Dow Breaks 47,000, Record Highs on Cooling Inflation — Trump-Xi Summit Ahead

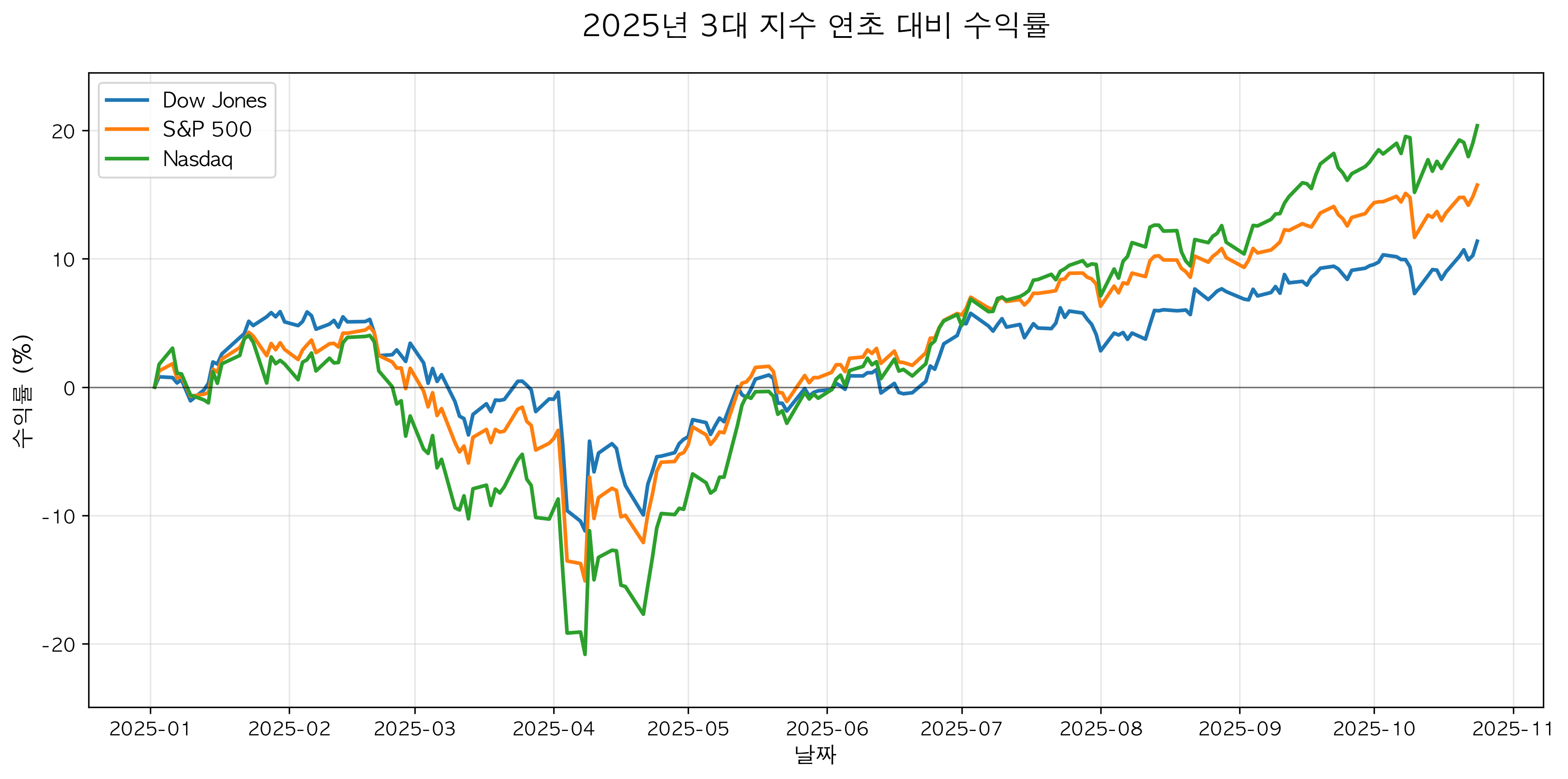

US markets hit all-time highs on October 25, 2025, as a powerful rally continued. The Dow Jones Industrial Average broke through 47,000 for the first time ever, while the S&P 500 and Nasdaq also climbed to record levels, fueling investor optimism.

The rally was driven by two key catalysts: lower-than-expected inflation data and news of an upcoming Trump-Xi summit. Expectations that the Fed will continue cutting rates, combined with signs of easing US-China trade tensions, provided strong momentum for the market.

📊 5 Key News Stories

1. Major Indices Hit All-Time Highs

The Dow Jones broke through 47,000 for the first time in history, rising 472.51 points (1.01%) to close at 47,207.12. The S&P 500 and Nasdaq also posted record highs.

Index Performance:

- Dow Jones: +1.01% → 47,207.12

- S&P 500: Record high

- Nasdaq: Record high

Chart: 2025 year-to-date returns for 3 major indices — Dow, S&P 500, and Nasdaq all showing strength

Chart: 2025 year-to-date returns for 3 major indices — Dow, S&P 500, and Nasdaq all showing strength

Implications: US equity markets have maintained a solid uptrend throughout 2025, with the rally particularly concentrated in large-cap stocks. Breaking through Dow 47,000 represents an important psychological milestone.

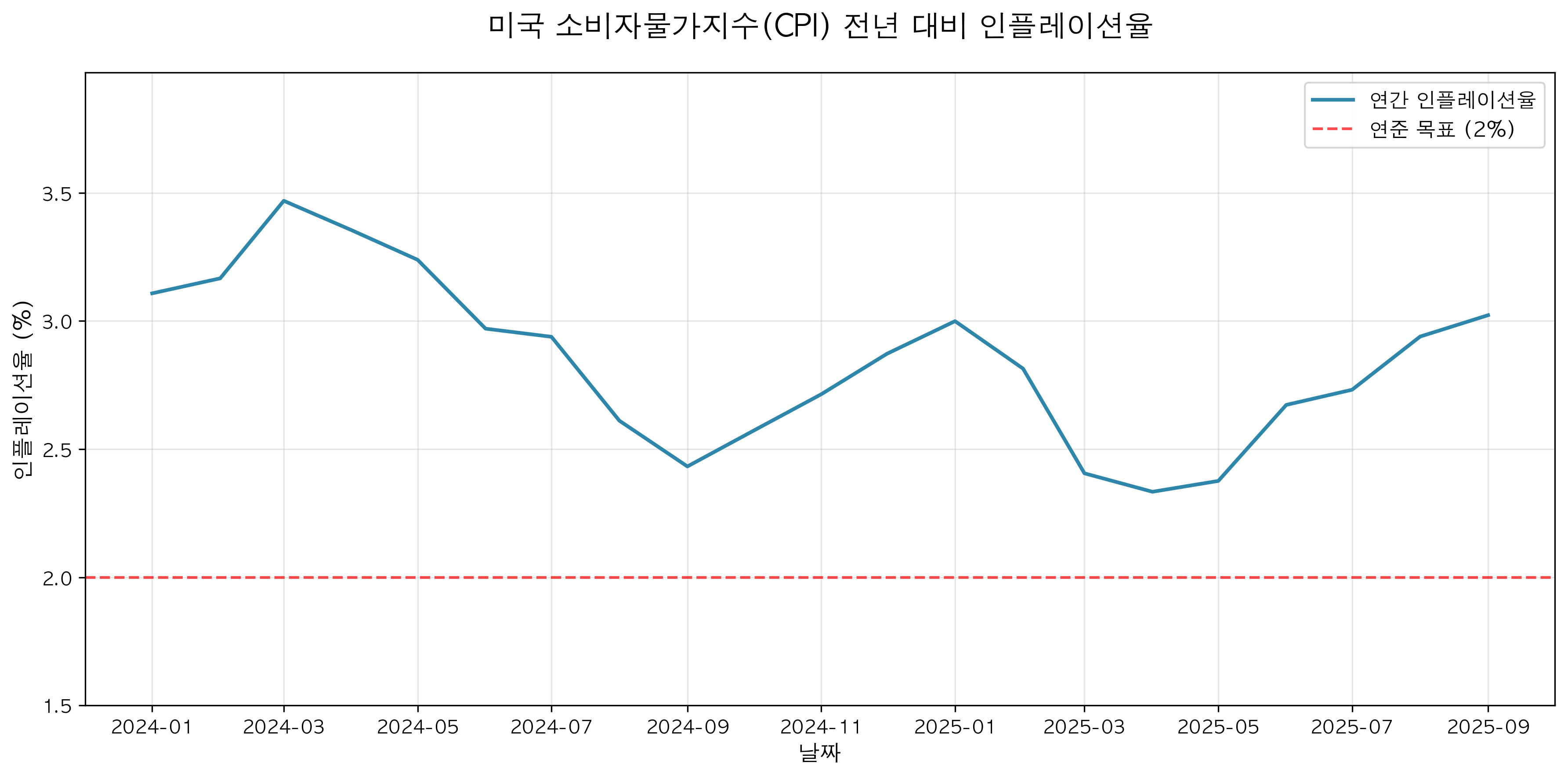

2. Lower-Than-Expected Inflation Data

The September Consumer Price Index (CPI), delayed by the government shutdown, came in below expectations:

- Monthly CPI: +0.3% (expected 0.4%)

- Annual Inflation Rate: 3.0% (expected 3.1%)

This raised expectations that the Fed will continue its rate-cutting trajectory.

Chart: US Consumer Price Index (CPI) year-over-year inflation rate — trending toward the Fed's 2% target

Chart: US Consumer Price Index (CPI) year-over-year inflation rate — trending toward the Fed's 2% target

Implications: Inflation is gradually cooling toward the 2% target. This gives the Fed room to continue cutting rates, creating a favorable environment for equities.

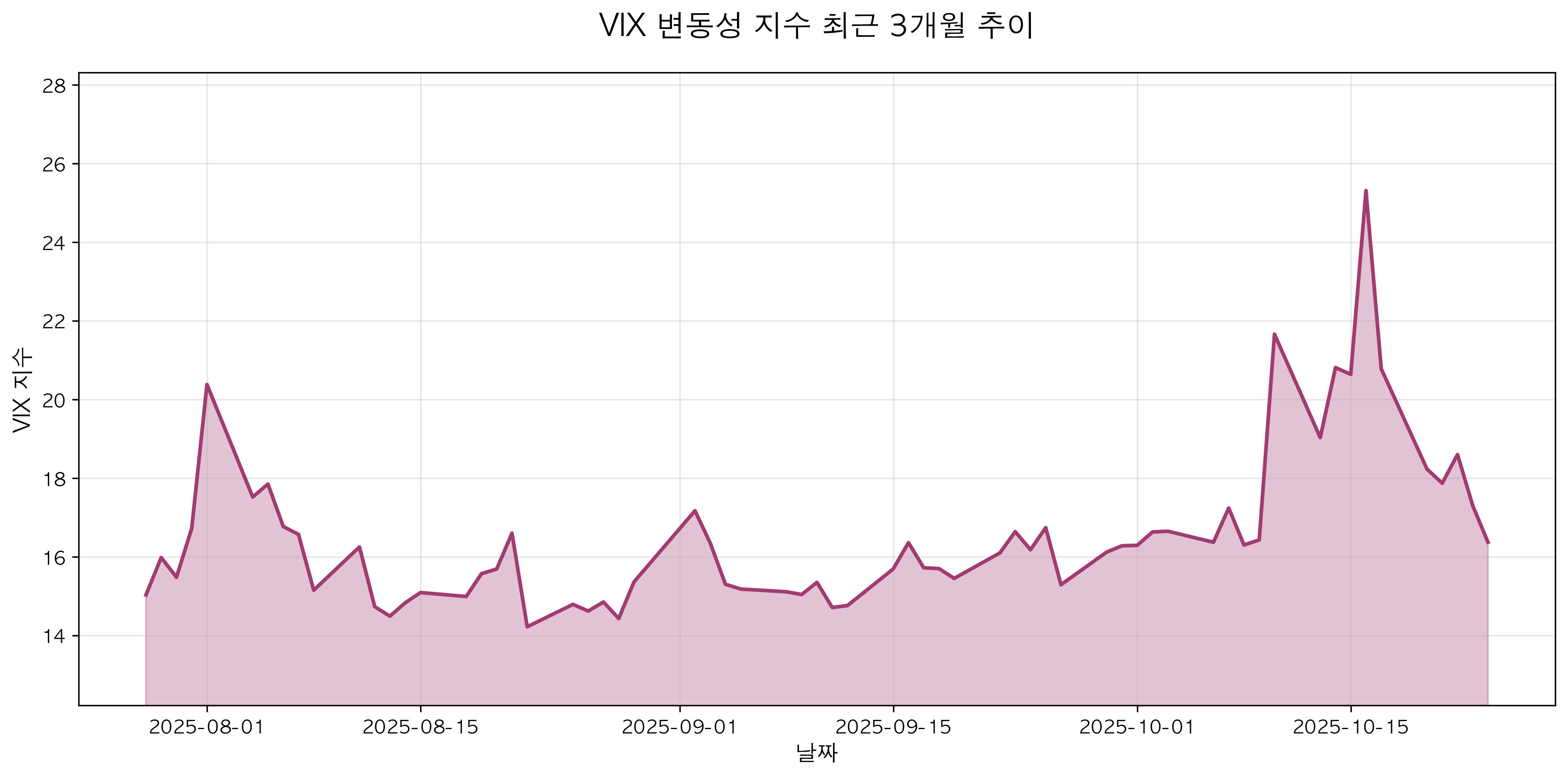

3. Trump-Xi Summit Scheduled

The White House announced that President Trump and Chinese President Xi Jinping will hold a bilateral meeting in South Korea on October 30. This is being interpreted as a sign of easing US-China trade tensions, significantly improving investor sentiment.

Chart: VIX volatility index over the past 3 months — market anxiety declining on easing trade tensions

Chart: VIX volatility index over the past 3 months — market anxiety declining on easing trade tensions

Implications: The VIX (fear gauge) is trending lower as market anxiety subsides. If the summit is successful, it could positively impact global trade and supply chains.

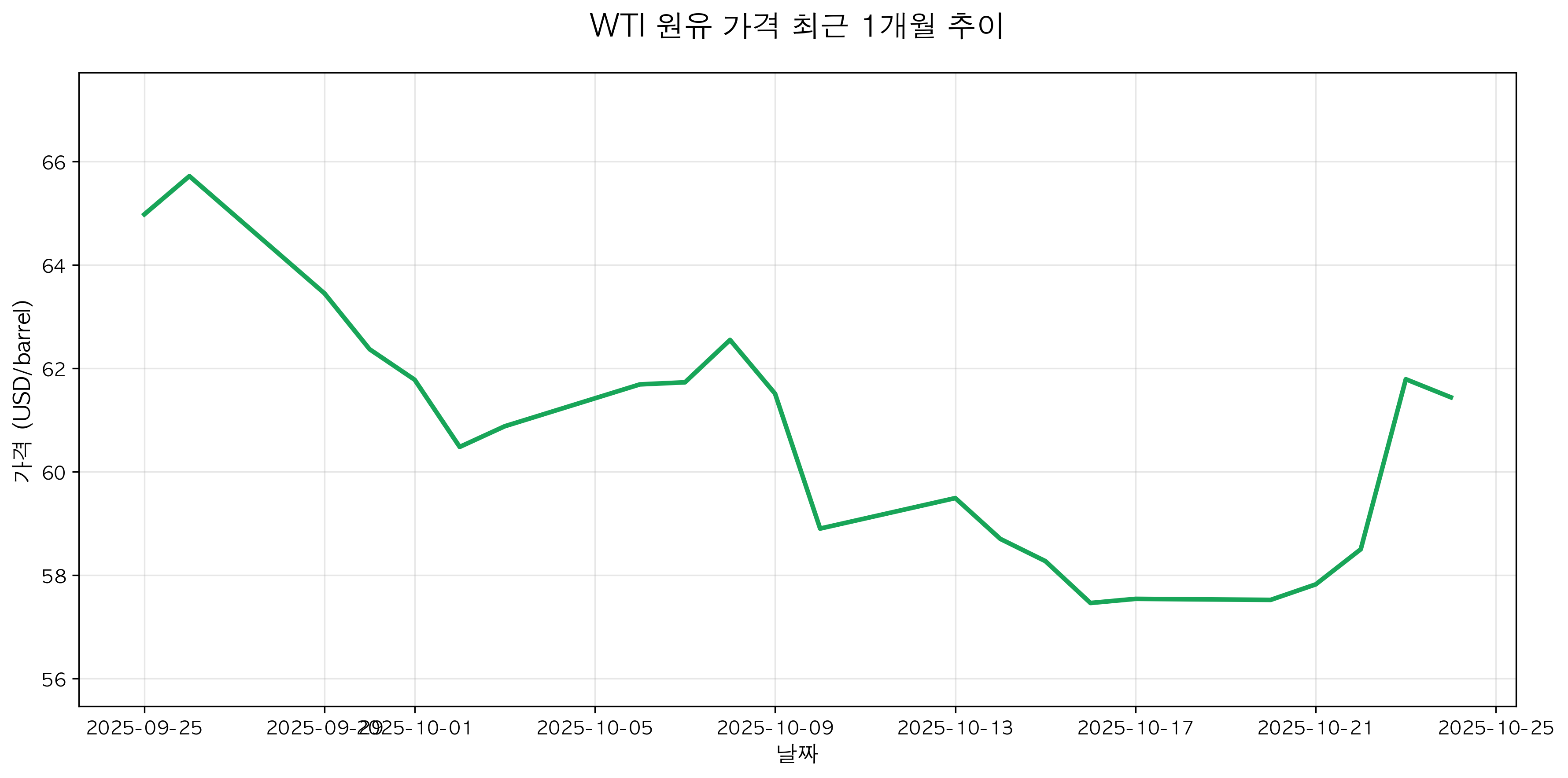

4. Russia Oil Sanctions Intensified

The Trump administration imposed additional sanctions on Russia's two largest oil companies (Rosneft and Lukoil) to push for an end to the war. This caused international oil prices to surge, boosting energy sector stocks.

Chart: WTI crude oil price over the past month — spiking on intensified Russia sanctions

Chart: WTI crude oil price over the past month — spiking on intensified Russia sanctions

Implications: The energy sector benefited from the sanctions in the short term. However, rising oil prices could add inflationary pressure and potentially impact Fed policy.

5. Strong Earnings Season

More than three-quarters of S&P 500 companies reporting Q3 earnings beat expectations. Investors are now focused on Big Tech earnings reports scheduled for this week.

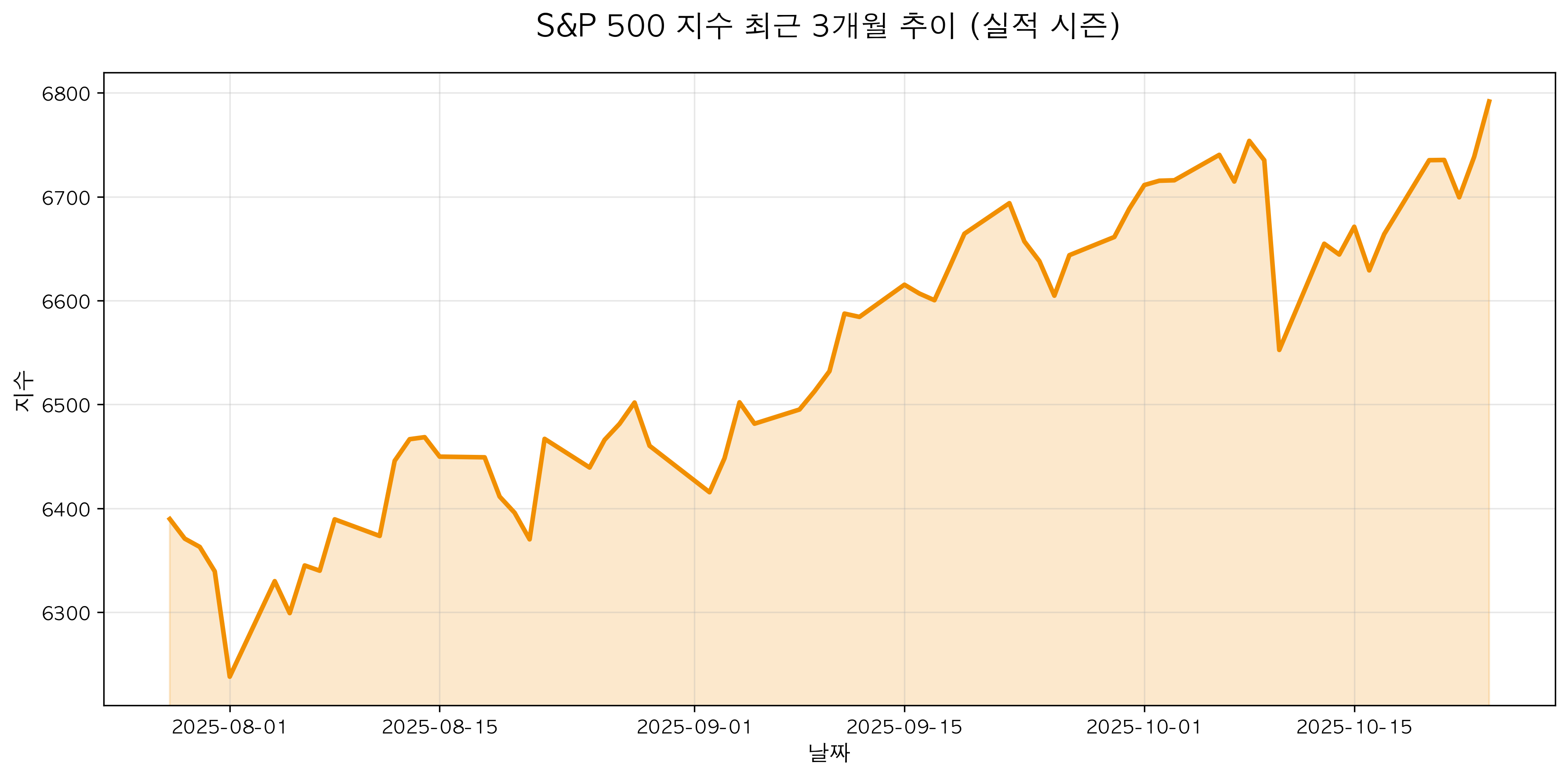

Chart: S&P 500 index over the past 3 months — strength continues after earnings season began

Chart: S&P 500 index over the past 3 months — strength continues after earnings season began

Implications: Strong corporate earnings justify stock market valuations. If Big Tech meets expectations, it could provide additional upward momentum.

💡 What Investors Should Watch

1. Rate Cut Expectations vs. Oil Price Risk

While cooling inflation has boosted rate cut expectations, rising oil prices from Russia sanctions pose an inflation re-acceleration risk. Energy price trends must be closely monitored.

2. Trump-Xi Summit Outcome

The results of the October 30 Trump-Xi meeting will be a key variable determining global market direction. Watch for tariff relief and trade agreement progress.

3. Big Tech Earnings Reports

Big Tech earnings scheduled for this week will determine the market's next direction. Key metrics: AI investment returns, cloud growth rates, and profitability improvements.

4. Significance of Dow Breaking 47,000

Breaking psychological resistance can signal additional upward momentum, but it also raises overheating concerns. Valuation checks are needed.

🎯 Sector Outlook

🟢 Strong Sectors

- Energy: Benefiting from oil price surge due to Russia sanctions

- Financials: Resilient despite rate cuts, improving on strong earnings

- Technology: Optimism ahead of Big Tech earnings

🔴 Cautionary Sectors

- Utilities: Benefit from rate cuts but face valuation pressure

- Real Estate: Potential correction after excessive gains

📌 Conclusion: Manage Risks Amid Optimism

October 25, 2025 marked a historic moment as US markets witnessed the Dow breaking through 47,000. Low inflation, rate cut expectations, Trump-Xi summit anticipation, and strong corporate earnings created powerful synergy for a strong rally.

However, investors must guard against excessive optimism:

- Inflation re-acceleration risk from rising oil prices

- Potential Big Tech earnings disappointments

- Uncertainty around Trump-Xi summit outcomes

- Valuation overheating concerns

Smart investors enjoy optimism while maintaining risk management. Prepare for volatility through sector diversification, valuation checks, and news monitoring.

This news analysis is based on data as of October 25, 2025. Investment decisions should be made at your own discretion and responsibility.

Comments (0)

No comments yet. Be the first to comment!