Top 5 S&P 500 Stocks That Surged in September 2025 — Deep Performance Analysis & What Fueled Their Rally

Period: Sep 2 – Oct 2, 2025 (KST)

Index: S&P 500 (large-cap US stocks)

Disclaimer: This is not investment advice. Educational purposes only.

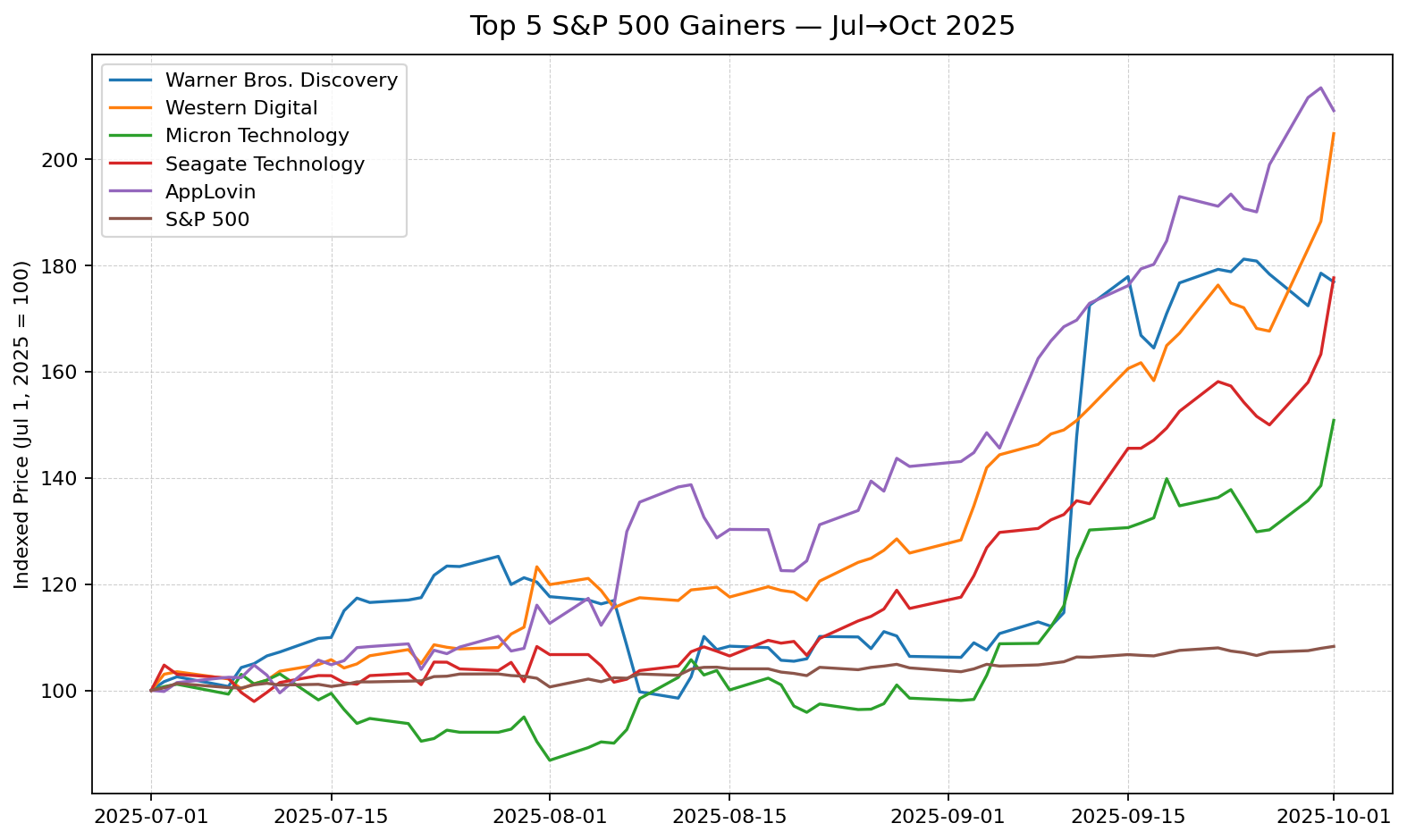

Line chart: four-month returns for WBD, WDC, MU, STX, APP, S&P500

Warner Bros. Discovery (WBD) — A Corporate Shake-Up Story

Warner Bros. Discovery’s stock became the single biggest gainer in the S&P 500 over the past month, soaring more than 70%. That scale of movement doesn’t come out of thin air. It came from a mix of takeover speculation, corporate restructuring, and global expansion plans.

First, in mid-September, news broke that Paramount/Skydance was preparing a cash acquisition proposal for WBD. Even before any deal was confirmed, just the possibility of a takeover was enough to lift the stock by 20–30% in a single day. Investors know that in an acquisition, buyers usually pay a “premium” above the market price, so they rushed in ahead of any official confirmation.

Second, management themselves revealed a bold plan: by 2026, WBD would be split into two companies—one focusing on Streaming and Studios, the other on Networks and Sports. This move is often interpreted positively because investors believe that, separated, each unit’s true earnings power and growth prospects can be recognized more clearly. The finance term for this is SoTP (Sum of the Parts), and it frequently results in a higher overall valuation.

Finally, WBD announced that HBO Max will roll out in 14 Asia-Pacific countries. That signals not just more users but also more subscription revenue, licensing income, and a larger global footprint. In the streaming business, scale and reach matter enormously, so international expansion is treated as a growth accelerant.

Put together, WBD gave investors three reasons to believe its value would soon be recognized at a higher level:

- A potential acquisition premium,

- Unlocking hidden value via a spin-off,

- New recurring revenue from international expansion.

Western Digital (WDC) — When AI Meets Storage Needs

Western Digital saw its stock rise over 65% in a single month, and the explanation lies squarely in the AI data center boom.

Analysts at Morgan Stanley nearly doubled their price target, moving from $99 to $171, citing a surge in demand for storage from hyperscalers (the likes of Amazon, Microsoft, and Google). These companies are rapidly building out AI infrastructure, and every AI model requires enormous amounts of data to be stored, retrieved, and trained on.

The storage industry also provided hard evidence: prices for hard disk drives (HDDs) were reported to be rising, and delivery times were being extended. That combination—higher prices and longer lead times—is a classic signal that demand is overwhelming supply.

For Western Digital, this environment means several positives working together. They can sell more units, they can charge more per unit, and the mix of products sold tilts toward high-capacity “nearline” HDDs used in data centers. All of that translates into wider margins and faster profit growth.

Investors reframed their view of Western Digital from a “cyclical hardware company” to an “essential AI infrastructure provider.” That re-rating helped push the stock higher.

Micron Technology (MU) — The Memory Supercycle in Action

Micron rose around 57% in the same period, powered by a very different but equally powerful theme: memory chips are entering a boom cycle, thanks to AI.

Micron’s Q4 FY25 results came in strong, with $11.3 billion in revenue, and more than half of that came from data centers. Most importantly, Micron confirmed that its HBM (High Bandwidth Memory) chips were already sold out for 2025, and supply for 2026 also looked extremely tight.

On top of that, prices for both DRAM and NAND memory chips were rising after a long downturn. When prices rise in memory markets, margins expand very quickly because the cost structure is largely fixed. HBM in particular is high-priced and carries especially attractive margins.

This set of conditions—sold-out supply, price increases, and high-margin products—signaled to investors that Micron’s earnings could expand dramatically in the near future. Investors called it the return of the memory supercycle, and Micron’s leadership in HBM positioned it as one of the biggest winners of AI-driven demand.

Seagate Technology (STX) — Bigger Drives, Bigger Profits

Seagate’s stock rose about 56–57% over the month, reflecting both industry dynamics and a breakthrough product launch.

Just like Western Digital, Seagate benefits from hyperscaler demand for storage. Analysts raised their targets sharply, with some boosting their expectations for the stock to well over $250. But Seagate also had its own company-specific catalyst: it began shipping 28–30TB HDDs built on HAMR (Heat-Assisted Magnetic Recording) technology. These drives allow hyperscalers to store more data per device, which improves both economics and efficiency.

From a financial perspective, higher-capacity drives typically mean higher selling prices and better margins. Combine that with the fact that AI workloads are exploding in size, and Seagate suddenly looks like a company sitting at the center of a long-term demand wave.

The recovery in Seagate’s profit and cash flow during FY25 Q4 reinforced the idea that this was not just hype—it was already showing up in the numbers.

AppLovin (APP) — From Gaming Ads to Mainstream Advertising Giant

AppLovin’s stock surged more than 50% in the last month, but for a different set of reasons than the hardware companies. Its story was about index inclusion, growth momentum, and AI-powered advertising technology.

On September 22, AppLovin was officially added to the S&P 500 index. This kind of event has a mechanical effect: every ETF and index fund tracking the S&P 500 must buy shares, creating automatic demand for the stock. That alone can drive prices up.

But the company also had fundamental momentum. In Q2 2025, AppLovin reported revenue up 77% year-over-year, driven by its Axon AI advertising engine. This engine allows advertisers to target users more effectively, increasing return on ad spend and making AppLovin’s platform more valuable.

Importantly, AppLovin is no longer just about gaming ads. It is rapidly expanding into e-commerce and other verticals, which means its Total Addressable Market (TAM) is much larger than before. That expansion story, combined with index inclusion and impressive growth numbers, made it a standout among tech names.

Pulling It All Together

Each of these five stocks rose for different reasons, but the common thread is simple: investors were given clear reasons to believe these companies will earn more in the future.

- Warner Bros. Discovery showed the possibility of deal premiums, spin-off value, and new global subscribers.

- Western Digital and Seagate demonstrated how AI is creating an unprecedented hunger for data storage, boosting both prices and sales volumes.

- Micron proved that the memory supercycle is back, with HBM and DRAM demand skyrocketing.

- AppLovin combined index inclusion, stellar growth, and AI ad technology to win investor confidence.

Beginner’s Glossary

- Re-rating — When a stock is valued at a higher multiple (like PER) because its outlook improves.

- SoTP (Sum of the Parts) — A method of valuing separate business units and adding them up, often higher than valuing the company as a whole.

- HBM (High Bandwidth Memory) — A type of very fast, high-priced memory essential for AI chips.

- Nearline HDD — A class of very large-capacity hard drives built for data centers.

Comments (0)

No comments yet. Be the first to comment!