AI Theme Stocks Overheating? — 5 Things to Check "When Expectations Run Ahead of Earnings"

This article is for informational purposes only and does not constitute investment advice.

When you look at the market these days, the expectation that 'AI will change everything' is deeply embedded in prices. The problem is that when expectations run too far ahead, even small disappointments can trigger sharp reversals. Below is a 3-minute guide that validates this logic with data and outlines key checkpoints for investors.

Today's Headlines (2025-10-13, KST) • BoE (Bank of England) FPC warns: "Sharp correction possible if AI expectations or Fed independence trust wavers" (10/08, local time) • IMF cautions: "Valuations approaching levels similar to dot-com era" (10/12, local time) • (Context) Rising US-China tech/trade uncertainties, concerns over heightened volatility in mega-cap tech stocks

1) Why Are Warnings Growing Now?

The Bank of England's FPC warned that "if AI expectations fade or doubts arise about Fed independence, a sharp correction could follow." In other words, optimism is already priced in, making the market vulnerable to even small psychological shifts. The IMF also cautioned that recent stock price surges are approaching valuation levels similar to the dot-com era. Logic chain: Expectations↑ → Prices↑ → Expectation wobble = Amplified downside.

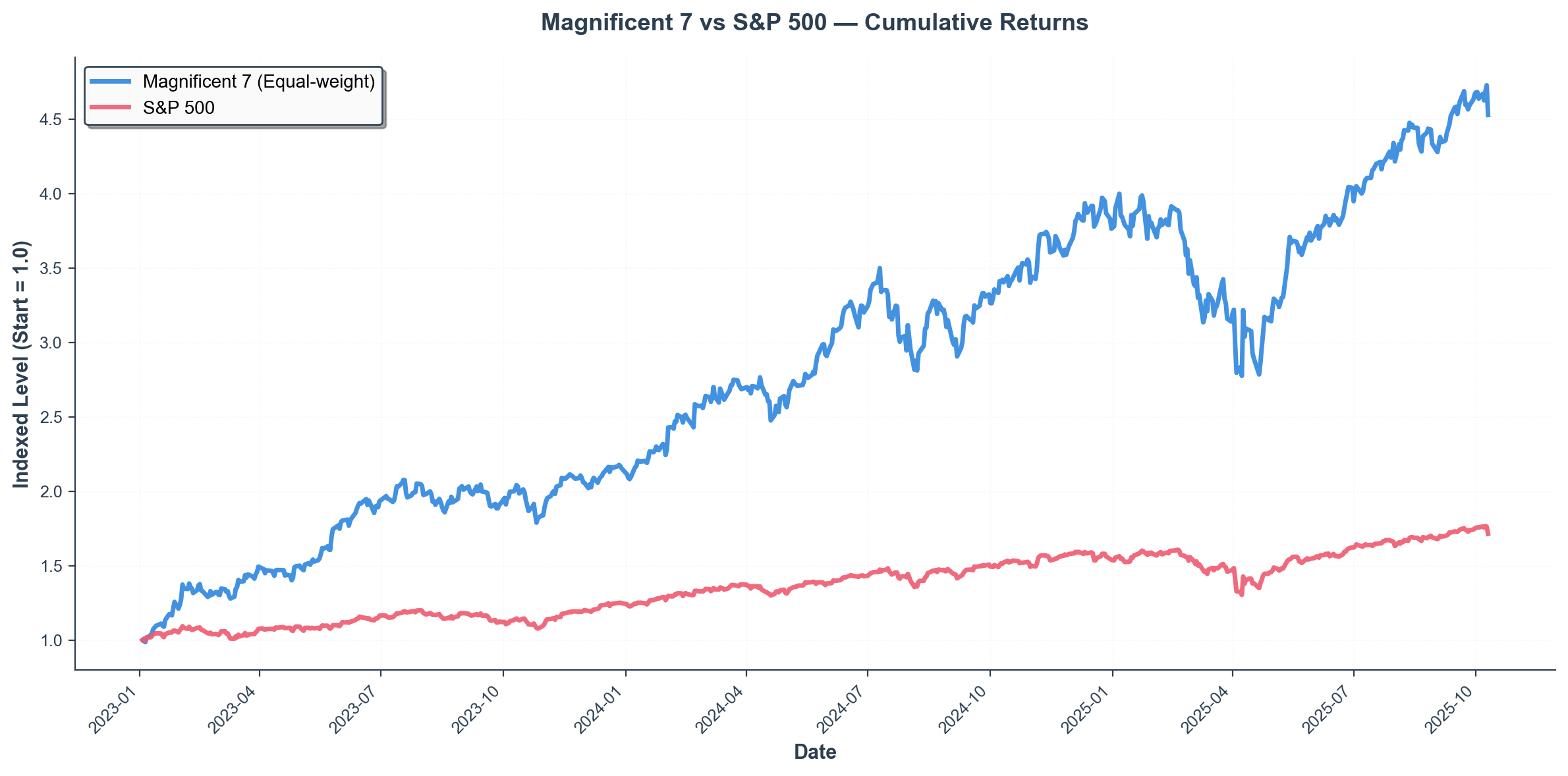

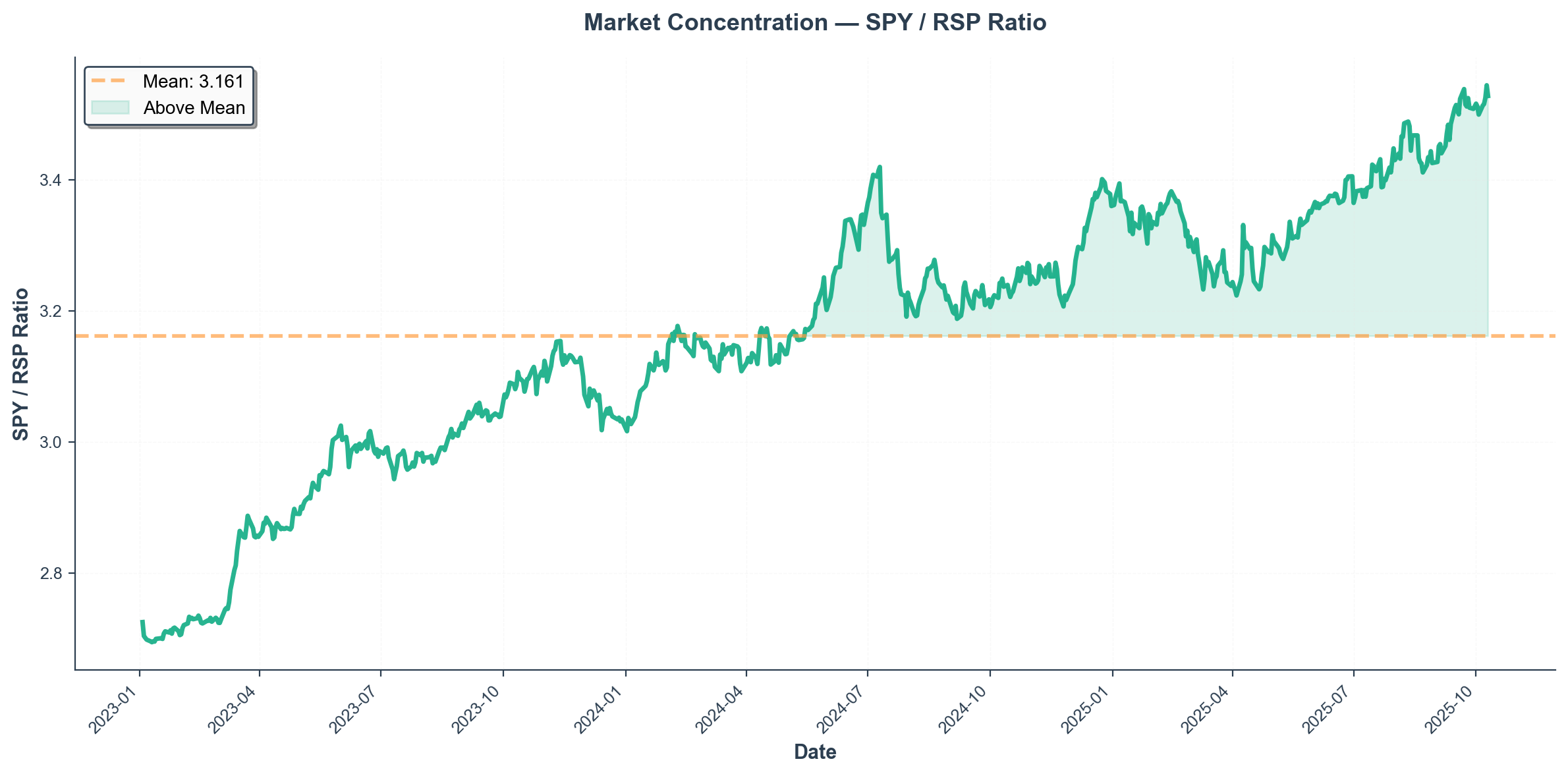

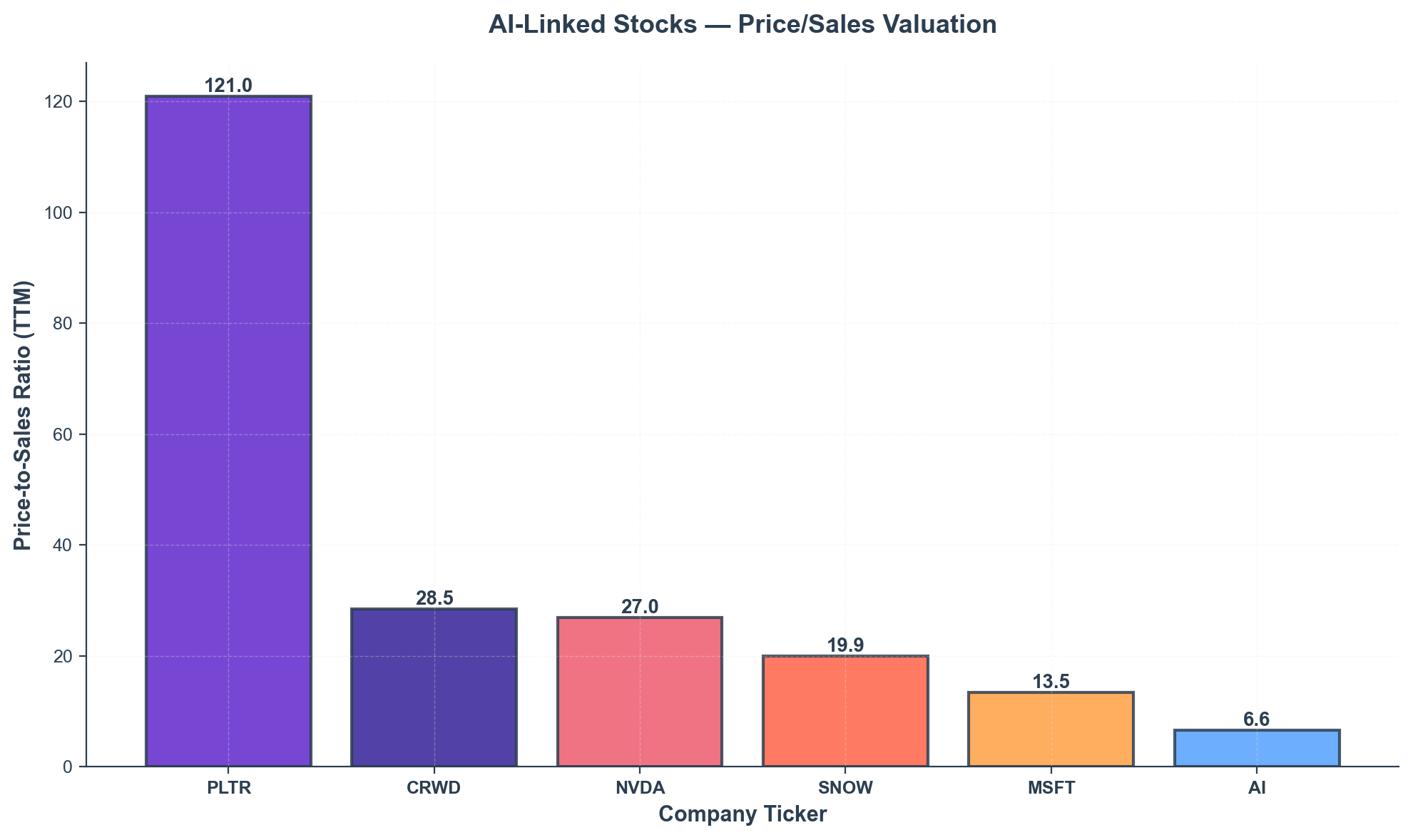

2) "Expensive and Concentrated" — Structural Vulnerability

The top 10 stocks in the S&P 500 now account for roughly 37% of the index, near historic highs. With a structure where a handful of stocks drive the entire index, one or two disappointing headlines can ripple across the entire market. Moreover, the higher the multiples (especially P/S and P/E), the faster multiple compression (= price correction) occurs if earnings don't materialize on time. Logic chain: Concentration↑ + High valuation↑ → Sensitivity to expectation misses↑.

3) ROI Reality — "Many Pilots, But Few Making Money"

According to corporate surveys, only a minority of companies are generating 'AI value at scale', while most have yet to clearly reflect it in their P&L. The common thread among successful companies is that they've simultaneously strengthened their operational framework: data quality, security, processes, and upskilling. Logic chain: Delayed cash flow proof → Weak 'foundation' to support high expectations.

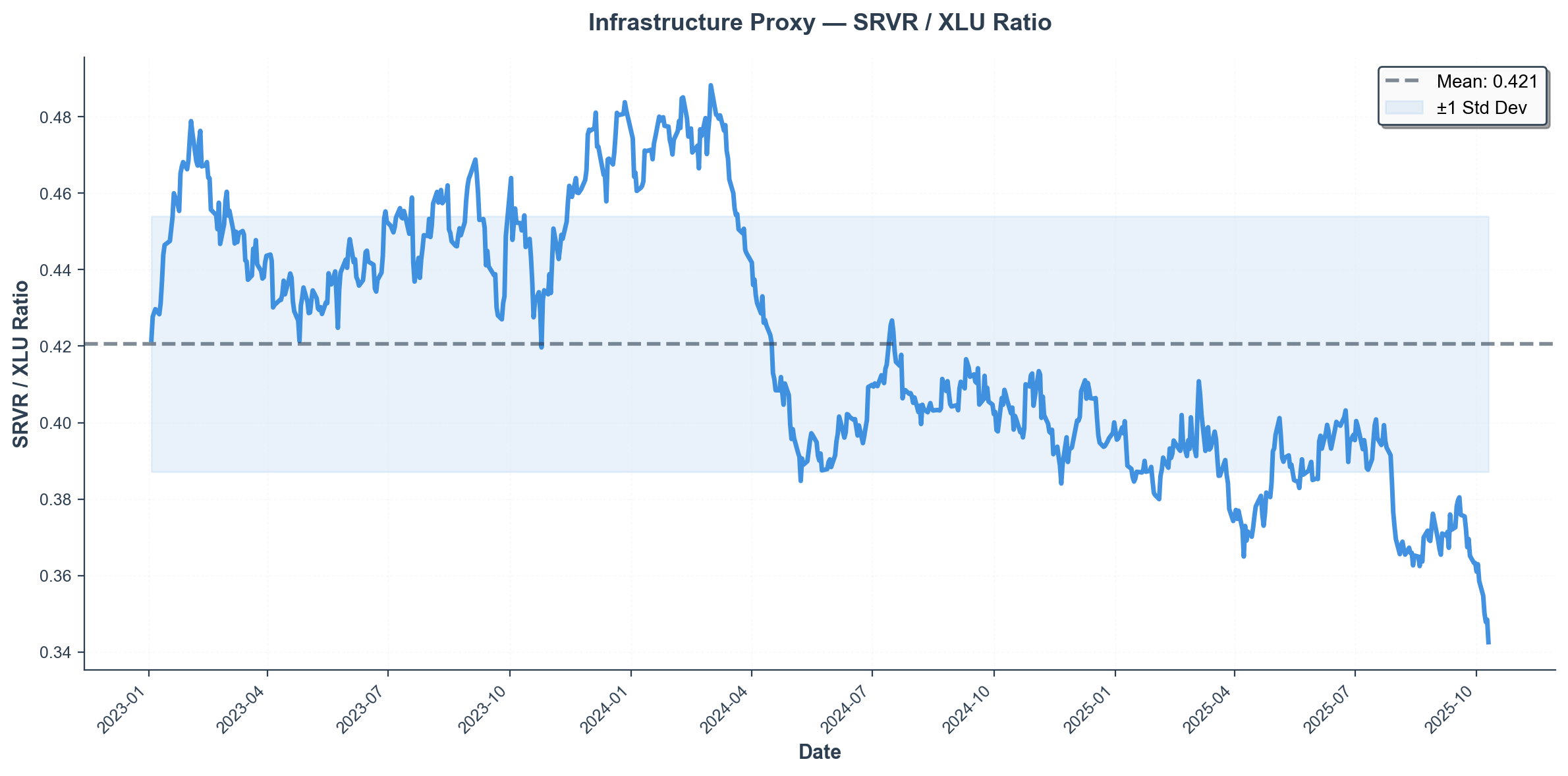

4) Infrastructure Bottlenecks — Power & Data Centers Determine the Pace

The IEA forecasts that data center power demand could more than double by 2030. Even if technology races ahead, delays in power, land, and transmission infrastructure can slow deployment and monetization speeds, leading to delays in the earnings needed to justify valuations. Logic chain: Infrastructure bottleneck → Execution delay → Gap between expectations and reality widens.

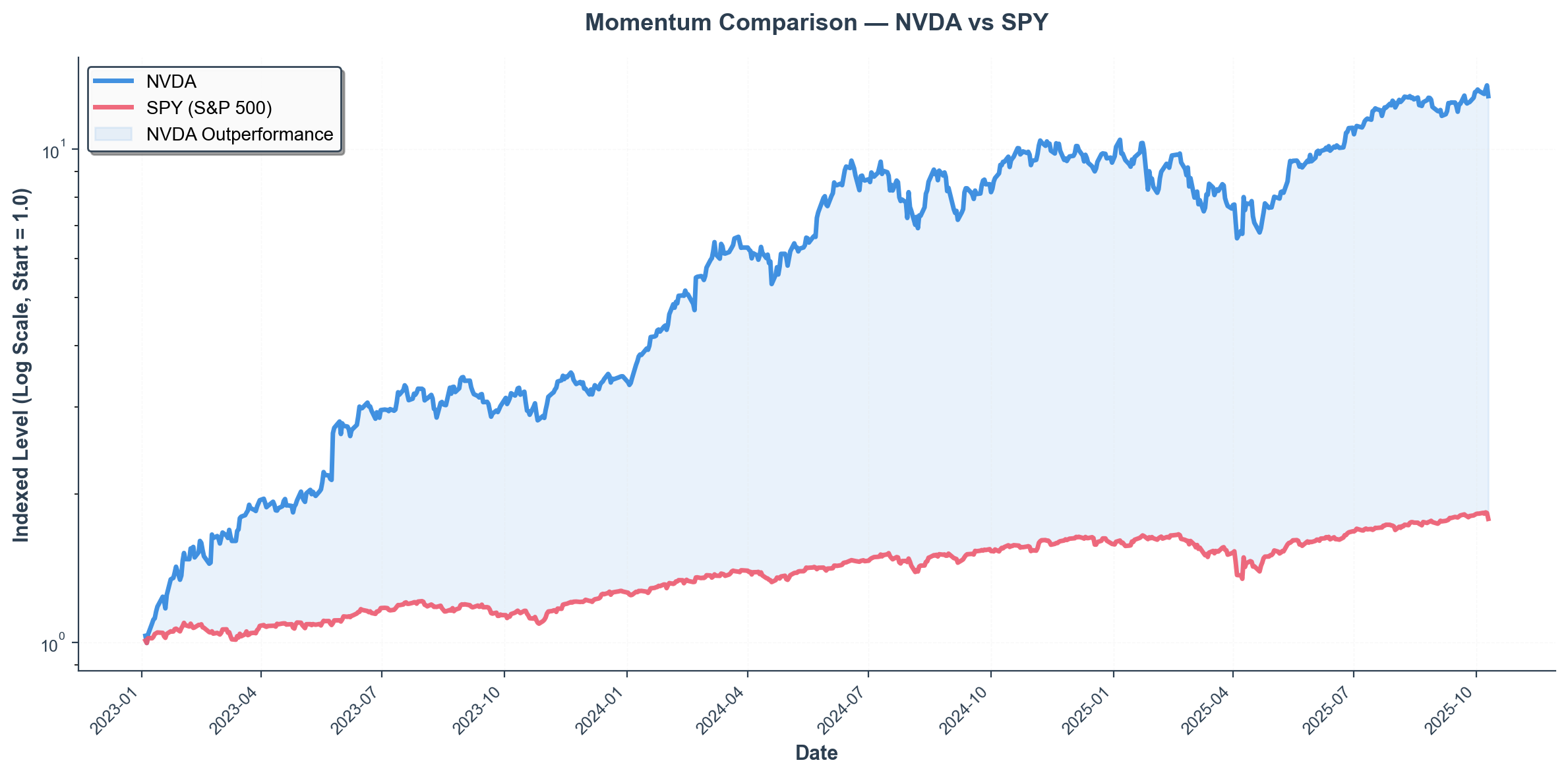

5) Sentiment and Momentum — Chasing on the Way Up, Fleeing on the Way Down

Momentum-driven markets attract chase-buying during uptrends, but when declines begin, exits tend to accelerate. With the market currently concentrated in a few mega-caps, small triggers like earnings misses, regulation, or policy variables can trigger cascading risk-off flows. (The BoE's 'sharp correction' scenario targets this psychology.)

Investor Checklist (Quick Version)

- Guidance vs Multiple: Does the forward revenue/earnings trajectory justify current multiples?

- Concentration Risk: Is your portfolio excessively tilted toward a few mega-caps?

- Infrastructure & Policy Calendar: Track the execution timeline for power/data center expansion and regulation/subsidies.

Data: Yahoo Finance (yfinance); Example period 2023-01-01~today. Actual figures and coverage may vary depending on data provider policies.

Comments (0)

No comments yet. Be the first to comment!