Gold Smashes $4,200 as Safe‑Haven Demand Surges

Intro Gold prices vaulted above $4,200 per ounce — a record high — in the past 12–18 hours as renewed bets on U.S. rate cuts and lingering trade and geopolitical fears propelled investors into safe-haven assets.

Main Spot gold surged ~1.6%, hitting a session peak of $4,217.95 before settling near $4,209.49. U.S. December gold futures rose about 1.5% to $4,227.60. The precious metal has now gained roughly 60% year-to-date.

Analysts point to two powerful drivers: expectations of further rate cuts by the Federal Reserve and safe-haven demand amid geopolitical and economic uncertainty. Powell's comments hinting at the end of quantitative tightening (QT) and future easing highlighted the appeal of gold in a lower-rate environment. The U.S. dollar's recent weakness also added tailwinds, as gold becomes more attractive when the dollar falls.

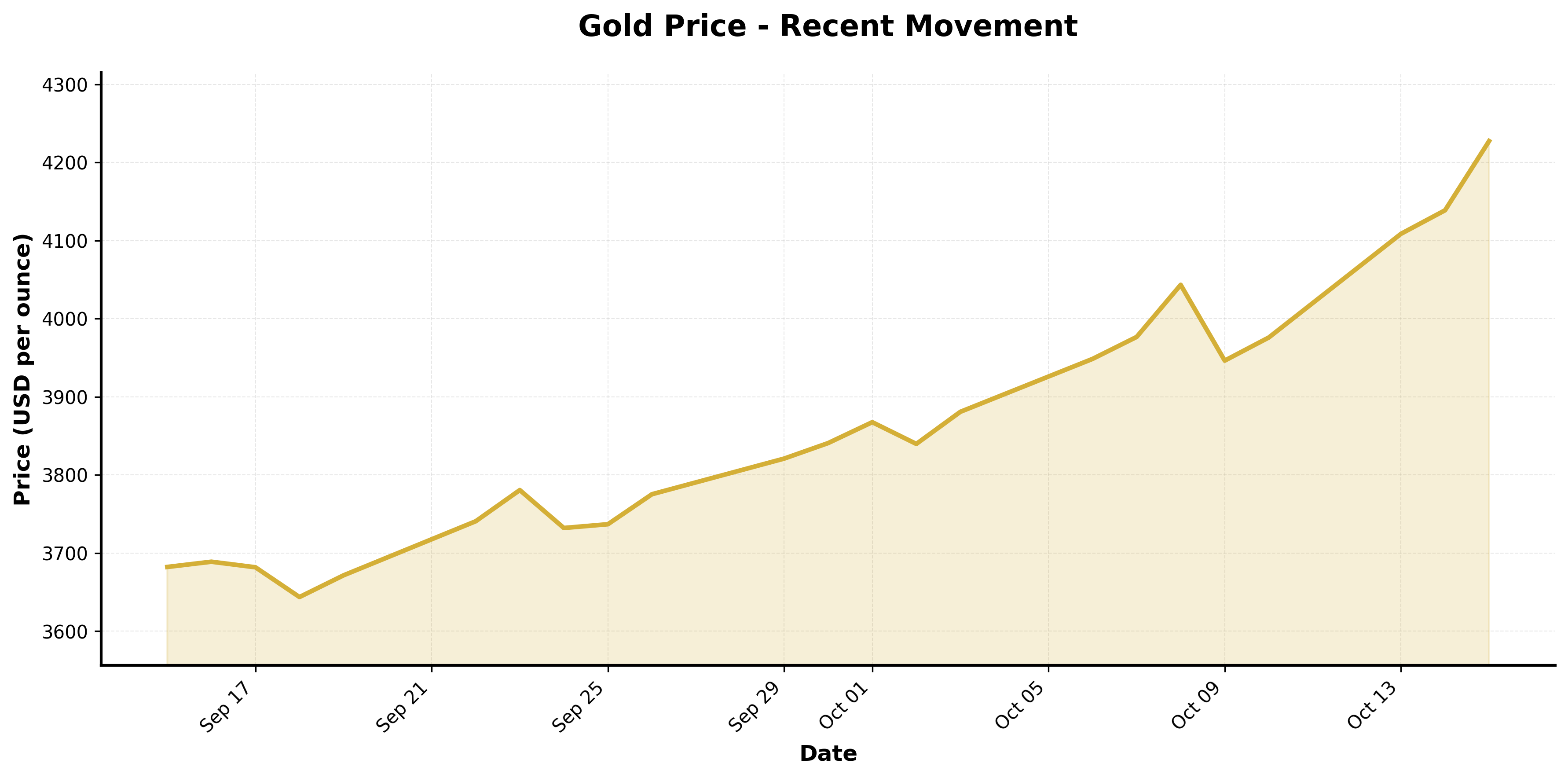

Below is a chart of gold's recent price path:

Caption: Spot gold price breaking through $4,200 amid risk flows and rate easing hopes.

Caption: Spot gold price breaking through $4,200 amid risk flows and rate easing hopes.

Analysis Why is gold running so hard now?

- Rate expectations and opportunity cost: Gold yields nothing (it doesn't pay interest). When interest rates fall or are expected to fall, the "cost" of holding gold declines.

- Safe-haven flows: In turbulent times—trade shocks, policy uncertainty, shutdowns—investors tend to pile into assets perceived as stable, such as gold.

- Dollar depreciation: A weaker dollar amplifies gold gains, since dollar-denominated gold becomes cheaper to foreign buyers and more attractive.

- Concentration of risk: The rise in gold suggests investors see sizable downside risk. It often acts as a barometer of market nervousness.

- Structural demand: Central bank purchases and inflows into gold ETFs bolster the rally and provide support even amid profit-taking pressures.

But there are caveats: gold valuations look extended, and a sharp policy pivot or meaningful economic rebound could reverse momentum.

Outlook Key inflection points to watch:

- Fed decisions: A full pivot away from tightening or confirmation of cuts will likely prop gold further.

- Dollar strength or reversal: If the dollar reverses course, that could cap gold gains.

- Geopolitical surprises: Any escalation in trade conflicts, military flashpoints, or policy shock would feed further safe-haven demand.

- ETF flows & central bank behavior: Observing capital flows in/out of gold funds and central bank reserve allocations can suggest sustaining power.

- Technical pullbacks: Given the velocity of the move, corrections could occur, especially if gold becomes overbought on momentum indicators.

For risk-aware investors, gold's surge underscores that markets are no longer discounting only a rosy outcome. It's a strong reminder that uncertainty remains—and that in the current environment, gold is viewed less as a speculative bet and more as insurance.

(Sources: Reuters)

Comments (0)

No comments yet. Be the first to comment!