Bank Earnings Strength Lifts Risk Assets — But Liquidity Strain Warning Emerges

Introduction Global markets saw bank earnings beats push risk assets (stocks) higher. However, money markets also showed signs of liquidity stress, creating uncertainty about future market direction.

Body Major U.S. banks reported third-quarter earnings that exceeded expectations in both revenue and net income. According to Reuters, Bank of America posted strong revenue, while Morgan Stanley delivered solid trading results. This drove financial sector indices higher and fueled broader market gains.

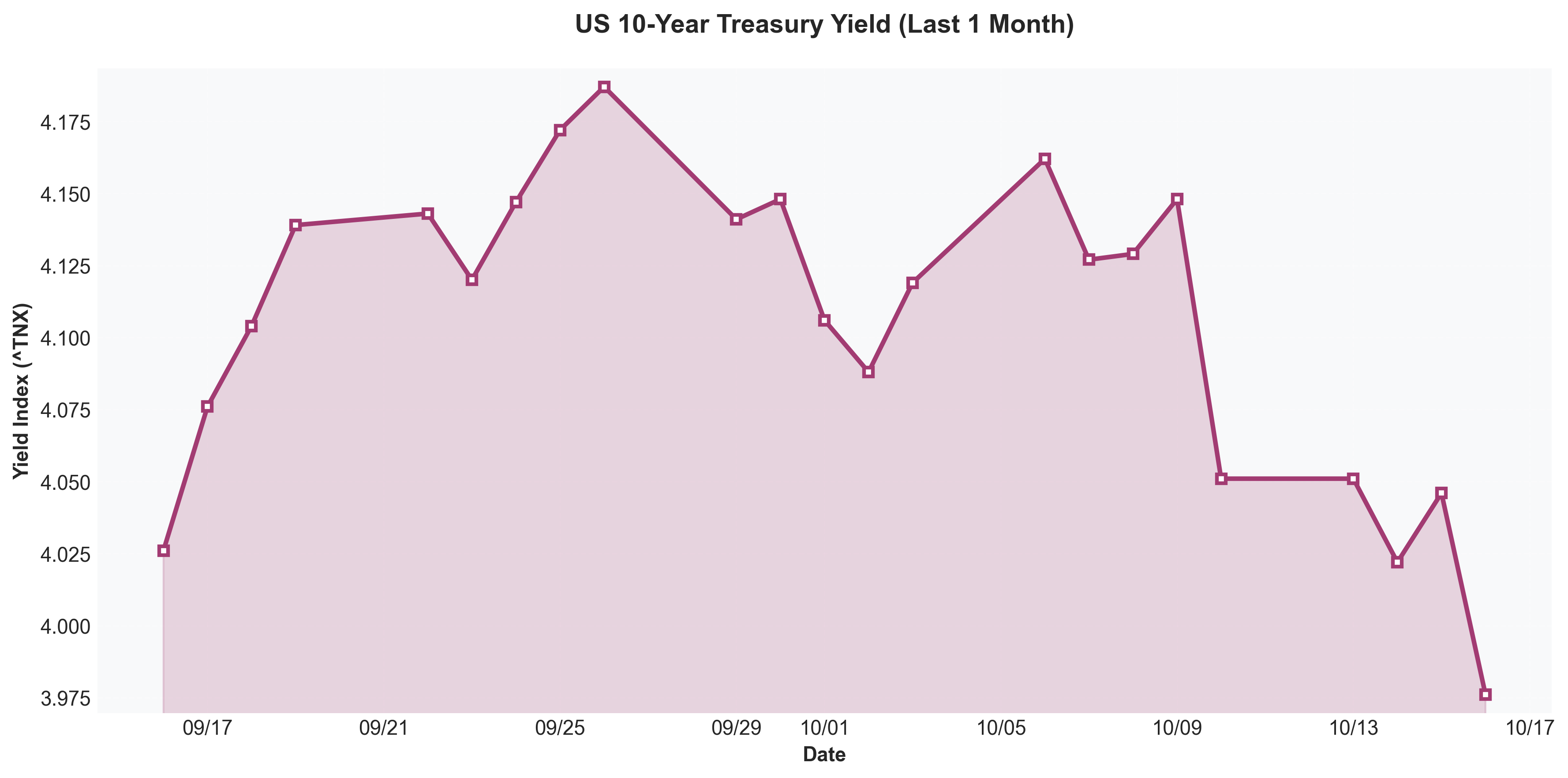

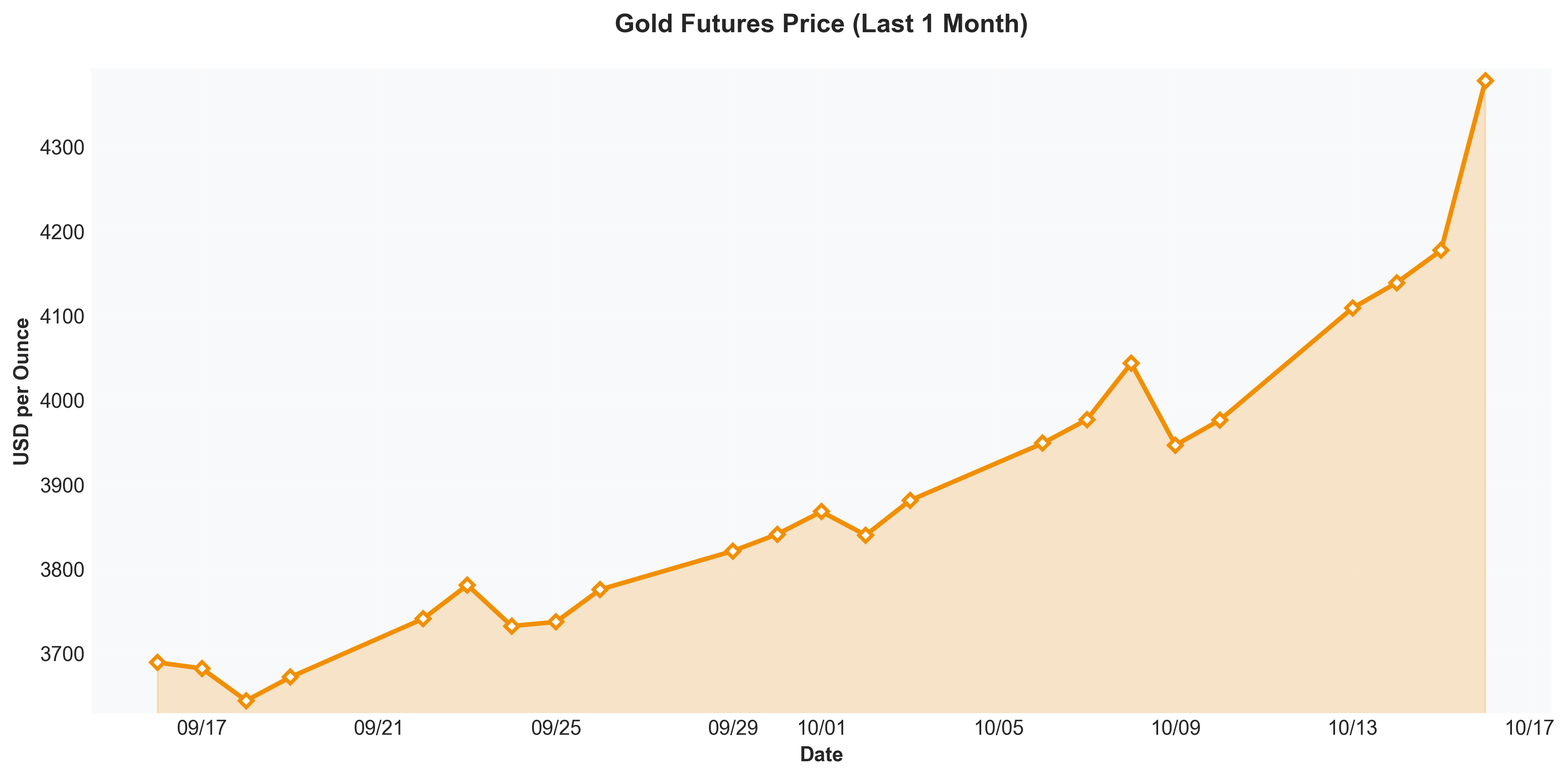

At the same time, markets are detecting liquidity stress signals. Reuters reported a "risk on" flow with stocks and bonds moving together, while bonds and gold continued to act as safe havens in a mixed environment. Additionally, the U.S. government shutdown delayed key economic data releases, making policy decisions more ambiguous.

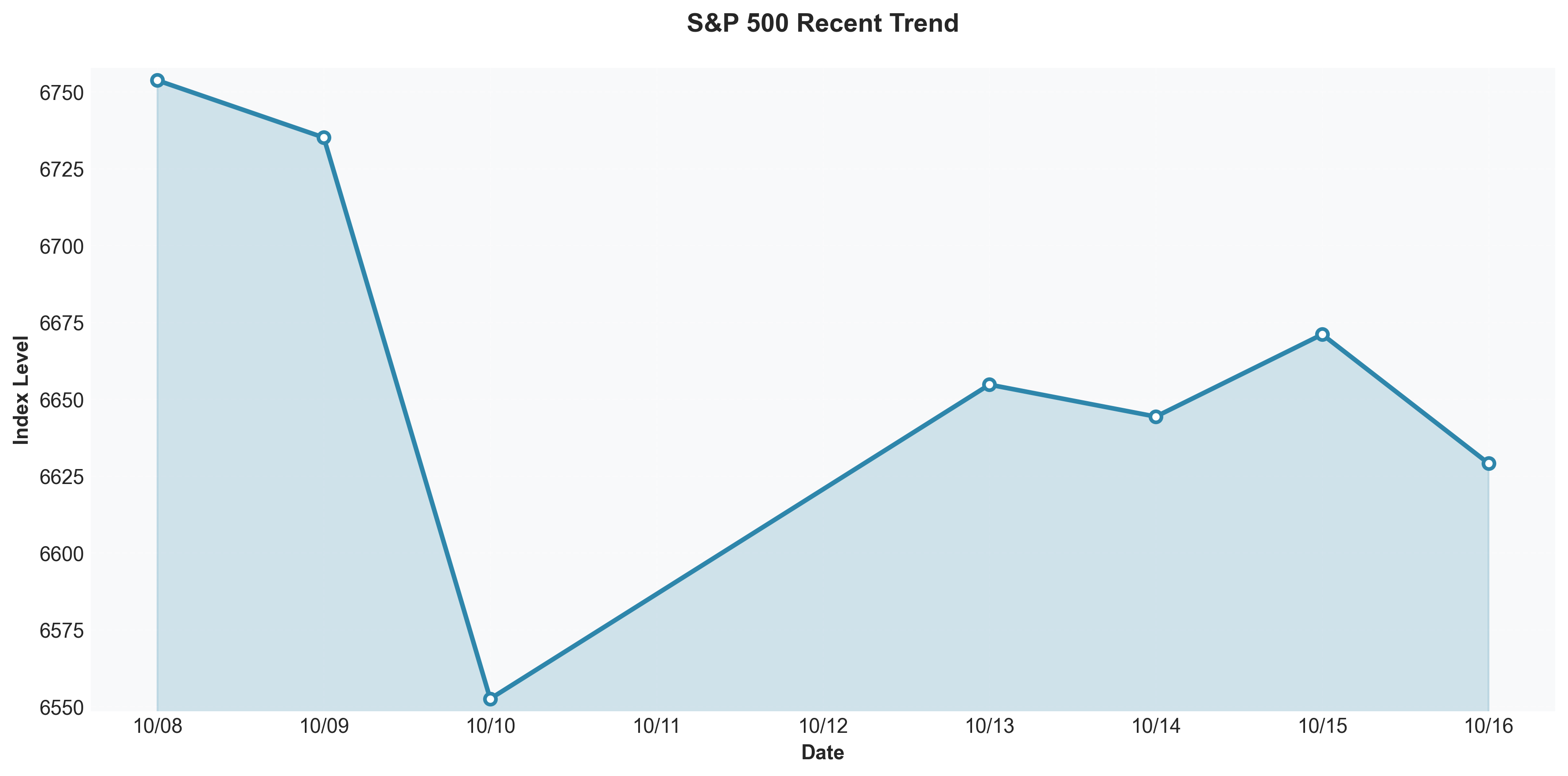

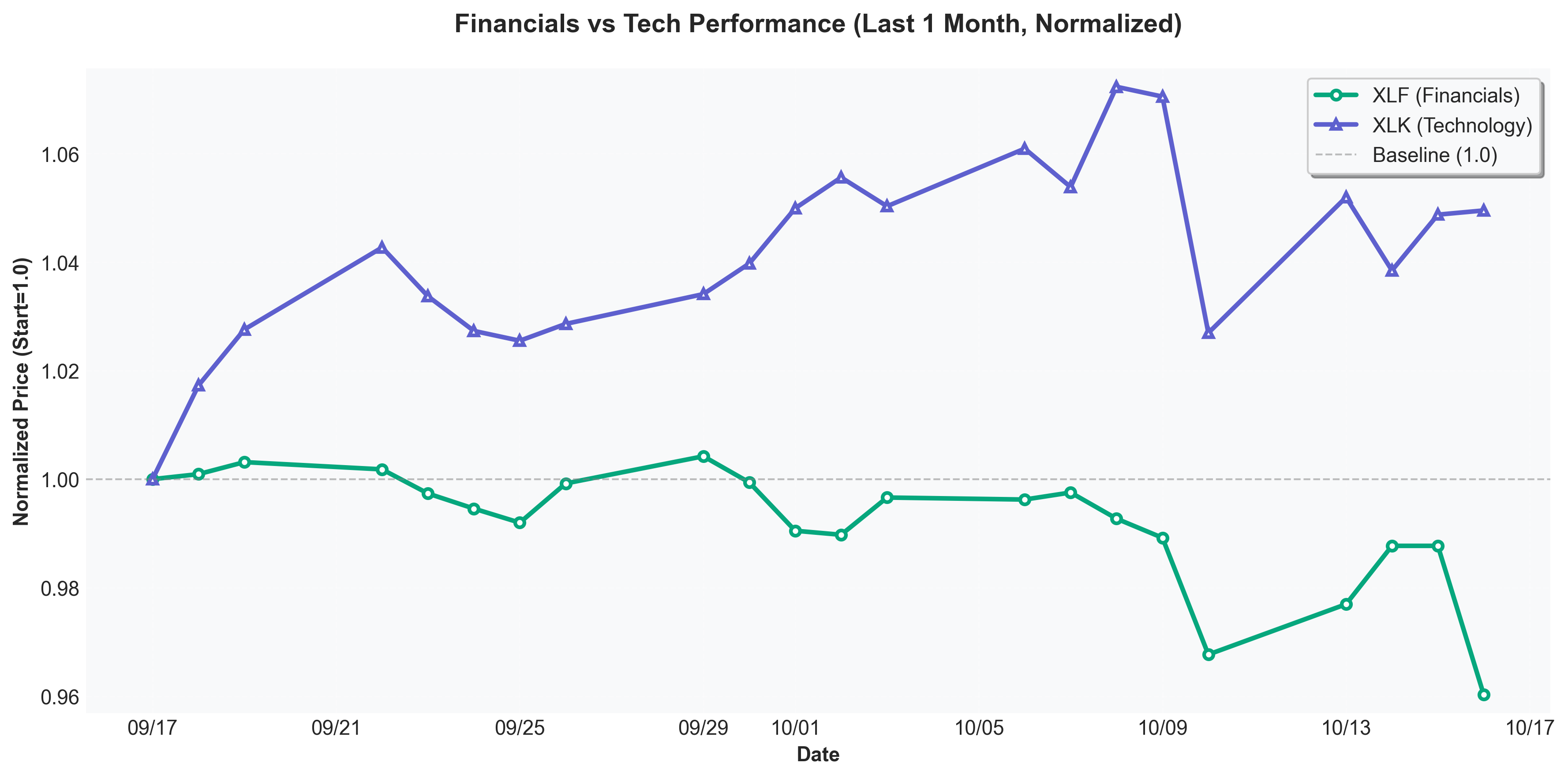

For example, the S&P 500 and Nasdaq rebounded on bank earnings optimism and rate cut expectations, with tech stocks leading the momentum. Meanwhile, bond yields fluctuated, reflecting the uncertain atmosphere.

The charts below visualize these trends.

Caption: S&P 500 daily close trend — showing partial rebound following bank earnings releases.

Caption: S&P 500 daily close trend — showing partial rebound following bank earnings releases.

Caption: U.S. 10-year Treasury yield (last 1 month) — a key variable reflecting both liquidity stress and discount rates.

Caption: U.S. 10-year Treasury yield (last 1 month) — a key variable reflecting both liquidity stress and discount rates.

Caption: Gold futures (last 1 month) — showing whether safe-haven demand persists amid risk asset rallies.

Caption: Gold futures (last 1 month) — showing whether safe-haven demand persists amid risk asset rallies.

Caption: Financials (XLF) vs Technology (XLK) sector returns (last 1 month, normalized) — comparing whether the rebound is earnings-driven or momentum-driven.

Caption: Financials (XLF) vs Technology (XLK) sector returns (last 1 month, normalized) — comparing whether the rebound is earnings-driven or momentum-driven.

Analysis Several factors explain these market dynamics:

-

Earnings Uncertainty Resolution Financials were considered a wildcard. If banks had disappointed, it would have damaged overall market confidence. Instead, better-than-expected results boosted investor sentiment.

-

Liquidity Stress Beneath the Surface Despite earnings-driven gains, warnings emerged about declining market liquidity. Without this supporting fuel, momentum may be difficult to sustain. (Watch bond yields and dollar volatility closely.)

-

Data Vacuum Expands Uncertainty The U.S. government shutdown delayed major economic data releases, making it harder for markets to respond based on actual data. This forces markets to rely more on sentiment than fundamentals.

-

Risk Assets vs Safe Havens Conflict Even on days when stocks rise, gold and treasuries sometimes move higher or show volatility, suggesting investors are hedging against uncertainty.

Implications This environment offers several takeaways for investors:

-

Balance Check Required Rather than simply chasing gains, be aware that sharp rallies in low-liquidity environments can reverse quickly.

-

Policy Risk vs Market Response Gap Fed and Treasury commentary, shutdown resolution, and fiscal stimulus remain key variables that could drive price action.

-

Defense Over Returns At this juncture, defensive portfolios (e.g., partial cash positions, quality stock focus) may be more advantageous than aggressive positioning.

-

Momentum Sustainability Verification This rebound is backed by tech/AI momentum. Whether it broadens to other sectors matters.

-

Prepare for Corrections If a pullback occurs, strategies targeting support levels or moving average zones could prove useful.

In conclusion, this rally reflects a combination of earnings optimism and tech momentum. However, liquidity pressures and policy uncertainty remain risks that could strike unexpectedly. Investors should ride the trend while maintaining vigilance.

(Sources: Reuters, Bloomberg, AP)

Comments (0)

No comments yet. Be the first to comment!