Global Trade Shock: U.S.–China Tensions Spur Market & Growth Concerns

Intro: On the sidelines of the annual meetings of the International Monetary Fund and World Bank in Washington, policymakers flagged that escalating U.S.–China trade and export‑control frictions are clouding the global economic outlook and unnerving equity markets.

Main – Background + Current Status + Relevant Figures: Trade relations between the U.S. and China have re‑intensified: the U.S. is threatening sweeping tariffs or export curbs, while China has responded with mineral export controls and strategic supply‑chain moves. The IMF's latest commentary warned that the "new normal" includes persistent trade shock risk.

At the same time, the latest global growth forecast from the IMF's World Economic Outlook projects global GDP growth at 3.2% in 2025 and 3.1% in 2026—modest, and reliant on counter‑vailing factors.

In markets: risk assets have weakened—bank stocks and global equities are vulnerable to any surprise shock to trade or credit, given current valuations.

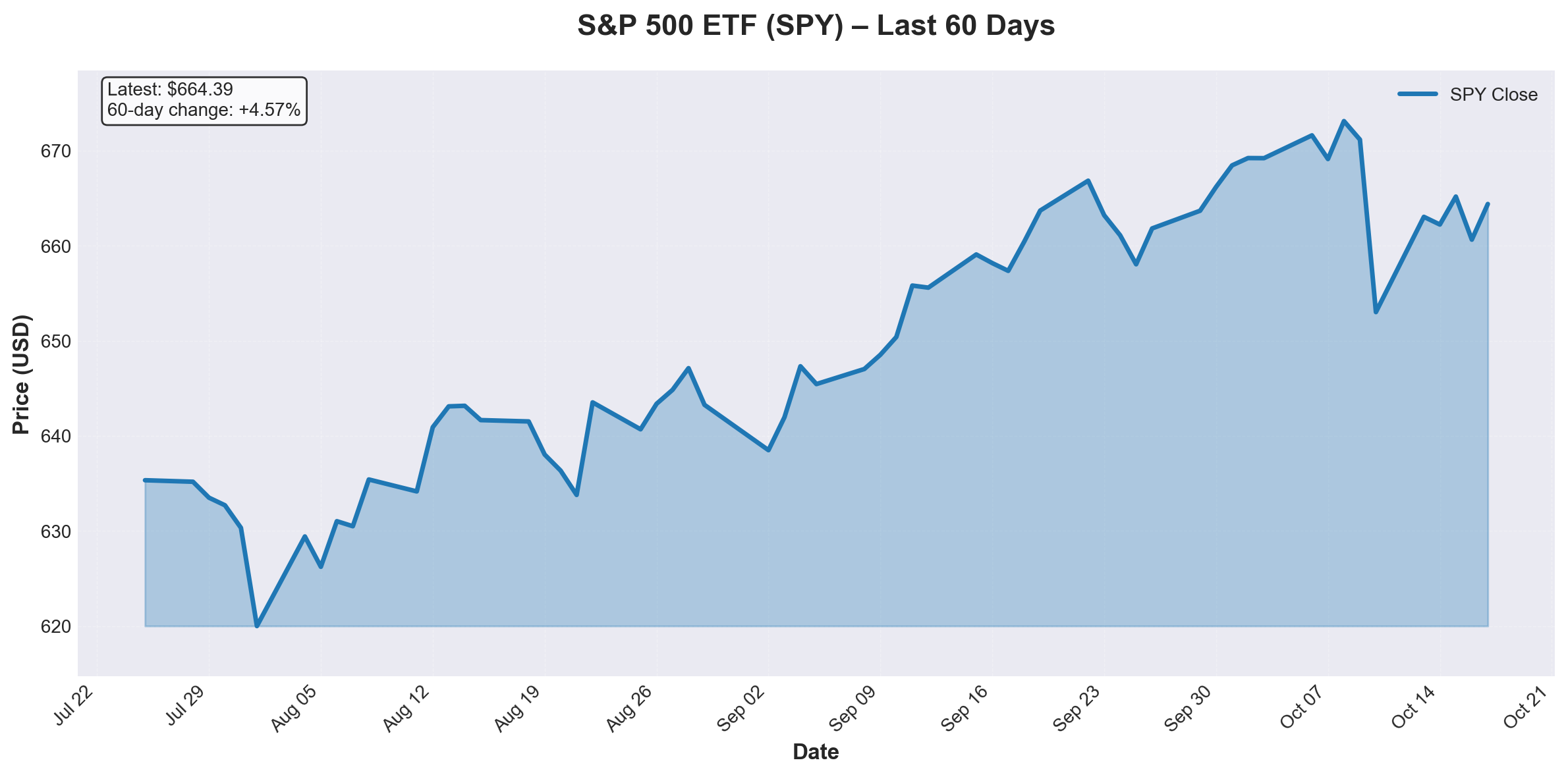

Here is a chart of the S&P 500's recent trend (proxy for global risk appetite):

Chart: S&P 500 ETF closing price over the past 60 days, illustrating recent choppiness and risk‑off moves.

Chart: S&P 500 ETF closing price over the past 60 days, illustrating recent choppiness and risk‑off moves.

Analysis – Why This Is Important & What's Changing: Why this matters:

- Trade shock risk: The U.S.–China dynamic has shifted from episodic to structural: export controls, strategic minerals, supply‑chain realignments mean that shocks may last longer and be larger than in past trade wars. This raises uncertainty for corporate earnings, supply chains and inflation.

- Growth elasticity falling: With growth in major economies already modest, incremental negative shock from trade could have magnified effects—especially via investment, technology flows, and global value chains. The IMF noted that delaying policy resolution reduces global output by ~0.4% in near term.

- Valuation risk: Equities are broadly valued for steady growth; if trade shocks dent that narrative, rotations or sell‑offs may accelerate.

In effect: Markets are increasingly pricing in "geopolitical risk premium" rather than assuming smooth expansion.

Outlook – Implications & What to Monitor: Key items for investors:

- Trade policy announcements: Any surprise tariffs, export bans or supply‑chain restrictions will matter.

- Corporate guidance on supply chains: Earnings commentary pointing to disruptions, higher input costs or logistics bottlenecks are red flags.

- Macro data surprise: If global manufacturing, trade‑volume or cap‑ex numbers fall below expectations, risk appetite may retreat.

For portfolios: It's worth revisiting sensitivity to trade shocks—especially in sectors like tech, industrials, chemicals, autos and materials. Diversification across geographies and supply chains may be more important than assumed.

(Sources: Reuters, Guardian, FT)

Comments (0)

No comments yet. Be the first to comment!