai_citation:12‡Wall Street Journal

Why It Matters

- If inflation runs hotter than expected, rate hike discussions could resume, weighing on equity markets.

- Conversely, cooling inflation and strengthened rate cut expectations would be positive for stocks.

- During heavy earnings periods, "strong earnings → stock gains" or "weak earnings → corrections" flows can emerge, making investor sentiment more volatile.

Checkpoints

- Watch US CPI release dates and actual vs. expected readings

- Track major companies' earnings calendars and forward guidance content

- Monitor interest rate and bond market movements (e.g., 10-year Treasury yield)

- Consider portfolio risk management as market volatility could increase

🔍 Summary

- Oil surge & sanctions → Energy sector benefits + inflation risk increases

- Strong tech earnings → Growth sector strength

- US-China trade/tech risks resurface → Tech companies on watch

- Inflation, interest rates, and earnings likely to drive market direction

- Investors should monitor sector flows + macro indicators + company earnings schedules together

Comments (0)

No comments yet. Be the first to comment!