The Biggest Stock Losers of Q3 2025 — Why These 5 Companies Fell and What It Means for Investors

— A story-driven explainer for readers curious about the quarter’s biggest market declines (7-minute read)

Disclaimer: This article is for informational purposes only and does not constitute investment advice.

Overview: The Quarter That Shocked a Few Names

While the S&P 500 posted mild gains in Q3 2025, not every stock shared the joy.

A handful of once-steady companies delivered the opposite — sharp quarterly declines that revealed how fragile investor sentiment can be when costs rise and guidance weakens.

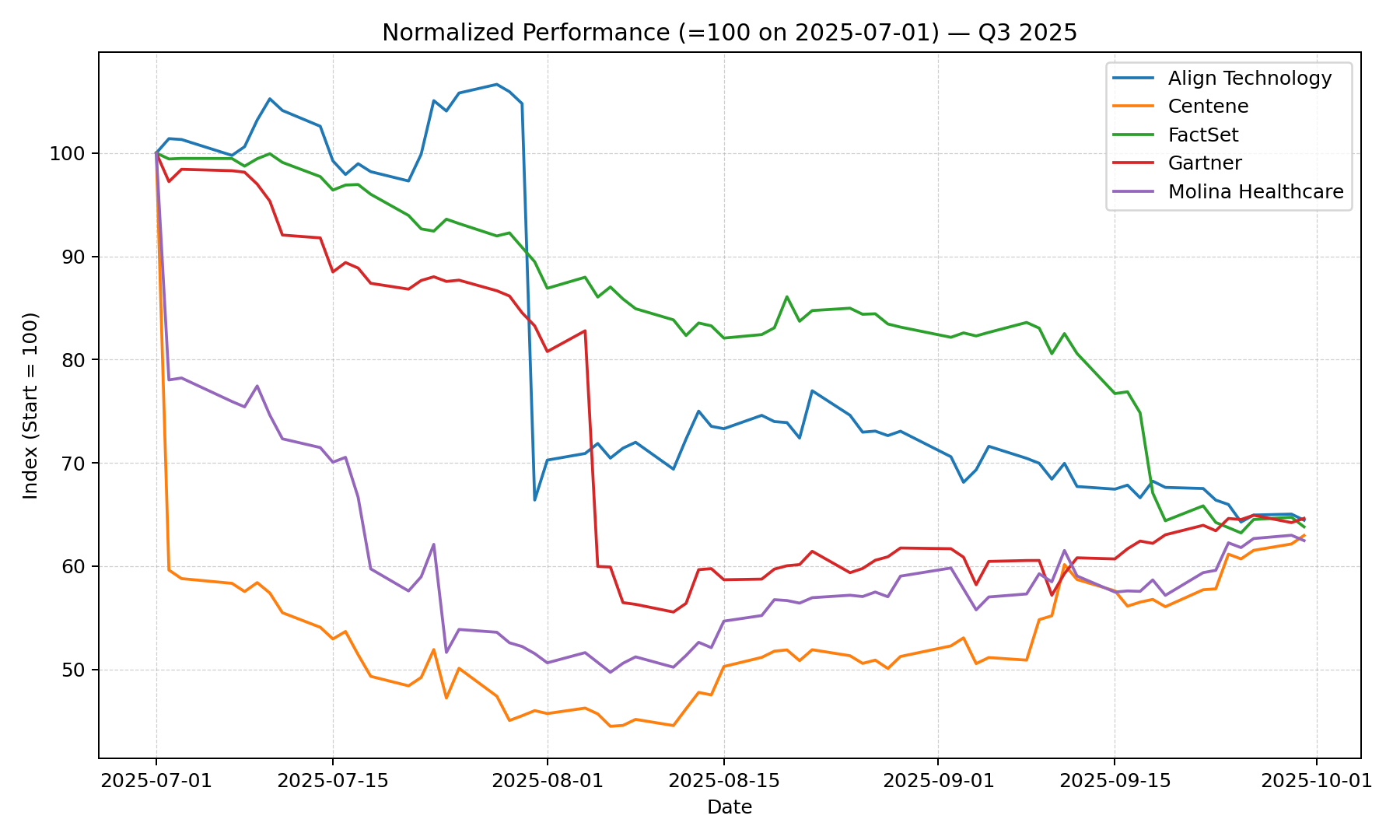

Here’s a snapshot of the five most notable laggards in the S&P 500 for the third quarter:

| Rank | Company | Sector | Q3 2025 Price Change | Main Reason |

|---|---|---|---|---|

| 1 | FactSet (FDS) | Financial Data | ↓ 36% | Weak profit guidance, cautious client budgets |

| 2 | Molina Healthcare (MOH) | Health Insurance | ↓ 35% | Medical costs surged faster than premiums |

| 3 | Centene (CNC) | Health Insurance | ↓ 34% | Withdrew 2025 guidance; surprise loss |

| 4 | Align Technology (ALGN) | Medical Devices | ↓ 33% | Lowered revenue outlook; weak consumer demand |

| 5 | Gartner (IT) | Information Services | ↓ 25% | Slower research growth; trimmed full-year forecast |

Relative performance of the five biggest decliners from July to September 2025-Q3.

Relative performance of the five biggest decliners from July to September 2025-Q3.

1. FactSet (FDS) — “Corporate spending cooled down”

FactSet provides financial data and analytics to investment firms and corporations.

In September, its stock plunged after the company issued weaker profit guidance than Wall Street expected.

The reason?

Corporate clients are getting cautious with their data and research budgets. FactSet hinted that growth in new contracts and upgrades is slowing as finance teams tighten spending amid policy and rate uncertainty.

In short: growth expectations reset → valuation multiple reset.

What to watch next:

- Renewal rates and net new annual contract value (ACV)

- Average revenue per client (ARPU) — can upselling offset slower growth?

- Margin guidance stability

2. Molina Healthcare (MOH) — “Medical costs outpaced premiums”

Molina, a major U.S. health insurer, cut its full-year outlook twice during the quarter.

The key problem was higher-than-expected medical claims, or in industry terms, a spike in the Medical Care Ratio (MCR).

Behind the scenes:

- After Medicaid eligibility “redeterminations,” the remaining members turned out to be sicker and more expensive to insure.

- Adjustments in government risk-sharing programs also pressured profitability.

In short: healthcare costs grew faster than the premiums Molina collected.

What to watch next:

- Whether MCR peaks and starts to normalize

- State-level premium adjustments in upcoming contracts

- Broader medical cost trends — drugs, mental health, and outpatient care

3. Centene (CNC) — “Guidance withdrawn, confidence shaken”

Centene, another major Medicaid and ACA marketplace insurer, shocked investors by withdrawing its 2025 earnings guidance in July.

Soon after, it reported a surprise quarterly loss and an elevated medical loss ratio of 93%.

Why?

Revenue from risk-adjustment programs under the Affordable Care Act came in much lower than expected, while patient utilization of high-cost services increased.

In short: uncertainty about future margins made investors nervous.

What to watch next:

- 2026 premium increases approved by regulators

- Stabilization of risk-adjustment reimbursements

- Early signs that medical inflation is slowing

4. Align Technology (ALGN) — “Consumers hit pause on their smiles”

The maker of Invisalign braces had one of the quarter’s biggest single-day drops after cutting its revenue outlook.

The company cited weaker demand for elective dental care, especially in North America and Europe.

What drove it:

- Households are pulling back on discretionary spending amid high interest rates.

- Orthodontic clinics saw fewer new starts as patients delayed cosmetic treatments.

- Management also announced cost cuts and restructuring to protect margins.

In short: high rates and weak consumer confidence hit elective healthcare.

What to watch next:

- Recovery in “case starts” (new Invisalign treatments)

- Margin stability from cost-cutting

- Demand rebound in China and other key markets

5. Gartner (IT) — “The forecast, not the earnings, broke sentiment”

Gartner actually beat profit expectations in Q2, but lowered its full-year revenue guidance.

That single line in the earnings call was enough to send the stock down over 20%.

The culprit was slowing demand in its core research division.

CIOs and enterprise buyers are taking longer to renew or expand subscriptions, reflecting caution on IT budgets.

In short: the company is still profitable, but growth looks less certain.

What to watch next:

- Net contract value (new sales minus cancellations)

- Conference and event attendance (a proxy for enterprise demand)

- Whether double-digit growth can return in 2026

Common Threads Behind the Declines

1. Guidance mattered more than earnings

Every one of these companies saw investors react more to future guidance than to the actual quarterly numbers. When management says “next quarter will be slower,” markets move fast.

2. Cost pressures dominated

In healthcare, rising medical costs outpaced premiums.

In tech and analytics, higher labor and customer-acquisition costs squeezed margins.

3. The macro slowdown narrative

FactSet, Gartner, and Align all reflected a broader theme: businesses and consumers are hesitant to spend in a high-rate, uncertain environment. Even well-run companies can’t escape that cycle.

The Smarter Way to Read a Stock Drop

You don’t need a CFA to interpret these moves.

Whenever you see a big decline, try asking just three questions:

- What changed in the company’s forward guidance?

- Was the problem on the revenue side or the cost side?

- Is the issue temporary or structural?

These five stories from Q3 2025 show how quickly sentiment can shift when guidance weakens — even without a crisis.

For long-term investors, the lesson isn’t to avoid volatility, but to understand what’s behind it.

Sources

- Barron’s – S&P 500 Q3 2025 Winners and Losers

- Reuters – FactSet guidance miss; Molina and Centene profit warnings

- FierceHealthcare – Medicaid redetermination effects on MLR

- MarketWatch / Yahoo Finance – Align Technology forecast cut

- Reuters / Gartner Investor Relations – Q2 earnings and FY25 guidance update

Comments (0)

No comments yet. Be the first to comment!