Understanding Our Key Metrics

Before diving into the findings, let's understand the key metrics we're using to evaluate these companies:

- <strong>Revenue Growth %</strong>: Shows how much a company's sales have increased compared to the same period last year. A higher percentage means stronger growth.

- <strong>Debt-to-Revenue Ratio</strong>: Measures how much debt a company has relative to its revenue. A lower number is generally better, indicating the company needs less time to pay off its debt if it dedicated all revenue to debt repayment.

- <strong>Debt-to-Revenue Change %</strong>: Reveals how the debt-to-revenue ratio has improved. A negative percentage means the company has become more financially efficient, with less debt relative to its revenue.

The Standout Performers: Utilities Take the Lead

Our analysis revealed a fascinating trend: utility companies are dominating the list of top performers. These companies, traditionally seen as stable but slow-growing businesses, are showing remarkable revenue growth while simultaneously becoming more financially efficient. Eight of the eleven top-ranked companies come from the utilities sector, with energy companies taking two spots and technology represented by a single company (Intuit).

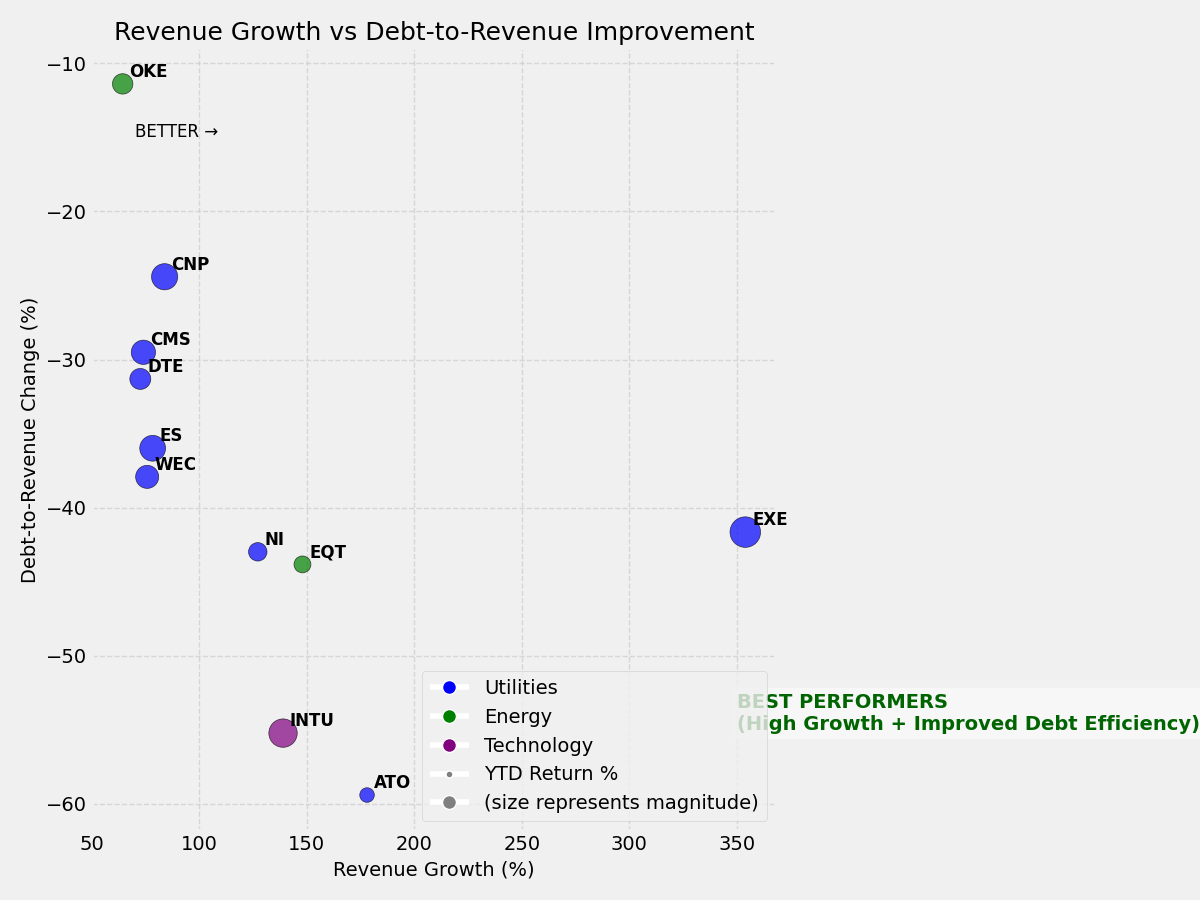

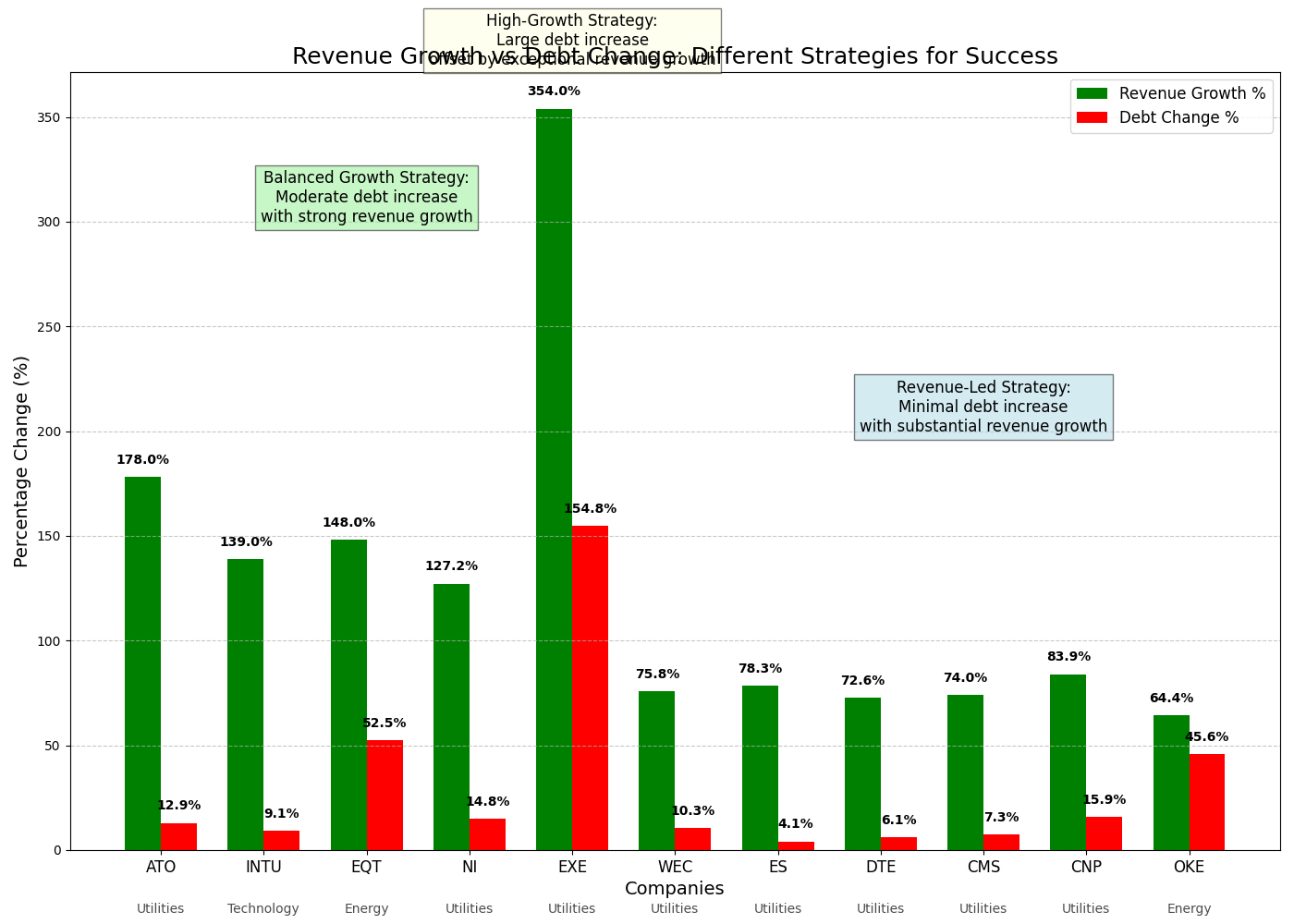

Different Paths to Success: Growth Strategies Revealed

What's particularly interesting is how these companies achieved their success through different strategies. Some companies like ES (Eversource Energy) improved their financial health primarily through revenue growth, increasing their debt by only 4.06% while growing revenue by 78.32%. Others like EXE (Exelon) took a more aggressive approach, significantly increasing their debt by 154.75% but growing their revenue even faster at an impressive 353.96%. Both approaches resulted in substantially improved debt-to-revenue ratios, showing there's more than one path to financial efficiency.

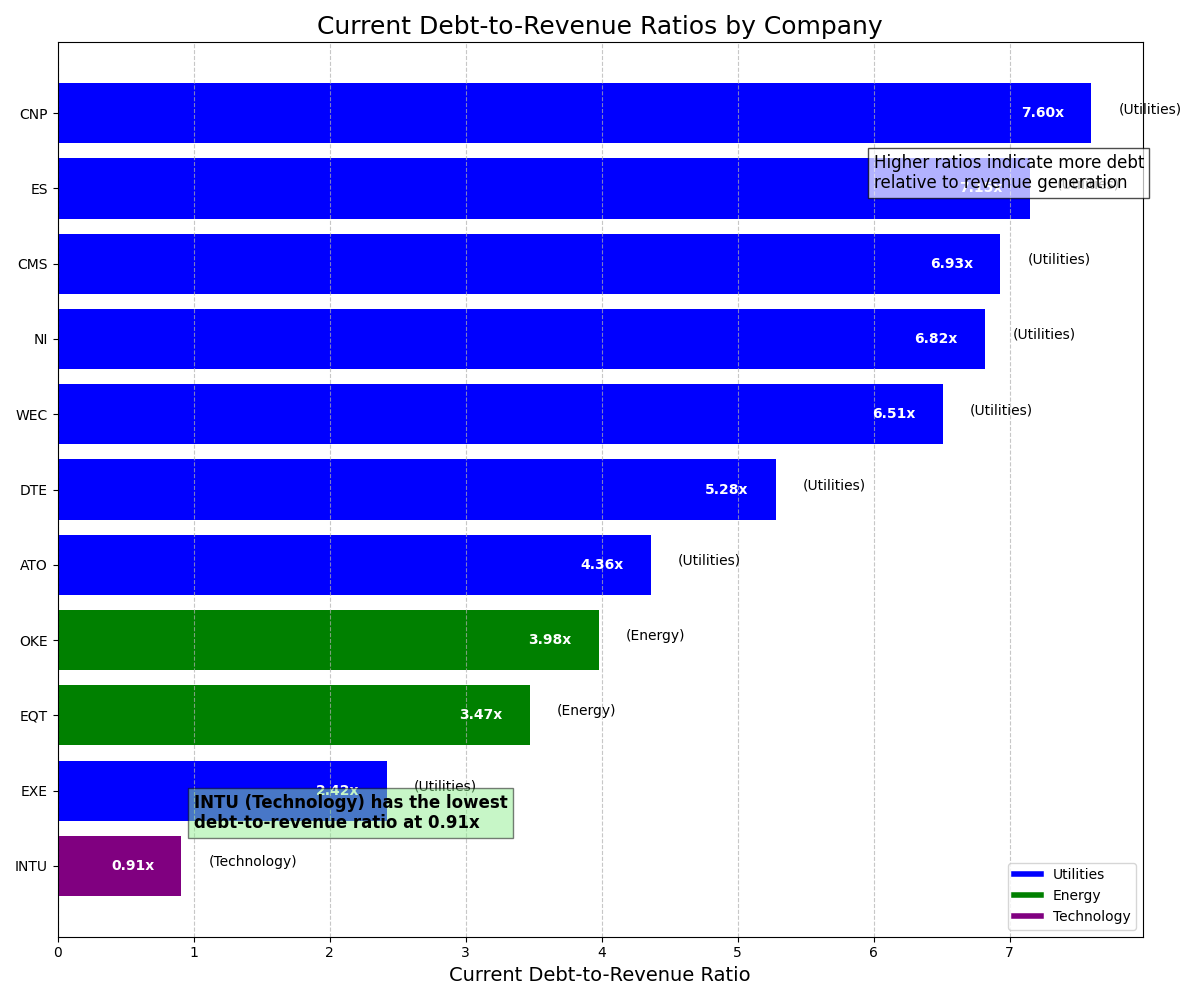

Current Financial Health: How They Stack Up

While all these companies have improved their financial efficiency, they're starting from different positions. Intuit (INTU) stands out as the company with the healthiest current debt-to-revenue ratio at just 0.91x, meaning its debt is less than its annual revenue. Most utility companies have higher ratios, which is typical for capital-intensive industries that require significant infrastructure investment. Despite these higher ratios, their substantial improvements show they're moving in the right direction during a challenging high interest rate environment.

Why This Matters for Investors

Understanding how companies manage growth and debt is especially important in today's economic environment. Companies that can grow revenue while improving their debt efficiency demonstrate strong management and operational excellence. They're potentially better positioned to weather economic challenges and may have more flexibility for future investments. This analysis provides educational context on financial health metrics that can help inform a deeper understanding of company performance.

Spotlight: Atmos Energy (ATO)

Let's look at our top-ranked company as an educational example. Atmos Energy (ATO) achieved an impressive 178.03% revenue growth while increasing its debt by only 12.88%. This led to a 59.40% improvement in its debt-to-revenue ratio, the best among all companies analyzed. The company's current debt-to-revenue ratio of 4.36x, while still substantial, represents a significant improvement in financial efficiency compared to its previous position.

- Utility companies are showing they can achieve high growth while improving financial efficiency

- Different strategies can lead to improved debt-to-revenue ratios

- Companies that manage debt efficiently while growing rapidly demonstrate strong operational execution

- The analysis highlights the importance of looking beyond simple growth numbers to understand financial health

Comments (0)

No comments yet. Be the first to comment!