The Quantum Computing Revolution: A Tale of Two Stocks

As quantum computing emerges from research labs into commercial applications, investors face a crucial question: Should they bet on pure-play quantum companies or established tech giants incorporating quantum technology? This analysis compares Rigetti Computing (RGTI), a quantum computing pioneer, with Nvidia (NVDA), a traditional tech powerhouse that's also investing in quantum technologies. Their contrasting trajectories offer valuable insights into the market's perception of quantum computing's commercial potential.

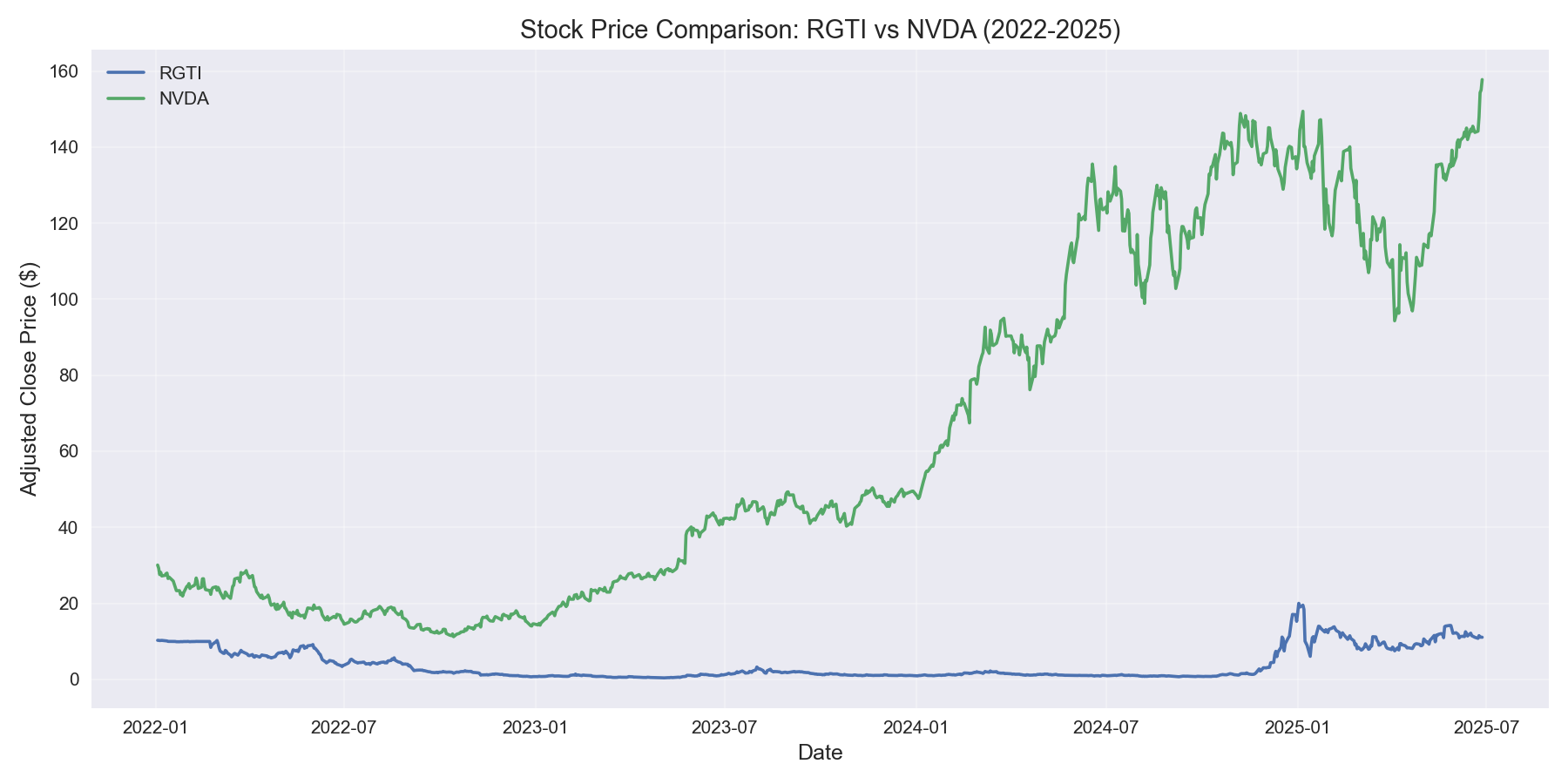

Stock Price Performance: A Study in Contrasts

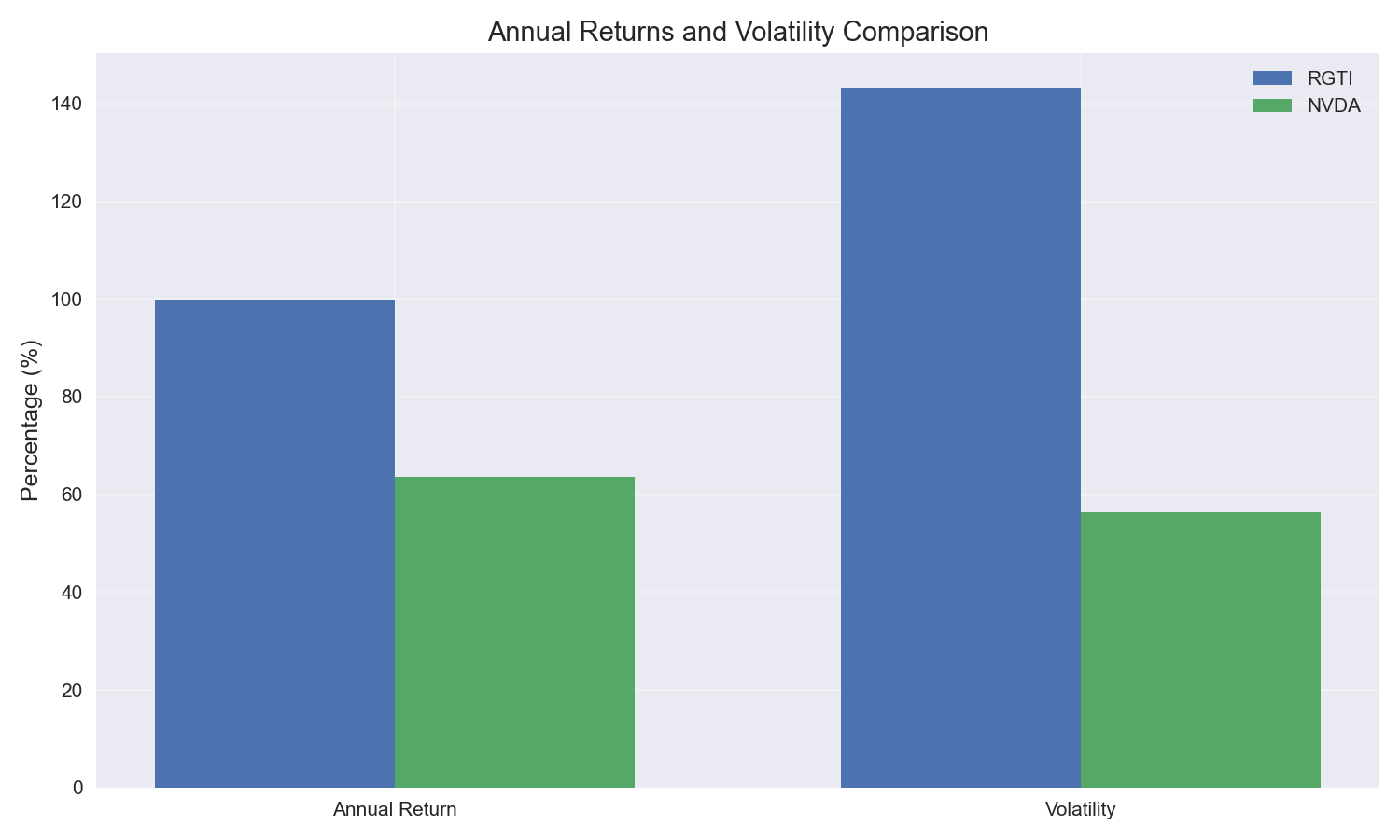

Our analysis reveals striking differences in both returns and volatility between these two companies. Rigetti Computing showed an impressive annualized return of 99.91%, significantly outpacing Nvidia's 63.60%. However, this higher return comes with substantially greater risk - RGTI's volatility stands at 143.11%, more than double Nvidia's 56.39%.

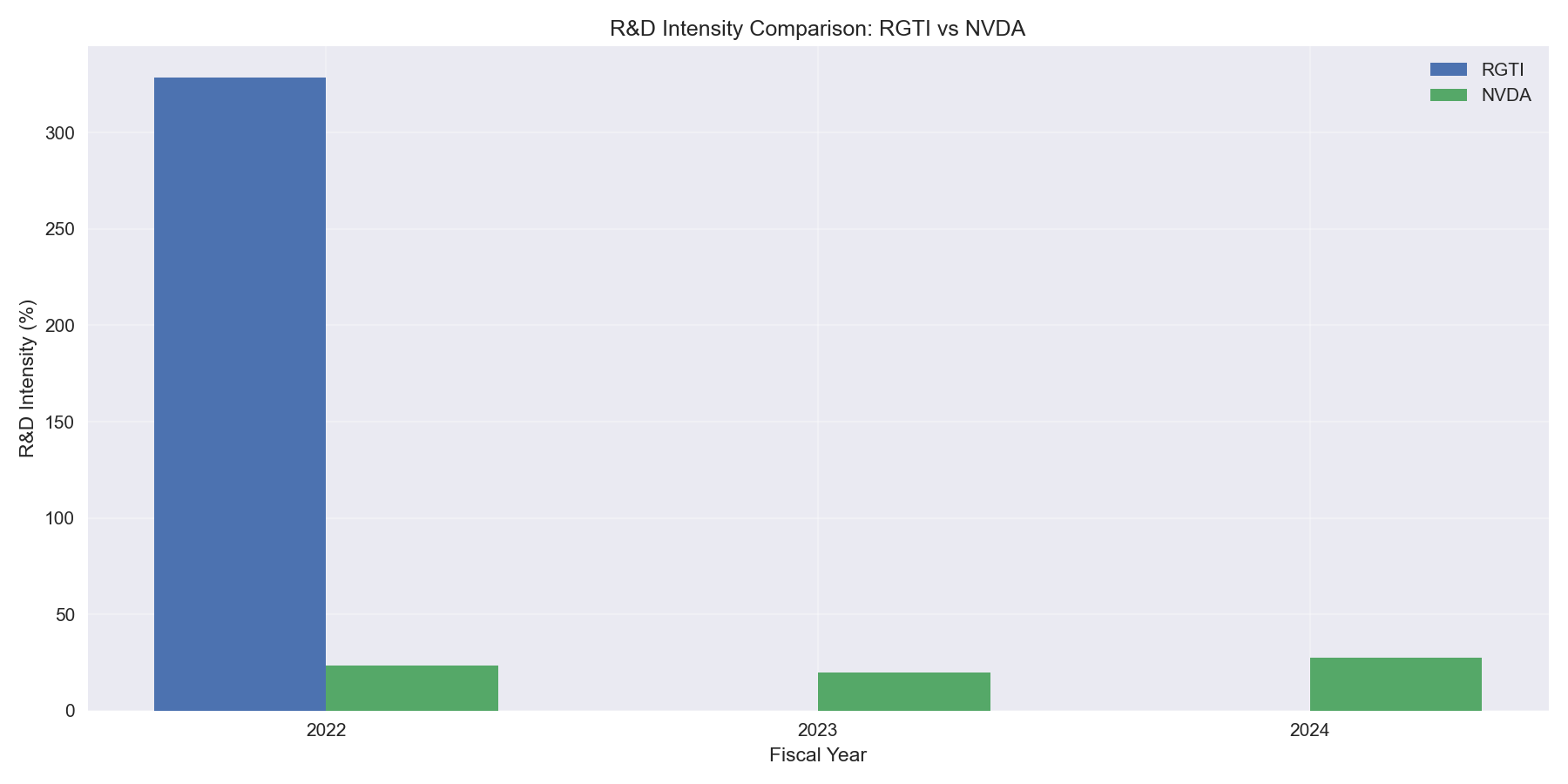

R&D Investment: The Innovation Engine

The R&D intensity analysis reveals fascinating insights into both companies' innovation strategies. Rigetti demonstrated an extraordinary R&D intensity of 328.55% in 2022, reflecting its heavy investment in quantum technology development. In contrast, Nvidia maintains a more balanced but still significant R&D intensity of 27.21% (latest data), showcasing its established business model while maintaining strong innovation focus.

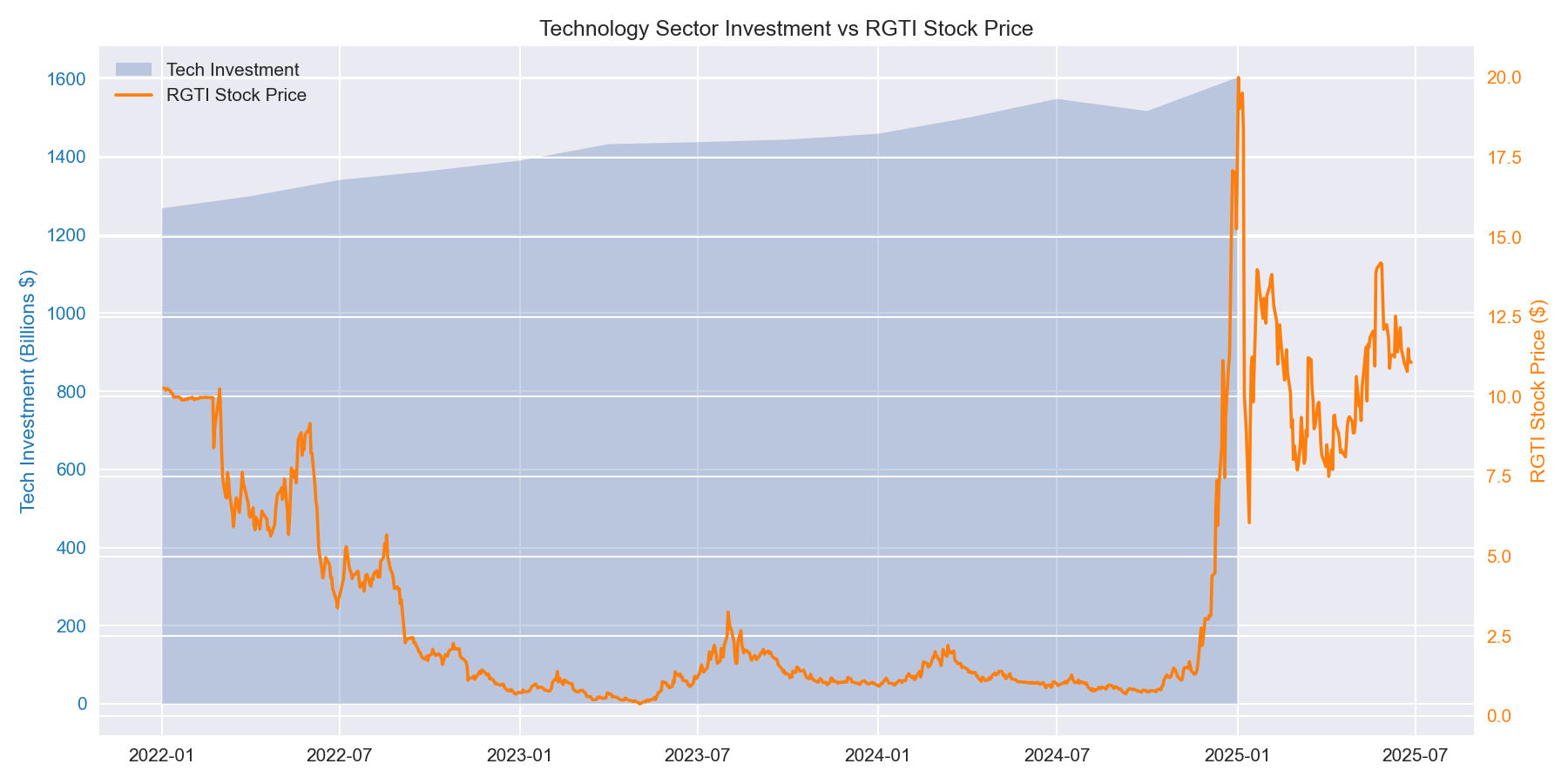

Technology Sector Context

The broader technology sector has shown robust growth, with total investment increasing by 26.41% from Q1 2022 to the latest period, reaching $1.6 trillion. Interestingly, we observed a strong negative correlation (-0.9586) between overall tech sector investment and RGTI's stock price, suggesting that quantum computing stocks may march to their own drum rather than following broader tech trends.

Conclusion

While quantum computing stocks like RGTI show higher potential returns, they come with significantly higher volatility. Nvidia represents a more stable investment approach to quantum computing exposure, backed by a diversified business model and consistent R&D investment. Investors must weigh their risk tolerance against the potential for quantum computing's revolutionary impact.

Comments (0)

No comments yet. Be the first to comment!