Introduction

In an era of monetary policy shifts, tech companies face unique challenges as interest rates fluctuate. High-growth tech firms, particularly those reinvesting heavily in expansion, often see their valuations most impacted by rate changes. This analysis dives deep into how two prominent tech companies - Palantir Technologies (PLTR) and Snowflake (SNOW) - navigated the interest rate environment from 2022 to 2025, revealing surprising patterns of resilience and vulnerability.

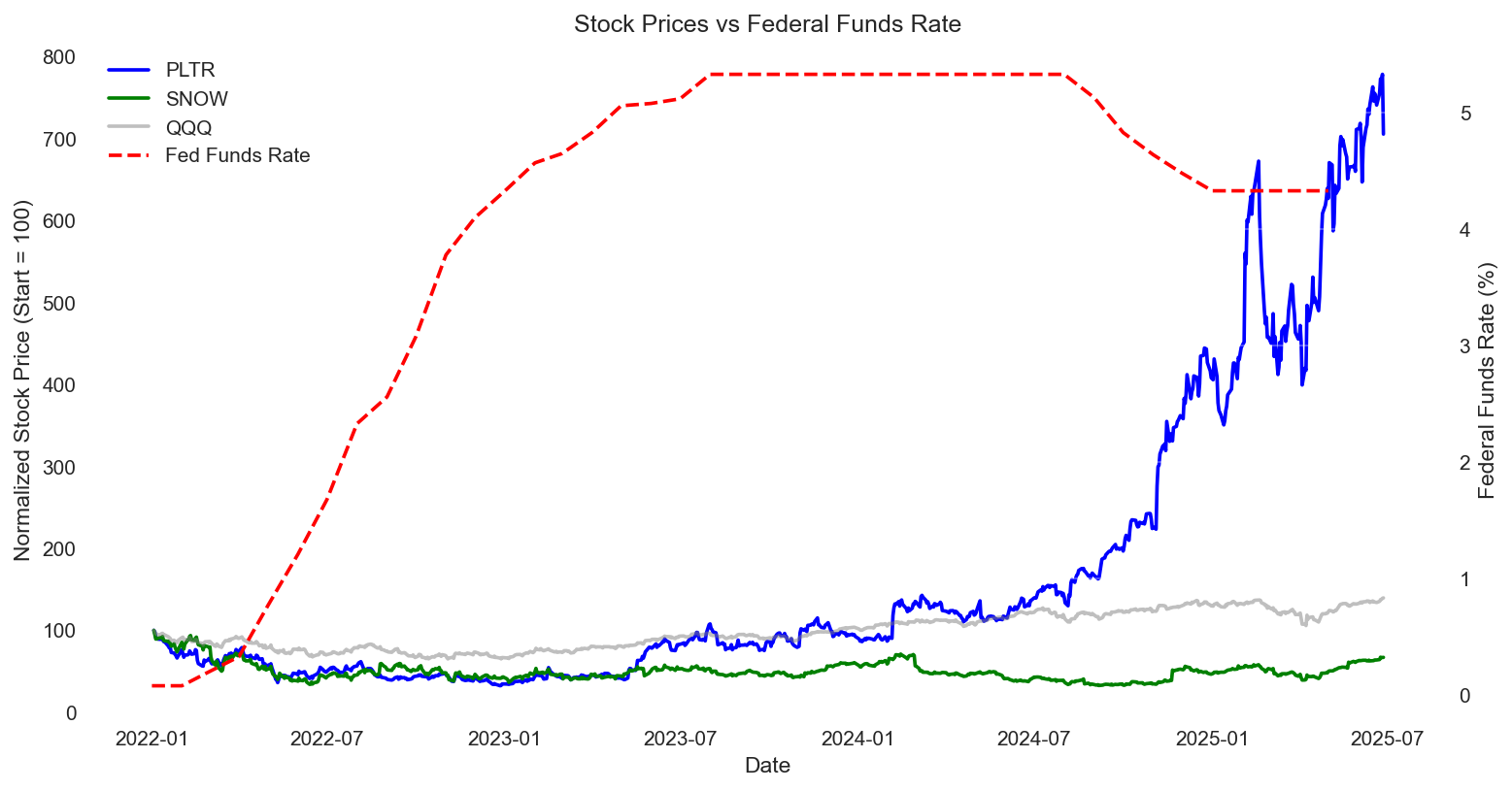

The Numbers Tell the Story: Interest Rates and Stock Performance

Our analysis reveals striking differences in how PLTR and SNOW responded to the rate environment. PLTR showed remarkable growth, with its stock price reaching a normalized level of 705.56 (from a base of 100), while SNOW's performance was more modest at 67.05. This divergence suggests that market reactions to interest rates aren't uniform across the tech sector.

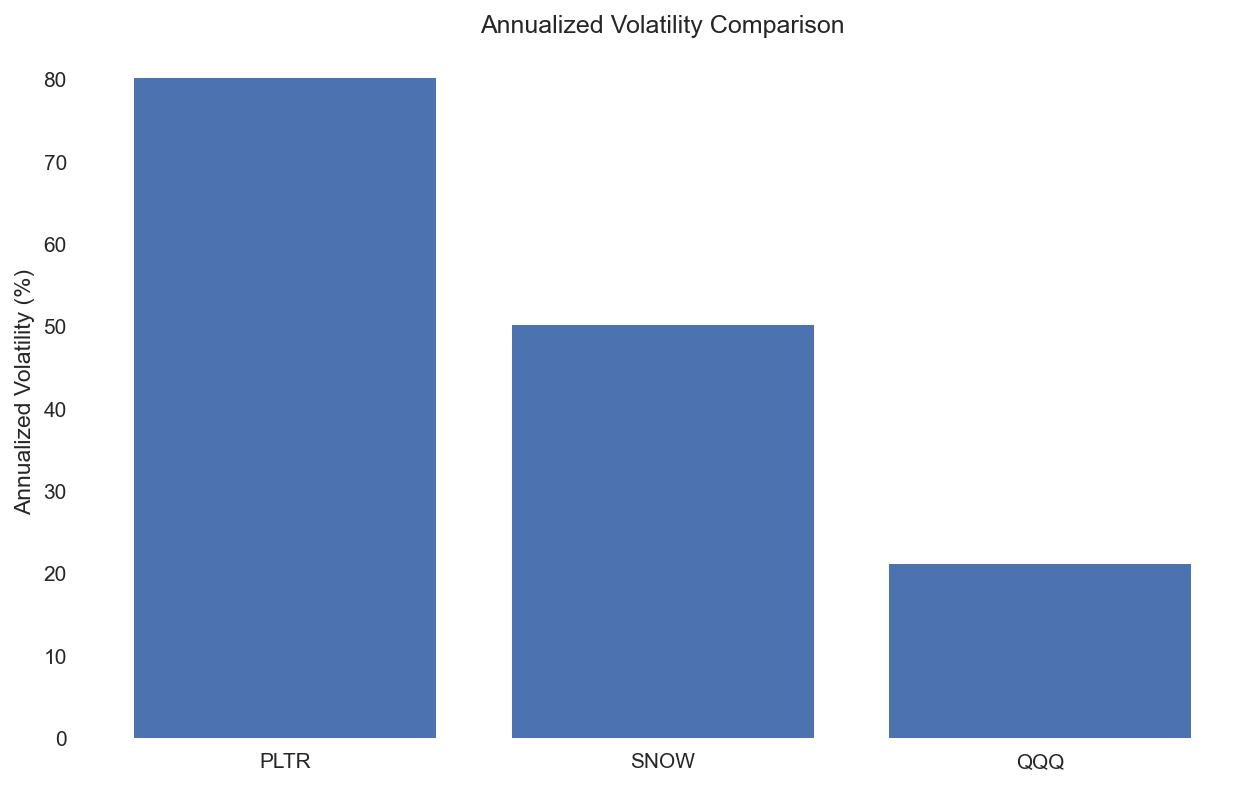

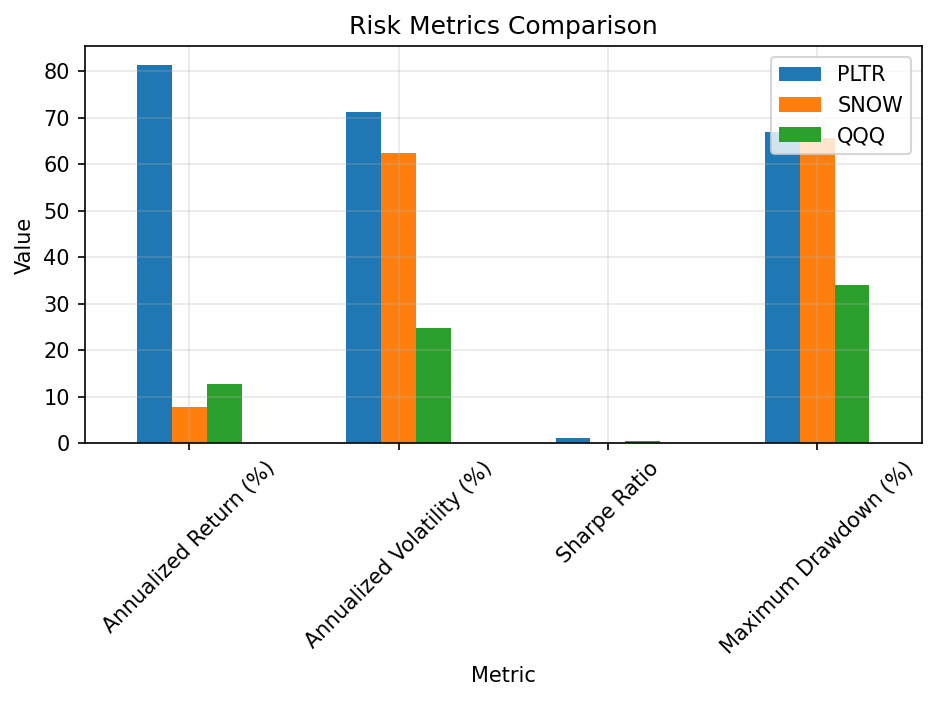

Volatility and Risk Profiles

The volatility analysis reveals significant differences in risk profiles. PLTR exhibited higher volatility at 80.17% annualized, compared to SNOW's 50.18%. For context, the broader tech sector (represented by QQQ) showed much lower volatility at 21.15%. This suggests that while PLTR offered higher potential returns, it came with substantially more risk.

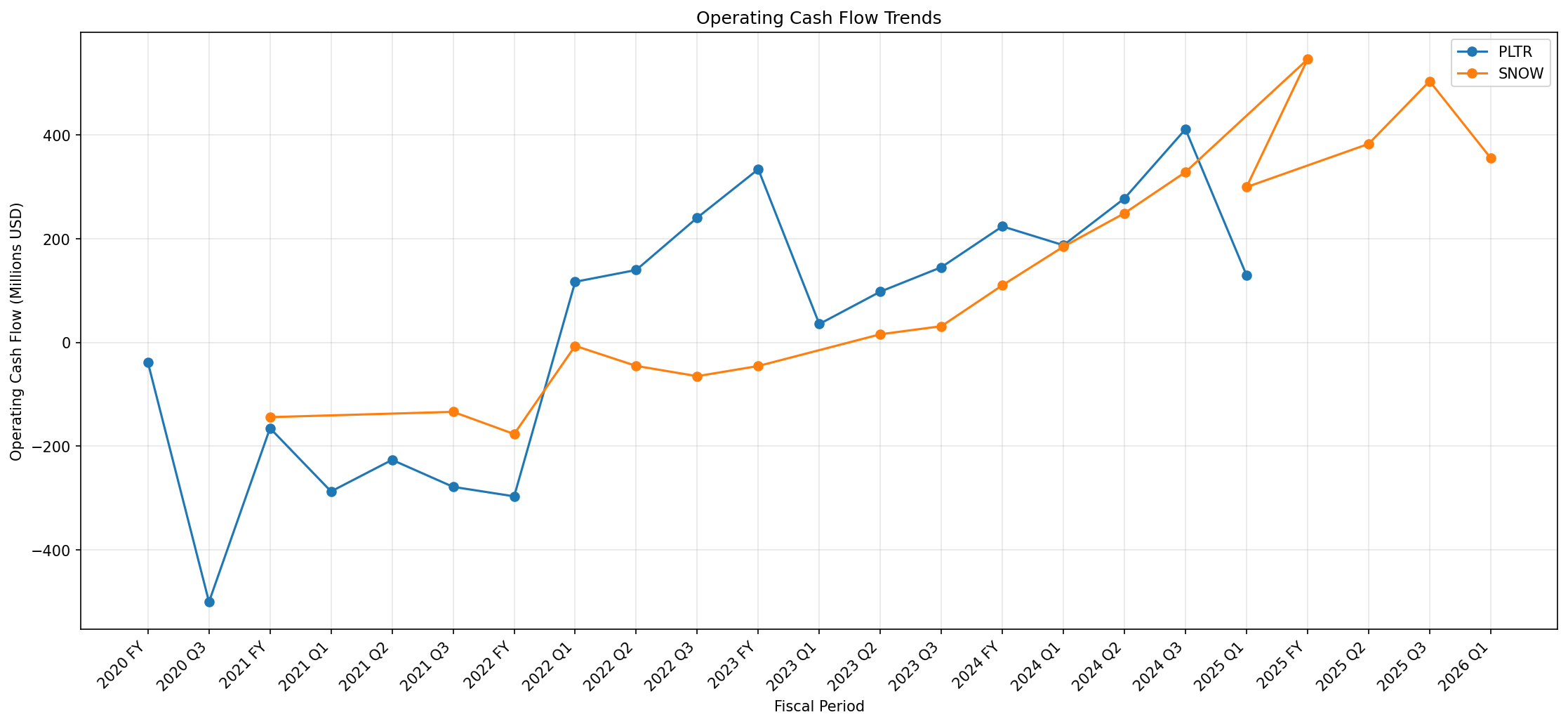

Cash Flow Analysis: A Tale of Two Companies

Operating cash flow trends tell a compelling story about each company's financial health during rate fluctuations. SNOW demonstrated robust cash generation with $355.47M in its latest quarter and impressive year-over-year growth of 395.23%. PLTR, while still cash-flow positive at $129.58M, showed more modest results with a -32.98% year-over-year decline.

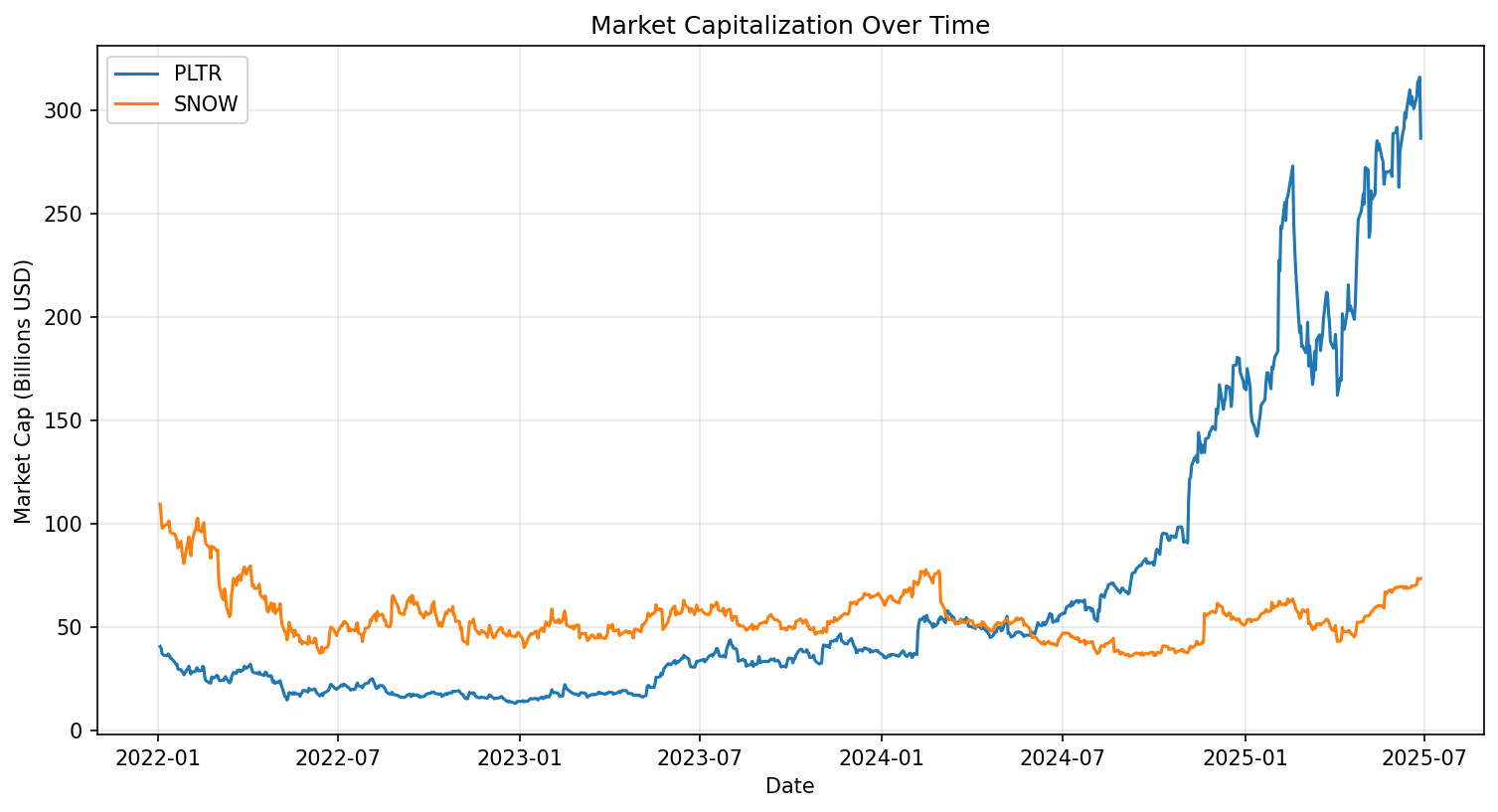

Market Valuation Dynamics

The market capitalization analysis reveals fascinating valuation dynamics. PLTR's current market cap of $286.32B represents a dramatic 329.3% premium over its historical average, while SNOW's $73.41B represents a more modest 33.9% premium. This suggests different market perceptions of each company's ability to thrive in a changing rate environment.

Risk-Adjusted Performance: The Complete Picture

The risk-adjusted performance metrics provide crucial insights. PLTR achieved an impressive 81.27% annualized return with a Sharpe ratio of 1.14, while SNOW posted a 7.72% return with a Sharpe ratio of 0.12. Both companies experienced significant drawdowns (PLTR: 66.98%, SNOW: 65.59%), highlighting the volatile nature of high-growth tech stocks during rate changes.

Conclusion

Our analysis reveals that PLTR demonstrated greater resilience to interest rate changes, delivering superior returns despite higher volatility. However, SNOW's more stable cash flow generation and conservative market premium suggest it might be better positioned for long-term stability in a high-rate environment. These findings highlight how different business models and market perceptions can lead to divergent outcomes in changing monetary conditions.

Comments (0)

No comments yet. Be the first to comment!