Introduction: The Allure of Buying the Dip

"Buy the dip" – those three words have become a rallying cry for investors across social media platforms and trading forums. The concept is intuitively appealing: wait for market downturns, then deploy your cash to scoop up assets at discount prices. But does this tactical approach actually work? Using nearly two decades of market data spanning bull markets, bear markets, and everything in between, we'll examine how different dip-buying strategies perform against a simple buy-and-hold approach.

Strategy Logic & Assumptions

Our simulation begins with a straightforward premise: an investor starts with $100,000 in initial capital and follows a systematic approach to buying market dips. When SPY drops by a predefined threshold (5%, 10%, or 15%) from its recent high, the investor deploys 20% of available cash to buy shares. A 20-day cooldown period prevents overtrading after each purchase. We tested this strategy using historical SPY data from 2005 through 2024, capturing multiple market cycles including the 2008 crash (financial crisis), the 2020 COVID crash, and the 2022 bear market.

Simulation Approach

The core logic of our simulation can be described in plain language as follows:

- Start with $100,000 in cash and no SPY shares. - Track the highest price SPY has reached so far. - Every day, check if the current SPY price has fallen by a set percentage (like 5%, 10%, or 15%) from that recent high. - If it has, and at least 20 trading days have passed since the last purchase: - Spend 20% of the remaining cash to buy SPY at the current price. - Update your cash and SPY holdings accordingly. - Mark the date of this purchase to enforce the cooldown period. - At the end of each day, calculate the total portfolio value (cash + SPY shares × current price). - Repeat this process every trading day from 2005 to 2024.

Results & Performance Metrics

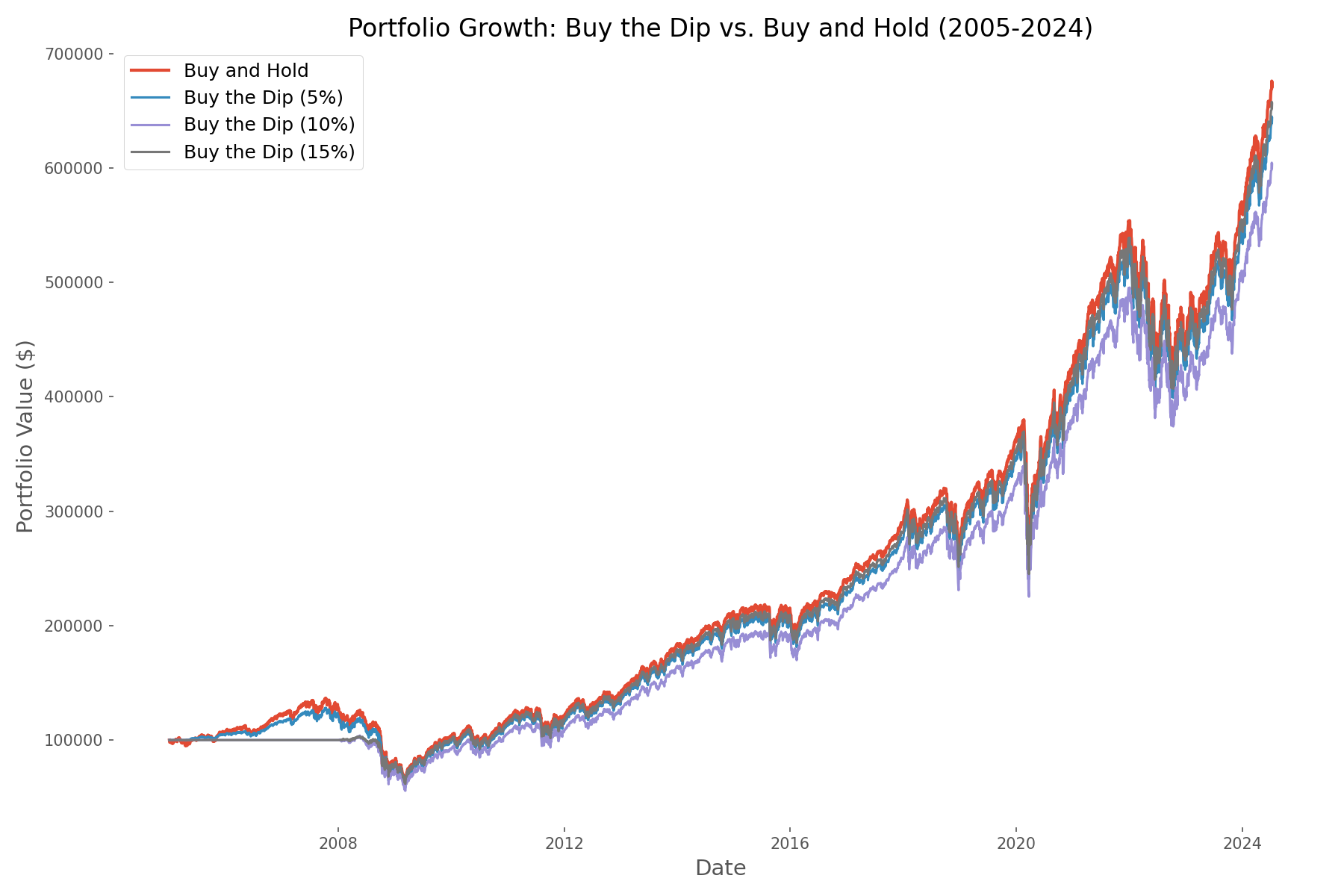

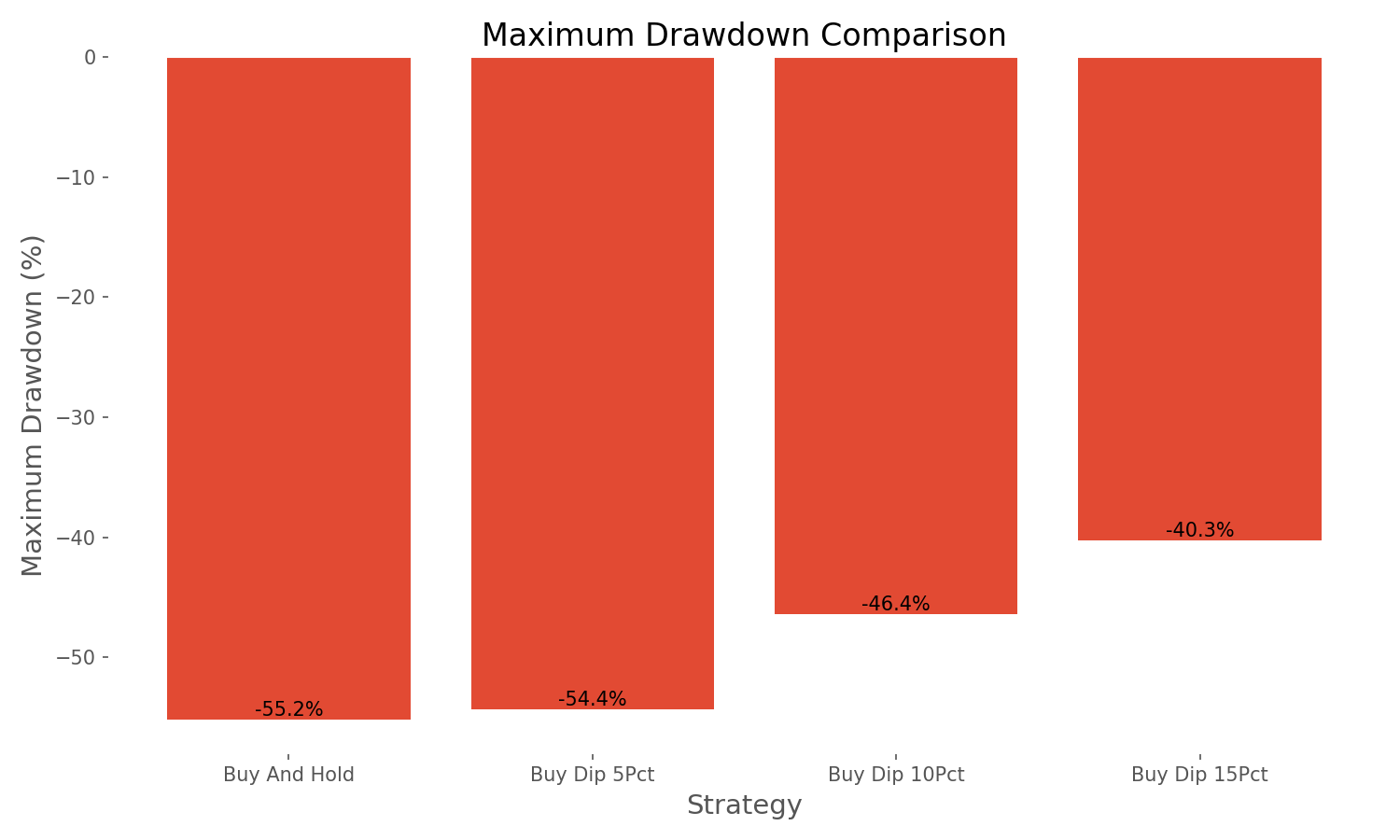

The results challenge conventional wisdom. Over the full period, the buy-and-hold strategy delivered the highest total return at 574.37%, outperforming all dip-buying approaches. Among the dip-buying strategies, the 15% threshold performed best with a 556.18% return. However, the story changes when we look at risk metrics. The 15% threshold strategy significantly reduced maximum drawdown to -40.26% compared to -55.20% for buy-and-hold – a substantial improvement in downside protection. It also achieved the best risk-adjusted returns with a Sharpe ratio of 0.48 versus 0.43 for buy-and-hold.

Case Studies: Market Crashes

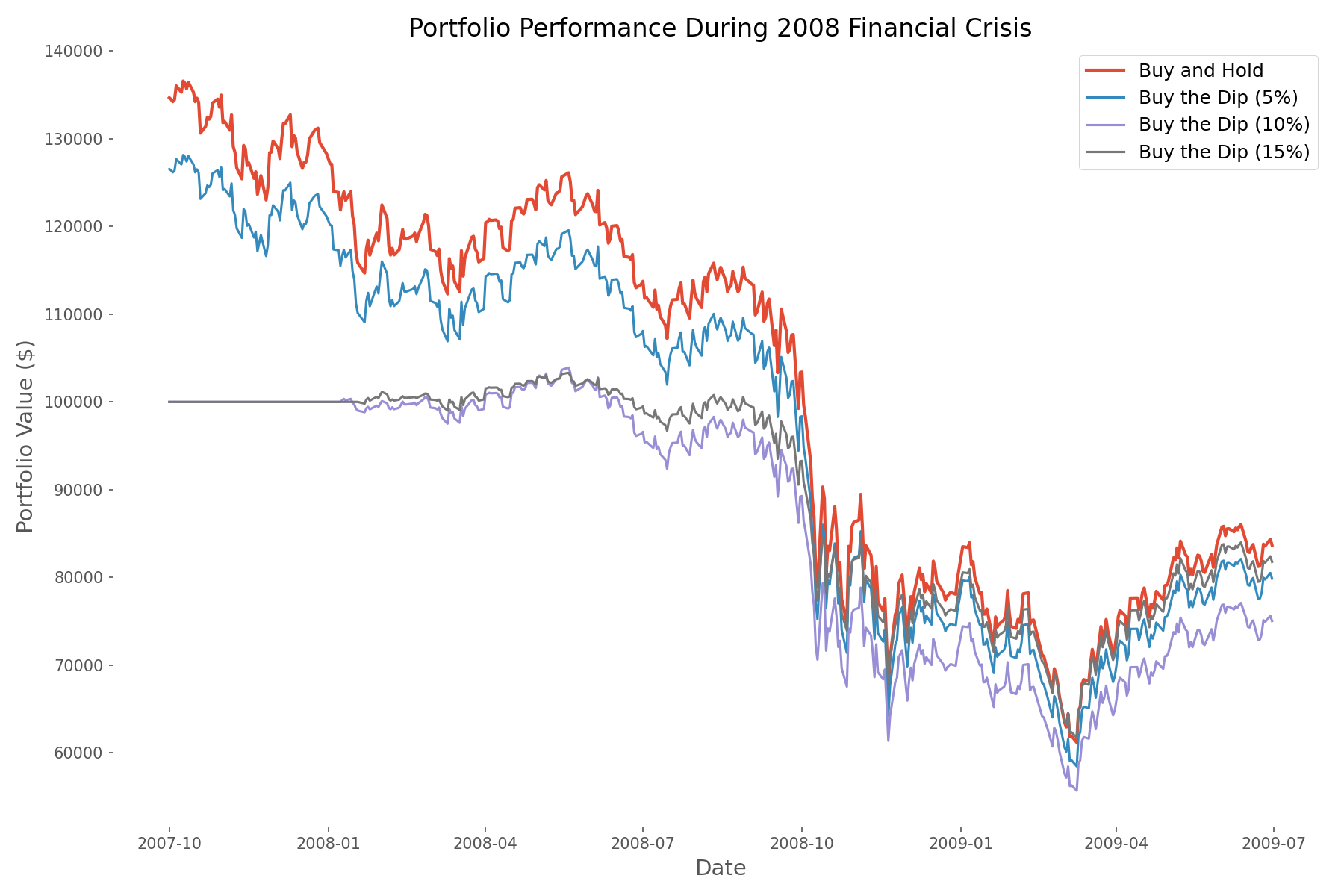

During the 2008 financial crisis, the buy-the-dip strategies showed their defensive value. The 15% threshold strategy triggered fewer but more significant buys, preserving cash during the early stages of the decline and deploying it at more attractive valuations. This resulted in better downside protection during the crash phase, though all buy-the-dip strategies lagged during the subsequent recovery.

The COVID-19 crash presented a different scenario – a sharp but brief market decline followed by a rapid recovery. While the buy-the-dip strategies provided better downside protection during the crash phase, they significantly underperformed during the V-shaped recovery that followed. The 2022 bear market demonstrated the value of buy-the-dip strategies in prolonged downturns, with the 15% threshold strategy performing particularly well.

Key Takeaways & Limitations

- Risk reduction, not return enhancement: The primary benefit of buy-the-dip strategies is reduced volatility and smaller drawdowns, not higher returns.

- Threshold matters: Larger dip thresholds (15%) provide a better balance between risk reduction and return preservation than smaller thresholds.

- Market environment dependency: The strategy performs best in prolonged bear markets but struggles in V-shaped recoveries and strong bull markets.

- Psychological benefits: Beyond the numbers, having a systematic approach to market downturns may help investors avoid panic selling at market bottoms.

So, should you buy the dip? Our analysis suggests that while the strategy doesn't deliver the market-beating returns many hope for, it does provide meaningful risk reduction benefits that may be valuable to risk-averse investors. The data points to using a higher threshold (15%) to avoid overtrading and focusing on significant market corrections rather than minor pullbacks.

Comments (0)

No comments yet. Be the first to comment!