💰 How Much Should You Invest in Your 20s?

"I don't make much money yet—should I even start investing?" "What's the point of investing just $100?" If you're in your 20s, you've probably asked yourself these questions. But here's the truth: It's not about how much—it's about building the habit.

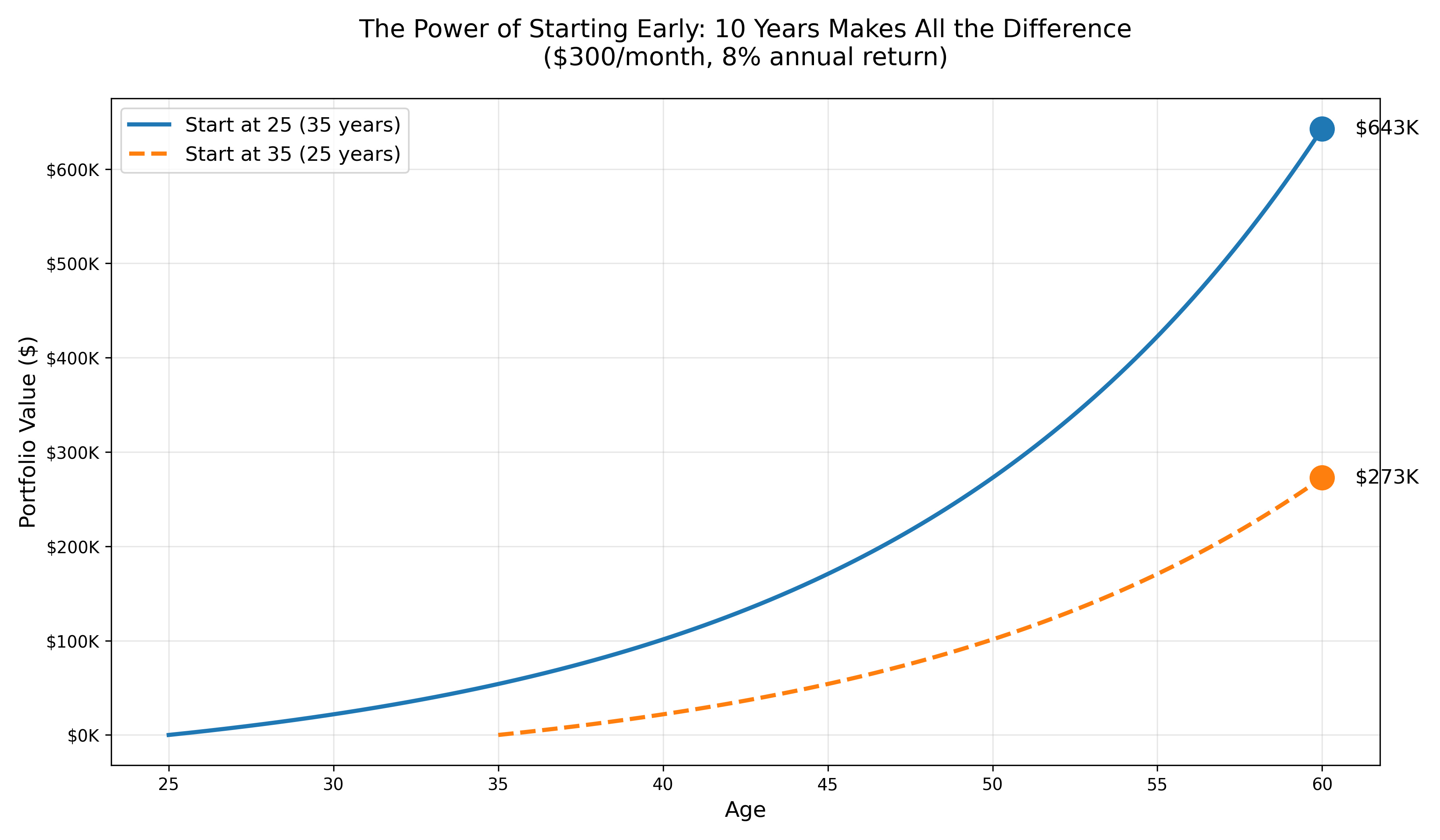

1️⃣ Timing Beats Amount Every Time

Many people say, "I'll start investing once I've saved up more money." But in the world of compound interest, when you start matters more than how much you start with.

The chart below makes this crystal clear.

Even with the same $300 monthly investment:

- Start at 25 → $640M by age 60 (~$640K USD)

- Start at 35 → $270M by age 60 (~$270K USD)

👉 Just a 10-year delay results in more than 2x difference. This is the power of compound interest, and why time is your most valuable asset.

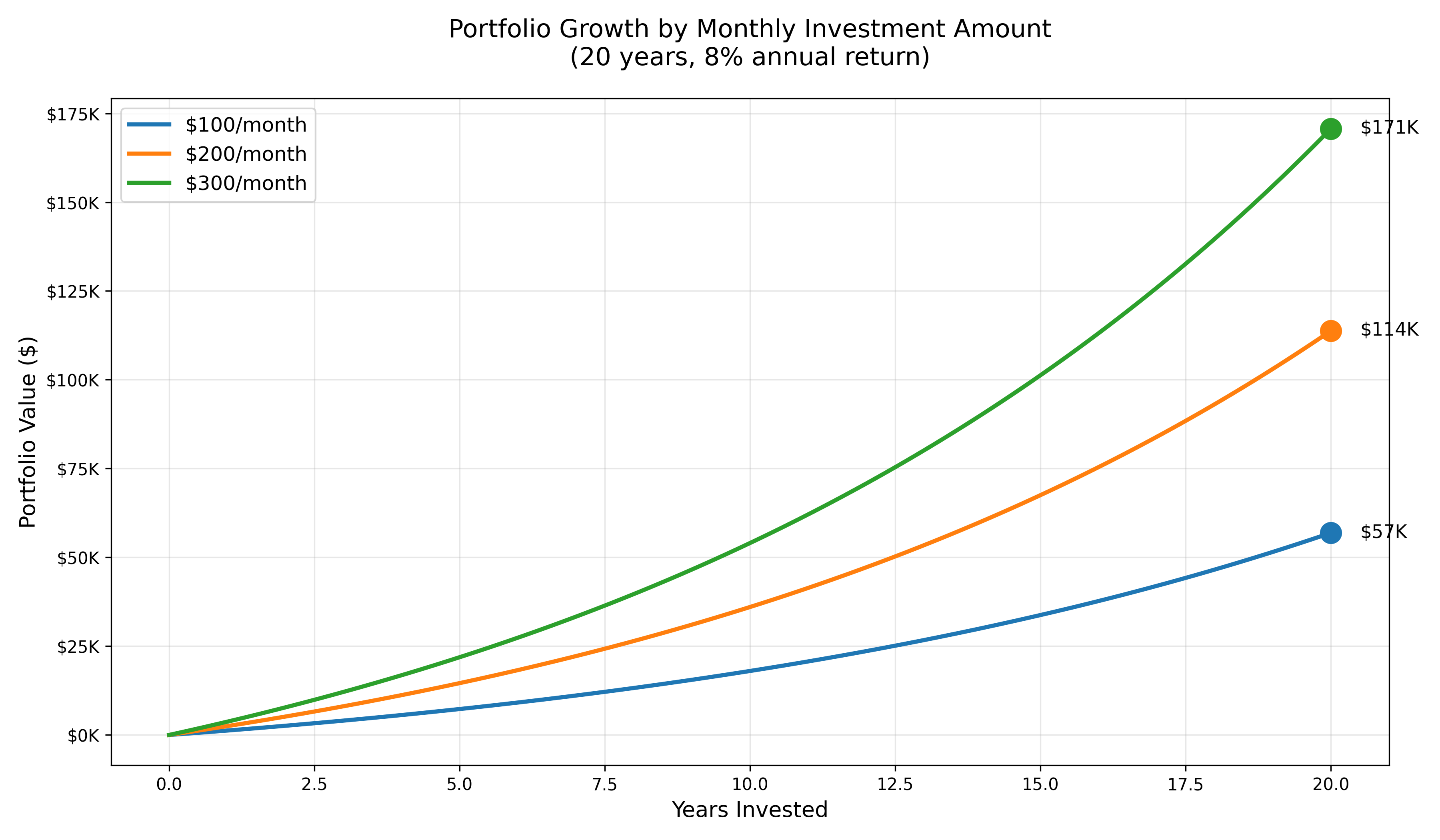

2️⃣ How Much Can You Realistically Start With?

The average take-home pay for people in their 20s is around $2,000-2,500 per month. After living expenses (rent, food, transportation), most can save about $300-500.

This means investing just $100-300 per month is already meaningful.

Here's what 20 years of consistent investing looks like (assuming 8% annual returns):

| Monthly Investment | 20-Year Expected Amount | Total Invested |

|---|---|---|

| $100 | ~$57K | $24K |

| $200 | ~$114K | $48K |

| $300 | ~$171K | $72K |

💡 The magic of compounding works best when you go "small and steady." Even $100/month can more than double your principal over 20 years.

3️⃣ Three Principles for Beginning Investors

🧩 (1) Set a Percentage, Not a Fixed Amount

Instead of saying "I'll invest $300 every month," commit to 10-15% of your paycheck. As your income grows, your investment automatically scales up too.

⚖️ (2) Survival First, Aggression Later

You have time to recover from losses in your 20s, but early losses can create lasting "investment fear" that drives people out of the market entirely. Start with stable ETFs, index funds, or a combo of high-yield savings + ETFs.

📚 (3) Learning IS Earning

Rather than chasing high returns from day one, focus on asking: "What am I investing in and why?" Keeping this record isn't just about money—it's about building compound thinking.

4️⃣ Your First Investment: Prioritize Consistency Over Perfection

What matters more than "success" with your first investment is the feeling of wanting to continue. Investments that are too complex or volatile will burn you out quickly.

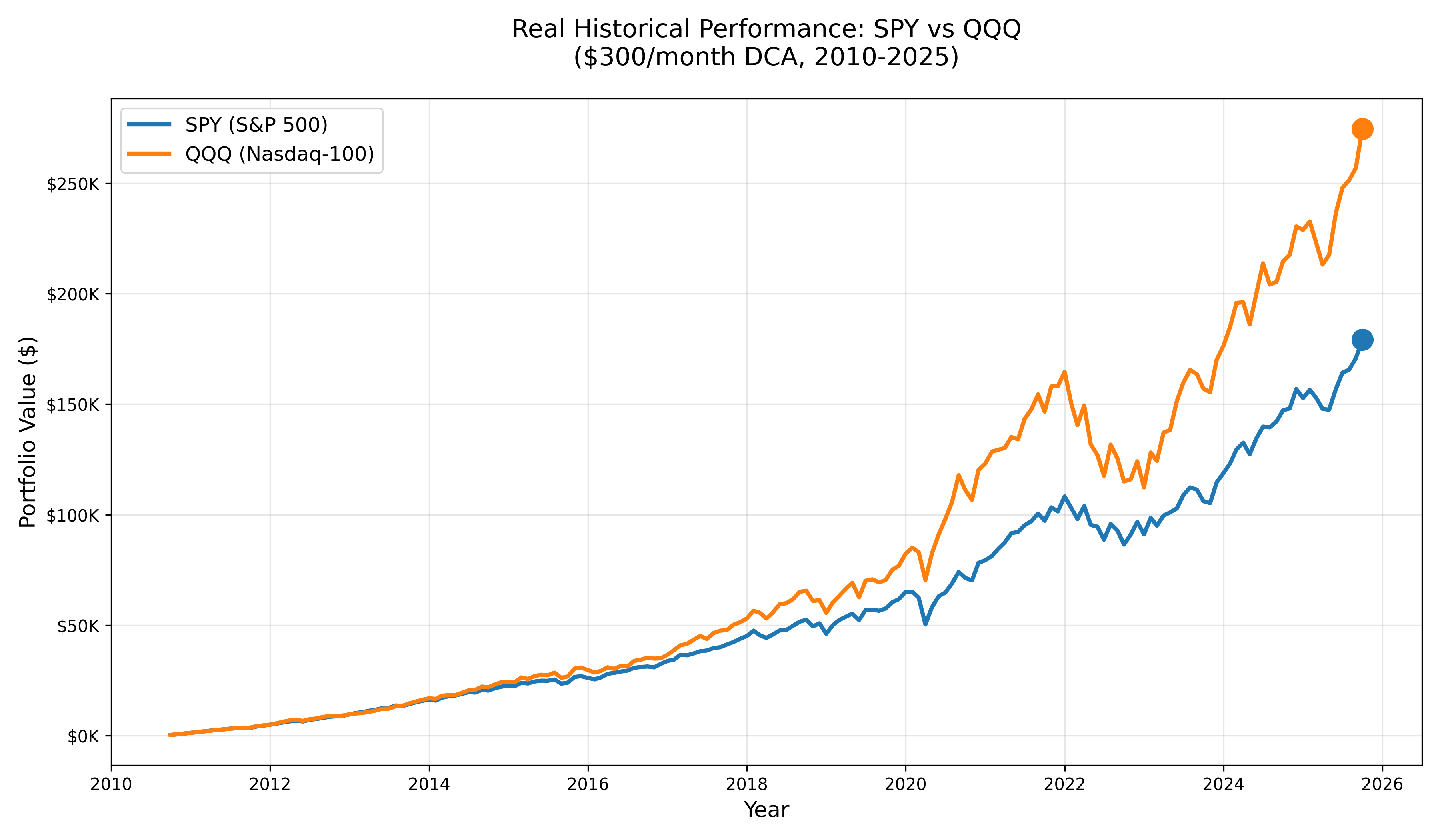

Real Data: The Power of Index Investing

This chart shows a simulation using real historical data from 2010 to 2025. If you had invested $300/month consistently:

- SPY (S&P 500): $54.3K invested → ~$179K (3.3x return)

- QQQ (Nasdaq-100): $54.3K invested → ~$275K (5.1x return)

Both ETFs delivered excellent results, but the key point is "15 years of consistency".

Recommended First Investments for Beginners

- VOO / SPY / IVV: Diversified exposure to 500 top U.S. companies (S&P 500)

- QQQ: Tech-heavy growth investing (Nasdaq-100)

- VTI / ITOT: Total U.S. stock market exposure

📈 The experience of "my money is working for me, even a little" builds the muscle of an investor mindset.

5️⃣ Conclusion: Start with $100

Someone might say, "What can you even do with that?" But investing isn't just about growing money— it's about learning to think about and design your future.

Having little money now means you have little to lose. That makes your 20s the safest time to fail.

Now is your starting point. Small. Early. Consistent. These three things are the most powerful strategy for investors in their 20s.

Comments (0)

No comments yet. Be the first to comment!