Big idea (in plain English)

Imagine a gym that sells memberships. The gym can expect a steady flow of cash as long as people keep their memberships. Software companies that sell subscriptions work the same way. The money they expect to collect every year from active subscriptions is called ARR — Annual Recurring Revenue. Investors often value subscription companies by asking: “How many dollars of Enterprise Value (EV) should I pay for each dollar of ARR?” That’s the EV/ARR multiple. If we test a few reasonable multiples (say 10×, 15×, 20×), we get a valuation band — a range that translates into an estimated stock price band.

Quick definitions (no jargon version)

- ARR (Annual Recurring Revenue): dollars expected to repeat every year from subscriptions.

- EV (Enterprise Value): the total value of a business to all investors. Shortcut formula: EV = Market Cap + Debt – Cash.

- EV/ARR multiple: how many dollars of EV investors pay for each $1 of ARR.

- RPO (Remaining Performance Obligations): contracted revenue not yet recognized. cRPO is the part due in the next 12 months — a useful ARR proxy.

- Subscription vs. Consumption: Subscription companies (like ServiceNow) recognize revenue ratably, so cRPO ≈ ARR. Consumption companies (like Snowflake) recognize revenue as customers use it, so cRPO is only a rough guide.

Where to find the numbers in a 10-K

- ServiceNow 10-K (FY2024): RPO = $22.3B, 46% due in next 12 months. Subscription revenue = $10.6B.

- Snowflake 10-K (FY2025): RPO = $6.9B, ~48% due in next 12 months. Revenue is consumption-based, so cRPO is indicative only.

Step-by-step: ARR-style estimate from cRPO

Why cRPO? It’s the company-reported contracted revenue expected in the next 12 months. For subscription models, it’s a practical proxy for ARR. For consumption models, it’s only a rough indicator.

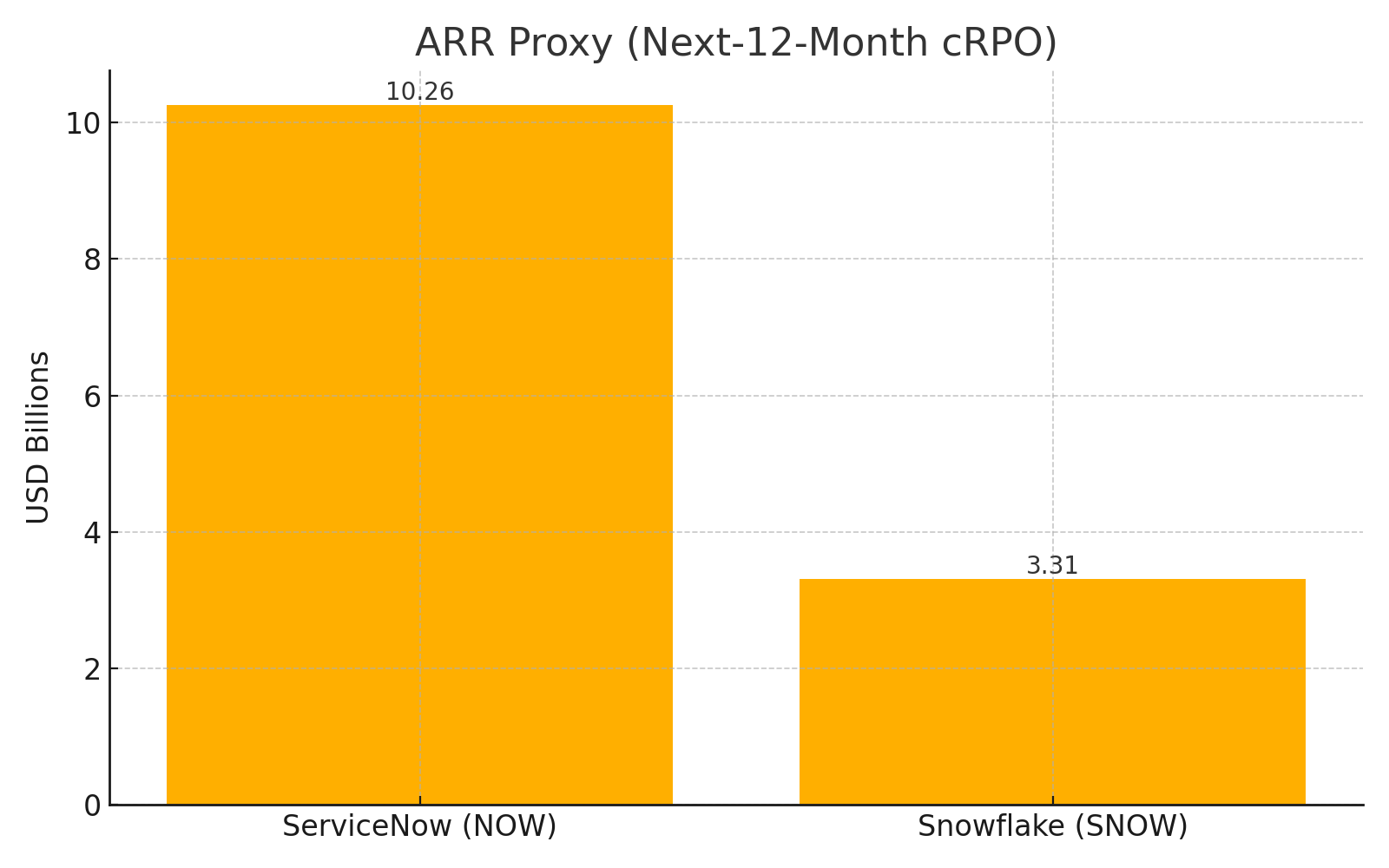

ServiceNow (NOW)

Given from 10-K: RPO = $22.3B, cRPO share = 46%. ARR ≈ 22.3 × 46% = $10.26B. Cross-check: ServiceNow subscription revenue in 2024 was $10.6B, consistent with the ARR estimate.

Snowflake (SNOW)

Given from 10-K: RPO = $6.9B, ~48% due in next 12 months. ARR proxy ≈ 6.9 × 48% = $3.31B. Important assumption: Snowflake is consumption-based; usage varies. Treat this as an indicative ARR, not strict subscription ARR.

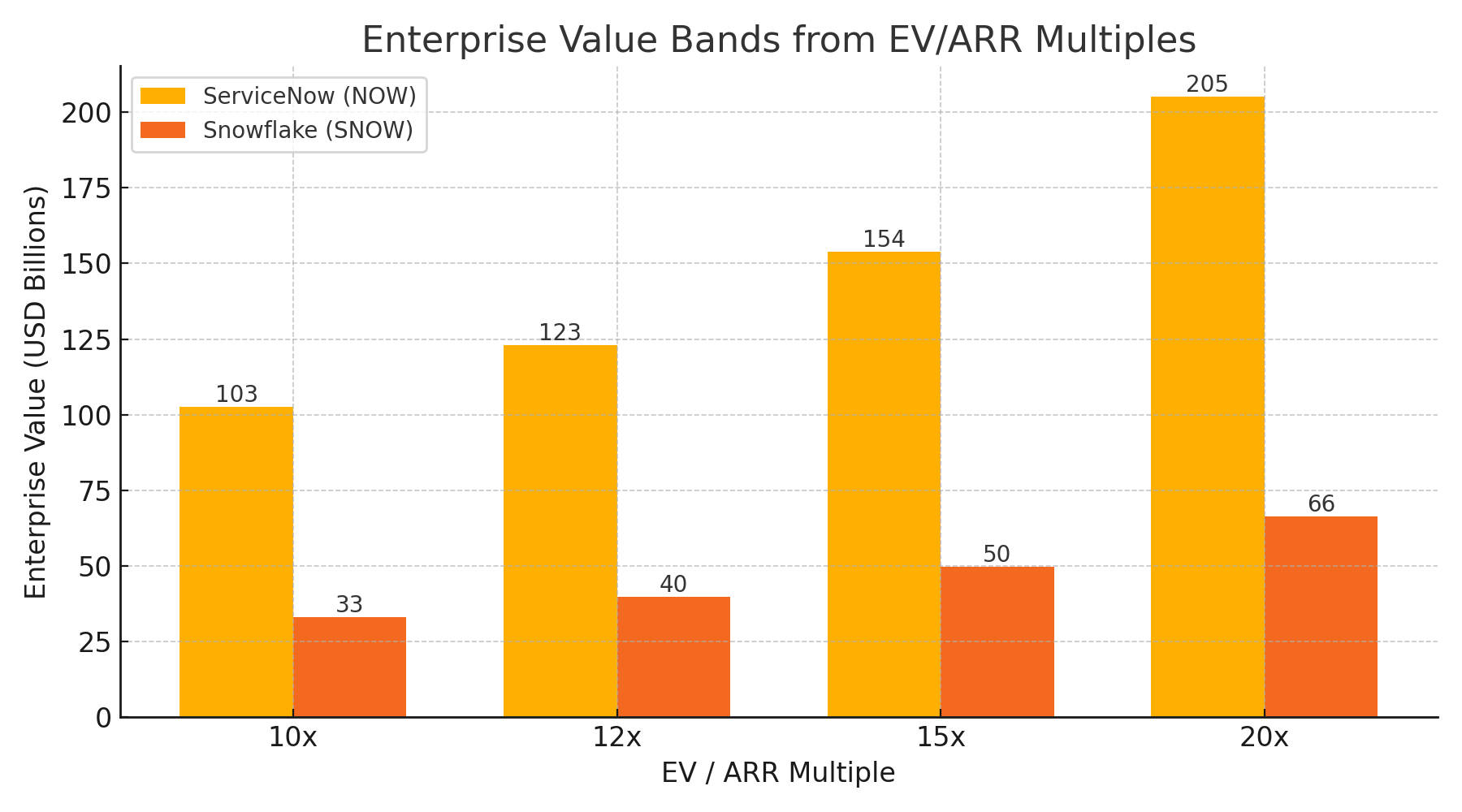

From ARR to a valuation band

Recipe: 1) Pick ARR. 2) Choose EV/ARR multiples (10×, 12×, 15×, 20×). 3) Compute EV = ARR × multiple. 4) Optionally adjust for net cash/debt and divide by shares to get per-share price.

| Company | ARR proxy (B$) | 10× EV (B$) | 12× EV (B$) | 15× EV (B$) | 20× EV (B$) |

|---|---|---|---|---|---|

| ServiceNow (NOW) | 10.26 | 102.6 | 123.1 | 153.9 | 205.2 |

| Snowflake (SNOW) | 3.31 | 33.1 | 39.7 | 49.7 | 66.2 |

Worked example details

ServiceNow (NOW)

- 10-K shows RPO = $22.3B; 46% due in next 12 months.

- Revenue is recognized ratably; subscription revenue = $10.6B.

- ARR ≈ 22.3 × 0.46 = 10.26B.

- At 12× EV/ARR: EV = $123.1B; at 20× EV/ARR: EV = $205.2B.

- Assumption: cRPO ≈ ARR is reasonable because revenue is ratable.

Snowflake (SNOW)

- 10-K shows RPO = $6.9B; ~48% due in next 12 months.

- Revenue recognized on consumption; ARR proxy ≈ 6.9 × 0.48 = 3.31B.

- At 10× EV/ARR: EV = $33.1B; at 20× EV/ARR: EV = $66.2B.

- Assumption: cRPO is a rough stand-in for ARR due to variable usage.

FAQ

- Why not just use last year’s revenue? Subscription revenue is a back-check, but cRPO gives a forward view tied to contracts.

- What multiple should I use? It depends on growth, margins, and durability. The point is to show sensitivity across bands.

- How do I get stock price from EV? Add net cash (or subtract net debt), then divide by diluted shares (see balance sheet and EPS footnotes).

Important notes (assumptions & limits)

- ServiceNow: treating cRPO as ARR is reasonable due to ratable recognition.

- Snowflake: cRPO as ARR is a simplification; actual usage can vary.

- Educational only, not investment advice. Always read company filings carefully.

Sources inside the filings

- ServiceNow (NOW) 10-K FY2024: RPO $22.3B; 46% cRPO; subscription revenue $10.6B.

- Snowflake (SNOW) 10-K FY2025: RPO $6.9B; ~48% cRPO; total revenue $3.6B; consumption model caveats.

Comments (0)

No comments yet. Be the first to comment!