November 19, 2025 U.S. Market Analysis: NVIDIA, Bitcoin, and the Data Blackout

U.S. markets have recorded three consecutive days of losses. This week's key themes are NVIDIA's earnings report, Bitcoin's sharp decline, and delayed employment data due to the government shutdown.

1. NVIDIA Earnings Report - A Watershed Moment for the AI Bubble

On Monday, November 17, the Dow Jones fell 557 points (-1.18%) to 46,590, the S&P 500 dropped 0.92% to 6,672, and the Nasdaq declined 0.84% to 22,708.

Investors are focused on NVIDIA's Q3 (FY2026) earnings report, scheduled for Wednesday, November 19, after market close.

Wall Street Consensus

- Revenue: $54.9 billion (56% YoY growth)

- Earnings Per Share (EPS): $1.25 (54% growth)

Why It Matters

NVIDIA has a market cap of $4.6 trillion, making it the world's largest company and representing about 8% of the S&P 500 index. Options markets expect the stock to move about 7% following the earnings release, representing approximately $320 billion in market cap movement.

![]()

The chart above shows the normalized price trends of NVIDIA (NVDA) and the Semiconductor ETF (SMH) over the past six months. It illustrates NVIDIA's relative performance compared to the broader semiconductor sector and recent volatility patterns.

Notable Developments

- SoftBank Group recently sold over 32 million shares of NVIDIA

- Peter Thiel's fund has exited its entire position

If NVIDIA's results fall short of expectations, concerns about an AI bubble could intensify. This report represents a pivotal moment for the entire AI industry.

Key Takeaway: The larger a company's market cap, the greater its impact on the overall market. Investors should consider not just individual stocks but the valuation and sustainability of the entire industry.

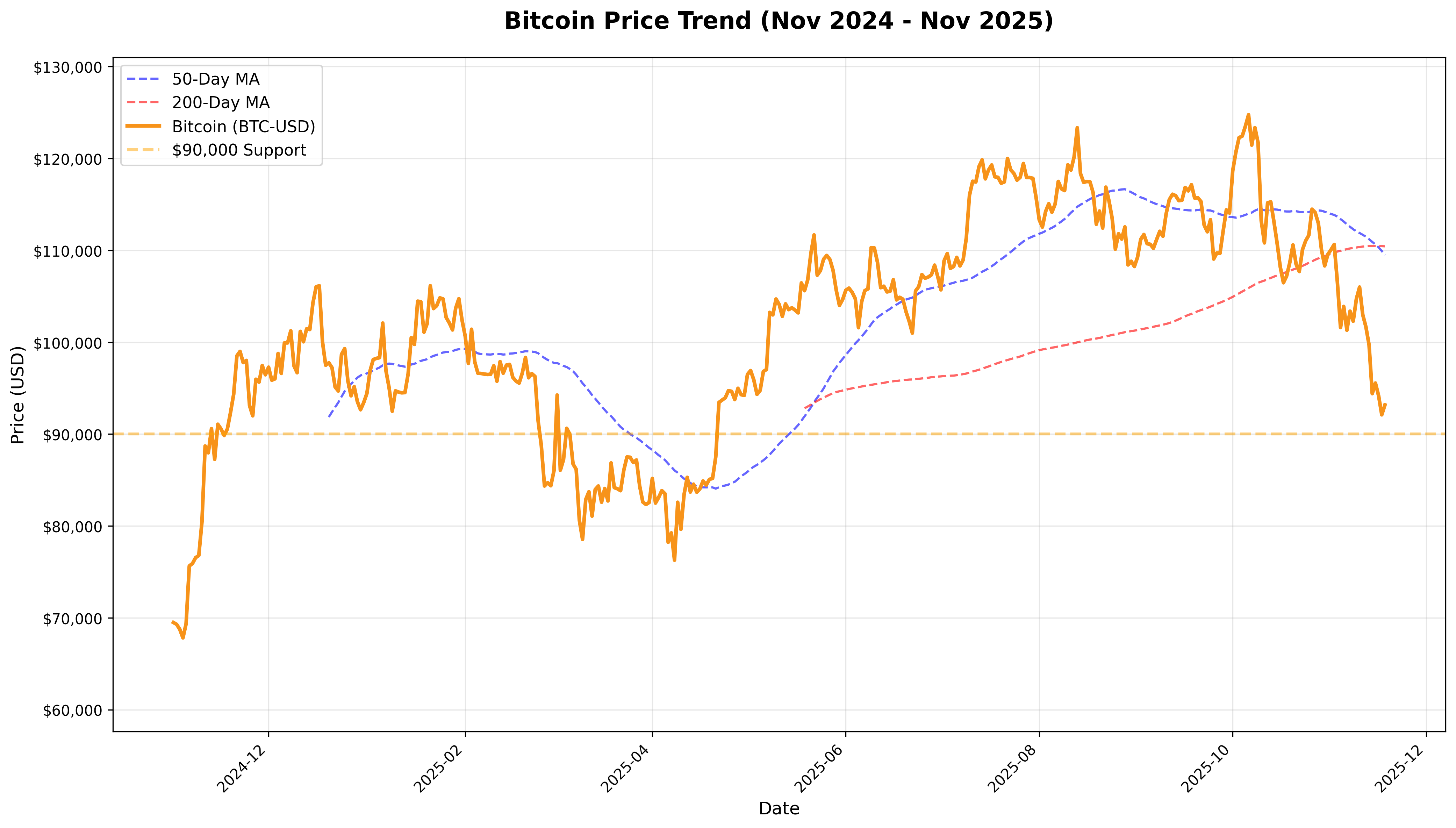

2. Bitcoin Breaks Below $90,000 - 2025 Gains Wiped Out

On Tuesday, November 18, Bitcoin fell to $89,420, dropping below $90,000. This means all 2025 gains have been erased.

Magnitude of the Decline

- All-time high: $126,250 (early October)

- Current decline: Approximately 29% from the peak

- Market cap loss: Over $600 billion

In Wall Street terms, Bitcoin has entered a bear market (down more than 20% from the high).

The chart above shows Bitcoin's price and 50-day/200-day moving averages from November 2024 to present. The orange dashed line represents the $90,000 support level, clearly showing Bitcoin's breakdown below this critical support.

Technical Analysis

- Failed to reclaim the $93,700 key support level over the weekend

- Broke below the 200-day moving average

- Death cross formed between the 50-day and 200-day moving averages

Market Sentiment

The Crypto Fear & Greed Index fell to 11 on Monday—the lowest since the 2022 bear market, indicating "extreme fear."

Background

Bitcoin was trading around $69,000 before Trump's re-election in November 2024, then surged 83% to its all-time high. This reflected expectations for crypto-friendly regulations under the Trump administration. However, prices plummeted after Trump reignited the trade war with China on October 10.

Key Takeaway: Risk assets are extremely sensitive to interest rate environments and macro economic outlooks. Assets that surge on policy expectations can correct rapidly when those expectations collapse.

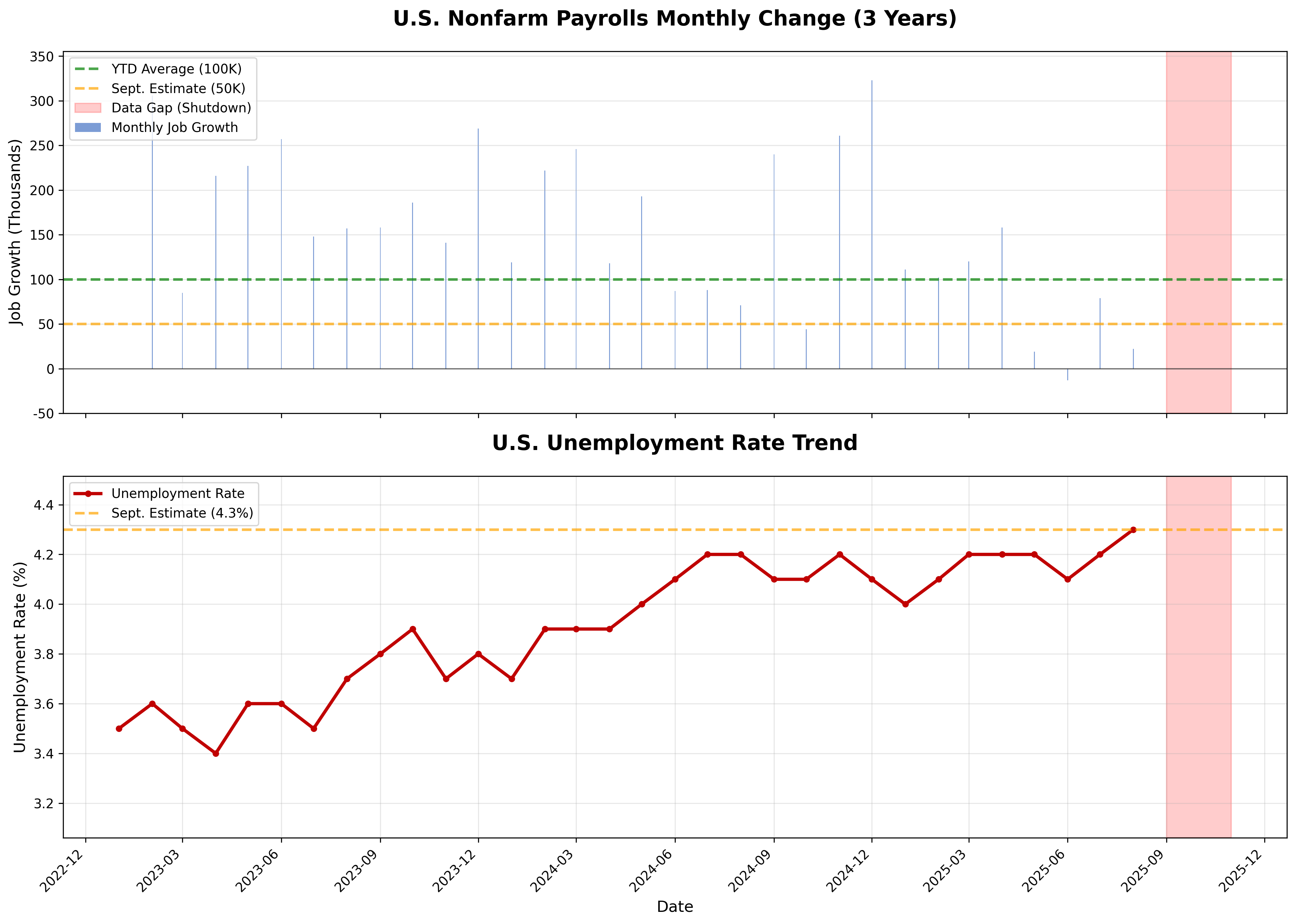

3. Delayed Employment Data Due to Government Shutdown - "Driving Blind"

The U.S. Department of Labor will release the September jobs report on Thursday, November 20, at 8:30 AM ET. This report is nearly 7 weeks late due to the 43-day federal government shutdown.

September Employment Forecast

- Nonfarm payrolls: 50,000 jobs added (estimate)

- Unemployment rate: 4.3% (expected to hold steady)

This represents a modest increase from August's 22,000 but remains weak compared to the year-to-date monthly average of 100,000 job additions.

The chart above shows monthly nonfarm payroll changes and unemployment rate trends over the past three years. The green dashed line represents the YTD average (100K), the orange dashed line shows the September estimate (50K), and the red shaded area indicates the data gap period due to the government shutdown.

Severity of the Data Blackout

The government shutdown has cut off the Fed, businesses, policymakers, and investors from information about U.S. economic health since late summer:

- 7 consecutive weeks without weekly jobless claims reports

- First time in 77 years the October unemployment rate may not be calculated

- No October inflation report expected

Fed Chair Jerome Powell compared setting monetary policy without official data to "driving blind."

Shift in Rate Expectations

- One month ago: December rate cut nearly certain

- Now: Rate cut probability fallen to below 50%

Key Takeaway: Economic data is the foundation of policy decisions. Data gaps from government shutdowns amplify market uncertainty and complicate Fed policy decisions. Investors should use alternative indicators from private research firms during official data blackouts, but recognize they cannot replace the accuracy and comprehensiveness of government data.

Conclusion: An Era of Uncertainty

This week sees three key variables converging simultaneously:

- NVIDIA earnings - Potential revaluation of the entire AI industry

- Bitcoin crash - Declining risk appetite and macro sensitivity

- Delayed employment data - Increased uncertainty in Fed policy decisions

Rather than overreacting to individual news items, investors need to see the bigger picture of how these three factors interconnect. Uncertainty around Fed rate policy is putting pressure on risk assets broadly, and NVIDIA's earnings could serve as a catalyst to change this trajectory.

Published: November 19, 2025

Comments (0)

No comments yet. Be the first to comment!