Introduction

In today's complex financial landscape, understanding a company's debt position is crucial for making informed investment decisions. While debt can fuel growth and expansion, it can also pose significant risks to a company's financial health. This analysis focuses on Apple Inc., using their latest balance sheet data to demonstrate how investors can effectively evaluate corporate debt. Through real data and visualizations, we'll explore the key metrics and warning signs that every investor should monitor.

Understanding Debt on Balance Sheets

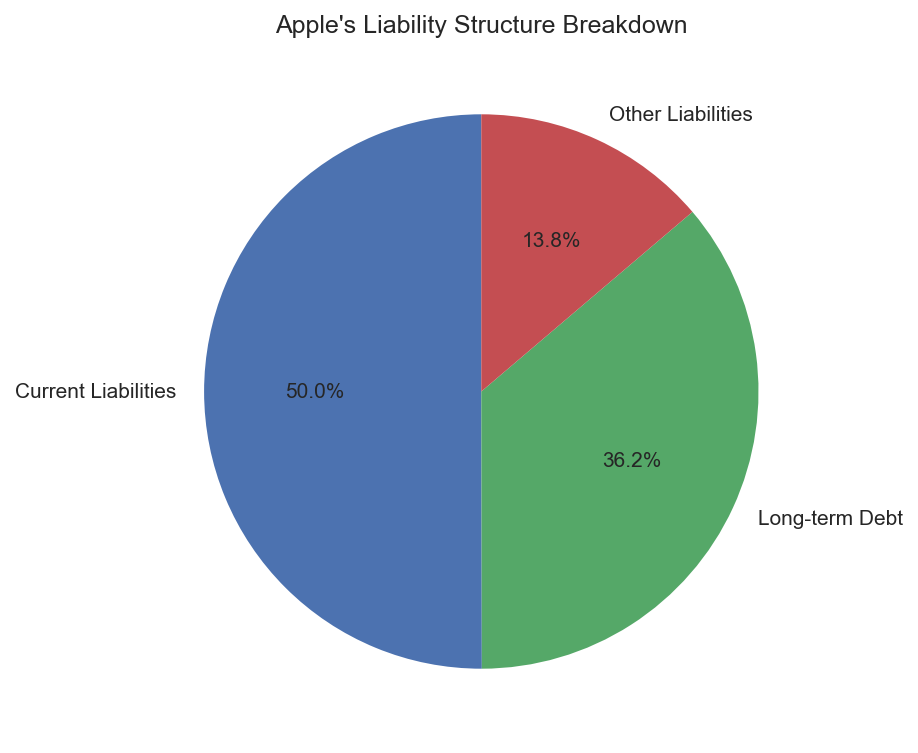

Apple's balance sheet reveals a total liability position of $290.44 billion, with $145.31 billion in current liabilities and $105.10 billion in long-term debt. These numbers might seem astronomical, but context is crucial. Let's break down how these figures translate into meaningful metrics for investors.

Key Debt Metrics and Industry Comparison

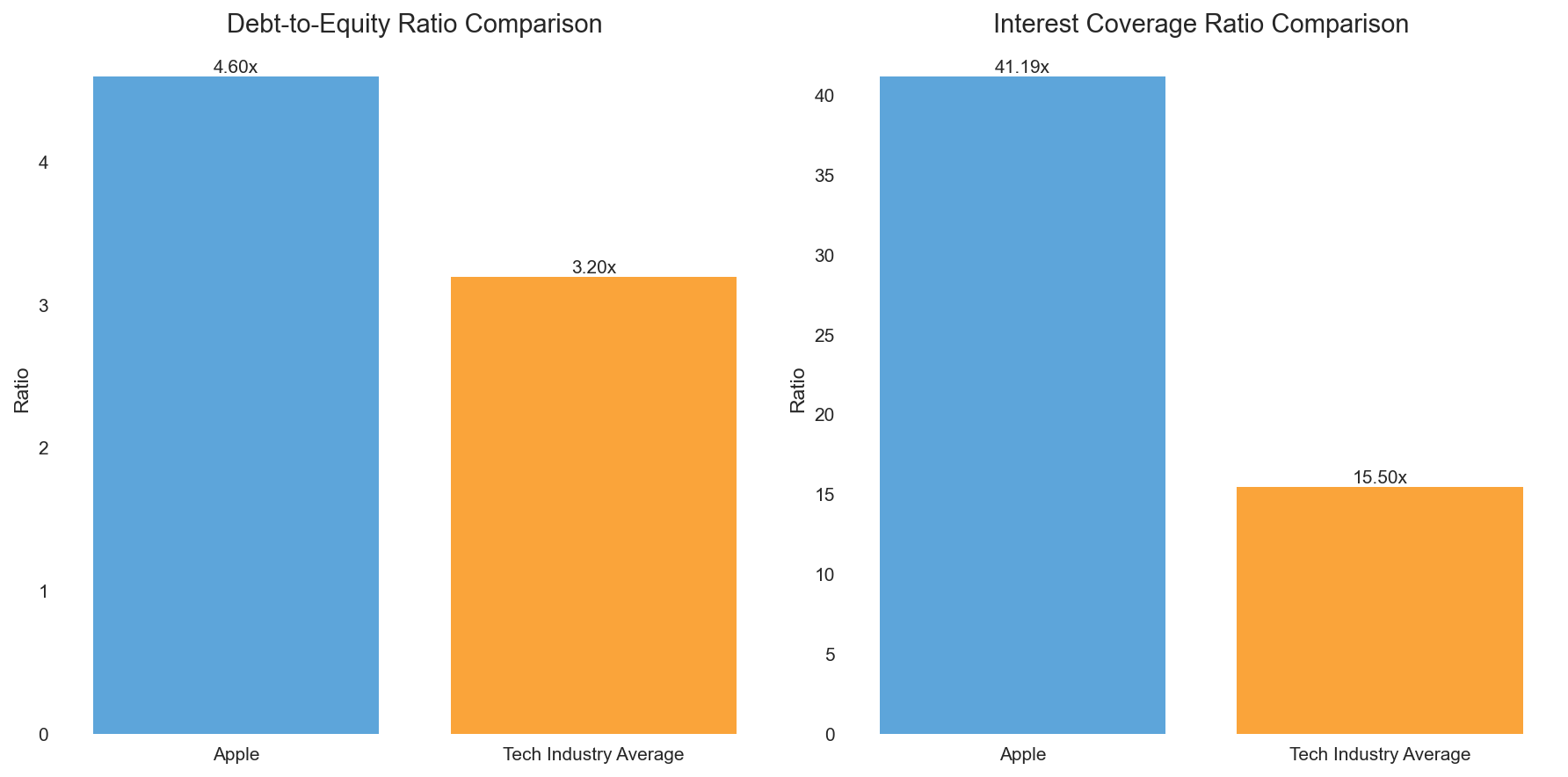

Our analysis reveals two critical metrics for Apple: a debt-to-equity ratio of 4.60 and an impressive interest coverage ratio of 41.19x. While Apple's debt-to-equity ratio exceeds the industry average of 3.2x, their interest coverage ratio significantly outperforms the industry standard of 15.5x. This indicates that despite carrying more leverage, Apple's strong earnings provide ample coverage for its debt obligations.

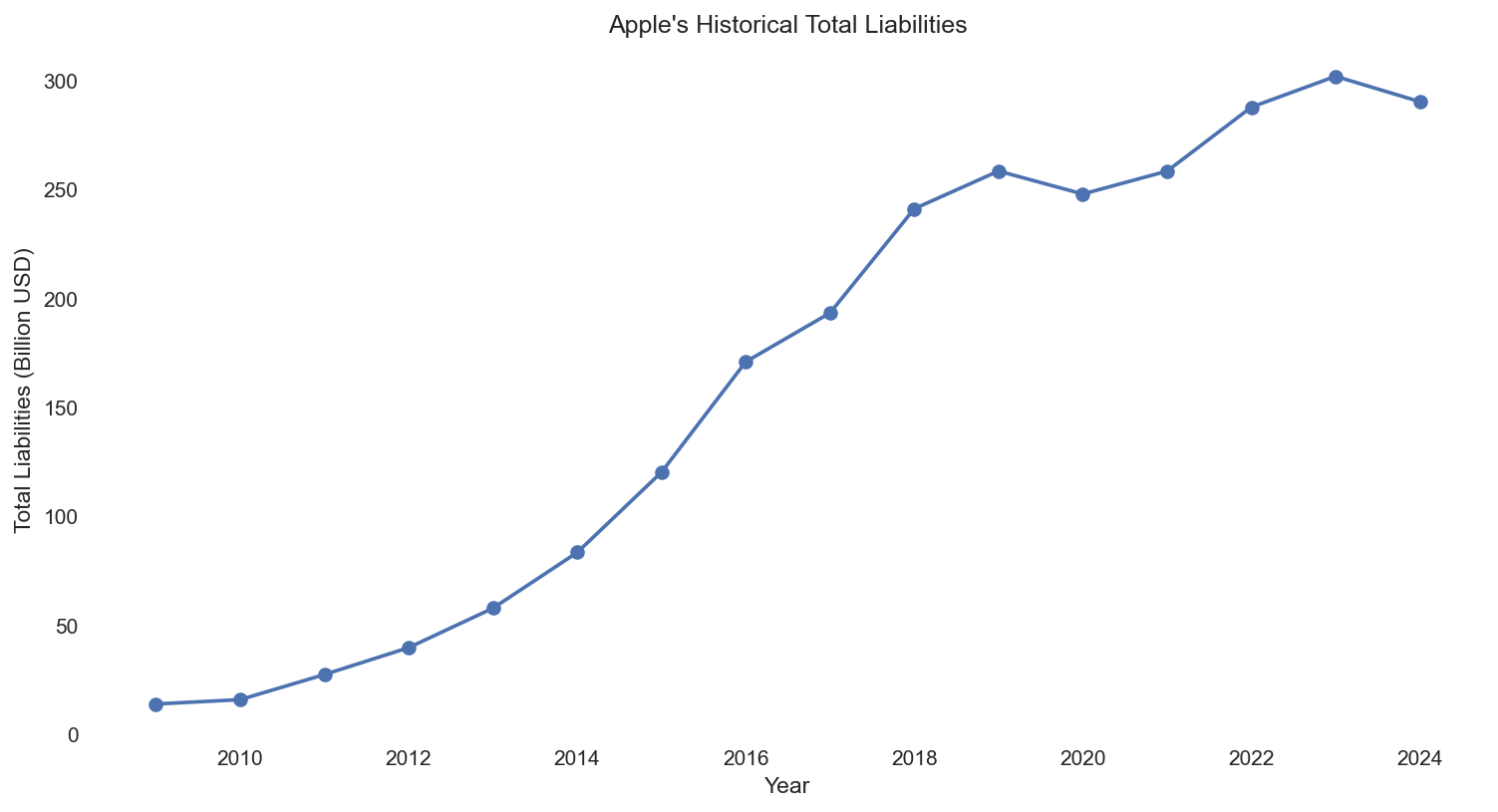

Historical Debt Trends and Economic Context

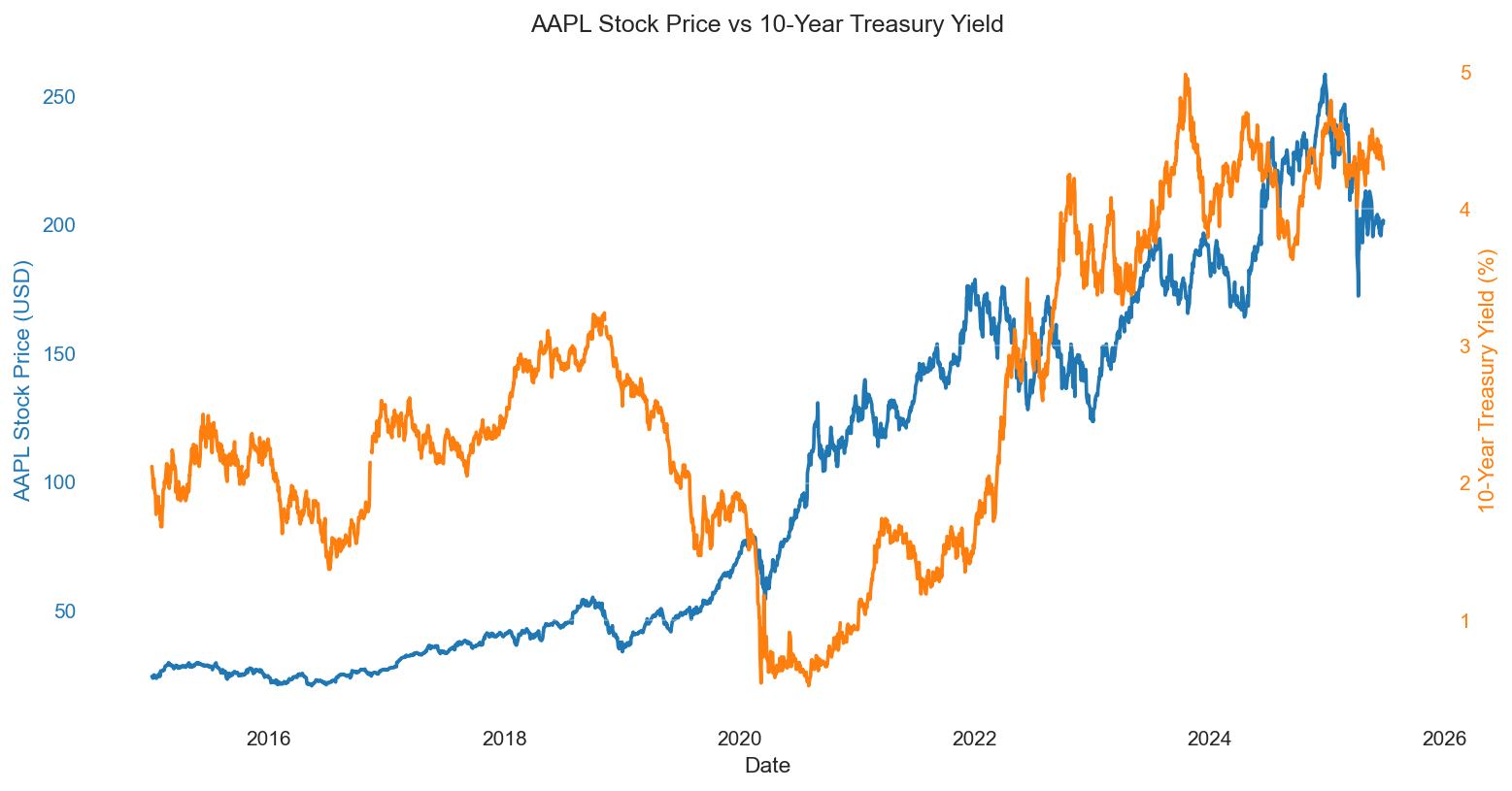

To understand the broader context, we analyzed Apple's debt levels against market conditions. Our analysis shows a moderate positive correlation (0.577) between Treasury yields and Apple's stock price, suggesting the company's strong financial position helps it weather rising interest rates effectively.

Conclusion

While Apple's debt metrics might raise initial concerns, deeper analysis reveals a company with strong fundamentals and excellent debt management capabilities. Their high interest coverage ratio of 41.19x provides a significant safety margin, demonstrating that robust operating performance can justify higher debt levels. For investors, this case study highlights the importance of looking beyond surface-level debt figures and considering multiple metrics in context.

- Always consider debt in relation to a company's earning power

- Compare debt metrics to industry averages for context

- Monitor interest coverage ratios as a key risk indicator

- Consider the broader economic environment when evaluating debt levels

Comments (0)

No comments yet. Be the first to comment!