Understanding the R&D Investment Landscape

In the world of biotechnology and pharmaceuticals, research and development (R&D) spending is the lifeblood of innovation. Think of R&D as the seed money that companies plant today, hoping to harvest life-saving medicines, breakthrough treatments, and revolutionary medical devices tomorrow. When we look at the R&D expenditures in the bio sector for 2024, we're essentially looking at a crystal ball showing us where the future of healthcare is being built.

The ranking system used in this analysis combines two critical metrics: absolute R&D spending (how much money companies invest) and R&D intensity (what percentage of their revenue they dedicate to research). This dual approach reveals both the scale of investment and the commitment level of each company to innovation.

The Metric Breakdown: What Do These Numbers Really Mean?

Before diving into the rankings, let's understand what we're measuring. **R&D Expenditure** represents the total dollars a company spends on research and development activities in a fiscal year. This includes everything from laboratory equipment and scientist salaries to clinical trial costs and regulatory filing fees. **R&D as Percentage of Revenue** shows how much of every dollar earned gets reinvested into research - it's a measure of commitment and strategic priority.

The **Total Score** in our ranking combines both metrics using a weighted formula that considers both the absolute investment capacity and the relative intensity. Companies scoring above 80 are considered 'Innovation Powerhouses,' those between 60-80 are 'Strong Investors,' and below 60 are 'Selective Investors.'

The Billion-Dollar Leaders: A Tale of Two Strategies

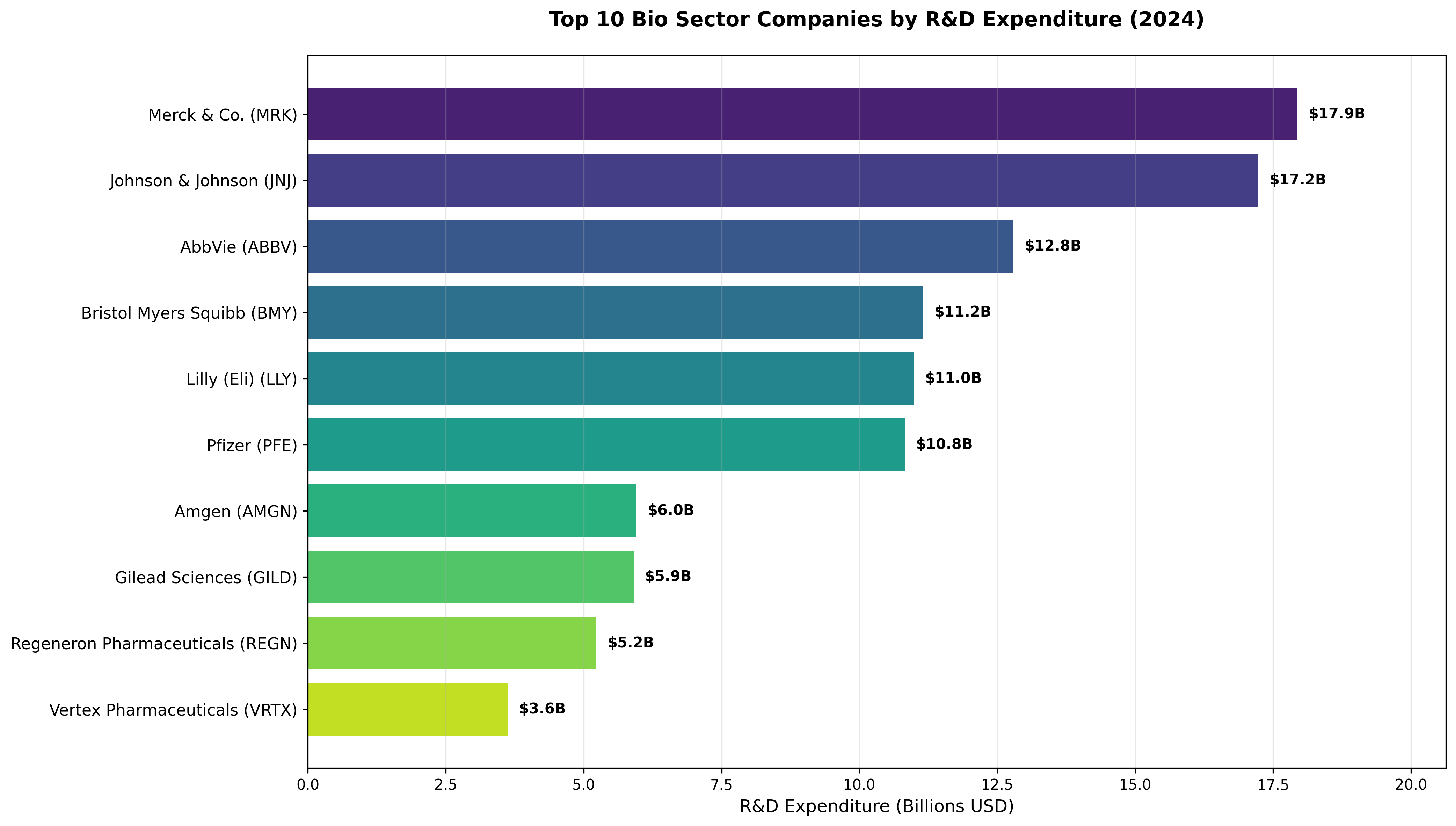

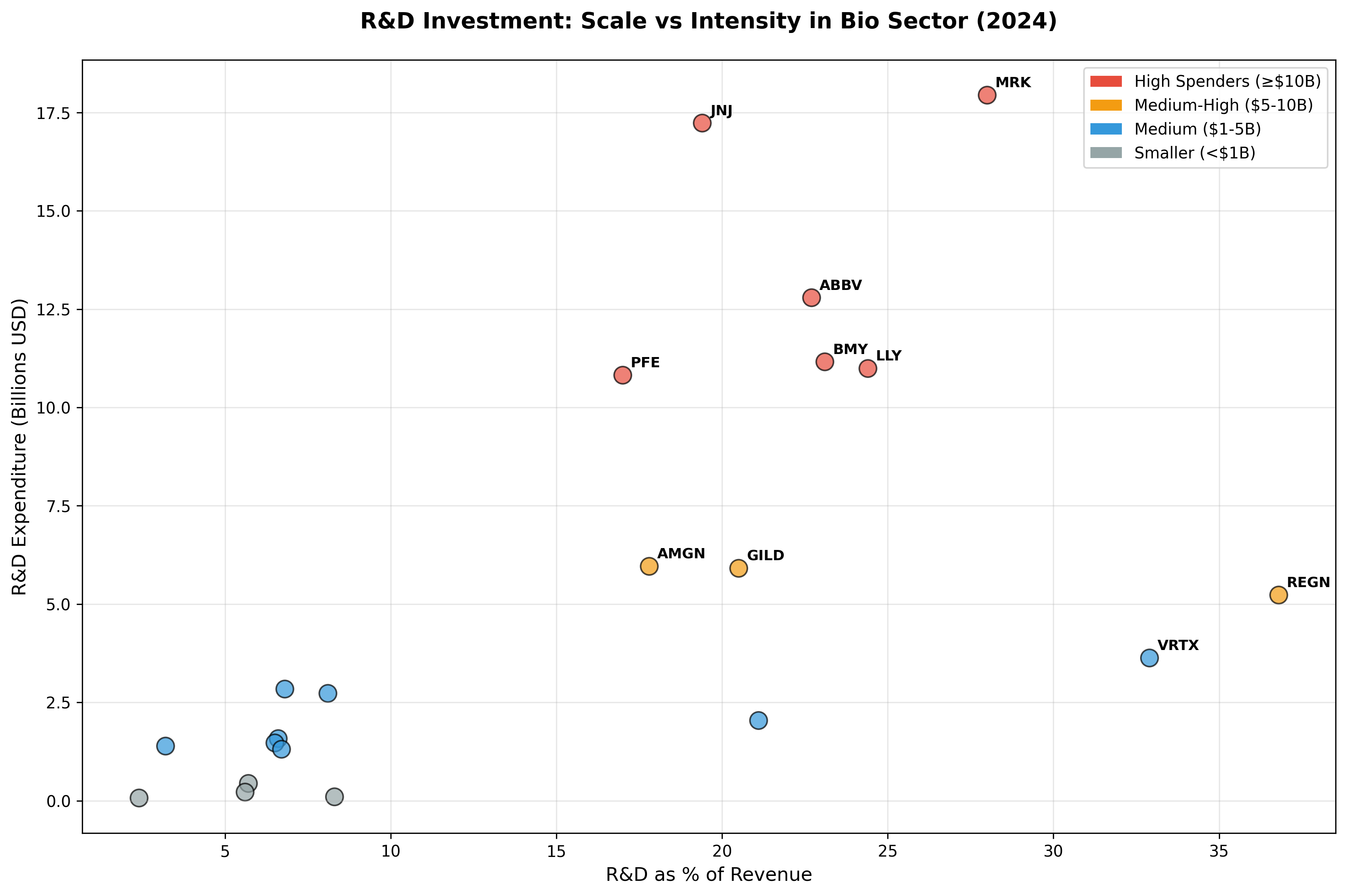

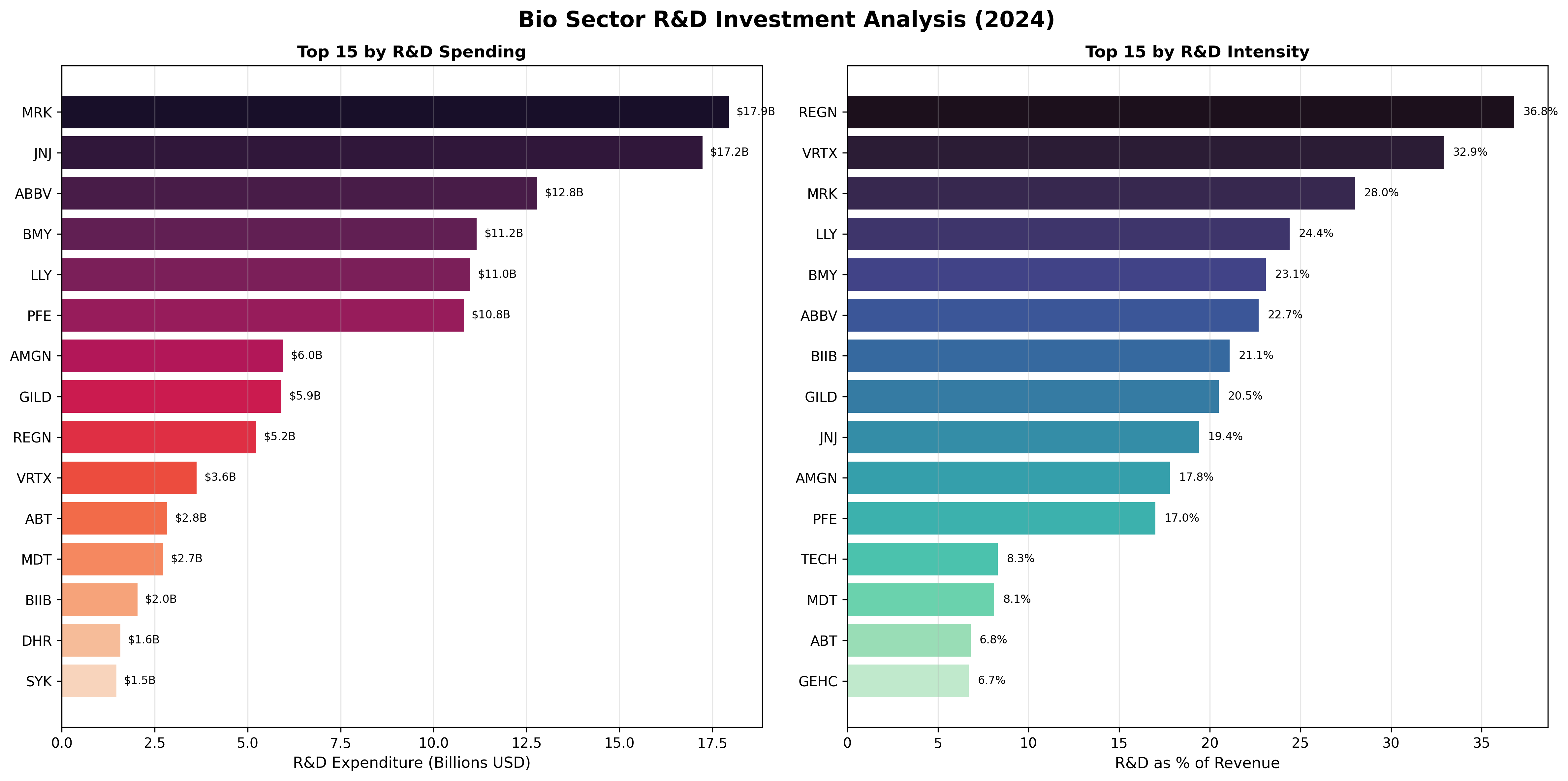

The story at the top of our rankings is fascinating. **Merck & Co. (MRK)** claims the crown with an astounding $17.94 billion investment, representing 28% of their total revenue. This isn't just big spending - it's strategic commitment. Every dollar in four that Merck earns gets reinvested into discovering the next generation of medicines. Close behind, **Johnson & Johnson (JNJ)** invested $17.23 billion, though at a lower intensity of 19.4% of revenue, reflecting their more diversified business model that includes consumer products and medical devices.

What's particularly interesting is how **AbbVie (ABBV)**, **Bristol Myers Squibb (BMY)**, and **Lilly (LLY)** cluster in the $10-13 billion range, each showing R&D intensities above 22%. These companies represent the 'pure-play' pharmaceutical strategy - focused primarily on drug development with aggressive reinvestment rates that signal confidence in their research pipelines.

The Intensity Champions: Small but Mighty

While the pharmaceutical giants dominate absolute spending, the most compelling story emerges when we examine R&D intensity. **Regeneron Pharmaceuticals (REGN)** leads this category with an extraordinary 36.8% of revenue dedicated to R&D - more than one in every three dollars earned! This level of commitment is typical of specialized biotech companies that bet everything on breakthrough innovation.

**Vertex Pharmaceuticals (VRTX)** follows closely at 32.9% intensity, demonstrating how focused biotech companies often outpace larger diversified firms in research commitment. These companies represent a 'high-risk, high-reward' philosophy - they may spend less in absolute terms than the giants, but they're putting a much larger portion of their resources on the line for each breakthrough.

The Complete Investment Picture

The complete picture reveals three distinct strategic approaches in the bio sector. **Diversified Giants** like Johnson & Johnson and Abbott Laboratories maintain substantial R&D budgets but at moderate intensity levels, balancing innovation with other business priorities. **Pure-Play Pharma** companies like Merck, AbbVie, and Lilly combine high absolute spending with high intensity rates. **Specialized Biotech** firms like Regeneron and Vertex may have smaller absolute budgets but demonstrate exceptional commitment through intensity rates exceeding 30%.

Key Insights: What This Means for Healthcare Innovation

- **Scale Matters**: The top 10 companies collectively invested over $117 billion in R&D during 2024, demonstrating the massive capital requirements for modern pharmaceutical innovation.

- **Intensity Reveals Strategy**: Companies with R&D intensities above 25% (Merck, Lilly, BMY, Regeneron, Vertex) are making the boldest bets on research-driven growth.

- **Diversity of Approaches**: From Merck's $18B investment to specialized players like Bio-Techne's focused $100M, successful R&D strategies come in many forms.

- **Innovation Clusters**: The sector shows clear clustering around $5-6B (Amgen, Gilead) and $10-11B (Lilly, Pfizer) investment levels, suggesting industry benchmarks for competitive positioning.

- **Future Pipeline Indicator**: High R&D intensity companies often signal the most aggressive timelines for bringing new treatments to market.

The Methodology Behind the Rankings

This analysis draws from comprehensive financial statement data covering 21 biotechnology and pharmaceutical companies within the S&P 500. R&D expenditure figures come directly from annual income statements, representing fiscal year 2024 data where available. The R&D percentage calculations use total revenue as the denominator, providing a standardized measure of research commitment across companies of different sizes.

Companies were identified through sector classification and business description analysis, focusing on entities with significant pharmaceutical, biotechnology, or medical device research activities. The Total Score combines absolute spending rank with intensity rank using a weighted formula that recognizes both financial capacity and strategic commitment to innovation.

Looking Forward: What These Investments Signal

The R&D investment patterns revealed in this analysis offer a window into the future of healthcare innovation. Companies with the highest combined scores - those balancing significant absolute investment with high intensity rates - are positioning themselves as the primary drivers of medical breakthroughs over the next decade. As we watch these research investments translate into new treatments, diagnostic tools, and therapeutic approaches, the companies leading today's R&D race are likely to shape tomorrow's healthcare landscape.

This analysis serves purely educational purposes, helping readers understand the scale and commitment levels across the biotechnology sector. The data reveals strategic priorities and investment philosophies, but should not be considered as investment advice or recommendations for any specific company or stock.

Comments (0)

No comments yet. Be the first to comment!