Meme Stock Frenzy Returns - Beyond Meat

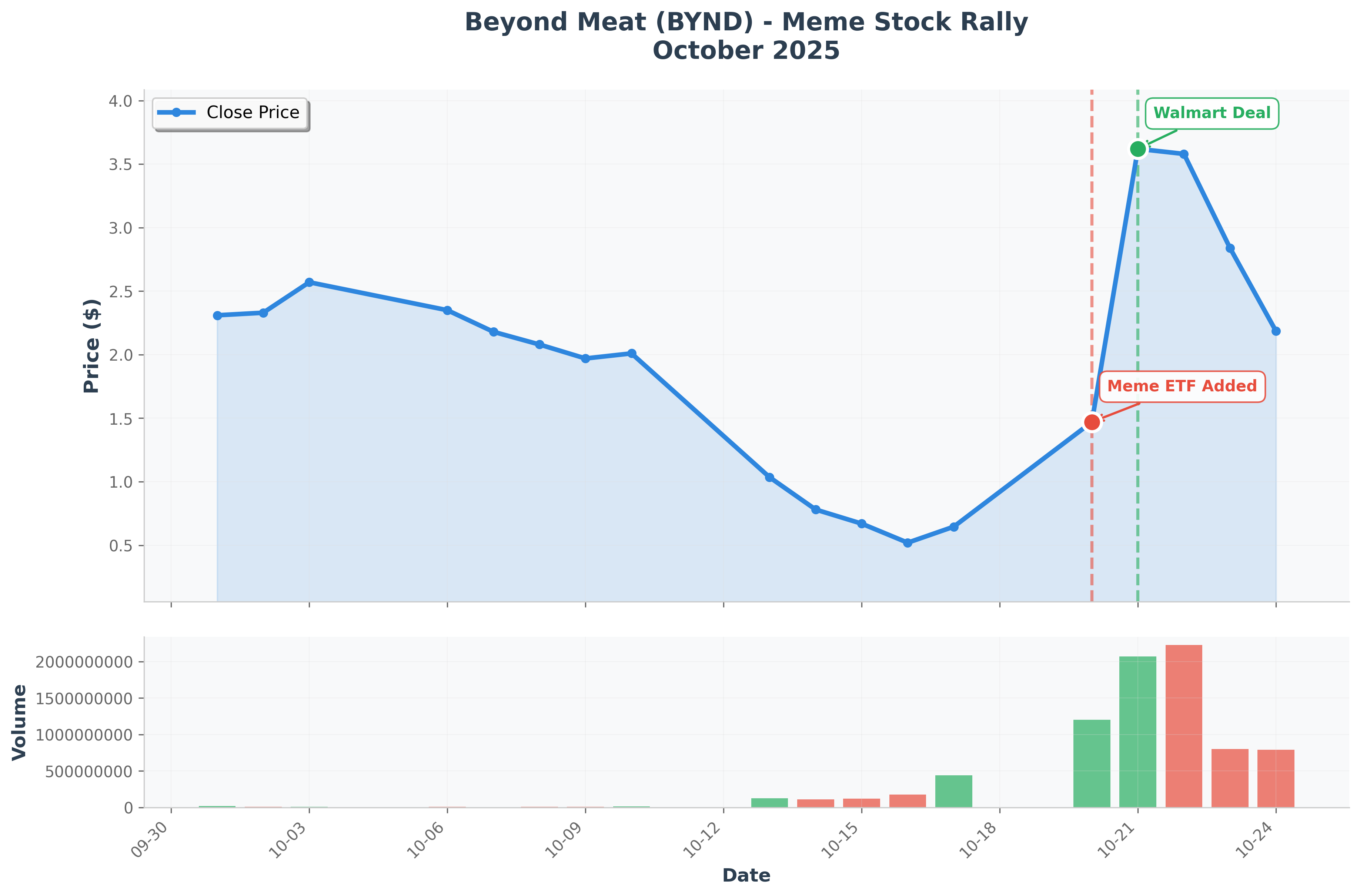

1. Meme Stock Frenzy Returns - Beyond Meat Surges 1,300% in 4 Days Before Plunging

Beyond Meat's stock skyrocketed over 1,300% in just four days, from $0.52 on October 16 to $7.69 on October 22. The rally was triggered by Roundhill Investment's addition of Beyond Meat to its meme stock ETF (MEME) and an announcement of an expanded distribution deal with Walmart. With Beyond Meat's short interest exceeding 63%, a short squeeze ensued, and retail investors purchased $35 million worth of shares in a single Tuesday session. However, the stock plunged again on Wednesday, demonstrating extreme volatility. Other meme stocks like Krispy Kreme and GoPro also rallied in sympathy.

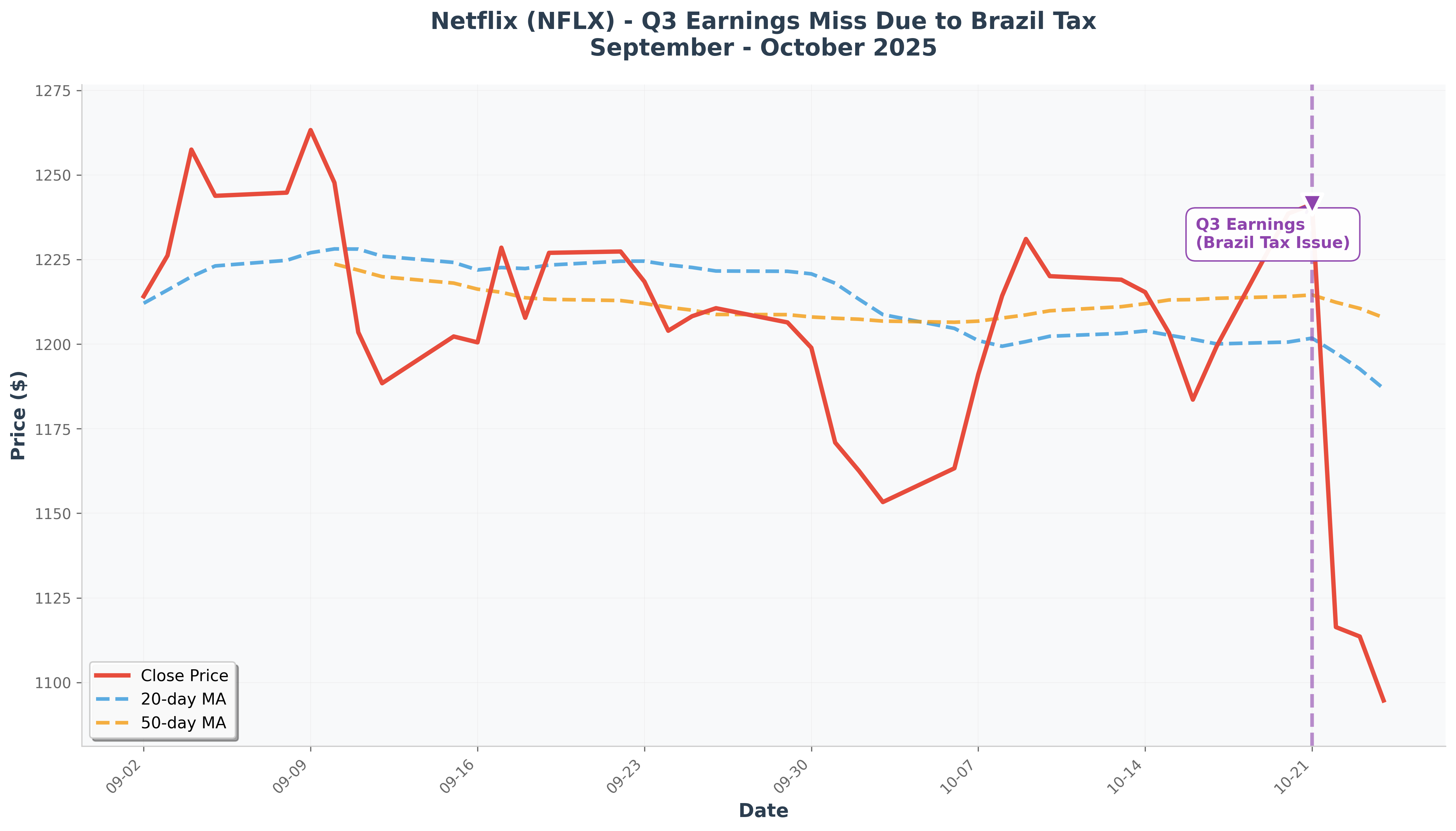

2. Netflix Misses Earnings Expectations Due to Brazil Tax Dispute

Netflix fell short of Wall Street's expectations in its Q3 earnings report due to an unexpected $619 million charge related to a tax dispute with Brazilian authorities. Earnings per share came in at $5.87, missing estimates of $6.96—the first time in over two years the company failed to meet revenue projections. The tax issue involves CIDE (Contribution for Intervention in the Economic Domain), a 10% tax on certain payments made by the Brazilian entity to foreign entities. Netflix shares dropped 5-6% immediately following the announcement.

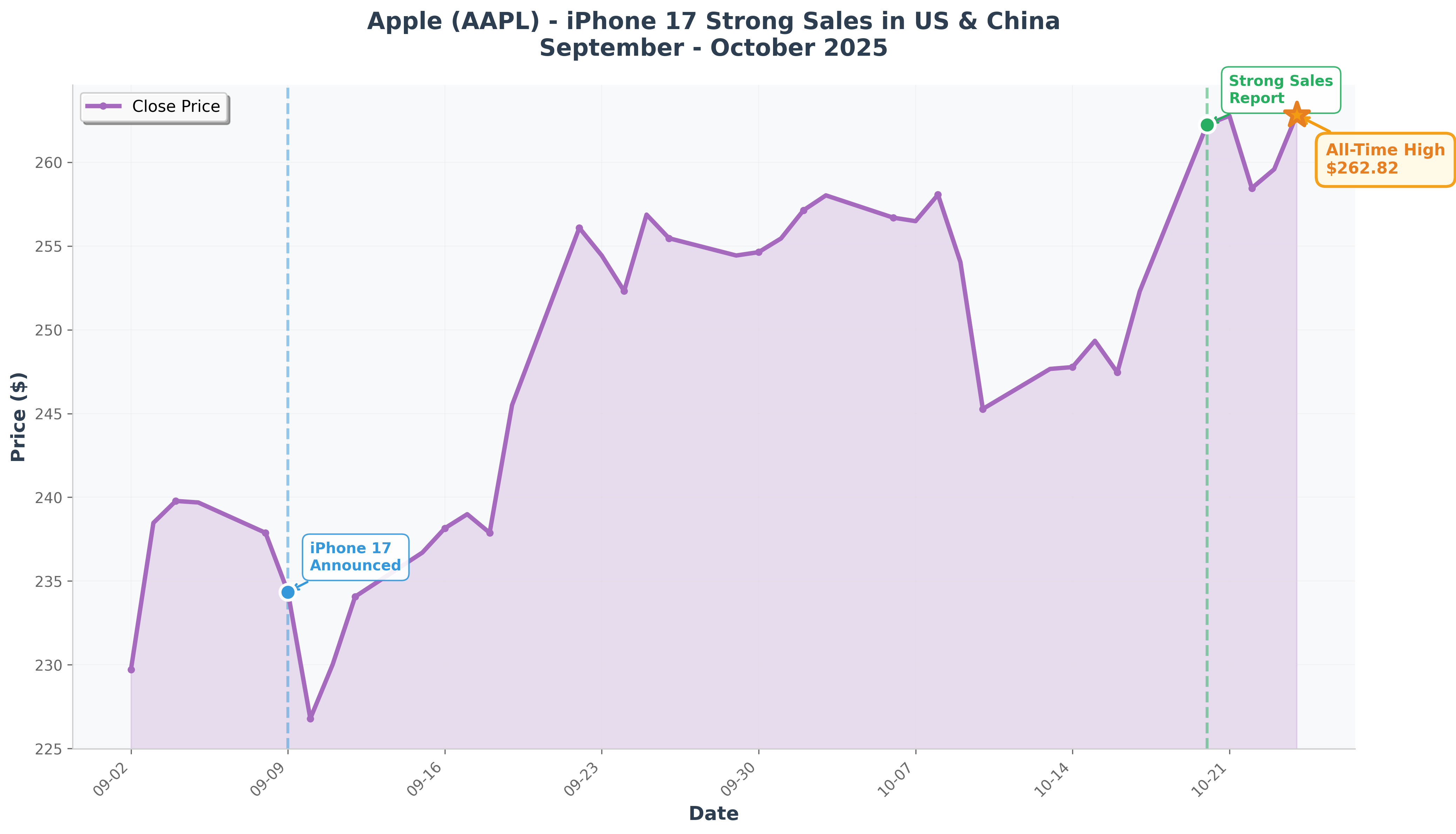

3. iPhone 17 Sales Up 14% vs. iPhone 16 in US and China

According to Counterpoint Research, the iPhone 17 series sold 14% more units than the iPhone 16 series during its first 10 days in the US and China. The base iPhone 17 model has been particularly popular in China, offering strong value for money. On the strength of this news, Apple's stock surged approximately 4% on Monday to reach an all-time high of $262.24. Loop Capital upgraded Apple from "Hold" to "Buy" with a price target of $315.

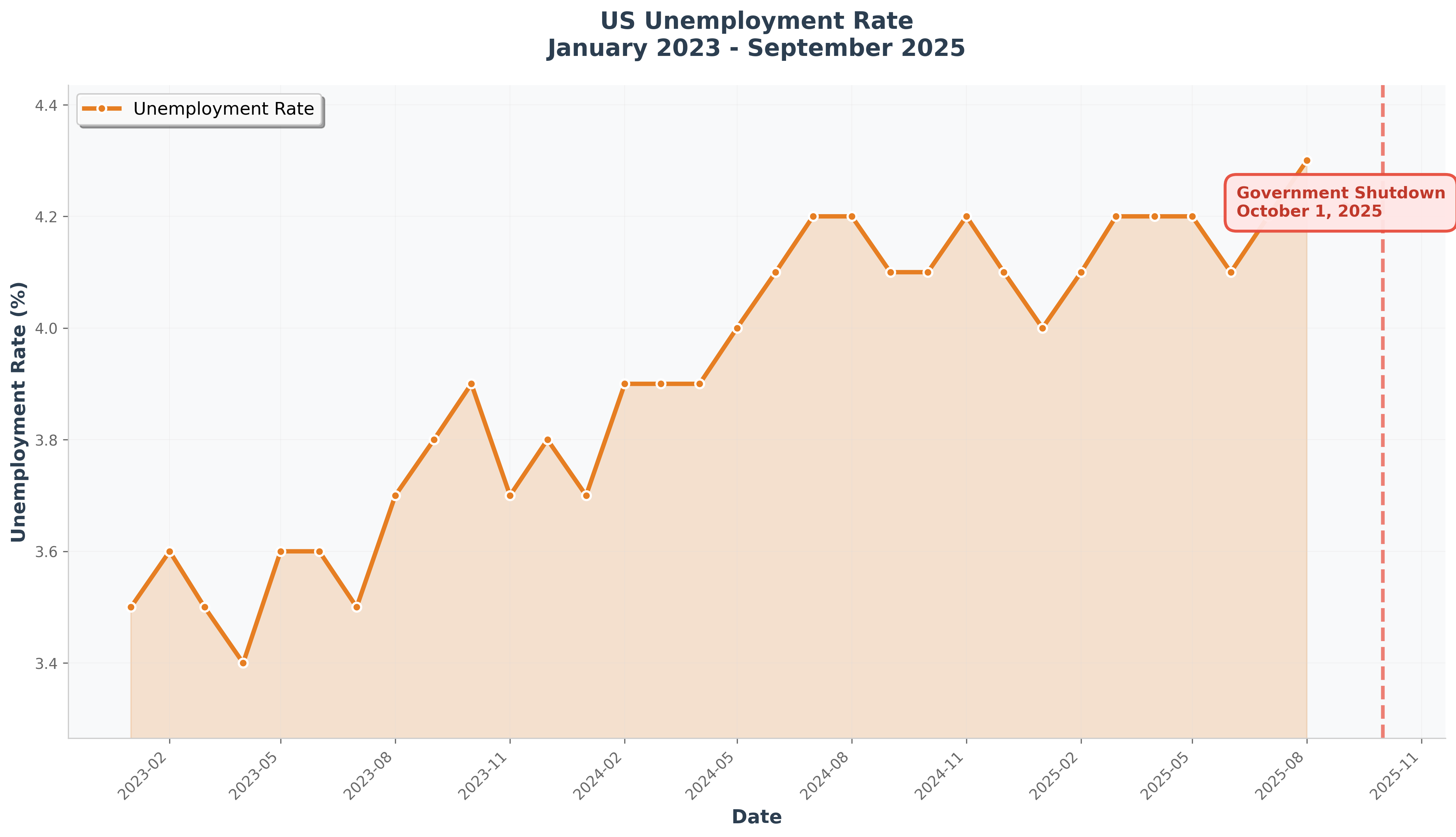

4. US Government Shutdown Enters Day 26, Economic Impact Spreads

The federal government shutdown that began on October 1 has now entered its 26th day, leaving approximately 750,000 federal employees furloughed without pay and halting economic data releases that inform Federal Reserve rate decisions. According to Moody's Analytics, each week of the shutdown reduces annual real GDP growth by approximately 0.1%, equivalent to about $30 billion in losses per quarter. More than 25 states have announced suspensions of November SNAP (food assistance) benefits, while disruptions have spread to national parks, small business loans, tax refunds, and other sectors.

5. September CPI Comes In Below Expectations, October Fed Rate Cut Almost Certain

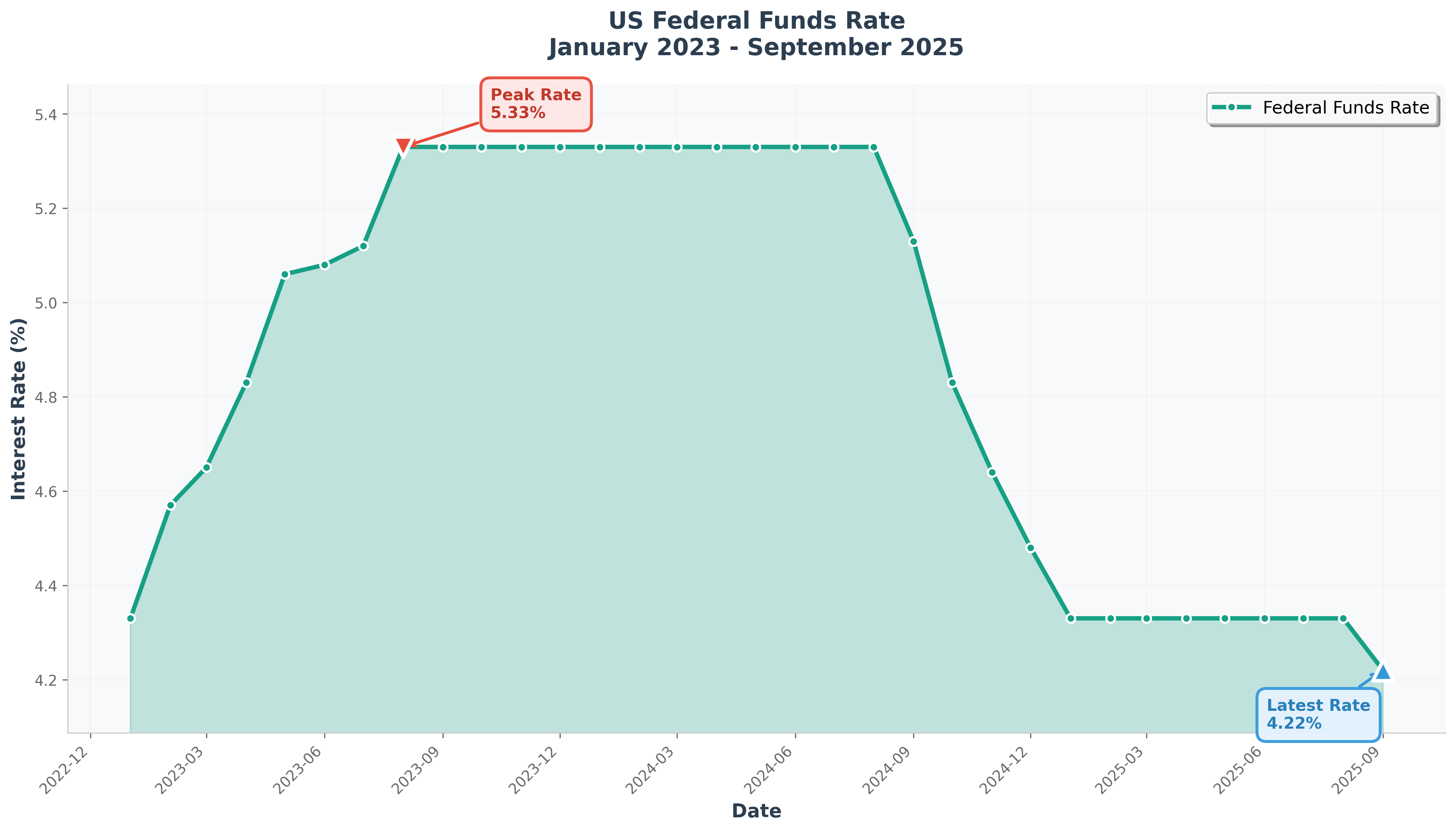

The September Consumer Price Index (CPI) released on October 24 rose 0.3% month-over-month, below the 0.4% consensus estimate. Core CPI increased 0.2%, the slowest pace in three months, while housing cost increases hit their lowest level since early 2021. As a result, markets are now pricing in a 98%+ probability of a 25 basis point (0.25 percentage point) rate cut at the October 29 Fed meeting, which would bring the federal funds rate down to 3.75-4.0%. While employment data was not released due to the government shutdown, the moderate inflation data provided further justification for additional rate cuts.

Comments (0)

No comments yet. Be the first to comment!