Understanding Gross Margin: The Foundation of Business Profitability

Before diving into our rankings, let's understand what gross margin actually means. Gross margin is calculated as (Total Revenue - Cost of Revenue) ÷ Total Revenue × 100. It represents the percentage of each dollar of revenue that remains after paying for the direct costs of producing goods or services. Think of it as the fundamental measure of how efficiently a company turns raw materials and labor into profitable products. A higher gross margin indicates that a company either charges premium prices, operates with exceptional efficiency, or both. In the consumer staples sector, gross margins tell a compelling story about brand power, market positioning, and business model sustainability.

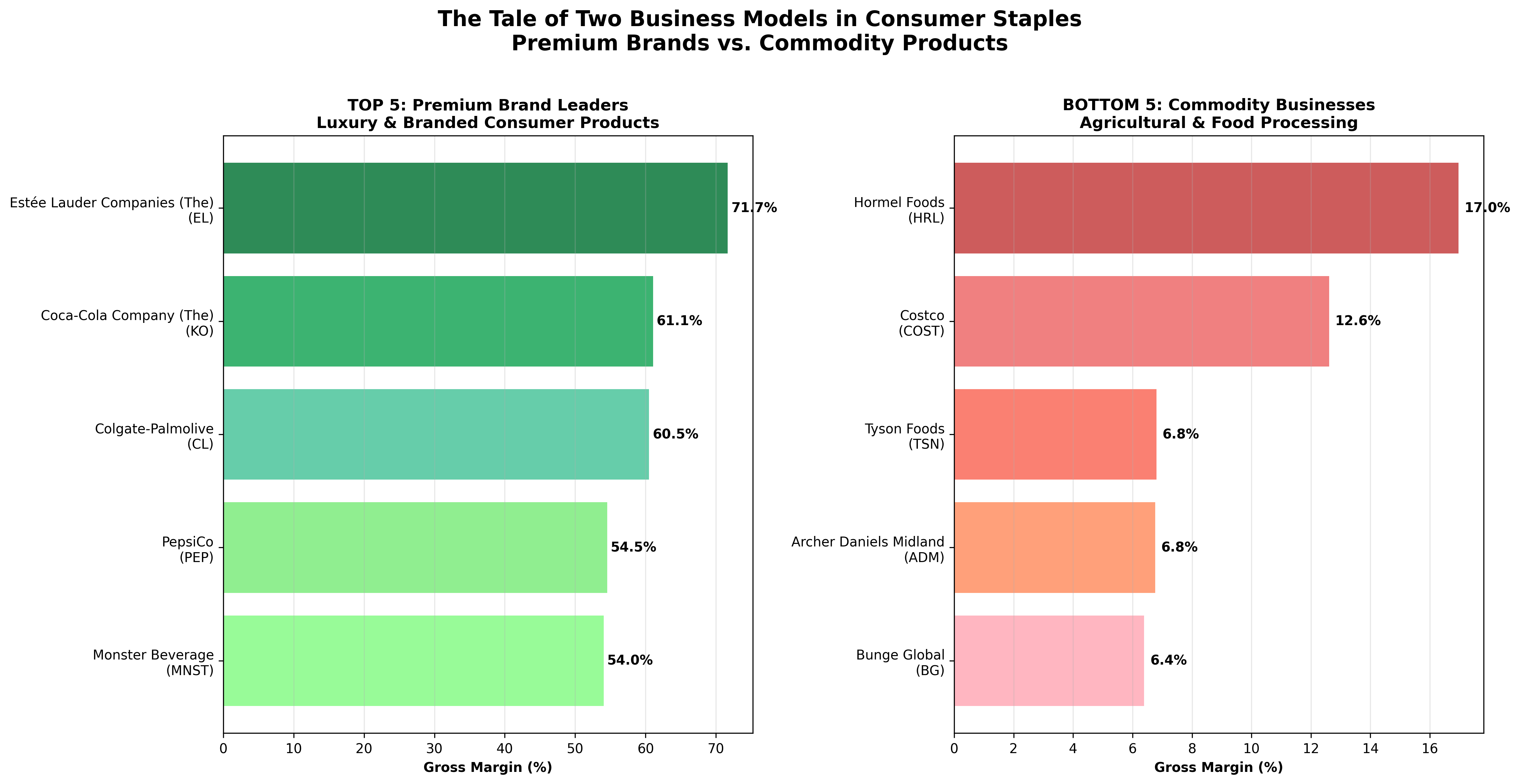

The Luxury Leader: Estée Lauder's Margin Mastery

At the top of our ranking sits Estée Lauder (EL) with an impressive 71.66% gross margin. To understand how remarkable this figure is, let's break down their numbers: with $15.6 billion in total revenue and only $4.4 billion in cost of revenue, they retain $11.2 billion in gross profit. This means that for every dollar customers spend on Estée Lauder products, the company keeps about 72 cents after covering production costs. This exceptional performance stems from their premium positioning in cosmetics and luxury personal care, where brand prestige allows for significant pricing power. The company's ability to command such margins reflects decades of brand building, innovation, and targeting affluent consumers who prioritize quality over price.

The Brand Power Trio: Beverages and Personal Care Dominate

Following Estée Lauder, we see three iconic consumer brands that have mastered the art of margin expansion. Coca-Cola (KO) at 61.06% demonstrates the power of a globally recognized beverage brand, where the cost of syrup and production is minimal compared to the premium consumers willingly pay for the experience. Colgate-Palmolive (CL) at 60.50% shows how essential personal care products can maintain pricing power, as consumers rarely compromise on oral hygiene quality. PepsiCo (PEP) rounds out the top four at 54.55%, proving that diversified snack and beverage portfolios can sustain high margins when backed by strong brand equity and distribution networks.

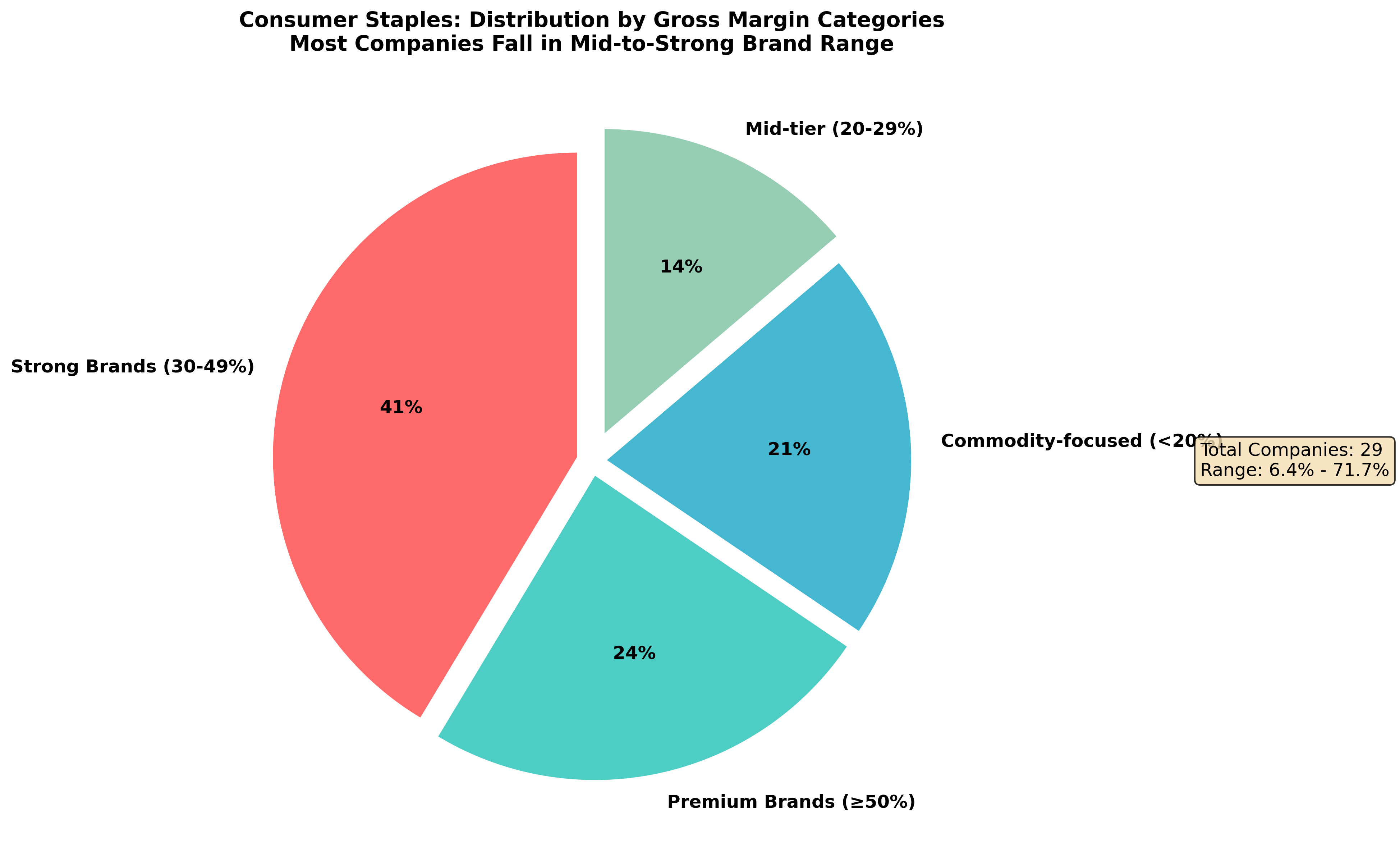

The Four-Tier Market Structure

Our analysis reveals that the Consumer Staples sector naturally segments into four distinct categories. Premium Brands (≥50% margin) represent just 7 companies but include the most valuable brand franchises in cosmetics, beverages, and personal care. Strong Brands (30-49% margin) encompass 12 companies, including household names like Procter & Gamble (PG) at 51.39% and Hershey (HSY) at 47.32%. The Mid-tier group (20-29% margin) contains 4 companies, primarily retailers like Target (TGT) and Walmart (WMT), where scale and efficiency matter more than brand premiums. Finally, the Commodity-focused segment (<20% margin) includes 6 companies, mostly agricultural processors and food distributors operating in highly competitive, price-sensitive markets.

- Premium Brands (≥50%): 7 companies led by luxury cosmetics and global beverage brands

- Strong Brands (30-49%): 12 companies including household staples and branded foods

- Mid-tier (20-29%): 4 companies focused on retail operations and distribution

- Commodity-focused (<20%): 6 companies in agricultural processing and bulk food production

The Commodity Challenge: Why Some Companies Struggle

At the bottom of our ranking, we find companies operating in fundamentally different business models. Bunge Global (BG) at 6.39% and Archer Daniels Midland (ADM) at 6.76% represent the agricultural commodity processing industry, where companies handle massive volumes of grains, oilseeds, and other raw materials with minimal differentiation opportunities. These businesses compete primarily on efficiency, scale, and logistics rather than brand recognition. Even Costco (COST) at 12.61%, despite being a retail success story, operates on a low-margin, high-volume model where member value proposition requires keeping prices—and margins—deliberately low. The 65-percentage-point gap between Estée Lauder and Bunge Global illustrates how business model choice fundamentally determines profitability potential.

Key Insights and Market Implications

This comprehensive analysis reveals several important patterns within the Consumer Staples sector. Companies with the highest margins share common characteristics: strong brand recognition, premium market positioning, customer loyalty, and pricing flexibility. They often operate in categories where consumers prioritize quality, convenience, or status over price sensitivity. Conversely, lower-margin companies typically operate in commoditized markets where price competition is fierce and differentiation is limited. The data suggests that successful consumer staples companies must either build powerful brands that command premium pricing or achieve exceptional operational efficiency at scale. The wide margin variation within this traditionally stable sector underscores the importance of strategic positioning and brand investment in driving long-term profitability.

Comments (0)

No comments yet. Be the first to comment!