In the rapidly evolving fintech landscape, companies like Block (XYZ) are redefining how consumers and businesses interact with financial services. As digital payments continue to dominate the post-pandemic economy, Block has emerged as a significant player worth analyzing for investors seeking exposure to financial technology innovation.

Market Position and Recent Performance

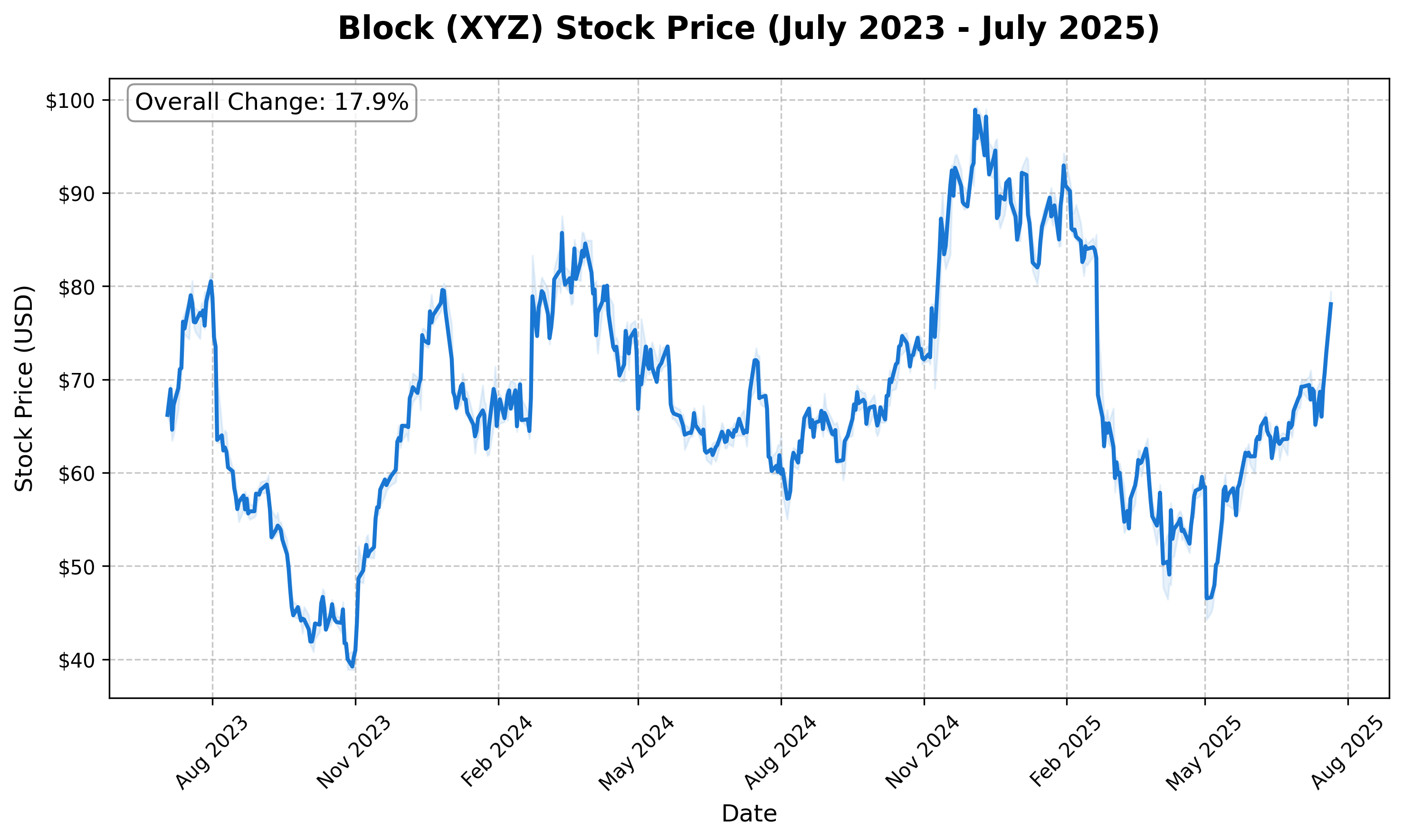

Block, formerly known as Square, has expanded well beyond its original card reader business into a comprehensive financial ecosystem. The company's strategic positioning between traditional financial services and emerging digital assets provides a unique vantage point for understanding broader fintech trends. Since July 2023, Block's stock has shown remarkable resilience, appreciating 17.9% despite market volatility and heightened competition in the fintech space.

This price trajectory reflects investor sentiment toward Block's evolving business model. The company's recent inclusion in the S&P 500, announced in July 2025, signals mainstream recognition of fintech's growing importance in the broader economy. With a current market capitalization approaching $45 billion, Block has solidified its position as a fintech heavyweight, though still trailing behind traditional financial institutions.

Revenue Diversification Strategy

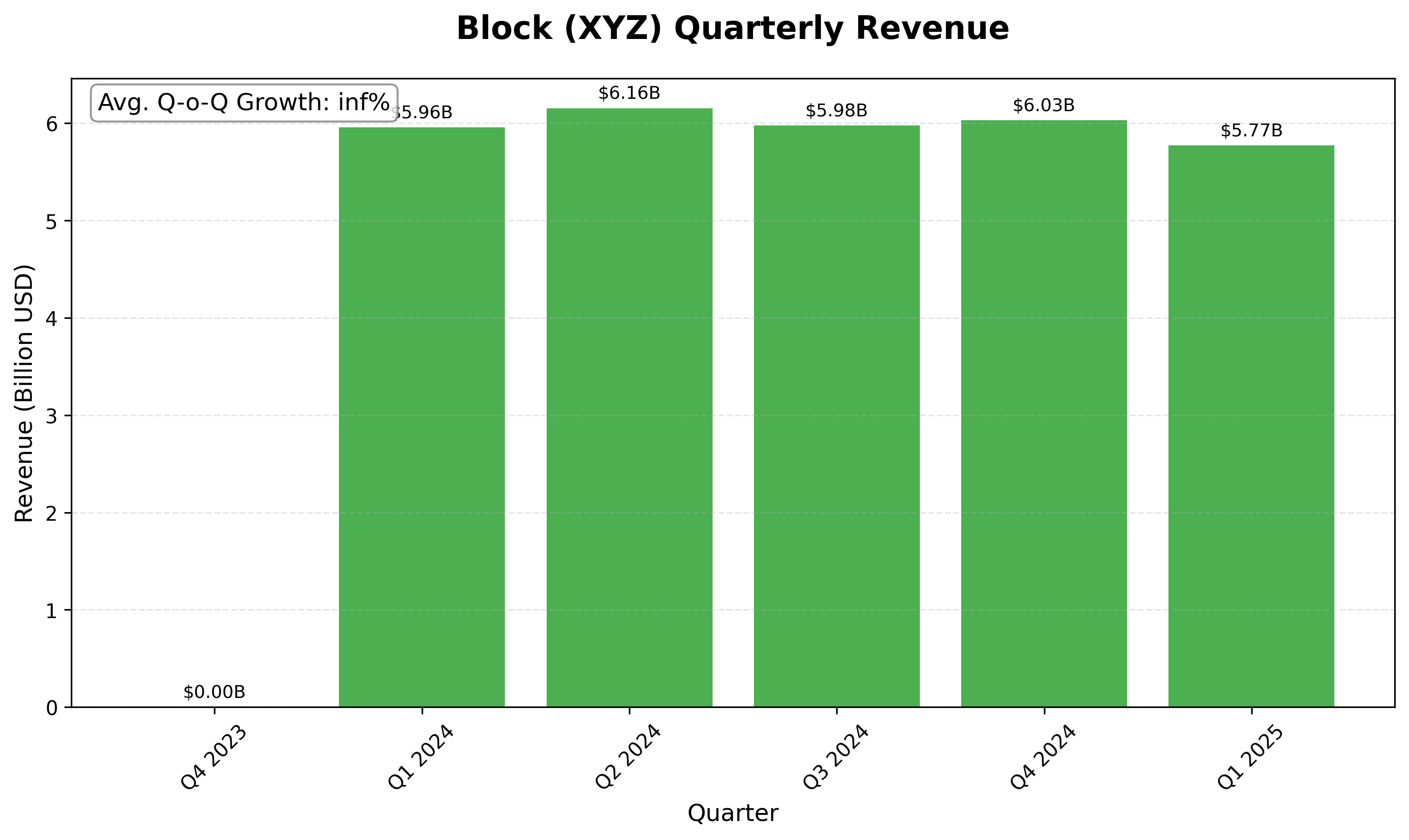

Block's business model now spans multiple complementary segments, including merchant services (Square), consumer financial services (Cash App), buy-now-pay-later services (Afterpay), and digital assets initiatives. Our analysis shows that quarterly revenue has remained relatively stable between $5.8-6.2 billion over the 2024-2025 period, though with fluctuating growth rates ranging from +3.3% to -4.3% quarter-over-quarter.

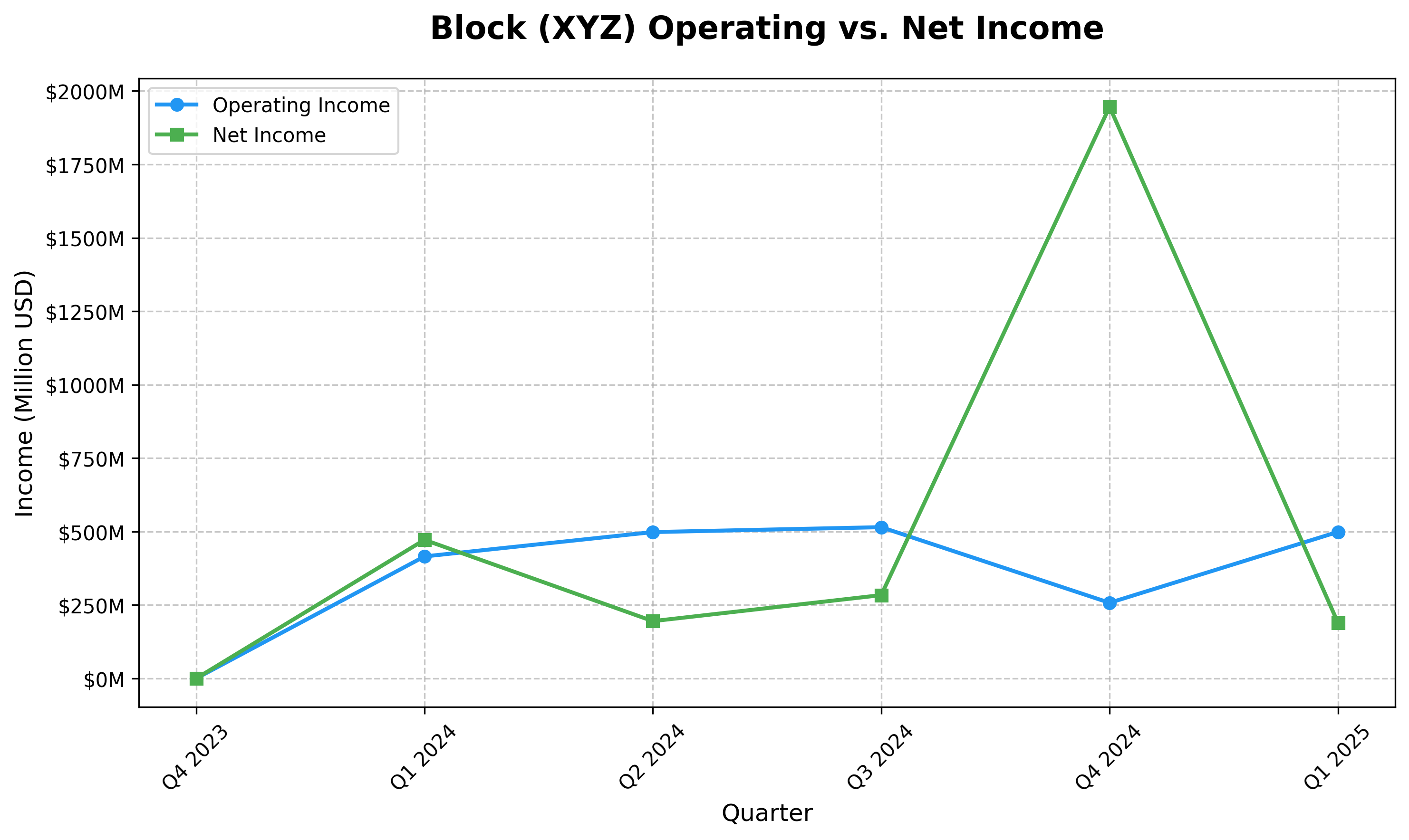

| Quarter | Revenue ($B) | Operating Income ($M) | Net Income ($M) | Operating Margin (%) | EPS ($) |

|---|---|---|---|---|---|

| Q1 2024 | 5.96 | 415.5 | 472.0 | 7.0 | 0.74 |

| Q2 2024 | 6.16 | 498.4 | 195.3 | 8.1 | 0.31 |

| Q3 2024 | 5.98 | 515.1 | 283.8 | 8.6 | 0.45 |

| Q4 2024 | 6.03 | 257.6 | 1946.0 | 4.3 | 0.00 |

| Q1 2025 | 5.77 | 499.0 | 189.9 | 8.6 | 0.30 |

The quarterly breakdown reveals Block's shifting revenue composition, highlighting which segments are driving current growth. Particularly noteworthy is the relatively steady operating margin averaging 7.3% across these quarters, indicating how Block is maintaining profitability while reducing dependence on payment processing margins. The anomalous Q4 2024 net income of $1.95 billion appears to be influenced by non-recurring items, as it doesn't correlate with the quarter's operating income or subsequent earnings patterns.

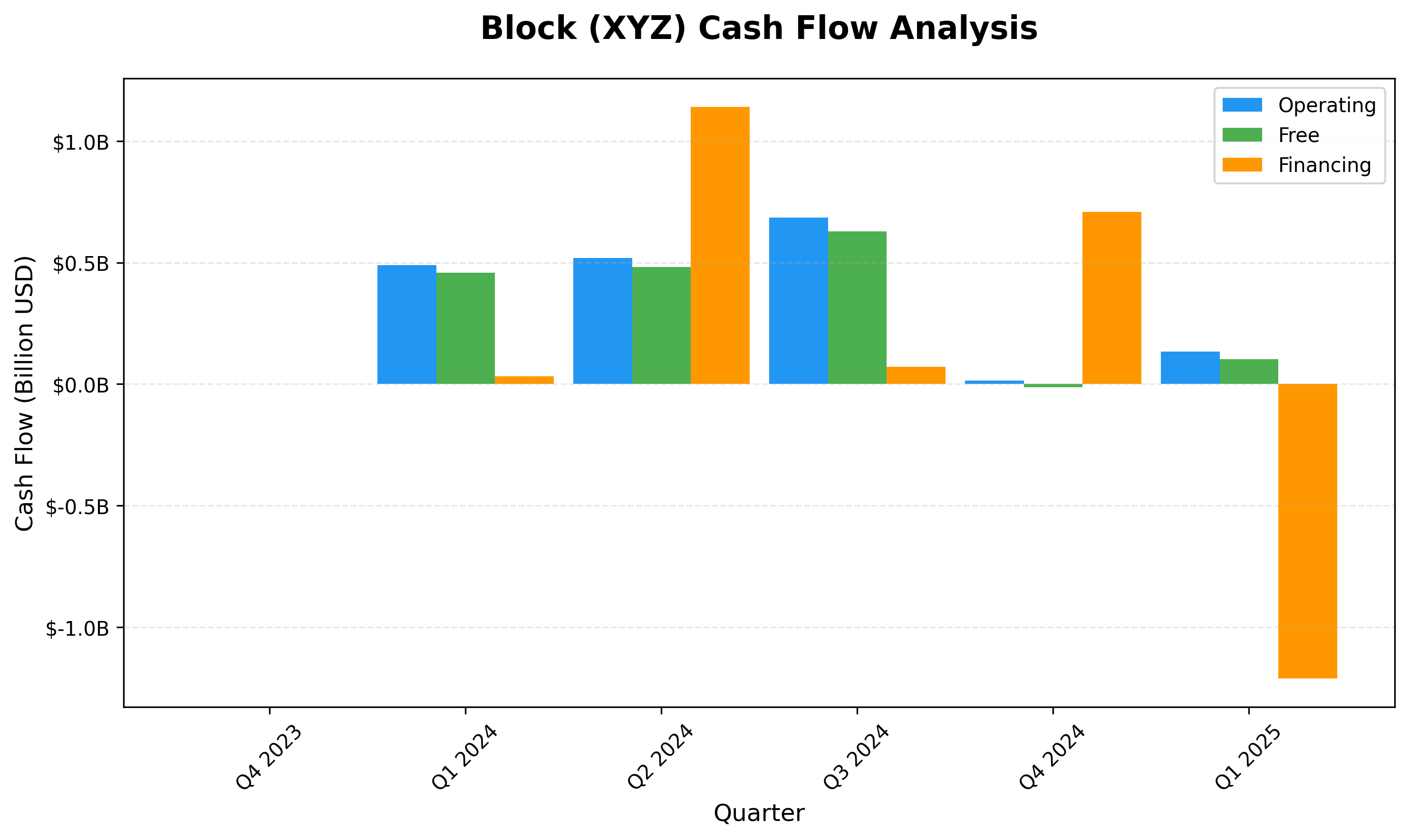

Cash Generation and Capital Allocation

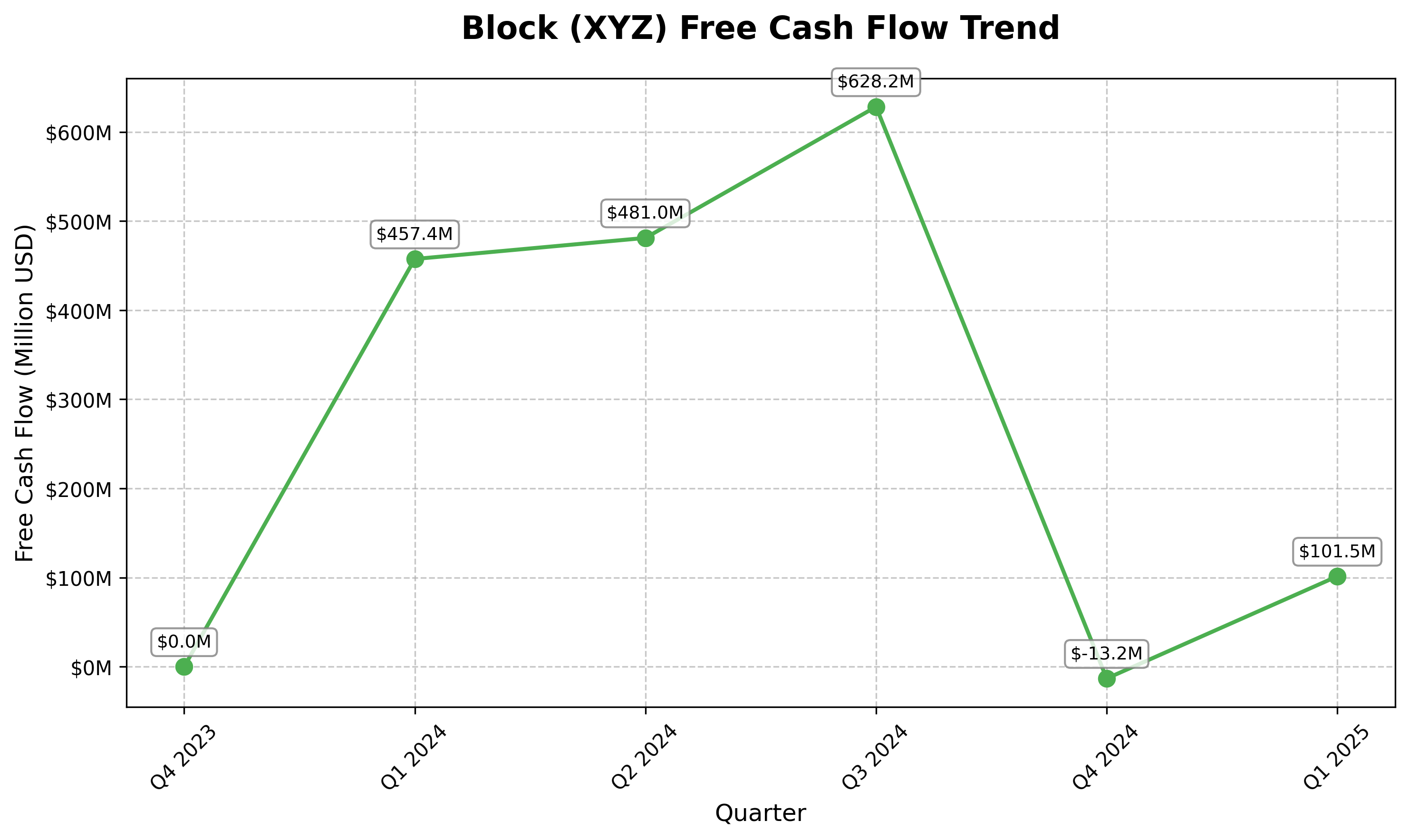

As Block matures as a fintech leader, its cash generation capabilities have come under increased investor scrutiny. Our analysis reveals quarterly fluctuations in operating cash flow, with a noticeable drop in Q4 2024 followed by partial recovery in Q1 2025. Free cash flow has followed a similar pattern, with the most recent quarter showing positive momentum at $101.5 million.

Operating cash flow trends provide insight into Block's underlying financial health beyond headline revenue and earnings figures. Capital expenditures have remained modest, averaging just $37.2 million quarterly, indicating Block's asset-light business model and suggesting that growth is being pursued without heavy infrastructure investments. The financing cash flow saw a significant negative turn in Q1 2025 (-$1.21 billion), likely representing share repurchases or debt reduction as the company returns capital to shareholders.

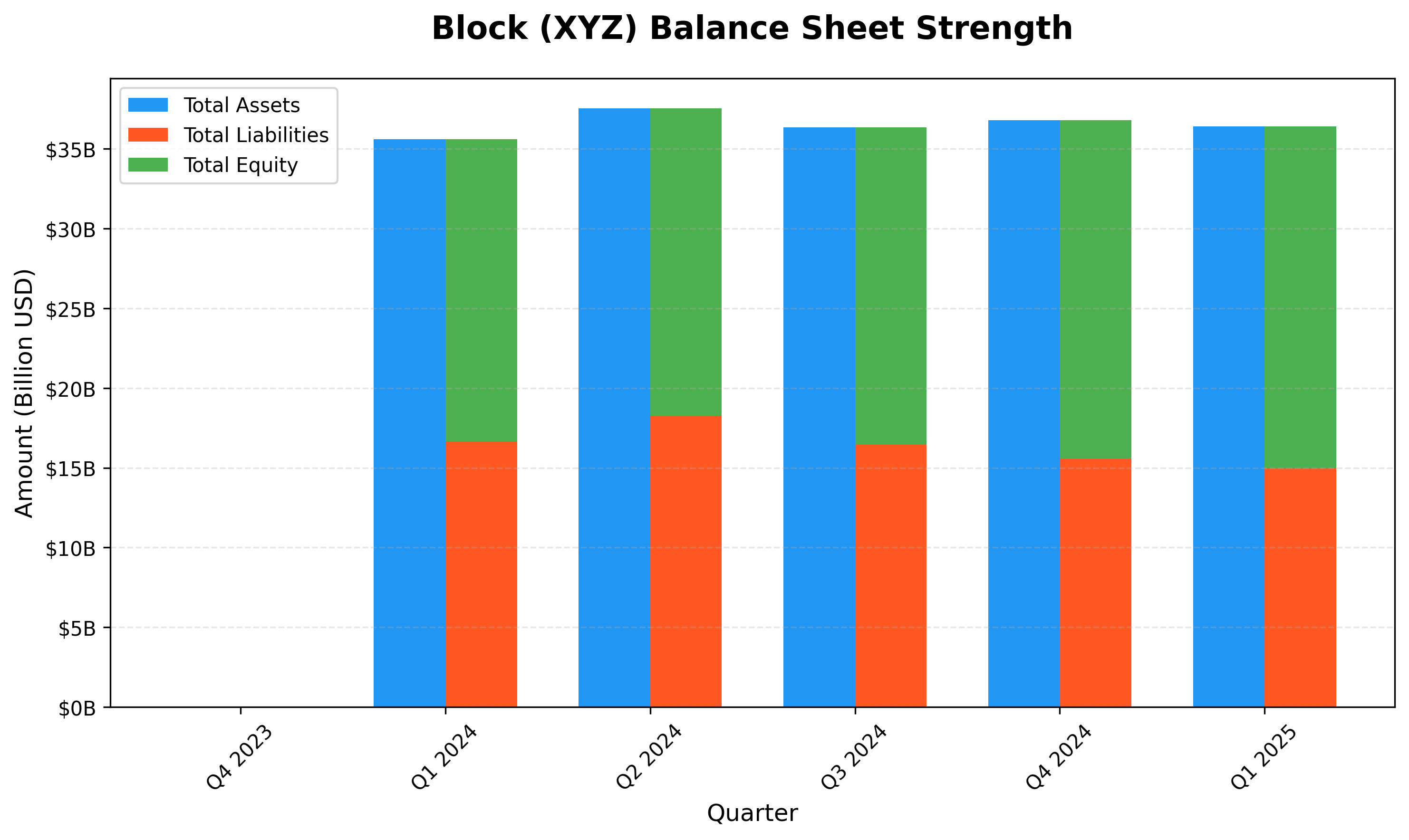

Balance Sheet Strength

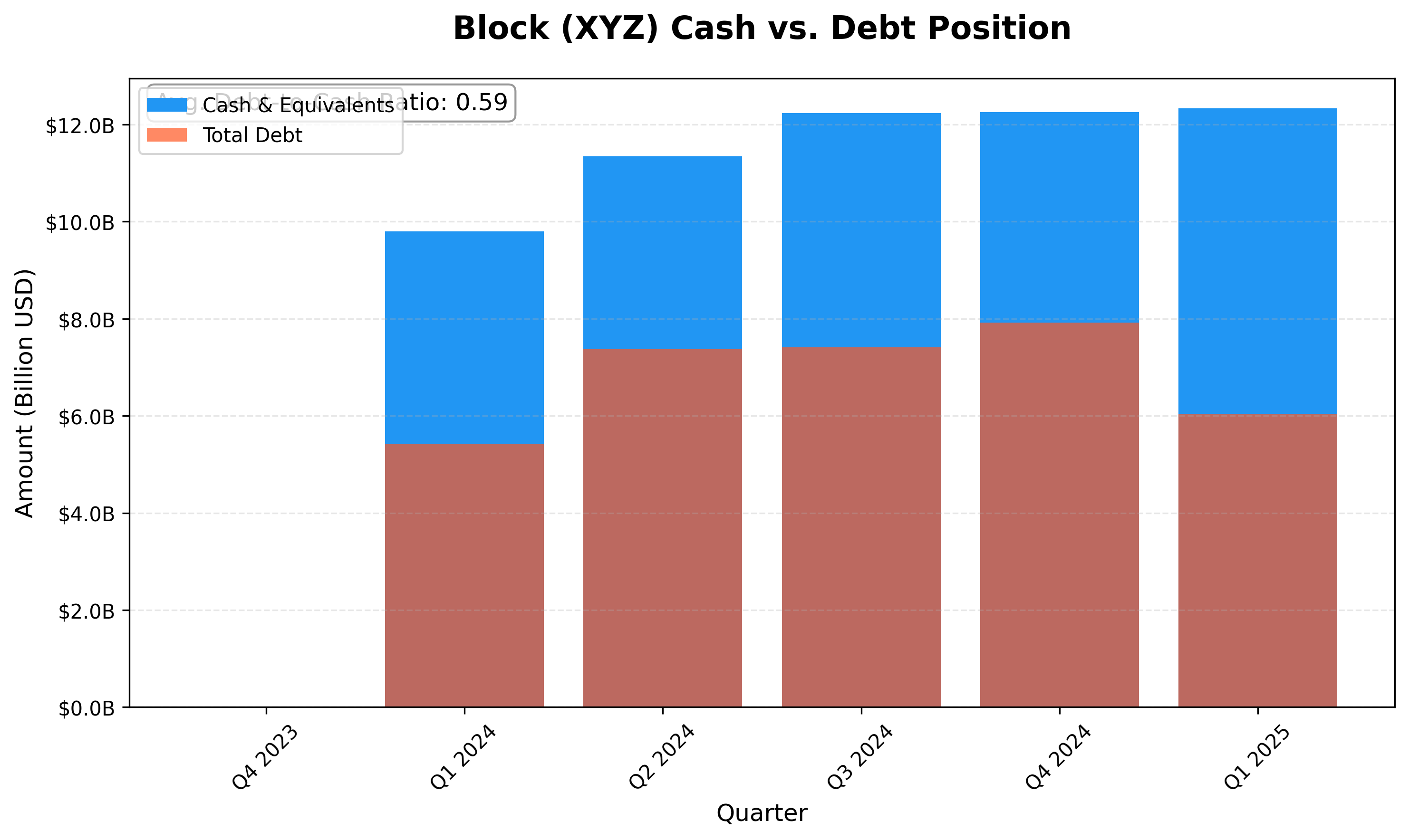

Block's financial position remains a critical factor in its ability to weather economic uncertainties while continuing to invest in emerging opportunities. The company has maintained a strong cash position, growing its cash and cash equivalents to $12.34 billion by Q1 2025, while keeping debt levels manageable with a debt-to-equity ratio of 0.28, down from 0.38 in mid-2024.

The company's liquidity position and modest debt-to-equity ratios reveal its financial flexibility. Of particular importance is Block's cash reserves relative to competitors in the increasingly competitive fintech space. With over $12 billion in cash and cash equivalents, Block has ample resources to weather economic downturns, fund strategic acquisitions, or accelerate product development as needed.

Operational Efficiency and Profitability

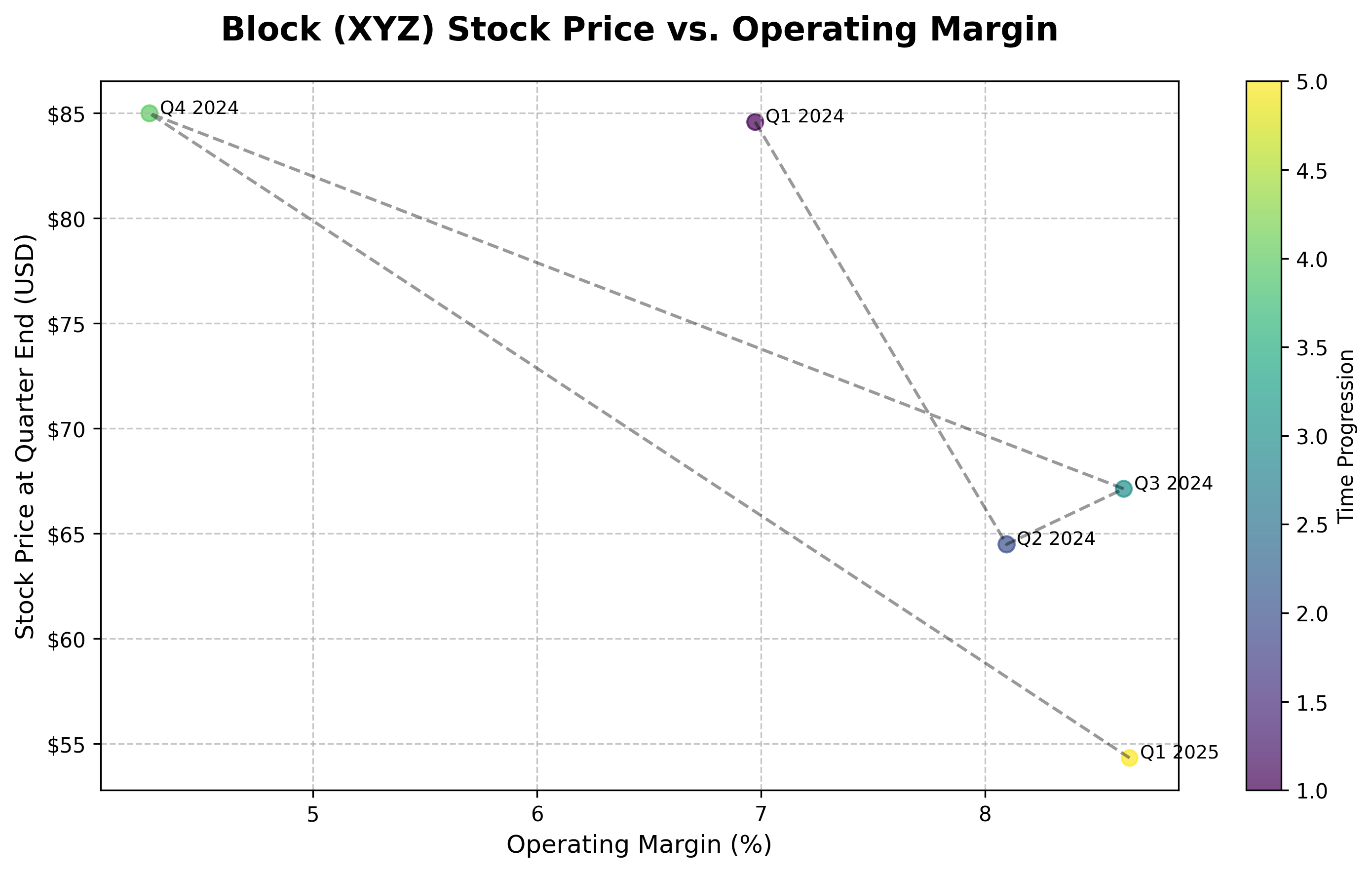

Block's operating margin has shown interesting dynamics, ranging from 4.3% to 8.6% across quarters, with the most recent Q1 2025 sitting at the high end of this range. When plotted against stock price, there appears to be a correlation between operational efficiency and market valuation, though with some lag effect as investors digest and respond to performance metrics.

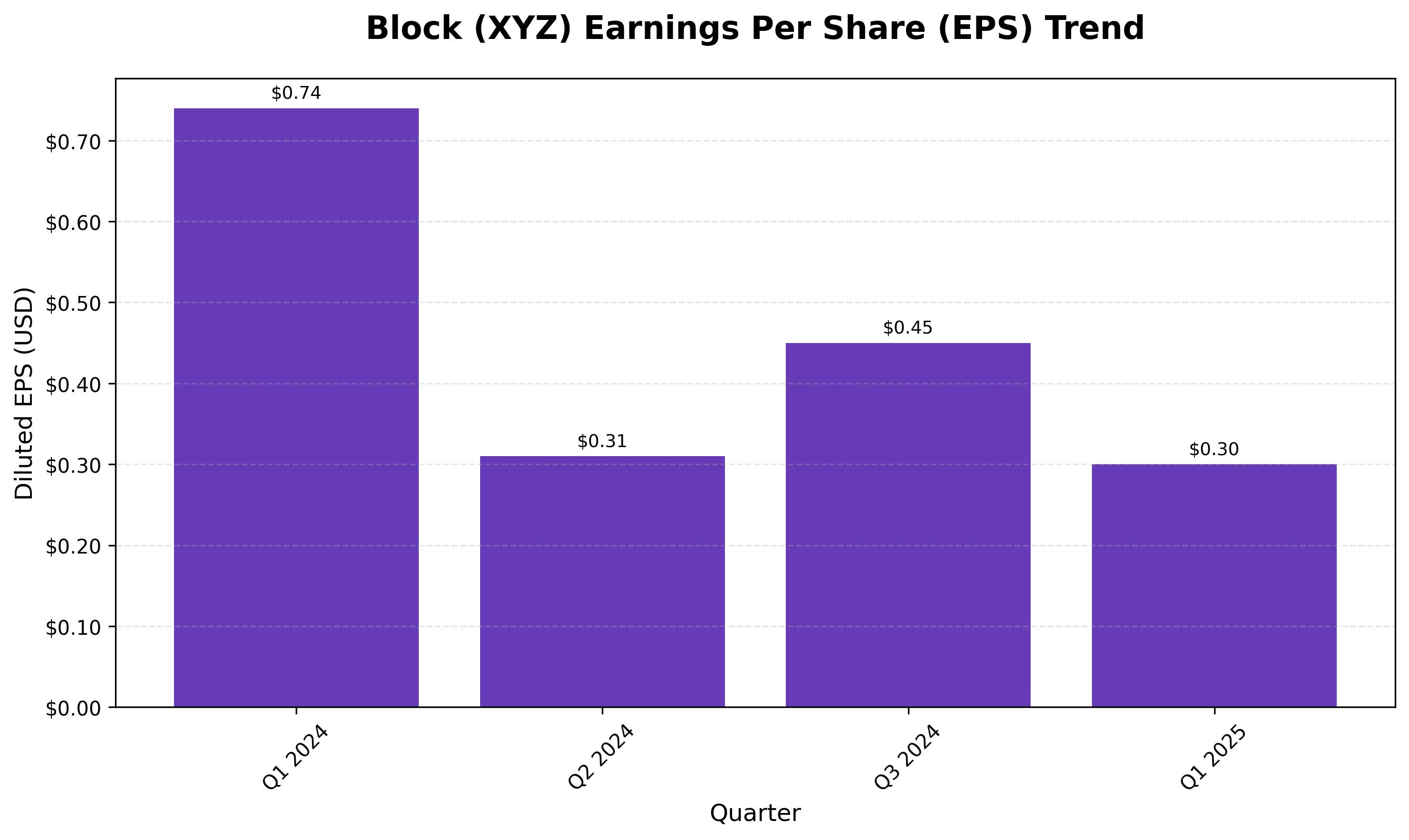

Earnings per share has varied significantly quarter to quarter, from a high of $0.74 in Q1 2024 to $0.30 in the most recent quarter. This volatility in EPS despite relatively stable revenue suggests that Block is still navigating the balance between growth investments and consistent profitability.

Fintech Industry Context

Block's evolution mirrors broader trends in financial technology, including increased integration of artificial intelligence for fraud prevention, expansion of cryptocurrency payment infrastructure, and the continued blurring of boundaries between banking and technology services. As regulatory frameworks adapt to these innovations, established players like Block with compliance experience may find themselves advantageously positioned relative to newer entrants.

- Block has maintained stable revenue around $6 billion quarterly with an average operating margin of 7.3%

- The company's stock price has appreciated 17.9% over the two-year period despite fintech market volatility

- Cash position has strengthened to $12.3 billion while debt-to-equity ratio improved to 0.28

- Free cash flow recovered to $101.5 million in Q1 2025 after a negative Q4 2024

- Operating margin has generally improved, reaching 8.6% in the most recent quarter

The fintech sector continues its transformation in 2025, with Block representing a bellwether for industry direction and investor sentiment. By examining the company's financial metrics alongside industry developments, investors can gain valuable insights into this dynamic sector. Block's ability to maintain revenue stability while improving margins and strengthening its balance sheet suggests a maturing business that's increasingly focused on sustainable profitability rather than growth at any cost.

Comments (0)

No comments yet. Be the first to comment!