Nvidia Invests $1 Billion in Nokia for 6G Market, U.S.-China Trade Deal Imminent

1. U.S.-China Trade Framework Agreement Reached, Trump-Xi Summit Approaching

October 28, 2025 (Monday)

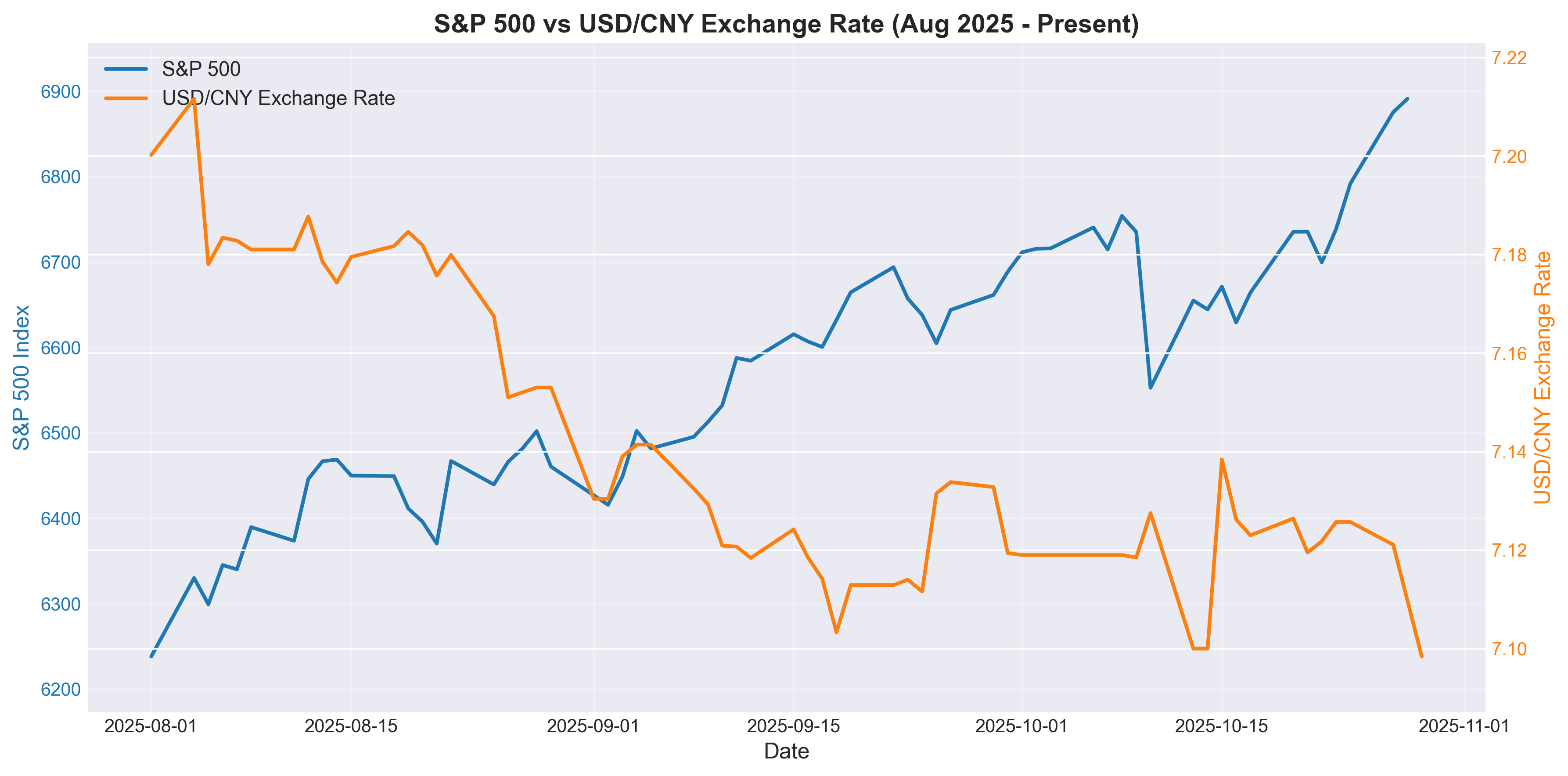

The United States and China reached a 'framework agreement' during trade negotiations held in Malaysia alongside the ASEAN summit. China's trade representative Li Chenggang announced a "preliminary agreement," while U.S. Treasury Secretary Scott Bessent described it as a "highly successful framework."

President Trump told reporters aboard Air Force One, "I have tremendous respect for President Xi, and we will reach an agreement." With this agreement, the U.S. has effectively withdrawn its threat to impose an additional 100% tariff on Chinese goods. Markets reacted positively, with expectations that a final trade agreement will be signed at the Trump-Xi summit in Gyeongju, South Korea on October 30-31.

Background: In early October, when China tightened rare earth export controls, the Trump administration threatened to raise tariffs on Chinese goods to 130%. Rare earths are critical materials for semiconductors, defense industries, and electric vehicle batteries. China supplies approximately 70% of global rare earths, making these restrictions a potential major shock to global supply chains. However, with both sides at the negotiating table, the trade war crisis appears to be easing.

Investors should note that this agreement does not address fundamental issues such as long-term trade imbalances and access to advanced technology. While markets may react positively in the short term, a cautious approach is needed regarding long-term sustainability.

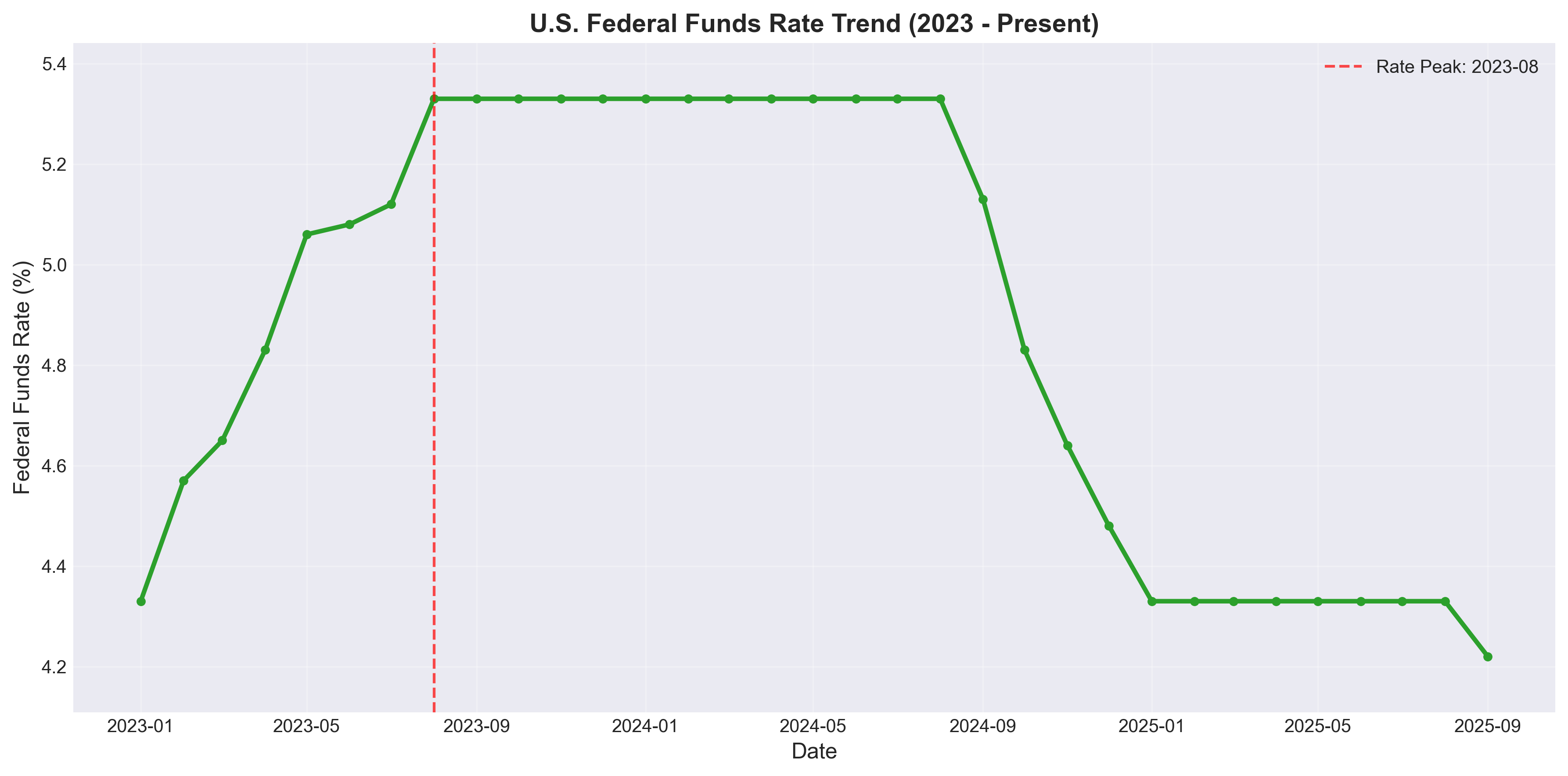

2. Fed Expected to Cut Rates by 0.25% on October 29

October 29, 2025 (Wednesday) Early Morning

The Federal Reserve will announce its interest rate decision following its two-day Federal Open Market Committee (FOMC) meeting on October 28-29. The CME FedWatch tool currently projects a 97.8% probability that the Fed will cut rates by 25bp (0.25 percentage points), with a 92.8% chance of an additional cut in December.

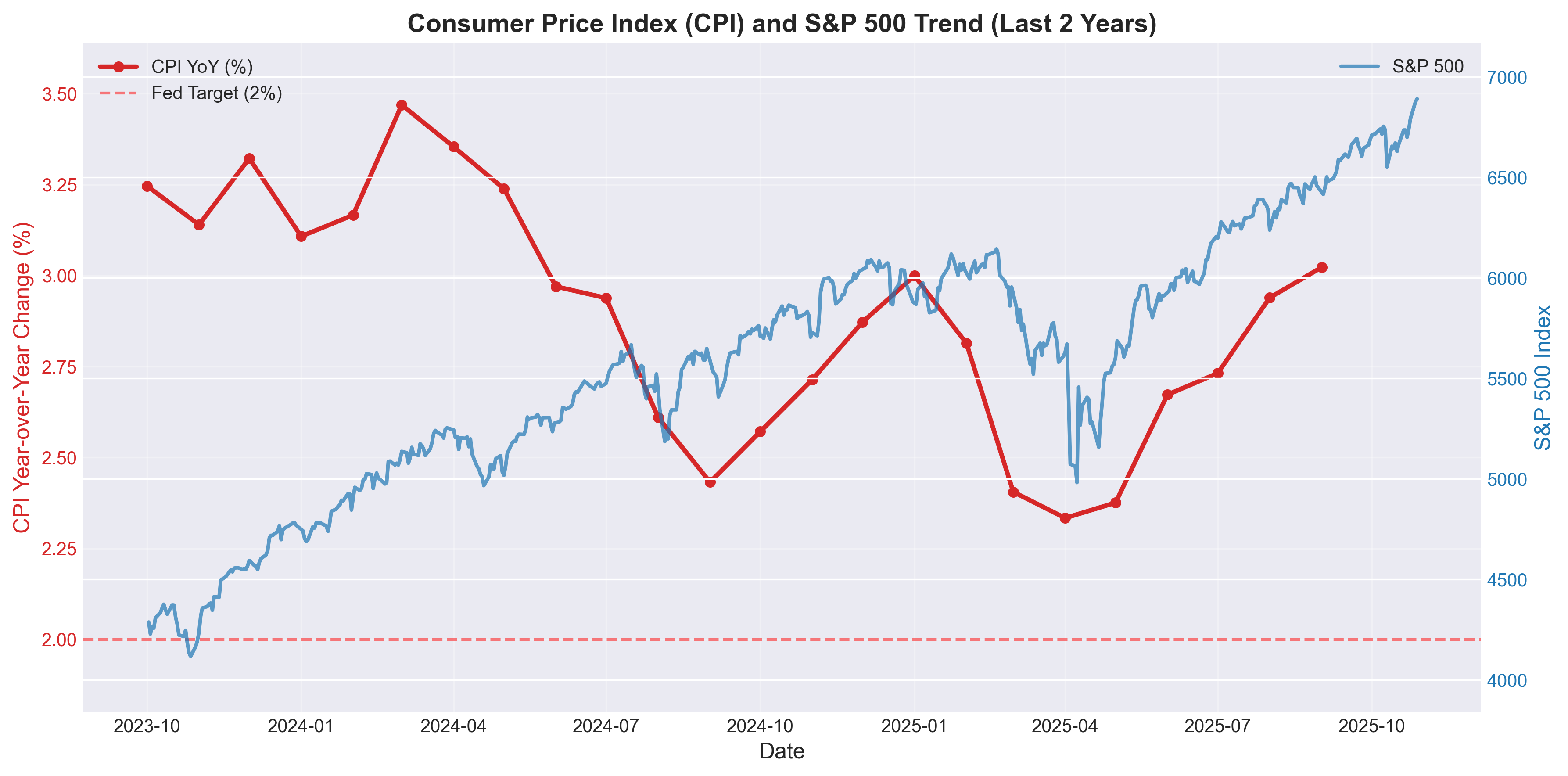

The rate cut backdrop includes the recently released September Consumer Price Index (CPI). September CPI rose 3% year-over-year, below the market expectation of 3.1%. With inflation easing, the Fed can focus more on supporting the labor market.

Key Point: Although the September employment report was delayed due to the government shutdown, Chairman Jerome Powell stated in an October 14 speech that "various private sector data indicates the economic outlook hasn't changed significantly from the September meeting." In other words, the Fed appears ready to cut rates despite incomplete data.

What It Means for Investors: Rate cuts are generally positive for stock markets. Lower borrowing costs reduce corporate financing expenses and enable consumers to spend and invest more. However, since markets already anticipate the rate cut, there may not be significant volatility immediately following the announcement. Powell's comments and future economic outlook will be more important variables.

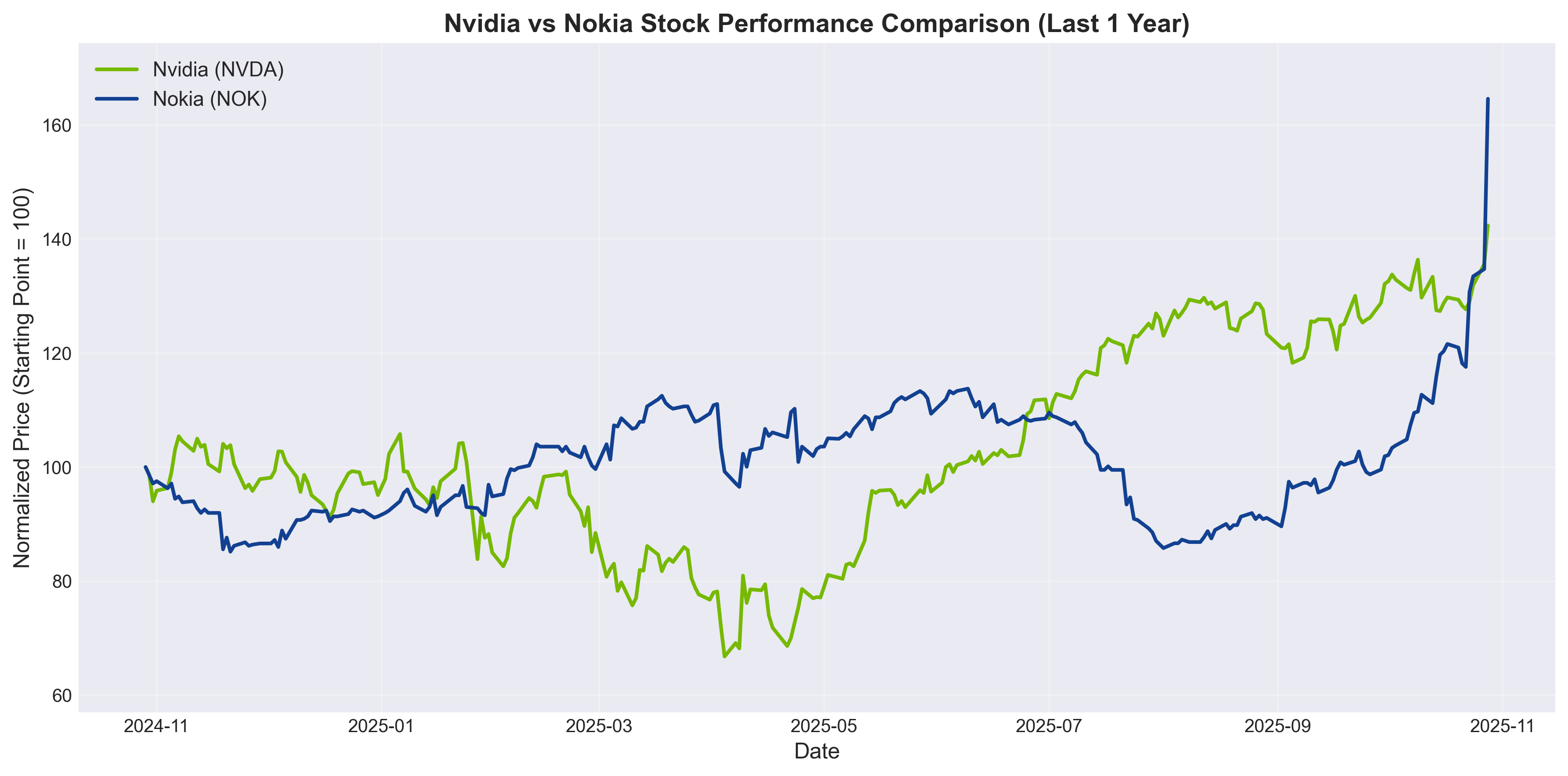

3. Nvidia Invests $1 Billion in Nokia to Capture 6G Market

October 29, 2025 (Tuesday) Early Morning

AI chip manufacturer Nvidia announced a $1 billion investment in Nokia to acquire a 2.9% stake. Nokia will issue approximately 166.39 million new shares, selling them to Nvidia at $6.01 per share. Following this news, Nokia's stock surged 22% during trading, reaching its highest level since January 2016.

The companies also established a strategic partnership to develop AI-powered 5G-Advanced and 6G networks. Nokia will optimize its 5G and 6G software to run on Nvidia chips, while Nvidia will explore integrating Nokia's data center networking technology into its AI infrastructure.

Industry Significance: 6G is next-generation communications technology targeting commercialization in the 2030s, with AI integration as a core component. McKinsey projects that capital expenditure on data center infrastructure will exceed $1.7 trillion by 2030. Nvidia holds a dominant position in the data center chip market and is now expanding its influence into the communications infrastructure market through this investment.

Investment Perspective: Nokia once dominated the mobile phone market but fell behind during the smartphone transition. It subsequently transformed into a 5G telecommunications equipment supplier but had a weaker presence compared to competitors like Ericsson and Huawei. However, the partnership with Nvidia provides Nokia an opportunity to regain leadership in the AI-era communications infrastructure market. For Nvidia, this represents a strategic move to expand its business beyond AI chips into the broader communications network landscape.

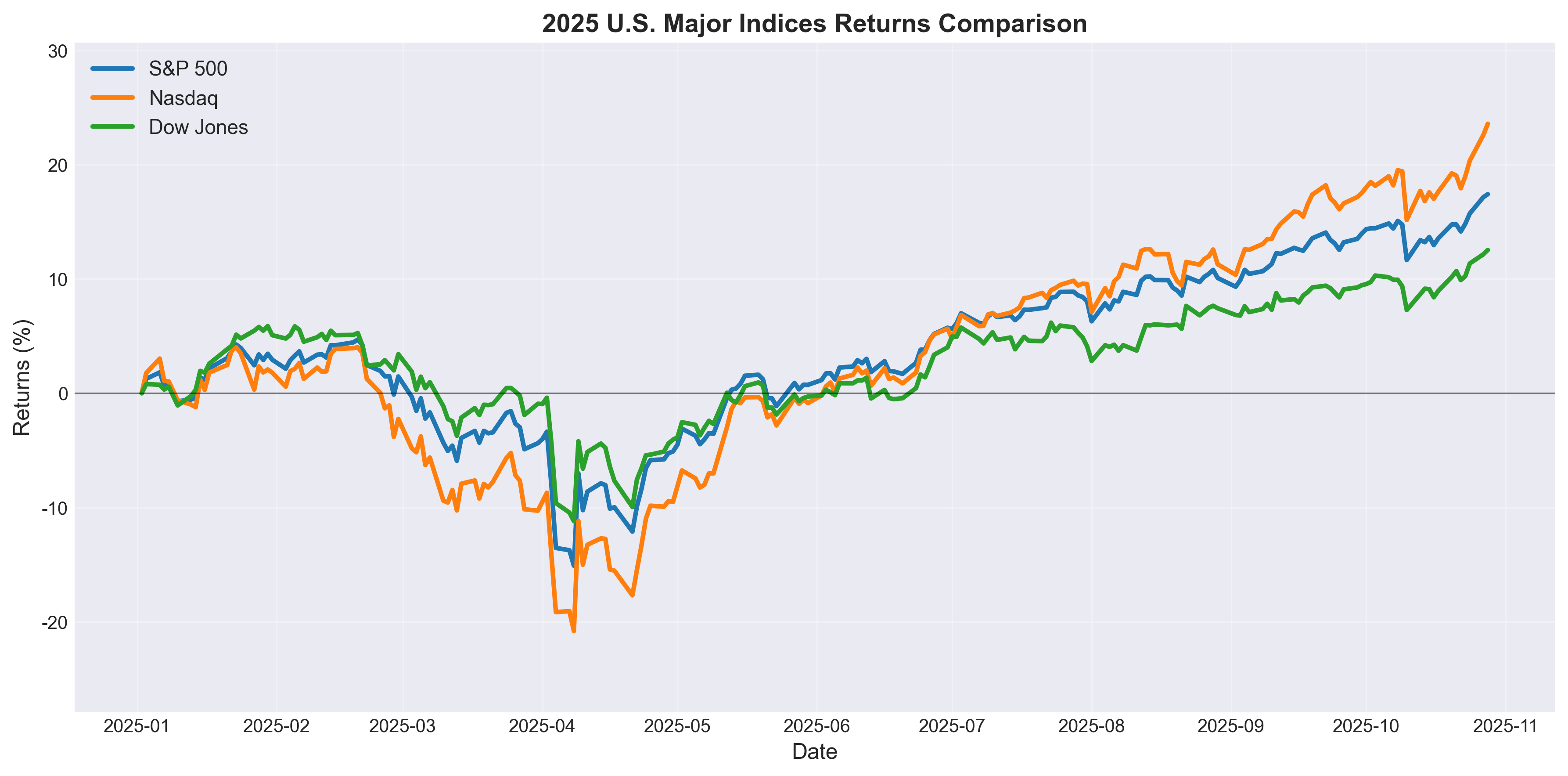

4. Markets Hit All-Time Highs on U.S.-China Trade Deal Optimism

October 29, 2025 (Tuesday) Morning

All three major U.S. indices closed at all-time highs on October 28 (Monday, U.S. time). The S&P 500 rose 0.23% to 6,890.89, breaking through the 6,900 level for the first time during trading. The Nasdaq Composite climbed 0.80% to 23,827.49, and the Dow Jones Industrial Average gained 161.78 points (0.34%) to close at 47,706.37.

Nvidia led the market rally, surging approximately 5% to set a new high. Investors responded positively to the announcement of the $1 billion Nokia investment. Apple and Microsoft also continued their upward momentum, surpassing $4 trillion in market capitalization.

Market Sentiment: Investors expect continued market strength as progress in U.S.-China trade negotiations combines with Fed rate cut expectations. The Conference Board's October consumer confidence index came in at 94.6, down slightly from September's 95.6 but exceeding the market expectation of 94.2, demonstrating economic resilience.

Caution Note: However, the S&P 500 has already set 29 new highs in 2025, and some analysts point to the need for a "healthy correction." Given the strongest six-month rally since the 1950s, short-term profit-taking is also possible.

5. Stocks Surge on Lower Inflation, Dow Breaks 47,000 for First Time

October 26, 2025 (Saturday)

U.S. markets surged on October 25 (Friday, U.S. time) after the delayed September Consumer Price Index (CPI) report came in lower than expected. The Dow Jones index jumped 472.51 points (1.01%) to close at 47,207.12, breaking through 47,000 for the first time ever. The S&P 500 rose 0.79% to 6,791.69, and the Nasdaq gained 1.15% to 23,204.87.

September CPI rose 0.3% month-over-month and 3% year-over-year, both below market expectations (0.4%, 3.1%). Though delayed by the government shutdown, the results clearly showed easing inflation. This was interpreted as a signal that the Fed can maintain its rate-cutting path, greatly buoying markets.

Sector Performance: Ford Motor surged 12% after its Q3 earnings report, recording its best single-day return since 2020. The automotive sector is considered a rate cut beneficiary, as lower rates reduce auto loan costs and stimulate consumer demand.

Economists' Views: Chris Zaccarelli, Chief Investment Officer at Northlight Asset Management, stated, "With the Fed cutting rates and corporate profits continuing to rise, it's hard to see this year's bull market ending." Bob Doll, CEO of Crossmark Global Investments, also emphasized, "When the Fed is cutting rates and earnings are good, markets don't fall significantly."

Comments (0)

No comments yet. Be the first to comment!