Understanding the Growth-Stability Ranking

The industrial sector is known for its cyclical nature, making companies that achieve steady growth particularly valuable to investors. This analysis examines which industrial companies in the S&P 500 have maintained strong revenue growth while keeping their stock price volatility low - a challenging combination that indicates exceptional operational management.

What These Metrics Mean

Our ranking is built on two fundamental metrics that, when combined, offer insights into a company's operational excellence and market perception:

- Revenue Growth %: The year-over-year percentage change in a company's total revenue from the most recent quarterly reports. It reveals how quickly a company is expanding its business.

- Stock Volatility: A measurement of how much a stock's price fluctuates over time. Lower volatility means more stable and predictable price movements.

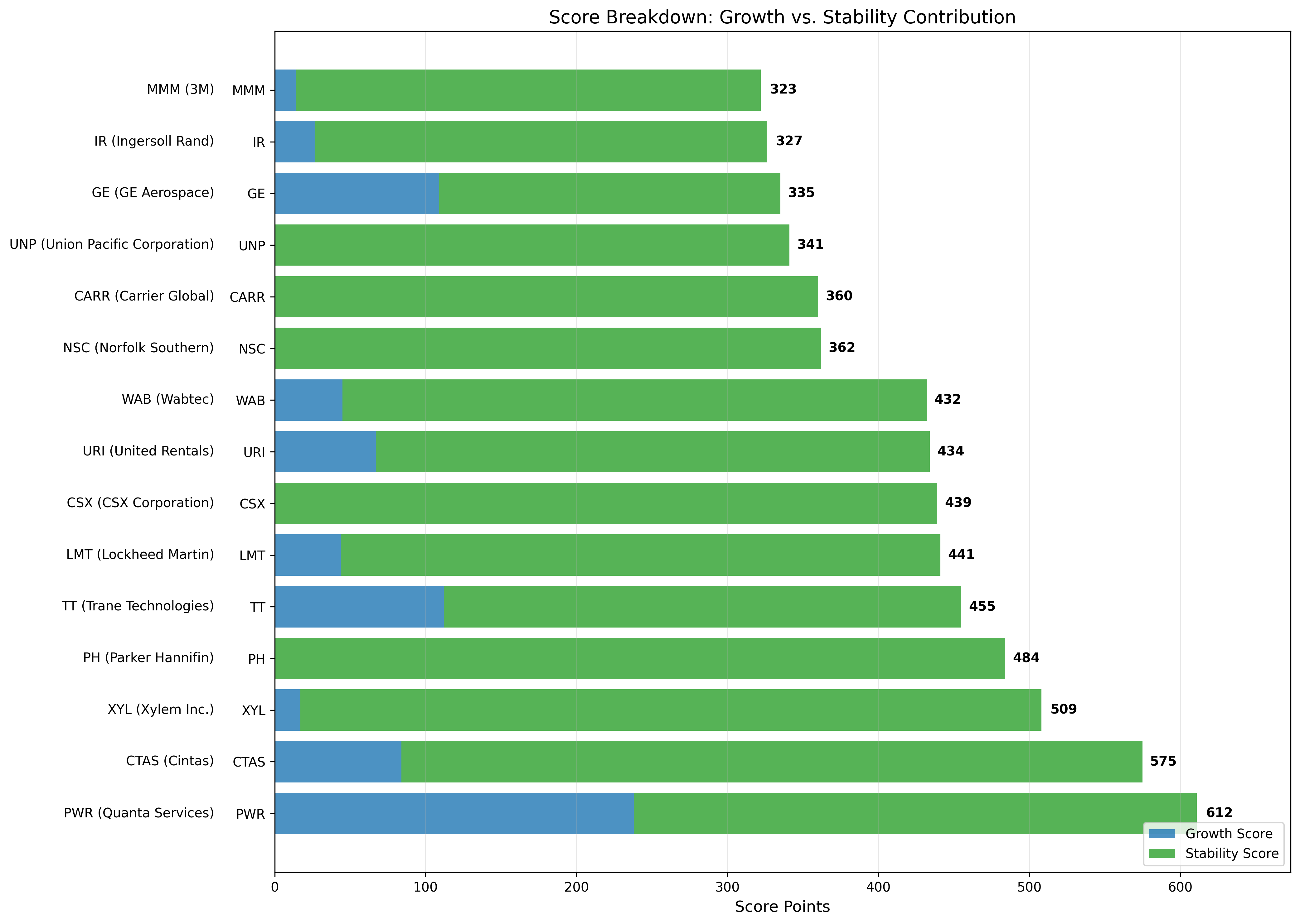

- Growth Score (max 500 points): Calculated as Revenue Growth % × 10, with a cap at 500 points. A 50% growth would earn the maximum score.

- Stability Score (max 500 points): Calculated as (0.035 - Stock Volatility) × 25,000, with a cap at 500 points. This formula rewards lower volatility with higher scores.

- Total Score (max 1000 points): The sum of Growth Score and Stability Score, providing a balanced assessment of growth and stability.

Breaking Down The Leaders

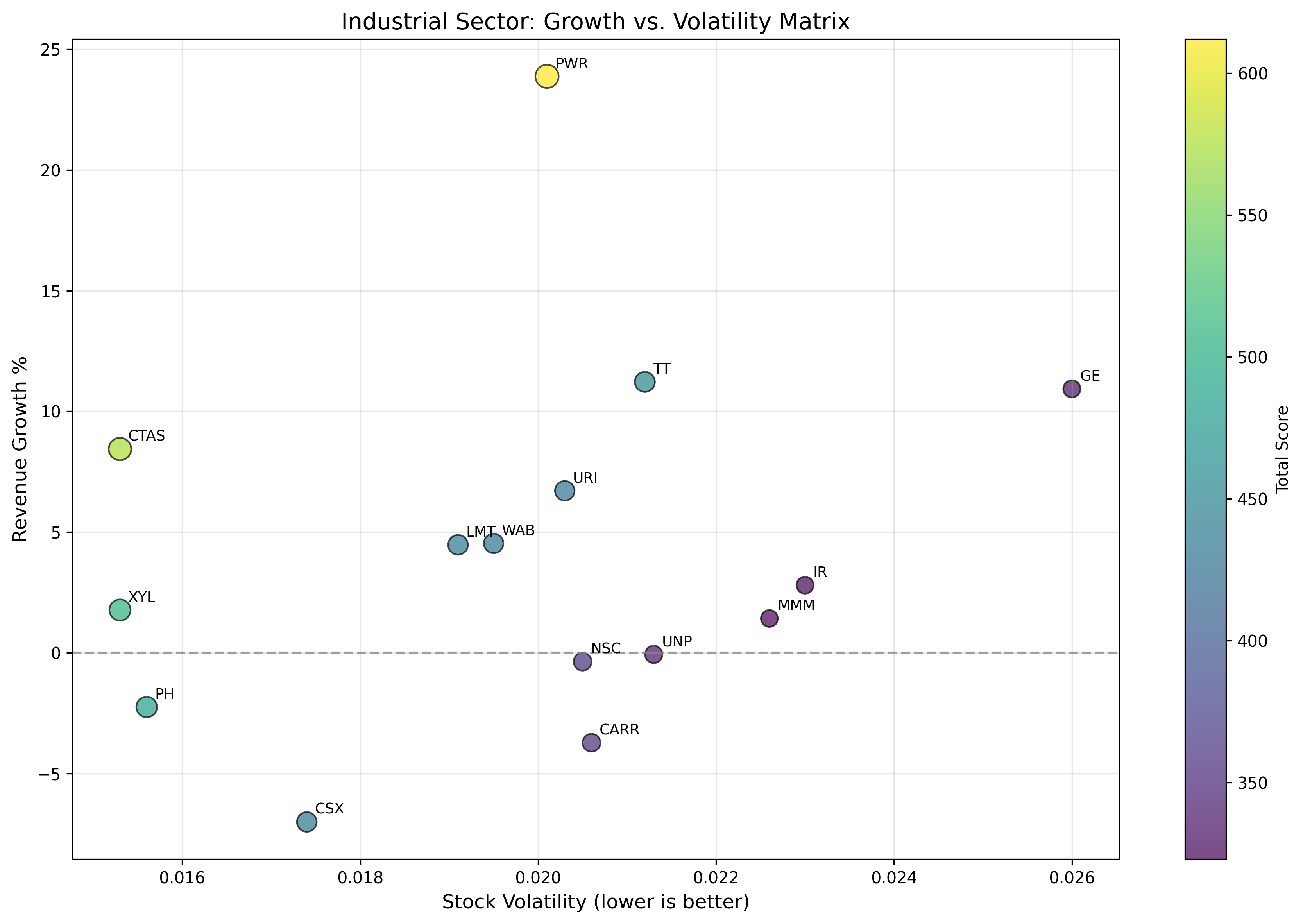

The visualization above reveals some fascinating patterns. Companies in the upper left quadrant (high growth, low volatility) achieve the highest total scores. Quanta Services (PWR) stands out with exceptional revenue growth of nearly 24% while maintaining reasonable stability. Meanwhile, Cintas (CTAS) and Xylem (XYL) showcase incredibly low volatility, making them stability champions.

The Stability Advantage

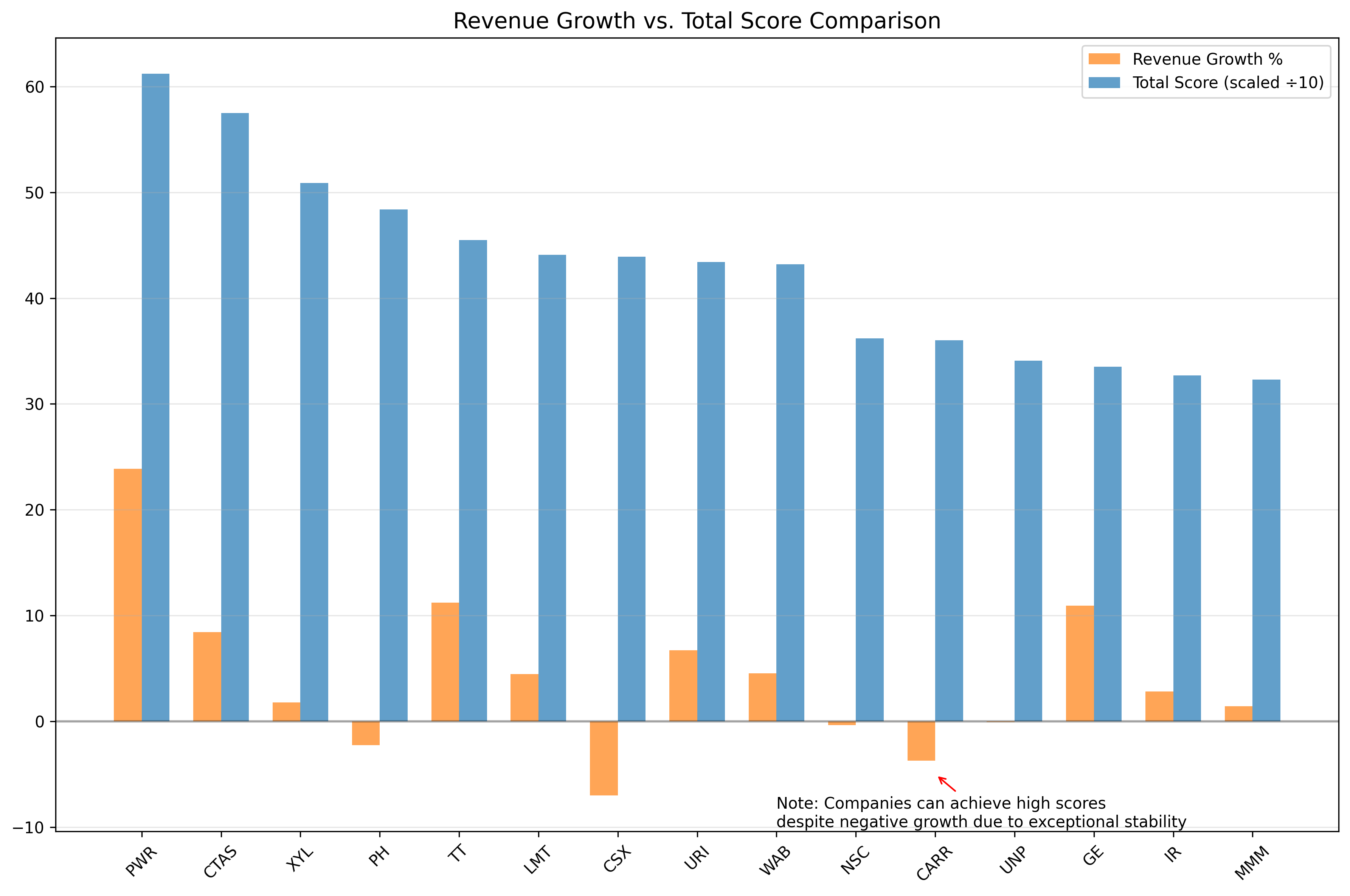

Perhaps the most surprising insight from this analysis is how companies with negative revenue growth still managed to rank well. Parker Hannifin (PH), for instance, ranks fourth overall despite a -2.25% revenue decline. The reason? Exceptional price stability that earned it 484 out of 500 possible stability points. This demonstrates that the market sometimes values consistency and predictability even when growth temporarily slows.

What This Means For Investors

Investors often face a difficult choice between high-growth companies (which can be volatile) and stable companies (which might grow slowly). This analysis highlights industrial companies that offer both attributes to varying degrees. While past performance doesn't guarantee future results, companies that have demonstrated an ability to grow revenue without dramatic price swings may be worth further research.

The data reveals different winning strategies: Quanta Services leads through exceptional growth with decent stability, while Cintas and Xylem achieve their high rankings primarily through remarkable stability combined with modest growth. Each approach has merit depending on market conditions and investor preferences.

Key Takeaways

- Growth and stability aren't mutually exclusive - top-ranked companies have found ways to balance both attributes

- Exceptional stability can compensate for modest or even negative short-term growth in the overall ranking

- The industrial sector contains companies with widely varying growth and stability profiles, providing options for different investor preferences

- Quanta Services (PWR) stands out with the strongest combination of growth and stability in this analysis

Comments (0)

No comments yet. Be the first to comment!