U.S. Stock Market November 24, 2025: AI Bubble Concerns and Healthcare's Rise

Introduction: A Turning Point in Market Paradigm

The third week of November 2025 witnessed dramatic shifts in U.S. stock markets. NVIDIA's better-than-expected earnings paradoxically triggered a stock decline, while confusion surrounding the Federal Reserve's rate policy amplified market volatility. Meanwhile, pharmaceutical giant Eli Lilly broke through the historic $1 trillion market capitalization milestone, signaling new possibilities for the healthcare sector.

This week's market movements represent more than temporary fluctuations—they signal a paradigm shift among investors. We're witnessing signs of a full-fledged sector rotation: "from growth to value," "from tech to healthcare."

1. AI Bubble Warning Signs: NVIDIA's Paradoxical Stock Decline

When Good Earnings Become a Liability

On November 20, NVIDIA announced its Q3 2025 earnings. Both revenue and net income far exceeded market expectations—a stellar performance by any measure. Yet the market's response was unforgiving. Following the announcement, NVIDIA's stock dropped 3%, and the NASDAQ plunged 2%.

The core of this "paradoxical phenomenon" lies in valuation burden and doubts about future growth. Investors are now asking a fundamental question: "Can the massive investments in AI infrastructure actually translate into profits?"

Data Evidence: Parallel Decline of AI Stocks

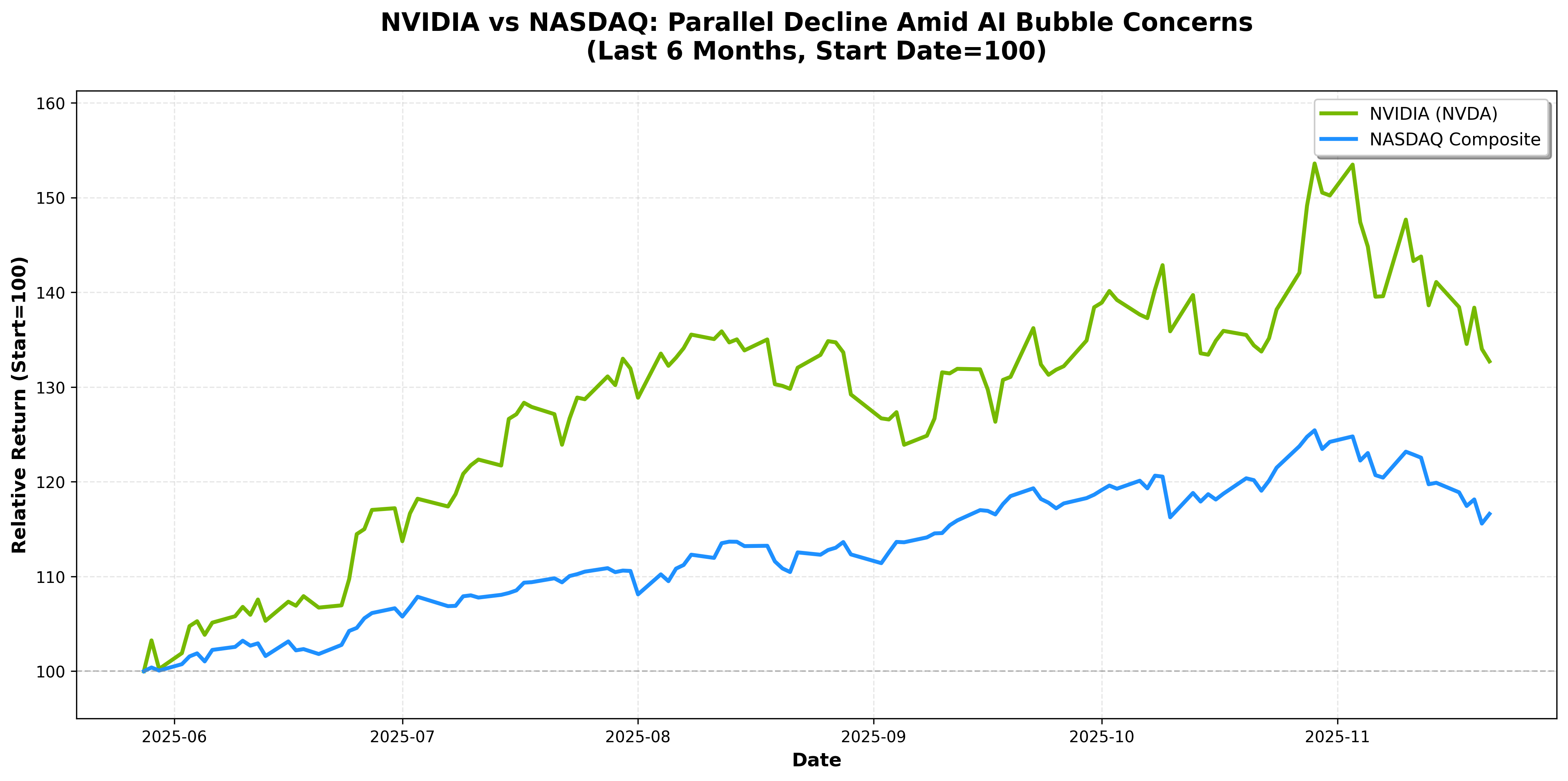

The chart below compares the movements of NVIDIA and the NASDAQ index over the past six months. Notably, both indicators show a clear downward trend beginning in November.

Chart 1: NVIDIA and NASDAQ Index Performance Comparison (Last 6 Months, Start Date=100)

Chart 1: NVIDIA and NASDAQ Index Performance Comparison (Last 6 Months, Start Date=100)

As the chart reveals, NVIDIA showed strong outperformance versus the NASDAQ through the summer, but this upward momentum weakened in autumn. In November, it declined alongside the NASDAQ, suggesting widespread concerns about AI-related stocks across the board.

Lessons for Investors

The old market adage "Buy the rumor, sell the news" has once again proven true. The strong earnings were already priced into the stock, and when investors failed to identify "the next growth catalyst," they took profits.

After two years of explosive growth in AI stocks, excessive expectations have formed. Now the market is beginning to more soberly evaluate actual profitability. While this can be viewed as a healthy market correction, it also signals that near-term volatility in the AI sector will persist.

2. The Fed's Tightrope Walk: Volatile Rate Cut Expectations

John Williams' Remarks Flip the Market

On November 21, New York Federal Reserve President John Williams stated in a press conference that "monetary policy remains somewhat restrictive, and there is room for rate cuts in the near term." The market reacted instantly to this single comment. The probability of a December rate cut surged from 39% before the remarks to 75% afterward, and major indices rebounded, partially recovering previous day losses.

However, on a weekly basis, the S&P 500 still recorded a -1.9% loss and the NASDAQ -2.7%. This demonstrates that a single day's positive news cannot reverse the overall downward trend.

Policy Uncertainty and Market Volatility

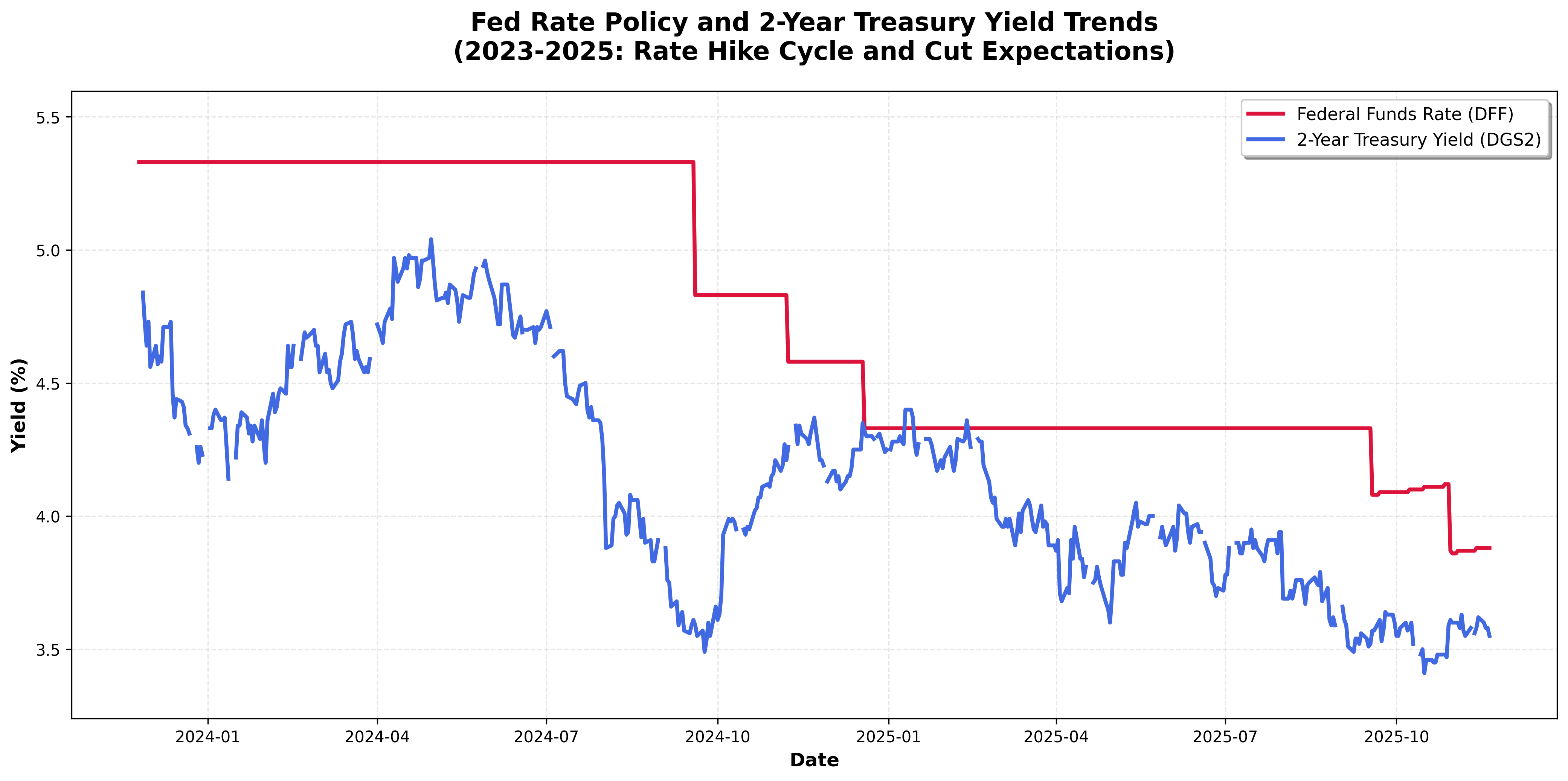

The chart below shows the trends in the Federal Funds Rate (DFF) and 2-Year Treasury Yield (DGS2) over the past two years. We can see that after the rate hike cycle that began in 2023 reached its peak, rate cut expectations have been forming in 2025.

Chart 2: Federal Funds Rate and 2-Year Treasury Yield Trends (2023-2025)

Chart 2: Federal Funds Rate and 2-Year Treasury Yield Trends (2023-2025)

The key point in the chart is the timing of President Williams' November 21 remarks (green dashed line). Around this point, the 2-year Treasury yield turned downward, indicating the market rapidly incorporated rate cut expectations.

Incomplete Data, Difficult Policy Decisions

The biggest challenge facing the Fed in November is incomplete economic indicators. With employment data releases delayed due to the government shutdown, the Fed faces a dilemma: making critical policy decisions with limited information.

Consequently, the market is extremely sensitive to every Fed official's comment, with rate cut probabilities nearly doubling in a single day—expanding volatility significantly. Investors are struggling to trust a "data-dependent Fed," suggesting that market uncertainty will persist for some time.

3. Healthcare's New Era: Eli Lilly Joins the $1 Trillion Club

First Pharmaceutical Company Achievement

On November 21, Eli Lilly surpassed $1 trillion in market capitalization, becoming the first pharmaceutical company to achieve this milestone. This represents a historic moment—the first healthcare company joining the "$1 trillion club" previously monopolized by tech giants.

The secret to Lilly's success is GLP-1 weight loss drugs. Sales of Zepbound (weight loss drug) and Mounjaro (diabetes drug) exploded by 109% and 184% respectively, positioning Lilly as the market leader ahead of competitor Novo Nordisk.

Evidence of Sector Rotation: Capital Flow to Healthcare

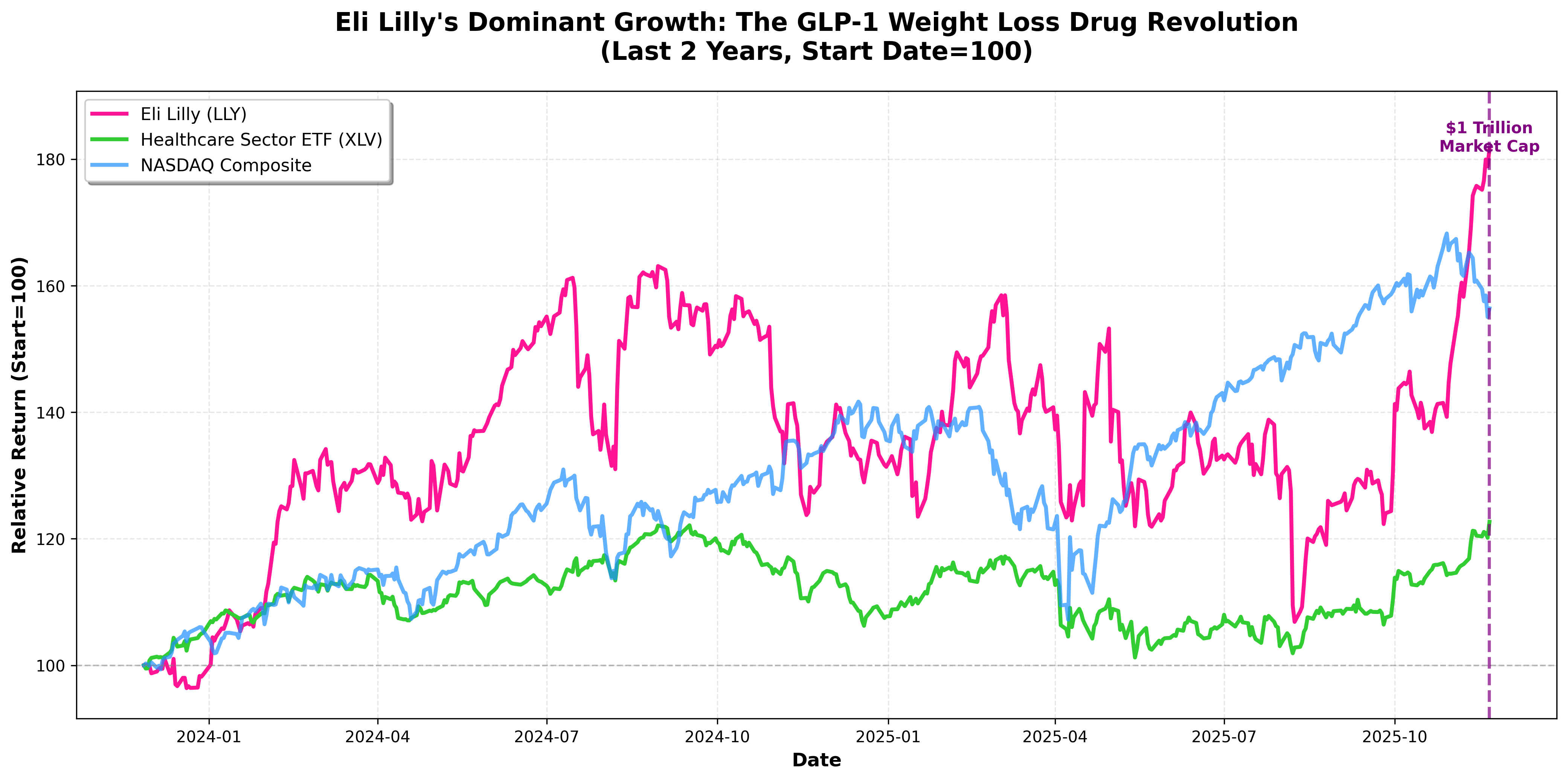

The chart below compares the performance of Eli Lilly, the Healthcare Sector ETF (XLV), and the NASDAQ index over the past two years. Lilly's dominant upward trend is striking.

Chart 3: Eli Lilly vs Healthcare Sector vs NASDAQ (Last 2 Years, Start Date=100)

Chart 3: Eli Lilly vs Healthcare Sector vs NASDAQ (Last 2 Years, Start Date=100)

As the chart demonstrates, Eli Lilly (pink line) has overwhelmingly outpaced both the overall healthcare sector (green line) and the NASDAQ (blue line) since 2023. Notably, the November 21 $1 trillion market cap milestone (purple dashed line) marks the peak of this upward trend.

A significant observation is that the Healthcare Sector ETF (XLV) has also shown solid performance compared to the NASDAQ. This suggests not just Lilly's exceptional performance, but a broader capital inflow into the healthcare sector overall.

The GLP-1 Revolution: Beyond Simple Pharmaceuticals

GLP-1 weight loss drugs have transcended simple pharmaceuticals to become an industry revolution-level megatrend. Wall Street analysts project this market will grow to $150 billion annually by 2030.

Factors behind Lilly's market dominance include:

- Superior Clinical Efficacy: Dual GLP-1 + GIP mechanism delivers better weight loss results than competing products

- Rapid Production Scale-up: Resolved supply chain bottlenecks and established mass production capacity

- Strong Distribution Network: Enhanced prescription and delivery systems for improved patient access

Investment Strategy Implications: Watch Sector Rotation

As concerns about AI stocks intensify, investors have discovered new growth engines in the traditional healthcare sector. This represents a textbook case of sector rotation strategy.

While the "Magnificent 7" big tech companies struggle with valuation burdens, healthcare companies like Lilly are earning investor trust through actual revenue growth and profitability improvements. Lilly's stock has risen 36% this year alone—far exceeding the NASDAQ's gains over the same period.

Conclusion: A Changing Market, New Opportunities

November 2025's market movements deliver a clear message: The AI sector, inflated by excessive expectations, has entered a correction phase, while healthcare showing real growth is emerging as a new investment destination.

The parallel decline of NVIDIA and the NASDAQ confirmed in Chart 1 shows that AI bubble concerns are not mere speculation. Chart 2's rate policy confusion signals continued near-term market volatility. And Chart 3's dominant rise of Eli Lilly proves the healthcare sector is establishing itself as a new growth engine.

Practical Advice for Investors

- Reassess AI Stock Portfolio: Consider reducing positions in stocks with excessively high valuations

- Expand Healthcare Sector Focus: Discover GLP-1-related pharmaceutical, medical device, and healthcare service companies

- Prepare for Rate Volatility: Maintain long-term investment perspective without being swayed by short-term volatility

- Sector Diversification: Build balanced portfolios avoiding concentration in specific sectors

Markets are constantly changing. This week's three major issues clearly indicate the direction of that change. Wise investors will read these signals and proactively adjust their portfolios.

Data Sources

- Chart 1: Yahoo Finance (NVDA, ^IXIC)

- Chart 2: Federal Reserve Economic Data (FRED)

- Chart 3: Yahoo Finance (LLY, XLV, ^IXIC)

Analysis Date: November 24, 2025

Comments (0)

No comments yet. Be the first to comment!