Meta, Google, Microsoft Q3 2025 Earnings: Google Wins Big

Big Tech's Mixed Earnings Week: Google, Microsoft, and Meta

🎯 Summary at a Glance

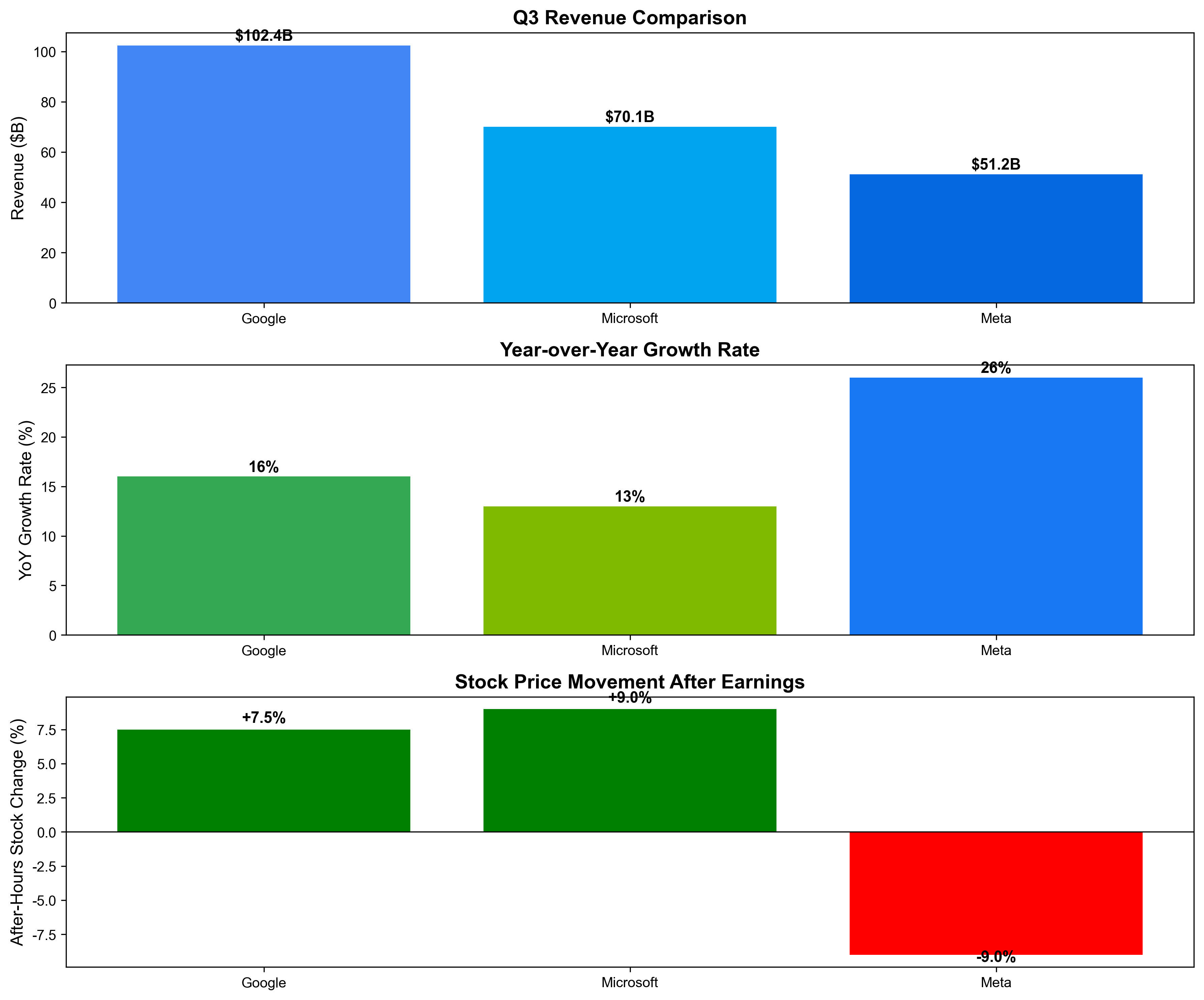

| Company | Revenue | YoY Growth | Stock Reaction | Key Highlight |

|---|---|---|---|---|

| $102.4B | +16% | 📈 +7.5% | First-ever $100B quarter | |

| Microsoft | $70.1B | +13% | 📈 +9% | Azure grows 33% |

| Meta | $51.2B | +26% | 📉 -9% | $15.9B tax hit |

🔍 Google (Alphabet) - Historic Quarter Achieved

🎯 One-Sentence Summary

Google crossed $100 billion in quarterly revenue for the first time in history, with explosive growth in Cloud and AI businesses exciting investors.

💰 Earnings Highlights

Revenue (Money Earned) Google earned $102.35 billion (~$140 trillion KRW) in Q3, significantly beating the estimate of $99.89 billion and crossing $100 billion for the first time ever.

This is a historic first for Google!

Net Income (Actual Profit) Net income was $34.97 billion, significantly up from last year's $26.3 billion.

EPS (Earnings Per Share) Adjusted EPS was $3.10, crushing expectations of $2.33. That's 33% higher than expected!

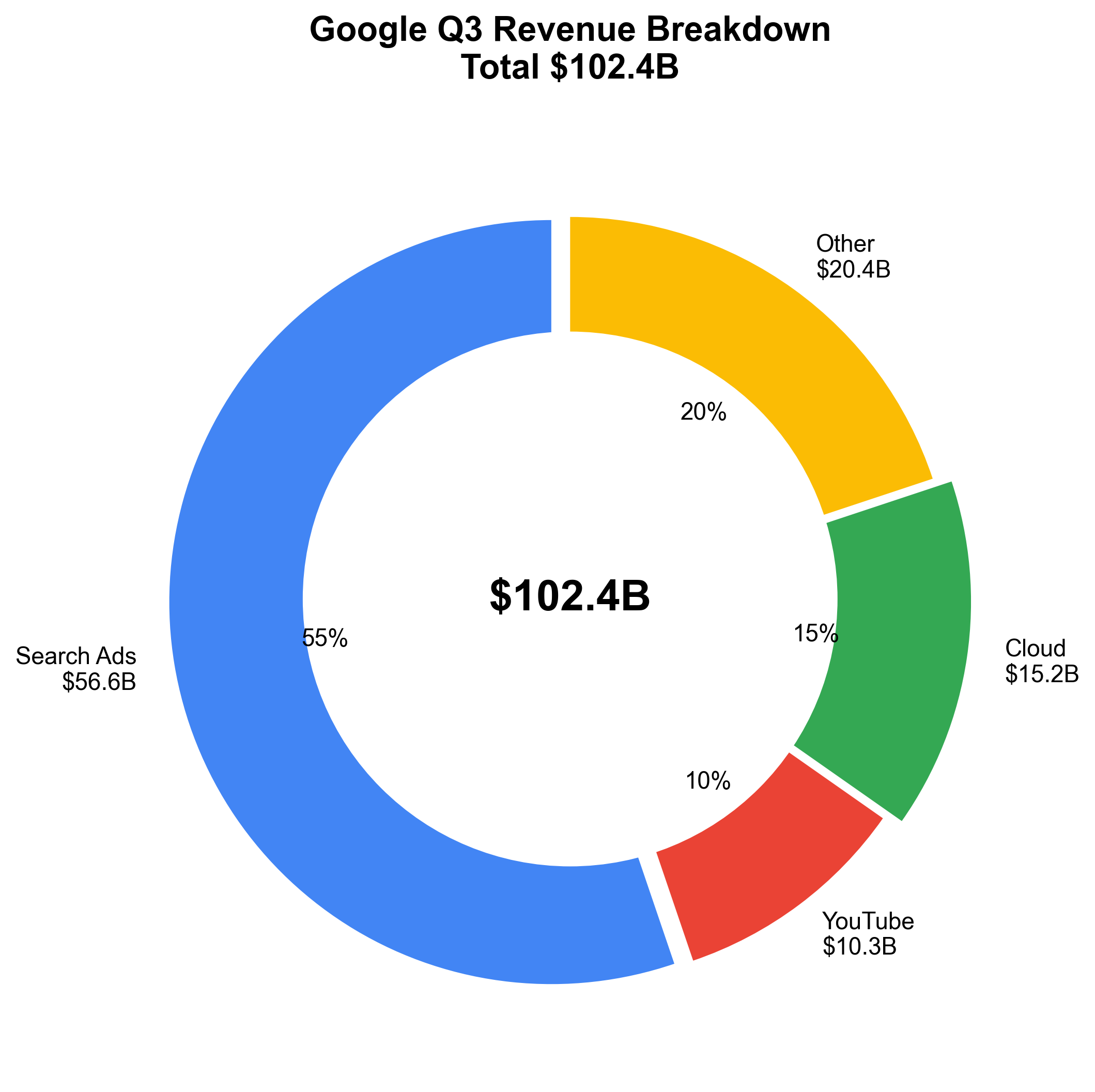

📊 Performance by Segment - How Did They Make Money?

1. Search Ads (Google's Core Business)

Search business generated $56.56 billion in revenue, up 15% year-over-year.

In simple terms:

- Made massive revenue from ads shown when we search on Google

- Despite fears that "AI search will kill Google," it's thriving

- AI chatbots like ChatGPT were supposed to be threats, but Google remains strong

2. YouTube (Second Cash Cow)

YouTube ad revenue was $10.26 billion, beating estimates of $10.01 billion.

YouTube Shorts (TikTok competitor) continues to grow!

3. Google Cloud (The Real Star!)

Google Cloud revenue was $15.15 billion, exceeding estimates of $14.74 billion.

What is Google Cloud?

- A service where companies rent Google's supercomputers instead of buying their own

- Especially crucial for AI development, which requires massive computing power

- CEO Sundar Pichai said "Google Cloud ended Q3 with $155 billion in backlog"

What is backlog?

- The amount customers have contracted to spend on Google services in the future

- $155 billion = future revenue is already locked in

- Investors love this because future sales are guaranteed

💸 "Capital Expenditure" - Google is Spending Big

Google raised its 2025 capital expenditure outlook to $91-93 billion.

How much did they raise it?

- Early 2025 forecast: $75 billion

- Mid-year update: $85 billion

- Now: $91-93 billion

- They keep raising it!

Why spend so much? Said they need more investment "due to growth across the business and cloud customer demand."

Simple analogy:

- Like a bakery doing so well that it expands from 2 ovens to 10

- In the AI era, more computers (data centers) are needed

- If they don't build now, customers will go to Microsoft or Amazon

📈 Market Reaction - Massive Win!

Stock surged up to 7.5% in after-hours trading.

Why did investors love it?

- $100B breakthrough symbolism: Psychologically huge milestone

- AI investment validated: Confirmed "spending on AI wasn't a waste"

- Cloud explosion: Proved Cloud is Google's new growth engine

- Search still strong: AI didn't kill Google Search

- Backlog: Future revenue already secured

Contrast with Meta:

- Meta: Down 9% due to tax bomb

- Google: Up 7.5% for exceeding in all segments

- Same day announcements, opposite outcomes!

🤖 AI Strategy - What's Google Doing?

Google's AI Arsenal:

- Gemini AI: Google's ChatGPT competitor

- "Our proprietary model Gemini now processes 7 billion tokens per minute through direct customer API usage," CEO announced

What are 7 billion tokens?

- The amount of information AI processes per minute

- Means it's being used massively

- Companies are actually using Google AI

AI Search: Rapidly rolling out AI Overviews and AI Mode globally in search.

⚠️ Any Concerns?

1. Massive Investment Burden

- $91-93 billion is a lot of money

- If this continues, profit margins could shrink

- Expected to increase further in 2026

2. Regulatory Risk In September, the EU fined Google $3.45 billion for anti-competitive practices in ad tech.

- This impacted net income

- Governments continue to monitor Google

3. AI Search Cannibalization

- If AI shows answers directly, users might not click ads

- Potential long-term impact on ad revenue

💡 Key Takeaways

- Historic quarter = First $100B breakthrough ✅

- All segments exceeded = Search, YouTube, Cloud all strong ✅

- AI investment paying off = Cloud explosive growth ✅

- But investment continues = Will spend more in 2026 ⚠️

- Stock surged +7.5% = Market very positive ✅

Conclusion: Google is perfectly adapting to the AI era. Search remains powerful, Cloud is growing explosively. Spending heavily, but results justify it, making investors cheer!

💻 Microsoft - Azure Explosive Growth

🎯 One-Sentence Summary

Microsoft beat expectations with explosive Azure cloud growth, though after-hours trading saw initial decline before strong recovery.

💰 Earnings Highlights

Revenue (Money Earned) Microsoft earned $70.07 billion (~$96 trillion KRW) in Q3, beating estimates of $68.42 billion.

EPS (Earnings Per Share) EPS was $3.46, exceeding expectations of $3.22.

Market Reaction - Volatile Initially dropped ~3% after earnings, but later reversed to ~9% gain.

Why the volatility?

- Initially: "Not as explosive as expected" led to disappointed selling

- Later: Realized results were actually great with strong guidance, bought back

- Investors had extremely high expectations for Microsoft

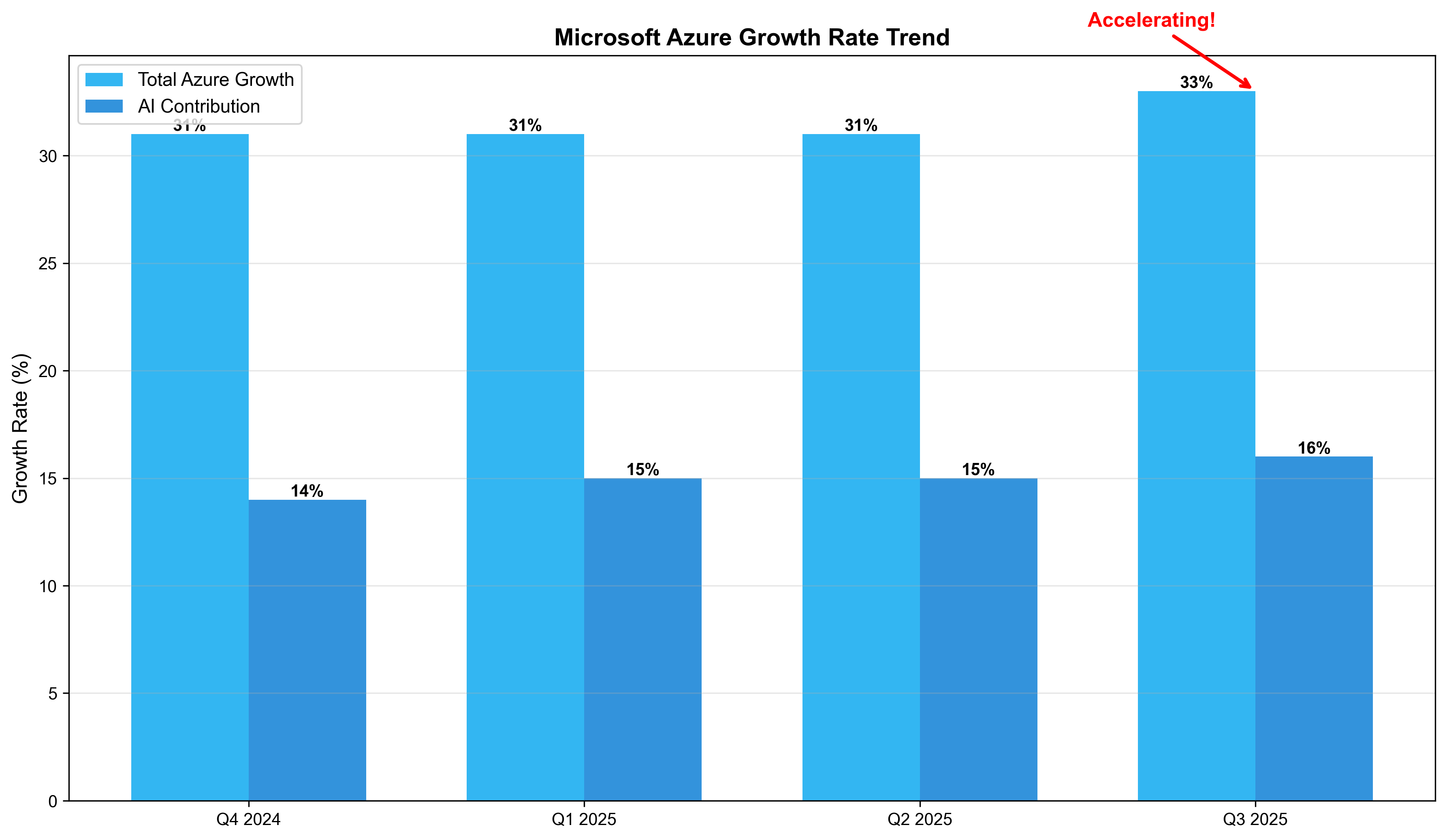

📊 Performance by Segment - Azure is Key!

Azure Cloud (Really Important!)

Azure revenue grew 33%, with 16 percentage points from AI. This exceeded analyst expectations of 30.3%.

What is Azure?

- Microsoft's cloud service

- Competes with Google Cloud and Amazon AWS

- Companies rent Microsoft's infrastructure instead of buying servers

- Essential for AI development these days

How impressive is 33% growth?

- Already a massive business, still growing 33%

- Imagine a bakery growing 30% annually

- Already the biggest bakery in town, but keeps growing

AI contributed 16 percentage points? Of Azure's total 33% growth, AI services alone contributed 16 percentage points.

- OpenAI (maker of ChatGPT) uses Microsoft Azure

- Other companies also use Azure to build AI

- Proves AI boom is generating revenue for Microsoft

Intelligent Cloud (Includes Azure)

Intelligent Cloud segment revenue was $26.75 billion, up ~21%, beating estimates of $26.16 billion.

🔮 Future Outlook - Getting Better

Q4 Revenue Guidance Microsoft forecasts Q4 revenue at $73.15-74.25 billion. The midpoint is higher than consensus of $72.26 billion.

Azure Growth Forecast Company expects constant currency Azure growth of 34-35%, higher than StreetAccount consensus of 31.5%.

In simple terms:

- "Next quarter will be even better than this one"

- Azure will grow faster

- AI demand stronger than expected

💸 Capital Expenditure - How Much Are They Spending?

Capital expenditure was $16.75 billion excluding finance leases, up nearly 53%, exceeding analyst expectations of $16.37 billion.

Why spend so much? CEO Satya Nadella said they plan to spend $80 billion this fiscal year building data centers to handle AI workloads.

$80 billion?! That's huge!

- Yes, it's an enormous amount

- But AI infrastructure competition is fierce

- If they don't build now, they'll fall behind Google and Amazon

- Nadella is all-in on "AI is the future"

AI Demand > Supply

Microsoft CFO Amy Hood said "demand is growing a bit faster, so we expect some AI capacity constraints even after June."

In simple terms:

- Can't provide as many computers as customers want

- Building data centers like crazy but still not enough

- This is a good sign: demand exceeds supply

- Building more means selling more

🤖 AI Strategy - OpenAI Partnership

Special Relationship with OpenAI

- Microsoft invested tens of billions in OpenAI (maker of ChatGPT)

- OpenAI primarily uses Microsoft Azure cloud

- Commercial bookings increased 18%, driven by OpenAI's Azure commitment

Simple analogy:

- Microsoft is OpenAI's major shareholder and major customer

- When OpenAI succeeds, Microsoft benefits twice:

- Equity value increase

- Azure usage revenue

📉 Why Did Stock Drop Initially?

Microsoft announced earnings, but Azure cloud computing segment growth initially didn't satisfy bullish investors.

Investors' Initial Reaction:

- Expectations too high: Even 33% growth didn't meet "expectations"

- Knee-jerk reaction: Disappointed selling without reading details

- Tariff concerns: Trump tariffs could increase data center construction costs

Why the recovery later?

- Earnings re-evaluation: Actually really good upon closer look

- Strong guidance: Next quarter outlook much better than expected

- AI validated: Confirmed AI investment is actually making money

⚠️ Concerns

1. Tariff Risk With President Trump's broad tariffs announced in early April, the optimistic outlook provided relief to investors worried about how tech companies would fare for the rest of the year.

In simple terms:

- Most data center equipment comes from overseas

- Tariffs could increase costs

- But Microsoft expressed confidence "it's manageable"

2. Continued Massive Investment

- $80 billion investment is really big money

- Management reaffirmed that capital spending will increase in the new fiscal year, but at a slower pace than the current fiscal year 2025

- Profit margin pressure continues for now

💡 Key Takeaways

- Beat expectations = All metrics strong ✅

- Azure 33% growth = AI is making money ✅

- Demand > supply = AI demand explosive ✅

- Massive investment continues = $80 billion being deployed ⚠️

- Stock up +9% = Market ultimately positive ✅

Conclusion: Microsoft is a clear AI era winner. Azure is growing explosively, and the OpenAI partnership is creating tremendous synergy. Spending enormously, but results justify it, making investors ultimately cheer!

📱 Meta - Stock Plunges on Tax Bomb

🎯 One-Sentence Summary

Meta's business performed amazingly well, but a one-time massive tax charge due to Trump's new tax law caused current profits to plummet.

💰 Earnings Highlights

Revenue (Money Earned) Meta earned $51.2 billion (~$70 trillion KRW) in Q3, 26% more than the same period last year.

In simple terms: Made massive money from ads on Facebook, Instagram, and WhatsApp. Ad impressions increased 14%, and revenue per ad also rose 10%.

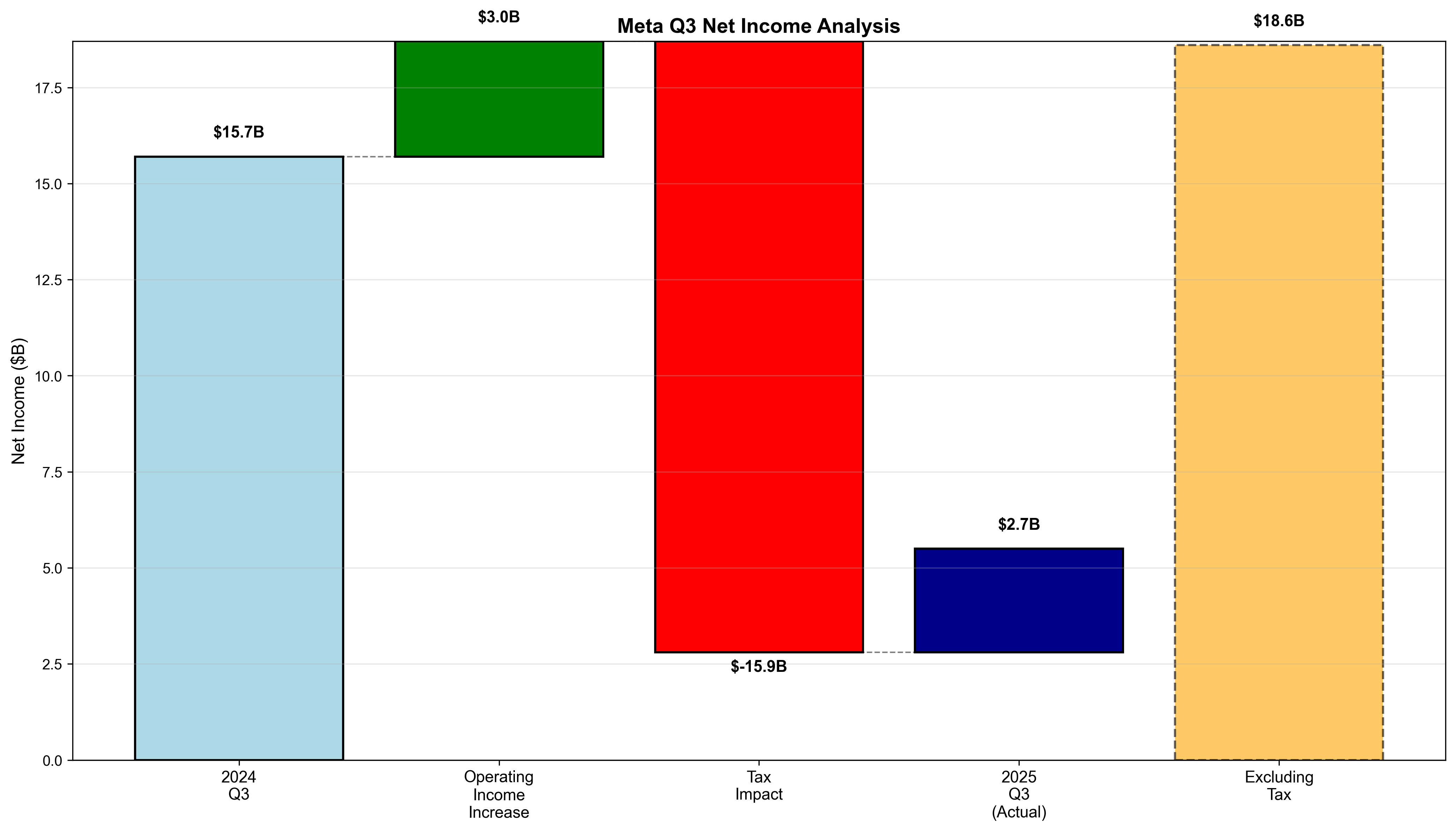

Net Income (Actual Profit) This is where the problem is. Net income was $2.7 billion, an 83% plunge from last year.

"83% plunge - is Meta going bankrupt?!" ❌ No!

🧾 Why Did Profit Plunge? - The Tax Bomb Secret

What is the "One Big Beautiful Bill Act"?

A massive tax reform bill passed by President Trump in July 2025. This law:

- Reduced taxes for regular people

- Eliminated taxes on tips and overtime pay

- Also allowed companies to pay less tax long-term

But why did Meta get hit with a tax bomb?

With this law's implementation, the "Corporate Alternative Minimum Tax" caused the value of Meta's accumulated "tax refund receivables" to disappear.

Beginner's analogy:

- Meta had lots of "tax refund coupons to redeem later"

- The new law made those coupons "now unusable"

- Accounting rules required recording the lost coupon value as a loss right now

So they recorded $15.9 billion (~$21 trillion KRW) in taxes all at once.

Did they actually pay $15.9 billion?

❌ No! This is the key point.

This is a "non-cash" tax.

In simple terms:

- They didn't actually wire $15.9 billion to the government

- Only recorded it on the books

- Like recording an "unrealized loss" when real estate value drops

- Like recording a loss without actually selling the house

So is this good or bad?

Short-term: Bad. This quarter's earnings look terrible.

Long-term: Good! Meta said they "can pay much less in U.S. federal taxes for the remainder of 2025 and for years to come."

How were earnings excluding the tax?

Excluding that $15.9 billion tax charge, net income would have been $18.64 billion, up 19% from last year.

This is Meta's real performance.

💸 What is "CapEx"?

Short for Capital Expenditure.

Beginner's explanation:

- Money the company invests in buildings, equipment, facilities for the future

- For Meta: money spent buying AI supercomputers, data centers, servers

- It's an expense now, but an investment to make more money later

Analogy: A chicken restaurant owner buying a new fryer is capital expenditure. Money goes out now, but you can sell more chicken with it to make money.

🤖 Why Is Meta Spending So Much Money?

Meta raised 2025 capital expenditure to $70-72 billion. (Previous outlook: $66-72 billion)

Why pour in so much money?

CEO Mark Zuckerberg said Meta needs continuously more computing power for AI (artificial intelligence) projects.

In simple terms:

- Convinced AI is the key to the future

- Need massive computers to compete with companies like OpenAI (ChatGPT maker)

- If they don't invest now, they'll fall behind later

- Warned "2026 capital expenditure will be much larger than 2025"

📈 How Did Investors React?

Stock fell 9% in after-hours trading.

Why the negative reaction?

- Tax shock unexpected: $15.9 billion is an enormous amount

- Excessive investment concerns: Spending too much on AI, uncertain when they'll recoup it

- Results were good, but: Investors more worried about "future profitability"

🔮 Future Outlook?

Positive aspects:

- Q4 revenue outlook at $56-59 billion, higher than analyst expectations

- Daily active users at 3.54 billion, up 8% year-over-year

- Instagram crossed 3 billion monthly users, Threads also exceeded 150 million

- Ad business remains solid

Concerns:

- Too much AI investment pressuring current profitability

- Reality Labs (VR/AR division) lost $4.4 billion in Q3 alone

- Uncertain when investment will pay off

💡 Key Takeaways

- Revenue up 26% = business is doing well ✅

- Net income down 83% = due to one-time tax, actual business is fine ✅

- Long-term tax burden decreases ✅

- But AI investment too heavy, worrying investors ⚠️

- Short-term stock down, need to watch long-term 🤔

Conclusion: Meta's short-term results look bad due to tax and excessive investment, but the actual business is healthy. If AI succeeds, jackpot; if it fails... time will tell!

📈 Market Reaction Overall

Why Mixed Results

| Company | After-Hours Stock | What Investors Liked | What Investors Worried About |

|---|---|---|---|

| 📈 +7.5% | • $100B breakthrough<br>• All segments exceeded<br>• AI success proven | • Massive investment continues | |

| Microsoft | 📈 +9% | • Azure 33% growth<br>• Strong guidance<br>• AI demand explosion | • Initially below expectations<br>• Tariff risk |

| Meta | 📉 -9% | • Revenue up 26%<br>• Users continue growing | • $15.9B tax shock<br>• Excessive AI investment |

🎯 Message from Big Tech 3

Commonality: AI Investment War

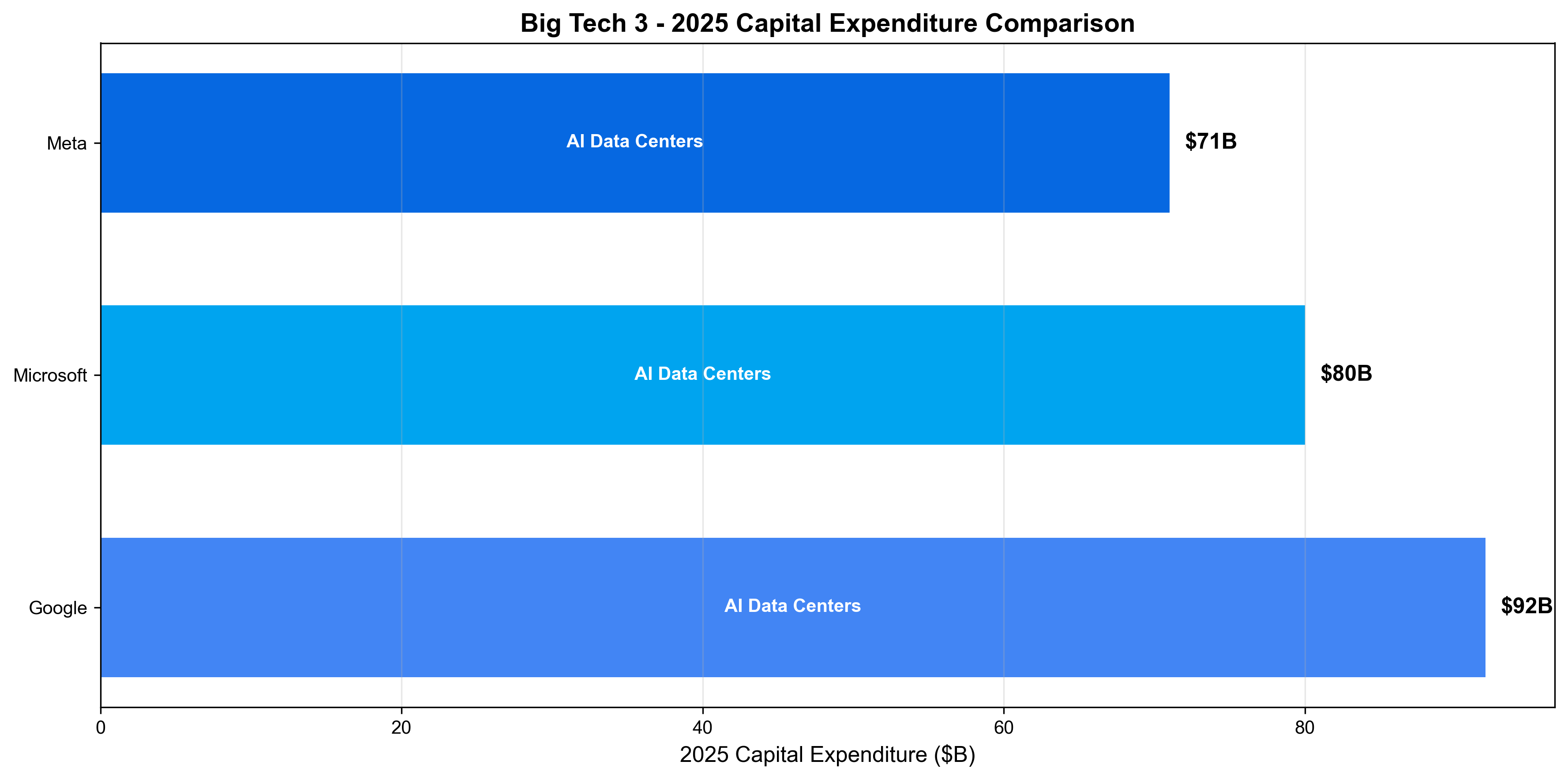

All three companies are pouring massive money into AI infrastructure:

- Google: $92B (continuing to raise)

- Microsoft: $80B

- Meta: $71B

- Total: ~$250B ($340 trillion KRW)

What this means:

- AI is essential, not optional

- Not investing now means falling behind in competition

- Long-term dominance more important than short-term profitability

Difference: Market's Evaluation Criteria

Google - "Perfect Balance"

- Investing in AI while maintaining existing business (Search)

- Cloud growth validates investment rationale

- Future revenue ($155B) already secured

Microsoft - "AI Winner"

- Azure + OpenAI synergy is clear

- Demand exceeds supply (good sign!)

- Guidance continues rising

Meta - "Excessive Investment Controversy"

- Revenue is highest but investment is also highest

- Reality Labs loses billions annually

- AI investment results still unclear

💭 Implications for Investors

Short-term Perspective (1-3 months)

- Google, Microsoft can sustain upward momentum

- Meta will have high volatility (need to digest tax issue)

- Will react sensitively to AI-related news

Medium-term Perspective (6-12 months)

- Q4 earnings more important (year-end ad season)

- AI monetization speed will determine stock price

- Capital expenditure burden will affect profit margins

Long-term Perspective (1+ years)

- Key is whether AI investment converts to revenue

- Need to watch regulatory risk (especially Google)

- Cloud market share competition intensifies

🔚 Final Summary

This Big Tech earnings season showed the tug-of-war of "AI Investment vs. Profitability".

✅ Google: Perfect results prove AI era adaptability ✅ Microsoft: Azure explosion confirms AI leadership ⚠️ Meta: Strong growth but pressured by tax and investment burden

Core Message: AI is Big Tech's future. Now is the time to spend money, and who invests more efficiently will determine winners and losers in 5 years.

Investors, don't be swayed by short-term volatility and watch the long-term trend! 🚀

Comments (0)

No comments yet. Be the first to comment!